33ecd080de225501b37513e9023209da.ppt

- Количество слайдов: 42

Business Life Insurance Concepts & Sales Opportunities L-16449 -A 4/04 For Producer Use Only. Not for Use With the General Public.

Overview • Types of business organizations • Life insurance uses • Sales Opportunities For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Types of Business Organizations • Sole proprietors • Partnerships • Corporations • Limited liability companies For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Closely-Held Businesses • Personal Wealth = The Business • Ownership = Management • The owner is the business is the owner For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Developing an Exit Strategy • Retirement Planning • Does the owner want to retire? How? • Succession Planning • Who takes over? How? • Estate Planning • Will taxes force a business sale? Life insurance is part of a successful Exit Strategy For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Business Life Insurance • Business succession • Key person indemnification • Employee benefits For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Business Succession What happens when an owner dies? Surviving owners have 5 choices: • • • Work with the Heirs Sell out to the Heirs Buy out the Heirs Work with Outside Buyers Liquidate the business For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Work with the Heirs • As Active Co-owners • Are they qualified? • Can’t we all get along? • As Inactive Co-owners • Will they demand money? • Will they support management? • Children heirs may require guardians For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Sell out to the Heirs • Do they have the money? • Can they run the business? • Are the sellers willing to stay on as mere employees? For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Buy Out the Heirs • At what price? • Do they have the money? • Cash • Installment purchase. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Work with Outside Buyers • Will they support management? • Are they qualified? • Do they get along? For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Liquidate the Business • A business in liquidation has only a fraction of the value of a going concern • Without planning, this option may be forced on the parties. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Business Succession What happens when the owner dies? Decedent’s Family have 2 Choices: • KEEP the business in the family • Who will run the business? • What is the source of funds for dependents? • How will estate settlement costs be paid? • SELL the business • Who will buy? • What price? • Where will the buyer get the money? For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

The Problem When a business owner dies, the business often dies too and with it the livelihood of the surviving owners and the deceased’s family. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

The Solution A Buy-Sell Agreement funded with Life Insurance For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Buy-Sell Agreements-Features • Business protected from inactive shareholders • Profits inure to those active in the business • Assurance of a fair price for the stock • Smooth transition • Family’s needs are met • Family’s future not tied to fate of the business • Source of liquidity to pay death taxes • “Fix” the value of the business for the IRS For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

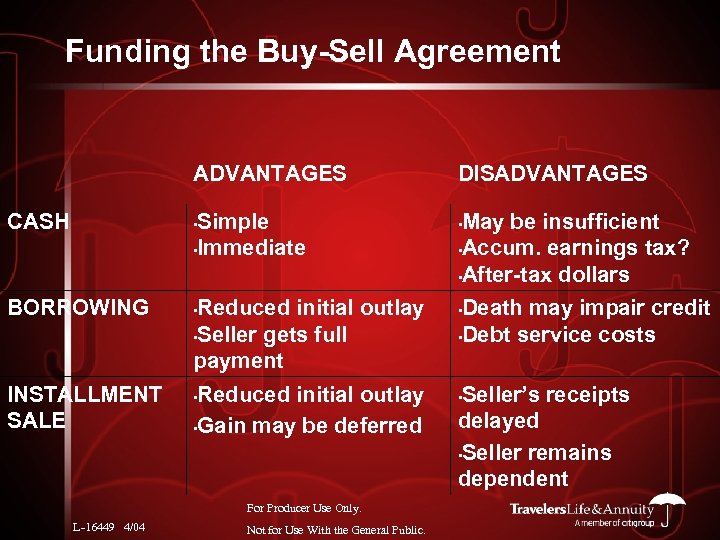

Funding the Buy-Sell Agreement ADVANTAGES CASH • Simple • Immediate BORROWING • INSTALLMENT SALE Reduced initial outlay • Seller gets full payment Reduced initial outlay • Gain may be deferred • For Producer Use Only. L-16449 4/04 Not for Use With the General Public. DISADVANTAGES May be insufficient • Accum. earnings tax? • After-tax dollars • Death may impair credit • Debt service costs • Seller’s receipts delayed • Seller remains dependent •

