d55caec17d6b3040f149a90085eaaa27.ppt

- Количество слайдов: 65

BUYING AND SELLING AN AUDIOLOGY PRACTICE Presented By JAMES M. RAMSEY ADA Convention ~ November 8, 2008 1 ADA -Las Vegas Nov 8, 2008

Introduction Objectives To provide the framework for valuing and purchasing/selling an Audiology practice To incorporate Effective Negotiating Skills in an effort to achieve an optimal outcome 2 ADA -Las Vegas Nov 8, 2008

Introduction Outline of Program q Review Basic Accounting Concepts q Valuation of an Audiology Practice q Effective Negotiating to Optimize the Outcome 3 ADA -Las Vegas Nov 8, 2008

Accounting 101 Basic Accounting Equation (Balance Sheet) q 4 Assets = Liabilities + Equity ADA -Las Vegas Nov 8, 2008

Sources of Funding q Debt (liability) q Equity § § 5 Capital (Yours – Others) Retained Earnings - Profits ADA -Las Vegas Nov 8, 2008

Financial Statements q q 6 Balance Sheet (Single Date Valuation) Assets = Liability(Debt) + Equity Profit and Loss Statement (Income Statement) § Stated Period of Time § Profits or <Losses> = Revenue - Expenses ADA -Las Vegas Nov 8, 2008

Accounting Terms/Concepts q q q 7 Accrual vs. Cash Basis of Accounting “Matching Principle” Double Entry Bookkeeping System Personal Checkbook Vs Using Quick. Books Fiscal Year vs. Calendar Year Reporting ADA -Las Vegas Nov 8, 2008

Accounting Terms/Concepts Current Assets – Working Capital q Current vs. Long Term Debt q Expense vs. Depreciable or Non-Depreciable Assets q Section 179 Depreciation q 8 ADA -Las Vegas Nov 8, 2008

Forms of Doing Business Distinction Focuses on q Tax Consequences q Liability Protection q Flexibility 9 ADA -Las Vegas Nov 8, 2008

Forms of Doing Business Most Frequent Legal / Tax Structure q Sole Proprietorship (1040 Schedule C) q General Partnership (1065 – Schedule K-1) q C-Corporation (Form 1120, W-2 Income) q S-Corporation (11205 – Taxed Like Partnership) q LLC/P – Limited Liability Corporation-Partnership (1065) q LP-Limited Partnership q Entities to Reduce Payroll Taxes 10 ADA -Las Vegas Nov 8, 2008

BUSINESS VALUATION 11 ADA -Las Vegas Nov 8, 2008

Business Valuation q q q 12 Define – Based on Reason for Valuation Liquidation – Focus on Value of Assets and Debt Not Profits Company Operating at a Loss Divorce – “Equitable Distribution” Intrinsic Value – Not Necessarily Reflected on Financial Statement Fair Market Value – Rev. Ruling 59 -60 The Price a Willing Buyer Would Pay or Accept Neither Being Under the Obligation to Buy or Sell ADA -Las Vegas Nov 8, 2008

Basic Valuation Models Adjusted Net Asset Method Income / Cash Flow Methodology q q q 13 Capitalization of Earnings Rule of Thumb Methods(Multiple of EBIDTA) Discounted Cash Flow ADA -Las Vegas Nov 8, 2008

Adjusted Net Asset Method Usually the Lowest Value q The Whole Equals the Sum of the Parts q Limited Applicability q § § 14 Not Suitable for a “Going Concern” Liquidation ADA -Las Vegas Nov 8, 2008

Income/Cash Approach An Audiology practice is worth the amount you would pay today to receive a stream of earnings (Cash Flow) in the future q Looks at Two Components (Time – Risk) q § § 15 Timing – Money you Receive in 5 Years is Worth less than Cash in Hand The Amount Received & Likelihood of Receiving– The Riskier the Future Cash Flow – Lower Value ADA -Las Vegas Nov 8, 2008

CAPITALIZATION OF EARNINGS 16 ADA -Las Vegas Nov 8, 2008

Capitalization of Earnings How much money you will receive on your investments (E = Annual Profits for One Year) 17 ADA -Las Vegas Nov 8, 2008

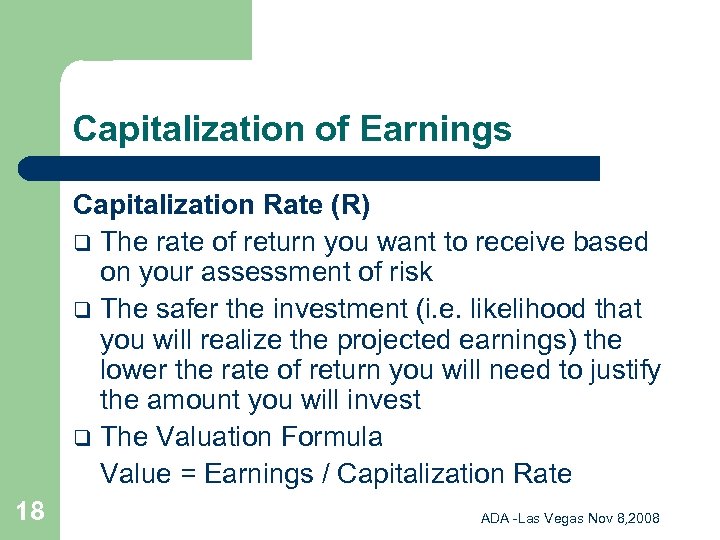

Capitalization of Earnings Capitalization Rate (R) q The rate of return you want to receive based on your assessment of risk q The safer the investment (i. e. likelihood that you will realize the projected earnings) the lower the rate of return you will need to justify the amount you will invest q The Valuation Formula Value = Earnings / Capitalization Rate 18 ADA -Las Vegas Nov 8, 2008

