C O L U M B IA I N S T I T U T E APPRAISING REO/FORECLOSURES COURSE NO. 125 Instructor: Diana T. Jacob Email: dianatjacob@yahoo. com Phone: 800. 437. 4160 office or 254. 582. 3940 hm

Course Objectives • Recognize indicators that define a declining market • Understand the terminology of a declining market • Practice formulas to assess a distressed market • Review engagement letter components that define distressed properties • Overview Scope of Work decisions in foreclosure assignments • Identify units of impact in market interactions when declining values are ongoing • Practice Case Study “as is”, “subject to” and making recommendations to the client and other intended users 2

Page 1 -3 What defines a declining market? • Properties selling for less than the amount sold in the same measure of historical time period used to analyze the movement or trend of a market is a market defined as one in decline. • The cause can also define a market which is trending downward for a short period or one which is appearing to steadily decline for a period which has had no forecasted end. If an event such as road construction is underway the decline may be shortlived. This cause has a definable period of end and creates what is known as a frictional market. 3

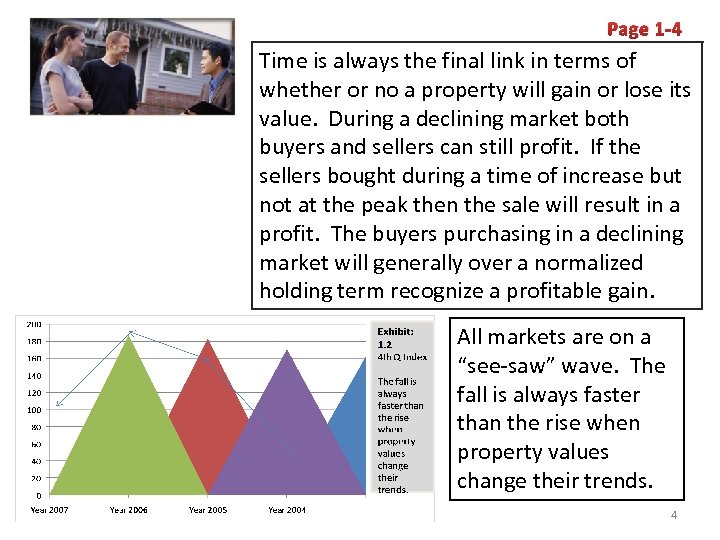

Page 1 -4 Time is always the final link in terms of whether or no a property will gain or lose its value. During a declining market both buyers and sellers can still profit. If the sellers bought during a time of increase but not at the peak then the sale will result in a profit. The buyers purchasing in a declining market will generally over a normalized holding term recognize a profitable gain. All markets are on a “see-saw” wave. The fall is always faster than the rise when property values change their trends. 4

Terms of a Declining Market Page 1 -5 • Pre-Foreclosure • Debt Forgiveness • Sheriff’s Sale • Trust Sale • Real Estate Owned • Friendly Foreclosure • Short Sale 5

Pages 1 -5 & 1 -6 Pre-Foreclosure and Debt Forgiveness Generally associated with Friendly Foreclosure; a voluntary surrender of the interest is given. Pre-Foreclosure An assignment where the relationship of the debtor/mortgagor and the lender/mortgagee has faltered. Problems for the appraiser is that often the inspection is from the exterior only across the street and the damage due to deferred maintenance is unknown but highly probable. In a Debt-Forgiveness although the lender may accept the surrender the IRS will not forgive the taxes due on the forgiven portion of the debt seen as income earned. 6

Sheriff’s Sale and Trust Sale Sheriff’s Sale A process of foreclosure which results from a formal process of legal notification and court granted permission to sell property at an auction to the highest bidder for defaulting mortgage payments Page 1 -6 Trust Sale Debt is secured by a Deed of Trust. The lender is the beneficiary of the Trust. The Beneficiary, in the event of a default, orders the Trustee to sell the property at a Trust Sale much like the Sheriff’s Sale process. 7

Short Sales and REO’s Page 1 -7 Short Sales – A sales transaction which is the transfer of property from a property owner to a buyer with permission from the mortgagee/lender as a deficiency will take place as the sale price is below the balance due. This results in the lender receiving less than is owed. REO – Sometimes called ORE (Other Real Estate) properties that have gone through the foreclosure process and are now in the possession of the lender are called Real Estate Owned (REO’s). 8

Economic Base –Affect on a Residential Market • The economic activity determines whether a neighborhood is in a state of growth, decline or stagnation. Page 1 -7 & 8 • The question that must be asked is, “How much of an area’s basic employment is tied to one industry or employer? ” • The Location Quotient (LQ) is a ratio that communicates an industry’s share of the local economy. • A LQ > than “ 1” is a base industry that exports as opposed to one that has a LQ < 1 which serves local demand (non-basic). 9

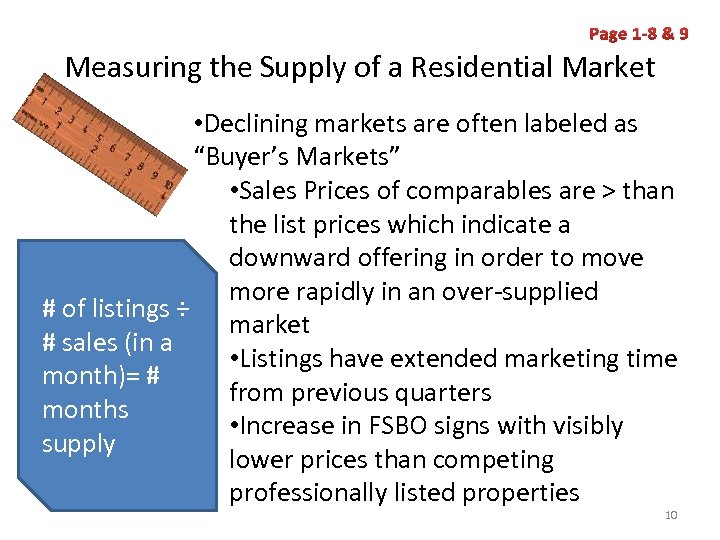

Page 1 -8 & 9 Measuring the Supply of a Residential Market • Declining markets are often labeled as “Buyer’s Markets” • Sales Prices of comparables are > than the list prices which indicate a downward offering in order to move more rapidly in an over-supplied # of listings ÷ market # sales (in a • Listings have extended marketing time month)= # from previous quarters months • Increase in FSBO signs with visibly supply lower prices than competing professionally listed properties 10

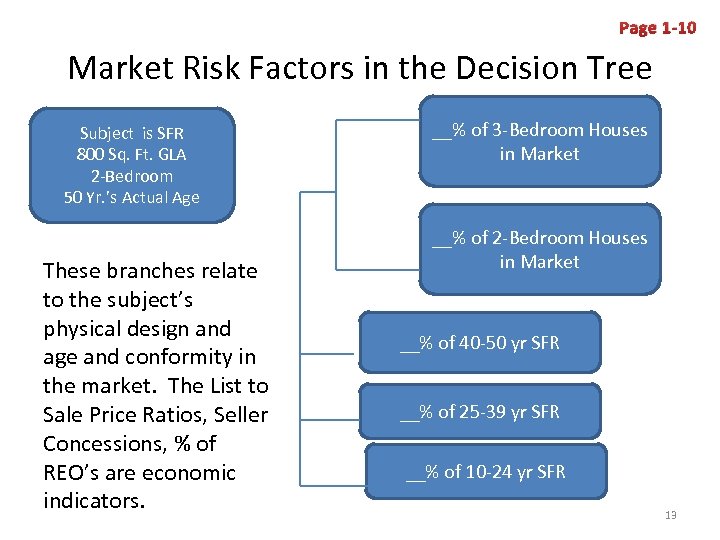

Page 1 -9 Risk Analysis – A Measure of Decline Impact There are varied methods of performing risk analyses; but the first step in any method is to identify the risk factors associated with risk analysis. In the residential real estate market the risk factors can begin with mapping out those factors on a decision tree. Each branch will relate to a risk factor which will have market impact on the appraisal. 11

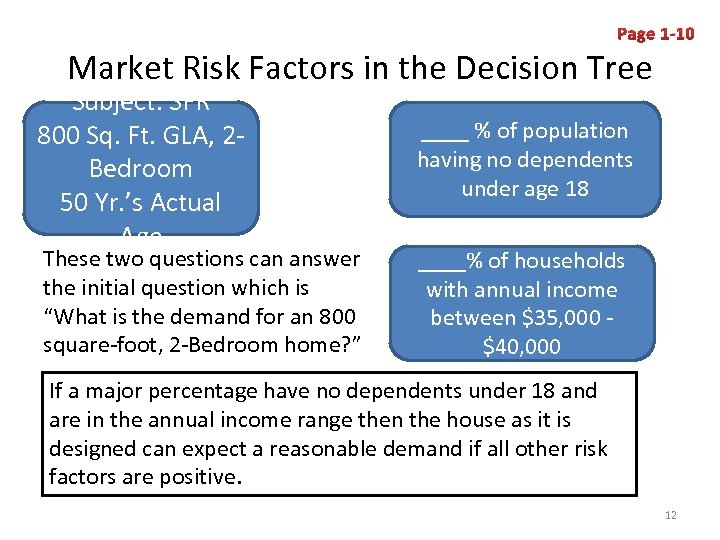

Page 1 -10 Market Risk Factors in the Decision Tree Subject: SFR 800 Sq. Ft. GLA, 2 Bedroom 50 Yr. ’s Actual Age These two questions can answer the initial question which is “What is the demand for an 800 square-foot, 2 -Bedroom home? ” ____ % of population having no dependents under age 18 ____% of households with annual income between $35, 000 - $40, 000 If a major percentage have no dependents under 18 and are in the annual income range then the house as it is designed can expect a reasonable demand if all other risk factors are positive. 12

Page 1 -10 Market Risk Factors in the Decision Tree Subject is SFR 800 Sq. Ft. GLA 2 -Bedroom 50 Yr. ’s Actual Age These branches relate to the subject’s physical design and age and conformity in the market. The List to Sale Price Ratios, Seller Concessions, % of REO’s are economic indicators. __% of 3 -Bedroom Houses in Market __% of 2 -Bedroom Houses in Market __% of 40 -50 yr SFR __% of 25 -39 yr SFR __% of 10 -24 yr SFR 13

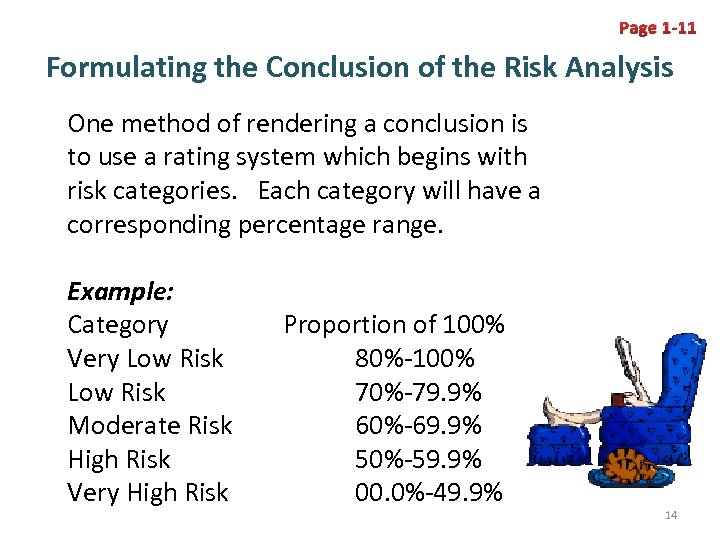

Page 1 -11 Formulating the Conclusion of the Risk Analysis One method of rendering a conclusion is to use a rating system which begins with risk categories. Each category will have a corresponding percentage range. Example: Category Very Low Risk Moderate Risk High Risk Very High Risk Proportion of 100% 80%-100% 70%-79. 9% 60%-69. 9% 50%-59. 9% 00. 0%-49. 9% 14

