Lecture2 Business Analysis handouts2013.ppt

- Количество слайдов: 76

Business Strategy Analysis Lecture 2 Case Study: American Online Prof Joanne Horton 1

Introduction: • Know the business ØAnalyst seeking to value telecommunications firm = know / understand: § Industry and the firms position § Firms strategy § The products § Customer demand § Evolving technology 2

Introduction • Many details of a business with which the analyst must be familiar • To focus thinking = need to identify the business strategy (business concept, business model) • What is the firm aiming to do? • How does it see itself generating value? • What are the consequences of the strategy? 3

Business Strategy Analysis • Why important? • To understand the influence of the economic environment on firm performance at a qualitative level • To assess how strategic choices translate into value creation (or destruction) • Base = reality, give meaning to information and future analysis • Home Depot • The Gap • It identify key profit drivers and key risks • To evaluate current performance and its sustainability in the future 4

Business Strategy Analysis • How? − Know the business (the analyst must be familiar with it!) − Understand the market forces − Evaluate the sources and sustainability of competitive advantage 5

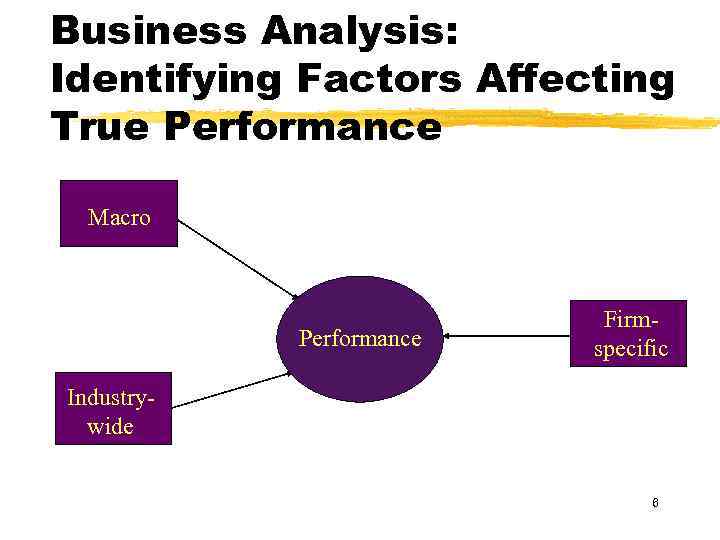

Business Analysis: Identifying Factors Affecting True Performance Macro Performance Firmspecific Industrywide 6

Key drivers: Airlines • Airlines typically operate with: Ø A given fleet, given gate allocation at airports Ø Fixed number of flights, Ø fixed costs, profitability driven by revenues Ø Available seat miles (ASM) Ø Load factor = determines revenue miles seat (RMS) Ø Ticket prices determines dollar yield per RMS Ø This yield and RMS drives revenue • Key profit drivers Ø Load factors and yields key drivers Ø Also be aware to changes in ASM = new routes, gate allocations Ø Other drivers: labour productivity, labour costs, commission rates, fuel costs per mile monitored. 7

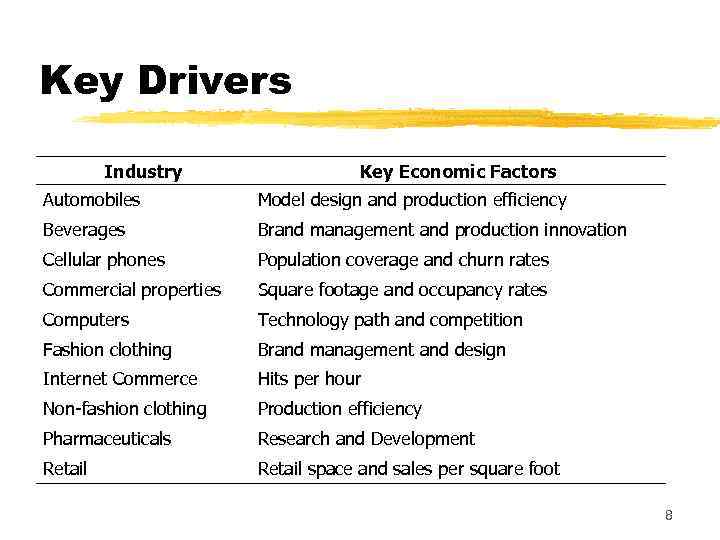

Key Drivers Industry Key Economic Factors Automobiles Model design and production efficiency Beverages Brand management and production innovation Cellular phones Population coverage and churn rates Commercial properties Square footage and occupancy rates Computers Technology path and competition Fashion clothing Brand management and design Internet Commerce Hits per hour Non-fashion clothing Production efficiency Pharmaceuticals Research and Development Retail space and sales per square foot 8

