5461278f5b5bcda7d6014ecc73bc5899.ppt

- Количество слайдов: 153

CALIFORNIA REAL ESTATE FINAL EXAMS TO BE USED IN PREPARING FOR THE SALESPERSON CALIFORNIA REAL ESTATE LICENSE TEST BY THOMAS E. FELDE 2015

FINAL EXAMINATION A 1. Three of the following real estate terms are closely associated. Which term does not belong with the group? A. Easement B. Lien C. Judgment D. Attachment A. The term “lien”, “judgment” and “attachment” are all liens. An easement is not a lien and does not belong with that group.

A-02 2. A restrictive covenant contained in a deed which prohibits sale to persons of a particular race will: A. Invalidate the conveyance B. Have no effect in the conveyance and the covenant will be unenforceable C. Create the power in the grantee to void the conveyance D. Retain in the grantor the power to enforce the covenant B. Racial restrictions contained in deeds have been outlawed and are now illegal and unenforceable and would have no affect whatsoever.

A-03 3. Protective covenants which place restrictions on grantees of lots in a new subdivision would probably be found in the: A. Original deed held by the subdivider B. Recorded declaration of restrictions C. Zoning codes D. Subdivision Map B. The original subdivider will generally create a number of protective covenants for the buyers of the properties within the subdivision. There are too many of these to list in each deed so he will create a complete list and record that, and that is known as the declaration of restrictions.

A-04 4. When a husband wife hold title to property in joint tenancy, the wife can will: A. One half of the husband’s share B. One half of the entire property C. One half of her share D. None of the property D. Anyone holding an interest in a property as a joint tenant cannot will any part of their share

A-05 5. A joint tenancy estate: A. Is a single estate B. Is an estate in severalty C. Involves real property only D. Involves personal property only A. It is a single estate because the joint tenants hold title as though they collectively constitute one person. Both real and personal property could be held in joint tenancy.

A-06 6. In real estate the word tenancy means: A. Two or more people joined in an enterprise B. A mode of holding ownership C. A tenacious person D. A device B. The word tenancy means a method or mode or means of holding ownership.

A-07 7. If Allen owns a freehold estate, which of the following actions would cause his interest to be converted to a less-than-freehold estate? A. A grant of the mineral and oil rights therein to a third party B. A grant of an easement for right of way over the land C. A leasing of the land for agricultural purposes to a third party for a period of five years D. None of the above D. If Allen holds a freehold estate he is the title holder. Any of the actions listed in choices “A”, “B” or “C” will not remove his title to the estate and he retains his freehold estate.

A-08 8. Three of the following real estate terms are closely associated. Which term does not belong with the group? A. Heir B. Executor C. Sale D. Will C. The terms listed in choices “A”, “B” and “D” refer to wills. The word sale has no relationship with these terms.

A-09 9. Austin deeded Shady Acres to Jones for the life of Baker. Under these circumstances: A. Jones holds a life estate and Austin an estate in remainder B. Jones holds a life estate and Austin an estate in reversion C. Jones holds a fee simple estate and Baker a life estate D. Baker holds a life estate and Jones an estate in remainder B. Jones hold the life estate and since Austin was the original grantor and the property will apparently be returned to him, Austin holds the estate in reversion, not an estate in remainder.

A-10 10. You have agreed to lease a store building from the owner for a period of ten years at a total rental of $12, 000. 00, payable at the monthly rate of $100. $200. 00 must be paid in advance which shall apply to the first and last month’s rent. Considering the terms agreed upon, it would be inappropriate to insert a clause in the terms of this lease covering which of the following? A. Condemnation proceedings B. Third party liability C. Compliance with federal laws D. Escalator clause, tied to the cost of living index D. Since the lease calls for a set amount of rent each month, as escalator clause would not be considered a part of the contract terms.

A-11 11. Which of the following would be appurtenant to land? A. Anything acquired by legal right that is to be used with the land for its benefit B. A right of way over another owner’s adjoining land C. Stock in a mutual water company D. All of the above D. All of the items listed in choices “A”, “B” and “C” are considered to be appurtenant to the land.

A-12 M 12. An individual who receives $225 per month on a money market savings account that pays 7 ½% per year, has invested which of the following amounts: A. $12, 500 B. $27, 000 C. $36, 000 D. $48, 000 C. $225 x 12 = $2700 per year $2700 divided by 7. 5% = $36, 000

A-13 13. A man willed his property to his favorite nephew John, and his wife Jane, giving them a 2/3 and 1/3 interest respectively with the right of survivorship. Title would be held by John and Jane as: A. Joint tenants B. Community property C. Tenants in common D. Tenancy in partnership C. Since John and Jane hold unequal interests they cannot take title as joint tenants nor as community property. Since they are not in business together, California Law allows only one other type and that would be the tenants in common. There would be no right of survivorship permitted in this instance.

A-14 14 When real property is subleased, the interest held by the sublessor is commonly called: A. A double lease B. A freehold lease C. An assignment D. A sandwich lease D. We have three parties involved in this contract. The owner, or landlord, the tenant that occupies the premises and the sublessor who is in the middle of the two. That position is referred to as the sandwich lease.

A-15 15. An appraiser using the cost method may use the unit cost per square foot or cost per cubic foot in his computations. On a unit cost basis: A. A small house would cost less than a larger house B. A large house would cost more than a small house C. A small house would cost more than a large house D. The cost of a small house and a large house would be the same C. There always a number of sizeable start-up costs in the construction of a new home. When you expand the size of the home the additional cost is proportionately not as great. Considering this, a small home would cost a great deal more by the square foot than a large home.

A-16 M 16. A seller took back a second trust deed and note in the amount of $11, 400 payable $240 per month, including interest at 7% per annum. If interest on the note begins July 15 and the first payment is made on August 15, the amount of the first payment that is applied to the principal is: A. $66. 50 B. $79. 80 C. $173. 50 D. $240. 00 C. $11, 000 x 7% = $798 per year $798 divided by 12 = $66. 50 per month $240 - $66. 50 = $173. 50

A-17 17. The statement, “The value of the best property in a neighborhood will be adversely affected by the presence of comparatively substandard property”, relates to one of the basic principles of value known as the principle of: A. Balance B. Contribution C. Regression D. Anticipation C. The statement of the question illustrates the principle of regression.

A-18 18. Which of the following would be classified as economic obsolescence? A. An oversupply of like properties B. Lack of onsite parking C. Poorly designed rooms D. Deteriorated roofing A. Economic Obsolescence results from factors that exist outside the property limits and adversely affect the value of the property. An oversupply of like properties would be an outside influence.

A-19 19. A lender would consider “debt-income ration” when: A. Estimating closing costs B. Qualifying a prospective borrower C. Appraising the subject property D. Filing for federal insurance B. The lender must consider what the prospective borrower’s gross income is in relation to what their total monthly payment will be for existing and future debts. If the ratio of debts to income is too high, the lender will not make the loan.

A-20 20. “The relationship between a thing desired and a potential purchaser” is a definition of: A. Value B. The “economic man” C. “Utility” as used in a definition of value D. Need A. This is one of the definitions of value.

A-21 21. Acme Finance Company hired an appraiser to appraise Mr. Thomas’ property. As a matter of ethics the appraiser could discuss his findings with: A. Acme Finance Company B. Mr. Thomas C. The listing broker D. All of the above A. The appraiser is only permitted to discuss his findings with the party that had originally hired him. In this case it would be the finance company.

A-22 22. A real estate broker who desires to operate a real estate office that is both competitive and profitable, is vitally concerned with “Desk Cost” is calculated by dividing the: A. Total cost of furniture by the number of salespersons B. Net profit of the firm by the number of desks available C. Total cost of rent, utilities, telephone, advertising and other operating expenses by the number of salespersons D. Annual gross commissions earned by the number of desks C. Desk Cost is established by adding all the expenses of operating the office (rent, advertising, telephone, salaries, utilities) by the number of salespersons in the office.