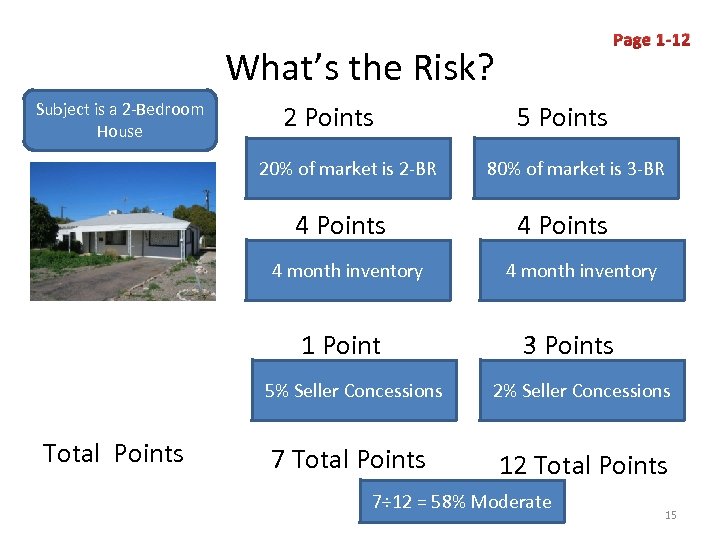

Page 1 -12 What’s the Risk? Subject is a 2 -Bedroom House 2 Points 20% of market is 2 -BR 4 Points 4 month inventory 1 Point 5 Points 80% of market is 3 -BR 4 Points 4 month inventory 3 Points 5% Seller Concessions Total Points 2% Seller Concessions 7 Total Points 12 Total Points 7÷ 12 = 58% Moderate 15

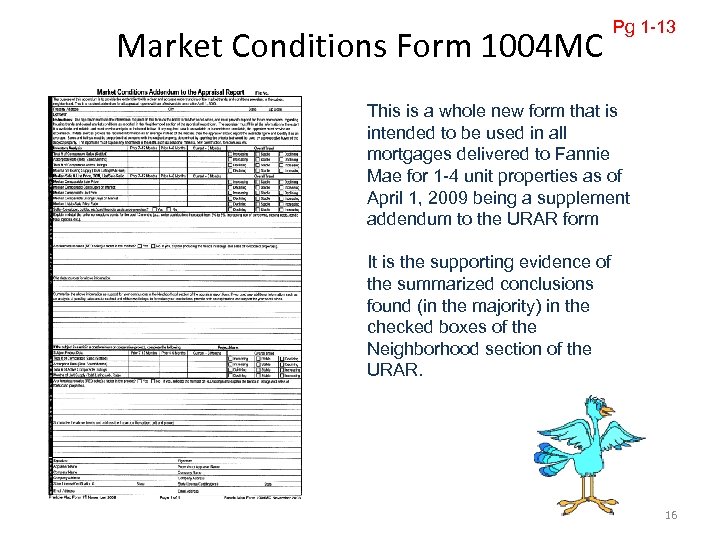

Market Conditions Form 1004 MC Pg 1 -13 This is a whole new form that is intended to be used in all mortgages delivered to Fannie Mae for 1 -4 unit properties as of April 1, 2009 being a supplement addendum to the URAR form It is the supporting evidence of the summarized conclusions found (in the majority) in the checked boxes of the Neighborhood section of the URAR. 16

Pg 1 -14 Market Conditions Form 1004 MC The instructions are very clear, note how many times the word “MUST” is used in the first two sentences…”The appraiser must use the information required on this form as the basis for his/her conclusions, and must provide support for those conclusions, regarding housing trends and overall market conclusions as reported in the Neighborhood section of the appraisal report form. The appraiser must fill in all the information to the extent it is available and reliable and must provide analysis as indicated below. …” 17

Websites to Research Page 1 -19 There are many websites where research on various appraisal assignments is beneficial. A few of those specific to declining markets are; www. indices. standardpoors. com www. ofheo. gov/download. asp www 2. standardpoors. com/spf/html/pro ducts/url_homeprice. htm www. radian. biz (by zip code) www. ugcorp. com (by zip code) 18

Page 1 -20 Comments – Communicating Due Diligence • Is the market activity contrary to published reports? If yes, tell them and tell them why and how you were able to confirm this. The SOW Rule • The market is not yet in decline requires the but is beginning to be impacted appraiser to identify such as extended marketing time. the extent of their research and analysis. • The market is in decline. Communicating the market’s activity conclusion is extremely critical when markets are in decline or are surrounding by declining markets. 19

Page 1 -20 Communicating the Market’s Status Communicating the stage of the transitioning market is the due diligence of reporting the conclusion of the market analysis. 1. The market you’re assigned to evaluate in not in decline which is contrary to the published state reports. 2. The subject’s market is not yet declining in price or value units (i. e. sale price per sq. ft. ) but its showing signs of transition such as increases in seller concessions and/or marketing time. 3. The market is in decline with no defined or projected time period for an end to the declining status. 20

Page 2 -3 & 4 The Engagement of the Pre-Foreclosure Client and any other intended users Assumption: The bank ordering the appraisal is the client. Question: Is there a secondary market involved? Intended Use(s) Assumption: Decision in process on defaulting mortgage. Question: Is this an in-house decision only or will someone else be relying on the information and/or have additional questions? 21

Page 2 -4 The Engagement of the Pre-Foreclosure Clearly there is a deficiency of information in the engagement letter needed to proceed with solving the appraisal problem. Question: Is the lender aware that under the market value definition using REO transactions may not be suitable if the sale represented undue stimulus? Do REO’s dominate the market or comprise a portion of the market? If the REO’s comprise a portion then use a proportionate share in the analysis and in the approaches to value to represent the market in its current status. The RUSH job conditions may not be acceptable based on the data available and data necessary to obtain under an exterior only inspection. 22

Page 2 -5 & 6 The Engagement of the Pre-Foreclosure Subject’s Relevant Characteristics Assumption: The date of exterior inspection is the effective date of the appraisal upon which these characteristics will be based and used in the appraisal. Question: What is the date that was in effect when the last reported relevant units of comparison were confirmed? Does the reader understand the impact of the assumption that those conditions may be changed; this is especially true on foreclosure properties where depression and anger are being experience by the homeowners who are losing their home. The risk and consequences should be discussed and considered in the analysis 23

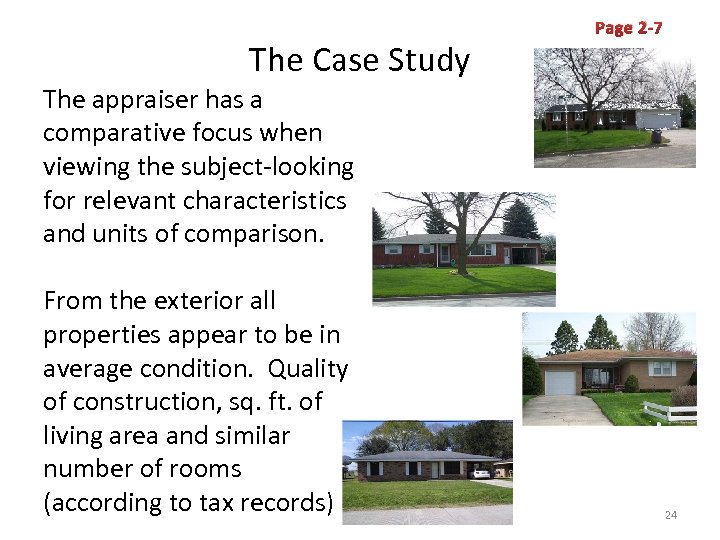

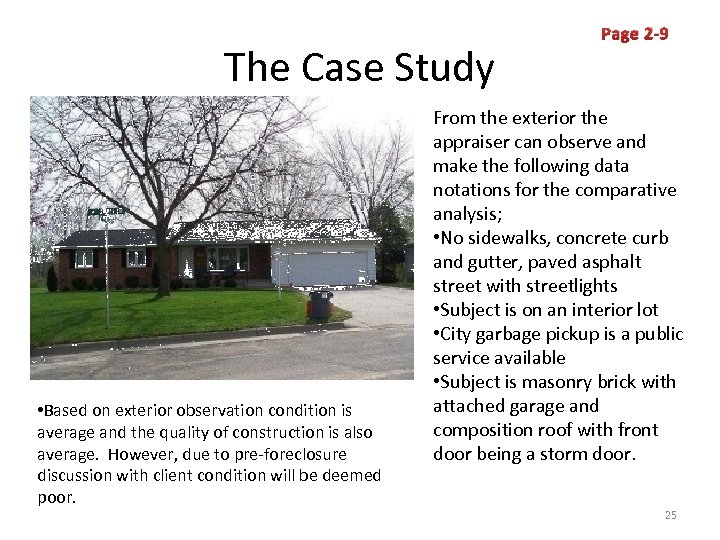

The Case Study Page 2 -7 The appraiser has a comparative focus when viewing the subject-looking for relevant characteristics and units of comparison. From the exterior all properties appear to be in average condition. Quality of construction, sq. ft. of living area and similar number of rooms (according to tax records) 24

The Case Study • Based on exterior observation condition is average and the quality of construction is also average. However, due to pre-foreclosure discussion with client condition will be deemed poor. Page 2 -9 From the exterior the appraiser can observe and make the following data notations for the comparative analysis; • No sidewalks, concrete curb and gutter, paved asphalt street with streetlights • Subject is on an interior lot • City garbage pickup is a public service available • Subject is masonry brick with attached garage and composition roof with front door being a storm door. 25

The Case Study Page 2 -10 • 3 ½ years ago the subject listed for $112, 600 selling at $108, 000 • Assessor Data: • Lot value $30, 000 • Assessed Value $116, 000 • No built in appliances • 2 bedroom 1 ½ bath • 40 years old 26

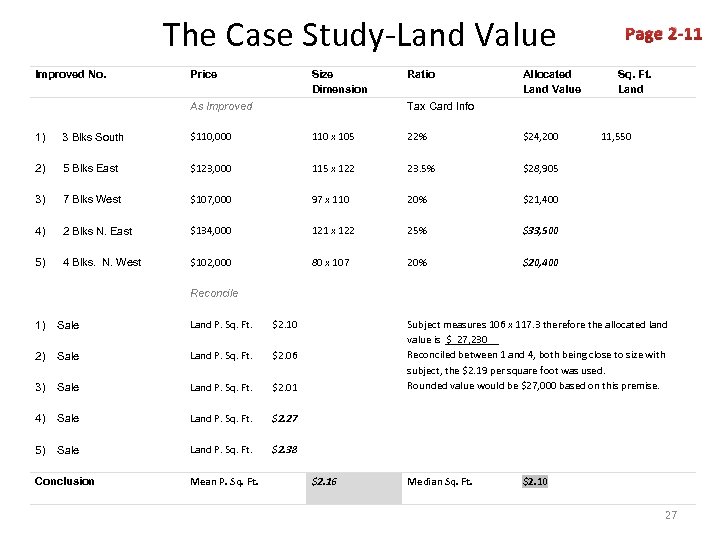

The Case Study-Land Value Improved No. Price Size Dimension As Improved Ratio Allocated Land Value Page 2 -11 Sq. Ft. Land Tax Card Info 1) 3 Blks South $110, 000 110 x 105 22% $24, 200 11, 550 2) 5 Blks East $123, 000 115 x 122 23. 5% $28, 905 3) 7 Blks West $107, 000 97 x 110 20% $21, 400 4) 2 Blks N. East $134, 000 121 x 122 25% $33, 500 5) 4 Blks. N. West $102, 000 80 x 107 20% $20, 400 Reconcile 1) Sale Land P. Sq. Ft. $2. 10 2) Sale Land P. Sq. Ft. $2. 06 3) Sale Land P. Sq. Ft. $2. 01 4) Sale Land P. Sq. Ft. $2. 27 5) Sale Land P. Sq. Ft. $2. 38 Conclusion Mean P. Sq. Ft. Subject measures 106 x 117. 3 therefore the allocated land value is $_27, 230__ Reconciled between 1 and 4, both being close to size with subject, the $2. 19 per square foot was used. Rounded value would be $27, 000 based on this premise. $2. 16 Median Sq. Ft. $2. 10 27