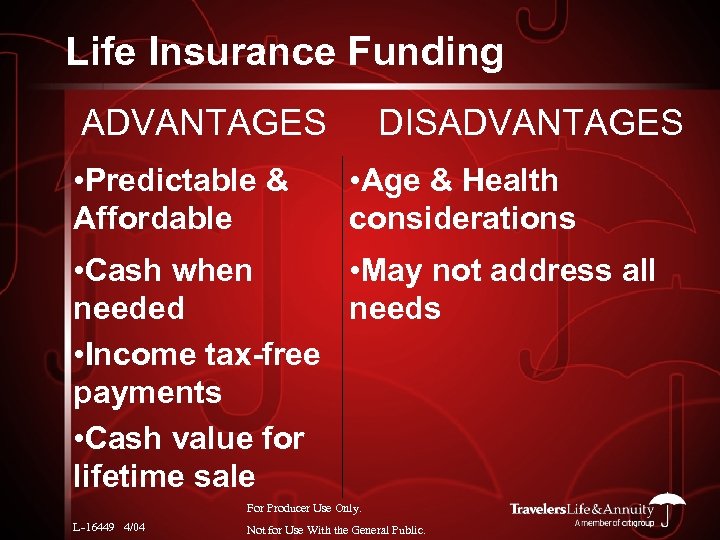

Life Insurance Funding ADVANTAGES • Predictable & Affordable DISADVANTAGES • Age & Health considerations • Cash when • May not address all needed needs • Income tax-free payments • Cash value for lifetime sale For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

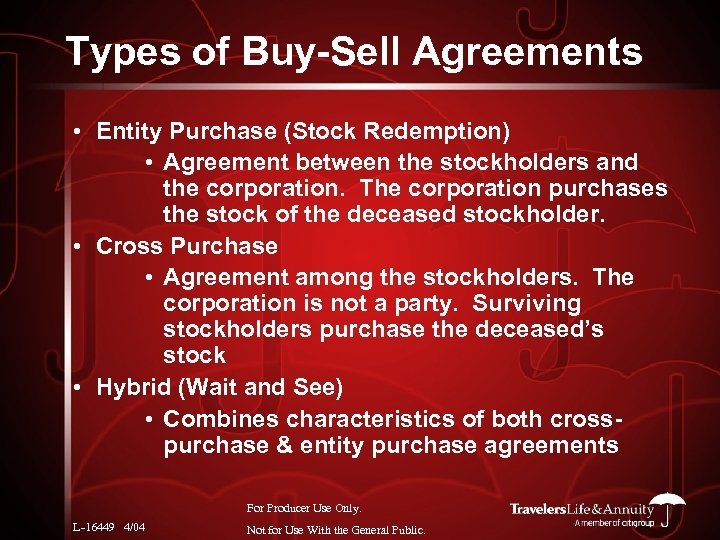

Types of Buy-Sell Agreements • Entity Purchase (Stock Redemption) • Agreement between the stockholders and the corporation. The corporation purchases the stock of the deceased stockholder. • Cross Purchase • Agreement among the stockholders. The corporation is not a party. Surviving stockholders purchase the deceased’s stock • Hybrid (Wait and See) • Combines characteristics of both crosspurchase & entity purchase agreements For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Key Person Insurance • The most important asset of any business is its people. • According to a Dun & Bradstreet study, 96% of business failures were due to people failures. • Attracting & retaining good people is critical to business success. • Insuring the business against loss of key people is as important as insuring against loss of equipment. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Key Person Insurance • Indemnifies the business for loss of a key employee. • Key persons exist throughout a company: • Person responsible for the firm’s credit • Product development manager • Key salespeople • Anyone whose loss would result in significant disruption For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Key Person Insurance - How Much? • How much would it cost to replace the employee? • How much is the employee worth in net profits? • How much would the business lose if the employee died today? • How much is the business willing to self-insure? For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Key Person Insurance – Benefits • • Cash to keep the business running Cash to re-assure creditors Cash to cover losses Cash to search for and hire a replacement • Simple to implement • No special agreements required For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Employee Benefits • Bonus Plans • Split Dollar • Deferred Compensation For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Bonus Plans • Employee purchases a life insurance policy • Employer pays premiums • Employee income = premiums paid • Ensures employee’s long-term financial security For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