A-23 23. All of the following would have an effect on the final estimate of value when making an appraisal of an old single family residence except: A. B. C. D. Purpose of the appraisal Suitability of the residence to the site Physical condition of the building Original cost of the residence D. Original cost has little or nothing to do with value when applying the cost approach to an older structure.

A-24 24. Which of the following is the least important factor when appraising a site for commercial purposes? A. B. C. D. Convenience of facility to shipping and labor sources The community’s purchasing power Zoning regulations Amenities D. Original cost has little or nothing to do with value when applying the cost approach to an older structure.

A-25 25. The process of expressing anticipated future benefits of ownership in dollars and discounting them to a present worth at a rate which is attracting purchase capital to similar investments is called: A. B. C. D. Projection Yield evaluation Equity manipulation Capitalization D. The statement of the question is a means of describing the income approach which is used to establish the value of income property. It is also referred to as the capitalization approach.

A-26 26. A real estate broker is reviewing a profit and loss statement for an apartment house, which lists expenses under the headings shown below. Under which heading would she most likely find taxes and fire insurance? A. B. C. D. Fixed expenses Operating expenses Capital expenses Other expenses A. The taxes and the fire insurance will not vary during the year and as a result, these are classified as fixed expenses.

A-27 M 27. A prospect is considering the purchase of an income property which has an operating statement showing $94, 500. 00 deducted from gross income to arrive at the net income. The deductions amount to 60% of the gross income. If the prospect wants a 12 ½% return on the purchase price of any investment he makes, what should he pay for the property? A. B. C. D. C. $81, 000 $196, 000 $504, 000 $720, 000 Expenses total $94, 500 Expenses are 60% of gross income To find gross income divide expenses by 60% $94, 500 divided by 60% = $157, 500 gross income - $94, 500 expenses = $63, 000 net income divided by 12 ½% = $504, 000

A-28 28. The Mt. Diablo Meridian line runs: A. B. C. D. East and West The same as township lines North and South North C. Base lines run East and West; Meridian lines run North and South.

A-29 M 29. Masters sold his residence which was unencumbered. Total deductions in escrow amounted to $215. 30 in addition to a broker’s commission of 6% of the selling price. The selling price was the only credit item. Masters received a check from escrow amounting to $15, 290. The selling price was most nearly: A. B. C. D. $16, 200 $16, 266 $16, 430 $16, 485 D. Selling Price (100%) = $15, 290 + $215. 30 + 6% $15, 290 + $215. 30 = $15, 505. 30 or 94% $15, 505. 30 divided by 94% = $16, 495

A-30 30. When a home has been kept in better than average condition, the effective age compared to the actual age would be: A. B. C. D. Less More The same None of the above A. The age of the property as it appears in the eye of the appraiser is referred to as effective age. If it looks better than actual age it would have a lower effective age.

A-31 31. A single family dwelling that is considered to be an improper improvement in relation to its site suffers a loss in value described as: A. B. C. D. Incurable location obsolescence Curable functional obsolescence Incurable functional obsolescence Curable physical obsolescence C. If a home is placed on a lot in a position that does not take advantage of a nice view or whatever amenities the property holds, it is a poor job of planning and would be considered functional obsolescence. Since it is difficult to move the home it would be considered incurable.

A-32 32. Which of the following would help to prevent economic obsolescence on an income property? A. B. C. D. All of the surrounding properties are prospering Proper management of the income property Excellent maintenance on the building All of the above A. Economic obsolescence results from outside influences. The only one mentioned in the choices is under item “A”.

A-33 M 33. Mr. & Mrs. Shorewood sold their home for $350, 000 and closed escrow on November 12, 2001. They had purchased the home in 1985 for a total price of $165, 000 and had been residing there since the purchase date. If they plan to purchase a smaller home for $200, 000 their taxable gain on the sale of November 12, would be: A. B. C. D. $185, 000 $150, 000 $35, 000 Nothing D. Under the 1998 tax law, gains on the sale of a personal residence of up to $500, 000 are tax exempt. The purchase of a replacement residence does not influence the tax consequences.

A-34 34. As a matter of good business practice, a real estate licensee should inform the buyer that as soon as the deed is recorded, they should file a change of ownership statement with the county tax assessor within: A. B. C. D. 15 days 30 days 45 days 60 days C. The Revenue and Taxation Code requires the person acquiring the property to file the statement within 45 days of the recording date of the deed.

A-35 M 35. Mayer sold his house and took back a note for $4, 200 secured by a second deed of trust. He promptly sold the note for $2, 730. This represents a discount of: A. B. C. D. B. 28% 35% 55% 65% Face amount of $4, 200 less selling price of $2, 730 = $1, 470 discount Discount of $1, 470 divided by $4, 200 (face amount) = 35%

A-36 M 36. An owner depreciated an improvement based on a cost basis of $160, 000, using the straight-line method. The improvements have been depreciated 37. 5% to date and the remaining economic life is estimated to be 15 years. Which of the following is a correct statement? The: A. B. C. D. Rate of depreciation exceeds 4% per annum Time of depreciation to date is over 10 years Present book value of the building is $120, 000 Rate of depreciation cannot be determined from the data given. A. 100% -37 ½% = 62 ½% Remaining to depreciate 62 ½% divided by 15 years = 4. 17% per year

A-37 M 37. A duplex with a fair market value of $120, 000, and an outstanding $80, 000 loan balance, was exchanged for a four plex with a market value of $195, 000 and an outstanding $146, 000 loan balance. The owner of the duplex would pay in cash or secondary financing most nearly: A. B. C. D. C. $6, 100 $8, 100 $9, 100 $15, 100 The amount of cash or boot necessary to make the exchange is the difference between each owner’s equity. Equity is the difference between the market value of the property and existing loans. Duplex value of $120, 000 - $80, 000 loan = $40, 000 equity Fourplex value of $195, 000 - $146, 000 loan = $49, 000 equity The difference between equities is $9, 000

A-38 38. In single-family house construction the term “footing” refers to: A. A beam under the floor boards B. A girder, running along the foundation, to which the ends of the floor boards are fixed. C. The spreading part at the base of the foundation wall or pier D. Reinforced concrete slab over which asphalt tile may be laid C. A footing is the heavy concrete section under the foundation. It is generally wider than the foundation wall itself and carries the weight of the structure.

A-39 39. In order for it to become effective and to transfer title, a deed must: A. B. C. D. Be acknowledged Be executed on a day other than Sunday Have a proper description of the property Contain the phrase “To have and to hold C. Of the items listed a property description of the property is the only essential requirement for an effective and valid deed.

A-40 40. To alienate title to property one: A. B. C. D. Secures an ALTA policy of title insurance Clouds the title Records a homestead Conveys title D. When an owner alienates the title to the property it means they have conveyed it.

A-41 41. Because of the long term nature of their assets, investments in amortized real estate loans make particularly good investments for: A. B. C. D. National banks Credit unions Life insurance companies Individuals C. When people buy life insurance, they generally pay for it over a long term. Insurance companies must invest these funds and real estate loans are very suitable investments.

A-42 42. Mrs. King borrowed money using a fully-amortized loan to finance the remodeling of her real property. If equal monthly payments include both principal and interest, the amount of the payment on the principal will: A. B. C. D. Increase at a constant amount Decline while the amount credited to interest increases Cause the amount credited to interest to remain constant Increase while the amount credited to interest decreases D. As the loan is paid off, the amount due for interest will decrease thereby allowing more to be applied to the principal.

A-43 43. When appraising a house built in 1910, an appraiser would use which of the following to estimate the cost new: A. B. C. D. A national cost index adjusted in 1910 Actual cost of construction in 1910 Current replacement or reproduction cost Current cost adjusted by the 1910 cost of living index C. When applying the cost approach in the appraisal of any structure, regardless of its age, the appraiser uses today’s costs to estimate the cost to reproduce or replace a like structure.