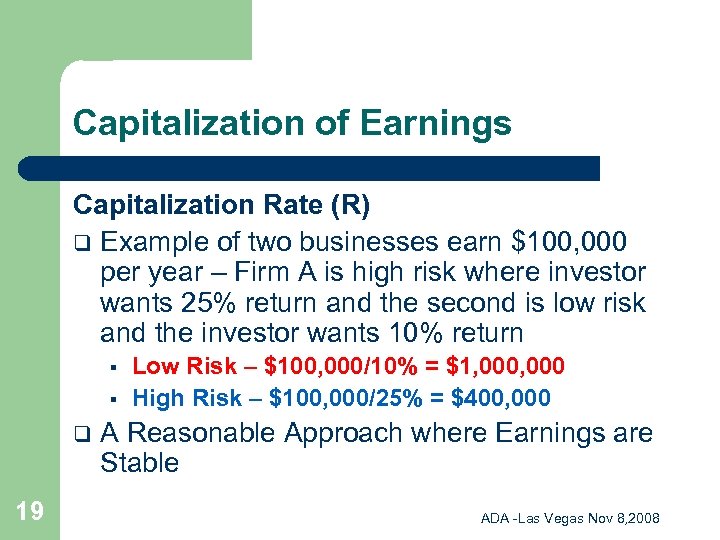

Capitalization of Earnings Capitalization Rate (R) q Example of two businesses earn $100, 000 per year – Firm A is high risk where investor wants 25% return and the second is low risk and the investor wants 10% return § § q 19 Low Risk – $100, 000/10% = $1, 000 High Risk – $100, 000/25% = $400, 000 A Reasonable Approach where Earnings are Stable ADA -Las Vegas Nov 8, 2008

DISCOUNTED CASH FLOW (DCF) 20 ADA -Las Vegas Nov 8, 2008

Discounted Cash Flow Based on the value of a stream of future cash flow taking into account both the timing of the receipts and the cost of capital. The value of a business is the amount you would pay today for a future stream of cash. 21 ADA -Las Vegas Nov 8, 2008

Discounted Cash Flow The Cost of Capital (Financing) q Percentage Financed by Debt x Cost of Debt q Percentage Financed by Equity x Cost of Equity q WACC – The Weighted Average Cost of Capital Using Debt and/or Capital 22 ADA -Las Vegas Nov 8, 2008

Discounted Cash Flow Computing Cost of Debt Cost to borrow from a lender to the Firm based on lender’s assessment of the Company’s creditworthiness 23 ADA -Las Vegas Nov 8, 2008

Key Terms q q 24 WACC – Weighted Average Cost of Capital The cost of financing using debt and or capital CAPM – Capital Asset Pricing Mode A mathematical calculation to compute the Cost of Equity ADA -Las Vegas Nov 8, 2008

Key Terms q EBIDTA – Earnings Before Interest, Depreciation Taxes and Amortization § § 25 A financial term used in business to reflect the cash flow of a business The “Starting Point” in computing “Free Cash Flow” to the Firm (FCF) ADA -Las Vegas Nov 8, 2008

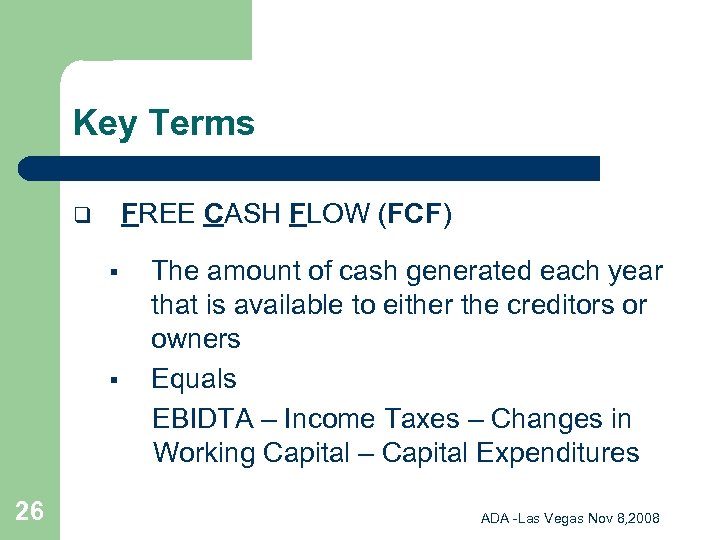

Key Terms FREE CASH FLOW (FCF) q § § 26 The amount of cash generated each year that is available to either the creditors or owners Equals EBIDTA – Income Taxes – Changes in Working Capital – Capital Expenditures ADA -Las Vegas Nov 8, 2008

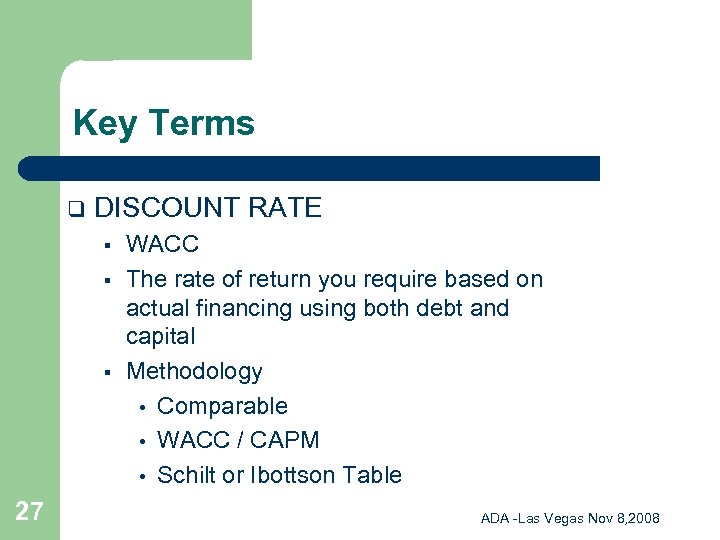

Key Terms q DISCOUNT RATE § § § 27 WACC The rate of return you require based on actual financing using both debt and capital Methodology • Comparable • WACC / CAPM • Schilt or Ibottson Table ADA -Las Vegas Nov 8, 2008

