d5890e41f0924ceaf41cf36b52e5e619.ppt

- Количество слайдов: 20

Business Finance (MGT 232) Lecture 1

Introduction

Introduction to the Course • What we are going to study: “ the BASICs of FINANCE in BUSINESSES” -How they outsource their money -How they manage their finances -The best utilization of their money -The return earned through its efficient management

Course Outline • • • • BUSINESS FINANCE INTRODUCTION THE FINANCIAL ENVIRONMENT TIME VALUE OF MONEY VALUATION OF SECURITIES (Bonds and shares) RISK AND RATES OF RETURN FINANCIAL STATEMENT ANALYSIS COST OF CAPITAL BUDGETING TECHNIQUES WORKING CAPITAL CONCEPTS, DIVIDEND POLICY CAPITAL MARKETS LONG TERM SECUITIES FINANCE USING EXCEL SPREADSHEET

Suggested Readings 1. Fundamental of Financial Management, seventh Edition by Eugene F. Brigham 2. Fundamental of Financial Management by Van Horne 3. Fundamental of Corporate Finance by Brealy and Myers 4. Corporate Finance By Ross Westerfield Jordan

Course requirements • • • 4 x Assignments 4 x Quizzes 4 x Discussion Topics 2 Sessional Exams 1 Final Exam

Business Finance Introduction

What is Finance? • Managing the large amount of Money (Dictionary Definition) Finance is: “attaining the amount of money, using it by investing and gaining return on your investment”

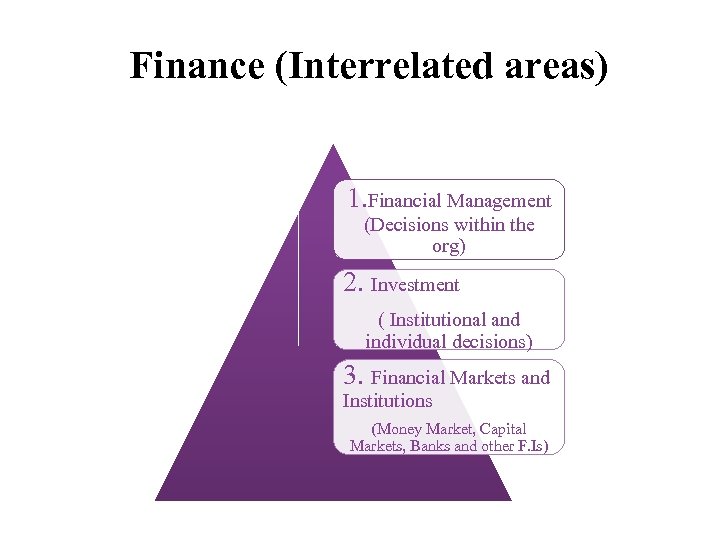

Finance (Interrelated areas) 1. Financial Management (Decisions within the org) 2. Investment ( Institutional and individual decisions) 3. Financial Markets and Institutions (Money Market, Capital Markets, Banks and other F. Is)

The Role of Financial Management • What is Financial Management? • The Goal of the Firm • Organization of the Financial Management Function

What is Financial Management? Concerns the acquisition, financing and management of assets with some overall goal in mind.

Investment Decisions Most important of the three decisions. • What is the optimal firm size? • What specific assets should be acquired? • What assets (if any) should be reduced or eliminated?

Financing Decisions • • Determine how the assets (LHS of balance sheet) will be financed (RHS of balance sheet). What is the best type of financing? What is the best financing mix? What is the best dividend policy? How will the funds be physically acquired?

Asset Management Decisions • How do we manage existing assets efficiently? • Financial Manager has varying degrees of operating responsibility over assets. • Greater emphasis on current asset management than fixed asset management.

What is the Goal of the Firm? Maximization of Shareholder Wealth! Value creation occurs when we maximize the share price for current shareholders.

Shortcomings of Alternative Perspectives Profit Maximization u Maximizing a firm’s earnings after taxes. Problems • Could increase current profits while harming firm (e. g. , defer maintenance, issue common stock to buy T-bills, etc. ). • Ignores changes in the risk level of the firm.

Shortcomings of Alternative Perspectives Earnings per Share Maximization u Maximizing earnings after taxes divided by shares outstanding. Problems • Does not specify timing or duration of expected returns. • Ignores changes in the risk level of the firm. • Calls for a zero payout dividend policy.

Strengths of Shareholder Wealth Maximization • Takes account of: current and future profits and EPS; the timing, duration, and risk of profits and EPS; dividend policy; and all other relevant EPS dividend policy factors. • Thus, share price serves as a barometer for business performance.

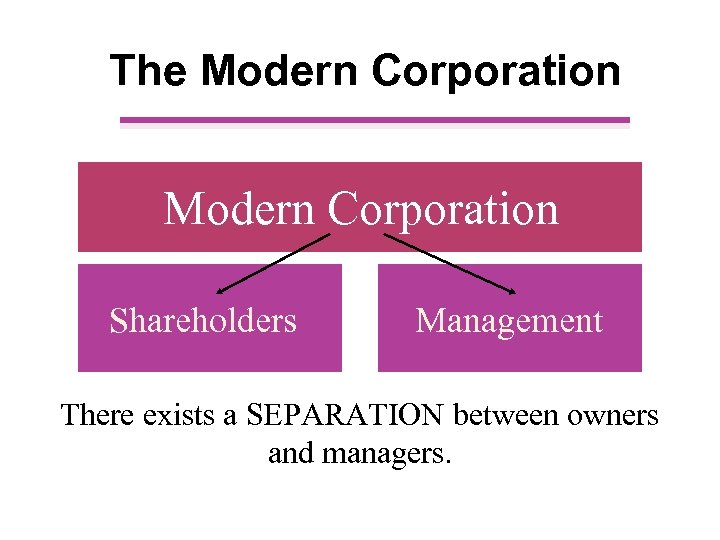

The Modern Corporation Shareholders Management There exists a SEPARATION between owners and managers.

Summary • • • What is Finance? And interrelated areas Financial Management Three Important FM decisions Goal of a Firm (some alternatives) Structure of a Modern Corporation

d5890e41f0924ceaf41cf36b52e5e619.ppt