A-44 44. When a purchase money deed of trust is used to obtain a loan from an institutional lender, the trustor: A. B. C. D. Holds the deed of trust Receives a note for the amount borrowed Signs a note for the amount borrowed Loans the funds C. The trustor is the borrower and is the party that signs the note and trust deed. The beneficiary is the lender who holds the note and trust deed.

A-45 45. The event for income tax purposes, where money is paid to an owner of real property that is taken as a result of condemnation proceedings, is known as: A. B. C. D. A tax free exchange Involuntary conversion Subrogation Economic obsolescence B. For income tax purposes, eminent domain proceedings are known as involuntary conversion.

A-46 46. During a period of time in which unemployment is declining and the gross national product is increasing: A. B. C. D. The value of single family residences would tend to increase in value New home sales would tend to increase Demand for existing housing would increase All of the above would be true D. With full employment and a high level of national production, people will be earning more money which in turn, will increase the demand for housing and the cost of homes.

A-47 47. An owner of commercial property entered into separate open listing contracts with a number of different real estate brokers. Under these circumstances, each broker will: A. Have an opportunity to earn a full commission if he or she is the procuring cause B. Equally share the commission if any one of the brokers sells the property C. Earn a full commission if the owner sells the property herself D. Have the right to exercise an option to purchase the property at the listed price A. Under an open listing, the broker that is the procuring cause is the one who earns the commission. It also allows the owner to sell the property himself or herself without paying a commission.

A-48 48. Irons, a 15 year old emancipated minor, entered into a listing with a broker to sell real property that he owned. When the broker finds a buyer and both parties have signed a purchase contract, the broker should obtain proof of the emancipation to satisfy the demands of the: A. B. C. D. Escrow holder Title company Buyer’s broker B. The title company will demand proof of emancipation to be sure that the grantor is competent to convey title.

A-49 49 The relationship of the escrow holder to the parties in the sale and purchase of real property is that of an: A. B. C. D. Advocate Independent contractor Employee Agent D. The escrow holder is the agent for both parties to the transaction. This relationship is greater than that of an employee.

A-50 50. Most of the junior loans that are available today are secured through: A. B. C. D. Savings and loan associations Private investors Commercial banks Mortgage bankers B. Most second and third trust deeds today are only available through private investors and individuals.

A-51 51. The size of the population needed to support a successful neighborhood shopping center is: A. B. C. D. 3, 000 to 5, 000 to 10, 000 30, 000 minimum 100, 000 B. A neighborhood shopping center usually contains a key tenant such as a supermarket and has other small shops or stores in the adjoining area. The number of people to support this type of shopping center should be between 5, 000 and 10, 000.

A-52 52. The Federal National Mortgage Association (FNMA) was created for the primary purpose of: A. Advancing funds to mass production builders in or near urbanized areas B. Lending money on FHA Title II loans when banks, Savings and Loan Associations or private lenders are unwilling to do so C. Increasing the amount of housing credit available to the economy D. Supervise public lending agency associations C. FNMA was created originally as a secondary mortgage market. The idea was to purchase existing FHA and VA loans from lenders and thus make more money available in the housing market.

A-53 53. The main benefit for the lender under FHA financing over conventional financing is the: A. B. C. D. Mortgage insurance Higher yield Ease of sale in the secondary money market Higher loan to value ratio A. The mortgage insurance protects the lender in the event of a loss due to foreclosure. Although the lender can sell the loan to FNMA a secondary money market, it is not the main advantage.

A-54 54. Which of the following is generally considered a freehold estate? A. B. C. D. An estate for years An estate at sufferance An estate of inheritance All of the above C. A freehold estate means there is an ownership interest involved. An “estate of inheritance” is another name for a fee simple estate, the highest form of ownership.

A-55 55. If the Federal Reserve wants to increase the amount of money available to member banks to ease a tight money market it could: A. B. C. D. Raise the discount rate to its member banks Lower the minimum reserves required by its member banks Raise the minimum reserves required by its member banks Sell government bonds B. If the Fed allows the member banks to reduce their minimum reserves, this means more cash would be available for loans and would ease a tight money market

A-56 56. The fastest way to calculate one month’s interest on a real estate loan with an interest rate of 7. 2% interest per annum is to multiply the principal balance by: A. B. C. D. . 006. 6 7. 2% and divide by 12 12 divide by. 072 A. By dividing the 7. 2% rate by 12 first, you can find one month’s interest by multiplying the loan amount by. 006 7. 2% divided by 12 =. 006, rate for one month

A-57 57. At the time of closing the sale of a residence, escrow will issue a closing statement. The buyer’s statement will show some items that the seller has prepaid or is in arrears on and are to be prorated or adjusted between the buyer and seller. Those items may include all of the following except: A. B. C. D. Impounds Interest, fire insurance premium, assessments and property taxes Delinquent interest and principal on unsecured home improvement loans D. The buyer would not be assuming an unsecured home improvement loan so no proration would be made for any delinquent interest or principal payment.

A-58 e 58. Mr. John Adams grants an option to Mr. Frank Jason to purchase the Adams’ ranch. This option most clearly constitutes a: A. B. C. D. Voluntary lien on Adams’ ranch Contract to keep an offer open Fiduciary agreement Offer to enter into a contract B. An option is a contract that keeps an offer open. It does not constitute a lien.

A-59 59. If a buyer defaults on his agreement to buy real property, one of the seller’s remedies is rescission of the contract. If the seller elects to rescind the contract under this circumstance, he must: A. Promptly attempt to sell the property to keep damages suffered by him to a minimum B. Promptly notify the buyer and restore or offer to restore to him everything of value that was received upon condition that the buyer do likewise C. Publish notice of the rescission in a newspaper of general circulation D. Immediately sue for damages suffered as a result of the buyer’s reach B. A rescission requires that all monies and property be restored and each party is put back into their original position before the contract was executed.

A-60 60. When a real estate broker speaks of “tax shelter” he could be referring to: A. B. C. D. The depreciation allowance on income property An installment sale of property A tax deferred exchange Any of the above D. A tax shelter protects part of the owner’s income or profits from taxation. The use of any of the three techniques could lead to a tax savings.

A-61 61. Commercial banks consider liquidity and marketability of loans to be of paramount importance when they make mortgage investments secured by real property. Such banks are referring to the: A. Activities of secondary mortgage markets B. Superiority of short term loans over long term loans C. Resale of homes D. Effects of the security offered by the Federal Deposit Insurance Corporation A. To be in a liquid position the bank must be able to sell the existing loan quickly and without loss. This usually can be done in the secondary mortgage market.

A-62 62. A seller of a home suffered damages due to misrepresentations made by the broker with whom the seller had been dealing with. In the lawsuit filed against the broker by the seller, the broker contended that he was not liable since the listing contract had been an oral and not a written agreement as required under the statute of frauds. Under these circumstances the court would likely rule that: A. Since the contract was not in writing, the statute of frauds would relieve the broker of any liability B. The broker would not be liable for any damages if escrow had closed before damages had been established C. The broker is liable and the statute of frauds is not the issue D. The broker is only liable if the misrepresentations had been given in written form C. If the seller allowed the broker to represent him in dealings with third parties, the seller is responsible for all acts including any misrepresentations made by the broker. The creation of an agency relationship is not dependent upon a written contract. It is true, however, that a broker must have a written agreement in a suit for a commission.

A-63 63. Which of the following is not required to obtain an easement by prescription A. B. C. D. A use of the property hostile and adverse to the true owner’s title A public confrontation with the owner before witnesses A claim of right Open, notorious and uninterrupted use for 5 years B. Adverse use of the property must be done openly and notoriously against the will of the owner but this does not mean a public confrontation.

