10d313dc5b123a985c495ec4bef0b1d3.ppt

- Количество слайдов: 32

Business Organization Bus 20 Section 72192 Class 13 Tuesday, October 11, 2011

Factors to Consider in Selecting Legal Form 1) 2) 3) 4) 5) 6) 7) 8) What willing to do? How much control? Share profits? Special Taxes? Skills Needed? Business continuance? Financing Needs? Liability exposure?

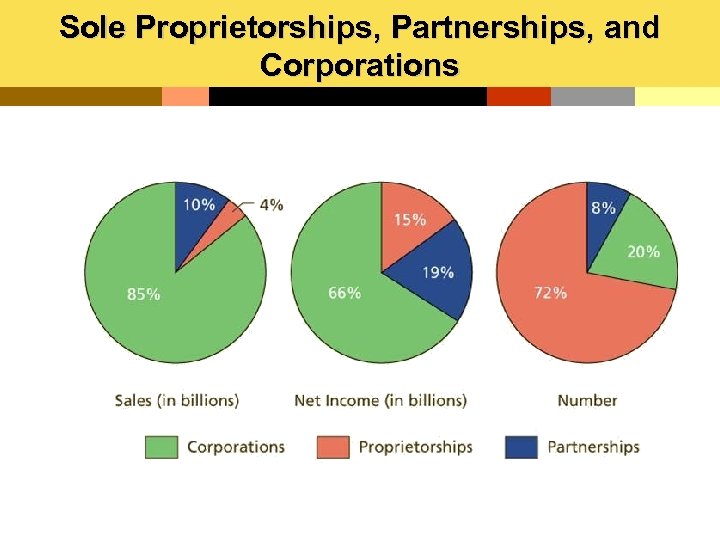

Sole Proprietorships, Partnerships, and Corporations

#1 - Sole Proprietorship • a business owned by only one person

![Advantages of Sole Proprietorships R Most common [mom and pop]- 75% R Easiest and Advantages of Sole Proprietorships R Most common [mom and pop]- 75% R Easiest and](https://present5.com/presentation/10d313dc5b123a985c495ec4bef0b1d3/image-5.jpg)

Advantages of Sole Proprietorships R Most common [mom and pop]- 75% R Easiest and cheapest to form [open] and close [disband] R Few government regulations R Complete Control of business R Get all earned income – distribution of profits R No special taxes

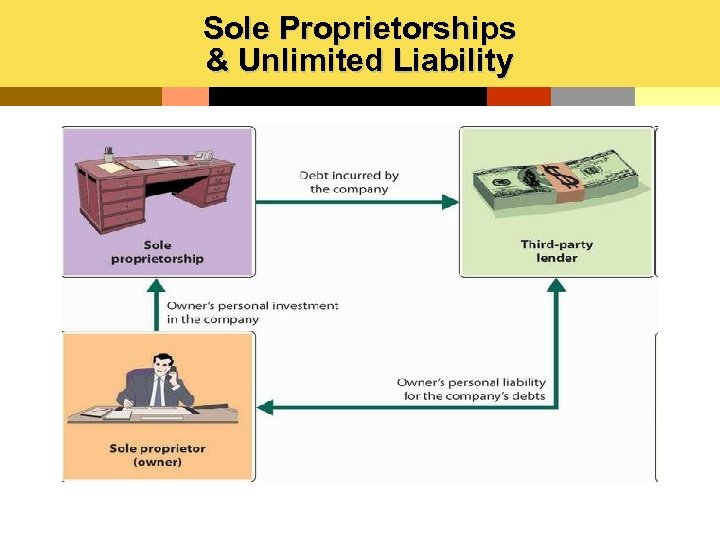

Disadvantages of Sole Proprietorships T Owner supplies all talents T Limited skills & continuity T Death = dissolution T Own Resources = financing – limited sources of funds T Unlimited liability

