bf5d3dfac52901a56317bef409161664.ppt

- Количество слайдов: 37

Canton Fair South Africa: Where is the market growing? Oct 16 th, 2013

Canton Fair South Africa: Where is the market growing? Oct 16 th, 2013

South Africa: Key Facts!

South Africa: Key Facts!

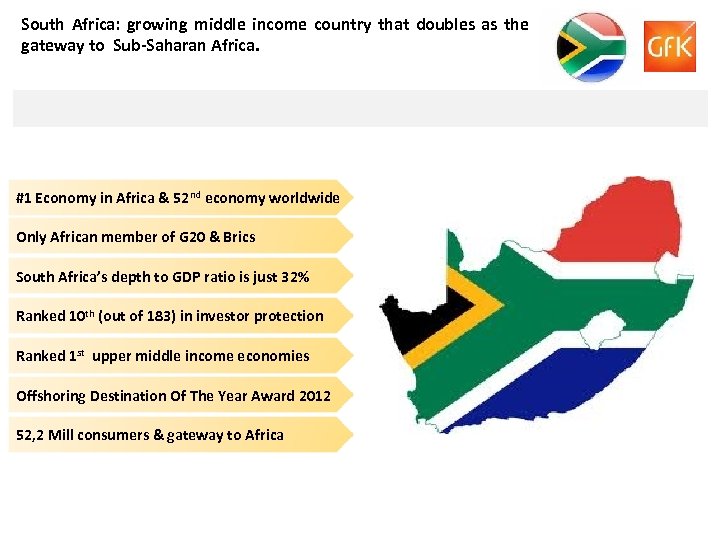

South Africa: growing middle income country that doubles as the gateway to Sub-Saharan Africa. #1 Economy in Africa & 52 nd economy worldwide Only African member of G 20 & Brics South Africa’s depth to GDP ratio is just 32% Ranked 10 th (out of 183) in investor protection Ranked 1 st upper middle income economies Offshoring Destination Of The Year Award 2012 52, 2 Mill consumers & gateway to Africa

South Africa: growing middle income country that doubles as the gateway to Sub-Saharan Africa. #1 Economy in Africa & 52 nd economy worldwide Only African member of G 20 & Brics South Africa’s depth to GDP ratio is just 32% Ranked 10 th (out of 183) in investor protection Ranked 1 st upper middle income economies Offshoring Destination Of The Year Award 2012 52, 2 Mill consumers & gateway to Africa

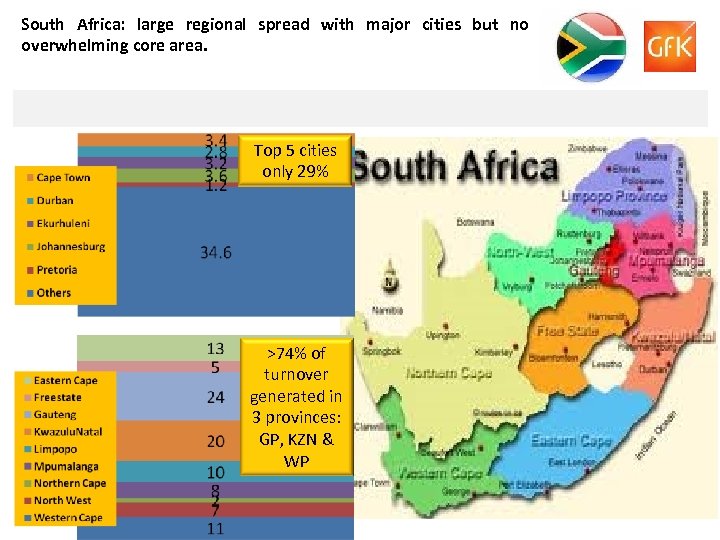

South Africa: large regional spread with major cities but no overwhelming core area. Top 5 cities only 29% >74% of turnover generated in 3 provinces: GP, KZN & WP

South Africa: large regional spread with major cities but no overwhelming core area. Top 5 cities only 29% >74% of turnover generated in 3 provinces: GP, KZN & WP

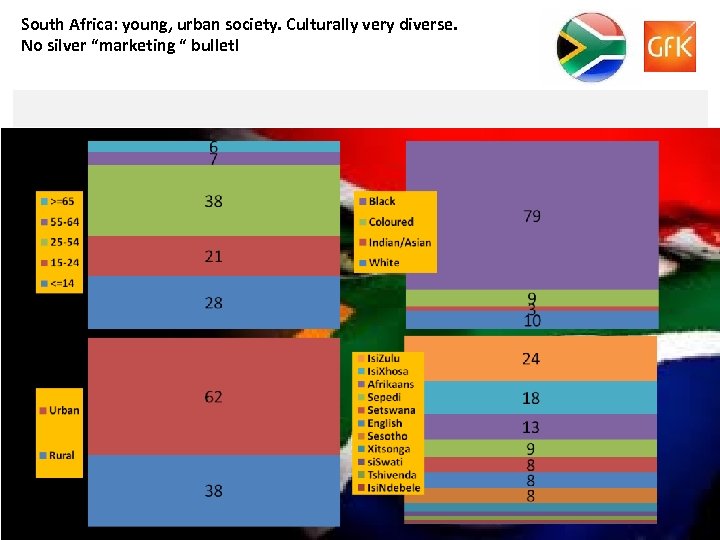

South Africa: young, urban society. Culturally very diverse. No silver “marketing “ bullet!

South Africa: young, urban society. Culturally very diverse. No silver “marketing “ bullet!

Where to buy: The Retail Structure of South Africa

Where to buy: The Retail Structure of South Africa

South Africa: Modern, very formalised retail structures dominate. High degree of shopping malls (>1000) encourage chains and franchise systems. Retail Overview South Africa SOUTH AFRICA 2013

South Africa: Modern, very formalised retail structures dominate. High degree of shopping malls (>1000) encourage chains and franchise systems. Retail Overview South Africa SOUTH AFRICA 2013

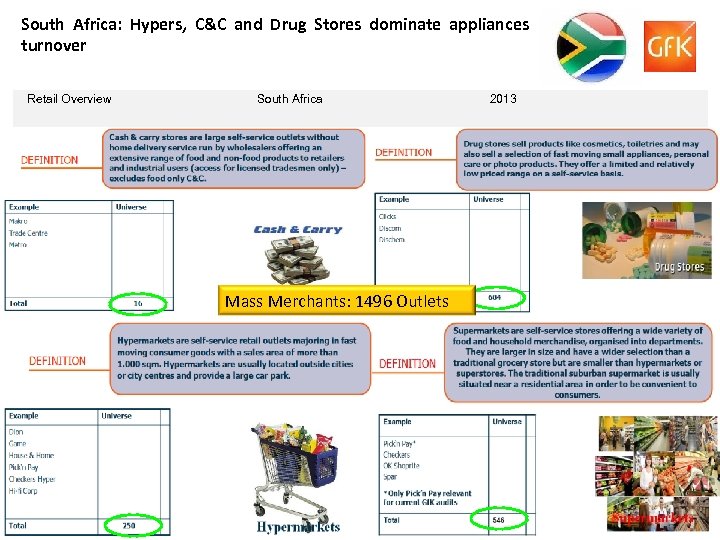

South Africa: Hypers, C&C and Drug Stores dominate appliances turnover Retail Overview South Africa Mass Merchants: 1496 Outlets 2013

South Africa: Hypers, C&C and Drug Stores dominate appliances turnover Retail Overview South Africa Mass Merchants: 1496 Outlets 2013

But lots of other active channels with massive turnover contribution! Retail Overview South Africa All Others: 8125 Outlets 2013

But lots of other active channels with massive turnover contribution! Retail Overview South Africa All Others: 8125 Outlets 2013

WHERE is the market growing?

WHERE is the market growing?

