Bureau van Dijk Worldwide Bureau van Dijk is

- Размер: 4.3 Mегабайта

- Количество слайдов: 22

Описание презентации Bureau van Dijk Worldwide Bureau van Dijk is по слайдам

Bureau van Dijk Worldwide Bureau van Dijk is an international company with offices in 30 cities, including the world’s principal financial centers, across 25 countries

Bureau van Dijk Worldwide Bureau van Dijk is an international company with offices in 30 cities, including the world’s principal financial centers, across 25 countries

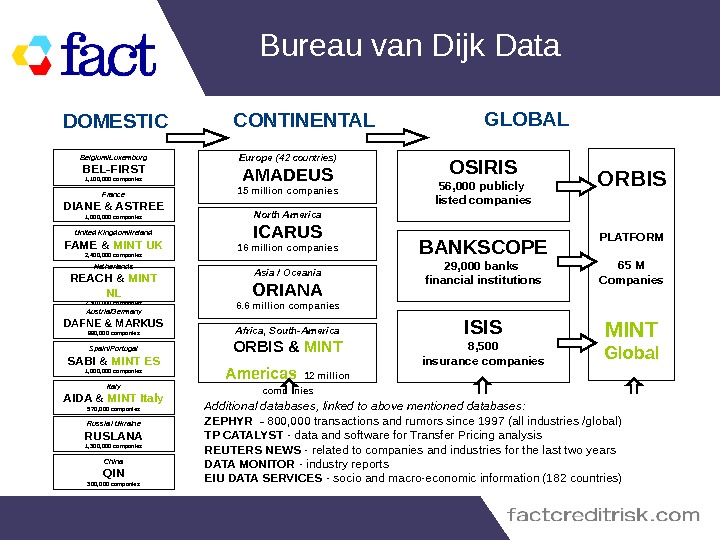

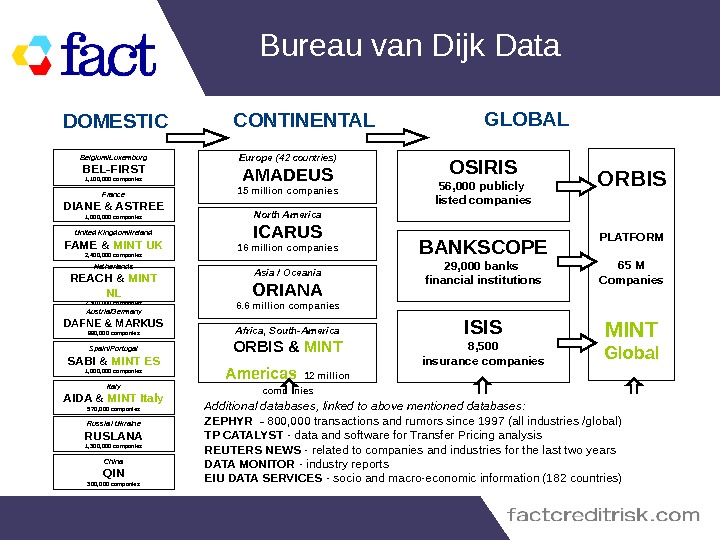

Bureau van Dijk Data GLOBAL DOMESTIC CONTINENTAL Africa, South-America ORBIS & MINT Americas 12 million companies. Europe (42 countries) AMADEUS 15 million companies ORBIS PLATFORM 65 M Companies MINT Global. OSIRIS 56, 000 publicly listed companies ISIS 8, 500 insurance companies. BANKSCOPE 29, 000 banks financial institutions. Belgium/Luxemburg BEL-FIRST 1, 100, 000 companies Spain/Portugal SABI & MINT ES 1, 000 companies Italy AIDA & MINT Italy 570, 000 companies Russia / Ukraine RUSLANA 1, 300, 000 companies China QIN 300, 000 companies Netherlands REACH & MINT NL 2, 300, 000 companies Austria/Germany DAFNE & MARKUS 980, 000 companies. United Kingdom/Ireland FAME & MINT UK 2, 400, 000 companies France DIANE & ASTREE 1, 000 companies North America ICARUS 16 million companies Asia / Oceania ORIANA 6. 6 million companies Additional databases, linked to above mentioned databases: ZEPHYR — 800, 000 transactions and rumors since 1997 (all industries /global) TP CATALYST — data and software for Transfer Pricing analysis REUTERS NEWS — related to companies and industries for the last two years DATA MONITOR — industry reports EIU DATA SERVICES — socio and macro-economic information (182 countries)

