798d79ba747be7966fa67e9a55a4fae0.ppt

- Количество слайдов: 16

Business Intelligence & XBRL @ MPS Paolo Lombardi Banca Monte dei Paschi di Siena VII European Banking Supervisors XBRL Workshop Munich, Bundesbank, 9 th -10 th May 2007

Message & Agenda q Semantic-based Business Intelligence broadens the field of applications of XBRL & provides practical opportunities for integration of Basel II principles with excellence in banking practice. q The Monte dei Paschi di Siena Bank is currently exploring such an evolution path, moving from several years of practical usage of XBRL. q Today’s presentation will briefly describe our experience at MPS on XBRL, vis-à-vis Research & Development activities in the field of Semantic-based Knowledge Management for more efficient banking in the Basel II-modified scenario. MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 2

Monte dei Paschi di Siena q Banca MPS is the organization leading the Monte dei Paschi di Siena Group (Italy's fourth largest banking group). q We pride ourselves with being the oldest bank in the world (founded in 1472), yet maintaining strong inclination for product and services innovation. Our mission is centered on Commercial Banking and excellence in distribution, maximizing the value of our 2000 active branches. q MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 3

MPS’s balance sheet in XBRL q Since 2005, the first Italian bank to publish it on its website q MUSING, MPS & XBRL Filing the BS in the absence of a Jurisdiction: XBRL is a “de facto” standard VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 4

www. musing. eu MUSING – MUlti-industry, Semantic-based next generation business INtelli. Gence MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 5

The MUSING initiative q q A Consortium of 15 organisations from 9 European countries carrying out a Research & Technology Development project (2006 -2010) in the field of knowledge management, sponsored by the European Commission (Sixth Framework Programme - IST). The paradigm: to integrate advanced Semantic Web and Human Language technologies for development of Business Intelligence (BI) applications towards industries with a deep socio-economic impact. User-driven initiative, 3 industrial verticalisations: ü Financial Risk Management (FRM) ü Internationalisation (INT) ü IT Operational Risk (IT-Op. R) The pervasively-used standard: XBRL MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 6

MISSION STATEMENT By applying innovative technological solutions, MUSING provides exclusive BI services for three application areas, all with high social impact. MUSING is committed to find other industries where its solutions can be deployed. The above is realised through development of an innovative, self-adapting BI system that integrates and specialises high-level semantic technologies; by combined use of declarative rule-based approaches & statistical methods in semantic technology; by accounting for temporal logic; and more. . . MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 S&T EXCELLENCE MUSING delivers next-generation knowledge management solutions and services to enable perceptive Business Intelligence (BI) activities, directly at the End-Users premises. MULTI-INDUSTRY PARADIGM The rationale of MUSING 7

End-users needs and needed R&D q Bound to R&D: High potential for more competitive banking services, but no off-the-shelf solutions in Semantic-based BI… q Here are some specific scientific and technological objectives: ü Development of an innovative, self-adapting BI system that integrates and specialises high-level semantic technologies for supporting next level of effectiveness in operations in different industries; ü Combined use of declarative rule-based approaches and statistical methods in semantic technology; ü Modelling and recognising evolving knowledge accounting for temporal logic; ü Support to development of innovative technologies that enable enterprise’s self-assessment. MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 8

Credit merit assessment for customers & prospects MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 9

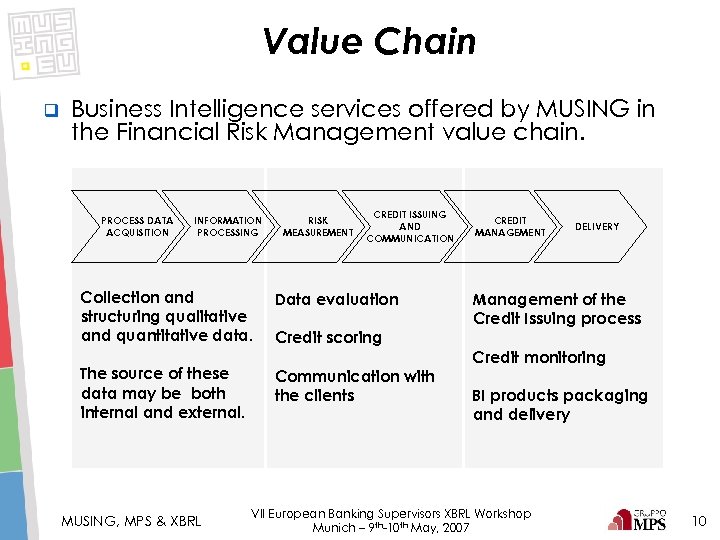

Value Chain q Business Intelligence services offered by MUSING in the Financial Risk Management value chain. PROCESS DATA ACQUISITION INFORMATION PROCESSING Collection and structuring qualitative and quantitative data. The source of these data may be both internal and external. MUSING, MPS & XBRL RISK MEASUREMENT CREDIT ISSUING AND COMMUNICATION Data evaluation Credit scoring Communication with the clients CREDIT MANAGEMENT DELIVERY Management of the Credit Issuing process Credit monitoring BI products packaging and delivery VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 10

