Burger King - UM Part_strategy_Final.pptx

- Количество слайдов: 14

Burger King strategic recommendations for Y 2012 October, 2011

TA & what do we know about them? Core TA in Russia, 16 -34, likes to visit Nigh clubs, Cinemas, and use Internet In Moscow our Core TA visit Ho. Re. Ca, use Metro, and notice Ad message in OOH Extension of the media mix with and Morning shows on Radio and 3 x 6 billboards helps us to cover elder target audience Messengers and Social Networks –the best way to reach Senior pupils and students. Bus stops and non-standard placement – for adding the “WOW” effect. Source: R-TGI 2010, base: Russia, Fast food users, TA: 16 -34 BC

Budget split for Y 2012 Budget mln. USD 13% 5% 45% 38% Radio Internet OOH Print

On-Line Media Channels Selection

Drivers and barriers of fast food restaurants visiting are different for each segment of TA All 14 -23 Variety, taste, no health or weight issues / no barriers • I like to taste new drinks – 58%/ 160 • I like to taste new food products – 54%/128 • I like to treat myself to foods not good for me – 56%/116 • I have a sweet tooth – 52%/123 All 24 -35 General busyness, no time for cooking or having a meal / no barriers • I try not to take a sick leave – 66%/112 • I find the more I have the more I want – 60%/125 • I’ve not enough time to do everything I would like to – 56%/113 • I often eat snacks rather than a proper meal – 37%/114 Families with Kids Busyness / preference for home cooking rather than restaurant food, weight issues • I like cooking – 61%/110 • I'm the person who aims at self-improvement – 58%/117 • I often eat snacks while on the move rather than eating a proper meal – 38%/118 • I spend a lot of time trying to "lose" weight – 25%/112 Source: TGI Comcon 2011, Moscow and SPb, all 14 -35, fast food restaurants visitors

Core Internet TA All 14 -23, because awareness of this group is converted to visiting. Other groups has minimal conversion. 8% Kroshka. Kartoshka All 14 -23 Sbarro 6% 10% Visit 10% Mc. Donald's 66% aware 31% visit 8% Rostik's KFC Vostochniy Bazar 2% 0% 0% 40% Visit 10% 8% 2% 0% 6% 4% 2% 0% Subway Sbarro Vostochniy Bazar Burger King 0% 60% Aware All 14 -35 with kids Rostik's KFC 4% Subway Teremok Burger King 20% Mu-mu 6% Mu-mu 4% Kroshka. Kartoshka All 24 -35 20% Kroshka. Kartoshka Rostik's KFC 40% Mc. Donald's 70% aware 29% visit Mu-mu Teremok Subway Vostochniy Bazar Burger King 0% Source: TGI Comcon 2011, Moscow, all 14 -35 20% 40% Mc. Donald's 71% aware 27% visit Sbarro 60% Aware 80% Teremok 60% Aware 80%

All 14 -23: active social networking, content consumption and online communication, interesting in education and entertainment Source: TGI Comcon 2011, Moscow, all 14 -23

All 24 -35: high involvement into content consumption, usage of messengers and online banking, interest to auto/moto, job search, traveling, goods and services Source: TGI Comcon 2011, Moscow, all 24 -35

First we recommend to determine key thematic sites. Use the most affinitive thematic sites. Affinity 300 Clublife. ru Be-in. ru Thematic Timeout. ru Lookatme. ru Other thematic 250 Afisha. ru Portals & social nets 200 Yandex. ru / Afisha MTV. ru 150 Kinopoisk. ru Mail. ru / Games-online 1000 0 500 1500 2000 2500 F 5. ru Rambler. ru / Post-box 128. 6 Live. Journal. com Mail. ru / Files Ifolder. ru Translate. ru Rambler. ru / Main page Yandex. ru / Music Promodj. ru Vkontakte. ru Yandex. ru / Video / Clips 100 Yandex. ru / Post-box Smotri. com Nightparty. ru Tvigle / Clips Odnoklassniki. ru Mail. ru / Dictionary 50 0 3000 3500 Reach of TA 4000 Yandex. ru / Main page Vkontakte. ru Mail. ru / Main page Mail. ru / Post-box