Bureau van Dijk Data GLOBAL DOMESTIC CONTINENTAL Africa, South-America ORBIS & MINT Americas 12 million companies. Europe (42 countries) AMADEUS 15 million companies ORBIS PLATFORM 65 M Companies MINT Global. OSIRIS 56, 000 publicly listed companies ISIS 8, 500 insurance companies. BANKSCOPE 29, 000 banks financial institutions. Belgium/Luxemburg BEL-FIRST 1, 100, 000 companies Spain/Portugal SABI & MINT ES 1, 000 companies Italy AIDA & MINT Italy 570, 000 companies Russia / Ukraine RUSLANA 1, 300, 000 companies China QIN 300, 000 companies Netherlands REACH & MINT NL 2, 300, 000 companies Austria/Germany DAFNE & MARKUS 980, 000 companies. United Kingdom/Ireland FAME & MINT UK 2, 400, 000 companies France DIANE & ASTREE 1, 000 companies North America ICARUS 16 million companies Asia / Oceania ORIANA 6. 6 million companies Additional databases, linked to above mentioned databases: ZEPHYR — 800, 000 transactions and rumors since 1997 (all industries /global) TP CATALYST — data and software for Transfer Pricing analysis REUTERS NEWS — related to companies and industries for the last two years DATA MONITOR — industry reports EIU DATA SERVICES — socio and macro-economic information (182 countries)

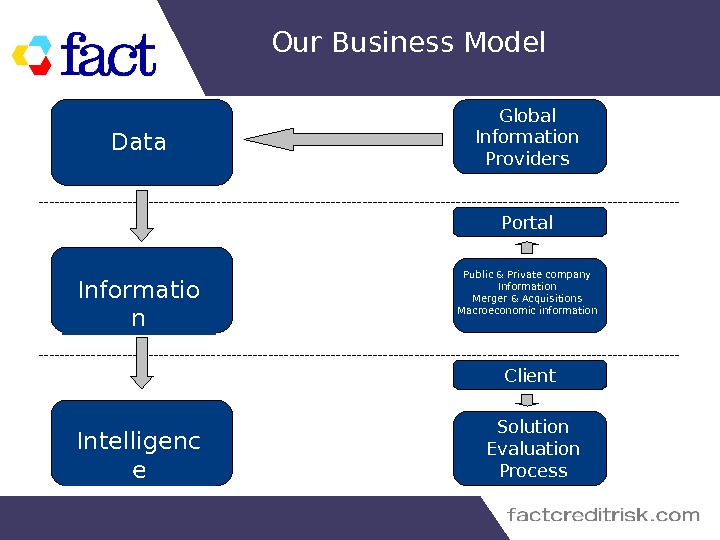

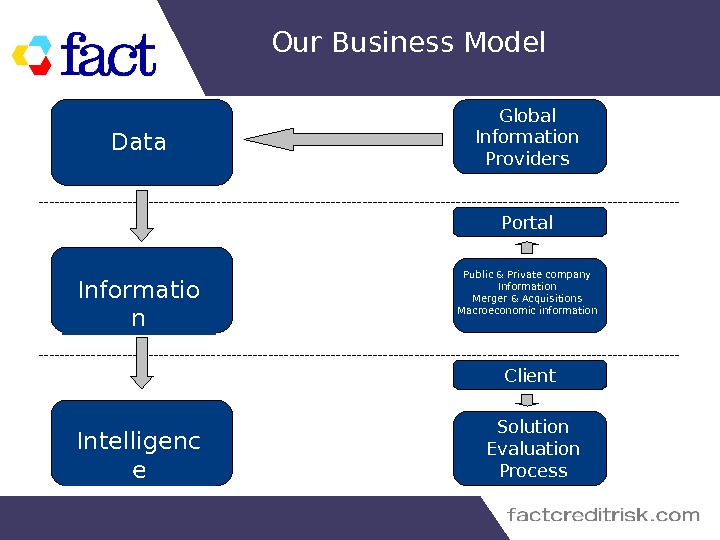

Our Business Model Informatio n. Data Intelligenc e Global Information Providers Portal Platform Client. Public & Private company Information Merger & Acquisitions Macroeconomic information Solution Evaluation Process

Our Business Model Informatio n. Data Intelligenc e Global Information Providers Portal Platform Client. Public & Private company Information Merger & Acquisitions Macroeconomic information Solution Evaluation Process