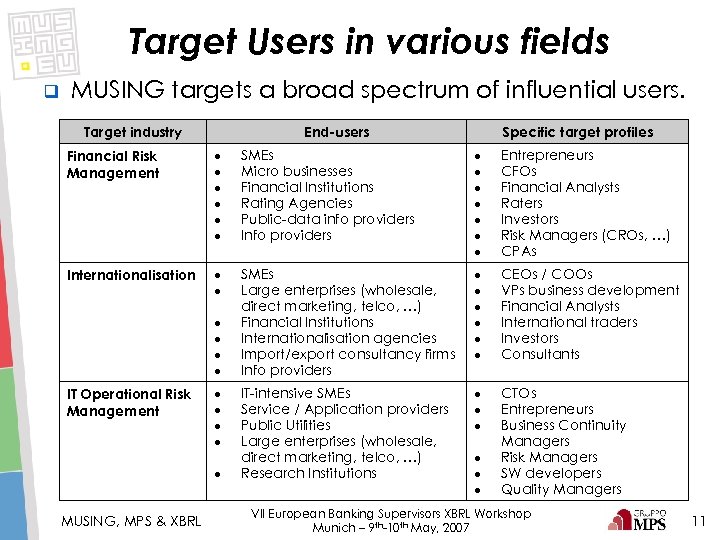

Target Users in various fields q MUSING targets a broad spectrum of influential users. Target industry End-users Specific target profiles Financial Risk Management SMEs Micro businesses Financial Institutions Rating Agencies Public-data info providers Info providers Entrepreneurs CFOs Financial Analysts Raters Investors Risk Managers (CROs, …) CPAs Internationalisation SMEs Large enterprises (wholesale, direct marketing, telco, …) Financial Institutions Internationalisation agencies Import/export consultancy firms Info providers CEOs / COOs VPs business development Financial Analysts International traders Investors Consultants IT-intensive SMEs Service / Application providers Public Utilities Large enterprises (wholesale, direct marketing, telco, …) Research Institutions CTOs Entrepreneurs Business Continuity Managers Risk Managers SW developers Quality Managers IT Operational Risk Management MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 11

Working examples q Automatic upload of Balance Sheets q Blending of qualitative & quantitative knowledge for prospect evaluation q Enterprise self-assessment MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 12

MUSING and XBRL q We strive to develop Business Intelligence services that support & automate the interactive process of analyzing and exploring structured & unstructured information to discern trends or patterns, thereby deriving insights and drawing conclusions, through flexible reporting. q In the above the MUSING Consortium of Partners is a convinced user of XBRL, and we “spontaneously support” usage of the standard: ü Among our target user communities ü Within the industrial R&D Framework Programme of EC itself MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 13

Opportunities for collaboration q Co-organisation of a workshop-like event on usage of next generation of business intelligence in banking q Host-a-pilot initiative (see musing. eu) MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 14

Conclusion & next steps q While the XBRL local jurisdiction acts as a catalytic element for practical applications, XBRL is already the de-facto standard for performing business intelligence in the banking industry, making possible to conjugate Basel II-compliant frameworks, process automation, and transparency requirements. q More MUSING services to be tested in the next 3 years: opening for collaboration with other European financial institutions, as per the spirit of the EC-funded R&D initiative. q Invited speech at the XBRL Conference in Munich: sneak preview of MUSING services running with XBRL in applications in various European countries. MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 15

Contact www. musing. eu paolo. lombardi@banca. mps. it Paolo Lombardi, Distribution Channels Department – Banca Monte dei Paschi di Siena S. p. A. Acknowledgements – Support from the European Commission, under the IST Programme, project IST-27097, is gratefully acknowledged MUSING, MPS & XBRL VII European Banking Supervisors XBRL Workshop Munich – 9 th-10 th May, 2007 16

798d79ba747be7966fa67e9a55a4fae0.ppt