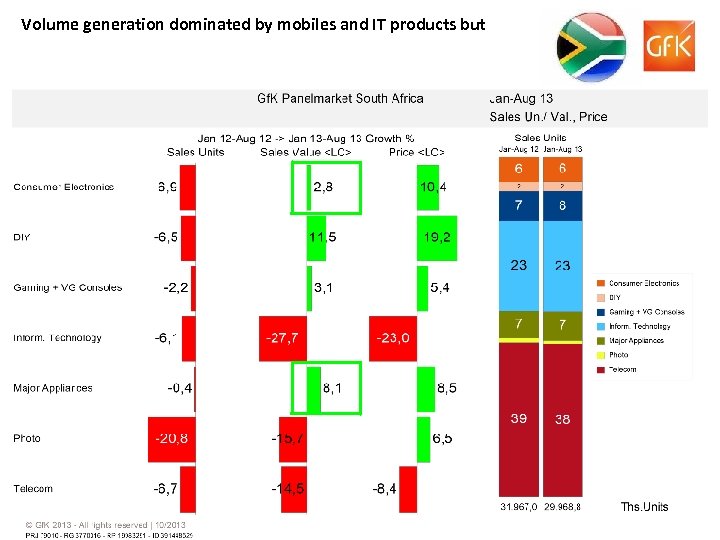

Volume generation dominated by mobiles and IT products but

Volume generation dominated by mobiles and IT products but

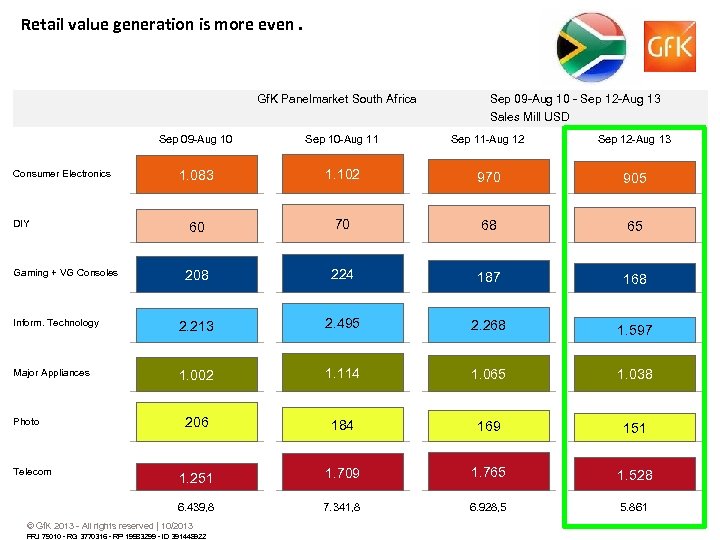

Retail value generation is more even. Gf. K Panelmarket South Africa Sep 09 -Aug 10 - Sep 12 -Aug 13 Sales Mill USD Sep 09 -Aug 10 Sep 10 -Aug 11 Sep 11 -Aug 12 Sep 12 -Aug 13 1. 083 1. 102 970 905 60 70 68 65 208 224 187 168 Inform. Technology 2. 213 2. 495 2. 268 1. 597 Major Appliances 1. 002 1. 114 1. 065 1. 038 206 184 169 151 1. 251 1. 709 1. 765 1. 528 6. 439, 8 7. 341, 8 6. 928, 5 5. 861 Consumer Electronics DIY Gaming + VG Consoles Photo Telecom © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 3770316 - RP 19983299 - ID 391448922

Retail value generation is more even. Gf. K Panelmarket South Africa Sep 09 -Aug 10 - Sep 12 -Aug 13 Sales Mill USD Sep 09 -Aug 10 Sep 10 -Aug 11 Sep 11 -Aug 12 Sep 12 -Aug 13 1. 083 1. 102 970 905 60 70 68 65 208 224 187 168 Inform. Technology 2. 213 2. 495 2. 268 1. 597 Major Appliances 1. 002 1. 114 1. 065 1. 038 206 184 169 151 1. 251 1. 709 1. 765 1. 528 6. 439, 8 7. 341, 8 6. 928, 5 5. 861 Consumer Electronics DIY Gaming + VG Consoles Photo Telecom © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 3770316 - RP 19983299 - ID 391448922

What‘s up with Small Appliances?

What‘s up with Small Appliances?

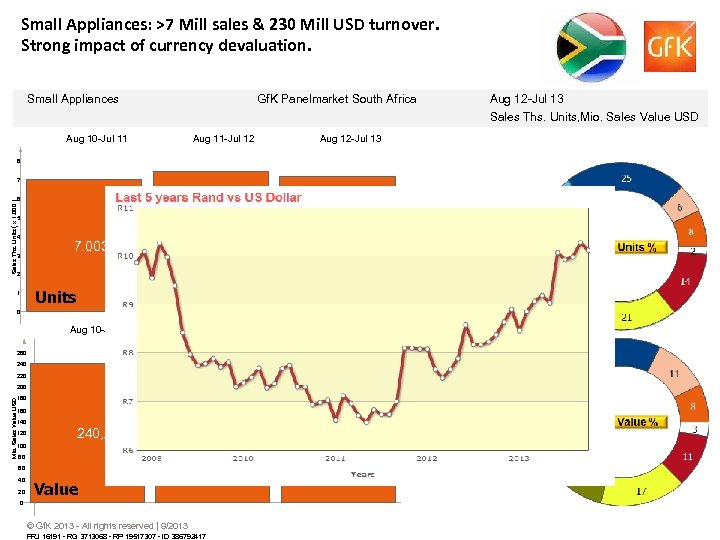

Small Appliances: >7 Mill sales & 230 Mill USD turnover. Strong impact of currency devaluation. Small Appliances Aug 10 -Jul 11 Gf. K Panelmarket South Africa Aug 11 -Jul 12 Aug 12 -Jul 13 8 7 Sales Ths. Units ( x 1. 000 ) 6 5 4 7. 003 3 7. 413 7. 191 2 Units 1 0 Aug 10 -Jul 11 Aug 11 -Jul 12 Aug 12 -Jul 13 260 240 220 200 Mio. Sales Value USD 180 160 140 120 240, 2 100 236, 6 80 60 40 20 Value 0 © Gf. K 2013 - All rights reserved | 9/2013 PRJ 16191 - RG 3713068 - RP 19517307 - ID 386792417 229, 1 Aug 12 -Jul 13 Sales Ths. Units, Mio. Sales Value USD

Small Appliances: >7 Mill sales & 230 Mill USD turnover. Strong impact of currency devaluation. Small Appliances Aug 10 -Jul 11 Gf. K Panelmarket South Africa Aug 11 -Jul 12 Aug 12 -Jul 13 8 7 Sales Ths. Units ( x 1. 000 ) 6 5 4 7. 003 3 7. 413 7. 191 2 Units 1 0 Aug 10 -Jul 11 Aug 11 -Jul 12 Aug 12 -Jul 13 260 240 220 200 Mio. Sales Value USD 180 160 140 120 240, 2 100 236, 6 80 60 40 20 Value 0 © Gf. K 2013 - All rights reserved | 9/2013 PRJ 16191 - RG 3713068 - RP 19517307 - ID 386792417 229, 1 Aug 12 -Jul 13 Sales Ths. Units, Mio. Sales Value USD

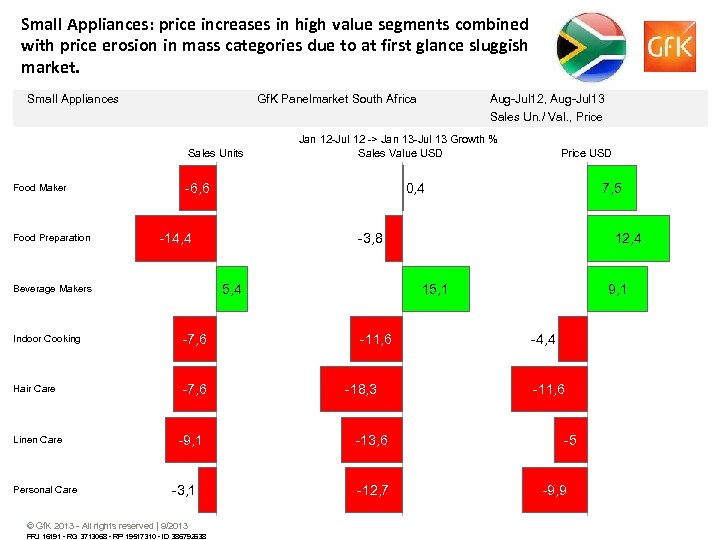

Small Appliances: price increases in high value segments combined with price erosion in mass categories due to at first glance sluggish market. Small Appliances Gf. K Panelmarket South Africa Sales Units Food Maker Food Preparation Hair Care -7, 6 Personal Care -9, 1 -3, 1 © Gf. K 2013 - All rights reserved | 9/2013 PRJ 16191 - RG 3713068 - RP 19517310 - ID 386792638 7, 5 -3, 8 5, 4 -7, 6 Price USD 0, 4 -14, 4 Indoor Cooking Linen Care Jan 12 -Jul 12 -> Jan 13 -Jul 13 Growth % Sales Value USD -6, 6 Beverage Makers Aug-Jul 12, Aug-Jul 13 Sales Un. / Val. , Price 12, 4 15, 1 -11, 6 -18, 3 -13, 6 -12, 7 9, 1 -4, 4 -11, 6 -5 -9, 9

Small Appliances: price increases in high value segments combined with price erosion in mass categories due to at first glance sluggish market. Small Appliances Gf. K Panelmarket South Africa Sales Units Food Maker Food Preparation Hair Care -7, 6 Personal Care -9, 1 -3, 1 © Gf. K 2013 - All rights reserved | 9/2013 PRJ 16191 - RG 3713068 - RP 19517310 - ID 386792638 7, 5 -3, 8 5, 4 -7, 6 Price USD 0, 4 -14, 4 Indoor Cooking Linen Care Jan 12 -Jul 12 -> Jan 13 -Jul 13 Growth % Sales Value USD -6, 6 Beverage Makers Aug-Jul 12, Aug-Jul 13 Sales Un. / Val. , Price 12, 4 15, 1 -11, 6 -18, 3 -13, 6 -12, 7 9, 1 -4, 4 -11, 6 -5 -9, 9