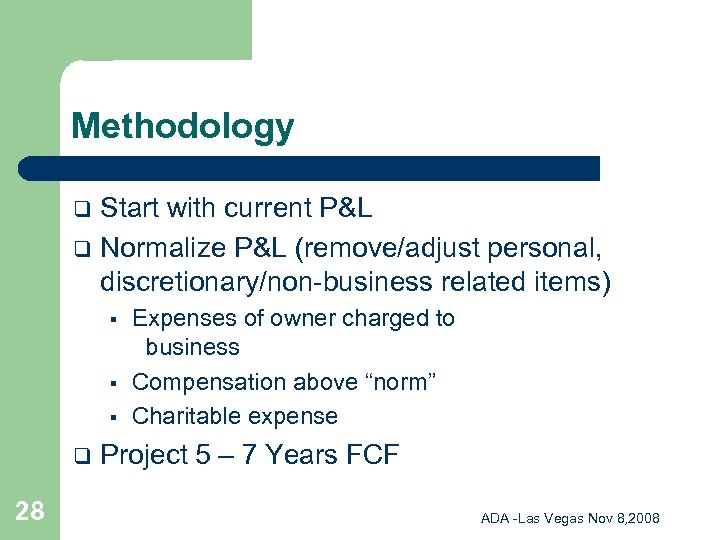

Methodology Start with current P&L q Normalize P&L (remove/adjust personal, discretionary/non-business related items) q § § § q 28 Expenses of owner charged to business Compensation above “norm” Charitable expense Project 5 – 7 Years FCF ADA -Las Vegas Nov 8, 2008

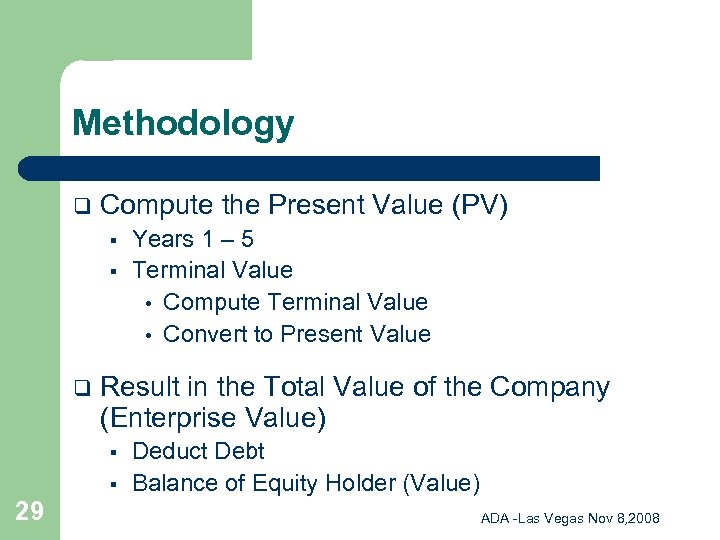

Methodology q Compute the Present Value (PV) § § q Result in the Total Value of the Company (Enterprise Value) § § 29 Years 1 – 5 Terminal Value • Compute Terminal Value • Convert to Present Value Deduct Debt Balance of Equity Holder (Value) ADA -Las Vegas Nov 8, 2008

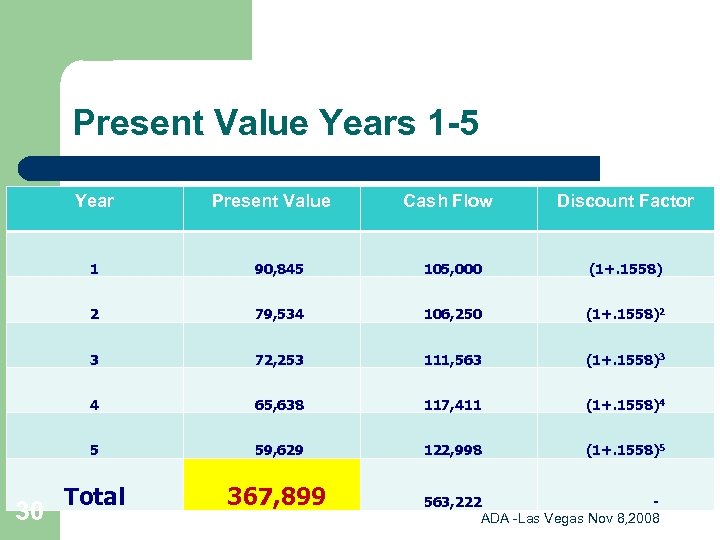

Present Value Years 1 -5 Year Cash Flow Discount Factor 1 90, 845 105, 000 (1+. 1558) 2 79, 534 106, 250 (1+. 1558)2 3 72, 253 111, 563 (1+. 1558)3 4 65, 638 117, 411 (1+. 1558)4 5 30 Present Value 59, 629 122, 998 (1+. 1558)5 Total 367, 899 563, 222 - ADA -Las Vegas Nov 8, 2008

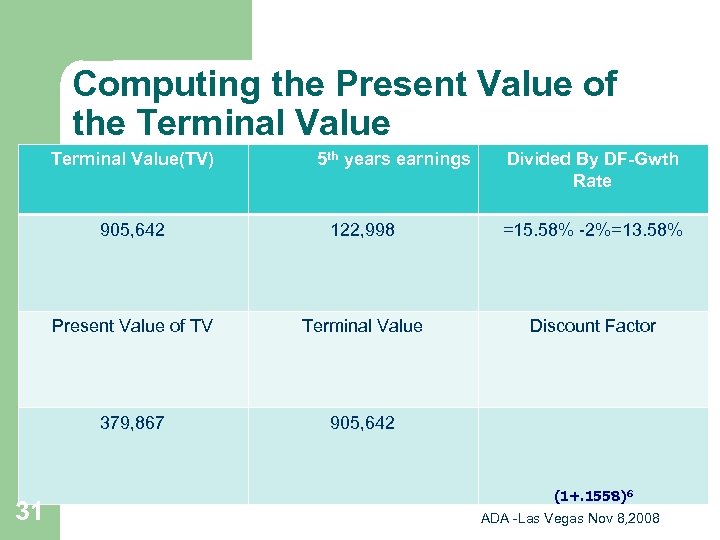

Computing the Present Value of the Terminal Value(TV) 5 th years earnings Divided By DF-Gwth Rate 905, 642 =15. 58% -2%=13. 58% Present Value of TV Terminal Value Discount Factor 379, 867 31 122, 998 905, 642 (1+. 1558)6 ADA -Las Vegas Nov 8, 2008