Global Information Partners

Global Information Partners

Client Segments Financial Institutions

Client Segments Financial Institutions

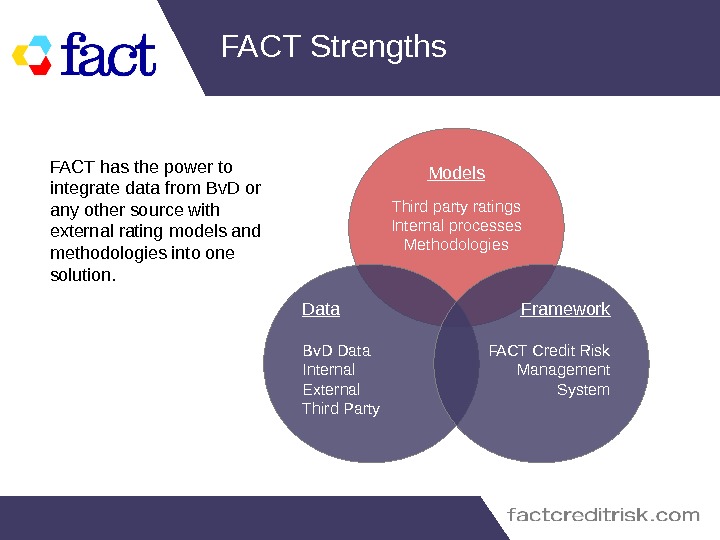

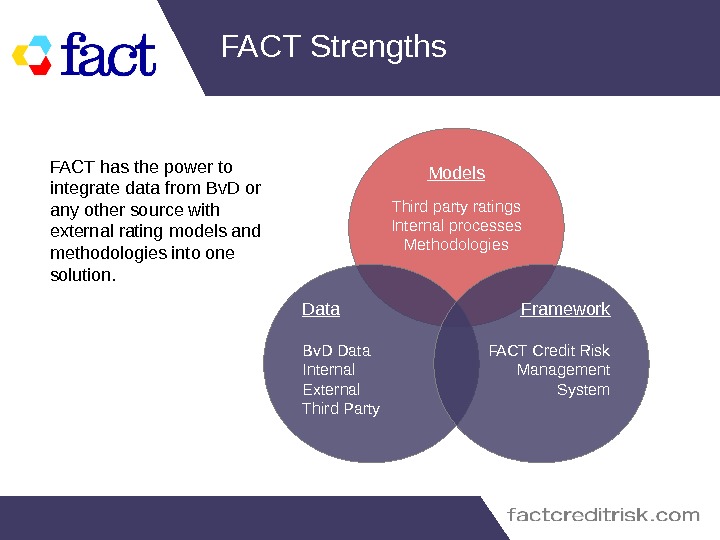

FACT Strengths Models Third party ratings Internal processes Methodologies Data Bv. D Data Internal External Third Party Framework FACT Credit Risk Management System. FACT has the power to integrate data from Bv. D or any other source with external rating models and methodologies into one solution.

FACT Strengths Models Third party ratings Internal processes Methodologies Data Bv. D Data Internal External Third Party Framework FACT Credit Risk Management System. FACT has the power to integrate data from Bv. D or any other source with external rating models and methodologies into one solution.

