eadd15fe38b587bcc29aa5e593fff971.ppt

- Количество слайдов: 41

Callaway Golf Company By: Seth Fraser, Megan Foreman, and Corey Daigle

Overview • Brief History of Callaway Golf • Where we are now • New Vision and Mission • External Analysis – CPM – EFE – Summary • Internal Analysis – IFE – Financial ratio analysis – Net Worth Analysis – Summary • Strategic Analysis – SWOT Matrix – SPACE – Grand Strategy Matrix – IE matrix • Possible strategies – QSPM • Recommendations – Strategic implementation and desired results – Annual objectives (goal) and polices • Evaluation Procedure

History of Callaway Golf • 1981 Ely Callaway sells wine vineyard for 14 million dollars • 83’ Ely renames the company Callaway Hickory Stick USA • 85’ Company moves to Carlsbad, CA • 86’ Callaway becomes first company to use computer controlled machines to insure flatness of the clubs, along with new and innovative designs • 88’ Company renames its self Callaway Golf Company • 89’ Introduce traditional sized steel clubs

History of Callaway Golf • 90’ Callaway drivers are number one on senior PGA tour • 92’ Callaway become publicly traded on NYSE under symbol ELY • 95’ Callaway becomes number one manufacturer of sales in woods and irons • 96’ Callaway becomes worlds largest manufacturer of clubs • 97’ Callaway acquires Odyssey Sports • 99’ Titanium drivers are introduced in Asia and Europe • 02’ Callaway lunches HX Golf Balls

Callaway Golf Today • Callaway uses cutting edge technology to manufacture the world’s longest driver (the Big Bertha) • Along with men's golf accessories and apparel they offer a large selection to women • Callaway also offers a Fantasy Golf Challenge via the internet which offers Callaway products as prizes

Callaway Golf Today • Callaway offers a golf magazine which has details on the number one players, courses and tips on golf • Callaway also offers free donations to the under privileged and to better health benefits such the under insured along with employee volunteering • As well Callaway offers great benefits and services to their employees • http: //www. callawaygolf. com/en/customerservice. aspx? pid=sitemap

Vision Statement One good shot is not enough.

Mission Statement At Callaway Golf, we make golf equipment for players world wide who think that hitting just one great shot is not enough. We believe technology is a powerful tool for creating userfriendly equipment that can help golfers of all styles and skill levels enjoy the game- and maybe a few more great shots along the way.

