3d74941bde57eefc50005381af7ff756.ppt

- Количество слайдов: 26

by g. natarajan advocate & cost accountant swamy associates

Era of simplicity… Notification 2/1999 Dt. 28. 02. 1999. Notification 6/1999 Dt. 09. 04. 1999. Rescinded by Notification 2/2003 Dt. 01. 03. 2003 Notification 21/2003 Dt. 20. 11. 2003. Rescinded by Notification 10/2005 w. e. f. 15. 03. 05

Era of complexity… Export of Services Rules, 2005 Introduced vide Notification 9/2005 Dt. 03. 2005 With effect from 15. 03. 2005. Amended by 28/2005 Dt. 07. 06. 2005 With effect from 16. 06. 2005. Amended by 13/2006 Dt. 19. 04. 2006 With effect from 19. 04. 2006

Basic thumb rules. Service must be provided from India and used outside India. Payment for such service must be received in convertible forex.

Category I The service must be in relation to immovable property situated outside India.

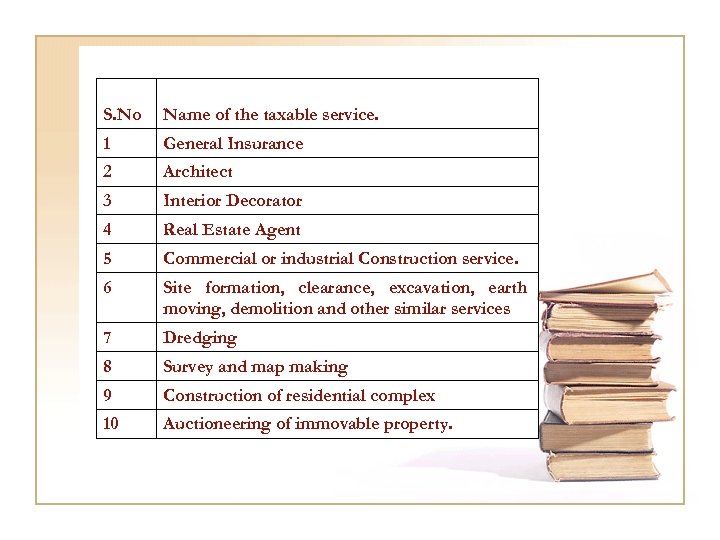

S. No Name of the taxable service. 1 General Insurance 2 Architect 3 Interior Decorator 4 Real Estate Agent 5 Commercial or industrial Construction service. 6 Site formation, clearance, excavation, earth moving, demolition and other similar services 7 Dredging 8 Survey and map making 9 Construction of residential complex 10 Auctioneering of immovable property.

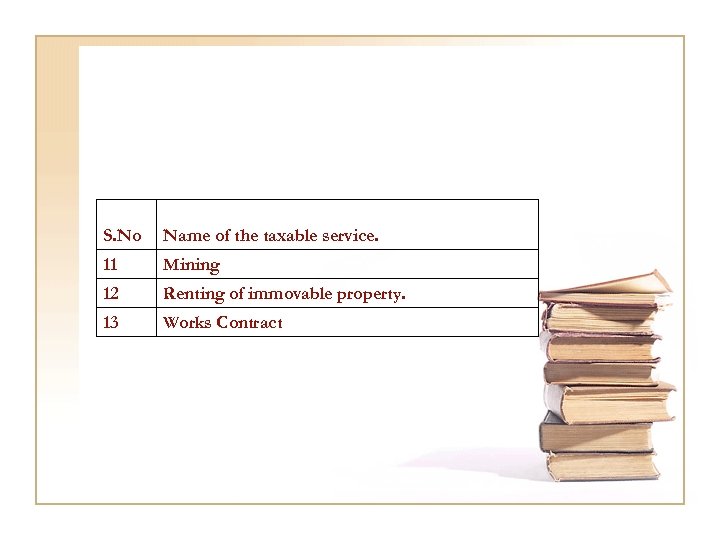

S. No Name of the taxable service. 11 Mining 12 Renting of immovable property. 13 Works Contract

Examples An Indian construction company, building a commercial complex, in Afghanistan. An interior decorator, being engaged for beautification of “White House”. Mining gold in Pakistan.

