1d4d77b5dfb3e7e9923993456c92c072.ppt

- Количество слайдов: 11

Business & Technology Risk Services Implementation of Basel II in Romania Progress to date and insights 22 nd February 2006 1 !@ #

Overview and Introductions • Basel II represents one of the biggest challenges facing the Romanian Banking Industry today, potentially changing the competitive dynamics of the industry within 3 years • To compete, an average sized Bank in Romania will need to invest between 1 -3 million euro’s for standardized approaches and between 5 -10 million to implement more sophisticated approaches of the Basel Accord • A typical medium sized bank has between 15 -25 initiatives to complete for standardized, and between 35 -50 initiatives for advanced approaches • BII leaders have a rigorous implementation approach, business buy-in and ownership, senior sponsorship and ready access to scarce resources 2 2

E&Y believes Basel II/CRD will give a new competitive dynamic to the Banking IRB Compliance likely Industry in Romania Leaders with ORM to be a minimum to compete effectively within 5 years “Capital release” will allow largest players to price aggressively for market share as competition intensifies “Data starvation” for risk modelling will lead to divesture of non-core portfolio’s Sophisticated risk management capabilities will act as a major market entry barrier 3 Risk based competition Op. Risk Advantage Capital advantage Non-bank competition Data advantage Margin enhancement New entry barriers Active portfolio management 3 will be able to better manage profitable growth Non-Banks, which are not subject to Basel II will see opportunities to serve niche segments Capital / efficiency advantages allow early adopters healthy margins amidst increased competition Secondary markets will emerge as more portfolios are rated

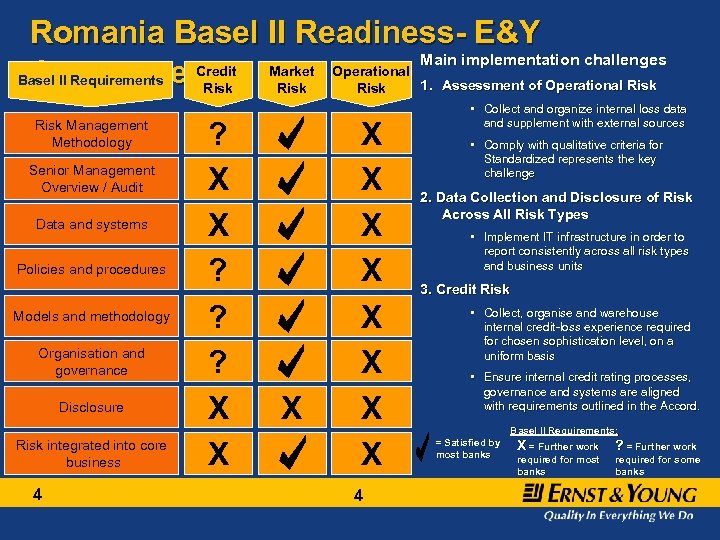

Romania Basel II Readiness- E&Y Main implementation challenges Credit Market Operational Assessment Basel II Requirements 1. Assessment of Operational Risk Risk Management Methodology Senior Management Overview / Audit Data and systems Policies and procedures Models and methodology Organisation and governance Disclosure Risk integrated into core business 4 ? X X ? ? ? X X X 4 • Collect and organize internal loss data and supplement with external sources • Comply with qualitative criteria for Standardized represents the key challenge 2. Data Collection and Disclosure of Risk Across All Risk Types • Implement IT infrastructure in order to report consistently across all risk types and business units 3. Credit Risk • Collect, organise and warehouse internal credit-loss experience required for chosen sophistication level, on a uniform basis • Ensure internal credit rating processes, governance and systems are aligned with requirements outlined in the Accord. Basel II Requirements: = Satisfied by most banks X = Further work ? = Further work required for most banks required for some banks

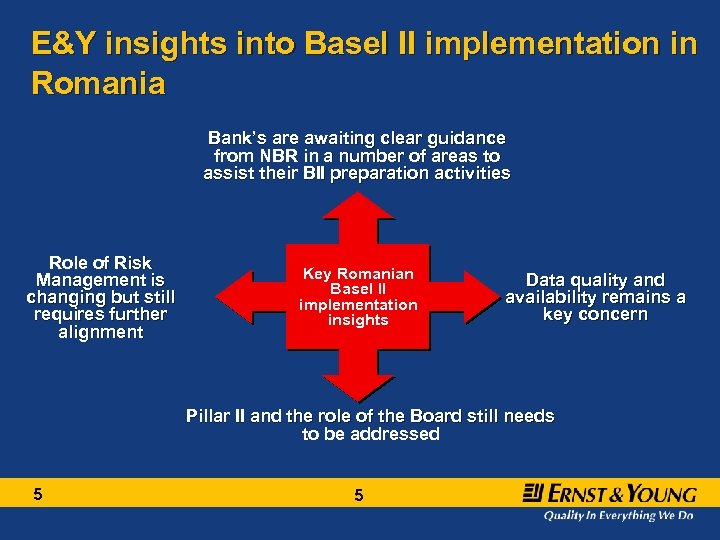

E&Y insights into Basel II implementation in Romania Bank’s are awaiting clear guidance from NBR in a number of areas to assist their BII preparation activities Role of Risk Management is changing but still requires further alignment Key Romanian Basel II implementation insights Data quality and availability remains a key concern Pillar II and the role of the Board still needs to be addressed 5 5