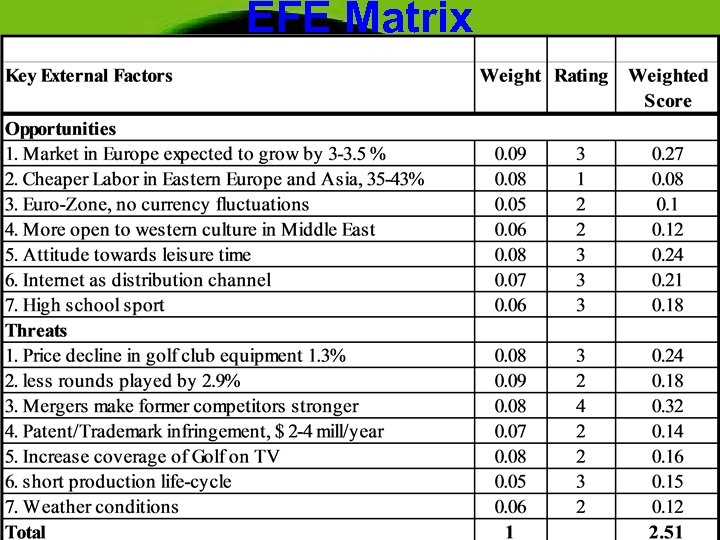

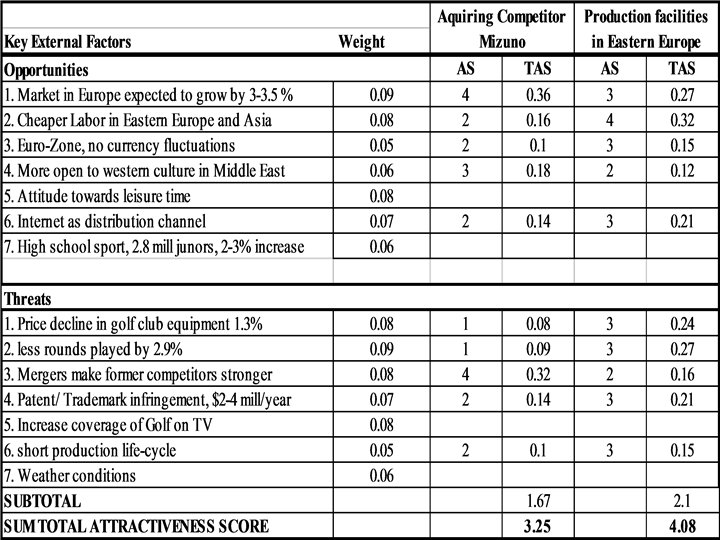

External Analysis Opportunities 1. Market in Europe expected to grow by 33. 5% 2. 35% -43% Cheaper Labor in Eastern Europe and Asia 3. Euro-Zone, no currency fluctuations 4. More open to western culture in the Middle East 5. Attitude towards leisure time 6. Internet as distribution channel 7. High school sport, 2. 8 mill Juniors, 2 -3% increase

External Analysis Threats 1. Price decline in golf club equipment 1. 3% 2. Less rounds played by 2. 9% 3. Mergers make former competitors stronger 4. Patent/Trademark infringement, $ 2 -4 mill/year 5. Increase coverage of Golf on TV 6. Short production life-cycle 7. Weather conditions

EFE Matrix

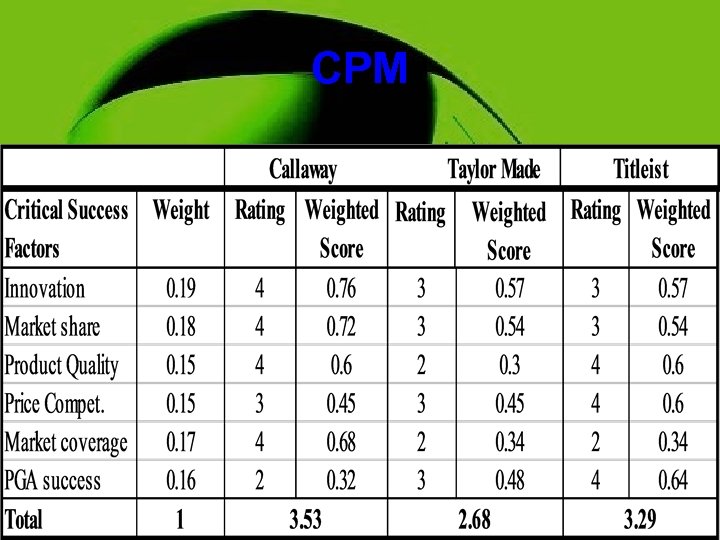

CPM

External Analysis Summary • At what point does market saturation occur in domestic and foreign markets • Cheaper labor in Asia and Eastern Europe • Short production life-cycle • Mergers make former competitors stronger • Internet as distribution channel • Marketing channels • Attitude towards leisure time • Consumer interest is getting younger and younger (high school)

