c68b0ef3e21000ba4f2b4c4defce4f19.ppt

- Количество слайдов: 43

Buying Better Weather New Financial Strategies for Managing Weather and Climate Risk John A. Dutton The Pennsylvania State University and Weather Ventures Ltd Department of Meteorology 30 Jan 2004 © John A. Dutton 2004

Topics… u Weather, climate, and earnings volatility u Risk hedging strategies u Basics of weather options © John A. Dutton October 2004

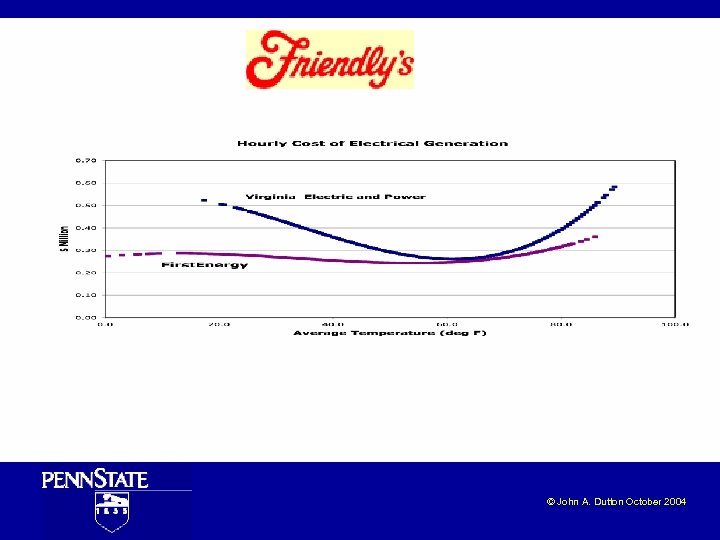

© John A. Dutton October 2004

Press Release 26 November 2001 A British Met Office study of 500 British businesses UK firms face a bill for more than £ 7. 6 billion a year because they have their heads in the clouds over the effects of the weather… … 95 per cent of those questioned admitted they’ve lost up to 10 per cent of their profits last year… Only 17 per cent take weather into account as a vital part of their business planning. The Met Office study also found: nearly half …think they can’t do anything to avoid losing money due to the weather. © John A. Dutton October 2004

The weather and climate appear on the income statements of many firms… …as explanations for changes in performance © John A. Dutton October 2004