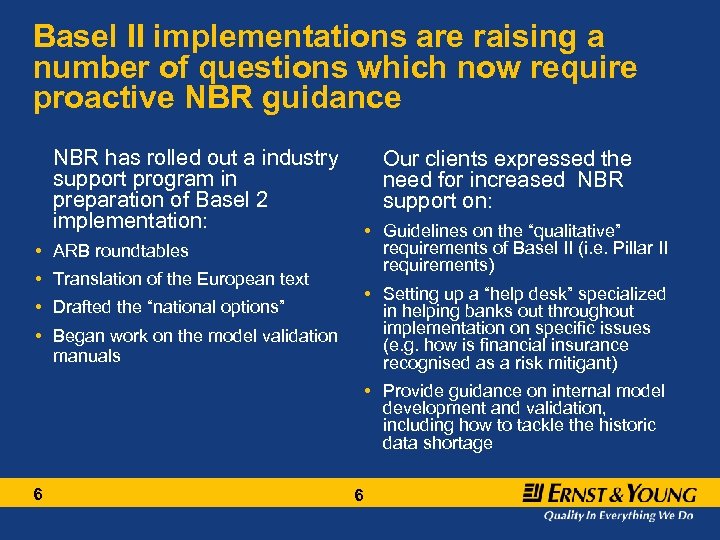

Basel II implementations are raising a number of questions which now require proactive NBR guidance NBR has rolled out a industry support program in preparation of Basel 2 implementation: Our clients expressed the need for increased NBR support on: • Guidelines on the “qualitative” requirements of Basel II (i. e. Pillar II requirements) • ARB roundtables • Translation of the European text • Setting up a “help desk” specialized in helping banks out throughout implementation on specific issues (e. g. how is financial insurance recognised as a risk mitigant) • Drafted the “national options” • Began work on the model validation manuals • Provide guidance on internal model development and validation, including how to tackle the historic data shortage 6 6

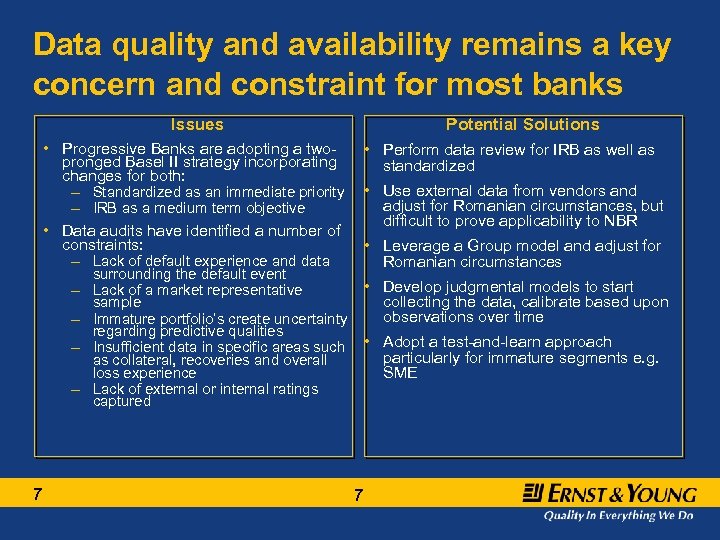

Data quality and availability remains a key concern and constraint for most banks Issues Potential Solutions • Progressive Banks are adopting a twopronged Basel II strategy incorporating changes for both: • Perform data review for IRB as well as standardized • Use external data from vendors and adjust for Romanian circumstances, but difficult to prove applicability to NBR – Standardized as an immediate priority – IRB as a medium term objective • Data audits have identified a number of constraints: – Lack of default experience and data surrounding the default event – Lack of a market representative sample – Immature portfolio’s create uncertainty regarding predictive qualities – Insufficient data in specific areas such as collateral, recoveries and overall loss experience – Lack of external or internal ratings captured 7 • Leverage a Group model and adjust for Romanian circumstances • Develop judgmental models to start collecting the data, calibrate based upon observations over time • Adopt a test-and-learn approach particularly for immature segments e. g. SME 7