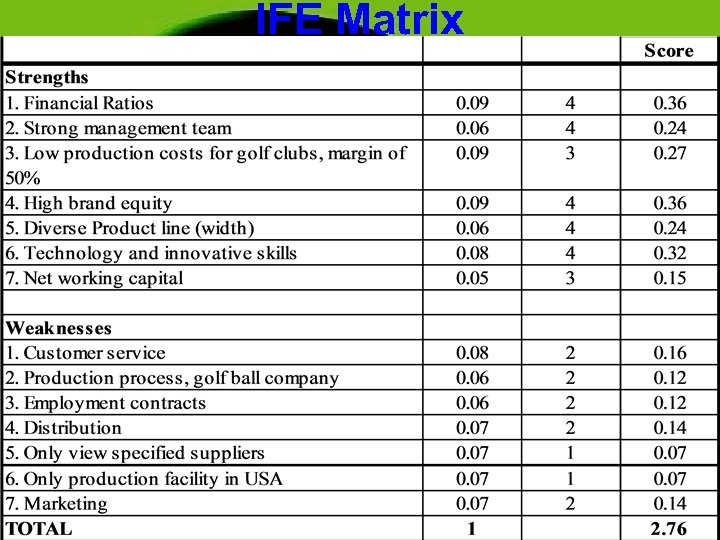

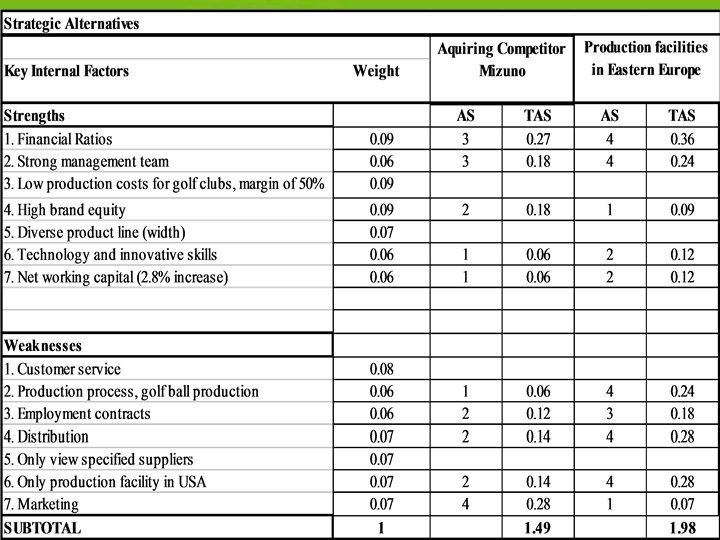

Internal Analysis Strengths 1. Financial ratios 2. Strong management team 3. Profit margin of 50%, low cost production 4. High brand equity 5. Diverse product line (width) 6. Technology and innovative skills 7. Net working capital( 2. 8% increase)

Internal Analysis Weaknesses 1. Customer service 2. Production process, golf ball company 3. Employment contracts 4. Distribution 5. Only view specified suppliers 6. Only production facility in USA 7. Marketing

IFE Matrix

Financial Ratio Analysis Company Industry Sector S&P 500 Valuation Ratios P/E Ratio (TTM) 25. 36 20. 11 20. 86 24. 01 P/E High - Last 5 Yrs 26. 90 43. 52 37. 56 45. 41 P/E Low - Last 5 Yrs 10. 82 14. 06 10. 28 16. 26 Beta 1. 45 0. 84 1. 05 1. 00 Price to Sales (TTM) 1. 44 2. 21 1. 19 3. 33 Price to Book (MRQ) 2. 00 3. 94 3. 21 4. 29 Price to Tangible Book (MRQ) 2. 81 6. 67 6. 04 7. 56 Price to Cash Flow (TTM) 12. 98 14. 31 11. 18 17. 32 Price to Free Cash Flow (TTM) 12. 65 24. 93 24. 73 28. 97 % Owned Institutions 87. 07 56. 96 51. 37 64. 19 Dividend Yield 1. 59 1. 32 2. 30 2. 04 Dividend Yield - 5 Yr Avg 1. 70 0. 96 2. 38 1. 48 Dividend 5 Yr Growth Rate 0. 00 7. 13 -3. 77 6. 48 Payout Ratio (TTM) 40. 06 16. 59 25. 54 26. 78 Dividends