Category II The service must be performed outside India, at least partly.

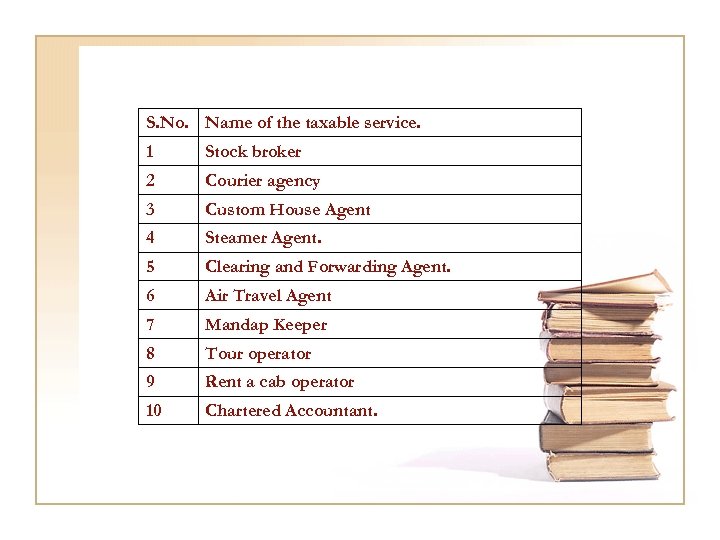

S. No. Name of the taxable service. 1 Stock broker 2 Courier agency 3 Custom House Agent 4 Steamer Agent. 5 Clearing and Forwarding Agent. 6 Air Travel Agent 7 Mandap Keeper 8 Tour operator 9 Rent a cab operator 10 Chartered Accountant.

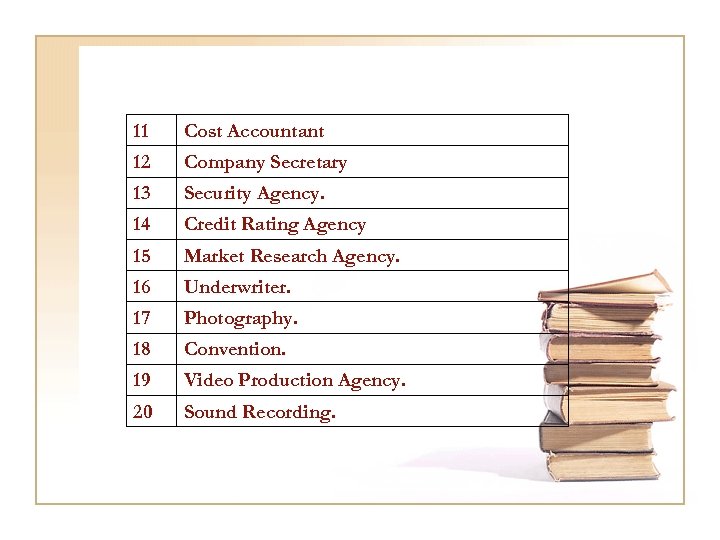

11 Cost Accountant 12 Company Secretary 13 Security Agency. 14 Credit Rating Agency 15 Market Research Agency. 16 Underwriter. 17 Photography. 18 Convention. 19 Video Production Agency. 20 Sound Recording.