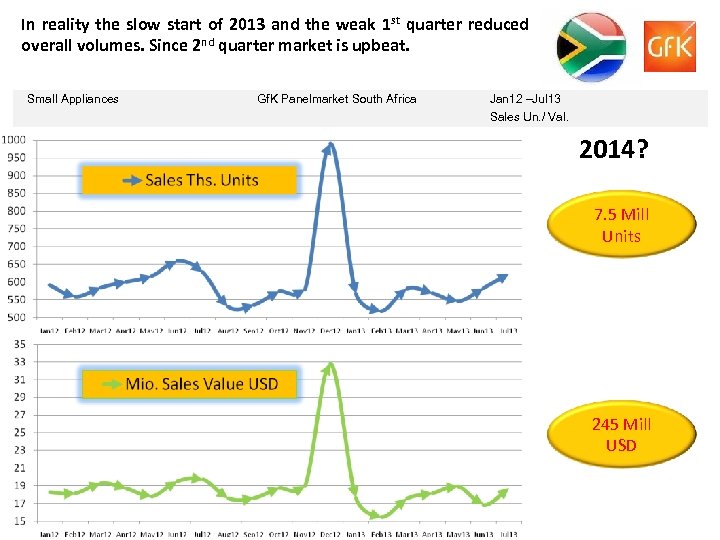

In reality the slow start of 2013 and the weak 1 st quarter reduced overall volumes. Since 2 nd quarter market is upbeat. Small Appliances Gf. K Panelmarket South Africa Jan 12 –Jul 13 Sales Un. / Val. 2014? 7. 5 Mill Units 245 Mill USD

In reality the slow start of 2013 and the weak 1 st quarter reduced overall volumes. Since 2 nd quarter market is upbeat. Small Appliances Gf. K Panelmarket South Africa Jan 12 –Jul 13 Sales Un. / Val. 2014? 7. 5 Mill Units 245 Mill USD

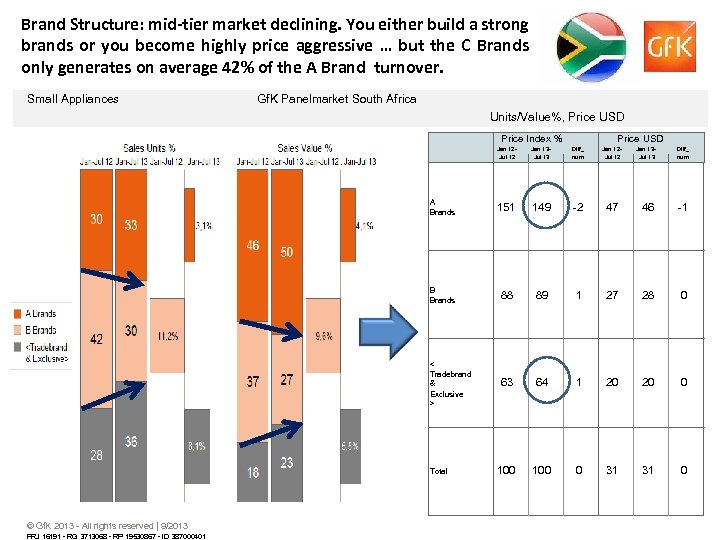

Brand Structure: mid-tier market declining. You either build a strong brands or you become highly price aggressive … but the C Brands only generates on average 42% of the A Brand turnover. Small Appliances Gf. K Panelmarket South Africa Units/Value%, Price USD Price Index % Price USD Jan 12 Jul 12 Jan 13 Jul 13 Diff_ num A Brands 151 149 -2 47 46 -1 B Brands 88 89 1 27 28 0 < Tradebrand & Exclusive > 63 64 1 20 20 0 100 0 31 31 0 Total © Gf. K 2013 - All rights reserved | 9/2013 PRJ 16191 - RG 3713068 - RP 19530867 - ID 387000401

Brand Structure: mid-tier market declining. You either build a strong brands or you become highly price aggressive … but the C Brands only generates on average 42% of the A Brand turnover. Small Appliances Gf. K Panelmarket South Africa Units/Value%, Price USD Price Index % Price USD Jan 12 Jul 12 Jan 13 Jul 13 Diff_ num A Brands 151 149 -2 47 46 -1 B Brands 88 89 1 27 28 0 < Tradebrand & Exclusive > 63 64 1 20 20 0 100 0 31 31 0 Total © Gf. K 2013 - All rights reserved | 9/2013 PRJ 16191 - RG 3713068 - RP 19530867 - ID 387000401

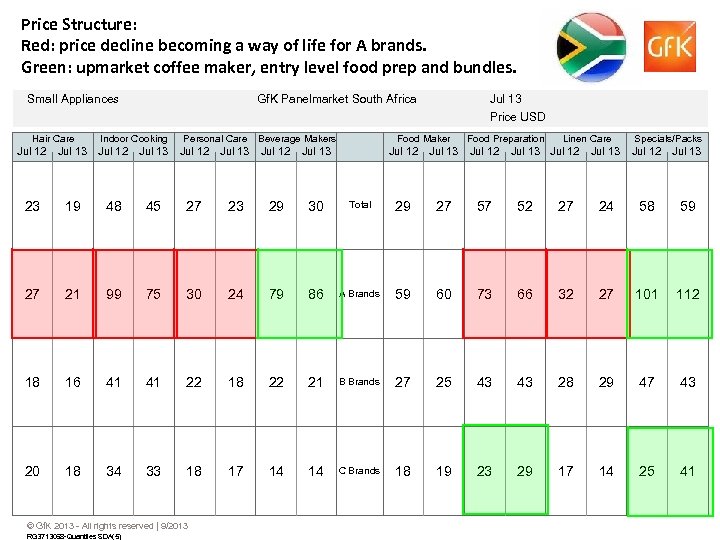

Price Structure: Red: price decline becoming a way of life for A brands. Green: upmarket coffee maker, entry level food prep and bundles. Small Appliances Hair Care Gf. K Panelmarket South Africa Indoor Cooking Personal Care Beverage Makers Jul 12 Jul 13 Jul 12 19 48 45 27 23 29 30 27 21 99 75 30 24 79 18 16 41 41 22 18 20 18 34 33 18 17 Food Maker Jul 13 23 © Gf. K 2013 - All rights reserved | 9/2013 RG 3713068 -Quantiles SDA(5) Jul 13 Price USD Food Preparation Jul 12 Jul 13 Jul 12 Total 29 27 57 52 86 A Brands 59 60 73 22 21 B Brands 27 25 14 14 C Brands 18 19 Linen Care Jul 13 Jul 12 Specials/Packs Jul 13 Jul 12 Jul 13 27 24 58 59 66 32 27 101 112 43 43 28 29 47 43 23 29 17 14 25 41

Price Structure: Red: price decline becoming a way of life for A brands. Green: upmarket coffee maker, entry level food prep and bundles. Small Appliances Hair Care Gf. K Panelmarket South Africa Indoor Cooking Personal Care Beverage Makers Jul 12 Jul 13 Jul 12 19 48 45 27 23 29 30 27 21 99 75 30 24 79 18 16 41 41 22 18 20 18 34 33 18 17 Food Maker Jul 13 23 © Gf. K 2013 - All rights reserved | 9/2013 RG 3713068 -Quantiles SDA(5) Jul 13 Price USD Food Preparation Jul 12 Jul 13 Jul 12 Total 29 27 57 52 86 A Brands 59 60 73 22 21 B Brands 27 25 14 14 C Brands 18 19 Linen Care Jul 13 Jul 12 Specials/Packs Jul 13 Jul 12 Jul 13 27 24 58 59 66 32 27 101 112 43 43 28 29 47 43 23 29 17 14 25 41

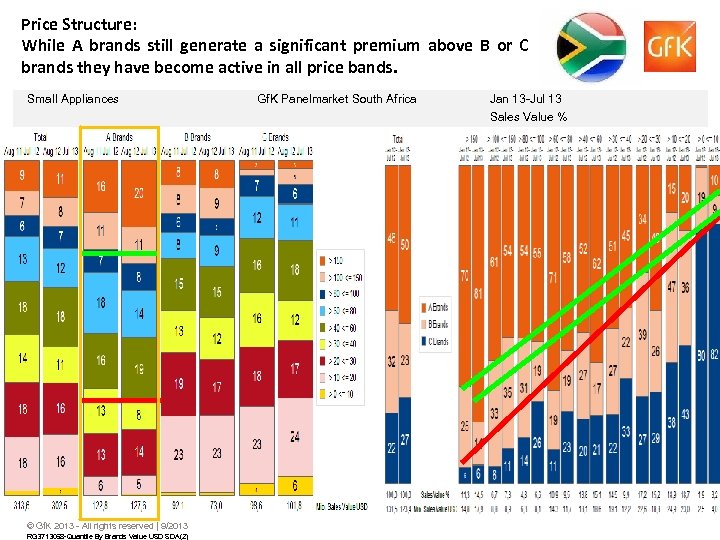

Price Structure: While A brands still generate a significant premium above B or C brands they have become active in all price bands. Small Appliances © Gf. K 2013 - All rights reserved | 9/2013 RG 3713068 -Quantile By Brands Value USD SDA(2) Gf. K Panelmarket South Africa Jan 13 -Jul 13 Sales Value %

Price Structure: While A brands still generate a significant premium above B or C brands they have become active in all price bands. Small Appliances © Gf. K 2013 - All rights reserved | 9/2013 RG 3713068 -Quantile By Brands Value USD SDA(2) Gf. K Panelmarket South Africa Jan 13 -Jul 13 Sales Value %

Major Appliances: Market Stability & Uptrading?