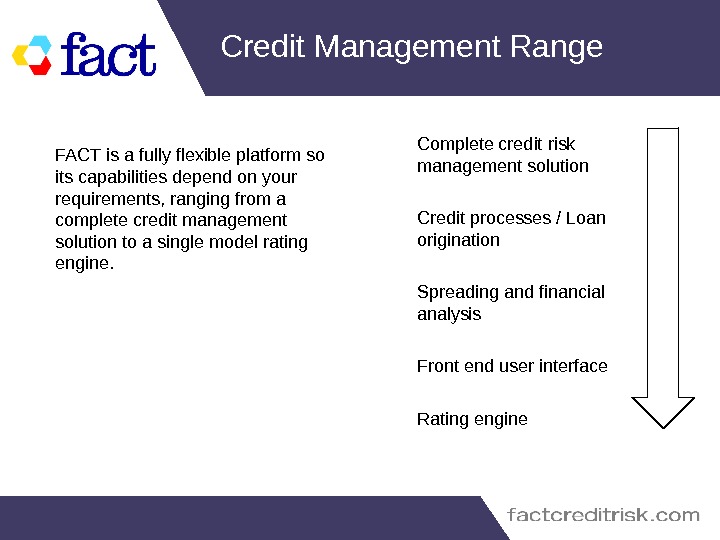

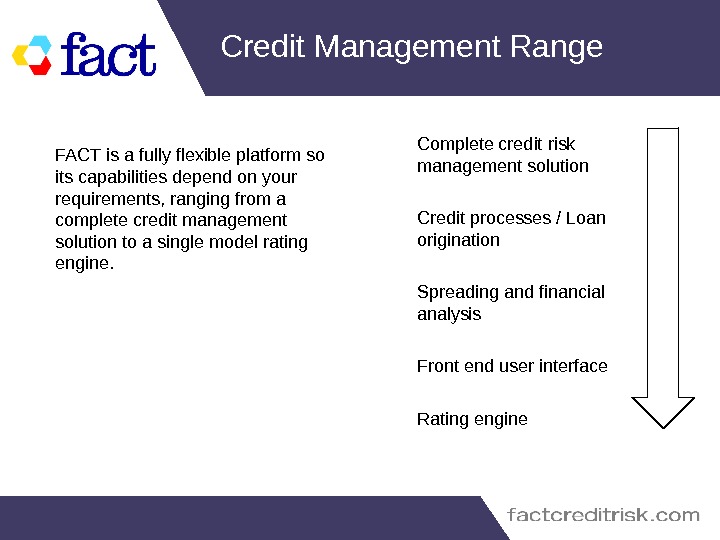

Credit Management Range Complete credit risk management solution Credit processes / Loan origination Spreading and financial analysis Front end user interface Rating engine. FACT is a fully flexible platform so its capabilities depend on your requirements, ranging from a complete credit management solution to a single model rating engine.

Credit Management Range Complete credit risk management solution Credit processes / Loan origination Spreading and financial analysis Front end user interface Rating engine. FACT is a fully flexible platform so its capabilities depend on your requirements, ranging from a complete credit management solution to a single model rating engine.

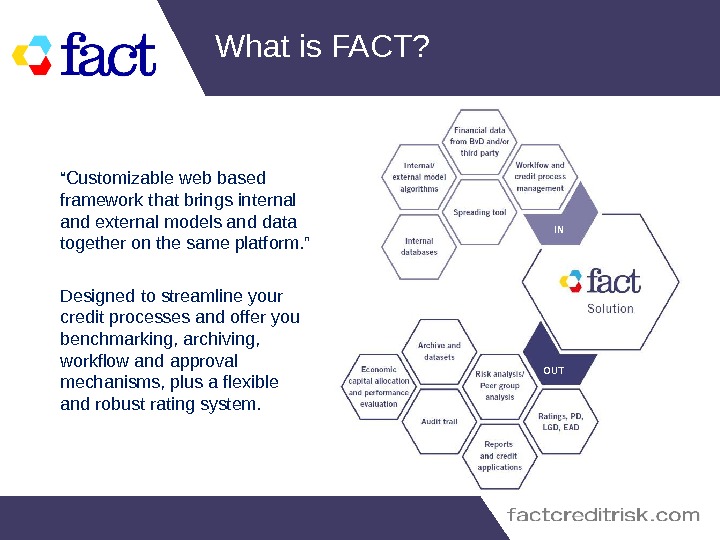

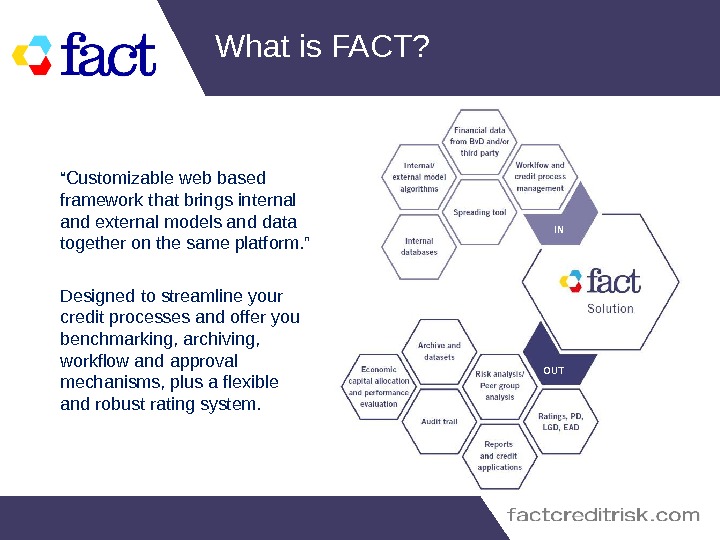

What is FACT? “ Customizable web based framework that brings internal and external models and data together on the same platform. ” Designed to streamline your credit processes and offer you benchmarking, archiving, workflow and approval mechanisms, plus a flexible and robust rating system. IN OUT