A-64 64. A balloon note is also known as: A. B. C. D. A fully-amortized loan A static loan A self-liquidating loan A partially-amortized loan D. A balloon note refers to a note that has a balloon payment at the end of its term. This means the note is not completely paid off at the end of its term and is only partially amortized.

A-65 65. When a borrower defaults under a note secured by a deed of trust, the trustor is allowed a specific period of time to redeem the property. During the redemption period, the right of possession is held by the: A. B. C. D. Escrow agent Trustee Trustor Beneficiary C. The trustor (owner and borrower) remains in possession of the property until the final sale by the trustee at the trustee’s sale.

A-66 66. Archer sold his home to Baker who decided not to record his deed but took possession of the property as her residence. Archer sold the same property to Carter, who examined the county recorder’s files but did not inspect the property. Carter received a deed from Archer and recorded it. Concerning the title to the property, which of the following is correct? A. B. C. D. Title vests with Carter The priority of recordation prevails Carter has recourse against Baker for failure to record Baker remains the owner D. Since Baker gave notice of an interest in the property by taking possession, his rights will prevail. It is essential that an interested buyer not only check the records but also investigate the interest of anyone in possession.

A-67 67. The owners of a single family residence entered into an Exclusive Agency listing with a real estate broker. Even though the broker had spent a considerable sum of money advertising the property, the owners were able to sell the property themselves without the assistance of the broker. Under these circumstances, the broker is entitled to: A. B. C. D. No commission One-half of the commission A full commission Expenses A. Since this was an Exclusive Agency Listing, the owners are only liable for a commission if any agent sells the property. Since they sold it themselves, no expenses or commission is owed.

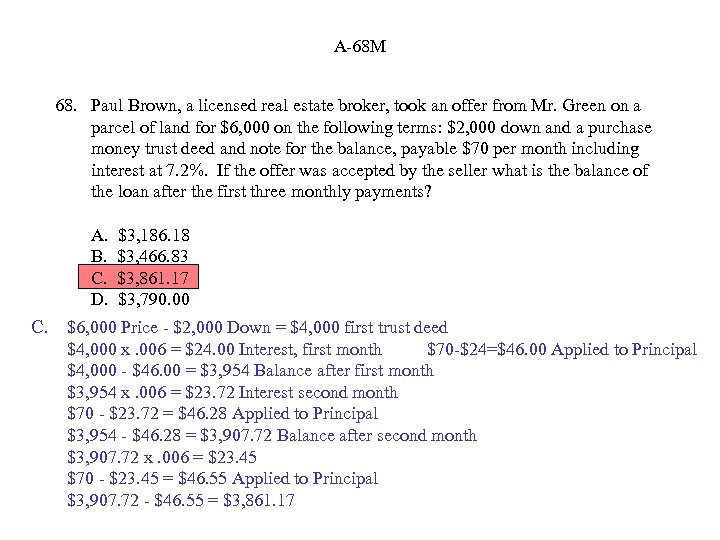

A-68 M 68. Paul Brown, a licensed real estate broker, took an offer from Mr. Green on a parcel of land for $6, 000 on the following terms: $2, 000 down and a purchase money trust deed and note for the balance, payable $70 per month including interest at 7. 2%. If the offer was accepted by the seller what is the balance of the loan after the first three monthly payments? A. B. C. D. C. $3, 186. 18 $3, 466. 83 $3, 861. 17 $3, 790. 00 $6, 000 Price - $2, 000 Down = $4, 000 first trust deed $4, 000 x. 006 = $24. 00 Interest, first month $70 -$24=$46. 00 Applied to Principal $4, 000 - $46. 00 = $3, 954 Balance after first month $3, 954 x. 006 = $23. 72 Interest second month $70 - $23. 72 = $46. 28 Applied to Principal $3, 954 - $46. 28 = $3, 907. 72 Balance after second month $3, 907. 72 x. 006 = $23. 45 $70 - $23. 45 = $46. 55 Applied to Principal $3, 907. 72 - $46. 55 = $3, 861. 17

A-69 69. A policy manual is: A. B. C. D. An outline of the Code of Ethics A book describing the insurance coverage for the employees A floor schedule for employees An outline of the procedures under which an office operates D. A policy manual is the outline of the office procedures.

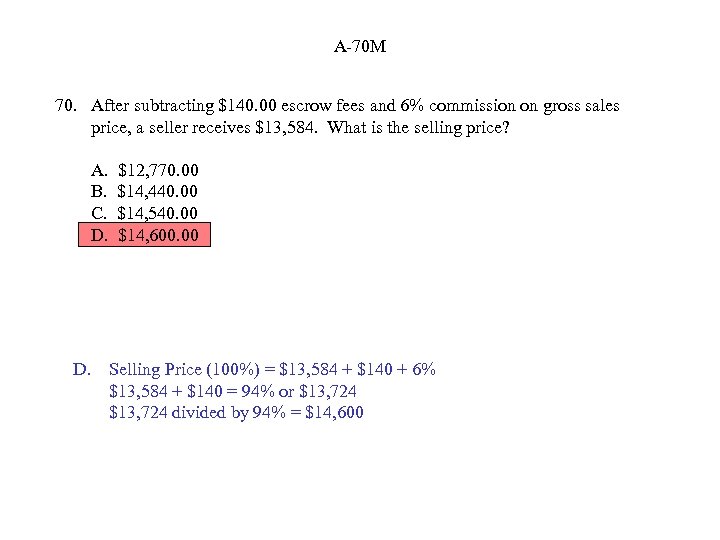

A-70 M 70. After subtracting $140. 00 escrow fees and 6% commission on gross sales price, a seller receives $13, 584. What is the selling price? A. B. C. D. $12, 770. 00 $14, 440. 00 $14, 540. 00 $14, 600. 00 D. Selling Price (100%) = $13, 584 + $140 + 6% $13, 584 + $140 = 94% or $13, 724 divided by 94% = $14, 600

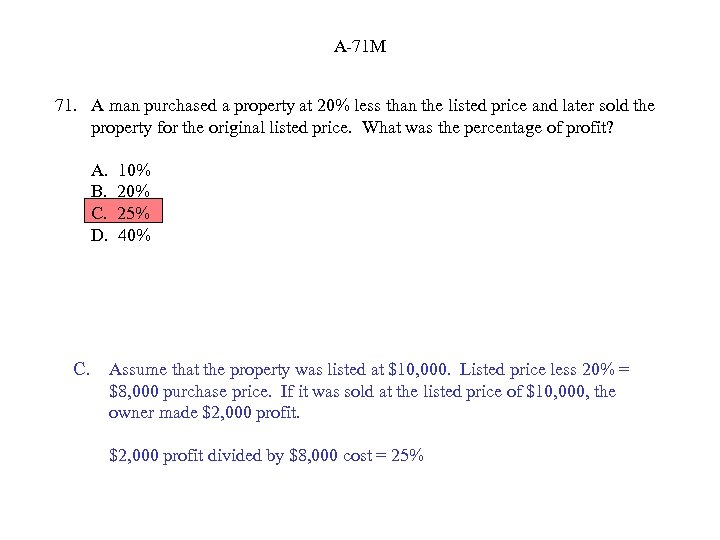

A-71 M 71. A man purchased a property at 20% less than the listed price and later sold the property for the original listed price. What was the percentage of profit? A. B. C. D. C. 10% 25% 40% Assume that the property was listed at $10, 000. Listed price less 20% = $8, 000 purchase price. If it was sold at the listed price of $10, 000, the owner made $2, 000 profit divided by $8, 000 cost = 25%

A-72 72. It is common procedure to record all of the following instruments, except: A. B. C. D. A real property sales contract A notice of completion Assignment of deed of trust or mortgage A promissory note secured by a deed of trust or mortgage D. A promissory note is never recorded. The trust deed or mortgage and the other documents mentioned in choices “A”, “B” and “C” will however be recorded.

A-73 73. When real property is used as the security for a loan, the property is said to be: A. B. C. D. Pledged Hypothecated Assigned Warranted B. To hypothecate property means to borrow money and use it as the security for the debt.