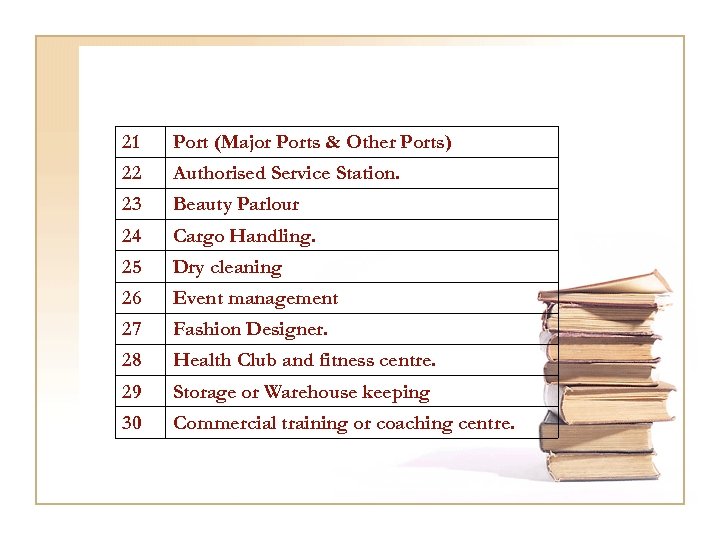

21 Port (Major Ports & Other Ports) 22 Authorised Service Station. 23 Beauty Parlour 24 Cargo Handling. 25 Dry cleaning 26 Event management 27 Fashion Designer. 28 Health Club and fitness centre. 29 Storage or Warehouse keeping 30 Commercial training or coaching centre.

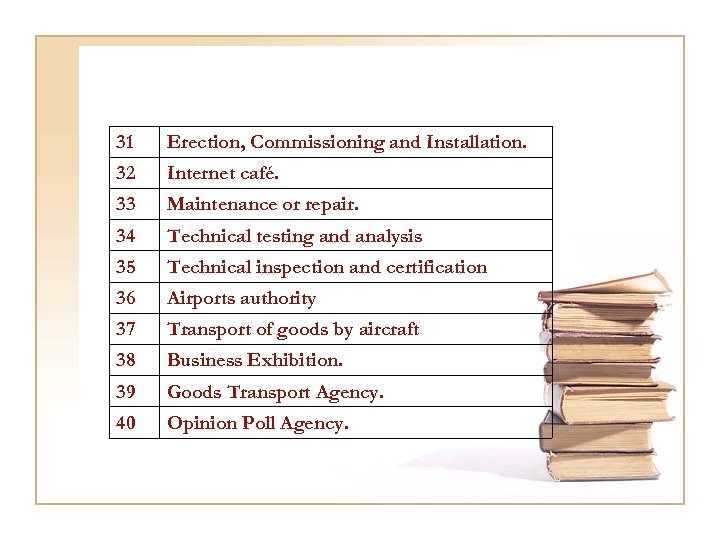

31 Erection, Commissioning and Installation. 32 Internet café. 33 Maintenance or repair. 34 Technical testing and analysis 35 Technical inspection and certification 36 Airports authority 37 Transport of goods by aircraft 38 Business Exhibition. 39 Goods Transport Agency. 40 Opinion Poll Agency.

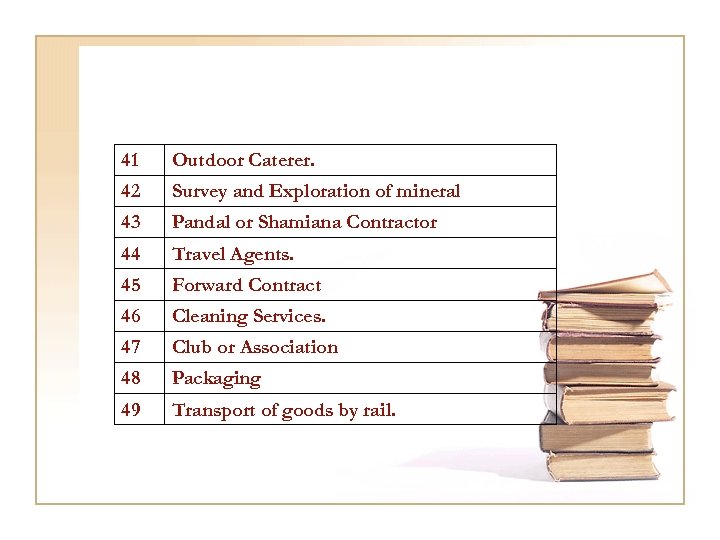

41 Outdoor Caterer. 42 Survey and Exploration of mineral 43 Pandal or Shamiana Contractor 44 Travel Agents. 45 Forward Contract 46 Cleaning Services. 47 Club or Association 48 Packaging 49 Transport of goods by rail.