Major Appliances: Market Stability & Uptrading?

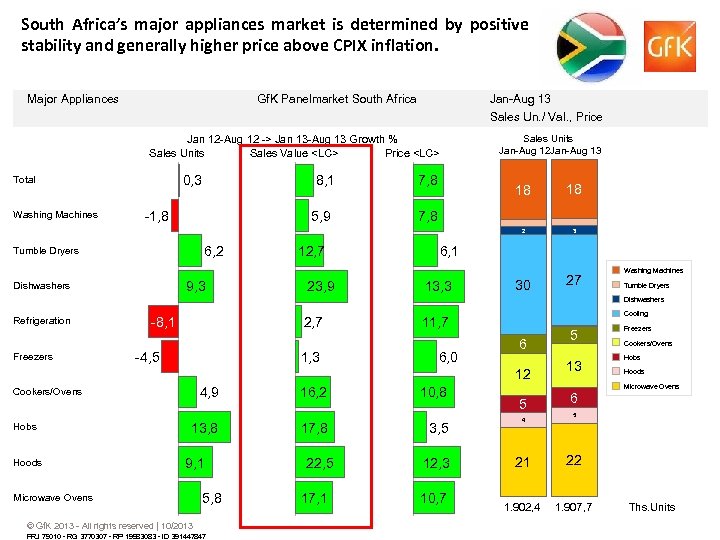

South Africa’s major appliances market is determined by positive stability and generally higher price above CPIX inflation. Major Appliances Gf. K Panelmarket South Africa Jan-Aug 13 Sales Un. / Val. , Price Jan 12 -Aug 12 -> Jan 13 -Aug 13 Growth % Sales Units Sales Value

South Africa’s major appliances market is determined by positive stability and generally higher price above CPIX inflation. Major Appliances Gf. K Panelmarket South Africa Jan-Aug 13 Sales Un. / Val. , Price Jan 12 -Aug 12 -> Jan 13 -Aug 13 Growth % Sales Units Sales Value

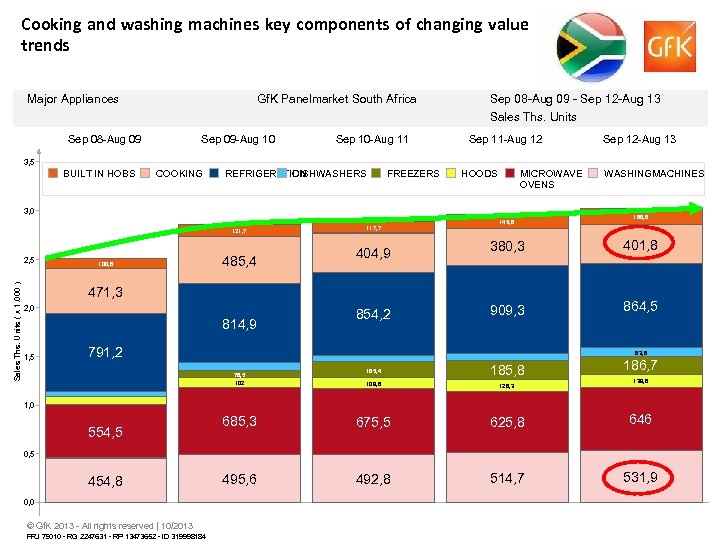

Cooking and washing machines key components of changing value trends Major Appliances Gf. K Panelmarket South Africa Sep 08 -Aug 09 Sep 09 -Aug 10 Sep 10 -Aug 11 Sep 08 -Aug 09 - Sep 12 -Aug 13 Sales Ths. Units Sep 11 -Aug 12 Sep 12 -Aug 13 3, 5 BUILT IN HOBS COOKING DISHWASHERS REFRIGERATION FREEZERS HOODS MICROWAVE OVENS 3, 0 121, 7 Sales Ths. U nits ( x 1. 000 ) 2, 5 100, 6 485, 4 117, 7 145, 6 814, 9 1, 5 168, 8 404, 9 380, 3 401, 8 854, 2 909, 3 864, 5 471, 3 2, 0 WASHINGMACHINES 791, 2 83, 8 186, 7 165, 4 185, 8 109, 6 126, 3 685, 3 675, 5 625, 8 646 495, 6 492, 8 514, 7 531, 9 78, 5 102 139, 6 1, 0 554, 5 0, 5 454, 8 0, 0 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2247631 - RP 13473652 - ID 319998184

Cooking and washing machines key components of changing value trends Major Appliances Gf. K Panelmarket South Africa Sep 08 -Aug 09 Sep 09 -Aug 10 Sep 10 -Aug 11 Sep 08 -Aug 09 - Sep 12 -Aug 13 Sales Ths. Units Sep 11 -Aug 12 Sep 12 -Aug 13 3, 5 BUILT IN HOBS COOKING DISHWASHERS REFRIGERATION FREEZERS HOODS MICROWAVE OVENS 3, 0 121, 7 Sales Ths. U nits ( x 1. 000 ) 2, 5 100, 6 485, 4 117, 7 145, 6 814, 9 1, 5 168, 8 404, 9 380, 3 401, 8 854, 2 909, 3 864, 5 471, 3 2, 0 WASHINGMACHINES 791, 2 83, 8 186, 7 165, 4 185, 8 109, 6 126, 3 685, 3 675, 5 625, 8 646 495, 6 492, 8 514, 7 531, 9 78, 5 102 139, 6 1, 0 554, 5 0, 5 454, 8 0, 0 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2247631 - RP 13473652 - ID 319998184

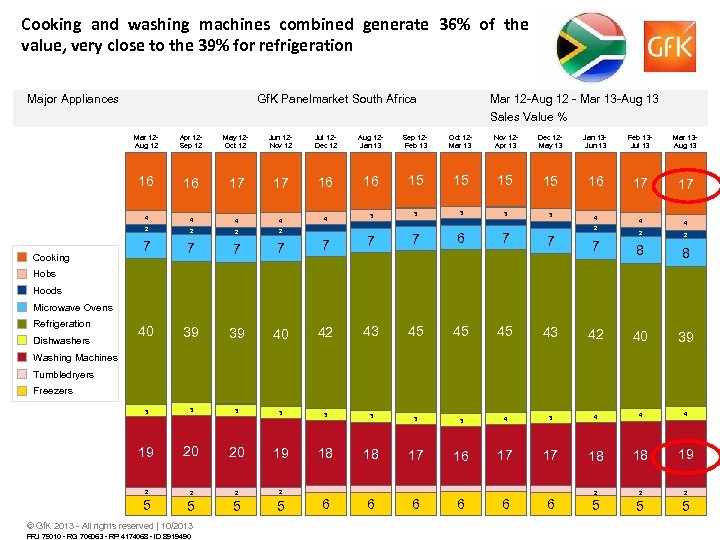

Cooking and washing machines combined generate 36% of the value, very close to the 39% for refrigeration Major Appliances Gf. K Panelmarket South Africa Mar 12 -Aug 12 - Mar 13 -Aug 13 Sales Value % Mar 12 Aug 12 Apr 12 Sep 12 May 12 Oct 12 Jun 12 Nov 12 Jul 12 Dec 12 Aug 12 Jan 13 Sep 12 Feb 13 Oct 12 Mar 13 Nov 12 Apr 13 Dec 12 May 13 Jan 13 Jun 13 Feb 13 Jul 13 Mar 13 Aug 13 16 16 17 17 16 16 15 15 16 17 17 4 4 3 3 3 4 4 2 2 2 7 7 6 7 7 7 8 8 39 40 42 43 45 45 45 43 42 40 39 3 3 3 4 3 4 4 4 18 18 17 16 17 17 18 18 19 2 2 2 5 5 5 7 7 7 40 39 3 Cooking 2 3 Hobs Hoods Microwave Ovens Refrigeration Dishwashers Washing Machines Tumbledryers Freezers 19 20 20 19 2 2 5 5 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706063 - RP 4174068 - ID 8919490 6 6 6

Cooking and washing machines combined generate 36% of the value, very close to the 39% for refrigeration Major Appliances Gf. K Panelmarket South Africa Mar 12 -Aug 12 - Mar 13 -Aug 13 Sales Value % Mar 12 Aug 12 Apr 12 Sep 12 May 12 Oct 12 Jun 12 Nov 12 Jul 12 Dec 12 Aug 12 Jan 13 Sep 12 Feb 13 Oct 12 Mar 13 Nov 12 Apr 13 Dec 12 May 13 Jan 13 Jun 13 Feb 13 Jul 13 Mar 13 Aug 13 16 16 17 17 16 16 15 15 16 17 17 4 4 3 3 3 4 4 2 2 2 7 7 6 7 7 7 8 8 39 40 42 43 45 45 45 43 42 40 39 3 3 3 4 3 4 4 4 18 18 17 16 17 17 18 18 19 2 2 2 5 5 5 7 7 7 40 39 3 Cooking 2 3 Hobs Hoods Microwave Ovens Refrigeration Dishwashers Washing Machines Tumbledryers Freezers 19 20 20 19 2 2 5 5 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706063 - RP 4174068 - ID 8919490 6 6 6