A-74 M 74. An apartment building develops a gross monthly income of $2, 025 per month. If an appraiser were to apply a gross rent multiplier of 10. 72, the estimated value would most nearly be: A. B. C. D. C. $21, 700 $226, 700 $260, 500 $287, 400 $2, 025 per month X 12 = $24, 300 annual income $24, 300 x 10. 72 = $260, 496 Although not stated, 10. 72 is an annual gross multiplier

A-75 75. The loan instrument which allows for future additional advance, but uses the same instrument for security is which of the following? A. B. C. D. Acceleration clause Reconveyance deed Exculpatory clause Open End trust deed D. The statement of the question is a good definition of an open end trust deed or mortgage.

A-76 76. Jones is the owner of an apartment in a cooperative apartment building. He makes monthly payments which cover principal and interest due on a note secured by a trust deed, taxes and insurance. Which of the following is correct? A. Taxes for his apartment are separately assessed by local government B. Special assessments by local government for street improvements will be apportioned to each apartment in the cooperative C. Jones cannot deduct his property taxes when he completes his income tax return D. Jones could lose his equity if other owners default in their payments on the note D. Assuming that the cooperative apartment is a community apartment project, we would find there is just one loan on the property and one payment to be made each month. If any one owner does not contribute toward his payment, all would suffer.

A-77 77. Mr. Able wants to make an improvement on his property that will not be in conformity with the deed restrictions as set forth in the original deed for the subdivision. If a neighbor wants to stop him from proceeding with the addition, he would obtain: A. B. C. D. An injunction A desist and refrain order A partition action An attachment A. An injunction is a court order requiring the violator of the deed restriction to stop proceeding with the violation.

A-78 78. With regard to general and specific liens, which of the following groups of words contains only specific liens: A. B. C. D. Mortgage, attachment, judgment, corporation tax lien Attachment, mechanic’s lien, mortgage, taxes Inheritance taxes, mortgages, assessment, mechanic’s lien Judgment, trust deed, attachment, taxes B. A judgment and inheritance taxes are both general liens. You will note these are included in choices “A”, “C” and “D”.

A-79 79. “A” gives a quitclaim deed to “B” for a parcel of real property, but “B” does not record the deed. In this situation, which of the following is true? The deed is: A. Invalid as between “A” and “B” B. Invalid as between “A” and “B” but valid as to subsequent recorded interests C. Valid as between “A” and “B” but invalid as to subsequent recorded interests without notice D. Valid as between “A” and “B” and valid as to subsequent recorded interests without notice C. Constructive notice of ownership can be given either by recording the deed or taking possession of the property. Since “B” did not record the deed nor take possession according to the question, the deed is valid between the grantor and the grantee, but not valid as to later recorded interests that had no notice of the original transaction.

A-80 80. Which of the following is covered under an extended coverage form of title insurance that is not covered under a standard policy of title insurance? A. B. C. D. Trust deed of record Tax lien Encroachment Homestead exemption C. The standard policy only covers items of record and would not protect against an encroachment. The extended policy would pick up this risk.

A-81 81. A standard title insurance policy insures against: A. B. C. D. A recorded deed in the chain of title that was not properly delivered Claims of persons in possession of the property Easements by prescription Losses sustained by improved property only A. The standard policy covers all matters of record and would cover a recorded deed even though it was not properly delivered.

A-82 82. Under which of the following circumstances would a deed be void? A. Grantor uses a name that is not his true name B. The grantee is a fictitious person C. The spelling of the name of the grantor in the body of the deed differs from that in the signature D. The grantee is sufficiently described in the deed but he is not named therein B. A fictitious person would be a name of a party who is not actually living. You cannot deed property to someone that does not exist.

A-83 83. A gift of real property by a valid will is known as: A. B. C. D. A devise A legacy A bequest None of the above A. The gift of real property is considered a devise; a gift of personal property is a legacy or a bequest.

A-84 84. Mr. Able died leaving no heirs but had willed Blackacre Ranch to a Mr. Baker. Mr Talbot was in possession of Blackacre under an existing lease that had ten years to run. During the probate of Mr. Able’s estate, the court found the will to be invalid. Under these circumstances, title to Blackacre would: A. B. C. D. Pass to Baker since it was Able’s intent Pass to Talbot since he is in possession Escheat to the state, subject to the exiting lease Pass to Able’s estate C. Since Mr. Able died and had no heirs and the will was invalid, his estate passes to the state by escheat, subject to the existing lease.

A-85 85. When a document is signed by officers acting on behalf of their corporation, a seal is attached which: A. B. C. D. Makes it eligible for recording Shows that consideration has been paid Implies authority of person signing All of the above C. The corporate seal merely implies that the parties that signed the document had the authority to do so.

A-86 M 86. If building costs increased 20 percent, the value of the investor’s dollar has decreased by A. B. C. D. 16 2/3% 20% 25% 33 1/3% A. The material I bought yesterday for $100 now costs 20% more or $120. If I only have $100, I can only buy 100/120, or 5/6 ths of what I could yesterday. My dollar has decreased 1/6 or 16 2/3%

A-87 87. Mr. Green signed a month-to-month lease with Mr. Brown. When Mr. Green gave Brown notice that the rent was going to be increased by $200 a month, Brown was going to cancel the lease and vacate the premises. Finally after negotiation they agreed to raise the rent to $180 a month and to continue the lease on a year to year basis, subject to termination by either party by giving a written notice 30 days before the end of the year. This would create: A. B. C. D. An estate at sufferance An estate at will An estate for years A periodic tenancy D. Even though this new lease is on a year to year basis, the fact that there is no definite termination date creates a periodic tenancy.

A-88 88. A copy of a structural pest control inspection report prepared pursuant to the Business and Professions Code must be delivered to the buyer: A. When there is visible evidence of infestation B. When it is a condition of the purchase contract or a requirement imposed as a condition of the financing C. After the seller has reviewed the report and given his permission D. In every instance, whether requested or not B. Although an inspection report is available to anyone that requests a copy from the state board, a copy is delivered to the buyer only when it is a condition of the purchase agreement or financing.

A-89 89. Unpaid real property taxes constitute a lien: A. B. C. D. Prior to a mortgage lien Concurrent with a mortgage lien After a mortgage lien None of the above A. Real property taxes have priority over every other type of lien.

A-90 90. An estate in which a tenant who rightfully came into possession of a property, and who retains possession after the expiration of the term without the consent of the landlord is known as: A. B. C. D. A life estate A periodic tenancy An estate at sufferance An estate at will C. The statement of the question is a good definition of an estate at sufferance.

A-91 91. Carlson borrowed $60, 000 to finance the purchase of his home. The trend of gradual economic inflation will affect the outstanding balance of the loan to the: A. B. C. D. Benefit of the beneficiary Benefit of the trustee Benefit of the trustor Disadvantage of the beneficiary and the trustor C. One of the benefits of the ownership of real estate that has been purchased by outside financing is that, if there is an increase in value, it all accrues to the owner of the property. The owner, in this instance, would be the trustor.

A-92 92. All of the following may be assigned, except a: A. B. C. D. Broker’s right to a commission Grant deed Mortgage Real property sales contract B. In order to transfer title from one party to another you need a deed. You cannot endorse or assign one deed to another. You must issue a new deed.

A-93 93. In respect to your understanding of an appurtenant easement, all of the following are true except: A. It is a burden on the servient tenement and a benefit to the dominant tenement B. It is capable of being transferred C. It must involve adjoining properties D. The dominant and servient tenement cannot be under the same ownership C. An appurtenant easement could exit over any number of properties along an alleyway. It would not be limited to just the property next to the dominant tenement.

A-94 94. The term “walkup” is used to refer to which of the following? A. B. C. D. A drive-in restaurant An apartment A trailer park A Real Estate Broker’s office B. A walkup is an apartment house of more than one story that does not have an elevator.