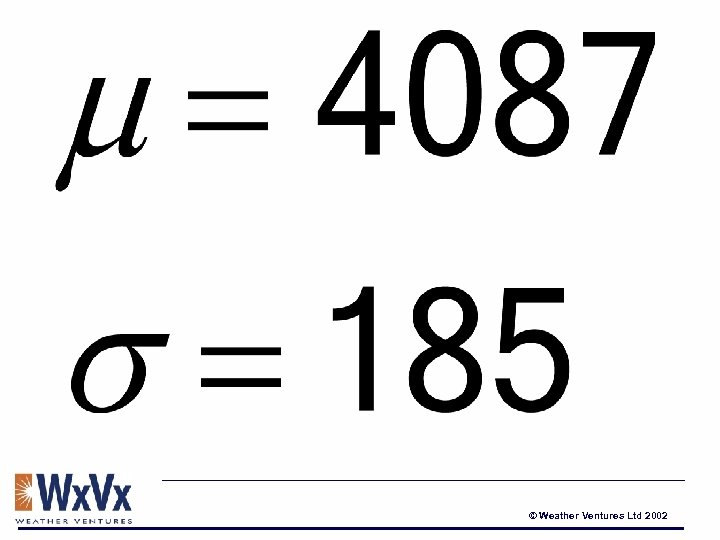

© Weather Ventures Ltd 2002

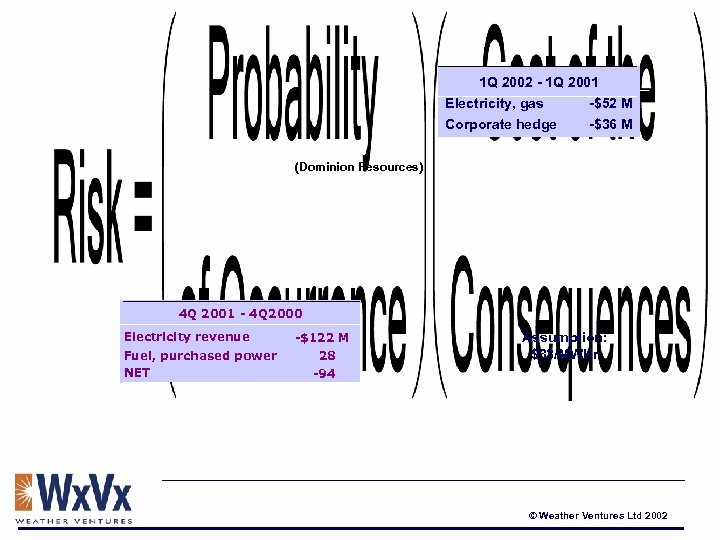

1 Q 2002 - 1 Q 2001 Electricity, gas Corporate hedge -$52 M -$36 M (Dominion Resources) 4 Q 2001 - 4 Q 2000 Electricity revenue Fuel, purchased power NET -$122 M 28 -94 Assumption: $33/MWHr © Weather Ventures Ltd 2002

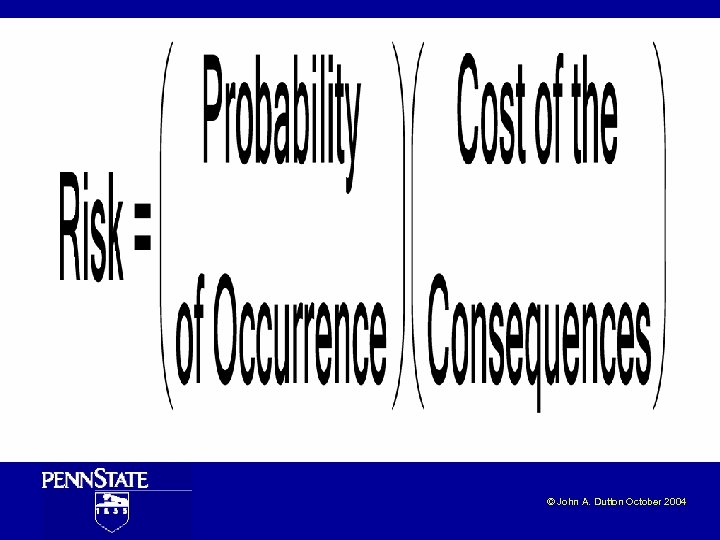

RISK… …the possibility that something bad might happen © John A. Dutton October 2004