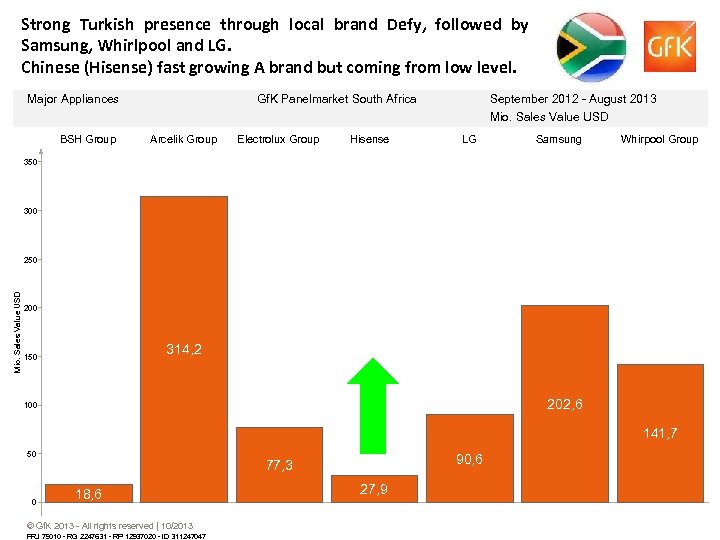

Strong Turkish presence through local brand Defy, followed by Samsung, Whirlpool and LG. Chinese (Hisense) fast growing A brand but coming from low level. Major Appliances BSH Group Gf. K Panelmarket South Africa Arcelik Group Electrolux Group Hisense September 2012 - August 2013 Mio. Sales Value USD LG Samsung Whirpool Group 350 300 M io. Sales Value USD 250 200 314, 2 150 202, 6 100 141, 7 50 0 90, 6 77, 3 18, 6 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2247631 - RP 12937020 - ID 311247047 27, 9

Strong Turkish presence through local brand Defy, followed by Samsung, Whirlpool and LG. Chinese (Hisense) fast growing A brand but coming from low level. Major Appliances BSH Group Gf. K Panelmarket South Africa Arcelik Group Electrolux Group Hisense September 2012 - August 2013 Mio. Sales Value USD LG Samsung Whirpool Group 350 300 M io. Sales Value USD 250 200 314, 2 150 202, 6 100 141, 7 50 0 90, 6 77, 3 18, 6 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2247631 - RP 12937020 - ID 311247047 27, 9

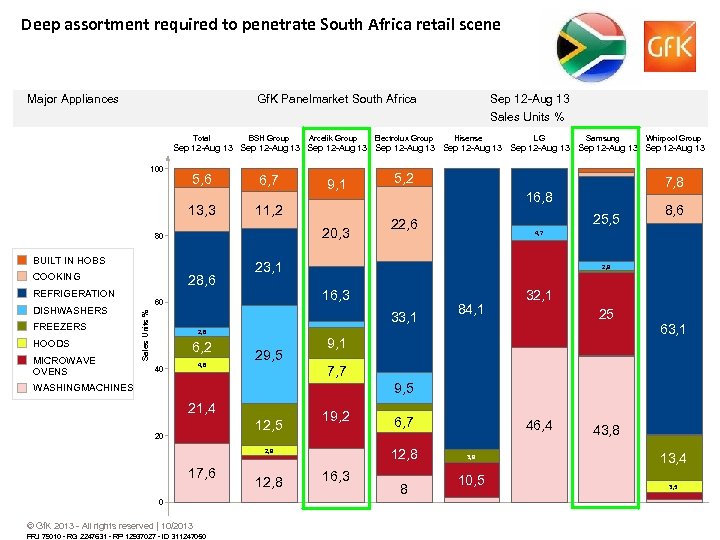

Deep assortment required to penetrate South Africa retail scene Major Appliances Gf. K Panelmarket South Africa Total BSH Group Arcelik Group Electrolux Group Sep 12 -Aug 13 Sales Units % Hisense LG Samsung Whirpool Group Sep 12 -Aug 13 Sep 12 -Aug 13 100 5, 6 6, 7 13, 3 11, 2 20, 3 80 BUILT IN HOBS COOKING 28, 6 REFRIGERATION FREEZERS HOODS MICROWAVE OVENS 5, 2 4, 6 40 29, 5 8, 6 4, 7 2, 9 33, 1 6, 2 25, 5 22, 6 16, 3 2, 8 7, 8 16, 8 23, 1 60 Sales Units % DISHWASHERS 9, 1 84, 1 32, 1 25 9, 1 63, 1 7, 7 9, 5 WASHINGMACHINES 21, 4 12, 5 20 19, 2 12, 8 2, 9 17, 6 0 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2247631 - RP 12937027 - ID 311247050 12, 8 6, 7 16, 3 8 46, 4 3, 9 10, 5 43, 8 13, 4 3, 5

Deep assortment required to penetrate South Africa retail scene Major Appliances Gf. K Panelmarket South Africa Total BSH Group Arcelik Group Electrolux Group Sep 12 -Aug 13 Sales Units % Hisense LG Samsung Whirpool Group Sep 12 -Aug 13 Sep 12 -Aug 13 100 5, 6 6, 7 13, 3 11, 2 20, 3 80 BUILT IN HOBS COOKING 28, 6 REFRIGERATION FREEZERS HOODS MICROWAVE OVENS 5, 2 4, 6 40 29, 5 8, 6 4, 7 2, 9 33, 1 6, 2 25, 5 22, 6 16, 3 2, 8 7, 8 16, 8 23, 1 60 Sales Units % DISHWASHERS 9, 1 84, 1 32, 1 25 9, 1 63, 1 7, 7 9, 5 WASHINGMACHINES 21, 4 12, 5 20 19, 2 12, 8 2, 9 17, 6 0 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2247631 - RP 12937027 - ID 311247050 12, 8 6, 7 16, 3 8 46, 4 3, 9 10, 5 43, 8 13, 4 3, 5

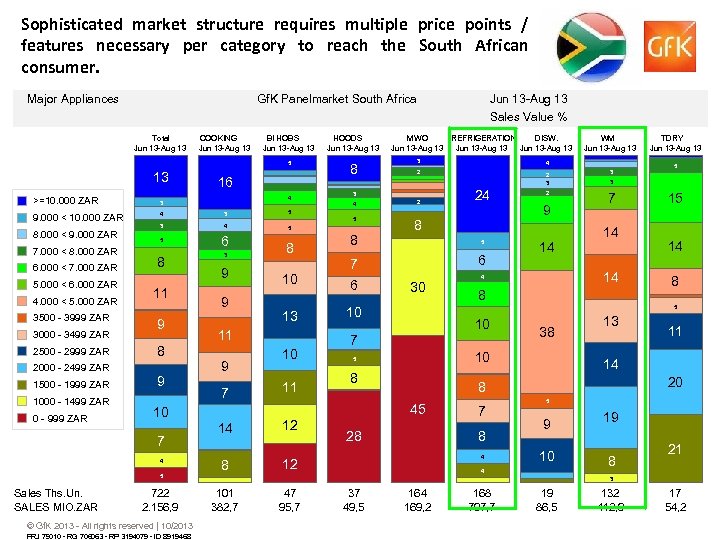

Sophisticated market structure requires multiple price points / features necessary per category to reach the South African consumer. Major Appliances Gf. K Panelmarket South Africa Total Jun 13 -Aug 13 >=10. 000 ZAR 9. 000 < 10. 000 ZAR 8. 000 < 9. 000 ZAR 7. 000 < 8. 000 ZAR 6. 000 < 7. 000 ZAR 5. 000 < 6. 000 ZAR 4. 000 < 5. 000 ZAR 3500 - 3999 ZAR 3000 - 3499 ZAR 2500 - 2999 ZAR 2000 - 2499 ZAR 1500 - 1999 ZAR 1000 - 1499 ZAR 0 - 999 ZAR HOODS Jun 13 -Aug 13 8 16 4 3 5 3 4 5 6 8 11 9 8 9 3 9 9 5 722 2. 156, 9 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706063 - RP 3194079 - ID 8919468 10 13 11 9 7 10 11 4 2 2 3 3 2 7 4 2 5 14 8 12 24 8 8 7 6 WM Jun 13 -Aug 13 3 5 6 30 9 14 5 3 14 14 4 TDRY Jun 13 -Aug 13 8 15 14 8 5 10 10 7 38 10 5 8 13 28 7 8 4 12 11 14 20 8 45 10 4 8 MWO REFRIGERATION DISW. Jun 13 -Aug 13 3 5 7 Sales Ths. Un. SALES MIO. ZAR BI HOBS Jun 13 -Aug 13 5 13 COOKING Jun 13 -Aug 13 Sales Value % 5 9 19 10 8 4 21 3 101 382, 7 47 95, 7 37 49, 5 164 169, 2 168 797, 7 19 86, 5 132 412, 9 17 54, 2