What is FACT? “ Customizable web based framework that brings internal and external models and data together on the same platform. ” Designed to streamline your credit processes and offer you benchmarking, archiving, workflow and approval mechanisms, plus a flexible and robust rating system. IN OUT

FACT – Spreading and Analysis FACT includes a fully customisable spreading tool which allows you to: Add or edit financial statement items and ratios Spread full accounts Change currencies and exchange rates Use complex calculations and Excel style formulas with the financials Produce precise financial projections Provide custom models and forecasting scenarios Analyse counterparty risk profiles to help you make more accurate credit decisions Standard web services, API protocol or customised imports are used to collate information from external databases to minimise time spent on data capture.

FACT – Spreading and Analysis FACT includes a fully customisable spreading tool which allows you to: Add or edit financial statement items and ratios Spread full accounts Change currencies and exchange rates Use complex calculations and Excel style formulas with the financials Produce precise financial projections Provide custom models and forecasting scenarios Analyse counterparty risk profiles to help you make more accurate credit decisions Standard web services, API protocol or customised imports are used to collate information from external databases to minimise time spent on data capture.

FACT – Rating FACT’s credit risk rating module helps financial institutions and companies to: Quantify, aggregate and manage risk across regions and product groups Independently manage internal rating models for efficient scoring, analysing and archiving Automatically feed external models, whether statistical, score card, structural or hybrid Incorporate any risk model as well as the facility to create your own models FACT can calculate the economic capital needed to cover your portfolios’ credit risk by using model outputs such as loss given default (LGD), exposure at default (EAD) and probability of default (PD).

FACT – Rating FACT’s credit risk rating module helps financial institutions and companies to: Quantify, aggregate and manage risk across regions and product groups Independently manage internal rating models for efficient scoring, analysing and archiving Automatically feed external models, whether statistical, score card, structural or hybrid Incorporate any risk model as well as the facility to create your own models FACT can calculate the economic capital needed to cover your portfolios’ credit risk by using model outputs such as loss given default (LGD), exposure at default (EAD) and probability of default (PD).

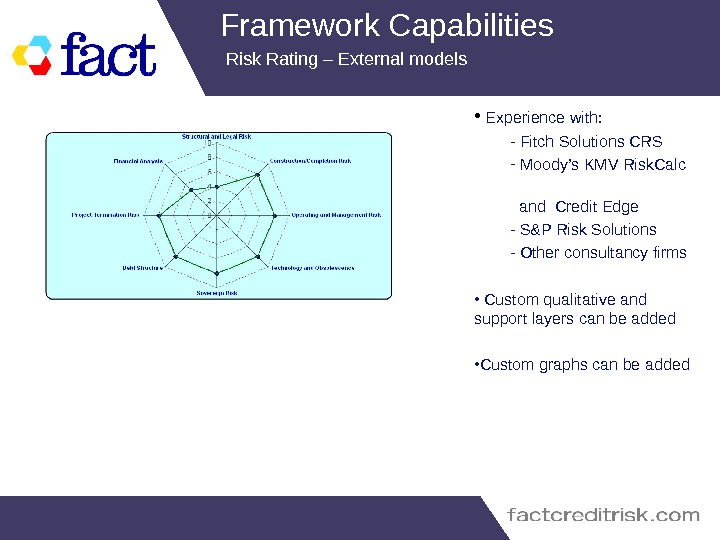

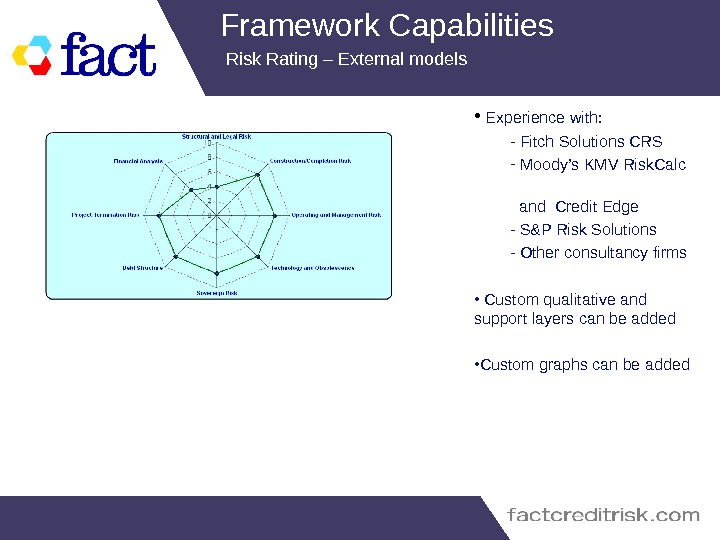

Framework Capabilities Risk Rating – External models • Experience with: — Fitch Solutions CRS — Moody’s KMV Risk. Calc and Credit Edge — S&P Risk Solutions — Other consultancy firms • Custom qualitative and support layers can be added • Custom graphs can be added