A-95 95. A “seller’s market” is considered to exist under which of the following conditions? A. The number of sellers far exceed the number of prospective buyers B. Fewer properties are available for sale in contrast to an ever increasing number of qualified buyers C. Competition between sellers is on the increase D. The multiple listing service is receiving a greater number of new listings but fewer sales B. If there a greater number of buyers for a fewer number of properties that are for sale, prices will be driven higher and the situation creates a “seller’s market”.

A-96 96. A commercial bank agreed to loan Davis $90, 000 for a one year term provided Davis agree to maintain a savings account with the bank in the amount of $9, 000 during the term of the loan. This provision is known as: A. B. C. D. Compensating balances Risk management Mortgage insurance A security deposit A. This situation is a good example of the practice known as “compensating balances”.

A-97 97. Title to real property can be acquired by which of the following? A. B. C. D. Accretion Hypothecation Certiorari Both “A” and “C” A. Title acquired by accretion refers to the gradual buildup of soil on a property as a result of wind or action of a river. The term “certiorari” has nothing to do with title to property.

A-98 98. A percolation test is often conducted in a new proposed subdivision to ascertain the: A. Ability of the soil to absorb water B. Width and depth requirement of footings C. Quantity and quality of well water D. Approximate size of the water storage tank needed to service a given size house or farm building A. Percolation is the process in which surface water seeps into the soil. A test indicates the speed or slowness of the process of absorption

A-99 99. When the business cycle is in its prosperity phase, it is usually followed by what phase of the real estate cycle? A. B. C. D. Low level of construction and borrowing activity Low level of sales transactions High level of sales transactions, construction and borrowing activity D. If business is quite active and in its prosperity phase, there would normally be a high level of sales, a lot of new construction and thus a great deal of borrowing activity.

A-100 100. Broker Thompson who held an exclusive authorization and right to sell listing, received an offer on the property under the exact terms and price of the listing. Before Thompson could present the offer, a cooperating broker gave Thompson another offer which was for the same price but with a slightly lower down payment. Under these circumstance, broker Thompson should: A. Present both offers to the seller at the same time B. Present the offers to the seller in the order received C. Refuse to submit the cooperating broker’s offer and submit the offer that meets the exact terms of the listing D. Hold the cooperating broker’s offer and suggest to her buyer that they increase their offered price A. If the broker has two offers on a property, both offers must be presented at the same time or the seller must be advised that another offer is coming when he or she presents the initial offer.

A-101 101. If an owner has riparian rights, it means the party has rights to the taking and use of water form: A. B. C. D. A river, stream or other watercourse Underground accumulations A bay of the ocean or lake All of the above A. Riparian rights gives the landowner the right to take water from a river or other watercourse that is flowing past the land. Littoral rights gives the party the right to take water from a lake or ocean.

A-102 102. Most people agree that the successful licensee possesses personal characteristics which reflect honesty, sincerity and a compelling desire to serve people. What primary attitude should the licensee possess in dealing with prospective clients? A. One that is “color blind” or absolutely free from bias B. One wherein minorities are treated with respect but advised to contact other brokers who deal with property suitable to their desires C. One wherein all clients are accepted willing, even though the licensee may prefer not to deal with some of them D. One which allows him to react according to his best judgment based on his understanding of the various social pressures involved A. The former Real Estate Commissioner coined the word “color blind”. This means that the licensee should not be concerned with the color of the prospective clients and treat each with equal respect and free from any bias.

A-103 103. Which of the following state agencies is empowered to prevent acts of discrimination in housing accommodations in California because of race, color, religion, national origin or ancestry? A. B. C. D. Real Estate Commission Labor Commission Department of Fair Employment and Housing Division of Housing C. Under the Rumford Act, complaints can be filed with the Department of Fair Employment and Housing.

A-104 104. Rezoning often involves ridding the area of nonconforming use. The means utilized may involve all of the following, except: A. B. C. D. Convenience of facility to shipping and labor sources The community’s purchasing power Zoning regulations Amenities C. The city can pass new zoning laws but they cannot make these new ordinances apply to property that has been improved some years back. They cannot be retroactive. .

A-105 105. The Alquist-Priolo Special Studies Zones Act is designed to control development in the vicinity of hazardous: A. B. C. D. Flood areas Earthquake faults Fire zones Toxic dumps B. This Act is designed to warn parties of hazardous earthquake faults.

A-106 M 106. Escrow closed May 1 with interest on a $4, 415 second trust deed paid to June 1. If the interest rate is 7. 2% the debit to the buyer, if the buyer assumed the loan, would be: A. B. C. D. B. $22. 09 $26. 49 $4, 415 None of the above Since the sellers paid one month’s interest in advance, this must be returned to them by the buyer. This will be a debit on the buyer’s statement. $4, 415 x. 006 (7. 2% divided by 12) = $26. 49

A-107 107. In the event there is no provision in the escrow instructions with regard to a termination date, the parties to the escrow have: A. B. C. D. 30 days 60 days A reasonable time As long as either desires C. If the parties had made no provisions as to the length of the escrow period. It would be set at a reasonable period of time.

A-108 108. Under the Bulk Sales provisions of Division 6 of the Uniform Commercial Code, the publishing and recording requirements are intended to alert which of the following of the intended transfer? A. B. C. D. Broker Creditor Vendee B. The intent of the Bulk Sales Law is to warn creditors of a potential or possible transfer of merchandise.

A-109 109. A valid bill of sale need not contain: A. B. C. D. The name of the buyer An acknowledgement A description of the property Signature of seller B. A bill of sale is the document used to grant title to personal property. This type of a document is not recordable and therefore need not be acknowledged.

A-110 110. An owner of a liquor store received an original off-sale general license from the State two years ago and now he wants to sell the business. The maximum he can charge for the license is: A. B. C. D. $2, 000 $4, 000 $6, 000 Not limited by law C. A liquor license cannot be sold for more than the $6, 000 during the first five years of its issuance.

A-111 111. As part of the terms of a listing, an owner specified that the existing first trust deed was to be assumed. The broker found a buyer who was willing to buy the property on the exact terms of the listing, except that he wanted to take the property “subject to” the loan. If the seller refused the offer on these terms, the broker would be entitled to: A. B. C. D. A full commission One half the agreed commission No commission A reimbursement of his expenses C. Since the broker did not procure a buyer that was “ready, willing and able to buy” under the exact terms of the listing, he is entitled to no commission.

A-112 112. A seller accepts a buyer’s offer on his home in which the broker has taken a $4, 000 deposit. The seller had agreed to pay the broker a $500. 00 commission. If the seller instructs the broker to deposit the $4, 000 in escrow, the broker should deposit: A. $3, 500 in escrow and keep $500 as his commission B. $4, 000 in his personal account until the close of escrow to insure payment of his commission C. $4, 000 in escrow D. $4, 000 in his trust account C. Although the broker has earned a commission, he cannot take this money from the seller at this time and must deposit the full $4, 000 in escrow as instructed.

A-113 113. Which of the following would most likely be decided after escrow has been opened by the buyer and seller? A. Terms of the purchase agreement B. Vesting of title C. The party who will be liable for delinquent taxes D. Whether the existing loan that is going to be taken over will be “assumed” or taken “subject to” B. Most buyers and sellers are not aware of the legal and tax implications at the time they sign the purchase agreement and the matter of vesting title is usually decided after escrow has been opened.

A-114 114. An oral agreement for the sale of real estate may be enforced where: A. The consideration is less than $2, 500 B. The purchasers have gone into possession, paid part of the purchase price and have made improvements C. The broke guarantees performance D. Two neutral witnesses will testify B. Although most real estate contracts are required to be in writing according to the Statute of Frauds, a contract where the purchasers have gone into possession, paid part of the purchase price and have made improvements on the property would be binding even though it was originally an oral agreement.