Value • Ability to earn above cost of capital − Cost of capital determined by market − Profit potential = determined by strategic choices • Identify drivers of profitability • • • Critical evaluate the drivers Understand their implications for firm valuation Why? 9

Business strategy analysis: the steps • Industry analysis – Why firms choose to operate in a specific industry or in a set of industries? • Competitive strategy analysis – How do firms compete with other firms in the chosen industry? • Corporate strategy analysis – Is the firm seeking to create value by exploiting synergies across the different businesses in which it operates? 10

Industry analysis Objective – Indentify the economic factors that influence industry profitability Relevance – Profitability differs across industry and within each industry over time What are the determinants of industry profitability? – Intensity of competition – Industry growth Which factors influence average industry profitability? – Strategy literature (Porter, 1980) identifies “ 5 forces” 11

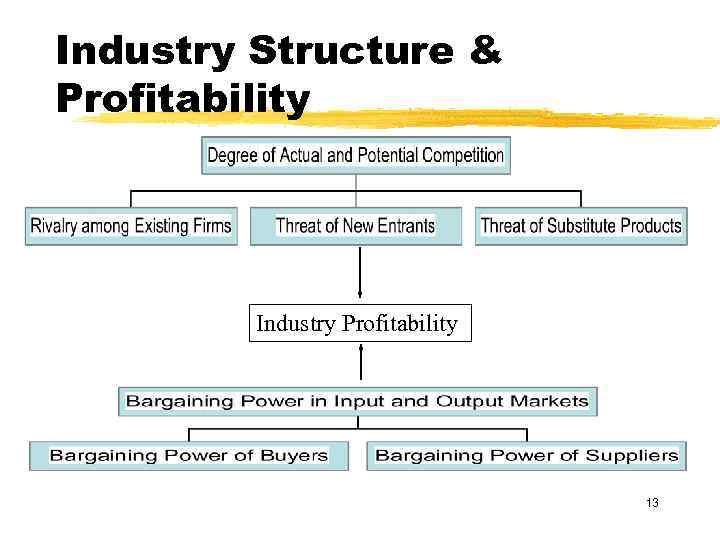

Five forces analysis • The Porter’s five forces analysis is a powerful tool for understanding the strength of firm current competitive position • The five forces are environmental forces that impact on a company’s ability to compete in a given industry • The purpose of five-forces analysis is to diagnose the principal competitive pressures within the industry the firm operates – Degree of “actual” competition – Degree of “potential” competition 12

Industry Structure & Profitability Industry Profitability 13

Five-forces analysis: Average profitability Threat of New Entrants Bargaining Power of Suppliers Rivalry Among Existing Firms in Industry Bargaining Power of Buyers Threat of Substitute Products 14

Competition • Intensity of competition • Degree of actual and potential competition • Sources of Competition: 3 15

Rivalry Among Existing Firms • Intensity determines by: ØIndustry growth rate ØConcentration and balance of competitors ØExample: IBM, Coke and Pepsi 16

Degree of Differentiation and Switching Costs • Avoiding head on competition • Little differentiation • Switching costs 17

Learning Economies & Ratio of Fixed to Variable • steep learning curve • ratio of FC to VC high 18

Excess Capacity, Threat of New Entrants • Excess capacity • Cut price • Exit barriers = exacerbate • New Entrants = constrain 19

Entry Barriers Determined By: • • Economies of scale First mover advantage Access to channels of distribution Legal barriers 20

Threat of Substitute Products • Not necessarily same form, but perform same function • Threat from utilising technologies • Depends on: 1. Relative price & performance 2. Customer willingness to substitute 21