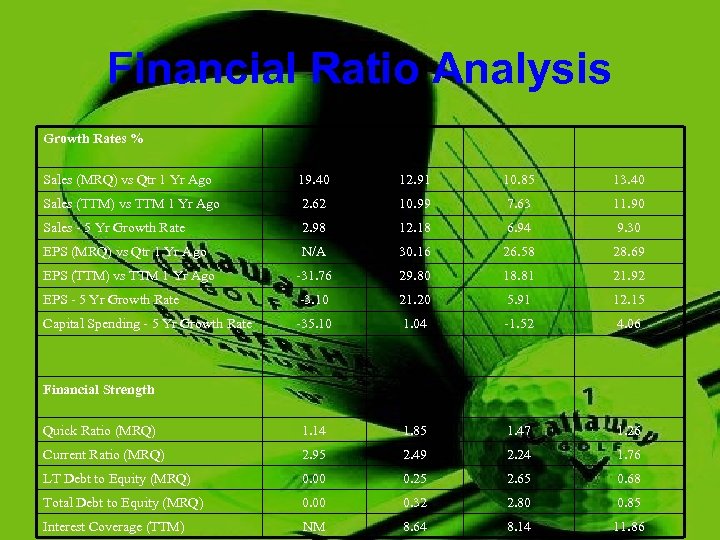

Financial Ratio Analysis Growth Rates % Sales (MRQ) vs Qtr 1 Yr Ago 19. 40 12. 91 10. 85 13. 40 Sales (TTM) vs TTM 1 Yr Ago 2. 62 10. 99 7. 63 11. 90 Sales - 5 Yr Growth Rate 2. 98 12. 18 6. 94 9. 30 EPS (MRQ) vs Qtr 1 Yr Ago N/A 30. 16 26. 58 28. 69 EPS (TTM) vs TTM 1 Yr Ago -31. 76 29. 80 18. 81 21. 92 EPS - 5 Yr Growth Rate -3. 10 21. 20 5. 91 12. 15 Capital Spending - 5 Yr Growth Rate -35. 10 1. 04 -1. 52 4. 06 Quick Ratio (MRQ) 1. 14 1. 85 1. 47 1. 26 Current Ratio (MRQ) 2. 95 2. 49 2. 24 1. 76 LT Debt to Equity (MRQ) 0. 00 0. 25 2. 65 0. 68 Total Debt to Equity (MRQ) 0. 00 0. 32 2. 80 0. 85 Interest Coverage (TTM) NM 8. 64 8. 14 11. 86 Financial Strength