Framework Capabilities Risk Rating – External models • Experience with: — Fitch Solutions CRS — Moody’s KMV Risk. Calc and Credit Edge — S&P Risk Solutions — Other consultancy firms • Custom qualitative and support layers can be added • Custom graphs can be added

FACT – Loan Origination With the FACT workflow manager you can: Make the approval process more efficient by organising and tracking your tasks Organise independent processes in an integrated, dynamic, automated and secure fashion Optimise your administrative workflow Provide a full audit trail of all completed processes Set up automated alerts

FACT – Loan Origination With the FACT workflow manager you can: Make the approval process more efficient by organising and tracking your tasks Organise independent processes in an integrated, dynamic, automated and secure fashion Optimise your administrative workflow Provide a full audit trail of all completed processes Set up automated alerts

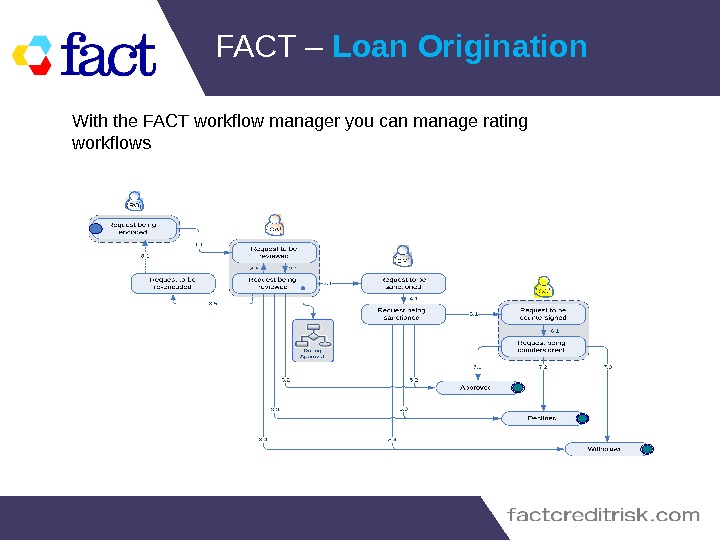

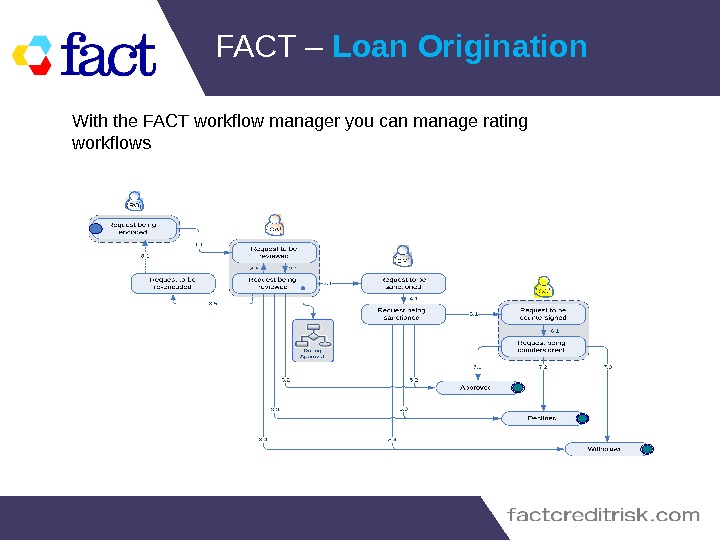

FACT – Loan Origination With the FACT workflow manager you can manage rating workflows

FACT – Loan Origination With the FACT workflow manager you can manage rating workflows

