6f7808345d1e4e43dae40ec4b18566f9.ppt

- Количество слайдов: 50

Business Plan Brief summary of Executive Summary and Business Plan

Chapters INSTRUCTIONS TO PREPARE A BUSINESS PLAN The Business Plan is composed by three parties: 1. Executive Summary 2. Textual part 3. 5 years Financial Projections (including Breakeven Analysis and cash flow) For each section suggestions follow. If applying to your Business take them in consideration developing your own paragraphs.

Executive Summary EXECUTIVE SUMMARY The summary is the doorway to the rest of the plan. Get it right or your target readers will go no further. Keep it short.

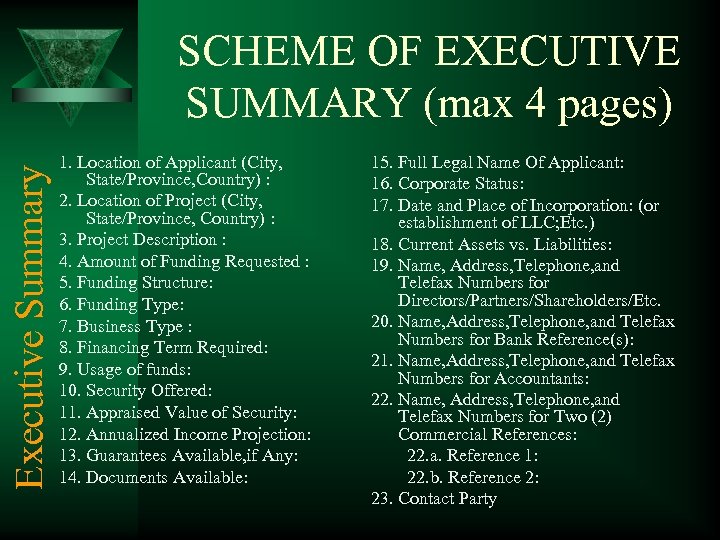

Executive Summary SCHEME OF EXECUTIVE SUMMARY (max 4 pages) 1. Location of Applicant (City, State/Province, Country) : 2. Location of Project (City, State/Province, Country) : 3. Project Description : 4. Amount of Funding Requested : 5. Funding Structure: 6. Funding Type: 7. Business Type : 8. Financing Term Required: 9. Usage of funds: 10. Security Offered: 11. Appraised Value of Security: 12. Annualized Income Projection: 13. Guarantees Available, if Any: 14. Documents Available: 15. Full Legal Name Of Applicant: 16. Corporate Status: 17. Date and Place of Incorporation: (or establishment of LLC; Etc. ) 18. Current Assets vs. Liabilities: 19. Name, Address, Telephone, and Telefax Numbers for Directors/Partners/Shareholders/Etc. 20. Name, Address, Telephone, and Telefax Numbers for Bank Reference(s): 21. Name, Address, Telephone, and Telefax Numbers for Accountants: 22. Name, Address, Telephone, and Telefax Numbers for Two (2) Commercial References: 22. a. Reference 1: 22. b. Reference 2: 23. Contact Party

Business Plan (Textual Part)

APPLICANT DATA (COMPLETE CAREFULLY!!!) General Data Specify the following information regarding your actual company: Ú Ú Ú Ú Ú Company Name: Company address: Country: Kind of Company: Capital (total face value): Capital real value: Number of shares: Face Value of each share: Names of shareholders specifying how many shares are owned by each one: Capital to be raised in Round 1: Capital to be raised in Round 2: Capital to be raised in Round 3: Balance of capital to be raised after Round 3: Ú Number of Months before reaching of Breakeven point: Ú Annual Net (of taxes) Profit at third year of future activity: Ú Comments on data of this section: Ú Ú

OBJECTIVES General Data Ú Objectives are business goals. Ú Companies need to set objectives and plan to achieve them. Ú Make sure your objectives are sure and measurable. Ú State specific goals.

MISSION General Data Ú The mission statement is like a business’ charter. Ú It should summarize your business goals, your business offering, and your target market. Ú What are you selling, and to whom? Ú Why?

General Data KEY TO SUCCESS Ú Every business has different keys to success. Ú These are a few key factors that make the difference between success and failure. Ú In a retail business, for example, location and parking might be keys to success. Ú Avoid listing more than three or four elements at the most.

COMPANY SUMMARY General Data Ú Use this first paragraph to summarize the company -related information to follow in this chapter. Ú Be brief. Ú Briefly explain what your company sells, through what channels, and to whom. Ú Think of this as writing to people who will only read this summary, not the rest of the chapter.