Sole Proprietorships & Unlimited Liability

#2 - Partnerships • a business owned jointly by two or more people

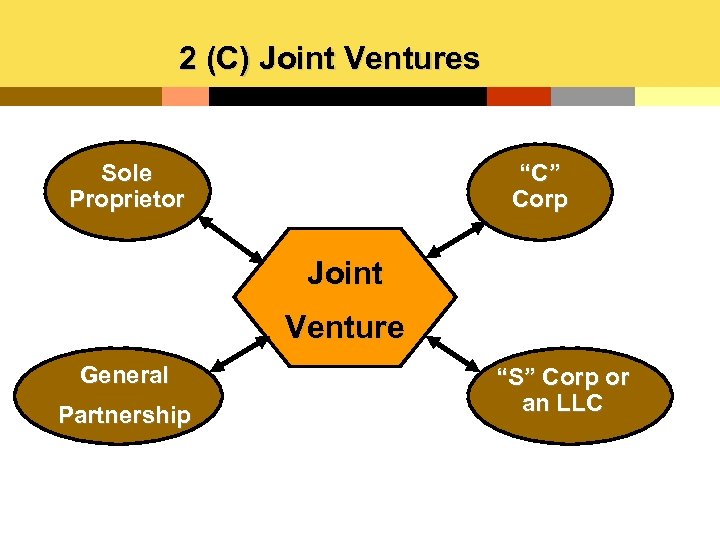

Types of Partnerships • 2 (A) General partnership – Partners completely share in the management of the business • 2 (B) Limited partnership – One general partner with unlimited liability and one limited partner with limited liability • 2 (C) Joint Venture [JV]: – A partnership established for a specific project or a limited time

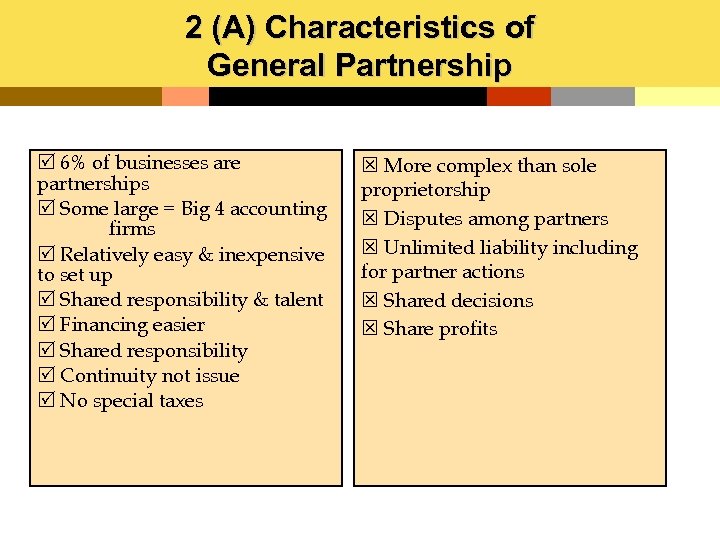

2 (A) Characteristics of General Partnership R 6% of businesses are partnerships R Some large = Big 4 accounting firms R Relatively easy & inexpensive to set up R Shared responsibility & talent R Financing easier R Shared responsibility R Continuity not issue R No special taxes T More complex than sole proprietorship T Disputes among partners T Unlimited liability including for partner actions T Shared decisions T Share profits

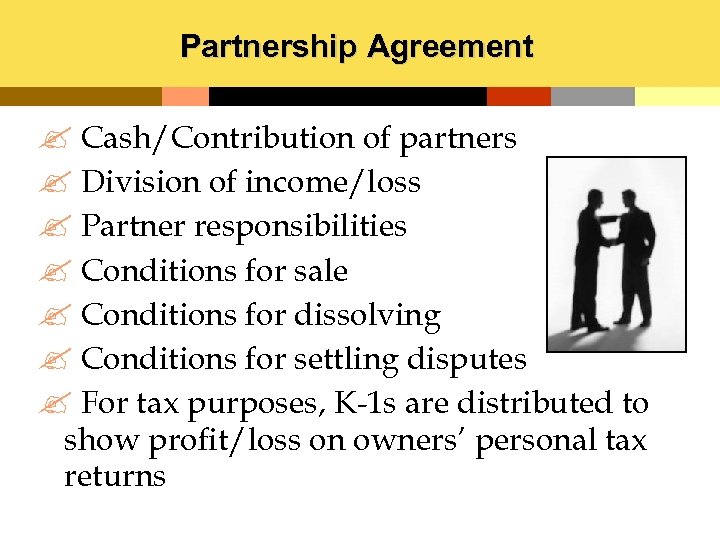

Partnership Agreement ? Cash/Contribution of partners ? Division of income/loss ? Partner responsibilities ? Conditions for sale ? Conditions for dissolving ? Conditions for settling disputes ? For tax purposes, K-1 s are distributed to show profit/loss on owners’ personal tax returns

