8237f534e0aec0c0f78ddf4e8a044dde.ppt

- Количество слайдов: 17

Cal. WORKs and Food Stamp Overpayments Kevin Aslanian Coalition of California Welfare Rights Organizations, Inc. 1901 Alhambra Blvd. Sacramento, CA 95816 Tel. 916 -736 -0616 Fax 916 -736 -2645 Cell 916712 -0071 Kevin. aslanian@ccwro. org -- web page: ccwro. org ATTENTION : This “Power Point” presentation is intended to be presented with an oral presentation to fill in the blanks left vacant. If you want a presentation, please contact CCWRO at 916 -736 -0616/916 -712 -0071 or complete our “training request form” at: http: //www. ccwro. org/index. php? option=com_content& view=article&id=47&Itemid=55

Cal. WORKs and Food Stamp Overpayments Kevin Aslanian Coalition of California Welfare Rights Organizations, Inc. 1901 Alhambra Blvd. Sacramento, CA 95816 Tel. 916 -736 -0616 Fax 916 -736 -2645 Cell 916712 -0071 Kevin. aslanian@ccwro. org -- web page: ccwro. org ATTENTION : This “Power Point” presentation is intended to be presented with an oral presentation to fill in the blanks left vacant. If you want a presentation, please contact CCWRO at 916 -736 -0616/916 -712 -0071 or complete our “training request form” at: http: //www. ccwro. org/index. php? option=com_content& view=article&id=47&Itemid=55

Overpayments -Causes Over income Over resources (Cal. WORKs – no longer for Food Stamps) Changes in household composition Allegation that children not in home “Man in the house” Child support direct payments Cal. WORKs – § 44 -350

Overpayments -Causes Over income Over resources (Cal. WORKs – no longer for Food Stamps) Changes in household composition Allegation that children not in home “Man in the house” Child support direct payments Cal. WORKs – § 44 -350

Overpayments Discovery IEVS New hire registry Bank records Quarterly reports Reassessments EDD reports

Overpayments Discovery IEVS New hire registry Bank records Quarterly reports Reassessments EDD reports

Cal. WORKs Collection Methods Credit Reporting Tax Intercept Grant Adjustment Court on Civil Judgment Voluntary Cash Recovery

Cal. WORKs Collection Methods Credit Reporting Tax Intercept Grant Adjustment Court on Civil Judgment Voluntary Cash Recovery

Cal. WORKs – Responsible Party for Overpayment Adults in Assistance Unit Children only after turn 18 if overpayment hasn’t been paid

Cal. WORKs – Responsible Party for Overpayment Adults in Assistance Unit Children only after turn 18 if overpayment hasn’t been paid

Cal. WORKs Administrative Errors County incorrectly budgeted income County did not consider resources County failed to removed members of the AU

Cal. WORKs Administrative Errors County incorrectly budgeted income County did not consider resources County failed to removed members of the AU

Cal. WORKs Excess Property Overpayments Property overpayments good faith v. non -good faith Good faith overpayment is the lesser of asset value or the OP amount

Cal. WORKs Excess Property Overpayments Property overpayments good faith v. non -good faith Good faith overpayment is the lesser of asset value or the OP amount

Cal. WORKs Overpayment Defenses Equitable Estoppel Administrative error v. fraud Latches Incorrect budgeting (QR 7 reporting mistakes)

Cal. WORKs Overpayment Defenses Equitable Estoppel Administrative error v. fraud Latches Incorrect budgeting (QR 7 reporting mistakes)

Cal. WORKs Fraud Worker can refer cases to Fraud Unit on hunch Cases are referred to Fraud Do not talk to the fraud investigators or anyone at the county welfare department about overpayment Paying it back will not stop fraud prosecution Stopping benefits will not stop fraud prosecution Be careful at hearing, self incrimination v. collateral estoppel The burden of proof is on the DA