COMPANY OWNERSHIP General Data Ú In this paragraph, describe the ownership of the company. Ú Is it a corporation, publicly traded? Ú Privately owned corporation, C or S? Ú Is it a sole proprietorship, or a partnership?

General Data START-UP SUMMARY Ú Summarize your start-up plan. Ú Explain an attached start-up table. Ú Detail start-up costs.

COMPANY SERVICES General Data Ú Use this section to explain the services that your company sells. Ú Refer briefly to the most important needs satisfied, key product benefits, and important customer segments. Ú Don’t worry about repeating some information again later in the product section.

General Data COMPANY LOCATION AND FACILITIES Ú Briefly describe offices and locations of your company, the nature and function of each one, square footage, lease arrangements, etc. Ú You may want to include more detail about facilities in your appendices.

General Data FUNDS UTILISATION Ú Briefly describe how funds are utilised.

General Data RISKS FOR INVESTORS Each investments has commercial, market, management, political, supplier and infrastructural risks such as 1. Commercial Risk, 2. Market Risk, 3. Management Risk, 4. Country/Government risk, 5. Supplier risk, 6. Infrastructure Risk, that Investors must know, please list them and explain how your Business reduces and manages the Investments risks.

General Data RISKS OF THE SPECIFIC ACTIVITY Each activity has specific risks such as 1. Completion cost 2. over-runs, 3. Start-up delays, 4. Direct competition, 5. Sales development, 6. Materials supplies, 7. Labor costs and disruptions, Management has to face, please list them and explain how your Business reduces and manages the Risks of your specific activity.

Services - Products SERVICES - PRODUCTS Ú Use this first paragraph to summarize the chapter to follow. Ú Emphasize the important points, such as 1. the main service(s) or product(s) and 2. the way that they address user needs.

Services - Products SERVICE – PRODUCTS DESCRIPTION ÚList and describe the service(s) or the product(s) your company offers. ÚAs you do, think in terms of customers and customer needs. ÚHow do you and your services fill the customers’ needs?

Services - Products COMPETITIVE COMPARISON Compare your offerings to those of your competitors. Why do people buy yours instead of these others? What benefits do you offer? 1. At what price? 2. To whom? 3. How does your mix compare to others. Ú Make a list of 1. benefits, 2. features, and 3. market groups, comparing each element. Ú Ú Ú

Services - Products SALES LITTERATURE Include copies of 1. advertisements, 2. brochures, 3. direct mail pieces, 4. Catalogs, and 5. technical specifications. This should be added to the appendices.

Services - Products SOURCING Explain the costs of providing the benefits you offer, whether they be products, services, or both. – Manufacturers and assemblers should list components and vendors. – Retailers or wholesalers should discuss their product lines and margins. – Service providers should explain the costs of providing the service.

Services - Products TECHNOLOGY Ú If applicable, what technology do you use to make your product or service? Ú Is this technology protected? 1. patent, 2. copyright, 3. trademark, 4. etc.

Services - Products FUTURE SERVICE - PRODUCT Ú Present an outlook for future services - products. Ú Is there a long-term Strategy? Ú How are new services - products established? Ú Is there a relationship between market segments, market demand, market needs, and service - product development?

MARKET ANALYSIS SUMMARY Market Ú This first paragraph is a simple summary. Ú Describe the different groups of target customers included in your market analysis. Ú In some major markets you may be able to include projections of the total market, in units and dollars, plus recent market performance, and projected market growth. Ú In many smaller businesses you will simply define the kinds of people who will be your customers.

MARKET SEGMENTATION The market segmentation concept is crucial to market assessment and market strategy. Ú Divide the market into workable market segments— divided by – age, – income, – service - product type, – geography, – buying patterns, – customer needs, – or other classification. Market Ú

INDUSTRY ANALYSIS Market ÚThis section sets the scene for the market forecast that follows. ÚProduce industry information that will serve as important background material.

INDUSTRY PARTECIPANTS ÚWho are the players, and how many? Market ÚIs this a concentrated industry in which there are only a few major players, or a dispersed industry in which many small companies take part. ÚWho are their suppliers?

DISTRIBUTION PATTERNS Ú Explain how distribution works in this industry. Market Ú Does it have regional distributors, as is the case for computer products, or magazines, or auto parts? Ú Does it depend on direct sales to large industrial customers? Ú Do manufacturers support their own direct sales forces?

Market COMPETITION AND BUYING PATTERNS Explain the nature of competition in this market. Ú What are the keys to success? Ú What buying factors make the most difference? – Price? – Product features? – Service? – Support? – Training? – Software? – Delivery dates? – Are brand names important?