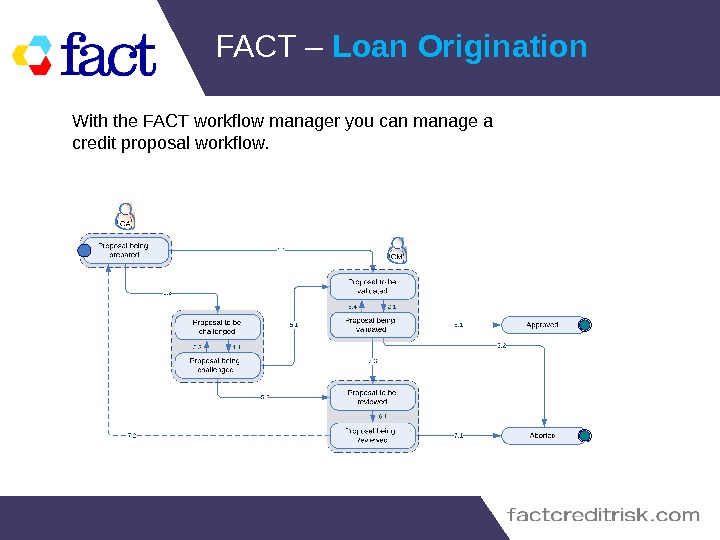

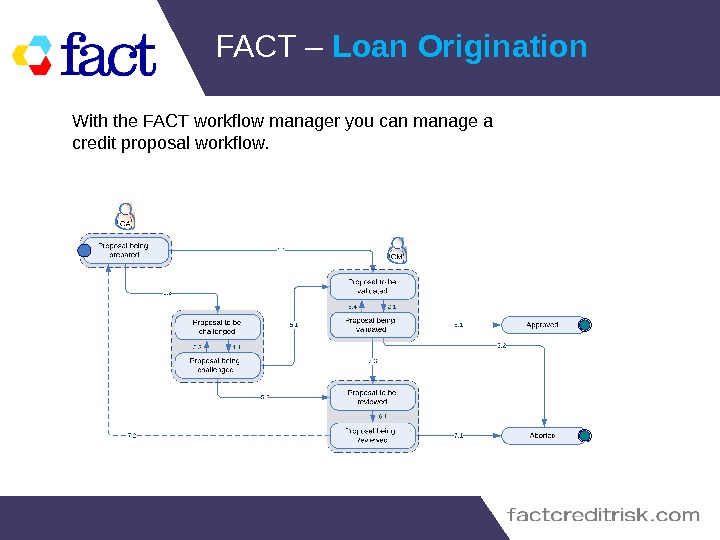

FACT – Loan Origination With the FACT workflow manager you can manage a credit proposal workflow.

FACT – Loan Origination With the FACT workflow manager you can manage a credit proposal workflow.

FACT – Loan Origination With the FACT workflow manager you can: workflow S we dbank. vsd

FACT – Loan Origination With the FACT workflow manager you can: workflow S we dbank. vsd

FACT Strengths • Creation of Customized reports • External and internal data and models can be easily integrated and personalised reports can be created, (configuration) • FACT – Login • FACT Corp • No bias towards any IP’s, rating agencies or models. • Scalable, secure and efficient (quick and intuitive e. g. fast search, easy to use with CRM and ERP)Docume nt Microsoft Office Word 97 —

FACT Strengths • Creation of Customized reports • External and internal data and models can be easily integrated and personalised reports can be created, (configuration) • FACT – Login • FACT Corp • No bias towards any IP’s, rating agencies or models. • Scalable, secure and efficient (quick and intuitive e. g. fast search, easy to use with CRM and ERP)Docume nt Microsoft Office Word 97 —

EDC Business case • Export Development Canada: • Best of every world: • Data from Bankscope and other provider (Bloomberg…) • Models from External Vendor • Platform FACT • Additional Info • Approval Workflows (credit limit, rating approval, transaction approvals etc. ) • 150 Users (Credit Analysts, Relationship Managers, Model developpers • Drivers: • Quality on quantity, number of transaction is average • Ability to reproduce and enhance the credit processes • Automation: Analysts must analyse, not Copy/Paste

EDC Business case • Export Development Canada: • Best of every world: • Data from Bankscope and other provider (Bloomberg…) • Models from External Vendor • Platform FACT • Additional Info • Approval Workflows (credit limit, rating approval, transaction approvals etc. ) • 150 Users (Credit Analysts, Relationship Managers, Model developpers • Drivers: • Quality on quantity, number of transaction is average • Ability to reproduce and enhance the credit processes • Automation: Analysts must analyse, not Copy/Paste