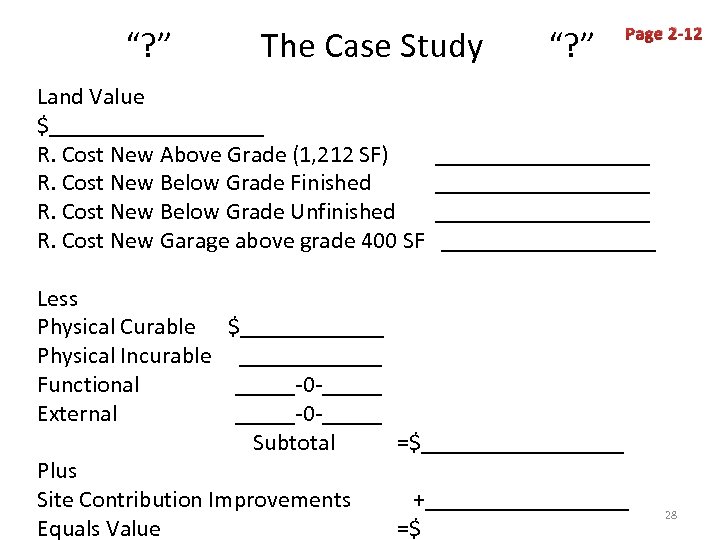

“? ” The Case Study “? ” Page 2 -12 Land Value $_________ R. Cost New Above Grade (1, 212 SF) _________ R. Cost New Below Grade Finished _________ R. Cost New Below Grade Unfinished _________ R. Cost New Garage above grade 400 SF _________ Less Physical Curable $______ Physical Incurable ______ Functional _____-0 -_____ External _____-0 -_____ Subtotal =$_________ Plus Site Contribution Improvements +_________ Equals Value =$ 28

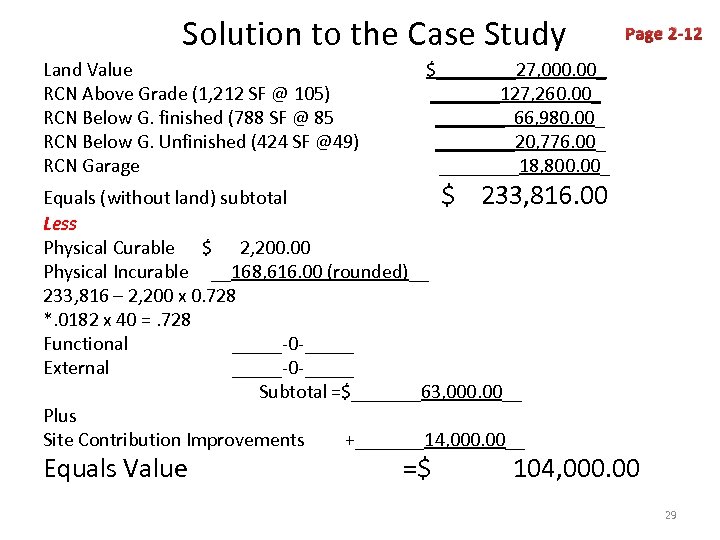

Solution to the Case Study Page 2 -12 Land Value RCN Above Grade (1, 212 SF @ 105) RCN Below G. finished (788 SF @ 85 RCN Below G. Unfinished (424 SF @49) RCN Garage $____27, 000. 00_ _______127, 260. 00_ _______ 66, 980. 00_ ____20, 776. 00_ ____18, 800. 00_ Equals Value =$ Equals (without land) subtotal $ 233, 816. 00 Less Physical Curable $ 2, 200. 00 Physical Incurable __168, 616. 00 (rounded)__ 233, 816 – 2, 200 x 0. 728 *. 0182 x 40 =. 728 Functional _____-0 -_____ External _____-0 -_____ Subtotal =$_______63, 000. 00__ Plus Site Contribution Improvements +_______14, 000. 00__ 104, 000. 00 29

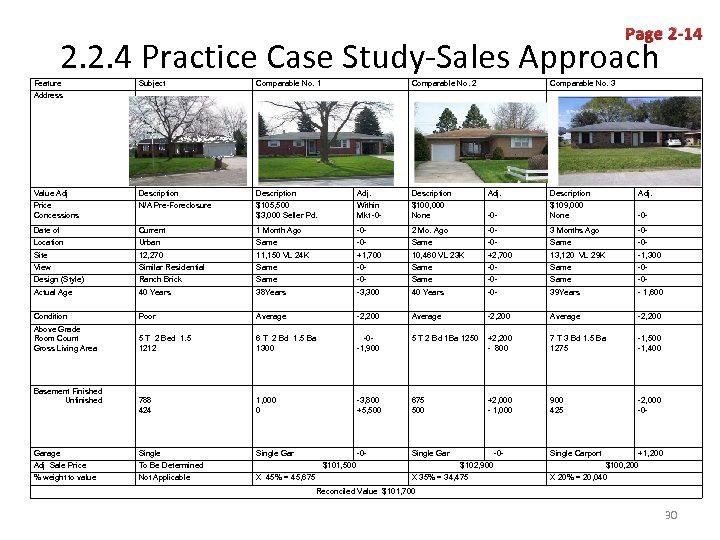

Page 2 -14 2. 2. 4 Practice Case Study-Sales Approach Feature Subject Comparable No. 1 Comparable No. 2 Comparable No. 3 Value Adj Description Adj. Price Concessions N/A Pre-Foreclosure $105, 500 $3, 000 Seller Pd. Within Mkt -0 - $100, 000 None -0 - $109, 000 None -0 - Date of Current 1 Month Ago -0 - 2 Mo. Ago -0 - 3 Months Ago -0 - Location Urban Same -0 - Site 12, 270 11, 150 VL 24 K +1, 700 10, 460 VL 23 K +2, 700 13, 120 VL 29 K -1, 300 View Similar Residential Same -0 - Design (Style) Ranch Brick Same -0 - Actual Age 40 Years 38 Years -3, 300 40 Years -0 - 39 Years - 1, 600 Condition Poor Average -2, 200 Above Grade Room Count Gross Living Area 5 T 2 Bed 1. 5 1212 6 T 2 Bd 1. 5 Ba 1300 -0 -1, 900 5 T 2 Bd 1 Ba 1250 +2, 200 - 800 7 T 3 Bd 1. 5 Ba 1275 -1, 500 -1, 400 788 424 1, 000 0 -3, 800 +5, 500 675 500 +2, 000 - 1, 000 900 425 -2, 000 -0 - Garage Single Gar -0 - Single Gar Adj Sale Price To Be Determined % weight to value Not Applicable Address Basement Finished Unfinished $101, 500 X 45% = 45, 675 -0$102, 900 X 35% = 34, 475 Single Carport +1, 200 $100, 200 X 20% = 20, 040 Reconciled Value $101, 700 30

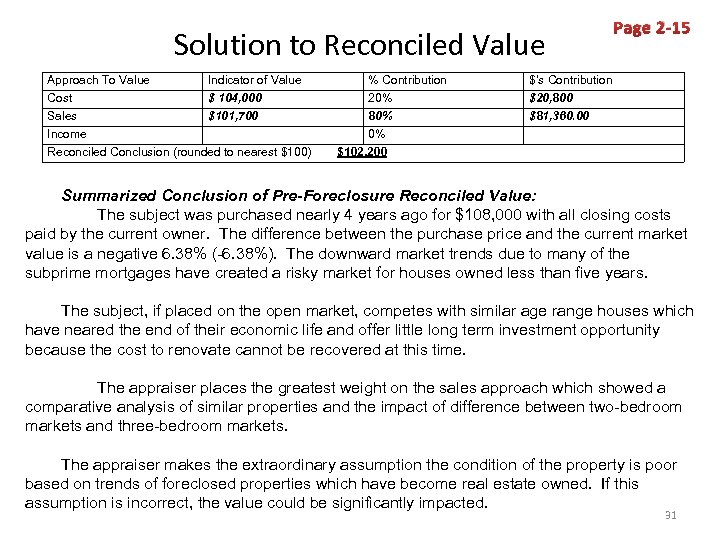

Solution to Reconciled Value Approach To Value Indicator of Value Cost $ 104, 000 Sales $101, 700 Income Reconciled Conclusion (rounded to nearest $100) % Contribution 20% 80% 0% $102, 200 Page 2 -15 $’s Contribution $20, 800 $81, 360. 00 Summarized Conclusion of Pre-Foreclosure Reconciled Value: The subject was purchased nearly 4 years ago for $108, 000 with all closing costs paid by the current owner. The difference between the purchase price and the current market value is a negative 6. 38% (-6. 38%). The downward market trends due to many of the subprime mortgages have created a risky market for houses owned less than five years. The subject, if placed on the open market, competes with similar age range houses which have neared the end of their economic life and offer little long term investment opportunity because the cost to renovate cannot be recovered at this time. The appraiser places the greatest weight on the sales approach which showed a comparative analysis of similar properties and the impact of difference between two-bedroom markets and three-bedroom markets. The appraiser makes the extraordinary assumption the condition of the property is poor based on trends of foreclosed properties which have become real estate owned. If this assumption is incorrect, the value could be significantly impacted. 31

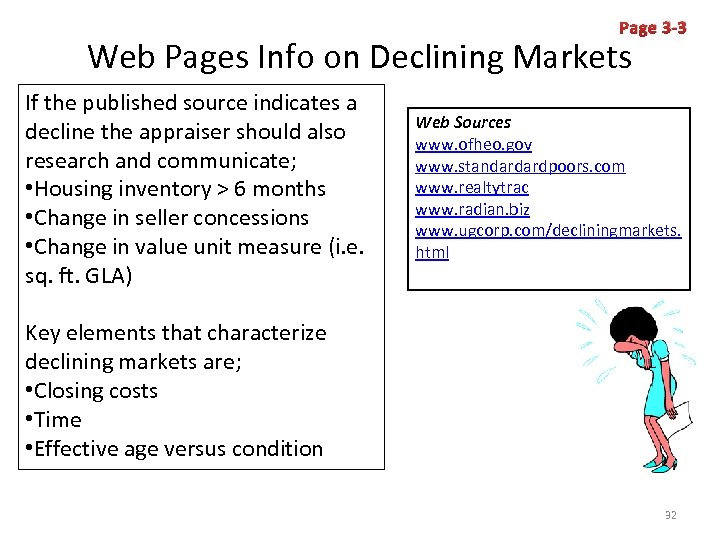

Page 3 -3 Web Pages Info on Declining Markets If the published source indicates a decline the appraiser should also research and communicate; • Housing inventory > 6 months • Change in seller concessions • Change in value unit measure (i. e. sq. ft. GLA) Web Sources www. ofheo. gov www. standardardpoors. com www. realtytrac www. radian. biz www. ugcorp. com/decliningmarkets. html Key elements that characterize declining markets are; • Closing costs • Time • Effective age versus condition 32

Closing Costs-Seller Paid Items “? ” Two categories of closing costs 1. Recurring – known as “pre-paids” inclusive of escrowed taxes, property insurance, flood insurance and/or PMI 2. Non-Recurring – a one time cost paid up front at closing. They can include a host of items such as Impact Fees, Recording Fees, Title Policy, Wire Transfer Fees, Home Inspection Fees etc. There is no such thing as “NO CLOSING COSTS”. The appraiser must review the contract terms and the local market to ensure the terms are identified as being reasonable for the current market and whether or not seller paid concessions could be earmarking a changing or declining market. Page 3 -4 If negotiations show seller paid concessions are typical for the transactions in virtually all cases then an adjustment for the concession would be unreasonable. 33

Page 3 -5 Seller Closing Costs – “To be or not to be!” At the heart of the issue is the “CASH EQUIVALENCY” of the transaction. In declining markets sale prices are often elevated to cover the masked seller concessions. You can readily identify this activity by comparing the other sales. Inflated sales have an excess of typical seller costs in the market. For this reason a careful review of all sales transactions in a specified market for the subject need to be scrutinized to ensure whether seller concessions are on the rise. Is it only the one sale inflated beyond a reasonable market or “arms-length” transaction? Or is the market moving solely because of a government subsidy program? 34