A-115 115. Exclusive of the down payment, a home buyer would pay the least closing costs if they were to use: A. B. C. D. A Cal-Vet loan An FHA loan A VA loan A conventional loan A. The Department of Veteran’s Affairs, under the Cal-Vet program, secure very reasonable closing costs such as escrow fees and title policy rates. These closing costs are generally much lower than those in other types of financing.

A-116 116. When an individual is buying property under a Real Property Sales Contract and is paying pro-rata taxes and insurance to the seller, which of the following is correct? A. B. C. D. Seller can deposit the funds in his personal bank account Seller must keep the funds in a separate trust account Seller can apply the funds to the principal of the loan Seller can use the funds until the taxes and insurance are due B. If payments are made on taxes and insurance to the seller as impounded amounts, these funds must be placed in a separate trust account for that purpose.

A-117 117. A real estate licensee was actively seeking listings by contacting owners in a non-integrated neighborhood and telling them that minorities were moving into the area and as a result, the values of homes in the area would suffer a loss in value and it was a good time to sell the property. This type of activity by the licensee would be considered: A. B. C. D. Steering Inducement of panic selling Blockbusting Both B & C D. Section 10177(I) of the Code identifies this illegal activity as “inducement of panic selling” or “blockbusting”.

A-118 M 118. The Barkers purchased a home for a total price of $80, 000. They put up a down payment of 21. 25% and obtained a 30 year amortized loan for the balance that had an interest rate of 10. 25% per annum. The lender required a monthly impound payment to cover the annual taxes of $800 and a 3 year insurance premium of $978. If the amount applied to the principal on the first monthly payment was $119, the total payment including the impound was most nearly: A. B. C. D. C. $657. 00 $703. 00 $751. 00 $805. 00 $80, 000 less $17, 000 (21. 25%) = $63, 000 loan $63, 000 X 10. 25% = $6457. 50 interest per year $6, 457. 50 divided by 12 = $538. 13 interest first month $800 taxes divided by 12 = $66. 67 per month $978 insurance divided by 36 = 27. 17 per month $119 prin + $538. 13 int + $66. 67 taxes + $27. 17 ins = $750. 97

A-119 119. Which of the following would be a correct statement concerning a note secured by a deed of trust? A. The trust deed is more important than the note B. The lien of the trust deed is a mere incidence of the debt C. The trust deed will govern if there is a conflict with the note as to the maturity of the obligation D. The trust deed outlaws before the note B. The note is the evidence of the debt and the trust deed is the security or mere incidence of the debt.

A-120 120. When a trust deed is foreclosed by court action: A. B. C. D. The procedure is the same as for a trustee’s sale The trustor has a one year redemption period A deficiency judgment is not possible on an investment property loan The trustor has a three month reinstatement right B. Any loan whether it’s a mortgage or a trust deed that is foreclosed by court action, allows the borrower or trustor to redeem the property within one year after the court foreclosure sale.

A-121 121. A deed of trust and note given to a seller to finance the purchase of vacant land on which the buyer intends to place a short term construction loan would most likely contain: A. B. C. D. Alienation clause An “or more” clause A subordination clause A prepayment penalty clause C. A subordination clause places an existing loan in a junior position. This would be essential if the buyer of the property wishes to obtain a construction loan since construction lenders insist on having first priority.

A-122 122. Smith purchased a home from Brown which had a conventional loan secured by a trust deed on the property. Smith wanted to assume the loan. The beneficiary agreed to the assumption and a substitution of liability. If this should happen: A. B. C. D. Brown is relieved from all liability Brown is primarily liable and Smith is secondarily liable The assumption has no effect on Brown’s liability Smith is primarily liable but Brown is a surety A. When a loan is assumed the original borrower is usually still secondarily liable. Since there was also a substitution of liability in this instance, Brown is relieved of all liability.

A-123 123. Which of the following statements concerning tax liens on real property is not correct: A. If real property is sold for delinquent taxes at a public auction the buyer receives title free and clear of any trust deed lien B. The real property tax lien is superior to any liens against the property as a result of contracts C. In the standard trust deed form, the beneficiary is usually given the power to foreclose his lien if the buyer doesn’t pay his property taxes D. The lien for real property taxes is on a parity with liens for special assessments, regardless of the time of creation of the liens A. Property purchased at a sale of the property due to delinquent taxes is bought subject to all other existing liens, including trust deeds.

A-124 124. When a buyer invests in the purchase of a condominium, he receives: A. Title to the unit and a joint tenancy ownership of the land B. Title to the air space known as the unit and a part ownership of the common area C. A joint tenancy ownership in a building and a common ownership D. All of the above B. One of the key differences in a condominium project is that the buyer receives title to 100% of the air space and becomes a tenant in common with the rest of the owners in the building to the common area.

A-125 125. The Subdivision Map Act requires: A. Delivery of a copy of the Real Estate Commissioner’s Public Report to all prospective purchasers B. The subdivider to prepare a tentative map and file it with the city or county C. Insertion of release clauses in all blanket mortgages covering subdivision property D. Submission of proposed sales contracts for subdivision lots that a local government agency has approved B. The Map Act is concerned with the physical development of a subdivision and a subdivider is required to prepare a map and file it with the city or county.

A-126 126. Which one of the statements in the following is in error? A licensee of the Department of Real Estate who wishes to sell subdivided property: A. Must show a termination date in an exclusive listing even though it is not known how long it will take to sell all of the lots B. May obtain the listing prior to the issuance of the Commissioner’s Public Report C. May not sell or offer to sell lots prior to the issuance of the commissioner’s Final Subdivision Public Report D. May sell lots at any time as long as the terms of sale are made subject to the issuance of the Commissioner’s Final Public Report D. A licensee may not sell or take an offer on a subdivision property until the Commissioner’s Final Public Report has been issued. It is permissible to take a reservation but this is not a contract or an offer on the property.

A-127 127. A real estate broker must prepare a Mortgage Loan Disclosure Statement when the broker negotiates: A. A loan of $30, 000 secured by a first trust deed against his own home B. The sale of a $4, 000 second trust deed C. The sale of a Real Property Security D. A loan of $8, 000 secured by a first trust deed from a private party and the broker receives a 10% commission from the borrower D. The Loan Brokerage Law applies to first trust deeds negotiated by a broker of less than $30, 000. In this instance the $8, 000 loan, obtained from a private party, would be under the law since the broker is taking a 10% commission.

A-128 128. A real estate broker who is active as a loan broker has arranged for a loan and has had his statement prepared and signed by the borrower. He then discovers that there is a lien on the property which was not disclosed to him during the negotiations. If the loan cannot be arranged due to the lien, the borrower would be liable for: A. Cost and expenses of originating the loan which have been paid or incurred plus the full commission B. One half of all costs, expenses and commissions shown on the statement C. No costs, expenses or commissions D. All costs and expenses paid or incurred and one half of the commission charges D. If the borrower has not disclosed all the information necessary for the broker to complete the loan, the broker is entitled to all of the costs and expenses plus one half of the commission he would have earned if he could have completed the loan.

A-129 129. In the event a real estate licensee sells an existing real property sales contract on behalf of the Vendor, it is the responsibility of the licensee to have an assignment recorded no later than: A. B. C. D. Five working days Ten working days 30 working days No specific time B. When a real estate licensee sells a trust deed or a real property sales contract he must be sure that the assignment is recorded within ten working days.

A-130 130. A “promotional note” is defined as a promissory note secured by a trust deed executed on unimproved real property, or executed after the construction of an improvement on the property but before the first sale of the property, so improved, is made, and which is subordinated, or which by its terms may become subordinate. The term “promotional note” does not include a “seasoned” note which was executed at a time more than: A. B. C. D. One year prior to it being offered for sale Two years prior to it being offered for sale Three years prior to it being offered for sale Four years prior to it being offered for sale C. A seasoned note is one that has been in existence for at least three years and is excluded under the law regarding real property securities.