Sophisticated market structure requires multiple price points / features necessary per category to reach the South African consumer. Major Appliances Gf. K Panelmarket South Africa Total Jun 13 -Aug 13 >=10. 000 ZAR 9. 000 < 10. 000 ZAR 8. 000 < 9. 000 ZAR 7. 000 < 8. 000 ZAR 6. 000 < 7. 000 ZAR 5. 000 < 6. 000 ZAR 4. 000 < 5. 000 ZAR 3500 - 3999 ZAR 3000 - 3499 ZAR 2500 - 2999 ZAR 2000 - 2499 ZAR 1500 - 1999 ZAR 1000 - 1499 ZAR 0 - 999 ZAR HOODS Jun 13 -Aug 13 8 16 4 3 5 3 4 5 6 8 11 9 8 9 3 9 9 5 722 2. 156, 9 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706063 - RP 3194079 - ID 8919468 10 13 11 9 7 10 11 4 2 2 3 3 2 7 4 2 5 14 8 12 24 8 8 7 6 WM Jun 13 -Aug 13 3 5 6 30 9 14 5 3 14 14 4 TDRY Jun 13 -Aug 13 8 15 14 8 5 10 10 7 38 10 5 8 13 28 7 8 4 12 11 14 20 8 45 10 4 8 MWO REFRIGERATION DISW. Jun 13 -Aug 13 3 5 7 Sales Ths. Un. SALES MIO. ZAR BI HOBS Jun 13 -Aug 13 5 13 COOKING Jun 13 -Aug 13 Sales Value % 5 9 19 10 8 4 21 3 101 382, 7 47 95, 7 37 49, 5 164 169, 2 168 797, 7 19 86, 5 132 412, 9 17 54, 2

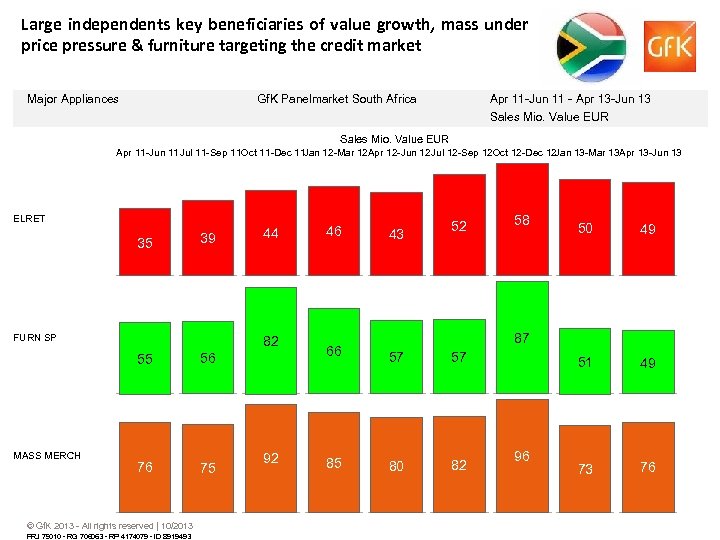

Large independents key beneficiaries of value growth, mass under price pressure & furniture targeting the credit market Major Appliances Gf. K Panelmarket South Africa Apr 11 -Jun 11 - Apr 13 -Jun 13 Sales Mio. Value EUR Apr 11 -Jun 11 Jul 11 -Sep 11 Oct 11 -Dec 11 Jan 12 -Mar 12 Apr 12 -Jun 12 Jul 12 -Sep 12 Oct 12 -Dec 12 Jan 13 -Mar 13 Apr 13 -Jun 13 ELRET 35 39 FURN SP 82 55 MASS MERCH 44 56 76 75 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706063 - RP 4174079 - ID 8919493 92 46 43 52 58 50 49 51 49 73 76 87 66 57 57 85 80 82 96

Large independents key beneficiaries of value growth, mass under price pressure & furniture targeting the credit market Major Appliances Gf. K Panelmarket South Africa Apr 11 -Jun 11 - Apr 13 -Jun 13 Sales Mio. Value EUR Apr 11 -Jun 11 Jul 11 -Sep 11 Oct 11 -Dec 11 Jan 12 -Mar 12 Apr 12 -Jun 12 Jul 12 -Sep 12 Oct 12 -Dec 12 Jan 13 -Mar 13 Apr 13 -Jun 13 ELRET 35 39 FURN SP 82 55 MASS MERCH 44 56 76 75 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706063 - RP 4174079 - ID 8919493 92 46 43 52 58 50 49 51 49 73 76 87 66 57 57 85 80 82 96

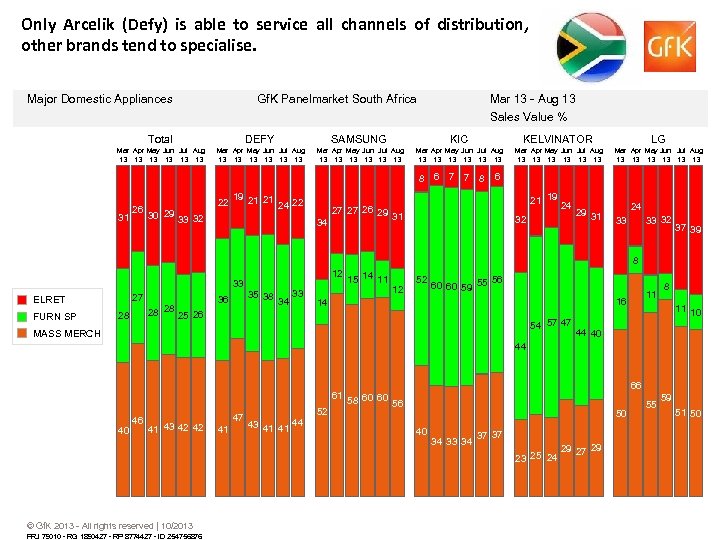

Only Arcelik (Defy) is able to service all channels of distribution, other brands tend to specialise. Major Domestic Appliances Gf. K Panelmarket South Africa Mar 13 - Aug 13 Sales Value % Total DEFY SAMSUNG KIC KELVINATOR LG Mar Apr May Jun Jul Aug 13 13 13 13 13 13 Mar Apr May Jun Jul Aug 13 13 13 8 6 7 7 8 6 31 26 22 30 29 33 32 19 21 21 24 22 34 21 19 24 27 27 26 29 31 32 29 31 24 33 32 33 37 39 8 33 27 ELRET FURN SP 28 28 28 25 26 36 12 33 35 38 34 15 14 11 12 52 56 60 60 59 55 11 16 14 54 57 47 MASS MERCH 8 11 10 44 40 44 61 40 46 41 43 42 42 47 41 52 43 41 41 44 66 58 60 60 56 50 40 34 33 34 37 37 23 25 24 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 1890427 - RP 8774427 - ID 254756876 29 27 29 55 59 51 50

Only Arcelik (Defy) is able to service all channels of distribution, other brands tend to specialise. Major Domestic Appliances Gf. K Panelmarket South Africa Mar 13 - Aug 13 Sales Value % Total DEFY SAMSUNG KIC KELVINATOR LG Mar Apr May Jun Jul Aug 13 13 13 13 13 13 Mar Apr May Jun Jul Aug 13 13 13 8 6 7 7 8 6 31 26 22 30 29 33 32 19 21 21 24 22 34 21 19 24 27 27 26 29 31 32 29 31 24 33 32 33 37 39 8 33 27 ELRET FURN SP 28 28 28 25 26 36 12 33 35 38 34 15 14 11 12 52 56 60 60 59 55 11 16 14 54 57 47 MASS MERCH 8 11 10 44 40 44 61 40 46 41 43 42 42 47 41 52 43 41 41 44 66 58 60 60 56 50 40 34 33 34 37 37 23 25 24 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 1890427 - RP 8774427 - ID 254756876 29 27 29 55 59 51 50

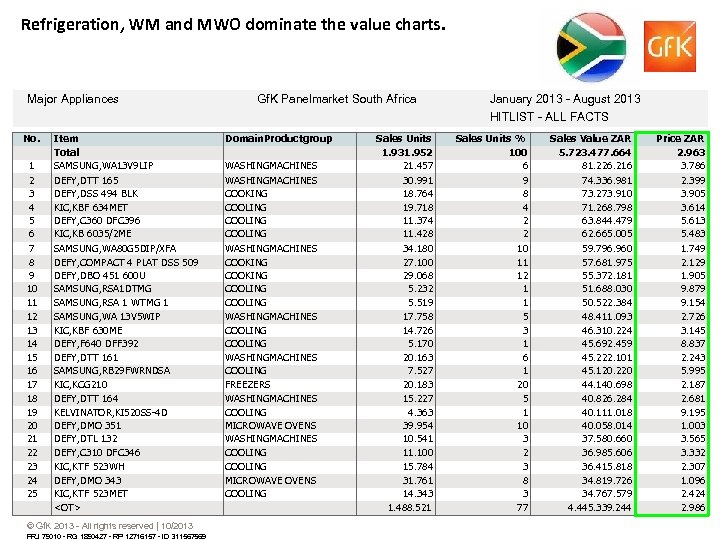

Refrigeration, WM and MWO dominate the value charts. Major Appliances No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Item Total SAMSUNG, WA 13 V 9 LIP DEFY, DTT 165 DEFY, DSS 494 BLK KIC, KBF 634 MET DEFY, C 360 DFC 396 KIC, KB 6035/2 ME SAMSUNG, WA 80 G 5 DIP/XFA DEFY, COMPACT 4 PLAT DSS 509 DEFY, DBO 451 600 U SAMSUNG, RSA 1 DTMG SAMSUNG, RSA 1 WTMG 1 SAMSUNG, WA 13 V 5 WIP KIC, KBF 630 ME DEFY, F 640 DFF 392 DEFY, DTT 161 SAMSUNG, RB 29 FWRNDSA KIC, KCG 210 DEFY, DTT 164 KELVINATOR, KI 520 SS-4 D DEFY, DMO 351 DEFY, DTL 132 DEFY, C 310 DFC 346 KIC, KTF 523 WH DEFY, DMO 343 KIC, KTF 523 MET