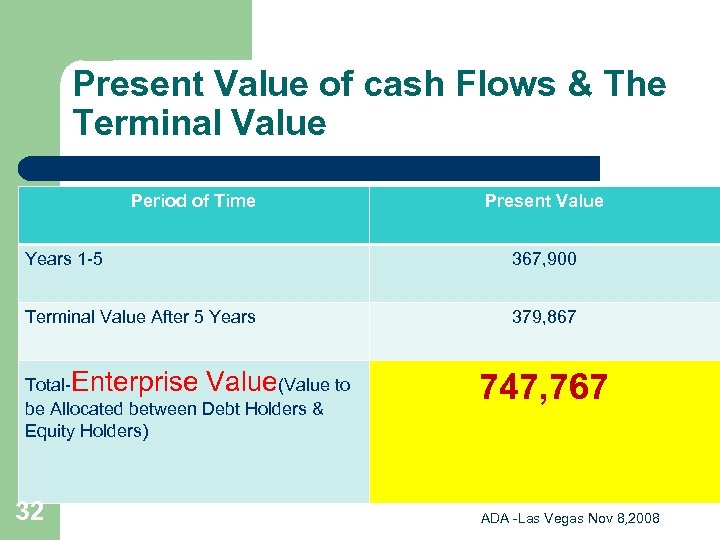

Present Value of cash Flows & The Terminal Value Period of Time Present Value Years 1 -5 367, 900 Terminal Value After 5 Years 379, 867 Total-Enterprise Value(Value to be Allocated between Debt Holders & Equity Holders) 32 747, 767 ADA -Las Vegas Nov 8, 2008

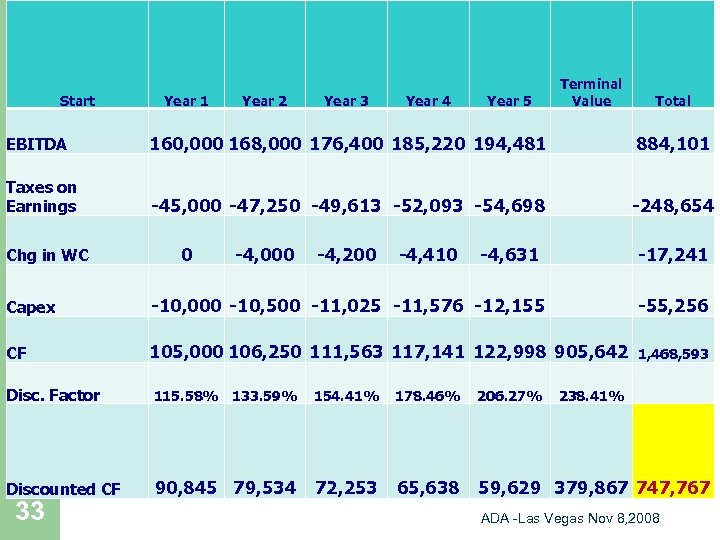

Start Year 1 Year 2 Year 3 Year 4 Year 5 Computing Enterprise Value 160, 000 168, 000 176, 400 185, 220 194, 481 EBITDA Taxes on Earnings Chg in WC Terminal Value 884, 101 -45, 000 -47, 250 -49, 613 -52, 093 -54, 698 0 -4, 000 -4, 200 -4, 410 Total -248, 654 -4, 631 -17, 241 Capex -10, 000 -10, 500 -11, 025 -11, 576 -12, 155 CF 105, 000 106, 250 111, 563 117, 141 122, 998 905, 642 -55, 256 1, 468, 593 Disc. Factor 115. 58% 133. 59% 154. 41% 178. 46% 206. 27% Discounted CF 90, 845 79, 534 72, 253 65, 638 59, 629 379, 867 747, 767 33 238. 41% ADA -Las Vegas Nov 8, 2008

Simplified Method For Computing Discount Rate (Cap Rate) James H. Schilt updated and published his theories in the June 1991 edition of the American Society of Appraisers publication, Business Valuation Review, in an article entitled “Selection of Capitalization Rates – Revisited”. He categorizes companies into one of the following five categories and assigns a risk premium accordingly. 34 ADA -Las Vegas Nov 8, 2008

Simplified Method for Computing Discount Rate-Cap Rate Established businesses with a strong trade position that are well financed, have depth and management, whose past earnings have been stable, and whose future is highly predictable (6 -10%) q Established businesses in a more competitive industry that are well financed, have depth and management, have stable past earnings, and whose future is fairly predictable (1115%) q 35 ADA -Las Vegas Nov 8, 2008

Simplified Method for Computing Discount Rate-Cap Rate q q 36 Businesses in a highly competitive industry that require little capital to enter, no management depth, and have a high element of risk, although the past record may be good. (16 -20%) Small businesses that depend upon the special skills of one or two people, or larger established businesses that are highly cyclical in nature. In both cases, future earnings may be expected to deviate widely from projections (21 -25%) ADA -Las Vegas Nov 8, 2008

Simplified Method for Computing Discount Rate-Cap Rate q 37 Small “one-man” businesses of a personal service nature, where transferability of the income stream is in question. (26 -30) ADA -Las Vegas Nov 8, 2008

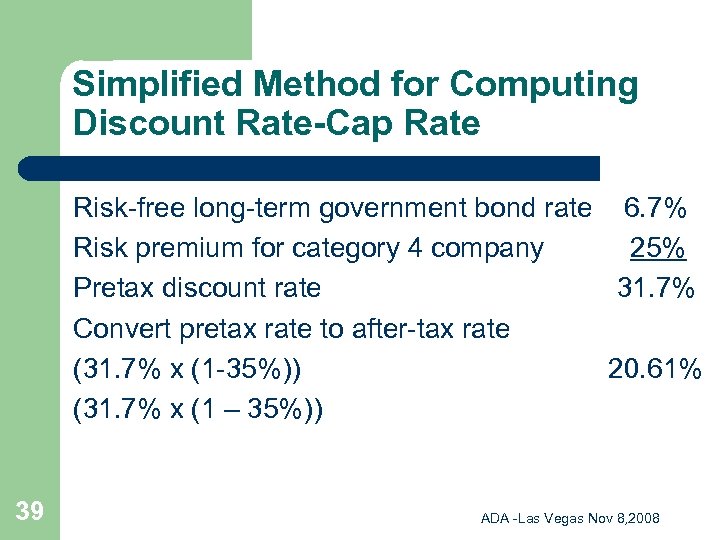

Simplified Method for Computing Discount Rate-Cap Rate You add the risk premium, calculated above to the risk-free rate, just as with the Ibbotson Method. The calculation of the discount rate for a privately held company in the 35% tax bracket using the Schilt’s Build-Up Method is as follows: 38 ADA -Las Vegas Nov 8, 2008