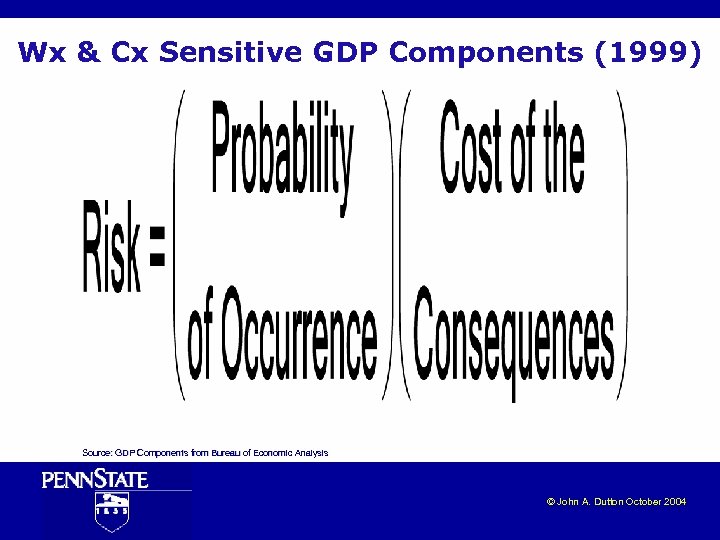

A definition of risk. . . © John A. Dutton October 2004

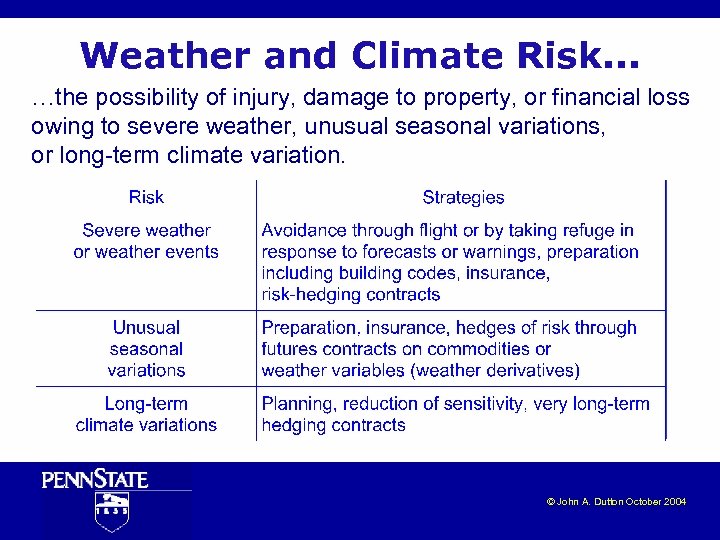

Weather and Climate Risk. . . …the possibility of injury, damage to property, or financial loss owing to severe weather, unusual seasonal variations, or long-term climate variation. © John A. Dutton October 2004

Wx & Cx Sensitive GDP Components (1999) Source: GDP Components from Bureau of Economic Analysis © John A. Dutton October 2004

While we may be endlessly fascinated by the weather and the vagaries of climate… …our clients are interested in the success in their business… …and in rewarding flows of cash and profits. © John A. Dutton October 2004

They don’t care about the weather… …they care about the $ © John A. Dutton October 2004

Risk transfer with forward contracts and future contracts © John A. Dutton October 2004

Forward contract An agreement and obligation to trade a fixed quantity and quality of a commodity for a fixed price at a future date. (Corn, wheat, oil, gold, currency, …) Futures contract A forward contract traded on an exchange (which provides both liquidity and transparency) (CBo. T, CME, NYMEX, …ICE, LIFFE…) Futures contracts are often called derivatives because their value derives from the underlying commodity or financial instrument © John A. Dutton October 2004