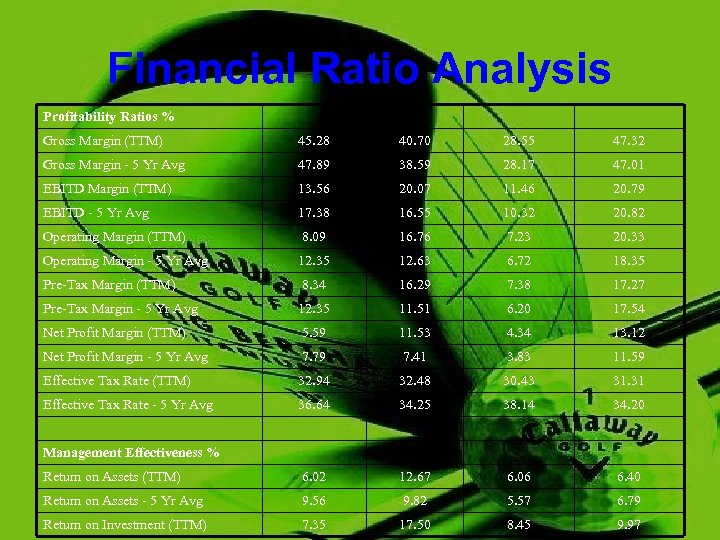

Financial Ratio Analysis Profitability Ratios % Gross Margin (TTM) 45. 28 40. 70 28. 55 47. 32 Gross Margin - 5 Yr Avg 47. 89 38. 59 28. 17 47. 01 EBITD Margin (TTM) 13. 56 20. 07 11. 46 20. 79 EBITD - 5 Yr Avg 17. 38 16. 55 10. 32 20. 82 Operating Margin (TTM) 8. 09 16. 76 7. 23 20. 33 Operating Margin - 5 Yr Avg 12. 35 12. 63 6. 72 18. 35 Pre-Tax Margin (TTM) 8. 34 16. 29 7. 38 17. 27 Pre-Tax Margin - 5 Yr Avg 12. 35 11. 51 6. 20 17. 54 Net Profit Margin (TTM) 5. 59 11. 53 4. 34 13. 12 Net Profit Margin - 5 Yr Avg 7. 79 7. 41 3. 83 11. 59 Effective Tax Rate (TTM) 32. 94 32. 48 30. 43 31. 31 Effective Tax Rate - 5 Yr Avg 36. 64 34. 25 38. 14 34. 20 Return on Assets (TTM) 6. 02 12. 67 6. 06 6. 40 Return on Assets - 5 Yr Avg 9. 56 9. 82 5. 57 6. 79 Return on Investment (TTM) 7. 35 17. 50 8. 45 9. 97 Management Effectiveness %

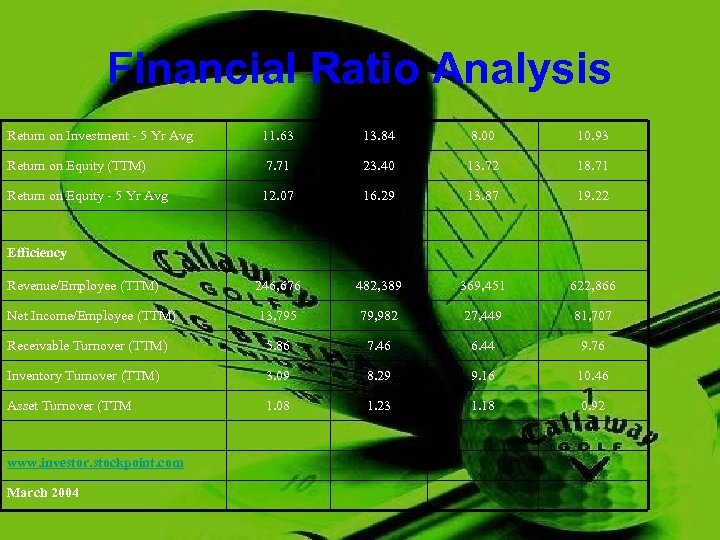

Financial Ratio Analysis Return on Investment - 5 Yr Avg 11. 63 13. 84 8. 00 10. 93 Return on Equity (TTM) 7. 71 23. 40 13. 72 18. 71 Return on Equity - 5 Yr Avg 12. 07 16. 29 13. 87 19. 22 Revenue/Employee (TTM) 246, 676 482, 389 369, 451 622, 866 Net Income/Employee (TTM) 13, 795 79, 982 27, 449 81, 707 Receivable Turnover (TTM) 5. 86 7. 46 6. 44 9. 76 Inventory Turnover (TTM) 3. 09 8. 29 9. 16 10. 46 Asset Turnover (TTM 1. 08 1. 23 1. 18 0. 92 Efficiency www. investor. stockpoint. com March 2004