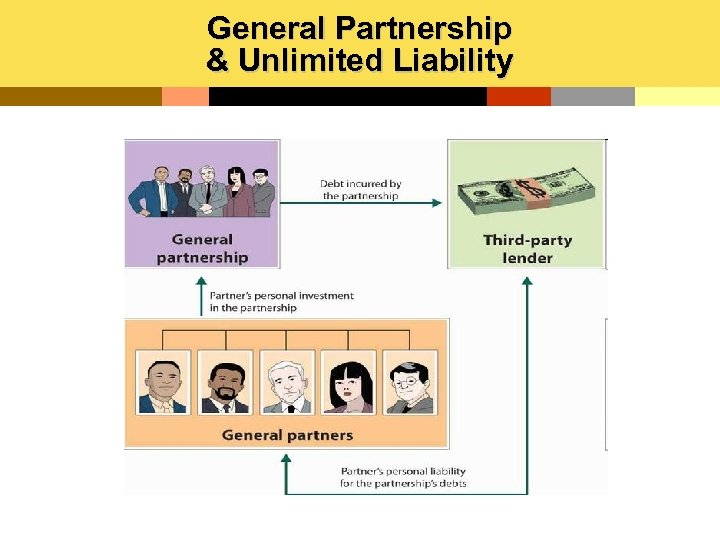

General Partnership & Unlimited Liability

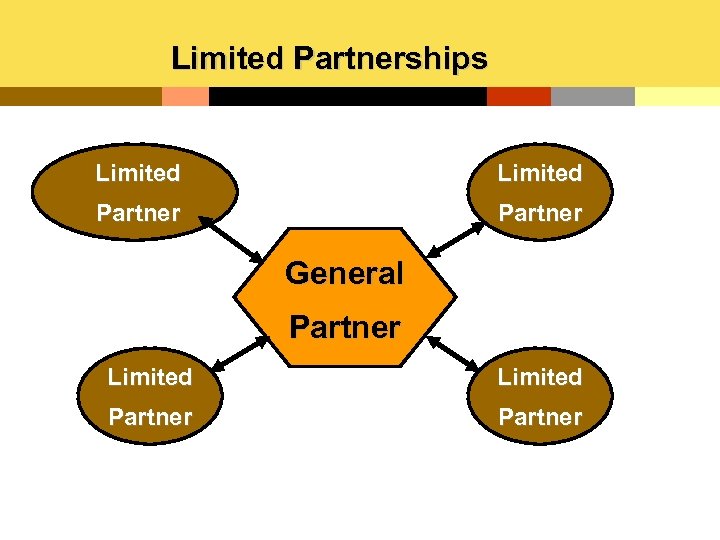

2 (B) Limited Partnerships ØPermitted by law ØPartners • General- runs business and responsible for liability • Limited- limited involvement, losses = investment

Limited Partnerships Limited Partner General Partner Limited Partner

2 (C) Joint Ventures Sole Proprietor “C” Corp Joint Venture General Partnership “S” Corp or an LLC

#3 - Corporations • a legal entity separate from the parties who own it

Corporations • Legal entity, created by the state, whose assets and liabilities are separate from its owners – Domestic • Does business in the state in which it is chartered – Foreign • Does business in states other than the state where it is chartered – Alien • Does business outside of the nation where it is incorporated – Private (Closely Held) • Corporation owned by only one person or a few people closely involved in its management – Public • Corporation whose stock anyone may buy, sell, or trade

Characteristics of Corporations as Legal Entities 1) 2) 3) 4) 5) Enter into binding contracts Buy/Sell property Sue/Be sued Responsible for all actions Taxed

The Elements of a Corporation • The Board of Directors – Inside directors – Outside directors • Stock [Equity] Ownership – Preferred stock – Common stock

Characteristics of Shareholders v. Invest money (stock or shares) v. Ownership % = some % of total shares v. Elects Board of Directors

Board of Directors 1) 2) 3) 4) 5) 6) 7) Comprised of people from inside and outside the corporation. Responsible for governing Oversees major policies & decisions Sets goals/direction of company Holds management accountable Hires/Evaluates CEO Approves dividends