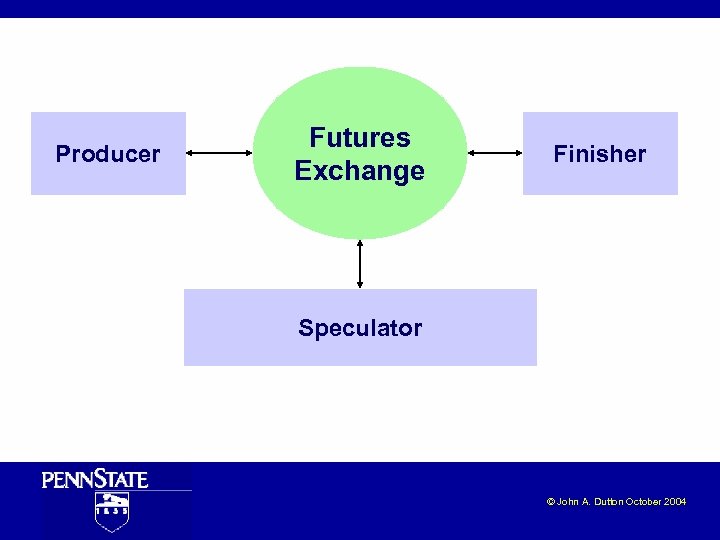

Producer Futures Exchange Finisher Speculator © John A. Dutton October 2004

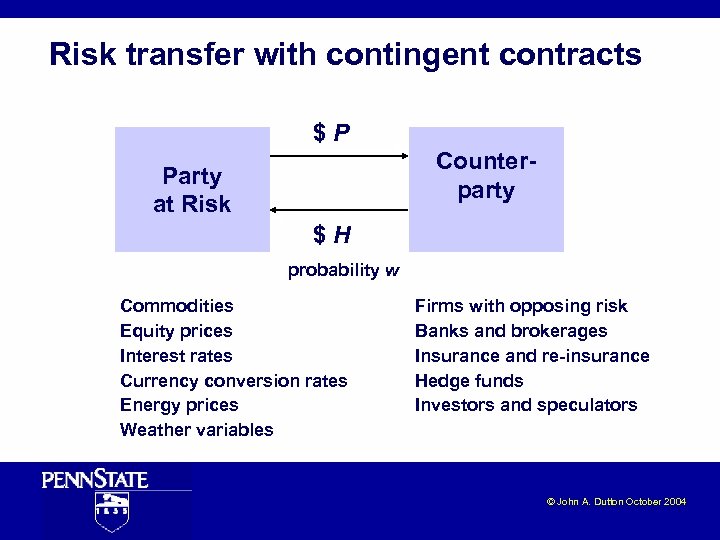

Risk transfer with contingent contracts © John A. Dutton October 2004

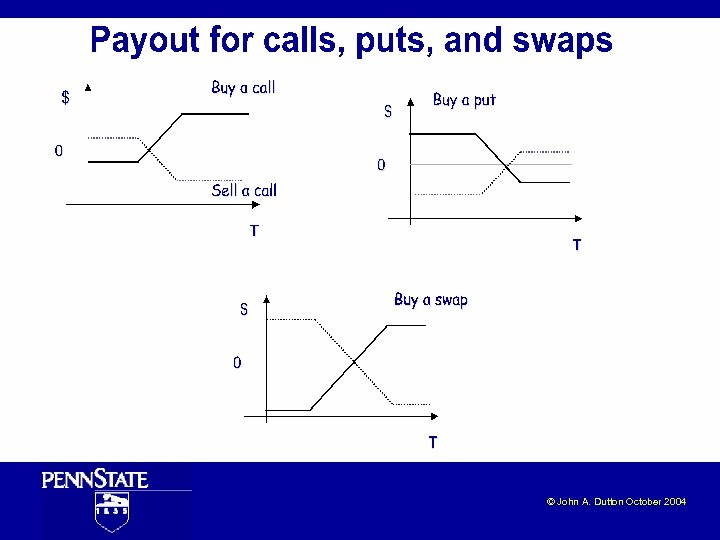

Option The right, but not the obligation, to execute a specified trade for a fixed price before a future date or to assume a position in a futures contract. (Option on a futures contract, option on a stock, ‘option’ on a weather variable…) A call is the right to buy, a put the right to sell. Contingent contracts specify a quantity, a price, and an expiration or settlement date. Options are also derivatives, and in some cases, second derivatives. © John A. Dutton October 2004

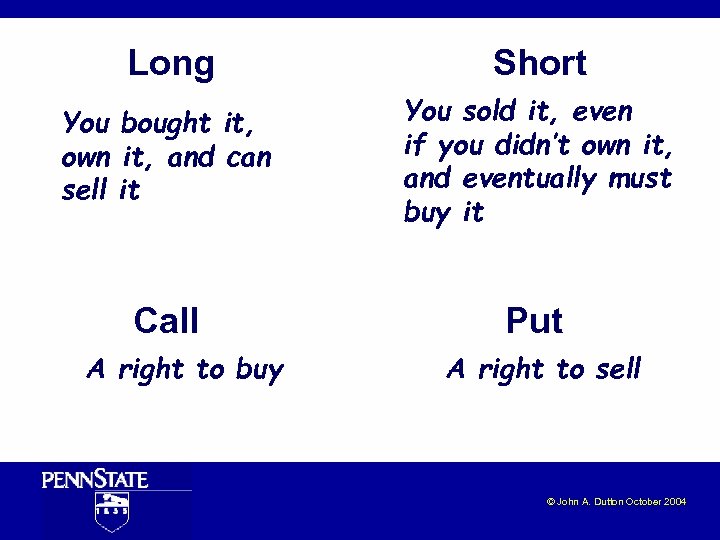

Long Short You bought it, own it, and can sell it You sold it, even if you didn’t own it, and eventually must buy it Call Put A right to buy A right to sell © John A. Dutton October 2004

$1. 18 $1. 65 © John A. Dutton October 2004

Risk transfer with contingent contracts $P Counterparty Party at Risk $H probability w Commodities Equity prices Interest rates Currency conversion rates Energy prices Weather variables Firms with opposing risk Banks and brokerages Insurance and re-insurance Hedge funds Investors and speculators © John A. Dutton October 2004