Simplified Method for Computing Discount Rate-Cap Rate Risk-free long-term government bond rate 6. 7% Risk premium for category 4 company 25% Pretax discount rate 31. 7% Convert pretax rate to after-tax rate (31. 7% x (1 -35%)) 20. 61% (31. 7% x (1 – 35%)) 39 ADA -Las Vegas Nov 8, 2008

RULES OF THUMB 40 ADA -Las Vegas Nov 8, 2008

Multiple of EBIDTA q 41 3 -6 Times EBIDTA (Earnings Before Interest, Depreciation, Taxes and Amortization ADA -Las Vegas Nov 8, 2008

Summary Net Asset Method-Not Valid q Capitalization-Simple & valid for Stable Earnings q DCF-Best for Valuing a steam of Cash Flow q Multiple Of EBIDTA- Over simplified but viewed with credibility q 42 ADA -Las Vegas Nov 8, 2008

NEGOTIATION 43 ADA -Las Vegas Nov 8, 2008

Objective To enhance your ability to achieve an optimal outcome that is devised with a sense of fairness with a sensitivity for maintaining and/or enhancing the long term relationship. 44 ADA -Las Vegas Nov 8, 2008

Overview q q 45 How People Typically Negotiate – Descriptive How People Should Negotiate – Prescriptive ADA -Las Vegas Nov 8, 2008

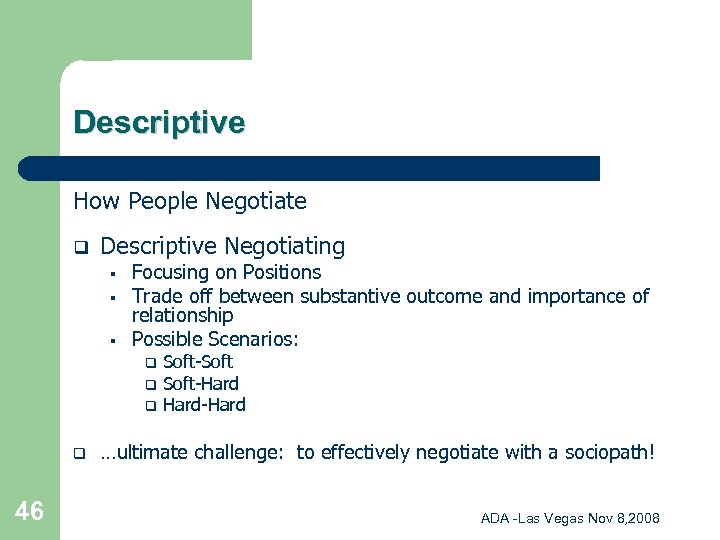

Descriptive How People Negotiate q Descriptive Negotiating § § § Focusing on Positions Trade off between substantive outcome and importance of relationship Possible Scenarios: q q 46 Soft-Soft-Hard-Hard …ultimate challenge: to effectively negotiate with a sociopath! ADA -Las Vegas Nov 8, 2008

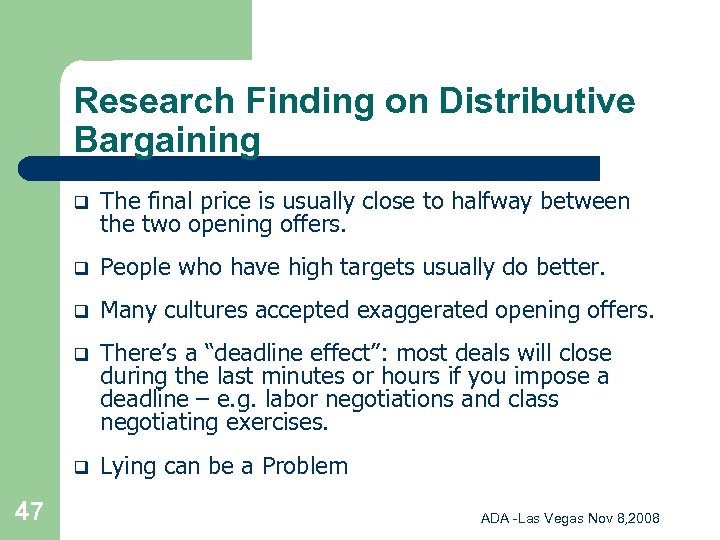

Research Finding on Distributive Bargaining q q People who have high targets usually do better. q Many cultures accepted exaggerated opening offers. q There’s a “deadline effect”: most deals will close during the last minutes or hours if you impose a deadline – e. g. labor negotiations and class negotiating exercises. q 47 The final price is usually close to halfway between the two opening offers. Lying can be a Problem ADA -Las Vegas Nov 8, 2008

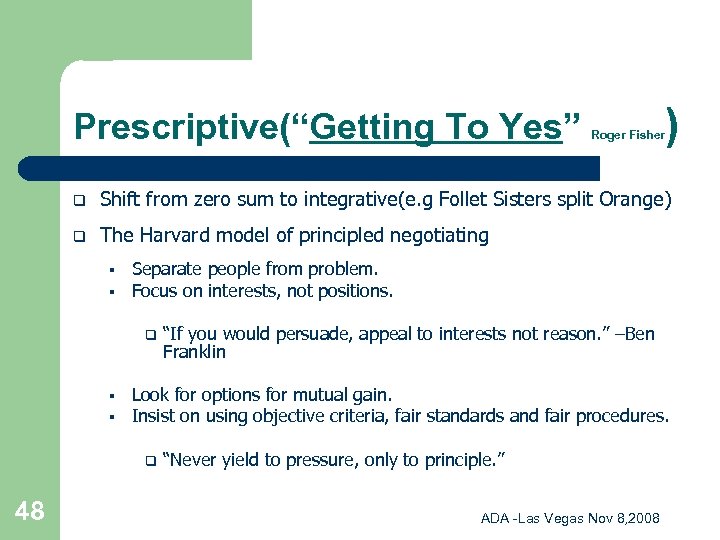

Prescriptive(“Getting To Yes” Roger Fisher ) q Shift from zero sum to integrative(e. g Follet Sisters split Orange) q The Harvard model of principled negotiating § § Separate people from problem. Focus on interests, not positions. q § § Look for options for mutual gain. Insist on using objective criteria, fair standards and fair procedures. q 48 “If you would persuade, appeal to interests not reason. ” –Ben Franklin “Never yield to pressure, only to principle. ” ADA -Las Vegas Nov 8, 2008