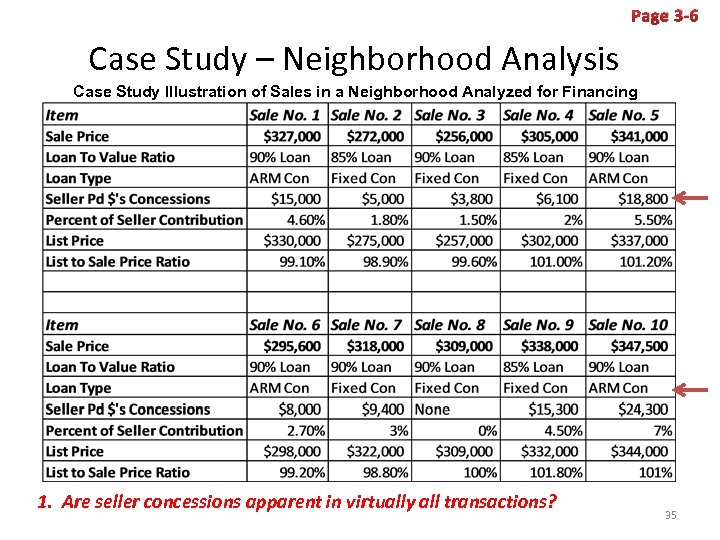

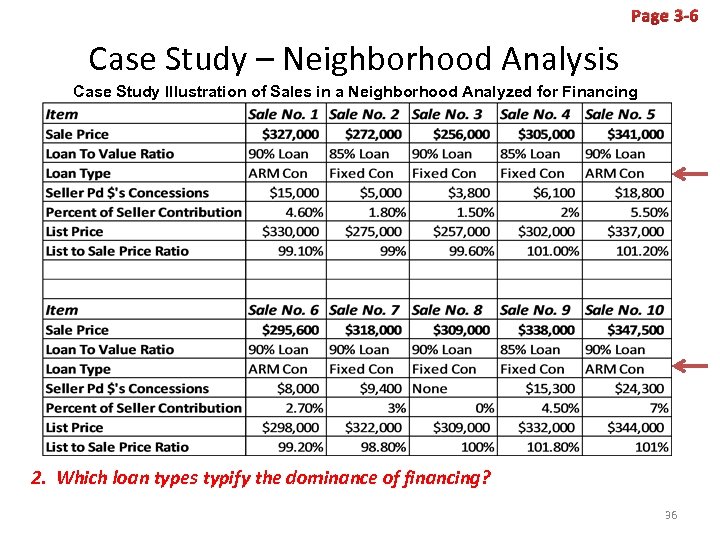

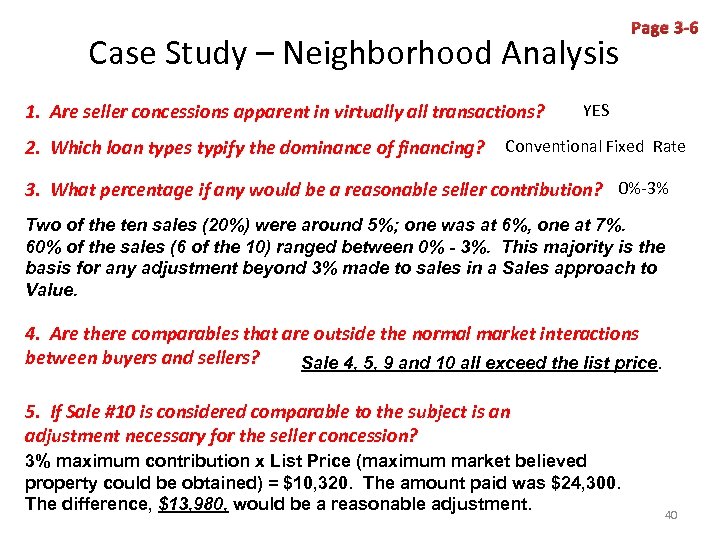

Page 3 -6 Case Study – Neighborhood Analysis Case Study Illustration of Sales in a Neighborhood Analyzed for Financing 1. Are seller concessions apparent in virtually all transactions? 35

Page 3 -6 Case Study – Neighborhood Analysis Case Study Illustration of Sales in a Neighborhood Analyzed for Financing 2. Which loan types typify the dominance of financing? 36

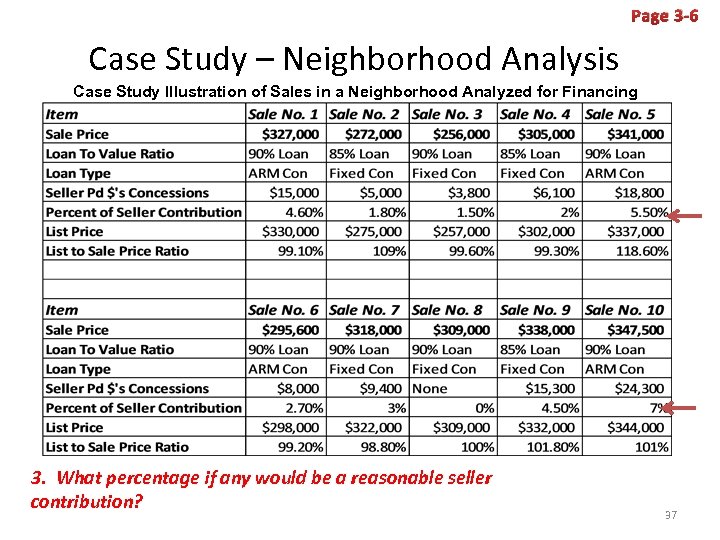

Page 3 -6 Case Study – Neighborhood Analysis Case Study Illustration of Sales in a Neighborhood Analyzed for Financing 3. What percentage if any would be a reasonable seller contribution? 37

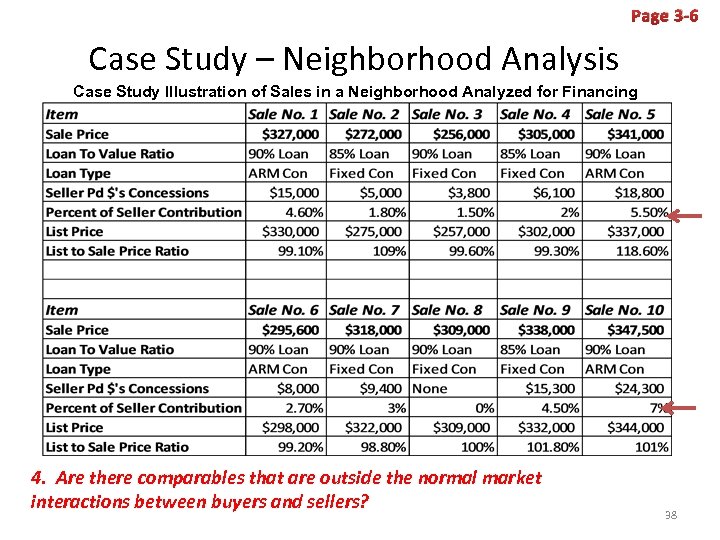

Page 3 -6 Case Study – Neighborhood Analysis Case Study Illustration of Sales in a Neighborhood Analyzed for Financing 4. Are there comparables that are outside the normal market interactions between buyers and sellers? 38

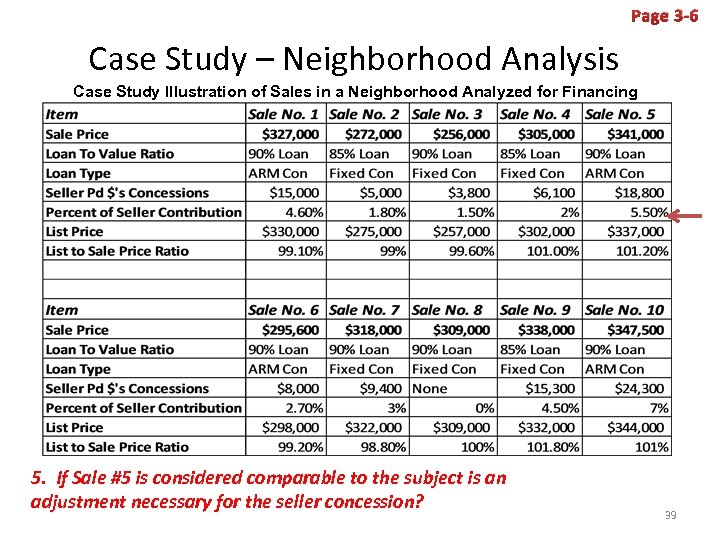

Page 3 -6 Case Study – Neighborhood Analysis Case Study Illustration of Sales in a Neighborhood Analyzed for Financing 5. If Sale #5 is considered comparable to the subject is an adjustment necessary for the seller concession? 39

Case Study – Neighborhood Analysis 1. Are seller concessions apparent in virtually all transactions? 2. Which loan types typify the dominance of financing? Page 3 -6 YES Conventional Fixed Rate 3. What percentage if any would be a reasonable seller contribution? 0%-3% Two of the ten sales (20%) were around 5%; one was at 6%, one at 7%. 60% of the sales (6 of the 10) ranged between 0% - 3%. This majority is the basis for any adjustment beyond 3% made to sales in a Sales approach to Value. 4. Are there comparables that are outside the normal market interactions between buyers and sellers? Sale 4, 5, 9 and 10 all exceed the list price. 5. If Sale #10 is considered comparable to the subject is an adjustment necessary for the seller concession? 3% maximum contribution x List Price (maximum market believed property could be obtained) = $10, 320. The amount paid was $24, 300. The difference, $13, 980, would be a reasonable adjustment. 40

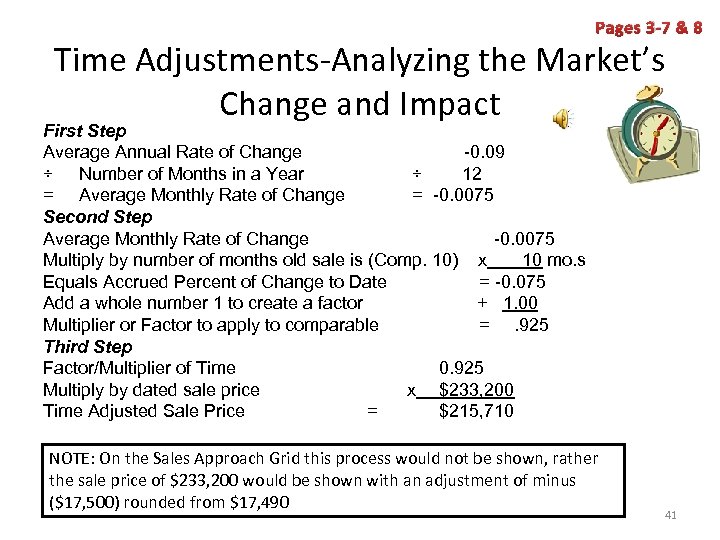

Pages 3 -7 & 8 Time Adjustments-Analyzing the Market’s Change and Impact First Step Average Annual Rate of Change -0. 09 ÷ Number of Months in a Year ÷ 12 = Average Monthly Rate of Change = -0. 0075 Second Step Average Monthly Rate of Change -0. 0075 Multiply by number of months old sale is (Comp. 10) x 10 mo. s Equals Accrued Percent of Change to Date = -0. 075 Add a whole number 1 to create a factor + 1. 00 Multiplier or Factor to apply to comparable =. 925 Third Step Factor/Multiplier of Time 0. 925 Multiply by dated sale price x $233, 200 Time Adjusted Sale Price = $215, 710 NOTE: On the Sales Approach Grid this process would not be shown, rather the sale price of $233, 200 would be shown with an adjustment of minus ($17, 500) rounded from $17, 490 41