Cal. WORKs Fraud Worker can refer cases to Fraud Unit on hunch Cases are referred to Fraud Do not talk to the fraud investigators or anyone at the county welfare department about overpayment Paying it back will not stop fraud prosecution Stopping benefits will not stop fraud prosecution Be careful at hearing, self incrimination v. collateral estoppel The burden of proof is on the DA

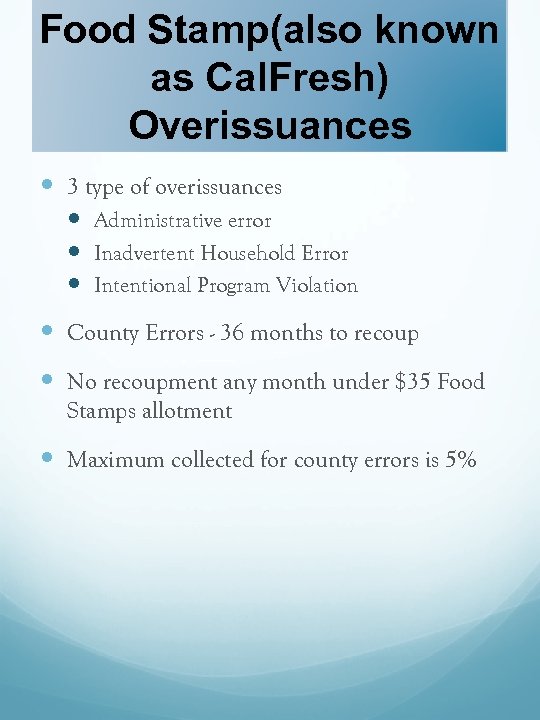

Food Stamp(also known as Cal. Fresh) Overissuances 3 type of overissuances Administrative error Inadvertent Household Error Intentional Program Violation County Errors - 36 months to recoup No recoupment any month under $35 Food Stamps allotment Maximum collected for county errors is 5%

Food Stamp(also known as Cal. Fresh) Overissuances 3 type of overissuances Administrative error Inadvertent Household Error Intentional Program Violation County Errors - 36 months to recoup No recoupment any month under $35 Food Stamps allotment Maximum collected for county errors is 5%

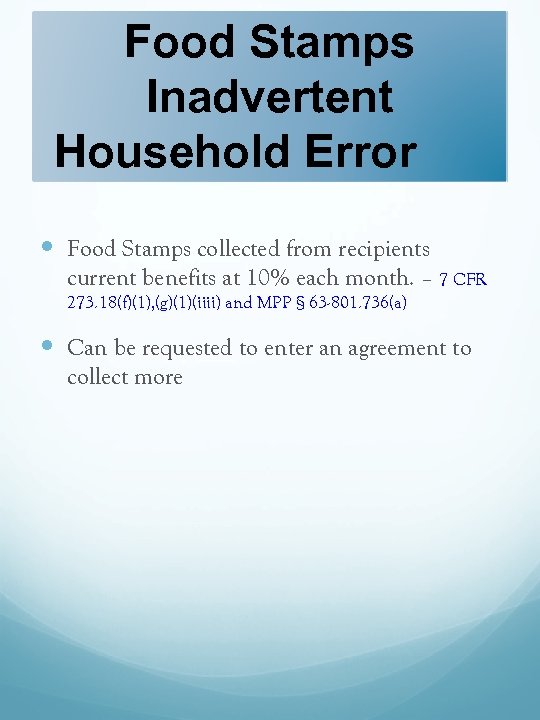

Food Stamps Inadvertent Household Error Food Stamps collected from recipients current benefits at 10% each month. – 7 CFR 273. 18(f)(1), (g)(1)(iiii) and MPP § 63 -801. 736(a) Can be requested to enter an agreement to collect more

Food Stamps Inadvertent Household Error Food Stamps collected from recipients current benefits at 10% each month. – 7 CFR 273. 18(f)(1), (g)(1)(iiii) and MPP § 63 -801. 736(a) Can be requested to enter an agreement to collect more