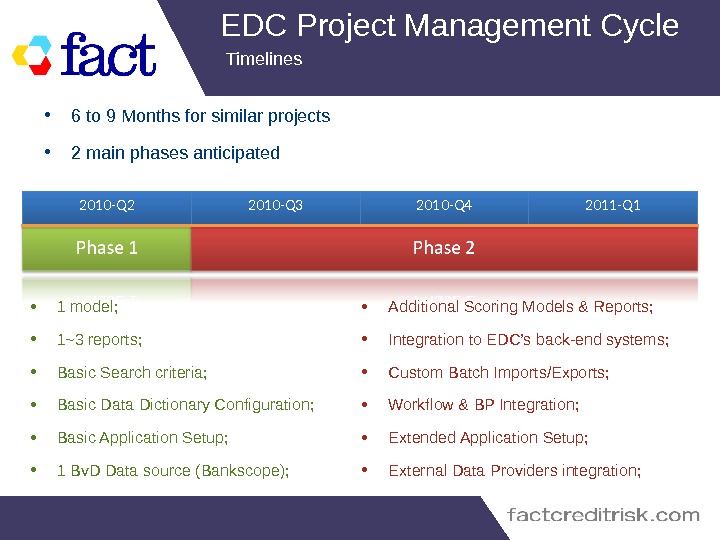

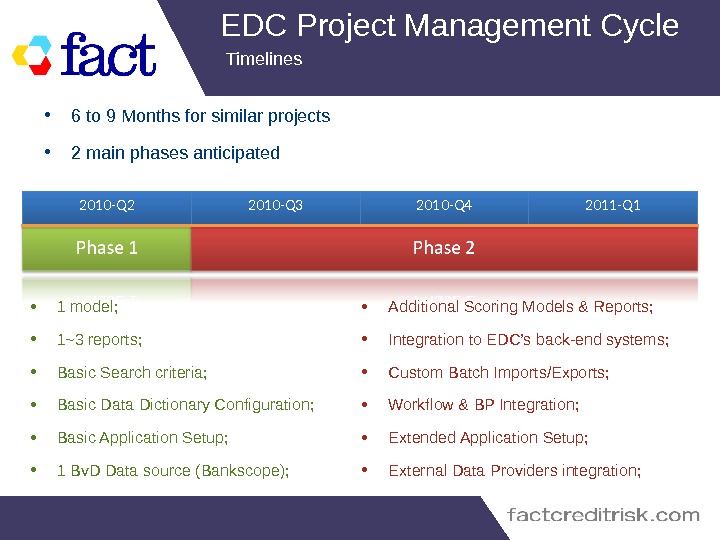

EDC Project Management Cycle Timelines • 6 to 9 Months for similar projects • 2 main phases anticipated 2010 -Q 2 2010 -Q 3 2010 -Q 4 2011 -Q 1 • 1 model; • 1~3 reports; • Basic Search criteria; • Basic Data Dictionary Configuration; • Basic Application Setup; • 1 Bv. D Data source (Bankscope); • Additional Scoring Models & Reports; • Integration to EDC’s back-end systems; • Custom Batch Imports/Exports; • Workflow & BP Integration; • Extended Application Setup; • External Data Providers integration;

EDC Project Management Cycle Timelines • 6 to 9 Months for similar projects • 2 main phases anticipated 2010 -Q 2 2010 -Q 3 2010 -Q 4 2011 -Q 1 • 1 model; • 1~3 reports; • Basic Search criteria; • Basic Data Dictionary Configuration; • Basic Application Setup; • 1 Bv. D Data source (Bankscope); • Additional Scoring Models & Reports; • Integration to EDC’s back-end systems; • Custom Batch Imports/Exports; • Workflow & BP Integration; • Extended Application Setup; • External Data Providers integration;

FACT USP’s • Open software architecture means internal developers can alter the platform to suit their needs, (customization) • External data and models can be easily integrated and personalised reports can be created, (configuration) • No bias towards any IP’s, rating agencies or models. • Scalable, secure and efficient (quick and intuitive e. g. fast search, easy to use with CRM and ERP)

FACT USP’s • Open software architecture means internal developers can alter the platform to suit their needs, (customization) • External data and models can be easily integrated and personalised reports can be created, (configuration) • No bias towards any IP’s, rating agencies or models. • Scalable, secure and efficient (quick and intuitive e. g. fast search, easy to use with CRM and ERP)

FACT : Customers Corporates who use FACT within their credit risk management : Banks who use FACT within their credit risk management :

FACT : Customers Corporates who use FACT within their credit risk management : Banks who use FACT within their credit risk management :