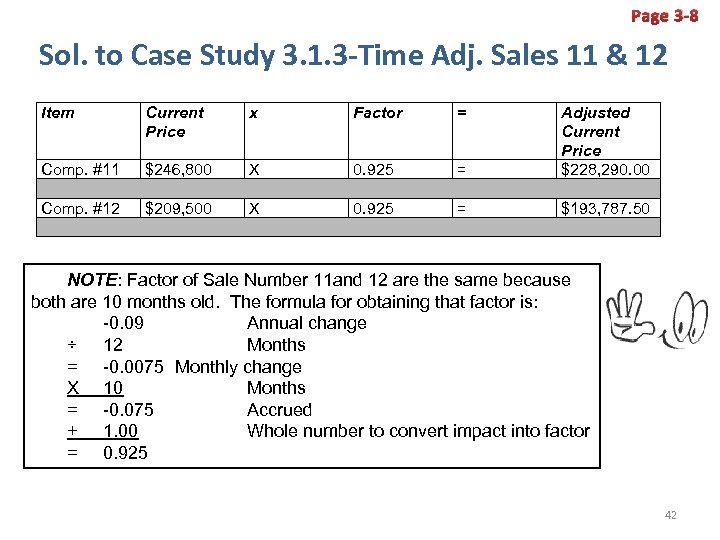

Page 3 -8 Sol. to Case Study 3. 1. 3 -Time Adj. Sales 11 & 12 Item Current Price x Factor = Comp. #11 $246, 800 X 0. 925 = Adjusted Current Price $228, 290. 00 Comp. #12 $209, 500 X 0. 925 = $193, 787. 50 NOTE: Factor of Sale Number 11 and 12 are the same because both are 10 months old. The formula for obtaining that factor is: -0. 09 Annual change ÷ 12 Months = -0. 0075 Monthly change X 10 Months = -0. 075 Accrued + 1. 00 Whole number to convert impact into factor = 0. 925 42

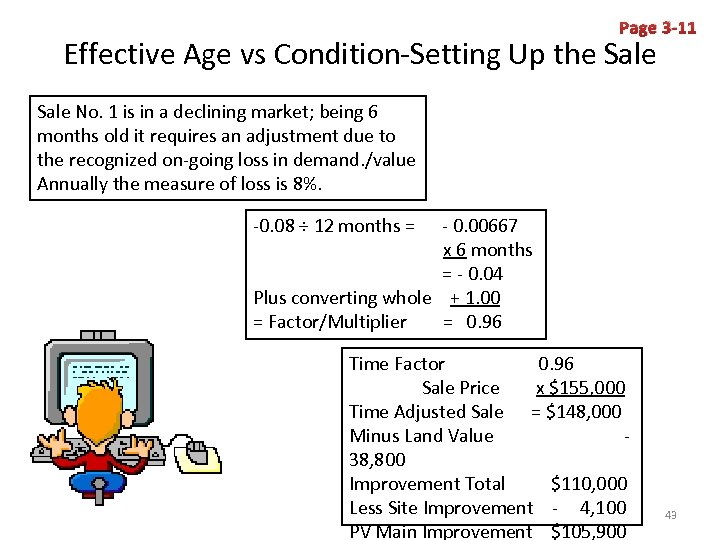

Page 3 -11 Effective Age vs Condition-Setting Up the Sale No. 1 is in a declining market; being 6 months old it requires an adjustment due to the recognized on-going loss in demand. /value Annually the measure of loss is 8%. -0. 08 ÷ 12 months = - 0. 00667 x 6 months = - 0. 04 Plus converting whole + 1. 00 = Factor/Multiplier = 0. 96 Time Factor 0. 96 Sale Price x $155, 000 Time Adjusted Sale = $148, 000 Minus Land Value - 38, 800 Improvement Total $110, 000 Less Site Improvement - 4, 100 PV Main Improvement $105, 900 43

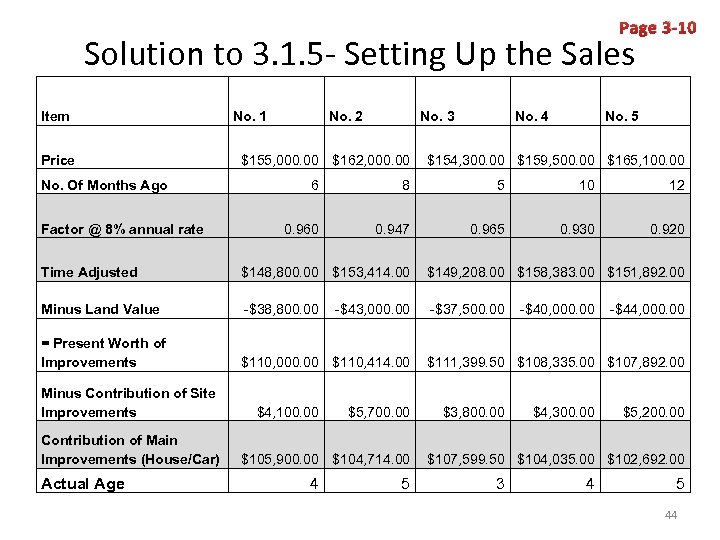

Page 3 -10 Solution to 3. 1. 5 - Setting Up the Sales Item Price No. Of Months Ago Factor @ 8% annual rate No. 1 No. 2 No. 3 $155, 000. 00 $162, 000. 00 No. 4 No. 5 $154, 300. 00 $159, 500. 00 $165, 100. 00 6 8 5 10 12 0. 960 0. 947 0. 965 0. 930 0. 920 Time Adjusted $148, 800. 00 $153, 414. 00 $149, 208. 00 $158, 383. 00 $151, 892. 00 Minus Land Value -$38, 800. 00 -$37, 500. 00 = Present Worth of Improvements $110, 000. 00 $110, 414. 00 Minus Contribution of Site Improvements Contribution of Main Improvements (House/Car) Actual Age $4, 100. 00 -$43, 000. 00 $5, 700. 00 $105, 900. 00 $104, 714. 00 4 5 -$40, 000. 00 -$44, 000. 00 $111, 399. 50 $108, 335. 00 $107, 892. 00 $3, 800. 00 $4, 300. 00 $5, 200. 00 $107, 599. 50 $104, 035. 00 $102, 692. 00 3 4 5 44

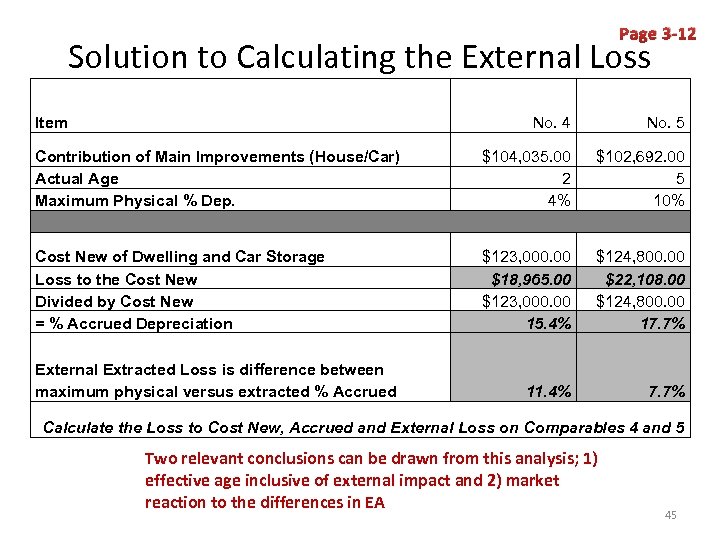

Page 3 -12 Solution to Calculating the External Loss Item No. 4 No. 5 Contribution of Main Improvements (House/Car) Actual Age Maximum Physical % Dep. $104, 035. 00 2 4% $102, 692. 00 5 10% Cost New of Dwelling and Car Storage Loss to the Cost New Divided by Cost New = % Accrued Depreciation $123, 000. 00 $18, 965. 00 $123, 000. 00 15. 4% $124, 800. 00 $22, 108. 00 $124, 800. 00 17. 7% 11. 4% 7. 7% External Extracted Loss is difference between maximum physical versus extracted % Accrued Calculate the Loss to Cost New, Accrued and External Loss on Comparables 4 and 5 Two relevant conclusions can be drawn from this analysis; 1) effective age inclusive of external impact and 2) market reaction to the differences in EA 45

Conclusions of Analysis 3. 1. 5 (b) Page 3 -13 In markets of uncertainty, it is customary to consider that new construction will slow down significantly and demand for existing housing will be competitive between sellers. …”based on the economic Principle of Integration, Growth, Stabilization, Decline and Gentrification, i. e. , life cycle of the neighborhood, the typical three x 20 years normal cycle is generally limited by the investor’s diminished confidence in the real estate market. 46

Conclusions of Analysis 3. 1. 5 (b) Page 3 -13 A lowered market confidence will result in the buyer’s view of the lifecycle being limited to a two cycle period (two x 20 years) or 40 to 50 years. It is with hesitation that any expectation of economic demand for the location beyond the 50 years can be made when markets are in a state of decline. This is a qualitative judgment under a principle and noted market conditions which indicate a slow-down or decline. 47

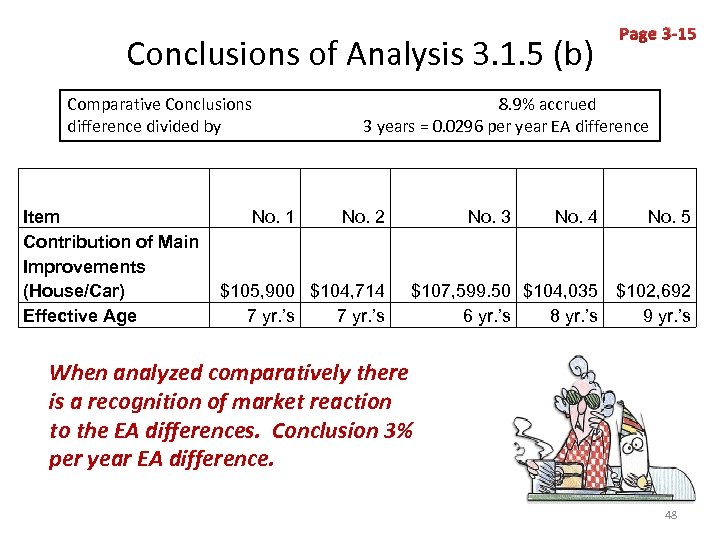

Conclusions of Analysis 3. 1. 5 (b) Comparative Conclusions difference divided by Item Contribution of Main Improvements (House/Car) Effective Age Page 3 -15 8. 9% accrued 3 years = 0. 0296 per year EA difference No. 1 No. 2 $105, 900 $104, 714 7 yr. ’s No. 3 No. 4 No. 5 $107, 599. 50 $104, 035 $102, 692 6 yr. ’s 8 yr. ’s 9 yr. ’s When analyzed comparatively there is a recognition of market reaction to the EA differences. Conclusion 3% per year EA difference. 48

Contrast of Transaction Type Page 3 -16 Before identifying the transaction type the appraiser must first identify the property type. Each property type has its own distinct ownership characteristics. Example; a condo unit will not have the same privileges of use, ownership or obligations of maintenance as the detached single-family or even the garden home or town-house. Secondly the appraiser must identify the reason for the demand. Is the demand for owner-occupancy or for tenant/income production? Depending on the type of investor basic market characteristics that have impact on the value will surface. For example: the investor of income property will be more concerned with the Durability, Quantity and Quality of the income with secondary consideration given to the residential 49 amenities.