Food Stamp Intentional Program Violation Fraud Cases Separate hearing procedures Be very careful

Food Stamp Intentional Program Violation Fraud Cases Separate hearing procedures Be very careful

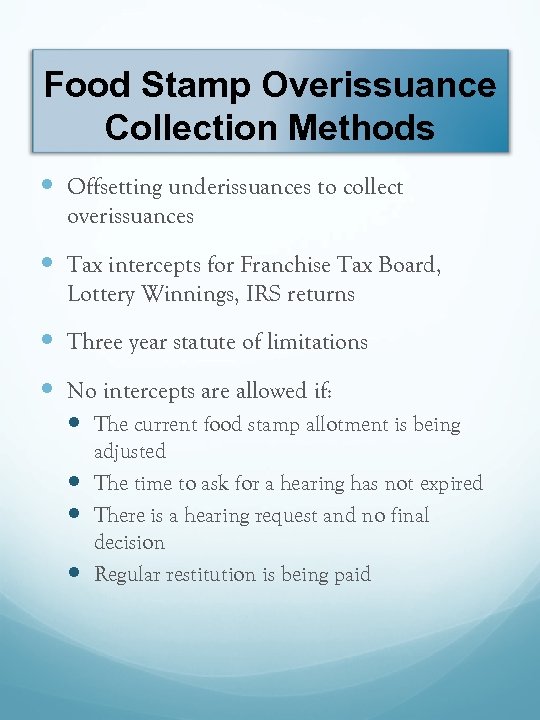

Food Stamp Overissuance Collection Methods Offsetting underissuances to collect overissuances Tax intercepts for Franchise Tax Board, Lottery Winnings, IRS returns Three year statute of limitations No intercepts are allowed if: The current food stamp allotment is being adjusted The time to ask for a hearing has not expired There is a hearing request and no final decision Regular restitution is being paid

Food Stamp Overissuance Collection Methods Offsetting underissuances to collect overissuances Tax intercepts for Franchise Tax Board, Lottery Winnings, IRS returns Three year statute of limitations No intercepts are allowed if: The current food stamp allotment is being adjusted The time to ask for a hearing has not expired There is a hearing request and no final decision Regular restitution is being paid

Pre-Intercept Rights Before a tax intercept the county has to: Issue a Notice of Action (NOA) about the referral to intercept The amount of the overpayment The right to contest the referral for an Intercept The name, address and phone number of the county’s contact to contest the intercept The right to an “administrative review” at anytime Possible reasons to disagree with the proposed action

Pre-Intercept Rights Before a tax intercept the county has to: Issue a Notice of Action (NOA) about the referral to intercept The amount of the overpayment The right to contest the referral for an Intercept The name, address and phone number of the county’s contact to contest the intercept The right to an “administrative review” at anytime Possible reasons to disagree with the proposed action

How to Fight Overpayments Always ask for a hearing Analyze case prior to hearing to determine self incrimination If the county does not have a case file, then they should lose the hearing because you need the case file to prove their case Ongoing issues about access to SIU file The burden of proof is on the county Look for underpayments, such as sanctions, transportation for working persons, failure to pay mileage.

How to Fight Overpayments Always ask for a hearing Analyze case prior to hearing to determine self incrimination If the county does not have a case file, then they should lose the hearing because you need the case file to prove their case Ongoing issues about access to SIU file The burden of proof is on the county Look for underpayments, such as sanctions, transportation for working persons, failure to pay mileage.

Note on Collection Agency Actions County can use own agency or contract with a third party Make sure underlying overpayment/overissuance exists Make sure notices were issued Challenge county to prove its case

Note on Collection Agency Actions County can use own agency or contract with a third party Make sure underlying overpayment/overissuance exists Make sure notices were issued Challenge county to prove its case

The End

The End