MAIN COMPETITORS List the main competitors. What are the strengths and the weaknesses of each one. Consider their 1. product, 2. price, 3. distribution channels, 4. reputation, 5. management, 6. financial position, and 7. technology. Ú In what segments of the market do they operate? Market Ú Ú Ú

Market MARKET ANALYSIS Use the text to describe and refer to 1. the detailed market analysis 2. that examines your total potential market, 3. focusing on different customer segments.

STRATEGY SUMMARY Market Ú On which segments of the market will you focus, and why? Ú How does your business offering (including what you sell, at what price, how you sell, and where you sell) match the customer needs in your target segments? Ú How does this offering compare to competitors’ offerings?

PRICING STRATEGY Market Ú Include 1. present price list, 2. discount structure, and 3. credit terms. Ú Compare these to 1. the needs and wants of the customer, and 2. to the offerings of your competitors.

SALES FORECAST Market Ú Use the text to summarize and highlight the Sales Forecast in a detailed sales forecast table. Ú Try to emphasize important points and explain assumptions to the sales forecast. Ú The monthly sales forecast chart and annual sales forecast chart should be drafted.

STRATEGIC ALLIANCES Market Ú Explain 1. co-marketing, 2. co-development, 3. commission, and 4. cooperative arrangements. Ú Is your fate tied to that of any other company? Ú Can you link your promotion or distribution strategies to another company in a way that improves your company’s position?

MANAGEMENT SUMMARY Management Ú Use this first paragraph as a summary. Ú Include 1. how many employees are in the company, and 2. how many members are there in the management team. Ú How many are founders of the company?

ORGANIZATIONAL STRUCTURE Management ÚExplain your organization structure. ÚIf you can, include a diagram of the organization as an additional illustration in the appendices.

MANAGEMENT TEAM Management ÚList the most important members of the management team. ÚInclude summaries of their backgrounds and experience, using them like brief resumes. ÚDescribe their functions with the company.

PERSONNEL PLAN Management Ú Ú Prepare a personnel plan, projecting 1. employees, 2. salaries, and 3. departments. Explain 1. the plan, 2. assumptions, 3. personnel needs, 4. costs, and 5. benefits.

FINANCIAL PLAN Financial Plan Ú Use this first section to summarize the financial plan in a few paragraphs. Ú How fast is the business expected to grow, and how do you intend to finance that growth? Ú Or are you growing slowly and producing profits?

IMPORTANT ASSUMPTIONS Financial Plan ÚUse this section to discuss important assumptions, including the assumptions covered in the attached spreadsheets. ÚExplain how key assumptions have affected your financial projections.

KEY FINANCIAL INDICATORS Financial Plan ÚList the indicator values for the most important financial variables, comparing projected results to actual and past results. ÚExplain the projected performance in light of the past performance and specific business activities planned.

FIVE YEARS FINANCIAL PROJECTION (Tables)

BREAK-EVEN ANALYSIS financial projections Ú Explain the break-even assumptions in the Break-even table from the Tables menu, and the break-even chart. Ú Divide your estimated annual fixed costs by your gross profit percentage to determine the amount of sales revenue you'll need to break even. For example, if Valerie's fixed costs are $6, 000 per month, and her expected profit margin is 66. 7%, her break-even point is $9, 000 in sales revenue per month ($6, 000 divided by. 667). In other words, Valerie must make $9, 000 each month just to pay her fixed costs and her direct (product) costs. (This number does not include any profit, or even a salary for Valerie. )

financial projections PROJECTED CASH FLOW Ú Use the text portion to explain the key elements of the pro forma cash flow, which presents projected changes in cash balances. Ú The cash flow chart shows month-by-month cash flow and cash balances. Ú Your cash flow shows where money comes from, how you're going to use it and when you'll need to get your next loan or investment.

financial projections FIVE YEARS PROJECTED PROFIT AND LOSSES Ú The profit and loss account is ‘a summary of the results of a business’s transactions for a period ending on the date of the balance sheet. Ú Use the text portion to explain the key elements of the pro forma income statement, which presents projected profits and losses. Ú The income statement table is called “Profit and Loss” in your Tables menu.