Relative Bargaining Power in Input and Output • Degree of competition = potential • Industry bargaining power = actual 22

Bargaining Power of Buyers/customers • 2 factors: 1. Price sensitivity 2. Relative bargaining • Bargaining Powers of Suppliers • • Mirror image Example: Coke and Pepsi 23

Applying Industry Analysis • Example personal computers ü 1981 IBM = PC with Intel and Microsoft DOS ü 1997 installed base of 100 million PCs ü 1997 shipments totalled 30 m units up 21% from 1996 ü 1998 characterised by low profitability • Why? , What does the future hold? 24

Applying Industry Analysis • Example personal computers ü 1981 IBM = PC with Intel and Microsoft DOS ü 2005 installed base of 800 million PCs ü 2005 shipments totalled 136 m units up 15% from 2004 expect growth to be between 1215% range for 2006 -2007 ü 2005 characterised by low profitability • Why? , What does the future hold? 25

Applying Industry Analysis z 2010 shipments were 350. 9 m units up approx 14% from 2009 expected growth to be approx 4% for 2011. z 2010 characterised by low profitability z. Why? What does the future hold? 26

Degree of Actual and Potential Competition 27

Bargaining Power Input & Output 28

Summary • Price competition: ØIntense rivalry, low barriers to entry • Low profit potential: ØPressure to spend large £ to introduce products rapidly, customer services etc ØPower of suppliers/buyers 29

Summary • Thus firms both create the forces of competition and counter these forces • Challenging other firms • Counter competitive forces 30

Limitations of Industry Analysis • Assumption that industries have clear boundaries • It is not always easy to demarcate industry boundaries ØE. G Dell’s industry focus on? 31

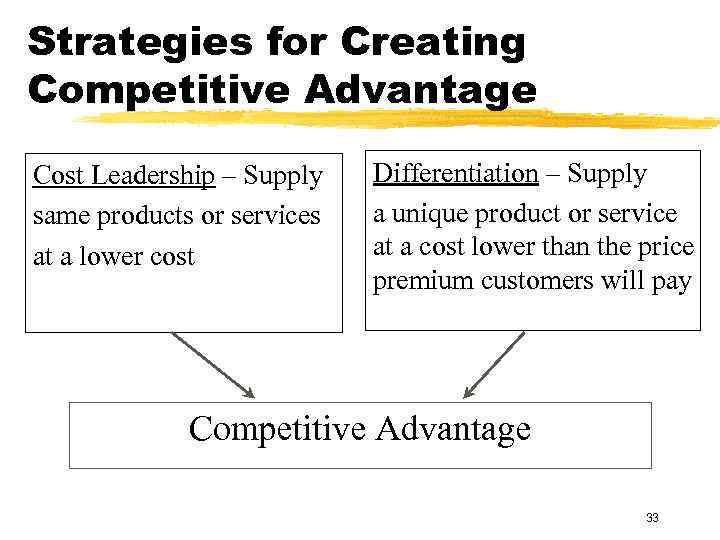

Competitive Strategy Analysis • Firm profitability is influenced by: - The structure of the industry - But also by…its ‘strategic choices’ • 2 generic competitive strategies 1. Cost leadership 2. Differentiation 32

Strategies for Creating Competitive Advantage Cost Leadership – Supply same products or services at a lower cost Differentiation – Supply a unique product or service at a cost lower than the price premium customers will pay Competitive Advantage 33

Competitive Strategy Analysis • Competitive strategies aim at achieving a sustainable ‘competitive advantage’ - The way firms are able to ‘defend’ their competitive advantage from the threat of competition • Influences future profitability levels • Has a clear impact on analysts forecasting activities • Impacts firm value 34

Cost Leadership • Supply same product offered by competitors at a lower price − Example: Ryanair, IKEA • Often clearest way to achieve competitive advantage • Many ways to achieve 35

Differentiation • Unique within industry, highly valued by customers − Example: Apple iphone • Successful ? • Drivers: • Providing superior intrinsic-value • AND/OR investing in signals of value 36