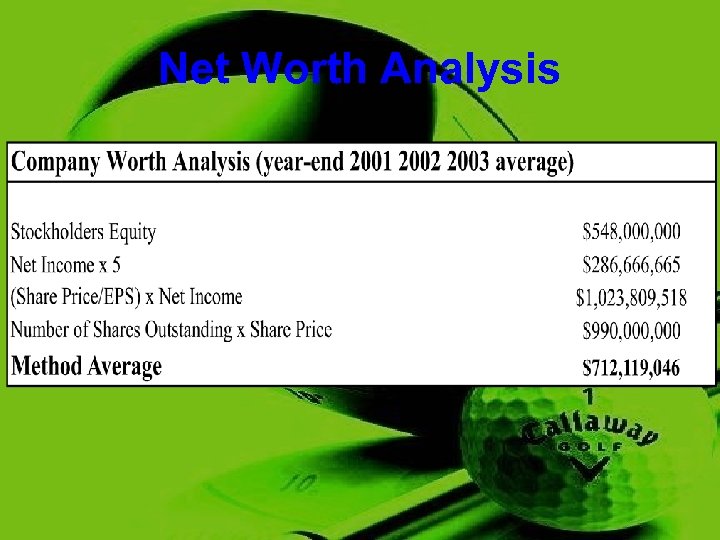

Net Worth Analysis

Stock Performance

Internal Analysis Summary • • • Strong Financials New Working Capital Increasing Profit Margin of 50% Weak marketing campaign Weak Distribution Channels

SWOT Matrix • S-O Strategies 1. Expand production into Eastern Europe 2. Open selected Callaway shops around the world • W-O Strategies 1. Start Callaway Online shop 2. Callaway Golf Camps

• • S-T Strategies 1. Improve Production 2. Callaway Golf Camps 3. Acquire competitors like Mizuno W-T Strategies 1. Move Marketing Channels 1. Select personalities for endorsements 2. Buy golf ball manufacturer 3. Backward integration

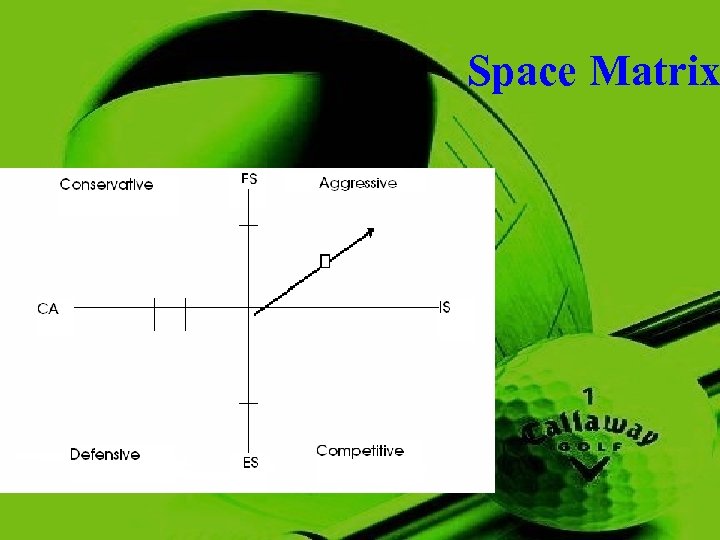

Space Matrix

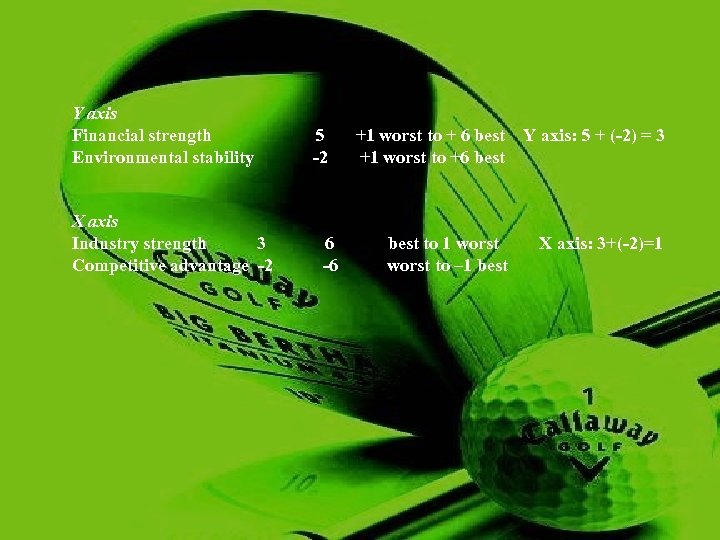

Y axis Financial strength Environmental stability X axis Industry strength 3 Competitive advantage -2 5 -2 6 -6 +1 worst to + 6 best +1 worst to +6 best Y axis: 5 + (-2) = 3 best to 1 worst to – 1 best X axis: 3+(-2)=1