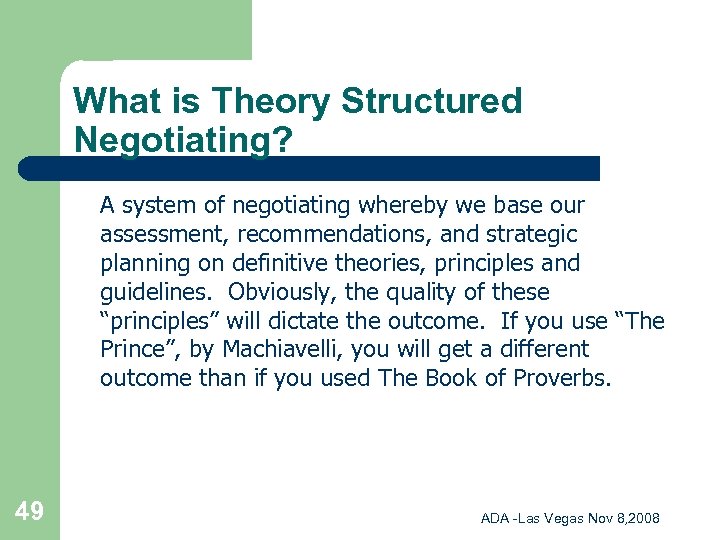

What is Theory Structured Negotiating? A system of negotiating whereby we base our assessment, recommendations, and strategic planning on definitive theories, principles and guidelines. Obviously, the quality of these “principles” will dictate the outcome. If you use “The Prince”, by Machiavelli, you will get a different outcome than if you used The Book of Proverbs. 49 ADA -Las Vegas Nov 8, 2008

Theory Structured Negotiating “Blueprinting The Negotiation” The Components q § § 50 Each Side’s “Consequences of No Agreement” (CNA) or “Best Alternative To A Negotiated Agreement (BATNA). Each side’s desired outcome based on the issues and priorities. (Each sides wish list) ADA -Las Vegas Nov 8, 2008

The Process (Blueprint) q q 51 Estimating/Predicting/Identifying each side’s § CNA/BATNA § Wish List Validating the accuracy of each side’s CNA and wish list Creating value (Lax and Sebenius) Claiming value (Lax and Sebenius) ADA -Las Vegas Nov 8, 2008

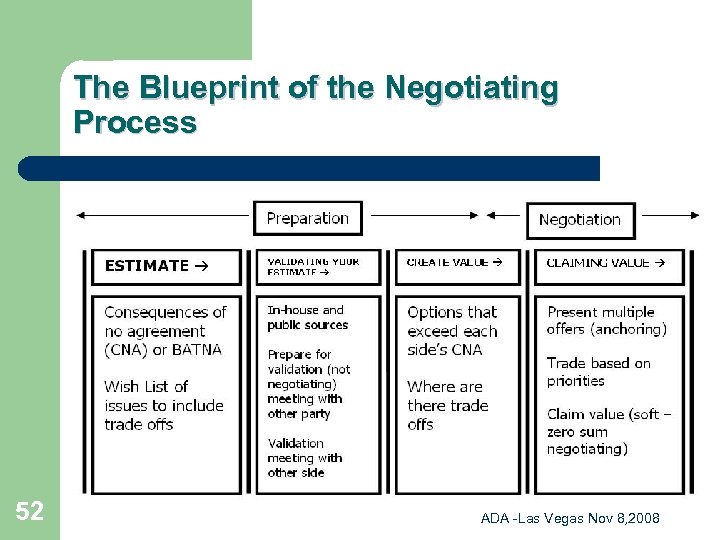

The Blueprint of the Negotiating Process 52 ADA -Las Vegas Nov 8, 2008

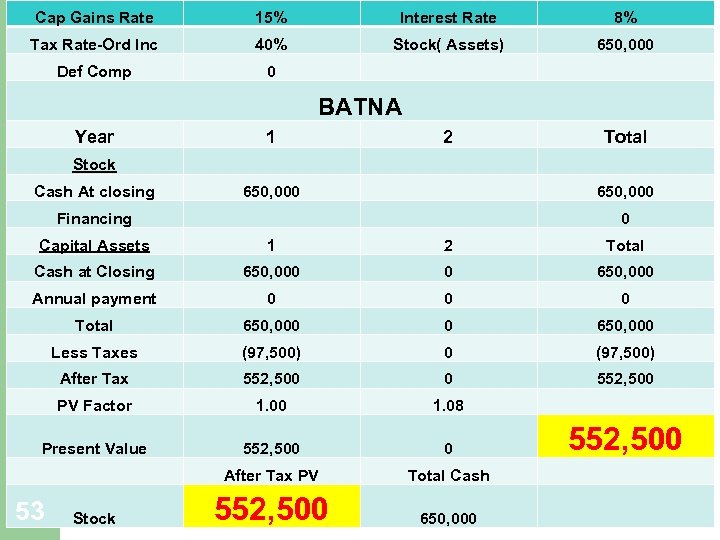

Cap Gains Rate 15% Interest Rate 8% Tax Rate-Ord Inc 40% Stock( Assets) 650, 000 Def Comp 0 BATNA Year 1 2 Total Stock Cash At closing 650, 000 Financing 0 Capital Assets 1 2 Total Cash at Closing 650, 000 0 650, 000 Annual payment 0 0 0 Total 650, 000 0 650, 000 Less Taxes (97, 500) 0 (97, 500) After Tax 552, 500 0 552, 500 PV Factor 1. 00 1. 08 Present Value 552, 500 0 552, 500 After Tax PV Total Cash Stock 552, 500 53 650, 000 ADA -Las Vegas Nov 8, 2008