Contrast of Transaction Type Page 3 -16 The third consideration in the tier of gathering and analyzing data are the physical characteristics. This will generally be associative with some type of demographic analysis in the market place. From that point forward the trends can be identified in that location for that specific property type which is defined by matching up the current physical characteristics of the market along with the demand from the investors. The appraiser having identified these important characteristics (property type, type of investor, physical characteristics of the property and the trends) can then view the sale as being either an arms-length or bank owned transaction. 50

Contrast of Transaction Type Page 3 -16 Arms-Length The willing exchange between buyer and seller each acting without duress REO Real Estate Owned is a property taken back through the foreclosure process and managed until it can be sold. 51

Contrast of Transaction Type Page 3 -17 • In the identification of market trends the appraiser should consider both pending sales and active listings in each appraisal assignment. This trend analysis also includes an analysis of the list to sales price ratio. When the demand is lower than the supply the ratio is usually less than 100%. • When there are sales who’s listing price is lower than the sale price over an extended period of time and the housing inventory is 6+ months its probable there is decline on-going and in order to sell the seller must make excessive contributions which are often rolled into the sales price to ensure the borrower will qualify for the loan. This is a sale that will need to be adjusted for lack of market worthiness/characteristic an unaffected value in exchange. 52

Page 3 -18 Using Statistics to Identify Markets in Decline From a regional and state perspective the OFHEO and the Standards and Poor’s Index can show the broader region’s performance. However, when the subject is in its final stages of value conclusions a more specific and tighter boundary must be considered. Websites that report per zip code are; www. radian. biz and www. ugcorp. com/decliningmarkets. html Another indicator is to statistically analyze the sales within a defined market calculating the mean and median sales prices for a defined market area and compare them to last year’s same time period. 53

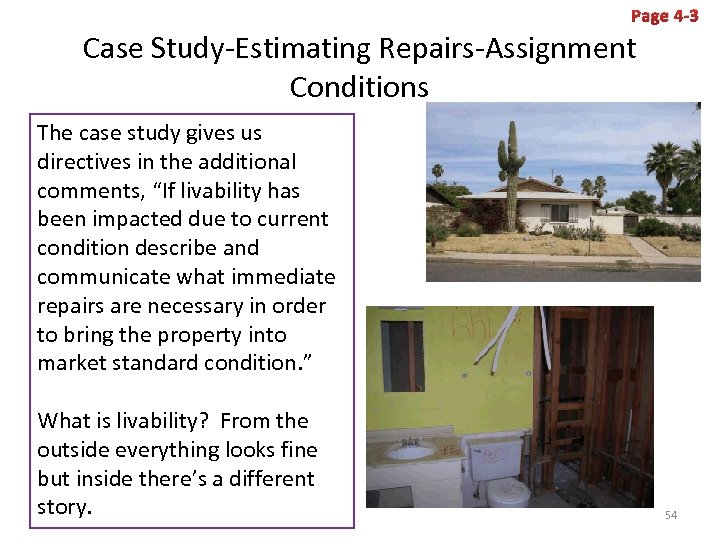

Page 4 -3 Case Study-Estimating Repairs-Assignment Conditions The case study gives us directives in the additional comments, “If livability has been impacted due to current condition describe and communicate what immediate repairs are necessary in order to bring the property into market standard condition. ” What is livability? From the outside everything looks fine but inside there’s a different story. 54

Page 4 -4 Case Study-Estimating Repairs-Assignment Conditions The verbiage of the form implies to the uninformed or inexperienced recipient that a more comprehensive inspection is being done than is actually the task of the appraisal inspection. To ensure understanding clarify those uncertain points. 55

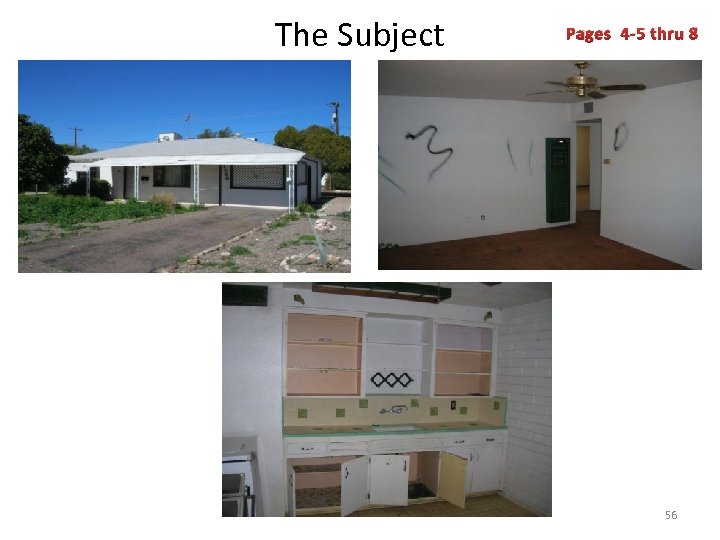

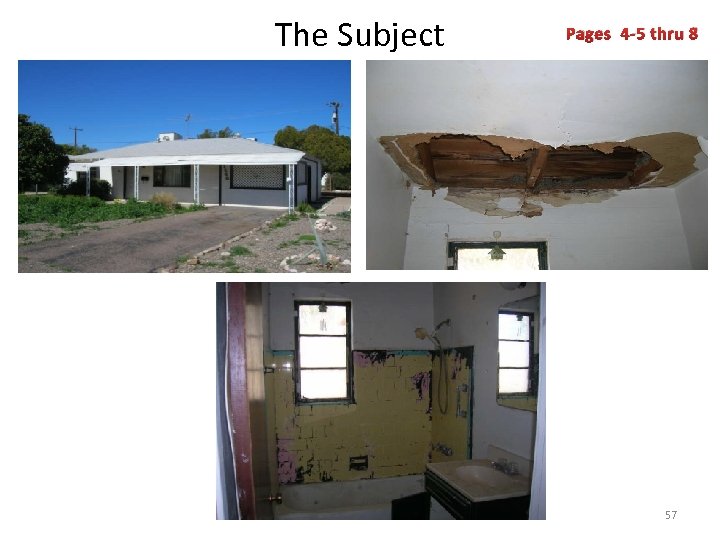

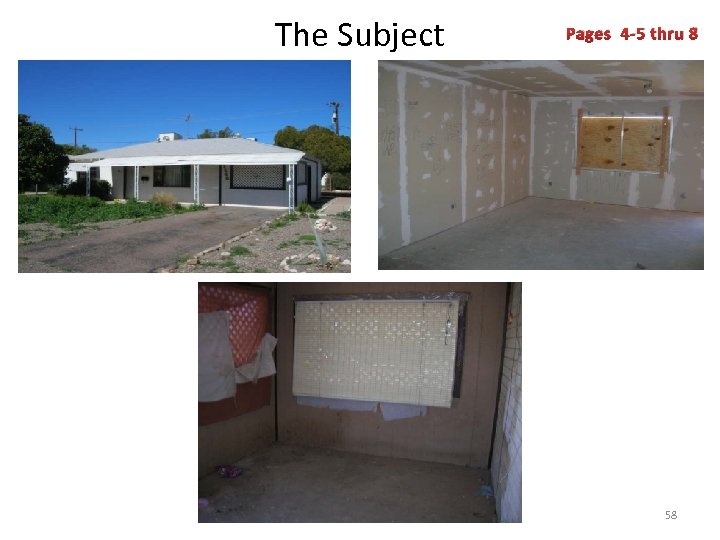

The Subject Pages 4 -5 thru 8 56

The Subject Pages 4 -5 thru 8 57

The Subject Pages 4 -5 thru 8 58

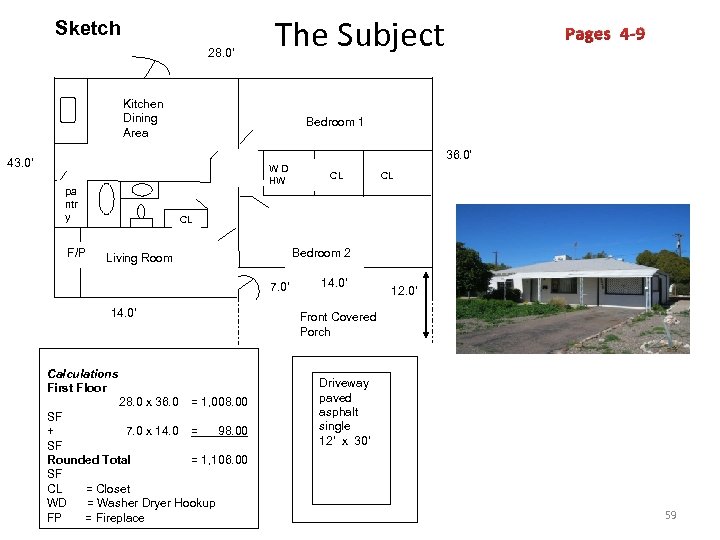

Sketch 28. 0’ The Subject Kitchen Dining Area Pages 4 -9 Bedroom 1 36. 0’ 43. 0’ WD HW pa ntr y F/P CL CL CL Bedroom 2 Living Room 7. 0’ 14. 0’ 12. 0’ Front Covered Porch Calculations First Floor 28. 0 x 36. 0 14. 0’ = 1, 008. 00 SF + 7. 0 x 14. 0 = 98. 00 SF Rounded Total = 1, 106. 00 SF CL = Closet WD = Washer Dryer Hookup FP = Fireplace Driveway paved asphalt single 12’ x 30’ 59

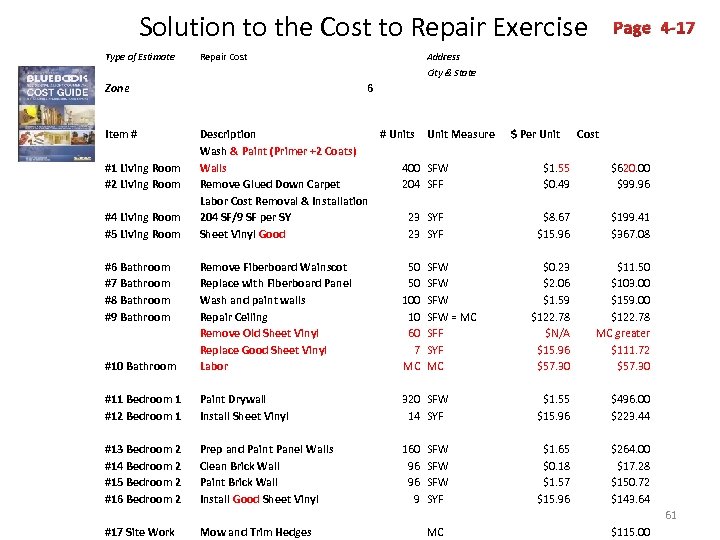

4. 2. 3 Calculate the Cost to Repair Page 4 -17 Pages 11 -16 detail the Blue Book Cost breakdown which is to be the basis for the cost worksheet on page 17. Perform the cost estimate of repairs for the subject under its current condition. 60

Solution to the Cost to Repair Exercise Type of Estimate Repair Cost Page 4 -17 Address City & State Zone Item # 6 Description # Units Wash & Paint (Primer +2 Coats) Walls 400 Remove Glued Down Carpet 204 Labor Cost Removal & Installation 204 SF/9 SF per SY 23 Sheet Vinyl Good 23 Unit Measure #10 Bathroom Remove Fiberboard Wainscot Replace with Fiberboard Panel Wash and paint walls Repair Ceiling Remove Old Sheet Vinyl Replace Good Sheet Vinyl Labor 50 50 10 60 7 MC SFW SFW = MC SFF SYF MC #11 Bedroom 1 #12 Bedroom 1 Paint Drywall Install Sheet Vinyl #13 Bedroom 2 #14 Bedroom 2 #15 Bedroom 2 #16 Bedroom 2 Prep and Paint Panel Walls Clean Brick Wall Paint Brick Wall Install Good Sheet Vinyl #1 Living Room #2 Living Room #4 Living Room #5 Living Room #6 Bathroom #7 Bathroom #8 Bathroom #9 Bathroom $ Per Unit Cost SFW SFF $1. 55 $0. 49 $620. 00 $99. 96 SYF $8. 67 $15. 96 $199. 41 $367. 08 $0. 23 $2. 06 $1. 59 $122. 78 $N/A $15. 96 $57. 30 $11. 50 $103. 00 $159. 00 $122. 78 MC greater $111. 72 $57. 30 320 SFW 14 SYF $1. 55 $15. 96 $496. 00 $223. 44 160 96 96 9 $1. 65 $0. 18 $1. 57 $15. 96 $264. 00 $17. 28 $150. 72 $143. 64 SFW SFW SYF 61 #17 Site Work Mow and Trim Hedges MC $115. 00