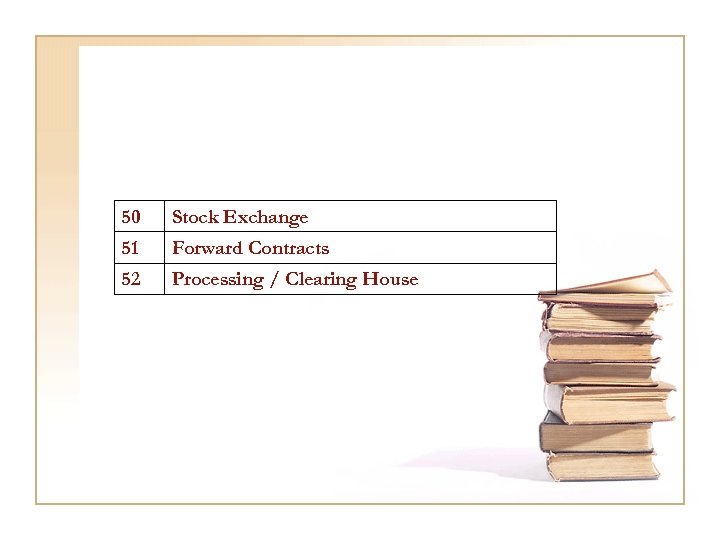

50 Stock Exchange 51 Forward Contracts 52 Processing / Clearing House

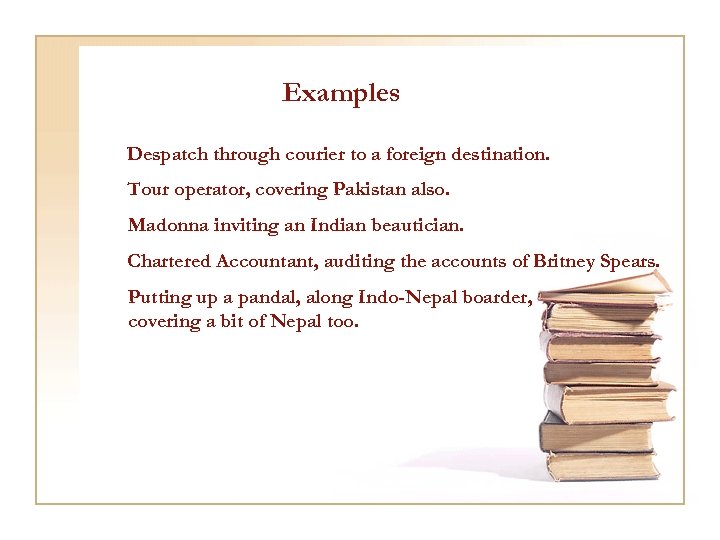

Examples Despatch through courier to a foreign destination. Tour operator, covering Pakistan also. Madonna inviting an Indian beautician. Chartered Accountant, auditing the accounts of Britney Spears. Putting up a pandal, along Indo-Nepal boarder, covering a bit of Nepal too.