Achieving and Sustaining • To achieve competitive advantage • Uniqueness = determines sustainability • Forecasting 37

Questions? ? ? • Need to address, inter alia ü“What are the key success factors and risk associated with the firm’s chosen competitive strategy” ü“Does the firm currently have resources and capabilities to deal with key success factors and risk? ” ü “Is the company’s competitive advantage sustainable? Are there any barriers that make imitation of the firm’s strategy difficult? ” 38

Application • Dell computers Ø 1993 2 nd largest PC, 1984 sold direct ØFollowed low cost strategy Ø 2002 achieved $31 billion revenues, $1. 7 billion net income ØPrevious four years: 75% growth in revenues, 58% growth in net income ØMost profitable PC maker in highly competitive industry 39

Dell Corp Ø 1998 ranked first in total return during 3, 5 and 10 years, ranked tenth in return for 1998 ØA $1, 000 at end of 1988 investment had a market value of $351, 356 at the end of 1998 an average compound annual return of 79. 7%. Returns for other periods: ØAnnualised five-year return, 1994 -98 159. 2% ØAnnualised three-year return, 1996 -98 223. 4% Ø 1998 return 248. 5% 40

How? ? • Low cost strategy • • • 1) direct selling. 2) made-to-order 3) 3 rd party service 4) low accounts receivable 5) focused investment in R&D • Sustainable ? 41

Summary Many details of the business to discover = five main categories 1. Know the firm’s product 2. Know the technology required to bring the product to the market 3. Know the firm’s knowledge base 4. Know the competitiveness of the industry 5. Know the political, legal and regulatory environment 42

Case Study: Starbucks Inc. 43

Starbucks • Is the leading retailer, roaster and brand of speciality coffee in the world • Sells whole bean coffees through its speciality groups, mail-order business, supermarkets, online • Why has it been so successful? − Competitive advantage − Profitability drivers • What its business strategy ? 44

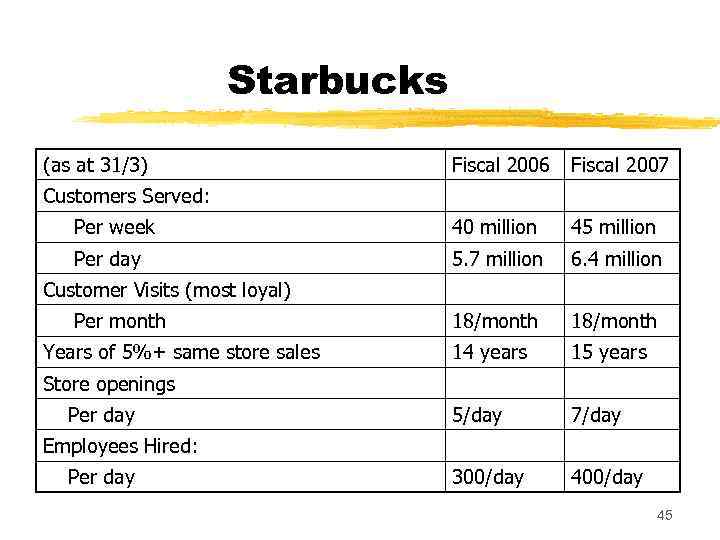

Starbucks (as at 31/3) Fiscal 2006 Fiscal 2007 Per week 40 million 45 million Per day 5. 7 million 6. 4 million Per month 18/month Years of 5%+ same store sales 14 years 15 years 5/day 7/day 300/day 400/day Customers Served: Customer Visits (most loyal) Store openings Per day Employees Hired: Per day 45

Starbucks • Initial success • Aided by the early strategy = first to the market • Did not borrow from the banks • Refused to raise funds by franchising • Capital-intensive strategy of owning stores • Taking the company public 46

Profit Drivers: Brand • Brand strength and innovation • Starbucks relied primarily on a cluster strategy as it expanded throughout the US • Some cannibalisation was inevitable • Starbucks utilized very little traditional advertising • Advertising as a % of sales was 1. 2% in 2008, well under the 3 -5% level commonly seen for large restaurant chains • Despite low advertising brand awareness is high, with 83% of US adults and 95% of coffee drinkers aware of Starbucks. 47