The Cost of the “AS-IS” Condition Page 5 -3 The determination of whether or not a repair cost is curable or not depends not only on the market but also the reason why the repair is needed. Is the repair due to a typical worn out condition that was simply a lack of maintenance or was it due to vandalism. Vandalism is always considered incurable as the market will not sympathize with an owner whose property has been vandalized seeing the condition as an indicator of increased risk in the future in terms of crime activity. 62

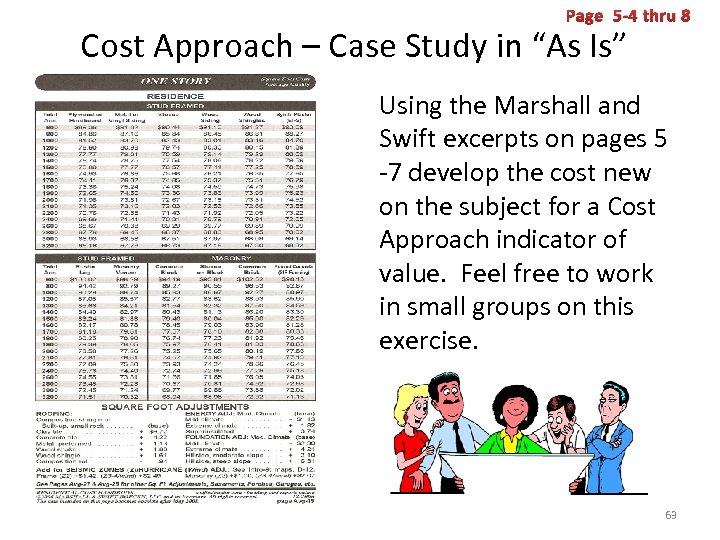

Page 5 -4 thru 8 Cost Approach – Case Study in “As Is” Using the Marshall and Swift excerpts on pages 5 -7 develop the cost new on the subject for a Cost Approach indicator of value. Feel free to work in small groups on this exercise. 63

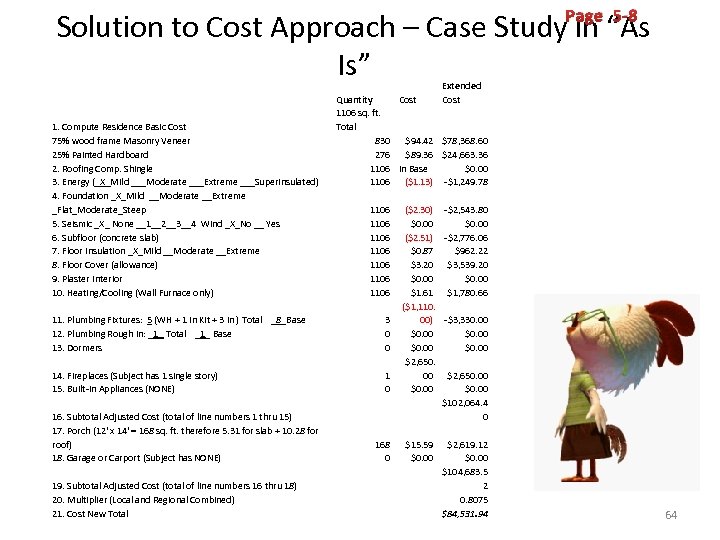

Page 5 -8 Solution to Cost Approach – Case Study in “As Is” 1. Compute Residence Basic Cost 75% wood frame Masonry Veneer 25% Painted Hardboard 2. Roofing Comp. Shingle 3. Energy (_X_Mild ___Moderate ___Extreme ___Superinsulated) 4. Foundation _X_Mild __Moderate __Extreme _Flat_Moderate_Steep 5. Seismic _X_ None __1__2__3__4 Wind _X_No __ Yes 6. Subfloor (concrete slab) 7. Floor Insulation _X_Mild __Moderate __Extreme 8. Floor Cover (allowance) 9. Plaster Interior 10. Heating/Cooling (Wall Furnace only) Extended Quantity Cost 1106 sq. ft. Total 830 $94. 42 $78, 368. 60 276 $89. 36 $24, 663. 36 1106 in Base $0. 00 1106 ($1. 13) -$1, 249. 78 1106 1106 11. Plumbing Fixtures: 5 (WH + 1 in Kit + 3 in ) Total _8_Base 12. Plumbing Rough In: _1_ Total _1_ Base 13. Dormers 3 0 0 14. Fireplaces (Subject has 1 single story) 15. Built-In Appliances (NONE) 1 0 16. Subtotal Adjusted Cost (total of line numbers 1 thru 15) 17. Porch (12' x 14' = 168 sq. ft. therefore 5. 31 for slab + 10. 28 for roof) 18. Garage or Carport (Subject has NONE) 19. Subtotal Adjusted Cost (total of line numbers 16 thru 18) 20. Multiplier (Local and Regional Combined) 21. Cost New Total 168 0 ($2. 30) -$2, 543. 80 $0. 00 ($2. 51) -$2, 776. 06 $0. 87 $962. 22 $3. 20 $3, 539. 20 $0. 00 $1. 61 $1, 780. 66 ($1, 110. 00) -$3, 330. 00 $0. 00 $2, 650. 00 $0. 00 $102, 064. 4 0 $15. 59 $0. 00 $2, 619. 12 $0. 00 $104, 683. 5 2 0. 8075 $84, 531. 94 64

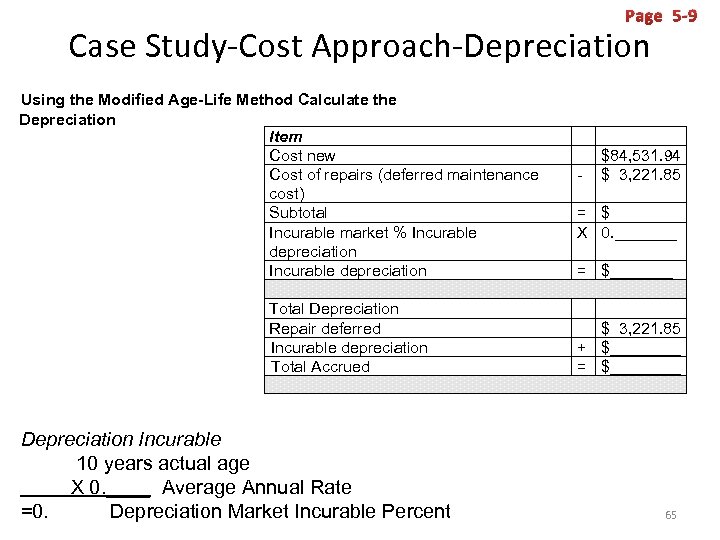

Page 5 -9 Case Study-Cost Approach-Depreciation Using the Modified Age-Life Method Calculate the Depreciation Item Cost new Cost of repairs (deferred maintenance cost) Subtotal Incurable market % Incurable depreciation Total Depreciation Repair deferred Incurable depreciation Total Accrued Depreciation Incurable 10 years actual age X 0. ____ Average Annual Rate =0. Depreciation Market Incurable Percent - $84, 531. 94 $ 3, 221. 85 = $ X 0. _______ = $_______ $ 3, 221. 85 + $____ = $____ 65

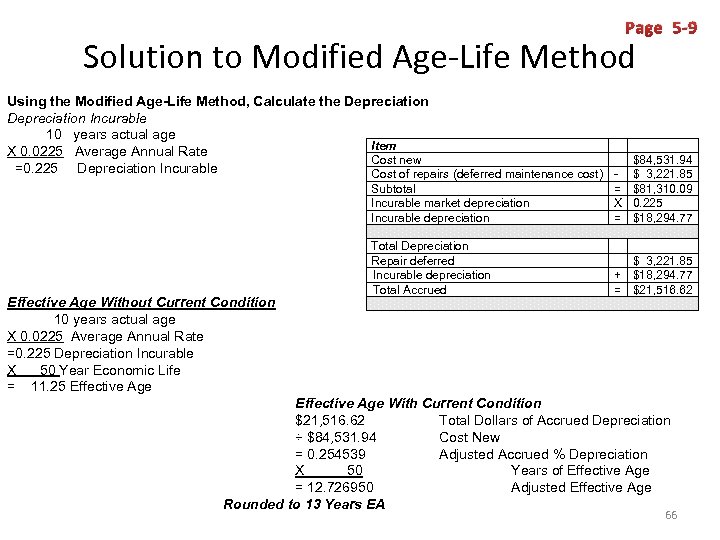

Page 5 -9 Solution to Modified Age-Life Method Using the Modified Age-Life Method, Calculate the Depreciation Incurable 10 years actual age Item X 0. 0225 Average Annual Rate Cost new =0. 225 Depreciation Incurable Cost of repairs (deferred maintenance cost) Subtotal Incurable market depreciation Incurable depreciation Effective Age Without Current Condition 10 years actual age X 0. 0225 Average Annual Rate =0. 225 Depreciation Incurable X 50 Year Economic Life = 11. 25 Effective Age $84, 531. 94 $ 3, 221. 85 = $81, 310. 09 X 0. 225 = $18, 294. 77 Total Depreciation Repair deferred Incurable depreciation Total Accrued $ 3, 221. 85 + $18, 294. 77 = $21, 516. 62 Effective Age With Current Condition $21, 516. 62 Total Dollars of Accrued Depreciation ÷ $84, 531. 94 Cost New = 0. 254539 Adjusted Accrued % Depreciation X 50 Years of Effective Age = 12. 726950 Adjusted Effective Age Rounded to 13 Years EA 66

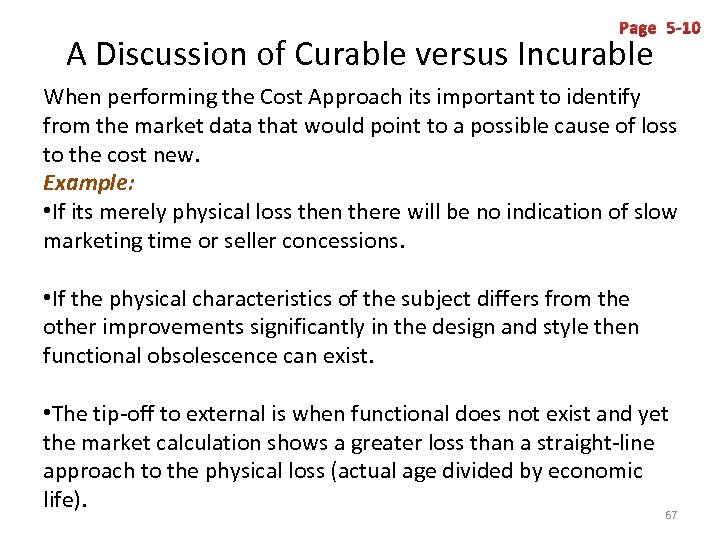

Page 5 -10 A Discussion of Curable versus Incurable When performing the Cost Approach its important to identify from the market data that would point to a possible cause of loss to the cost new. Example: • If its merely physical loss then there will be no indication of slow marketing time or seller concessions. • If the physical characteristics of the subject differs from the other improvements significantly in the design and style then functional obsolescence can exist. • The tip-off to external is when functional does not exist and yet the market calculation shows a greater loss than a straight-line approach to the physical loss (actual age divided by economic life). 67

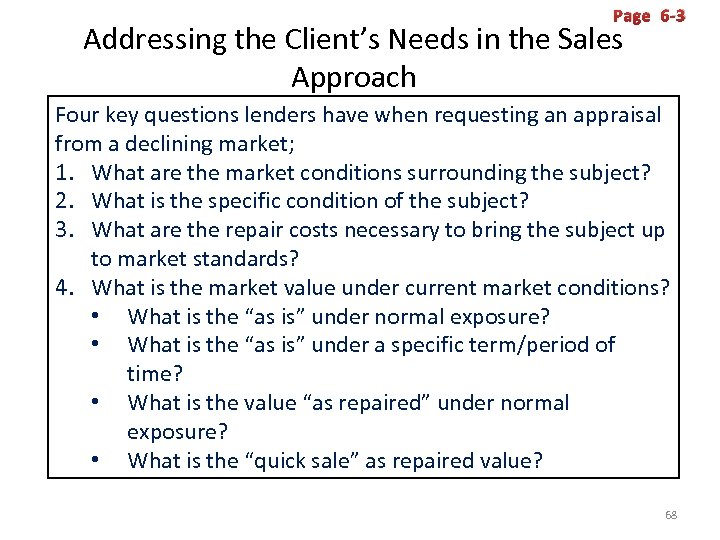

Page 6 -3 Addressing the Client’s Needs in the Sales Approach Four key questions lenders have when requesting an appraisal from a declining market; 1. What are the market conditions surrounding the subject? 2. What is the specific condition of the subject? 3. What are the repair costs necessary to bring the subject up to market standards? 4. What is the market value under current market conditions? • What is the “as is” under normal exposure? • What is the “as is” under a specific term/period of time? • What is the value “as repaired” under normal exposure? • What is the “quick sale” as repaired value? 68