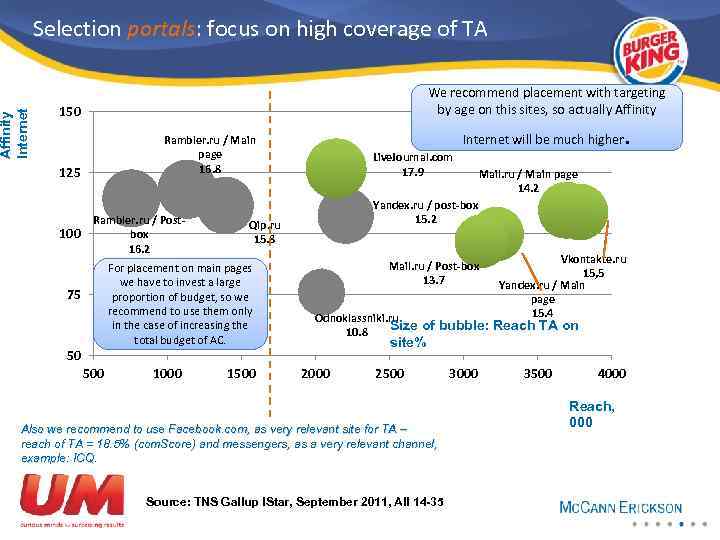

Affinity Internet Selection portals: focus on high coverage of TA We recommend placement with targeting by age on this sites, so actually Affinity 150 125 100 Internet will be much higher Rambler. ru / Main page 16. 8 Rambler. ru / Postbox 16. 2 50 500 1000 1500 Mail. ru / Main page 14. 2 Yandex. ru / post-box 15. 2 Qip. ru 15. 8 For placement on main pages we have to invest a large proportion of budget, so we recommend to use them only in the case of increasing the total budget of AC. 75 Live. Journal. com 17. 9 . Mail. ru / Post-box 13. 7 Vkontakte. ru 15, 5 Yandex. ru / Main page 15. 4 Odnoklassniki. ru Size of bubble: Reach TA on 10. 8 site% 2000 2500 Also we recommend to use Facebook. com, as very relevant site for TA – reach of TA = 18. 5% (com. Score) and messengers, as a very relevant channel, example: ICQ. Source: TNS Gallup IStar, September 2011, All 14 -35 3000 3500 4000 Reach, 000

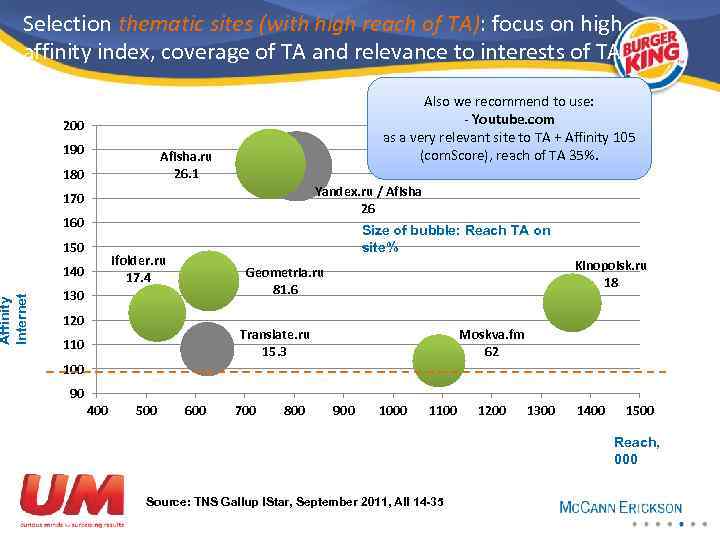

Affinity Internet Selection thematic sites (with high reach of TA): focus on high affinity index, coverage of TA and relevance to interests of TA Also we recommend to use: - Youtube. com as a very relevant site to TA + Affinity 105 (com. Score), reach of TA 35%. 200 190 Afisha. ru 26. 1 180 Yandex. ru / Afisha 26 170 160 150 Size of bubble: Reach TA on site% Ifolder. ru 17. 4 140 Kinopoisk. ru 18 Geometria. ru 81. 6 130 120 Translate. ru 15. 3 110 Moskva. fm 62 100 90 400 500 600 700 800 900 1000 1100 1200 1300 1400 1500 Reach, 000 Source: TNS Gallup IStar, September 2011, All 14 -35