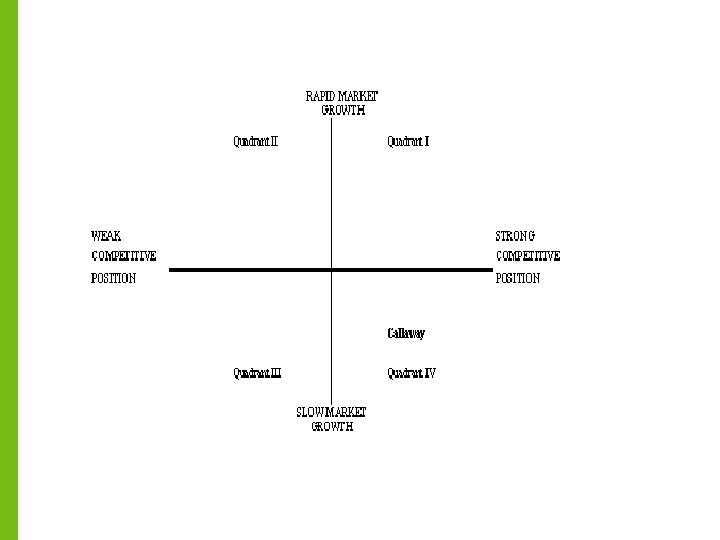

Grand Strategy Matrix

The Internal-External IE Matrix

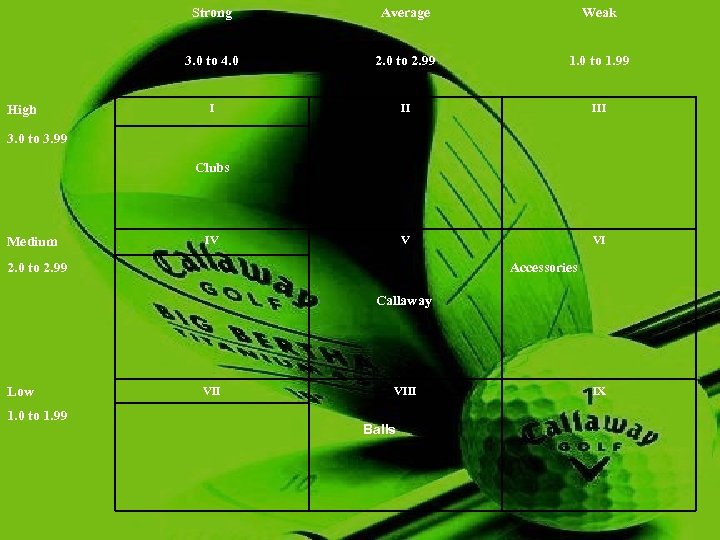

IE Information Clubs Revenues 84% Balls Accessories 8% 8%

Strong Weak 3. 0 to 4. 0 High Average 2. 0 to 2. 99 1. 0 to 1. 99 I II III V VI 3. 0 to 3. 99 Clubs Medium IV 2. 0 to 2. 99 Accessories Callaway Low 1. 0 to 1. 99 VIII Balls IX

Possible Strategies • Expand into East Europe • Open Selected Callaway shops around the world • Start Callaway online shopping • Move marketing channels • Select personalities for endorsements • Improve Production • Acquire competitors like Mizuno • Callaway Golf camps • Backward integration

QSPM

Primary Strategies 1. Improve production 2. Acquire competitors Recommendations Secondary Strategy 1. Expand into Eastern Europe 2. Open worldwide stores 3. Online shop 4. Special Credit cards… 5. Special low air flights… 6. 7. 8. 9. Offer younger customers (high school students) discounts on goods Set up web site for local golf courses (offer arranged tee time) Get in on Frisbee golf Offer competitions for free weekend golf resort