Profit Drivers: Brand • Continuous refinement of offerings and customer experience - Constantly refined and enlarged menus - Launched 22 new beverages during 2005/2006 - E. g. Pumkin Spice Latte, Green Tea Frappuccino - leads to incremental traffic through attracting new customers and generating repeat business. - New products = appliances to CDs/books/Wifi - In October 2006, SBUX announced the availability of the Starbucks Hear Music catalogue on the i. Tunes store, allowing i. Tunes customers to purchase a variety of digital music offered by Starbucks Entertainment - Starbucks Card - Via (CPG) (2009/10), Tia – gain new market share – been significant growth 48

Profit Drivers: Relationships • Starbucks places a high value on developing strong relationships with employees, suppliers and customers. • Employees - Offers attractive training and benefit programs that promote loyalty and lead to high quality service 49

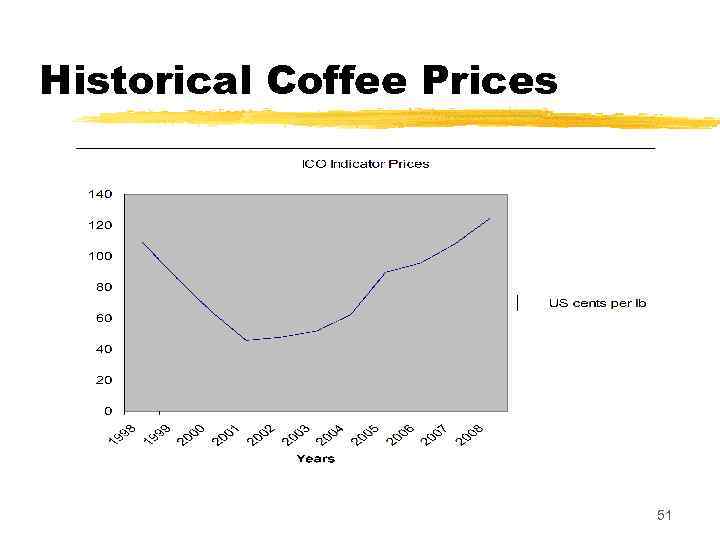

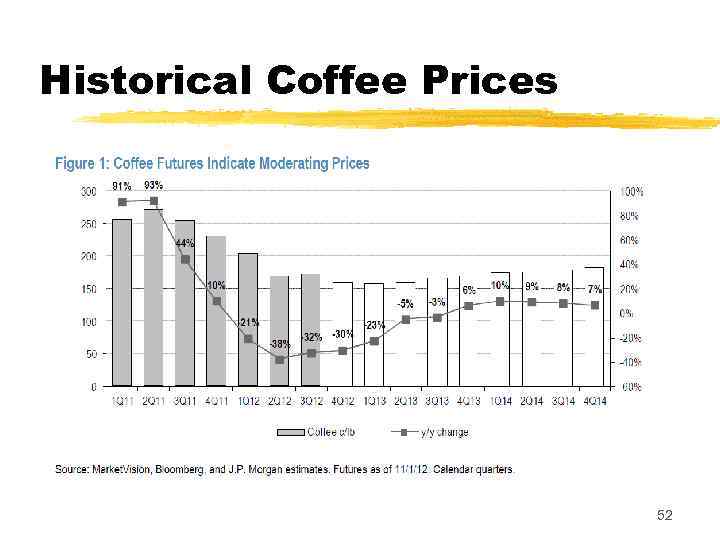

Profit Driver: Suppliers • Ethical practices in coffee procurement • Underappreciated competitive advantage • 1998 cent per lb = 108. 95, 2001 cent per lb = 45. 60, growers couldn’t afford to sustain their farms • Procurement became a major concern since SBUX = 2% of total purchase of global coffee in 2006 • SBUX has taken a number of steps • Socially responsible procurement practices • Long term contracts (fixed price, price-to-be fixed) • As of October 2008 SBUX had $583 m coffee purchase commitments including $337 m in fixed-price purchase commitments and $246 m of price-to-be-fixed 50