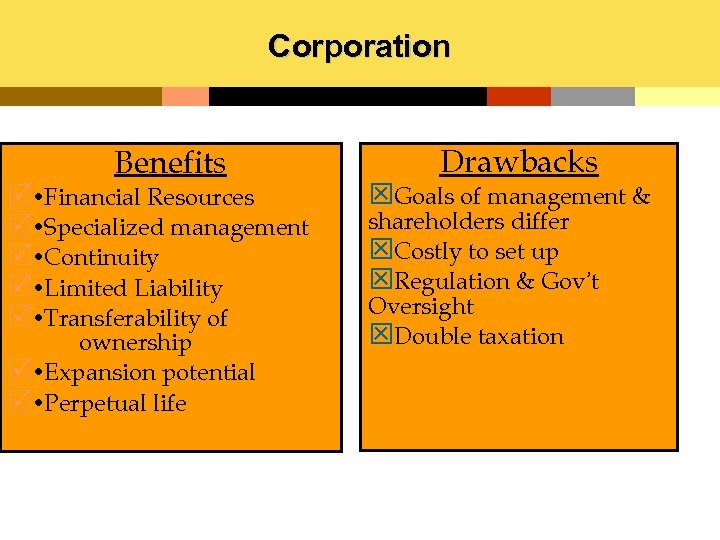

Corporation Benefits R Financial Resources R Specialized management R Continuity R Limited Liability R Transferability of ownership R Expansion potential R Perpetual life Drawbacks TGoals of management & shareholders differ TCostly to set up TRegulation & Gov’t Oversight TDouble taxation

Closely Held Corporation • stock is held by only a few individuals. . . not allowed to sell it to the general public

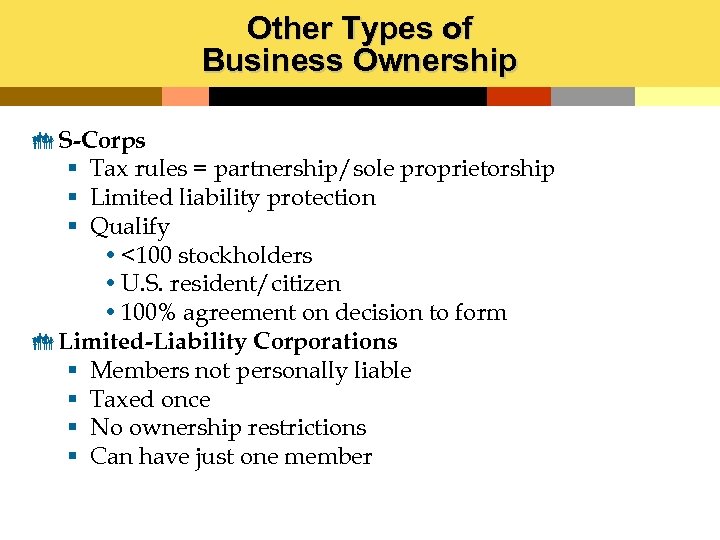

Other Types of Business Ownership S-Corps § Tax rules = partnership/sole proprietorship § Limited liability protection § Qualify • <100 stockholders • U. S. resident/citizen • 100% agreement on decision to form Limited-Liability Corporations § Members not personally liable § Taxed once § No ownership restrictions § Can have just one member

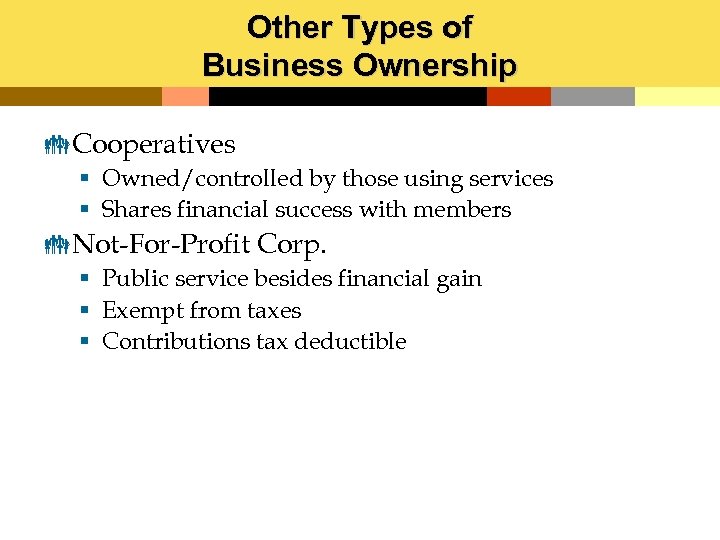

Other Types of Business Ownership Cooperatives § Owned/controlled by those using services § Shares financial success with members Not-For-Profit Corp. § Public service besides financial gain § Exempt from taxes § Contributions tax deductible