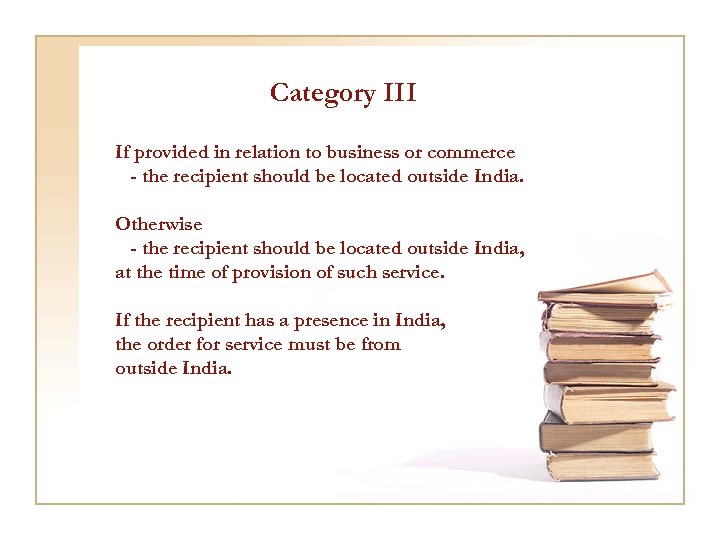

Category III If provided in relation to business or commerce - the recipient should be located outside India. Otherwise - the recipient should be located outside India, at the time of provision of such service. If the recipient has a presence in India, the order for service must be from outside India.

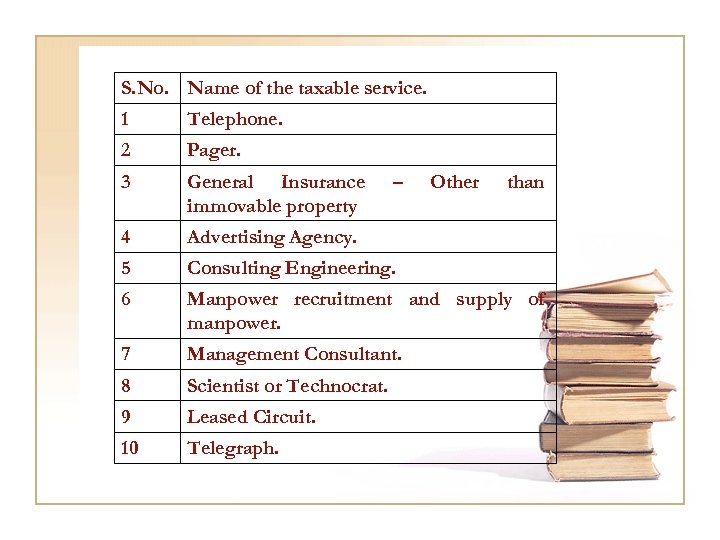

S. No. Name of the taxable service. 1 Telephone. 2 Pager. 3 General Insurance immovable property 4 Advertising Agency. 5 Consulting Engineering. 6 Manpower recruitment and supply of manpower. 7 Management Consultant. 8 Scientist or Technocrat. 9 Leased Circuit. 10 Telegraph. – Other than

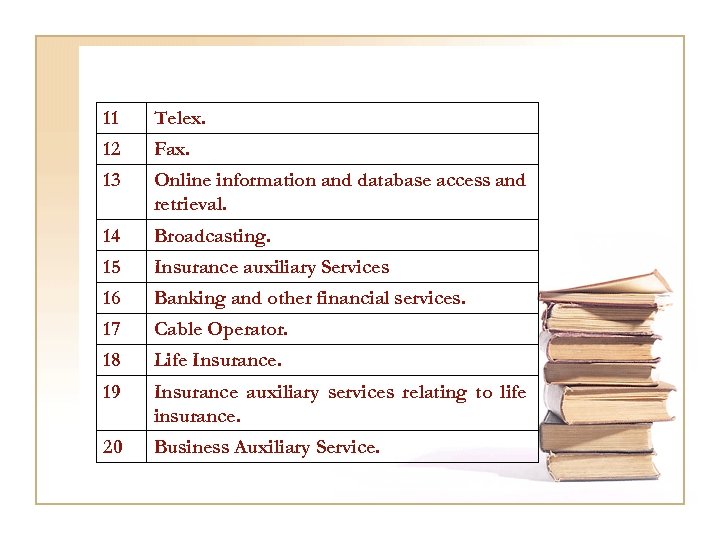

11 Telex. 12 Fax. 13 Online information and database access and retrieval. 14 Broadcasting. 15 Insurance auxiliary Services 16 Banking and other financial services. 17 Cable Operator. 18 Life Insurance. 19 Insurance auxiliary services relating to life insurance. 20 Business Auxiliary Service.