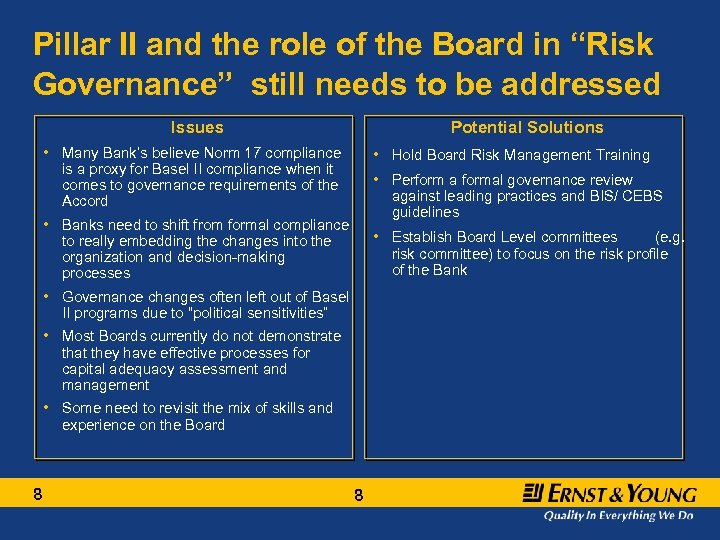

Pillar II and the role of the Board in “Risk Governance” still needs to be addressed Issues Potential Solutions • Many Bank’s believe Norm 17 compliance is a proxy for Basel II compliance when it comes to governance requirements of the Accord • Hold Board Risk Management Training • Perform a formal governance review against leading practices and BIS/ CEBS guidelines • Banks need to shift from formal compliance to really embedding the changes into the organization and decision-making processes • Establish Board Level committees (e. g. risk committee) to focus on the risk profile of the Bank • Governance changes often left out of Basel II programs due to “political sensitivities” • Most Boards currently do not demonstrate that they have effective processes for capital adequacy assessment and management • Some need to revisit the mix of skills and experience on the Board 8 8

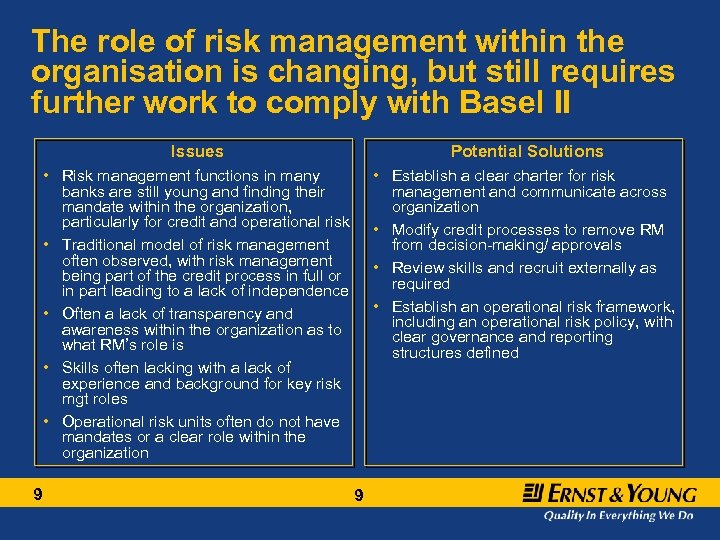

The role of risk management within the organisation is changing, but still requires further work to comply with Basel II Issues • Risk management functions in many banks are still young and finding their mandate within the organization, particularly for credit and operational risk • Traditional model of risk management often observed, with risk management being part of the credit process in full or in part leading to a lack of independence • Often a lack of transparency and awareness within the organization as to what RM’s role is • Skills often lacking with a lack of experience and background for key risk mgt roles • Operational risk units often do not have mandates or a clear role within the organization 9 Potential Solutions • Establish a clear charter for risk management and communicate across organization • Modify credit processes to remove RM from decision-making/ approvals • Review skills and recruit externally as required • Establish an operational risk framework, including an operational risk policy, with clear governance and reporting structures defined 9

Final thoughts … • Keep the Board and NBR notified as to progress towards Basel II • Manage the dependencies and risks in implementation • Use the opportunity to question the role of risk management across the organization • Tackle the “softer” areas of the Accord (e. g. governance) as well as the “hard” (e. g. IT systems) 10 10

Thank you! Andrew Mc. Cartney, Principal Ernst & Young Southeast Europe Andrew. Mc. Cartney@ro. ey. com 11 Ernst & Young Romania Phone: (21) 402 4000 Fax : (21) 410 7046 !@ #

1d4d77b5dfb3e7e9923993456c92c072.ppt