b73a3c3295ffd04a1999ccd7a23573f1.ppt

- Количество слайдов: 32

Building Your Own Best Business Model 2014 NDBA/SDBA National Convention Joseph H. Cady, CMC Managing Partner (858) 530 -8250 www. csconsultinggroup. com jcady@csconsultinggroup. com 1

Where We’ve Been Roaring 20’s Great Recession “New Normal” © CS Consulting Group LLC, All Rights Reserved. 2

Prolonged “New Normal” Environment Most banks: shifting customer needs; weak loan growth; low rates; increasing costs & regulations; strong competition; compressed margins; & reduced earnings But some banks have & continue to do well! How are they doing it? What about their business model? Lessons for the rest of us? © CS Consulting Group LLC, All Rights Reserved. 3

The Top of Mind Issue for C-level & BODs Today KPMG study: 90% of banks are re-evaluating their business models (BM) Next questions: What constitutes an effective BM in today’s environment? How do I get my bank there? © CS Consulting Group LLC, All Rights Reserved. 4

What is a Business Model & Why is it Important? Defined: How a bank creates, delivers & retains value Importance: Determines the way and how much money you make Components: – – – LOB segments & structure Customer acquisition methods Customer interactions Internal structure & performance Delivery channels © CS Consulting Group LLC, All Rights Reserved. 5

The Best Business Models: Unique Study Aims Examine those top banks that have continued to succeed, despite tough climate & peers failing ID effective BMs in today’s environment: commonalities & differences Can the best be emulated? Lessons for your bank (Copy of study results are available upon request) © CS Consulting Group LLC, All Rights Reserved. 6

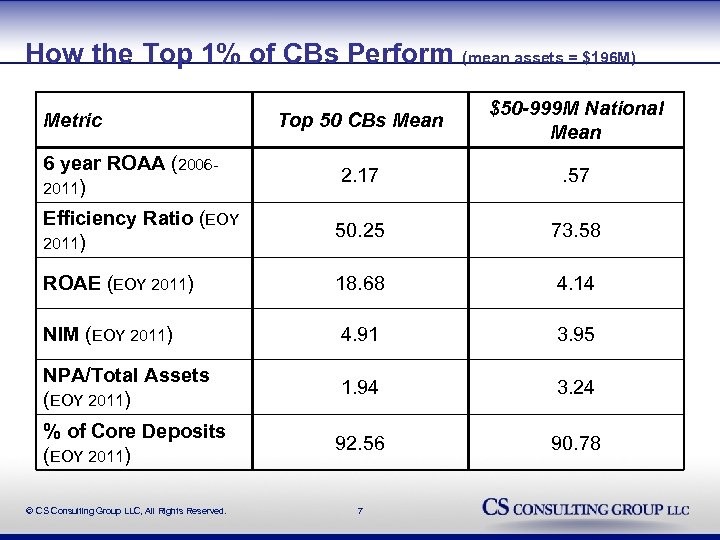

How the Top 1% of CBs Perform (mean assets = $196 M) Top 50 CBs Mean $50 -999 M National Mean 6 year ROAA (20062011) 2. 17 . 57 Efficiency Ratio (EOY 2011) 50. 25 73. 58 ROAE (EOY 2011) 18. 68 4. 14 NIM (EOY 2011) 4. 91 3. 95 NPA/Total Assets (EOY 2011) 1. 94 3. 24 % of Core Deposits (EOY 2011) 92. 56 90. 78 Metric © CS Consulting Group LLC, All Rights Reserved. 7

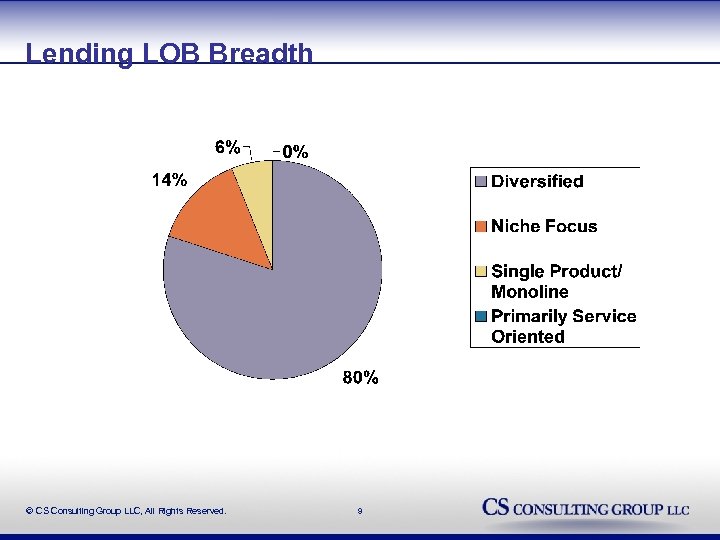

Key Findings: One or Many Business Models? Traditional – – community banking is alive & well! (80%) Business & retail operations Serving local communities; rural & some urban; many 100+ years old Standard products & services Strong referral networks Niche players in urban areas also prosper (20%) – Niches include CRE, mortgage, ag, & asset based lending – Local, regional, & national focus © CS Consulting Group LLC, All Rights Reserved. 8