Refrigeration, WM and MWO dominate the value charts. Major Appliances No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Item Total SAMSUNG, WA 13 V 9 LIP DEFY, DTT 165 DEFY, DSS 494 BLK KIC, KBF 634 MET DEFY, C 360 DFC 396 KIC, KB 6035/2 ME SAMSUNG, WA 80 G 5 DIP/XFA DEFY, COMPACT 4 PLAT DSS 509 DEFY, DBO 451 600 U SAMSUNG, RSA 1 DTMG SAMSUNG, RSA 1 WTMG 1 SAMSUNG, WA 13 V 5 WIP KIC, KBF 630 ME DEFY, F 640 DFF 392 DEFY, DTT 161 SAMSUNG, RB 29 FWRNDSA KIC, KCG 210 DEFY, DTT 164 KELVINATOR, KI 520 SS-4 D DEFY, DMO 351 DEFY, DTL 132 DEFY, C 310 DFC 346 KIC, KTF 523 WH DEFY, DMO 343 KIC, KTF 523 MET

Consumer electronics: booming sales & price erosion.

Consumer electronics: booming sales & price erosion.

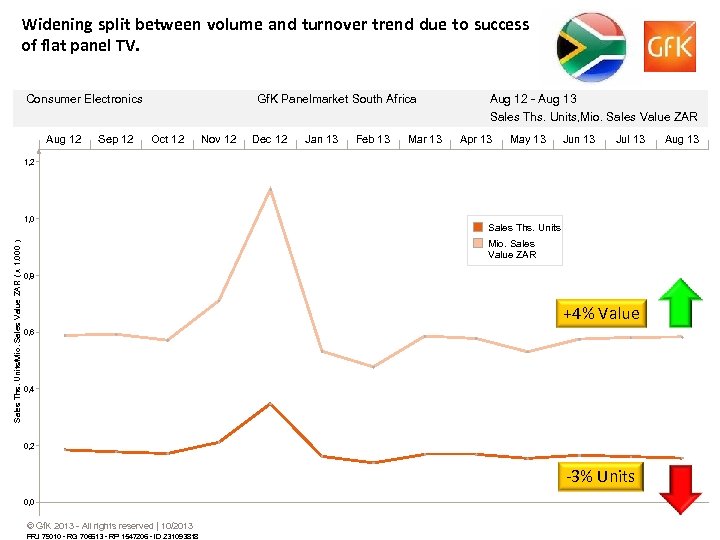

Widening split between volume and turnover trend due to success of flat panel TV. Consumer Electronics Aug 12 Sep 12 Gf. K Panelmarket South Africa Oct 12 Nov 12 Dec 12 Jan 13 Feb 13 Mar 13 Aug 12 - Aug 13 Sales Ths. Units, Mio. Sales Value ZAR Apr 13 May 13 Jun 13 Jul 13 1, 2 Sales Ths. U nits/Mio. Sales Value ZAR ( x 1. 000 ) 1, 0 Sales Ths. Units Mio. Sales Value ZAR 0, 8 +4% Value 0, 6 0, 4 0, 2 -3% Units 0, 0 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706613 - RP 1547206 - ID 231093818 Aug 13

Widening split between volume and turnover trend due to success of flat panel TV. Consumer Electronics Aug 12 Sep 12 Gf. K Panelmarket South Africa Oct 12 Nov 12 Dec 12 Jan 13 Feb 13 Mar 13 Aug 12 - Aug 13 Sales Ths. Units, Mio. Sales Value ZAR Apr 13 May 13 Jun 13 Jul 13 1, 2 Sales Ths. U nits/Mio. Sales Value ZAR ( x 1. 000 ) 1, 0 Sales Ths. Units Mio. Sales Value ZAR 0, 8 +4% Value 0, 6 0, 4 0, 2 -3% Units 0, 0 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706613 - RP 1547206 - ID 231093818 Aug 13

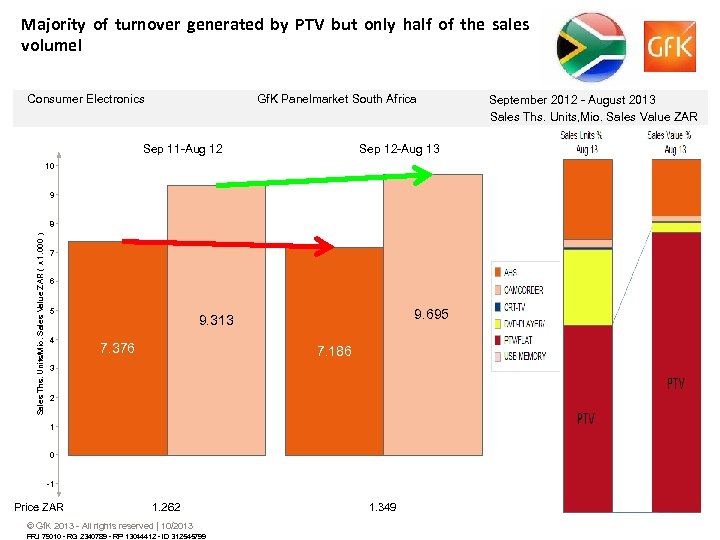

Majority of turnover generated by PTV but only half of the sales volume! Consumer Electronics Gf. K Panelmarket South Africa Sep 11 -Aug 12 Sep 12 -Aug 13 10 9 Sales Ths. Units/M io. Sales Value Z AR ( x 1. 000 ) 8 7 6 5 4 9. 695 9. 313 7. 376 7. 186 3 2 1 0 -1 Price ZAR 1. 262 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2340789 - RP 13044412 - ID 312545799 1. 349 September 2012 - August 2013 Sales Ths. Units, Mio. Sales Value ZAR

Majority of turnover generated by PTV but only half of the sales volume! Consumer Electronics Gf. K Panelmarket South Africa Sep 11 -Aug 12 Sep 12 -Aug 13 10 9 Sales Ths. Units/M io. Sales Value Z AR ( x 1. 000 ) 8 7 6 5 4 9. 695 9. 313 7. 376 7. 186 3 2 1 0 -1 Price ZAR 1. 262 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2340789 - RP 13044412 - ID 312545799 1. 349 September 2012 - August 2013 Sales Ths. Units, Mio. Sales Value ZAR

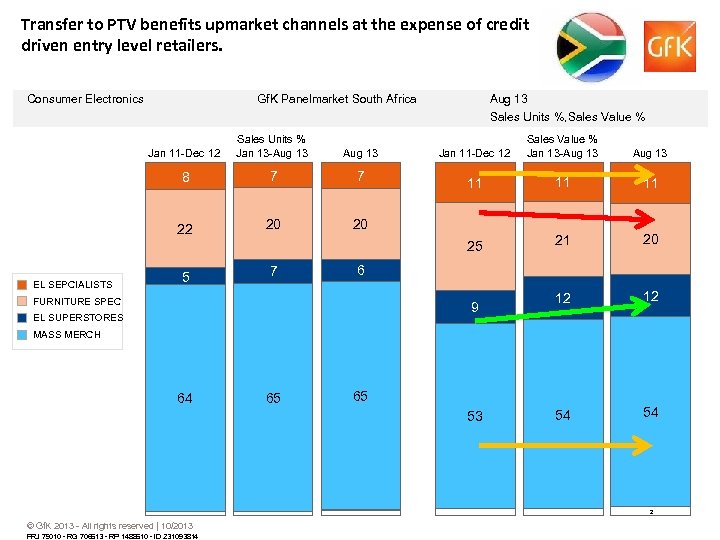

Transfer to PTV benefits upmarket channels at the expense of credit driven entry level retailers. Consumer Electronics Gf. K Panelmarket South Africa Jan 11 -Dec 12 Aug 13 8 7 7 22 20 20 5 7 Jan 11 -Dec 12 Sales Value % Jan 13 -Aug 13 11 11 11 25 EL SEPCIALISTS Sales Units % Jan 13 -Aug 13 Sales Units %, Sales Value % 21 20 12 12 54 54 6 FURNITURE SPEC 9 EL SUPERSTORES MASS MERCH 64 65 65 53 2 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706613 - RP 1488610 - ID 231093814