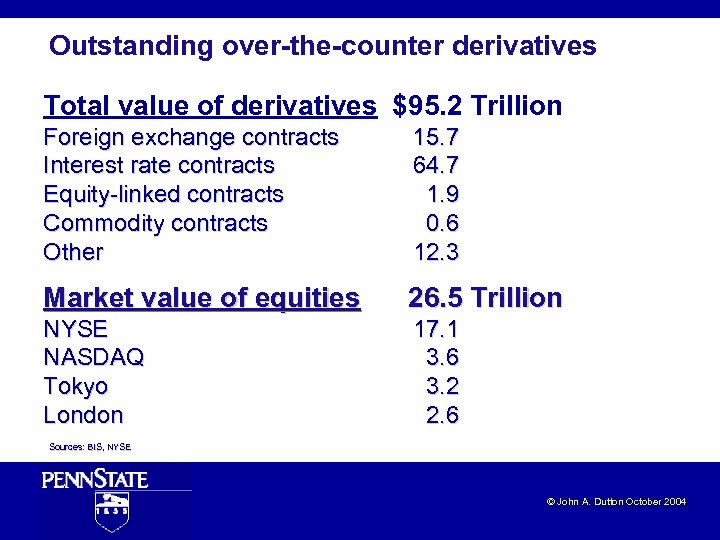

Outstanding over-the-counter derivatives Total value of derivatives $95. 2 Trillion Foreign exchange contracts Interest rate contracts Equity-linked contracts Commodity contracts Other 15. 7 64. 7 1. 9 0. 6 12. 3 Market value of equities 26. 5 Trillion NYSE NASDAQ Tokyo London 17. 1 3. 6 3. 2 2. 6 Sources: BIS, NYSE © John A. Dutton October 2004

Weather and climate… impacts on the business model © John A. Dutton October 2004

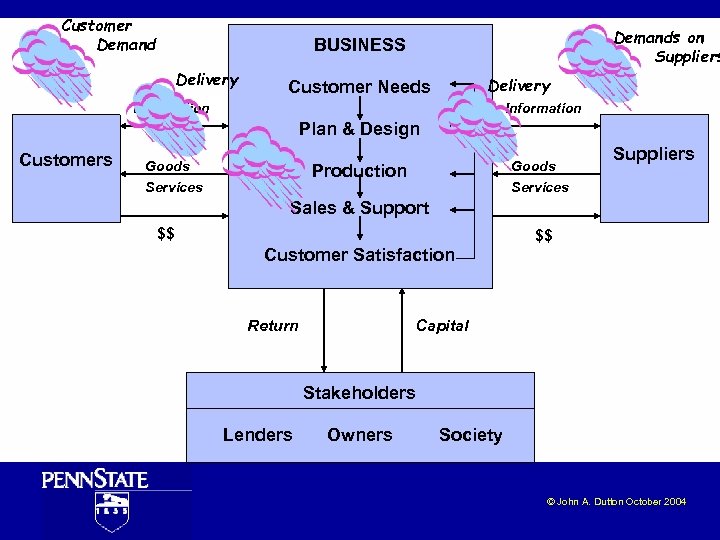

Customer Demands on Suppliers BUSINESS Delivery Customer Needs Information Plan & Design Customers Goods Production Services Suppliers Services Sales & Support $$ $$ Customer Satisfaction Return Capital Stakeholders Lenders Owners Society © John A. Dutton October 2004