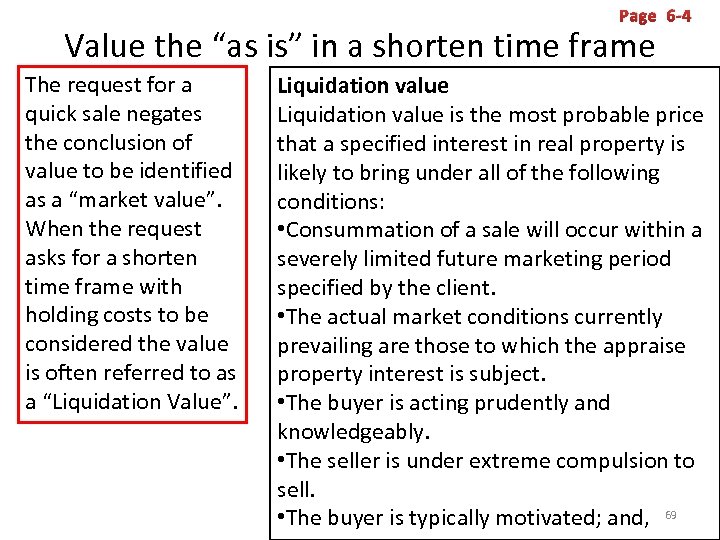

Page 6 -4 Value the “as is” in a shorten time frame The request for a quick sale negates the conclusion of value to be identified as a “market value”. When the request asks for a shorten time frame with holding costs to be considered the value is often referred to as a “Liquidation Value”. Liquidation value is the most probable price that a specified interest in real property is likely to bring under all of the following conditions: • Consummation of a sale will occur within a severely limited future marketing period specified by the client. • The actual market conditions currently prevailing are those to which the appraise property interest is subject. • The buyer is acting prudently and knowledgeably. • The seller is under extreme compulsion to sell. • The buyer is typically motivated; and, 69

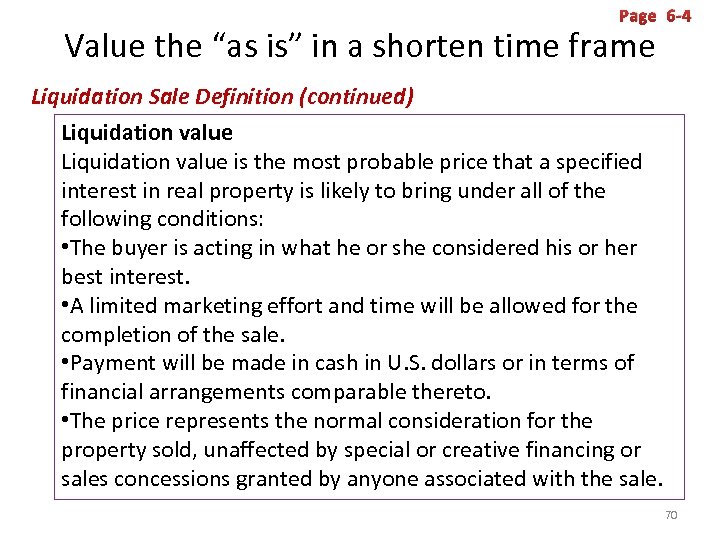

Page 6 -4 Value the “as is” in a shorten time frame Liquidation Sale Definition (continued) Liquidation value is the most probable price that a specified interest in real property is likely to bring under all of the following conditions: • The buyer is acting in what he or she considered his or her best interest. • A limited marketing effort and time will be allowed for the completion of the sale. • Payment will be made in cash in U. S. dollars or in terms of financial arrangements comparable thereto. • The price represents the normal consideration for the property sold, unaffected by special or creative financing or sales concessions granted by anyone associated with the sale. 70

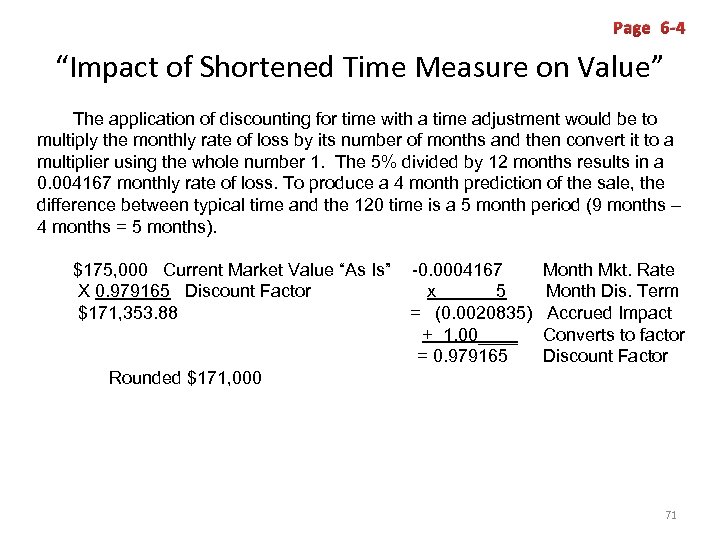

Page 6 -4 “Impact of Shortened Time Measure on Value” The application of discounting for time with a time adjustment would be to multiply the monthly rate of loss by its number of months and then convert it to a multiplier using the whole number 1. The 5% divided by 12 months results in a 0. 004167 monthly rate of loss. To produce a 4 month prediction of the sale, the difference between typical time and the 120 time is a 5 month period (9 months – 4 months = 5 months). $175, 000 Current Market Value “As Is” X 0. 979165 Discount Factor $171, 353. 88 -0. 0004167 x 5 = (0. 0020835) + 1. 00____ = 0. 979165 Month Mkt. Rate Month Dis. Term Accrued Impact Converts to factor Discount Factor Rounded $171, 000 71

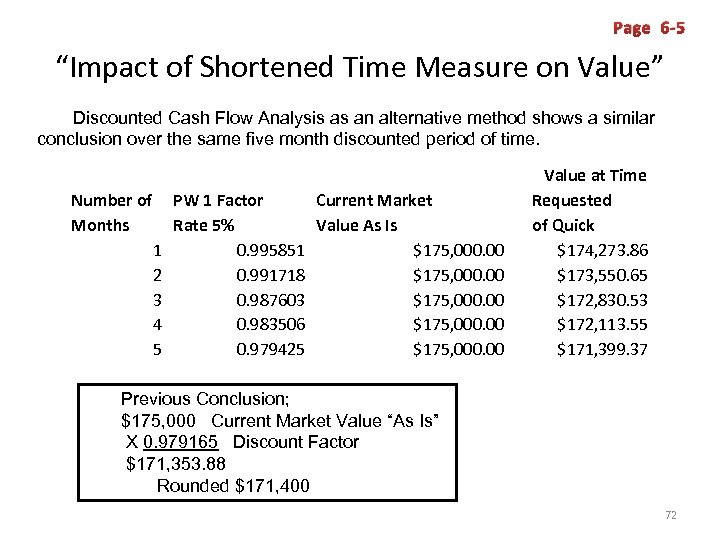

Page 6 -5 “Impact of Shortened Time Measure on Value” Discounted Cash Flow Analysis as an alternative method shows a similar conclusion over the same five month discounted period of time. Number of Months 1 2 3 4 5 PW 1 Factor Current Market Rate 5% Value As Is 0. 995851 $175, 000. 00 0. 991718 $175, 000. 00 0. 987603 $175, 000. 00 0. 983506 $175, 000. 00 0. 979425 $175, 000. 00 Value at Time Requested of Quick $174, 273. 86 $173, 550. 65 $172, 830. 53 $172, 113. 55 $171, 399. 37 Previous Conclusion; $175, 000 Current Market Value “As Is” X 0. 979165 Discount Factor $171, 353. 88 Rounded $171, 400 72

Page 6 -6 6. 2 “As is vs Subject To” Under the age, most software programs will support the reporting of both actual and effective age. The effective age would represent the incurable loss which includes the external loss; the condition adjustment would represent the deferred maintenance. If this is not allowed by the software then the adjustment for the effective age difference could be made on the blank line at the end of the pre-printed comparative units. 73

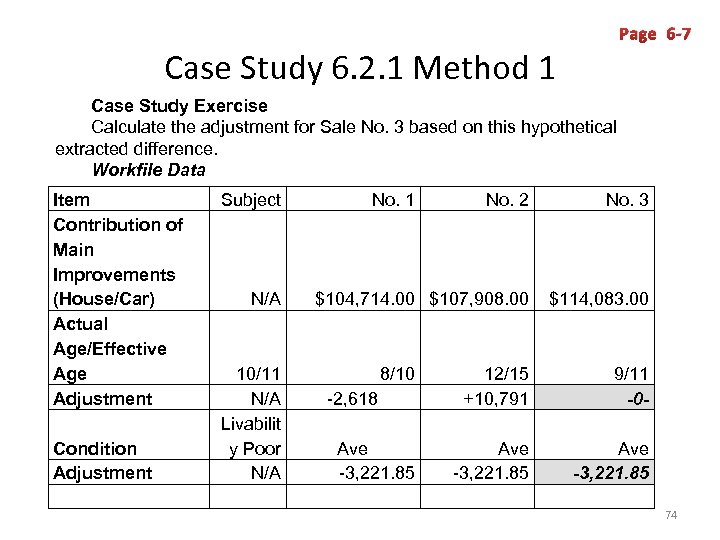

Page 6 -7 Case Study 6. 2. 1 Method 1 Case Study Exercise Calculate the adjustment for Sale No. 3 based on this hypothetical extracted difference. Workfile Data Item Contribution of Main Improvements (House/Car) Actual Age/Effective Age Adjustment Condition Adjustment Subject N/A 10/11 N/A Livabilit y Poor N/A No. 1 No. 2 No. 3 $104, 714. 00 $107, 908. 00 $114, 083. 00 8/10 12/15 +10, 791 9/11 -0 - Ave -3, 221. 85 -2, 618 74

Page 6 -10 Reporting “Subject To” Assignments What many won’t readily understand are the consequences of “uncertainties” in the appraisal development. Clearly communicate uncertainties and assumptions made in the appraisal such as: • Costs will be accurate and unchanging over the time of repairs. • Time of completion will not be impacted by climate or economic stresses on demand. • Repair costs are not inclusive of other costs during the time of holding (insurance, maintenance including lawn care, taxes, utilities, security, etc. ). • Demand conditions will not change which can impact days on the market and price changes. • No judgments are pending which could affect the title and passing of title due to legal entanglements of the “lis pendens” (judgment pending). 75

Page 6 -11 & 12 Reporting with Principles-an Economic Communication Principles of Opportunity Costs and Anticipation Questions and Answers Communicated with Principles What are the market conditions surrounding the subject? Translated through the principles – Why are buyers willing to buy in this location? What is the specific condition of the subject? Translated through the principles – Will the property be worth the risk as it is currently improved? What are the repair costs to bring the subject up to market standards? Translated through the principles – What will the costs of the opportunity include? What is the market value? Translated through the principles – Can a knowledgeable buyer see the opportunity of this investment for this amount and be willing to pay/make the sacrifice? 76

“We’re Finished” Thank you for letting Columbia Institute be your continuing education provider. Please take a few more moments and complete the evaluation located in the back of your textbook. Your comments are important to us. If there are other courses that you would like to see in the future please let us know by also adding that comment on your evaluation. 77