Historical Coffee Prices 51

Historical Coffee Prices 52

Risks: Competition • incursions are growing amongst fast food players • Dunkin’ Donuts • 7 -11 • Competitive clash continue to escalate • Restaurant sector is very competitive, with few barriers to entry. • Mc. Donalds – Nationwide marketing started in May 2009 – consensus impact on Starbucks • • • Mc. Donalds prices are $0. 35 -$0. 45 below $1. 5 billion coffee sales through 14, 000 domestic units in 2009 More convenient locations & more drive-thrus Well positioned to capture market share May have impact or co-exist ? – watch this space! 53

Risks: Growth • Classic rapid growth risks • Projects 30, 000 outlets from a base of 11, 000 • Saturation at home in 5 years (? ) • Growth international • China (1, 500 locations by 2015) • India • Brazil (currently only 25 stores) • Russia • Aggressive growth plan, possible through acquisitions 54

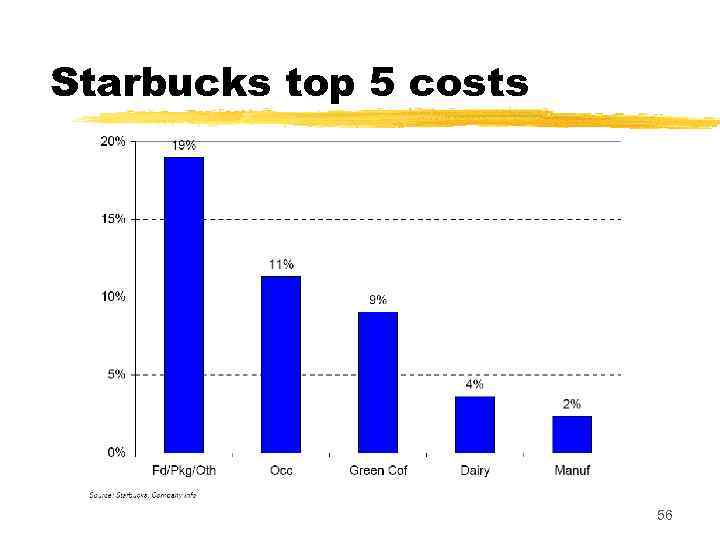

Risks: Costs • Input costs – inflation for key inputs • Leases/rental expense = 11% of total costs, 25% of cost of sales. • Labour costs represent 60%-75% of store operating expenses, 30% of total expenses, 42% of retail sales • Dairy prices (5 -10% of COGS) • Coffee (18% of COGS) more than a commodity = crop 55