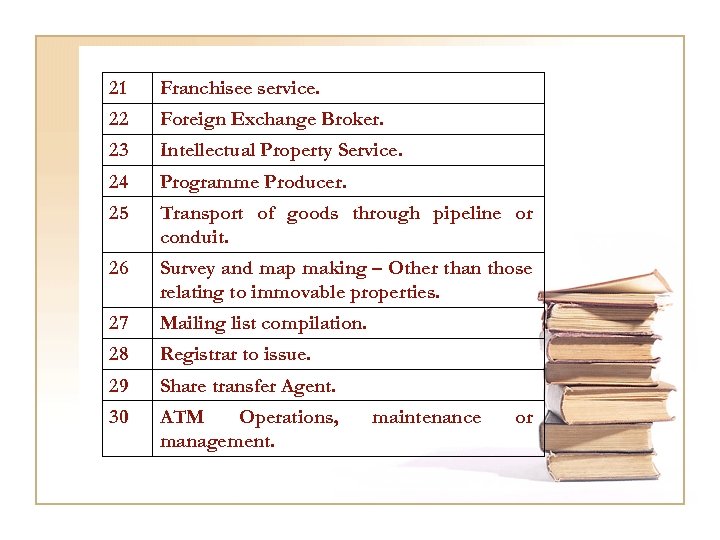

21 Franchisee service. 22 Foreign Exchange Broker. 23 Intellectual Property Service. 24 Programme Producer. 25 Transport of goods through pipeline or conduit. 26 Survey and map making – Other than those relating to immovable properties. 27 Mailing list compilation. 28 Registrar to issue. 29 Share transfer Agent. 30 ATM Operations, management. maintenance or

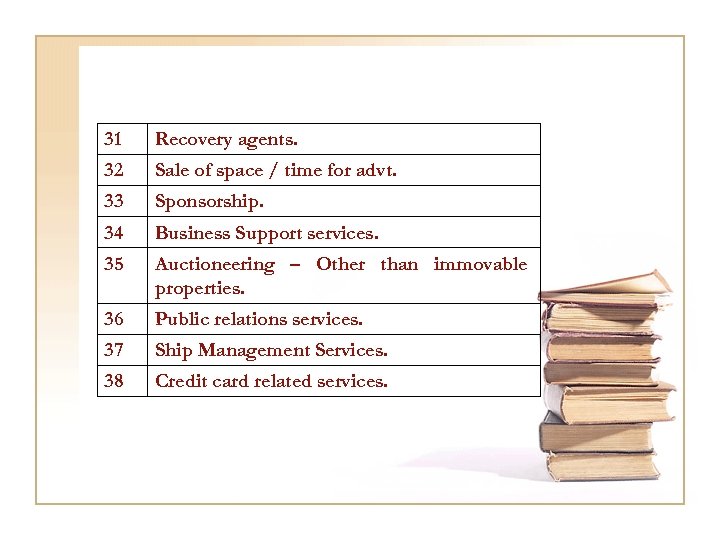

31 Recovery agents. 32 Sale of space / time for advt. 33 Sponsorship. 34 Business Support services. 35 Auctioneering – Other than immovable properties. 36 Public relations services. 37 Ship Management Services. 38 Credit card related services.