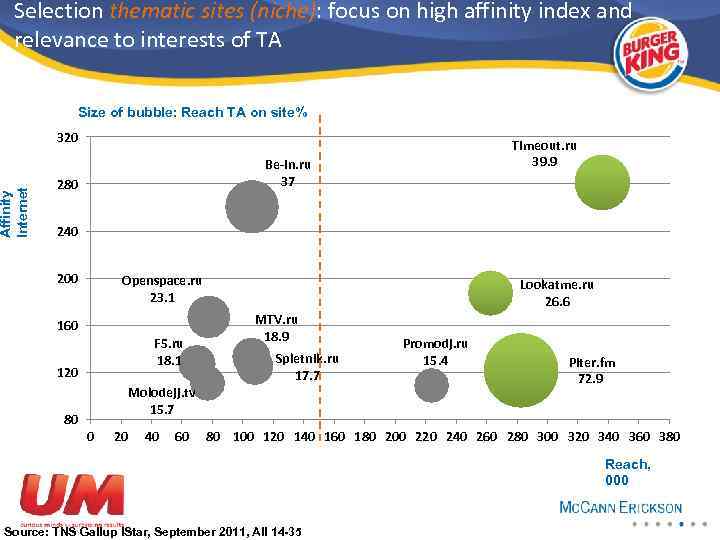

Selection thematic sites (niche): focus on high affinity index and relevance to interests of TA Size of bubble: Reach TA on site% Affinity Internet 320 Timeout. ru 39. 9 Be-in. ru 37 280 240 200 Openspace. ru 23. 1 160 F 5. ru 18. 1 120 Lookatme. ru 26. 6 MTV. ru 18. 9 Spletnik. ru 17. 7 Molodejj. tv 15. 7 80 0 20 40 60 Promodj. ru 15. 4 Piter. fm 72. 9 80 100 120 140 160 180 200 220 240 260 280 300 320 340 360 380 Reach, 000 Source: TNS Gallup IStar, September 2011, All 14 -35

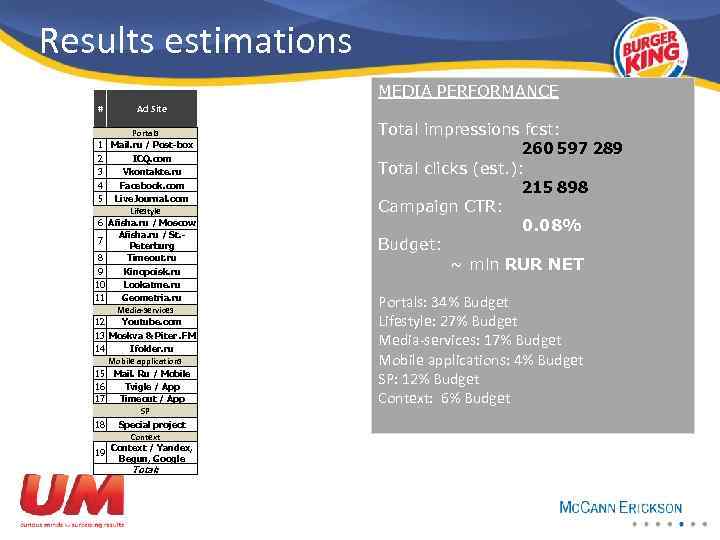

Results estimations MEDIA PERFORMANCE # 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Ad Site Portals Mail. ru / Post-box ICQ. com Vkontakte. ru Facebook. com Live. Journal. com Lifestyle Afisha. ru / Moscow Afisha. ru / St. Peterburg Timeout. ru Kinopoisk. ru Lookatme. ru Geometria. ru Media-services Youtube. com Moskva & Piter. FM Ifolder. ru Mobile applications Mail. Ru / Mobile Tvigle / App Timeout / App SP 18 Special project Context / Yandex, 19 Begun, Google Total: Total impressions fcst: 260 597 289 Total clicks (est. ): 215 898 Campaign CTR: 0. 08% Budget: ~ mln RUR NET Portals: 34% Budget Lifestyle: 27% Budget Media-services: 17% Budget Mobile applications: 4% Budget SP: 12% Budget Context: 6% Budget

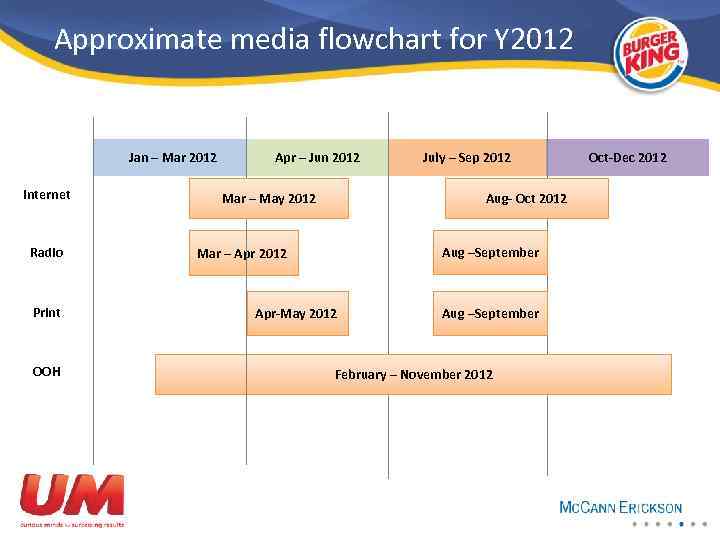

Approximate media flowchart for Y 2012 Jan – Mar 2012 Internet Radio Print OOH Apr – Jun 2012 Mar – May 2012 July – Sep 2012 Aug- Oct 2012 Aug –September Mar – Apr 2012 Apr-May 2012 Aug –September February – November 2012 Oct-Dec 2012

Burger King - UM Part_strategy_Final.pptx