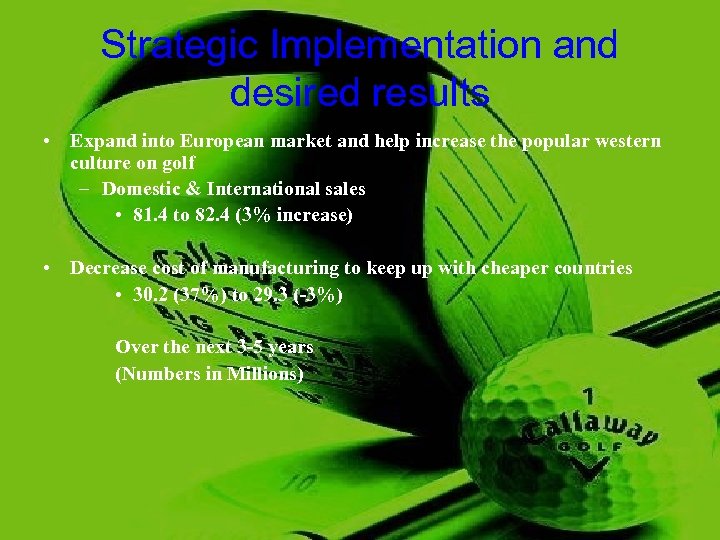

Strategic Implementation and desired results • Expand into European market and help increase the popular western culture on golf – Domestic & International sales • 81. 4 to 82. 4 (3% increase) • Decrease cost of manufacturing to keep up with cheaper countries • 30. 2 (37%) to 29. 3 (-3%) Over the next 3 -5 years (Numbers in Millions)

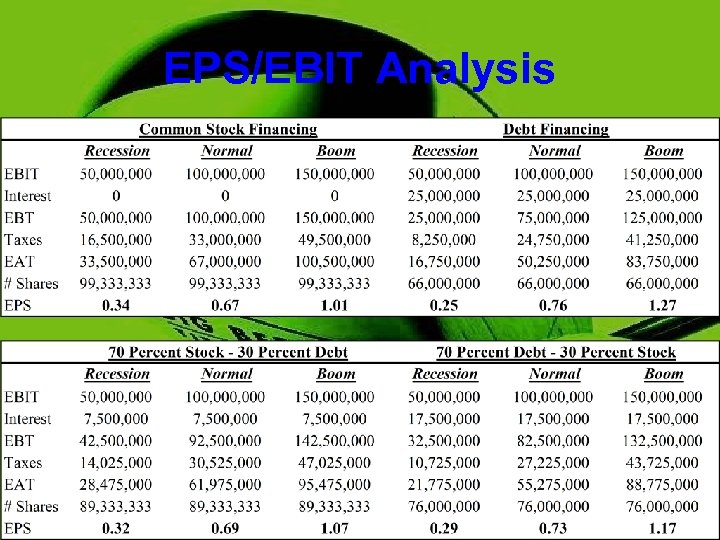

EPS/EBIT Analysis $Amount Needed $500 Million Interest Rate 5% Tax Rate 33% Shares Outstanding Stock Price 66 Million $15. 00

EPS/EBIT Analysis

Evaluations • Qtr & Annual financial reports • Yearly examination by firms head analysts of the company

Callaway in the News • http: //biz. yahoo. com/fool/050425/111445675824. html? . v=1 • http: //us. rd. yahoo. com/finance/freex/smart/SIG= 11 iuhmkjh/*http: //yahoo. smartmoney. com/stock watch/index. cfm? story=20050420&afl=yahoo • http: //us. rd. yahoo. com/finance/external/forbes/SI G=1299 rdilp/*http: //www. forbes. com/facesinthen ews/2005/04/14/0414 autofacescan 01. html? partn er=yahoo&referrer= • http: //biz. yahoo. com/bw/050322/225702_1. html • http: //biz. yahoo. com/bw/050321/215826_1. html

eadd15fe38b587bcc29aa5e593fff971.ppt