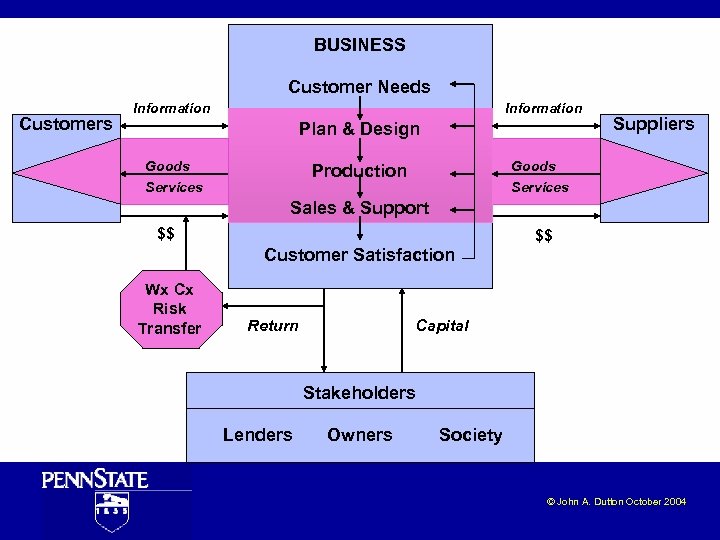

BUSINESS Customer Needs Customers Information Plan & Design Goods Production Services Suppliers Services Sales & Support $$ $$ Customer Satisfaction Wx Cx Risk Transfer Return Capital Stakeholders Lenders Owners Society © John A. Dutton October 2004