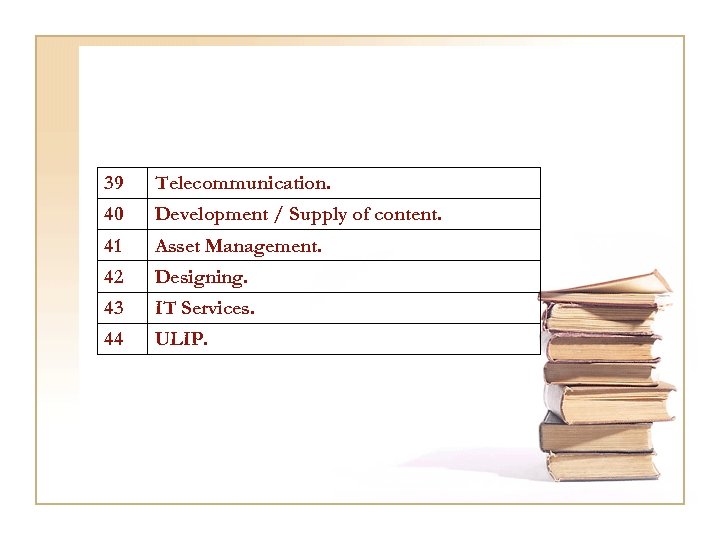

39 Telecommunication. 40 Development / Supply of content. 41 Asset Management. 42 Designing. 43 IT Services. 44 ULIP.

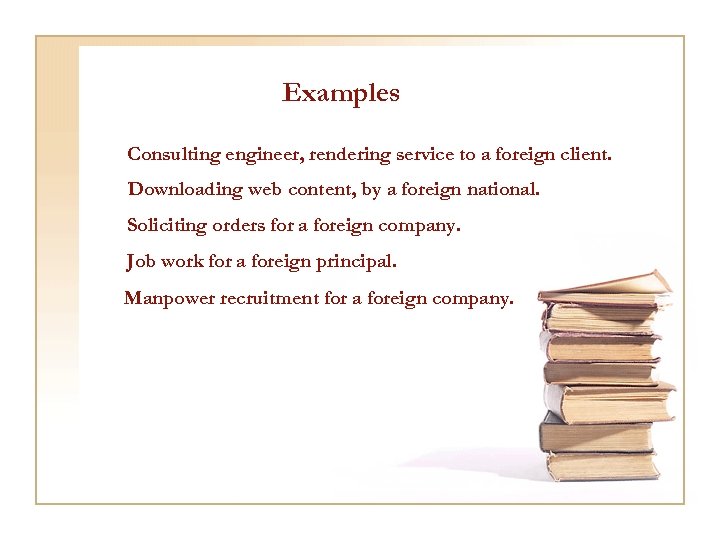

Examples Consulting engineer, rendering service to a foreign client. Downloading web content, by a foreign national. Soliciting orders for a foreign company. Job work for a foreign principal. Manpower recruitment for a foreign company.

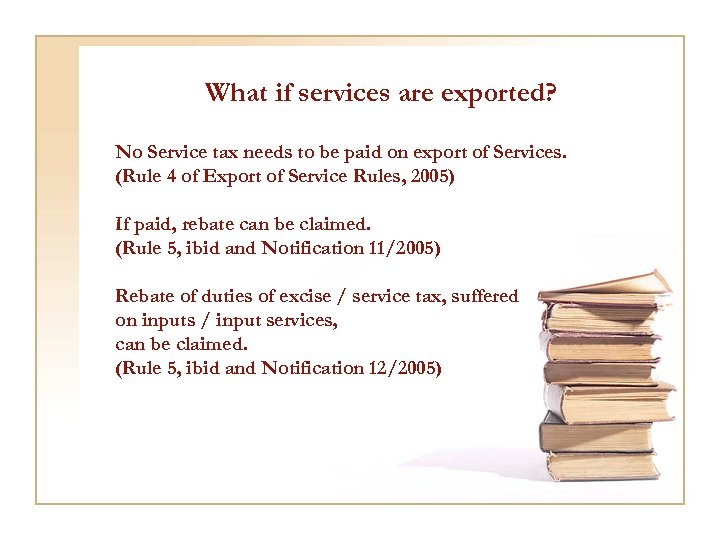

What if services are exported? No Service tax needs to be paid on export of Services. (Rule 4 of Export of Service Rules, 2005) If paid, rebate can be claimed. (Rule 5, ibid and Notification 11/2005) Rebate of duties of excise / service tax, suffered on inputs / input services, can be claimed. (Rule 5, ibid and Notification 12/2005)

What if services are exported? Cenvat can be availed for the inputs / input services used for the exported services. (Cenvat Credit Rules, 2004) Refund of unutilized credit. (Rule 5 of CCR, 2004 & Notification 5/2006)

3d74941bde57eefc50005381af7ff756.ppt