Transfer to PTV benefits upmarket channels at the expense of credit driven entry level retailers. Consumer Electronics Gf. K Panelmarket South Africa Jan 11 -Dec 12 Aug 13 8 7 7 22 20 20 5 7 Jan 11 -Dec 12 Sales Value % Jan 13 -Aug 13 11 11 11 25 EL SEPCIALISTS Sales Units % Jan 13 -Aug 13 Sales Units %, Sales Value % 21 20 12 12 54 54 6 FURNITURE SPEC 9 EL SUPERSTORES MASS MERCH 64 65 65 53 2 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706613 - RP 1488610 - ID 231093814

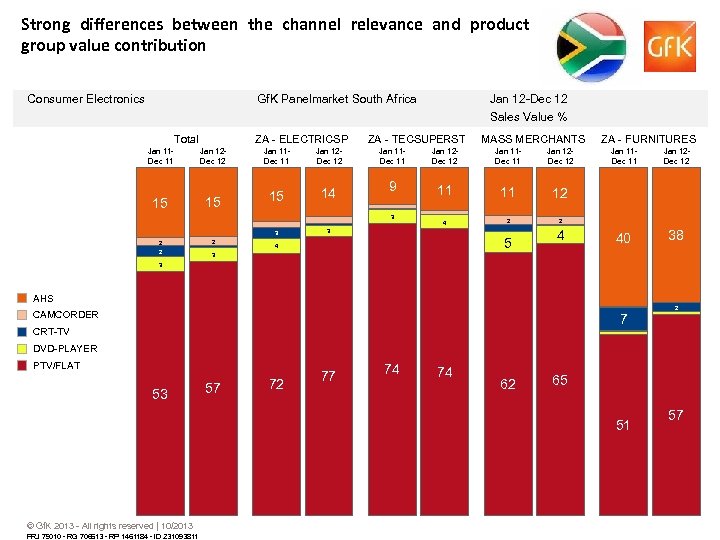

Strong differences between the channel relevance and product group value contribution Consumer Electronics Gf. K Panelmarket South Africa Total Jan 11 Dec 11 15 ZA - ELECTRICSP Jan 12 Dec 12 15 Jan 11 Dec 11 Jan 12 Dec 12 15 14 ZA - TECSUPERST 2 2 2 MASS MERCHANTS Jan 11 Dec 11 Jan 12 Dec 12 9 11 11 4 2 ZA - FURNITURES 12 2 3 3 Jan 12 -Dec 12 Sales Value % 3 5 4 Jan 11 Dec 11 Jan 12 Dec 12 40 38 3 4 3 AHS 2 CAMCORDER 7 CRT-TV DVD-PLAYER PTV/FLAT 53 57 72 77 74 74 62 65 51 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706613 - RP 1461184 - ID 231093811 57

Strong differences between the channel relevance and product group value contribution Consumer Electronics Gf. K Panelmarket South Africa Total Jan 11 Dec 11 15 ZA - ELECTRICSP Jan 12 Dec 12 15 Jan 11 Dec 11 Jan 12 Dec 12 15 14 ZA - TECSUPERST 2 2 2 MASS MERCHANTS Jan 11 Dec 11 Jan 12 Dec 12 9 11 11 4 2 ZA - FURNITURES 12 2 3 3 Jan 12 -Dec 12 Sales Value % 3 5 4 Jan 11 Dec 11 Jan 12 Dec 12 40 38 3 4 3 AHS 2 CAMCORDER 7 CRT-TV DVD-PLAYER PTV/FLAT 53 57 72 77 74 74 62 65 51 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 706613 - RP 1461184 - ID 231093811 57

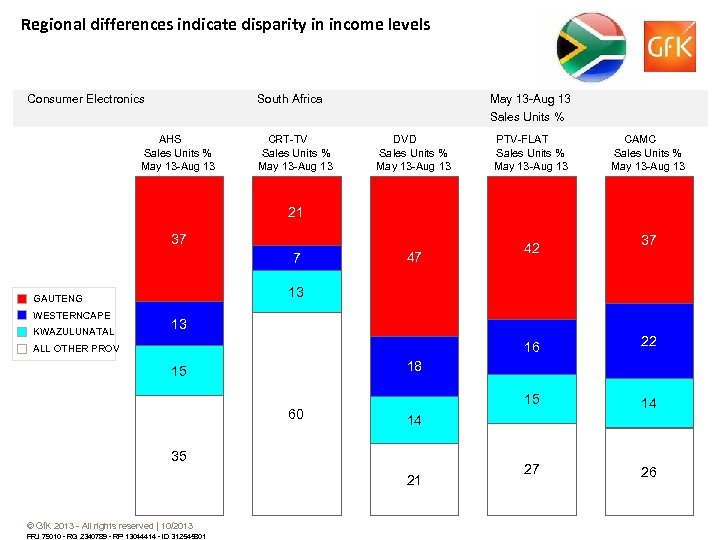

Regional differences indicate disparity in income levels Consumer Electronics South Africa AHS Sales Units % May 13 -Aug 13 CRT-TV Sales Units % May 13 -Aug 13 Sales Units % DVD Sales Units % May 13 -Aug 13 PTV-FLAT Sales Units % May 13 -Aug 13 CAMC Sales Units % May 13 -Aug 13 21 37 7 KWAZULUNATAL 37 13 GAUTENG WESTERNCAPE 47 42 13 16 60 27 26 14 35 21 PRJ 79010 - RG 2340789 - RP 13044414 - ID 312545801 14 18 15 © Gf. K 2013 - All rights reserved | 10/2013 22 15 ALL OTHER PROV

Regional differences indicate disparity in income levels Consumer Electronics South Africa AHS Sales Units % May 13 -Aug 13 CRT-TV Sales Units % May 13 -Aug 13 Sales Units % DVD Sales Units % May 13 -Aug 13 PTV-FLAT Sales Units % May 13 -Aug 13 CAMC Sales Units % May 13 -Aug 13 21 37 7 KWAZULUNATAL 37 13 GAUTENG WESTERNCAPE 47 42 13 16 60 27 26 14 35 21 PRJ 79010 - RG 2340789 - RP 13044414 - ID 312545801 14 18 15 © Gf. K 2013 - All rights reserved | 10/2013 22 15 ALL OTHER PROV

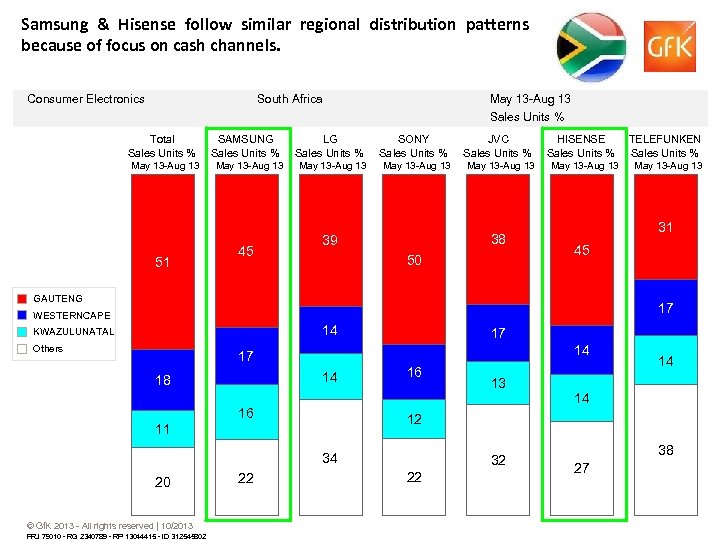

Samsung & Hisense follow similar regional distribution patterns because of focus on cash channels. Consumer Electronics South Africa Total Sales Units % May 13 -Aug 13 51 SAMSUNG Sales Units % May 13 -Aug 13 45 LG Sales Units % May 13 -Aug 13 Sales Units % SONY Sales Units % May 13 -Aug 13 JVC Sales Units % May 13 -Aug 13 38 39 50 HISENSE Sales Units % May 13 -Aug 13 TELEFUNKEN Sales Units % May 13 -Aug 13 31 45 GAUTENG 17 WESTERNCAPE 14 KWAZULUNATAL Others 17 14 18 16 16 34 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2340789 - RP 13044415 - ID 312545802 22 14 12 11 20 13 14 32 22 38 27

Samsung & Hisense follow similar regional distribution patterns because of focus on cash channels. Consumer Electronics South Africa Total Sales Units % May 13 -Aug 13 51 SAMSUNG Sales Units % May 13 -Aug 13 45 LG Sales Units % May 13 -Aug 13 Sales Units % SONY Sales Units % May 13 -Aug 13 JVC Sales Units % May 13 -Aug 13 38 39 50 HISENSE Sales Units % May 13 -Aug 13 TELEFUNKEN Sales Units % May 13 -Aug 13 31 45 GAUTENG 17 WESTERNCAPE 14 KWAZULUNATAL Others 17 14 18 16 16 34 © Gf. K 2013 - All rights reserved | 10/2013 PRJ 79010 - RG 2340789 - RP 13044415 - ID 312545802 22 14 12 11 20 13 14 32 22 38 27

Thank You!

Thank You!