How Do Corporations Grow? Internally • Expanding operations • New product development • Market expansion Externally • Mergers • Acquisitions • Leveraged buyouts (LBO)

Merger versus Acquisition t Merger- two companies combine to form new company t Acquisition- purchase of one company by another, generally by buying controlling interest of its stock

Motives Behind Mergers & Acquisitions 1) Gain complementary products 2) Attain new markets or distribution channels 3) Realize economies of scale

Leveraged Buyout (LBO) • A group of investors borrow money from banks and other institutions to acquire a company (or a division of one) – The assets of the purchased company are used to guarantee repayment of the loan

Hostile Takeover • a takeover resisted by the targeted company’s management and its board of directors

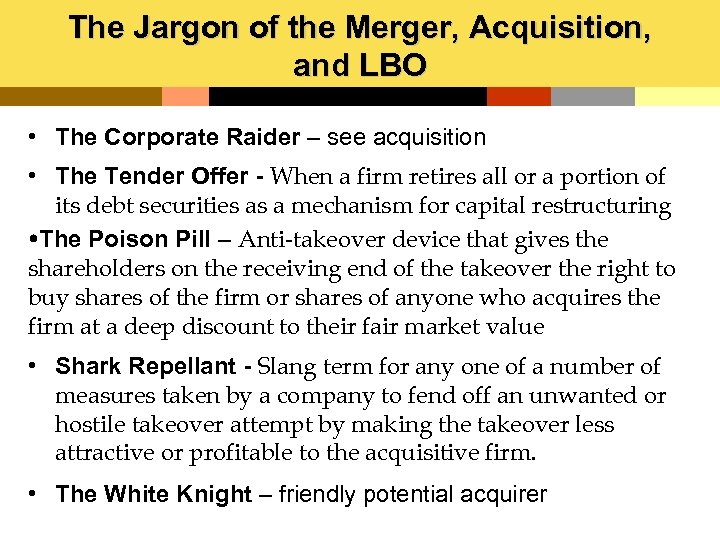

The Jargon of the Merger, Acquisition, and LBO • The Corporate Raider – see acquisition • The Tender Offer - When a firm retires all or a portion of its debt securities as a mechanism for capital restructuring The Poison Pill – Anti-takeover device that gives the shareholders on the receiving end of the takeover the right to buy shares of the firm or shares of anyone who acquires the firm at a deep discount to their fair market value • Shark Repellant - Slang term for any one of a number of measures taken by a company to fend off an unwanted or hostile takeover attempt by making the takeover less attractive or profitable to the acquisitive firm. • The White Knight – friendly potential acquirer

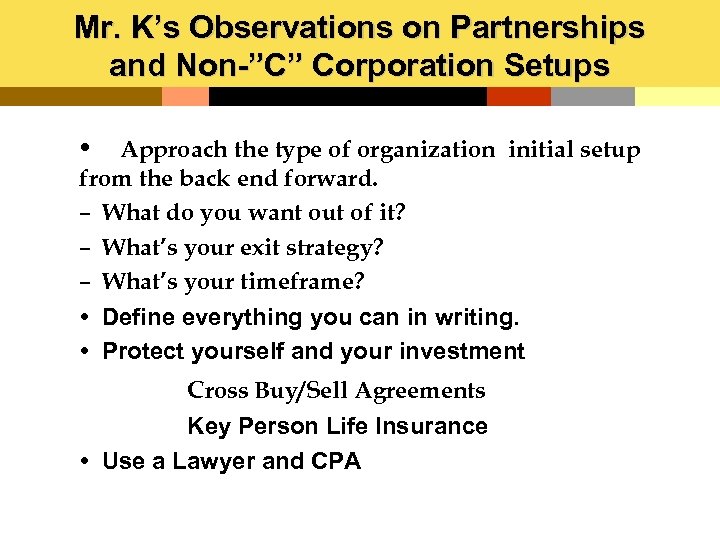

Mr. K’s Observations on Partnerships and Non-”C” Corporation Setups Approach the type of organization initial setup from the back end forward. – What do you want out of it? – What’s your exit strategy? – What’s your timeframe? Define everything you can in writing. Protect yourself and your investment Cross Buy/Sell Agreements Key Person Life Insurance Use a Lawyer and CPA

10d313dc5b123a985c495ec4bef0b1d3.ppt