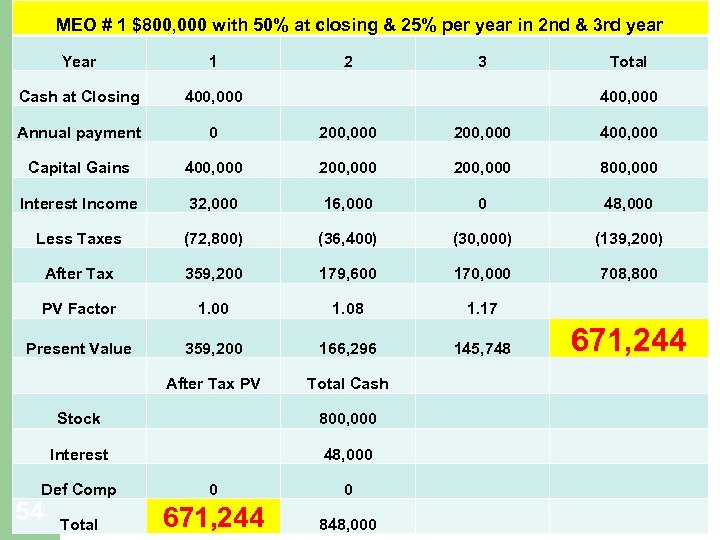

MEO # 1 $800, 000 with 50% at closing & 25% per year in 2 nd & 3 rd year Year 1 2 3 Total Cash at Closing 400, 000 Annual payment 0 200, 000 400, 000 Capital Gains 400, 000 200, 000 800, 000 Interest Income 32, 000 16, 000 0 48, 000 Less Taxes (72, 800) (36, 400) (30, 000) (139, 200) After Tax 359, 200 179, 600 170, 000 708, 800 PV Factor 1. 00 1. 08 1. 17 Present Value 359, 200 166, 296 145, 748 671, 244 After Tax PV Total Cash Stock 800, 000 Interest 48, 000 Def Comp 0 0 Total 671, 244 848, 000 54 ADA -Las Vegas Nov 8, 2008

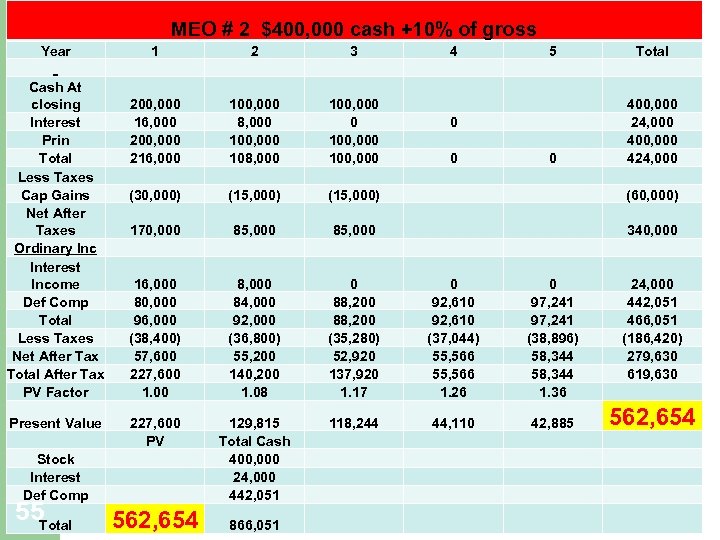

MEO # 2 $400, 000 cash +10% of gross Year Cash At closing Interest Prin Total Less Taxes Cap Gains Net After Taxes Ordinary Inc Interest Income Def Comp Total Less Taxes Net After Tax Total After Tax PV Factor Present Value Stock Interest Def Comp 55 Total 1 2 3 4 5 Total 200, 000 16, 000 200, 000 216, 000 (30, 000) 100, 000 8, 000 100, 000 108, 000 (15, 000) 100, 000 0 100, 000 (15, 000) 0 0 400, 000 24, 000 400, 000 424, 000 (60, 000) 170, 000 85, 000 340, 000 16, 000 80, 000 96, 000 (38, 400) 57, 600 227, 600 1. 00 8, 000 84, 000 92, 000 (36, 800) 55, 200 140, 200 1. 08 0 88, 200 (35, 280) 52, 920 137, 920 1. 17 0 92, 610 (37, 044) 55, 566 1. 26 0 97, 241 (38, 896) 58, 344 1. 36 24, 000 442, 051 466, 051 (186, 420) 279, 630 619, 630 227, 600 PV 129, 815 Total Cash 400, 000 24, 000 442, 051 118, 244 44, 110 42, 885 562, 654 866, 051 562, 654 ADA -Las Vegas Nov 8, 2008