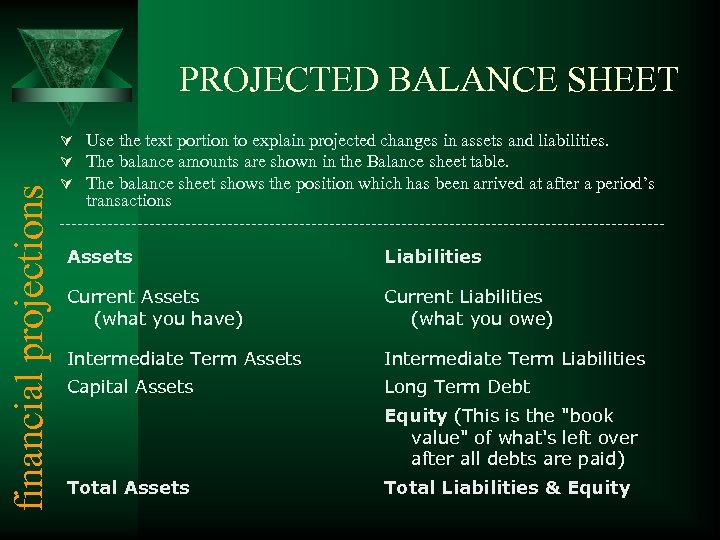

financial projections PROJECTED BALANCE SHEET Ú Use the text portion to explain projected changes in assets and liabilities. Ú The balance amounts are shown in the Balance sheet table. Ú The balance sheet shows the position which has been arrived at after a period’s transactions --------------------------------------------------Assets Liabilities Current Assets (what you have) Current Liabilities (what you owe) Intermediate Term Assets Intermediate Term Liabilities Capital Assets Long Term Debt Equity (This is the "book value" of what's left over after all debts are paid) Total Assets Total Liabilities & Equity

financial projections BUSINESS RATIOS Ú There are two basic methods of using financial ratios. The first is by comparing the firm's ratios with those of other companies in the industry. The second method is to compare the firm's present ratios with their past performance ratios. Ú Use the text portion to explain the important business ratios calculated in a worksheet. Ú Note the key changes, and highlight the most important ratios.

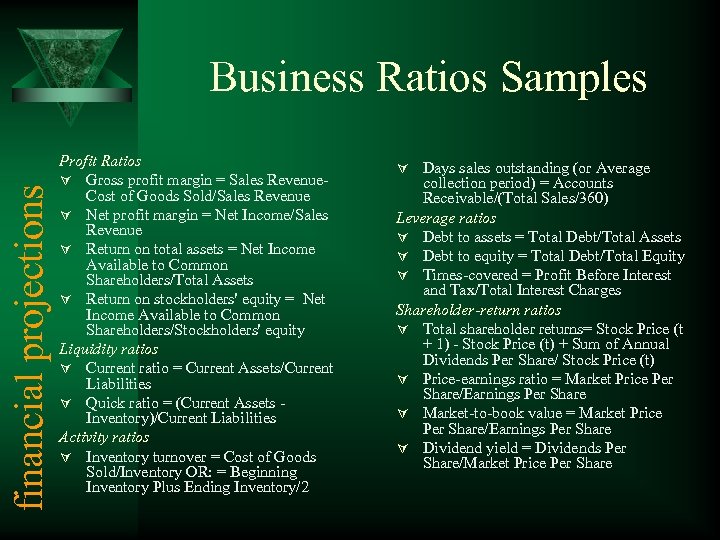

financial projections Business Ratios Samples Profit Ratios Ú Gross profit margin = Sales Revenue. Cost of Goods Sold/Sales Revenue Ú Net profit margin = Net Income/Sales Revenue Ú Return on total assets = Net Income Available to Common Shareholders/Total Assets Ú Return on stockholders' equity = Net Income Available to Common Shareholders/Stockholders' equity Liquidity ratios Ú Current ratio = Current Assets/Current Liabilities Ú Quick ratio = (Current Assets - Inventory)/Current Liabilities Activity ratios Ú Inventory turnover = Cost of Goods Sold/Inventory OR: = Beginning Inventory Plus Ending Inventory/2 Ú Days sales outstanding (or Average collection period) = Accounts Receivable/(Total Sales/360) Leverage ratios Ú Debt to assets = Total Debt/Total Assets Ú Debt to equity = Total Debt/Total Equity Ú Times-covered = Profit Before Interest and Tax/Total Interest Charges Shareholder-return ratios Ú Total shareholder returns= Stock Price (t + 1) - Stock Price (t) + Sum of Annual Dividends Per Share/ Stock Price (t) Ú Price-earnings ratio = Market Price Per Share/Earnings Per Share Ú Market-to-book value = Market Price Per Share/Earnings Per Share Ú Dividend yield = Dividends Per Share/Market Price Per Share

6f7808345d1e4e43dae40ec4b18566f9.ppt