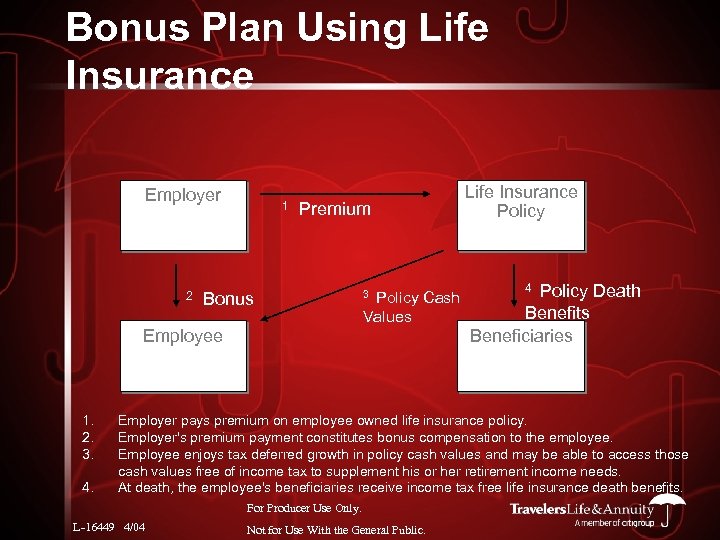

Bonus Plan Using Life Insurance Employer 2 1 Premium Bonus Employee 1. 2. 3. 4. Policy Cash Values 3 Life Insurance Policy Death Benefits Beneficiaries 4 Employer pays premium on employee owned life insurance policy. Employer's premium payment constitutes bonus compensation to the employee. Employee enjoys tax deferred growth in policy cash values and may be able to access those cash values free of income tax to supplement his or her retirement income needs. At death, the employee's beneficiaries receive income tax free life insurance death benefits. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Bonus Plans • Employer Advantages: • Tax Deductible • Simple to administer • Pick & choose participants • Employer Disadvantages: • Lack of control For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Bonus Plans • Employee Advantages: Asset Protection Control & Portability Relatively small out-of-pocket cost Tax-deferred growth of policy cash values • Potentially tax-free access to policy cash values • • • Employee Disadvantages: • Current taxation For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Split Dollar Plans • Method of purchasing life insurance • Several parties split the costs and benefits of a life insurance policy • 2 methods (depends on who owns policy): • Loan approach: Non-owner loans premiums to the policyowner • Economic Benefit (EB) approach: Policyowner provides life insurance benefits to the other party For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Split Dollar - Loan • Used when Non-Owner pays premiums • Exception: Non-equity plans • Employer lends premium to employee • Loan interest: • Based on Applicable Federal Rate (AFR) • Either paid by employee, or imputed to employee as income • Interest income to employer (lender) • Loan is repaid from policy cash value or death benefit For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

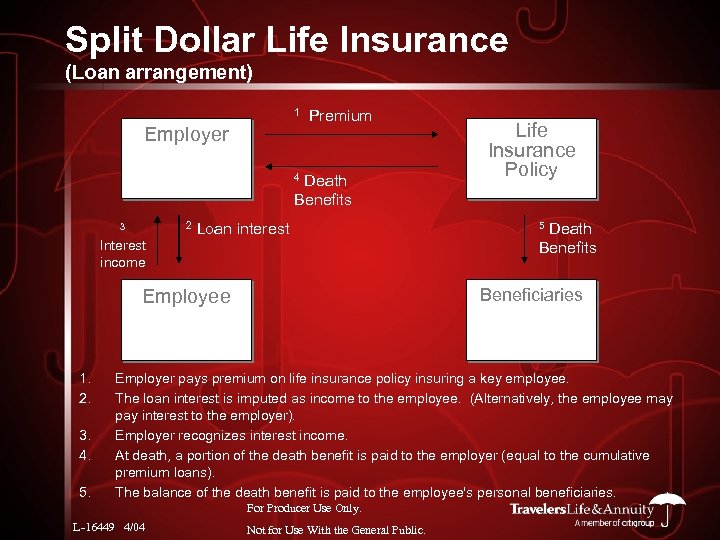

Split Dollar Life Insurance (Loan arrangement) 1 Employer Premium Death Benefits 4 2 3 Interest income Loan interest 3. 4. 5. Death Benefits 5 Beneficiaries Employee 1. 2. Life Insurance Policy Employer pays premium on life insurance policy insuring a key employee. The loan interest is imputed as income to the employee. (Alternatively, the employee may pay interest to the employer). Employer recognizes interest income. At death, a portion of the death benefit is paid to the employer (equal to the cumulative premium loans). The balance of the death benefit is paid to the employee's personal beneficiaries. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Split Dollar – Economic Benefit • Used when Owner pays premiums • Employer agrees to pay for some or all of the premium in return for an interest in the policy • Employer’s interest typically = premiums paid or policy cash value • Employee recognizes income every year: • Value of life insurance protection received (less any payments made by employee), • Value of other benefits received (policy cash values, dividends, riders, etc. ) • Employer recovers its interest from policy cash values or death benefit For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