© John A. Dutton October 2004

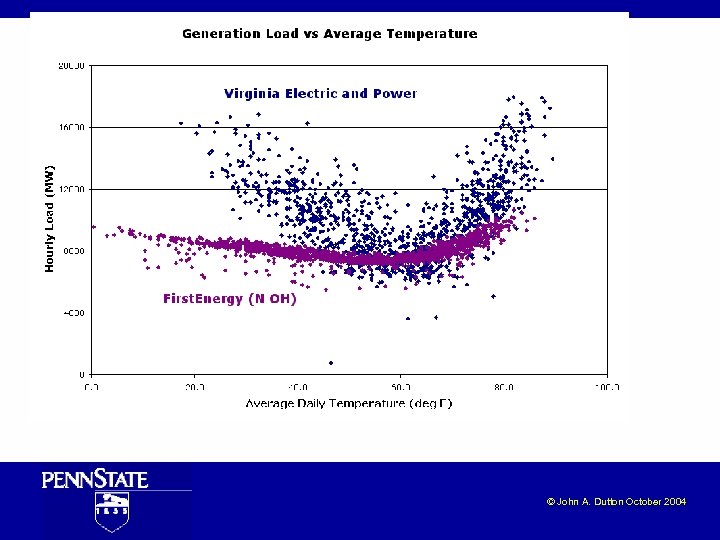

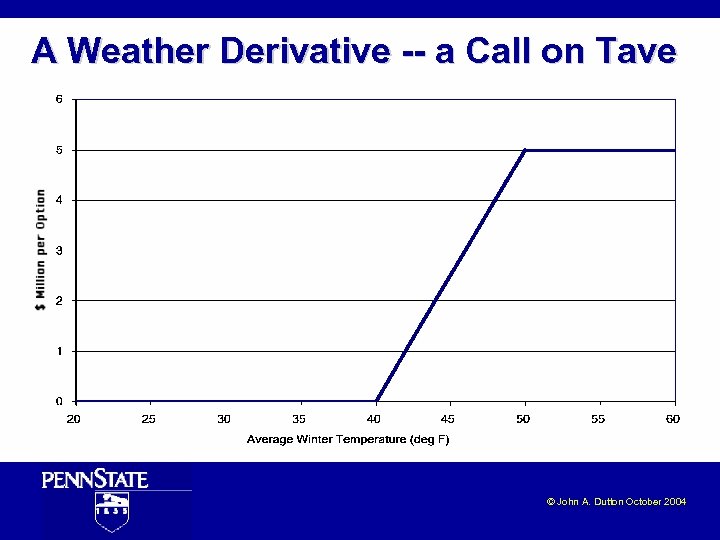

A Weather Derivative -- a Call on Tave © John A. Dutton October 2004

© John A. Dutton October 2004

© John A. Dutton October 2004

© John A. Dutton October 2004

© John A. Dutton October 2004

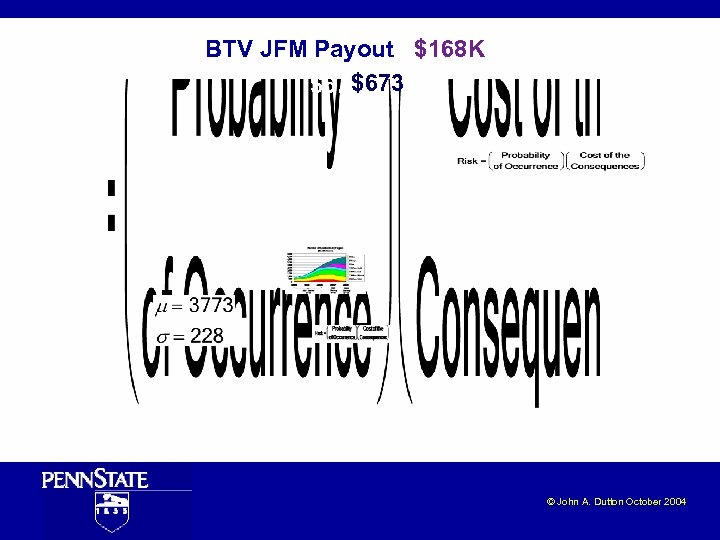

BTV JFM Payout $168 K $673 K © John A. Dutton October 2004

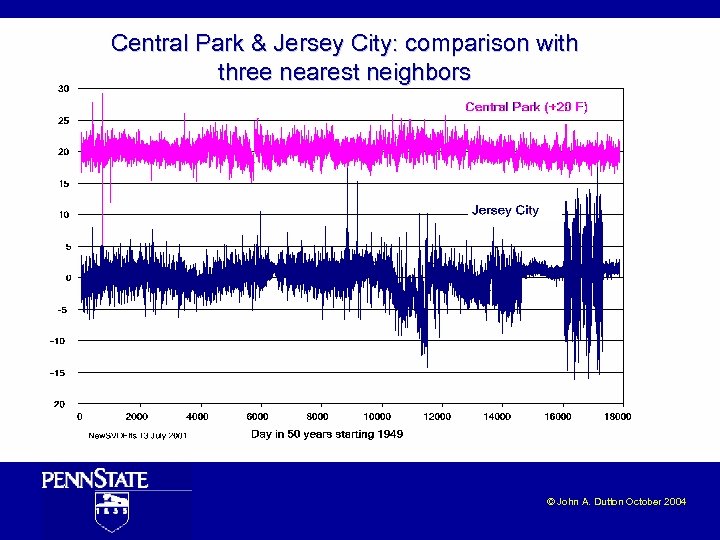

Central Park & Jersey City: comparison with three nearest neighbors © John A. Dutton October 2004

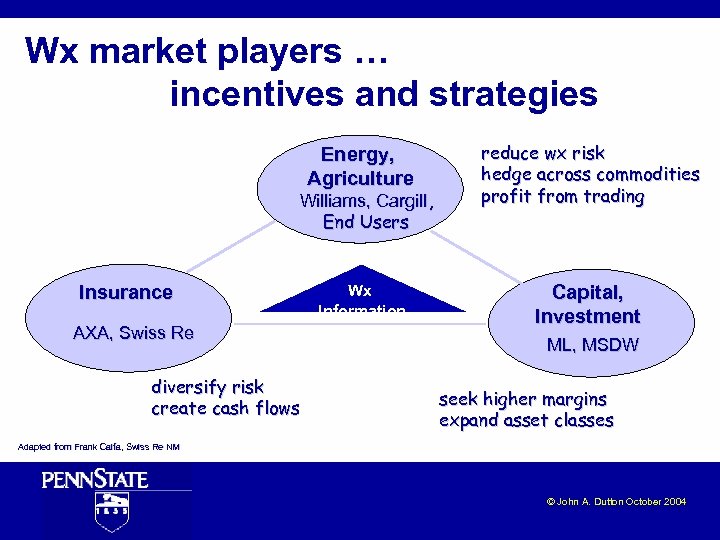

Wx market players … incentives and strategies Energy, Agriculture reduce wx risk hedge across commodities profit from trading Wx Information Capital, Investment Williams, Cargill, End Users Insurance AXA, Swiss Re diversify risk create cash flows ML, MSDW seek higher margins expand asset classes Adapted from Frank Caifa, Swiss Re NM Caifa, © John A. Dutton October 2004