A-131 131. Which of the following parties would be in violation of the real estate law if they were not licensed by the Department of Real Estate? A. An attorney in fact who signed a deed to the property owned by his principal B. An attorney operating a real estate business out of his law office without a real estate broker’s license C. An attorney’s secretary who also performs her duties as a secretary in a real estate business D. All of the above B. An attorney does not need a license if he is working for a client on a real estate transaction. This does not allow the attorney, however, to operate a real estate office without a broker’s license.

A-132 132. It is the primary duty of the Real Estate Commissioner to determine administrative policy and enforce the provisions of the Real Estate Law. Among the duties involved is the screening and qualifying of applicants for a license. The Commissioner should not issue a license to a broker applicant if the applicant cannot: A. Show that he has entered a plea of guilty or has been found guilty of, or has been convicted of a felony B. Prove to the Commissioner that he has procured or attempted to procure a real estate license by fraud, misrepresentation or deceit, by making any material misstatement of fact in his application C. Show that he is not a citizen of the United States D. Submit recommendations certifying that the applicant is honest and truthful D. The broker applicant must submit recommendations certifying that the applicant is honest and truthful. If the applicant cannot show this to the Commissioner, the Commissioner cannot issue the license.

A-133 133. A real estate salesman working under a licensed real estate broker may not: A. Secure a listing for the leasing of real property B. Take an open listing in the broker’s name that has no final or definite termination date C. Sell his own home D. Claim a commission through his broker on an exclusive listing that has no termination date D. If a licensee secures an exclusive listing without a termination date, the contract is void and no commission need be paid.

A-134 134. Jones and Smith, individual real estate brokers, wish to enter into a joint venture to purchase an office building. In this transaction: A. A permit from the California Corporation’s Commissioner would be required B. A partnership license would be required C. The real estate broker licenses they now have would be used D. No license or permit would be required D. If two brokers wish to enter into a purchase on their own of an office building, they need no license or special permits.

A-135 135. Certain requirements are deemed essential in a declaration of homestead. Which of the following is not a requirement? A. Statement that claimant is a married man B. Name of spouse, if any C. Statement that claimant is residing on the premises and claims it as a homestead D. A description of the property A. If the party filing the declaration of homestead is not married they cannot indicate in the form that they are a married person.

A-136 136. A lien created by a money judgment affects the real property of a judgment debtor: A. No matter where the property is located in the United States B. In each county where the Abstract of Judgment is recorded C. In the entire state, and it attaches by filing the Abstract of Judgment with the clerk of the court where the judgment was rendered D. Only in the county where the trial was held B. A judgment becomes a general lien in each county where the judgment has been recorded.

A-137 137. If title to real property is acquired by means of adverse possession, several requirements must be met by the adverse possessor. All of the following are essential elements of adverse possession except: A. B. C. D. Possession of the property must be open and notorious Claimant must have paid all real property taxes for five years continuously Person taking possession must reside on the property Possession must be held under a claim of right, or color of title C. One of the requirements for adverse possession is that the adverse possessor take possession of the property. This does not mean they must reside or live on the property. They could be using the land for farming or grazing purposes and still be considered using it.

A-138 138. When a property is sold and the financing is based on the extension of credit by the seller, the seller is permitted to retain the legal title by the use of a: A. B. C. D. Bailment Trust deed Real property sales contract Security agreement C. A real estate sales contract provides for a sale of real property in which the seller extends the credit to the buyer and the seller retains legal title to the property

A-139 139. A title insurance policy that is issued to cover every claim that is made against the title holder, would be which of the following? A. B. C. D. Standard Extended A. L. T. A. None of the above D. There is no title insurance policy that will cover every possible claim against the title holder.

A-140 140. If a person dies intestate, the probate court will appoint an: A. B. C. D. Executor Executrix Administrator Attorney-in-fact C. A person that has died intestate means that they left no will. In this instance the court must appoint an administrator. An executor is appointed by the decreased in the will if there is one.

A-141 141. The major part of the California Laws relating to real property are created by: A. B. C. D. The State Constitution Legislative Acts The Real Estate Commissioner The Business and Professions Code B. Most of our California laws today are created by the Senators and Assemblypersons in Sacramento

A-142 142. The reason that the Grant Deed has generally replaced the need of the Warranty Deed in California has been the reliance on: A. B. C. D. Abstracts of title Title insurance Quitclaim Deeds Certificates of Title B. A warranty deed gives express or written warranties whereas the grant deed merely gives implied warranties. Since the title insurance company guarantees that the grantor is telling the truth about the title, there is no need for a warranty deed.

A-143 143. Accrued depreciation in appraising terms is best described as: A. A book entry made to reflect the depreciation accrued over the economic life of an improvement, with allowance for later additions B. An appraiser’s estimate of the accumulated age depreciation, with allowance for condition based on effective age C. The total accrued loss of value based upon replacement cost figures using the chronological age only D. A projection for property residual purposes, using a conservative rate of accrual based on the remaining economic life B. Accrued depreciation for appraising refers to an estimate of the accumulated age, but the appraiser considers the effective age, not the actual or chronological age.

A-144 144. A joint tenancy holding in real property can legally be created by the execution of a deed by: A. B. C. D. A husband wife to themselves as joint tenants All existing joint tenants to themselves and others as joint tenants All existing tenants in common to themselves as joint tenants Any of the above ways D. A joint tenancy can be created in any of the ways described in choices “A”, “B” or “C”.

A-145 145. A real estate licensee must disclose his or her license status in newspaper advertisements when representing a client. In order to avoid a “blind ad” the licensee may use which of the following abbreviations: A. B. C. D. “Agt. ” “Bro. ” Neither “Agt. ” or “Bro. ” Either “Agt. ” or “Bro. ” D. The abbreviation of “Agt” or “Bro” is acceptable.

A-146 146. If a question of priority was raised between two trust deeds that had been executed against the same property and assuming neither contained a subordination clause, the trust deed that would have priority would be the one that had been: A. B. C. D. Executed and delivered first Used to secure a construction loan Used to purchase the property Recorded first D. The trust deed that was recorded first will have first priority.

A-147 147. In the sale of real property in which the buyer assumed an existing loan, the closing statement would show the loan as: A. B. C. D. A debit to the buyer A credit to the seller None of the above B. When an existing loan is being assumed by the buyer, the closing statements will show a credit to the buyer and a debit to the seller.

A-148 148. A promissory note that calls for a fixed amount to be paid each month towards the principal, plus accrued interest with a balloon payment due at the end of 5 years, is known as a: A. B. C. D. Fully amortized note Straight note Fixed payment note Partially amortized note D. The fact that there is a balloon payment on this note that is being paid off on a monthly basis (amortized) makes it a partially amortized note.

A-149 149. Contracts entered into by a person during a period of time in which the person develops mental health problems would become statutorily void when the person: A. Visits a psychiatrist twice a week, stays at home and cannot hold down employment B. Voluntarily commits himself or herself to a mental institution C. Is committed to a mental institution against his or her wishes D. Is legally adjudged insane and for whom a conservatory has been appointed by the court following a conservatory hearing D. A person is not considered incompetent until the courts have adjudged the person to be so.

A-150 150. A real estate licensee who fails to disclose a material fact to a prospective buyer while acting as the agent of the seller could be subject to: A. B. C. D. Disciplinary action by the Real Estate Commissioner Criminal action Civil action by the injured party All of the above D. Misrepresentation of a material fact that causes severe damages could lead to a loss of license as well as civil and criminal action.

END OF EXAM A

A-24 24. Which of the following is the least important factor when appraising a site for commercial purposes? A. B. C. D. Convenience of facility to shipping and labor sources The community’s purchasing power Zoning regulations Amenities D. Original cost has little or nothing to do with value when applying the cost approach to an older structure.

5461278f5b5bcda7d6014ecc73bc5899.ppt