6d1687391c86fd11110d0f1bcc5cab6d.ppt

- Количество слайдов: 7

Can/Am Exchange Cross-Border Investing, Capital Sourcing and Deal Syndication September 30, 2009

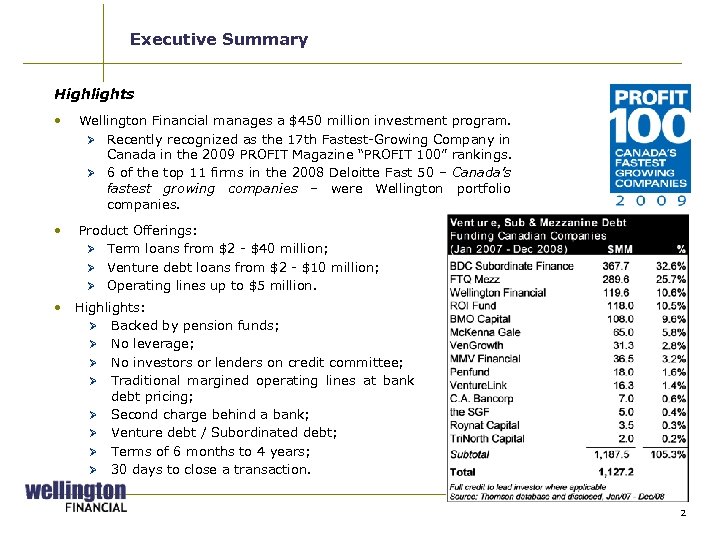

Executive Summary Highlights • Wellington Financial manages a $450 million investment program. Ø Recently recognized as the 17 th Fastest-Growing Company in Canada in the 2009 PROFIT Magazine “PROFIT 100” rankings. Ø 6 of the top 11 firms in the 2008 Deloitte Fast 50 – Canada’s fastest growing companies – were Wellington portfolio companies. • Product Offerings: Ø Term loans from $2 - $40 million; Ø Venture debt loans from $2 - $10 million; Ø Operating lines up to $5 million. • Highlights: Ø Backed by pension funds; Ø No leverage; Ø No investors or lenders on credit committee; Ø Traditional margined operating lines at bank debt pricing; Ø Second charge behind a bank; Ø Venture debt / Subordinated debt; Ø Terms of 6 months to 4 years; Ø 30 days to close a transaction. 2

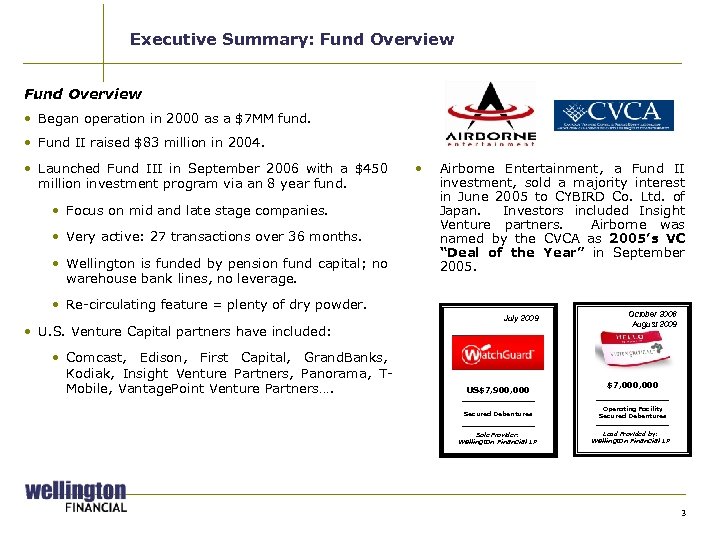

Executive Summary: Fund Overview • Began operation in 2000 as a $7 MM fund. • Fund II raised $83 million in 2004. • Launched Fund III in September 2006 with a $450 million investment program via an 8 year fund. • Focus on mid and late stage companies. • Very active: 27 transactions over 36 months. • Wellington is funded by pension fund capital; no warehouse bank lines, no leverage. • Airborne Entertainment, a Fund II investment, sold a majority interest in June 2005 to CYBIRD Co. Ltd. of Japan. Investors included Insight Venture partners. Airborne was named by the CVCA as 2005’s VC “Deal of the Year” in September 2005. • Re-circulating feature = plenty of dry powder. July 2009 • U. S. Venture Capital partners have included: • Comcast, Edison, First Capital, Grand. Banks, Kodiak, Insight Venture Partners, Panorama, TMobile, Vantage. Point Venture Partners…. US$7, 900, 000 Secured Debentures Sole Provider: Wellington Financial LP October 2006 August 2009 $7, 000 Operating Facility Secured Debentures Lead Provided by: Wellington Financial LP 3