Starbucks top 5 costs 56

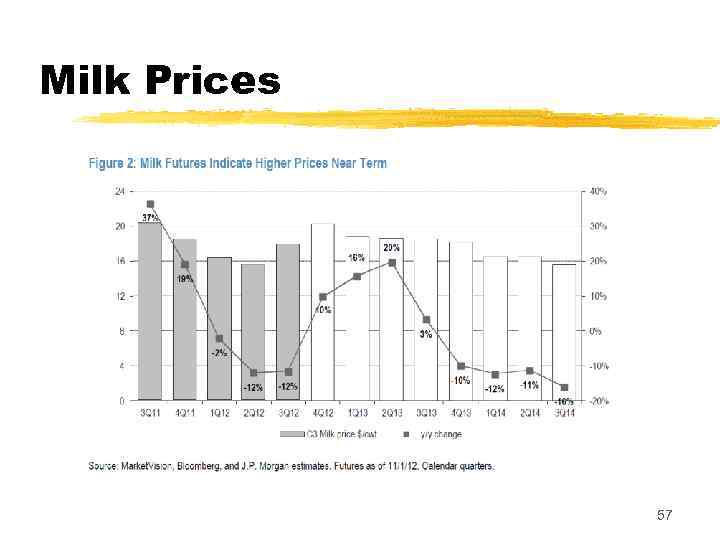

Milk Prices 57

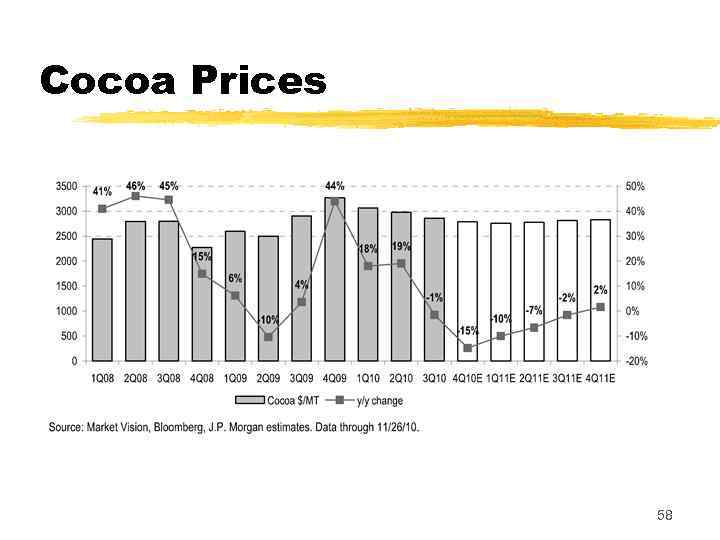

Cocoa Prices 58

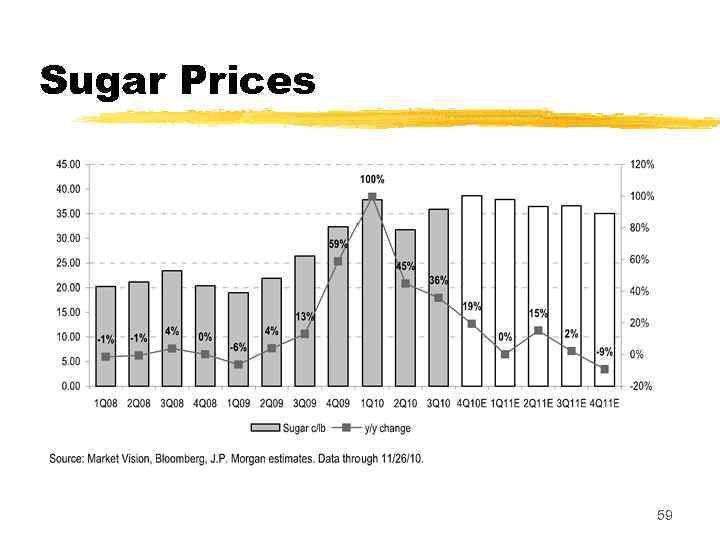

Sugar Prices 59

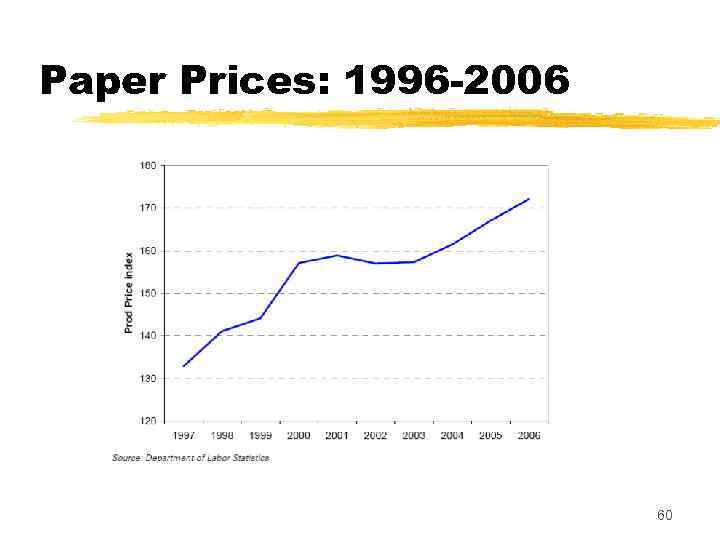

Paper Prices: 1996 -2006 60

Risks: Other • Health or Dietary concerns: • Economic factors • Speciality operations: Licensees 61

Management out of denial • Sharply slowing unit growth • More focus on the base business and cost savings • New CFO – Troy Alstead (Starbucks veteran) - $400 m in cost savings (4 -4. 5% of overall costs) • Entering new product markets esp. Via etc. 62