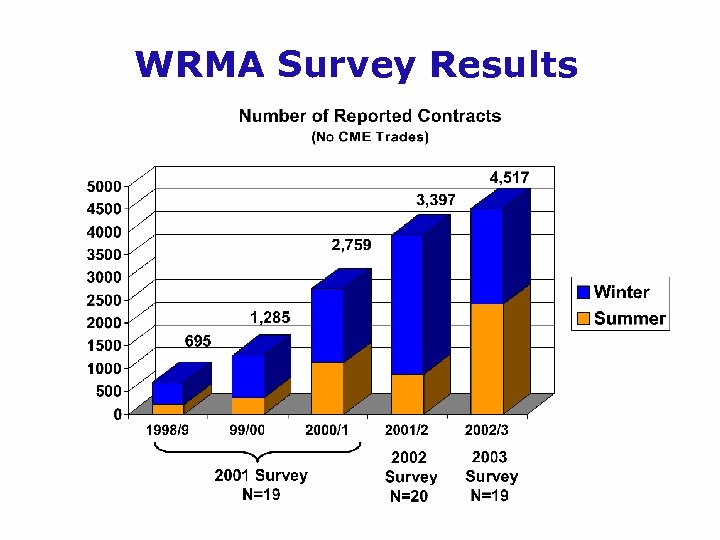

WRMA Survey Results

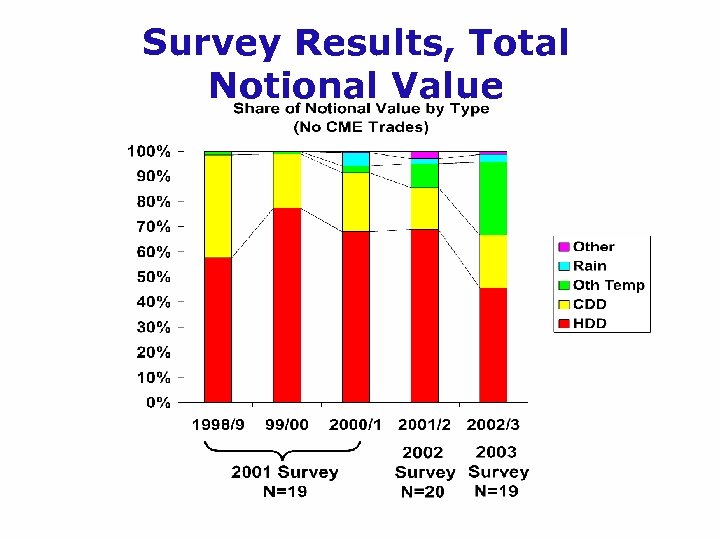

Survey Results, Total Notional Value

Survey Results, Notional Value by Type

Survey Results, Number of Contracts by Region

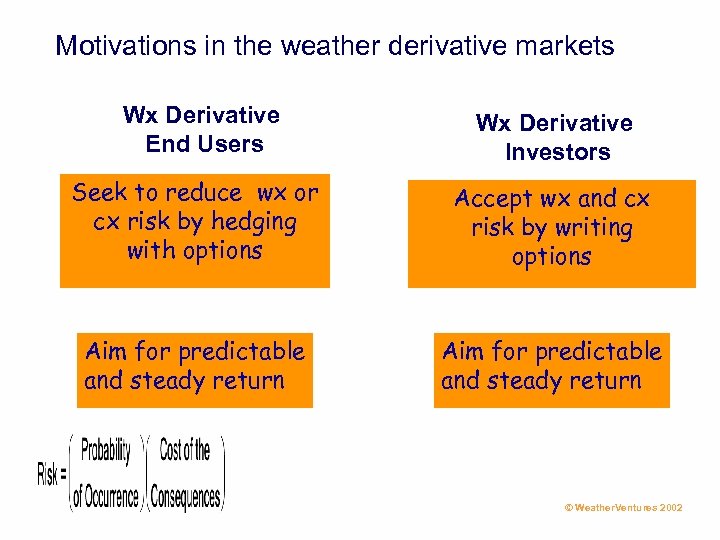

Motivations in the weather derivative markets Wx Derivative End Users Wx Derivative Investors Seek to reduce wx or cx risk by hedging with options Accept wx and cx risk by writing options Aim for predictable and steady return © Weather. Ventures 2002

Your clients don’t care about the weather… …they care about the $ © John A. Dutton October 2004

Coming Attractions Return versus Volatility: The Value of Climate Forecasts © John A. Dutton October 2004

c68b0ef3e21000ba4f2b4c4defce4f19.ppt