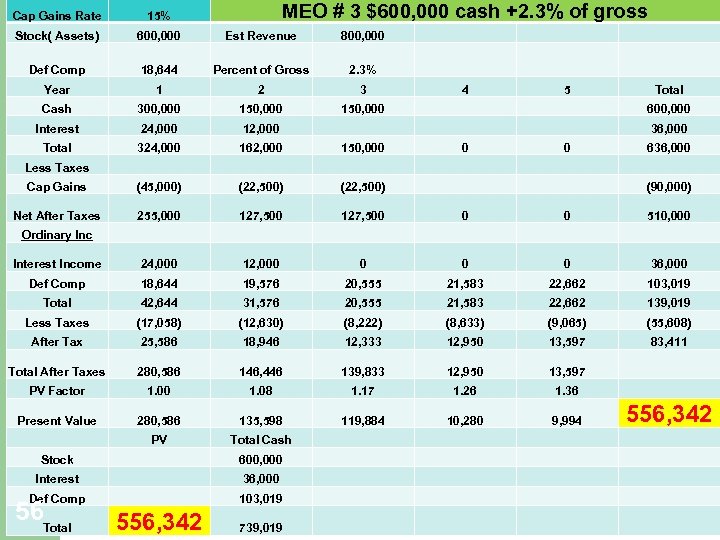

MEO # 3 $600, 000 cash +2. 3% of gross Cap Gains Rate 15% Stock( Assets) 600, 000 Est Revenue 800, 000 Def Comp 18, 644 Percent of Gross 2. 3% Year 1 2 3 4 5 Total Cash 300, 000 150, 000 600, 000 Interest 24, 000 12, 000 36, 000 Total 324, 000 162, 000 150, 000 0 0 636, 000 Less Taxes Cap Gains (45, 000) (22, 500) (90, 000) Net After Taxes 255, 000 127, 500 0 0 510, 000 Ordinary Inc Interest Income 24, 000 12, 000 0 36, 000 Def Comp 18, 644 19, 576 20, 555 21, 583 22, 662 103, 019 Total 42, 644 31, 576 20, 555 21, 583 22, 662 139, 019 Less Taxes (17, 058) (12, 630) (8, 222) (8, 633) (9, 065) (55, 608) After Tax 25, 586 18, 946 12, 333 12, 950 13, 597 83, 411 Total After Taxes 280, 586 146, 446 139, 833 12, 950 13, 597 PV Factor 1. 00 1. 08 1. 17 1. 26 1. 36 Present Value 280, 586 135, 598 119, 884 10, 280 9, 994 556, 342 PV Total Cash Stock 600, 000 Interest 36, 000 Def Comp 103, 019 556, 342 739, 019 56 Total ADA -Las Vegas Nov 8, 2008

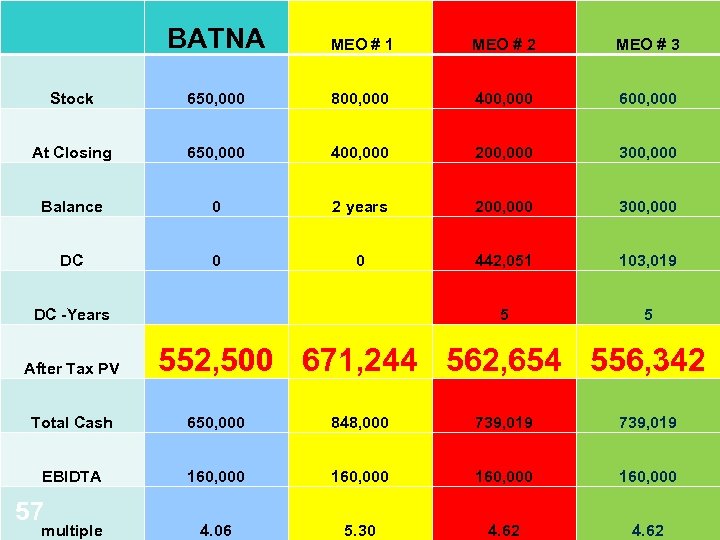

BATNA MEO # 1 MEO # 2 MEO # 3 Stock 650, 000 800, 000 400, 000 600, 000 At Closing 650, 000 400, 000 200, 000 300, 000 Balance 0 2 years 200, 000 300, 000 DC 0 0 442, 051 103, 019 DC -Years 5 5 After Tax PV 552, 500 671, 244 562, 654 556, 342 Total Cash 650, 000 848, 000 739, 019 EBIDTA 160, 000 57 multiple 4. 06 5. 30 ADA -Las Vegas Nov 8, 2008 4. 62

Tips – Techniques – Conventions Judgmental Errors in Negotiating q Define: § § 58 “The errors in our thinking or cognitive processes that result in our not negotiating rationally or not doing what’s in our own best interest. ” Consequences: q We don’t see flaws or adequately evaluate alternatives. ADA -Las Vegas Nov 8, 2008

Judgmental Errors in Negotiating Tips-Techniques-Conventions (Assess from both Descriptive and Prescriptive perspectives) q q 59 Non-Rational escalation-(Endowment Factor) Mythical Fixed Pie Anchoring and Adjustment Framing the negotiation – e. g. how people view gains/losses ADA -Las Vegas Nov 8, 2008

Tips – Techniques - Conventions q q 60 Give your logic before conclusions Importance of understanding the concept of organizational negotiating Negotiating one item at a time vs. multiple items Keys to Success: § Accurate emotional and intellectual empathy § You’re not ready to negotiate until you can present the other side’s point of view more articulately and persuasively than they can and then give an “appropriate” response” ADA -Las Vegas Nov 8, 2008

Tips – Techniques - Conventions The 3 rd Movement (Wharton) q § § § Never concede, only trade Value creating vs. value claiming – Pareto curve/Efficient frontier Role Playing(Preparation Most Important factor in your success) q q q § § 61 Opening Offer/Position Response Rebuttal § Not Optional Behavioral rehearsal Discovering “integrative” solutions Accurate empathy You’ll only appear to be extemporaneous ADA -Las Vegas Nov 8, 2008

Tips – Techniques - Conventions The Negotiating Team q § § § The People Factor q § § q 62 Spokesperson Back up Observer The “Dale Carnegie” component Cognitive dissonance – hard on the problem – soft on the people Principle of the “State of Disequilibrium” ADA -Las Vegas Nov 8, 2008

Tips – Techniques - Conventions Anger/handling criticism q § § § 63 Anger is one letter away from danger The most difficult emotion to control Disarming the critic ADA -Las Vegas Nov 8, 2008

Tips – Techniques - Conventions q 64 Munger: “The standard antidote to one’s overactive hostility is to train oneself to defer reaction. As my smart friend Tom Murphy so frequently says, ‘you can always tell someone off tomorrow, if it is such a good idea. ’” ADA -Las Vegas Nov 8, 2008

Tips – Techniques - Conventions Communication Skills q § § § 65 Listen more – Talk Less (20/80 Rule) – “Even a fool is thought wise if he keeps silent and discerning if he holds his tongue” –Proverbs 17: 28 Using “I” messages vs. “You” messages q Feeling q Behavior q Consequences The first sign you are communicating more effectively is when you do not follow your instincts. ADA -Las Vegas Nov 8, 2008

d55caec17d6b3040f149a90085eaaa27.ppt