Starbucks: Business Issues • Will Starbucks’ success attract new players into the market? • Could existing competitors merge or grow to be a more important force in the market? • How much is the consumer willing to pay for a cup of coffee? Will Starbucks be able to rise prices if coffee costs go up? • Will Starbucks be able to cut costs enough? Not much leverage available in price. • Will Starbucks survive the recession? 63

Case Study: American Online Lecture 2: Business Analysis 64

Questions 1. Prior to 1995, why was AOL so successful in the commercial online industry relative to its competitors Compu. Serve and Prodigy? 2. As of 1995, what are the key changes taking place in the commercial online industry? How are they likely to affect AOL's future prospects? 65

Prior to 1995 • At the time of the case, AOL was the dominant player in the commercial online services industry with bigger market share than its two main rivals—Prodigy and Compu. Serve. • AOL had a subscriber base of close to 4 million people.

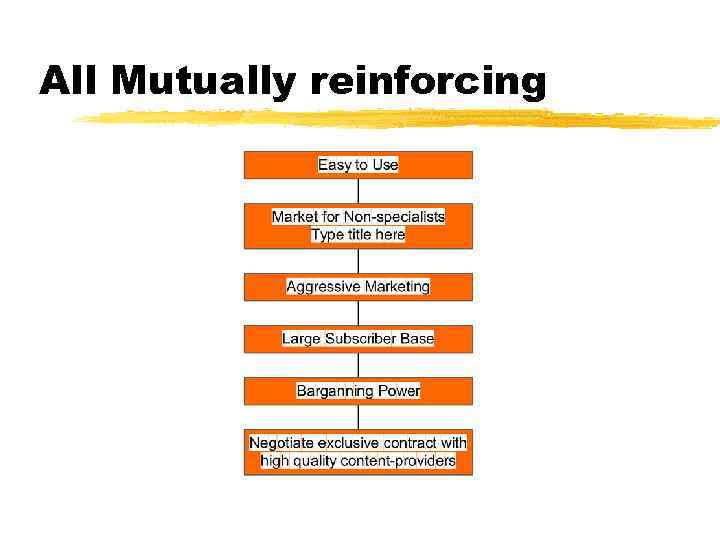

Reasons for Success 1. Easy to use interface 2. Successful marketing 3. Relationship with high quality providers

All Mutually reinforcing

Recoup Investment in Marketing? • Yes, with a high degree of certainty • Why: Ø AOL had the most user-friendly interface for accessing online services and the Internet, Ø customers who signed up with AOL did not have a reason to switch = subscriber retention rates were high. Ø powerful intermediary between a large subscriber base and high quality content providers, Ø significant bargaining power = increasing its profitability. Ø chat rooms, very popular part of AOL's service offering, benefited from the large subscriber base.

What were the key changes taking place? • • • Microsoft decided to enter the industry with its Microsoft Network (MSN) vast installed base of operating systems = natural advantage in gaining market share quickly Given the considerable financial resources available to Microsoft, MSN could be a source of formidable competition to AOL.

What were the key changes taking place 2. Potential Competition emerged: Ø Netscape Ø Easy to use web browser Ø Free access to internet + world-wide-web • AOL charged a free = considerable threat 3. E-mail providers entered the market e. g. AT&T, MCI

Changes in Competitive Landscape • AOL’s power over: Ø Subscribers Ø Content providers • Decreased dramatically • Content providers Ø Increased alternatives Ø Mover from AOL or Ø Demand higher fees • Subscribers: fees and retention rates likely to decrease

Competitive Advantage? • Potentially stay longer ØMedium for chat

Business Risk? • Due to rapid growth ØUnable to manage operations to meet demand? ØNeed significant investment in telecommunications equipment and computer hardware/software • Failure of this and increased competition ØMajor blow to future prospects

Subsequent developments • Forced to offer flat rate fee $19. 95 per month • Resulted in: ØDramatic increase in user connection time ØMajor operational problems ØSubscribers frustrated: inability to access

By Late 1996 • Retention rates fell significantly • Analysts estimated 50% of AOLs customers left after 1 year • Subscribers acquisition costs nearly doubled to $121 per subscriber

Lecture2 Business Analysis handouts2013.ppt