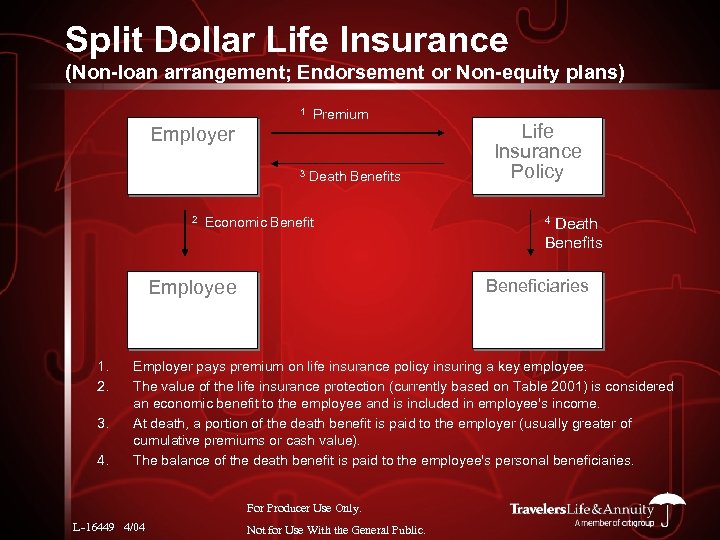

Split Dollar Life Insurance (Non-loan arrangement; Endorsement or Non-equity plans) 1 Premium Employer 3 2 Death Benefits Economic Benefit 3. 4. Death Benefits 4 Beneficiaries Employee 1. 2. Life Insurance Policy Employer pays premium on life insurance policy insuring a key employee. The value of the life insurance protection (currently based on Table 2001) is considered an economic benefit to the employee and is included in employee's income. At death, a portion of the death benefit is paid to the employer (usually greater of cumulative premiums or cash value). The balance of the death benefit is paid to the employee's personal beneficiaries. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Split Dollar Life Insurance • Advantages - Employer • Cost recovery • Selective benefits • Nominal ERISA compliance • Simple administration • Flexible design For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Split Dollar Life Insurance • Advantages - Employee • Reduced current cost for life insurance • Reduced gifts for estate planning purposes • Frees up cash for other needs For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Split Dollar Life Insurance • Disadvantages – Employer & Employee • Perceived complexity • Tax law changes • Need for a rollout strategy For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Deferred Compensation Plans • What is it? • An unsecured promise to pay future benefits • Informally funded with life insurance • Employers subject to ERISA must limit participation to “Top Hat’ employees For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Deferred Comp - Example • Corporation promises to pay key employee a supplemental retirement benefit of $30, 000 for 10 years. • Corporation purchases life insurance to “informally” fund its obligation • At retirement, corporation may use policy cash values to pay benefits • At employee’s death corporation recovers its costs from life insurance death benefit For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Deferred Compensation • Important Considerations: • Type of business • Owner vs. employee participants • Special concerns for controlling shareholders • Sponsoring company should be financially strong • The promise is as good as the company making it • Limited to “top hat” employees For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

The Business Insurance Market • Small business is Big Business! • Sales Opportunities • Larger insurance sales • Larger premiums • Larger commissions • Addressing client’s total insurance needs • Protect and strengthen client relationships For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

For a non-MEC (modified endowment contract) policy, income taxes are generally due upon withdrawal, only to the extent that they exceed cost basis. However, withdrawals during the first 15 policy years may be subject to special rules and could trigger a taxable distribution. For a MEC policy, income taxes are due upon withdrawal to the extent there are cash values in excess of cost basis (gain) in the contract. Further, a withdrawal of cash values in excess of cost basis before age 59 ½ could trigger a 10% tax penalty. While loaned amounts are generally not subject to taxation, a loan or assignment of a MEC with gain could result in a taxable event. Neither Travelers Life & Annuity nor its representatives provides tax or legal advice. Please have clients consult their own tax and/or legal advisor for such guidance. Variable life insurance is medically underwritten, so all candidates should be in reasonably good health. There may be partial and/or full surrender charges for early withdrawal from life insurance. The death benefit from life insurance is generally income tax-free, but have clients consult their own tax advisor about the income tax consequences when the life insurance death benefit is paid to an entity other than an individual. The comments about tax treatment simply reflect our understanding of current interpretations of tax laws as they relate to estate planning and life insurance. Since tax laws are always subject to interpretation and possible changes in the future, we recommend that clients seek the counsel of their attorney, accountant or other qualified tax advisor regarding estate and life insurance as it applies to their particular situation. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

Life insurance is issued by The Travelers Insurance Company or The Travelers Life and Annuity Company (depending on jurisdiction), One Cityplace, Hartford, CT 06103 -3415. Travelers Distribution LLC is the principal underwriter. In New York, policies are issued by The Travelers Insurance Company. This material describes a concept that may be used with a variable or a non-variable product. Variable products are sold by prospectus. For more information about a variable product, including fees and charges, request a prospectus from the address above. Variable life insurance is subject to market risk, including possible loss of principal, and a reduction of the death benefit depending on the death benefit selected. For Producer Use Only. L-16449 4/04 Not for Use With the General Public.

33ecd080de225501b37513e9023209da.ppt