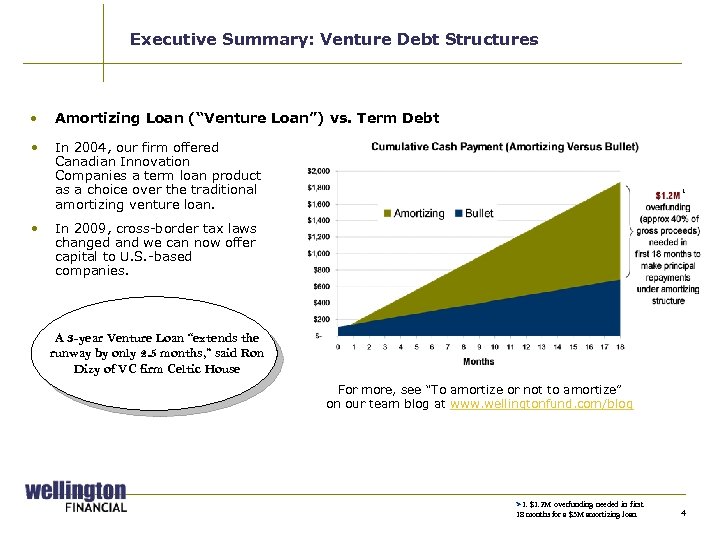

Executive Summary: Venture Debt Structures • Amortizing Loan (“Venture Loan”) vs. Term Debt • In 2004, our firm offered Canadian Innovation Companies a term loan product as a choice over the traditional amortizing venture loan. • 1 In 2009, cross-border tax laws changed and we can now offer capital to U. S. -based companies. A 3 -year Venture Loan “extends the runway by only 2. 5 months, ” said Ron Dizy of VC firm Celtic House For more, see “To amortize or not to amortize” on our team blog at www. wellingtonfund. com/blog Ø 1. $1. 2 M overfunding needed in first 18 months for a $3 M amortizing loan. 4

Cross-Border Investing, Capital Sourcing and Syndication Good News • Canada is open for business. • Governments are trying to be supportive of the “Innovation Economy” • 85 disclosed cross-border investments since January 2008. • Foreign VC investments over the past 12 weeks include: Ø Intel Capital – Trans. Gaming (Toronto) Ø Auctus - Capital Reserve Canada (Edmonton) Ø Lothian and Orbi. Med – Enobia Pharma (Montreal) – US$50 million round Ø Braemar Energy Ventures - General Fusion (Burnaby) - US$22 million round Ø Lime Rock Partner - Pan. Geo Subsea (St. John’s) - $11 million Ø General Catalyst Partners – Quick. Play Media (Toronto) Ø Granite Ventures - Indicee (Vancouver) Ø Grand. Banks – I Love Rewards (Toronto) - $8. 7 million round • Active M&A market: Ø September: CSA acquired DISTIL Interactive Ø September: Sabse acquired Mobivox Ø August: Intel acquired Rapid. Mind Ø August: Broadview Networks acquired New. Step Networks Ø July: Watch. Guard acquired Border. Ware Technologies Ø June: Integrated acquired Tundra Semi for $121 million Ø May: Vertex acquired Viro. Chem for US$420 million 5

Cross-Border Investing, Capital Sourcing and Syndication More Good News • Not one Canadian bank required a single dollar of government support. • Economy already out of recession, according to the Bank of Canada. • Canadian stock market welcomes smaller technology stories: Ø A $100 million market cap. company might have 3 or 4 equity research analysts. Ø A $250 million mkt. cap. company could expect 6 analysts to cover it. • Equity offering window is also open on our side of the border: Ø Onex just sold >$100 million of Celestica shares; Ø VC-backed Dragon. Wave just announced a $105 million treasury and secondary offering (60/40), coincident with a NASDAQ listing. Dragon. Wave went public in 2007 and the VCs are getting liquidity 100% above the original IPO price. • $12 billion goes into Science & Technology each year from governments alone. • Canadian IT and Communications Tech sectors employ more than 500, 000 people. • Canadian Fund of Funds have lots of capital to invest in U. S. VC funds: Ø EDC ($1. 2 billion), Teralys ($700 million), OVCF ($205 million)…. 6

Cross-Border Investing, Capital Sourcing and Syndication “Bad” News / Opportunities • Venture capital investments hit a 14 year low this year. • Several LP/GP structured funds may not be able to raise their next fund. Ø Some teams are splintering. • Ontario government has sunset the $1 billion Retail Venture Capital Industry. • U. S. venture market saw US$25 billion invested in 2008, while Canada saw just $1. 3 billion (5%), even though our economy is about 1/12 of the USA’s. • Canada needs more capital sources. Ø The current environment presents a wonderful opportunity for U. S. VCs to partner with great Canadian private companies that have already had one or two rounds of external financing. • Challenges exist primarily across early and mid stages. • “Section 116” was fixed in 2008 Federal Budget, but fine-tuning of actual legal wording continues. • Fewer Canadian VCs down the road may mean fewer opportunities to partner on, or just a higher percentage of high quality deals. 7

6d1687391c86fd11110d0f1bcc5cab6d.ppt