Lending LOB Breadth © CS Consulting Group LLC, All Rights Reserved. 9

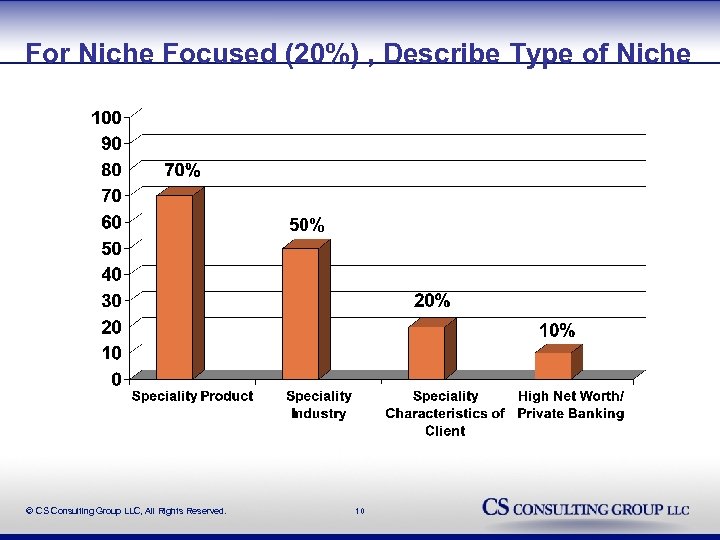

For Niche Focused (20%) , Describe Type of Niche 50% © CS Consulting Group LLC, All Rights Reserved. 10

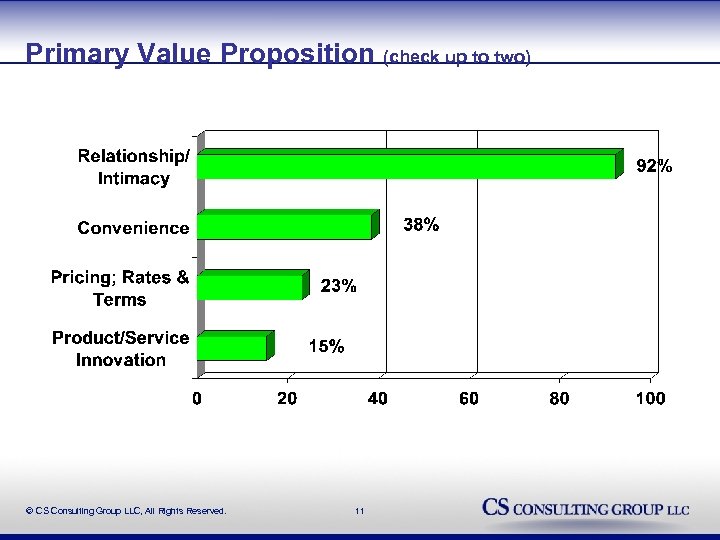

Primary Value Proposition (check up to two) © CS Consulting Group LLC, All Rights Reserved. 11

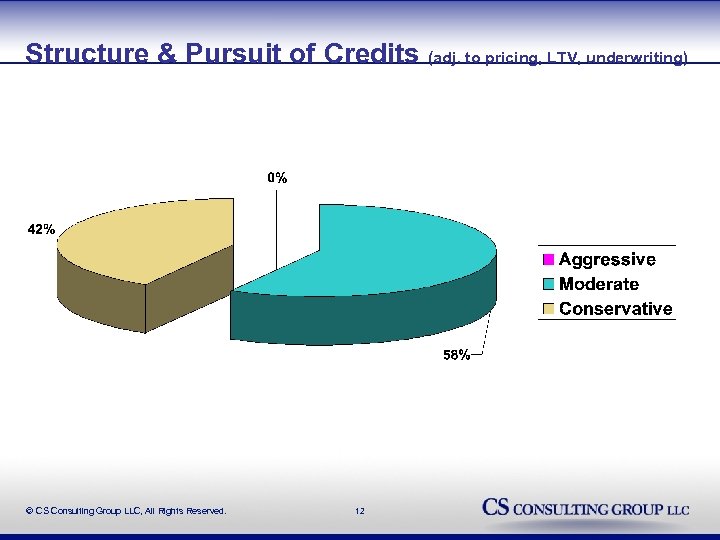

Structure & Pursuit of Credits (adj. to pricing, LTV, underwriting) © CS Consulting Group LLC, All Rights Reserved. 12

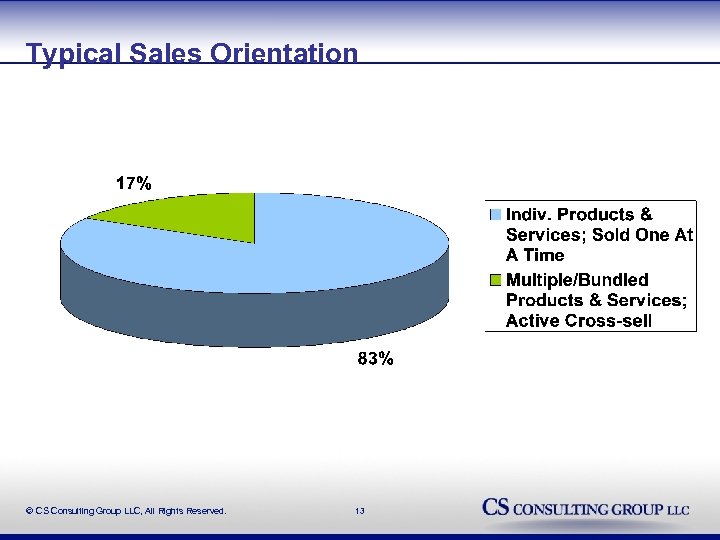

Typical Sales Orientation © CS Consulting Group LLC, All Rights Reserved. 13

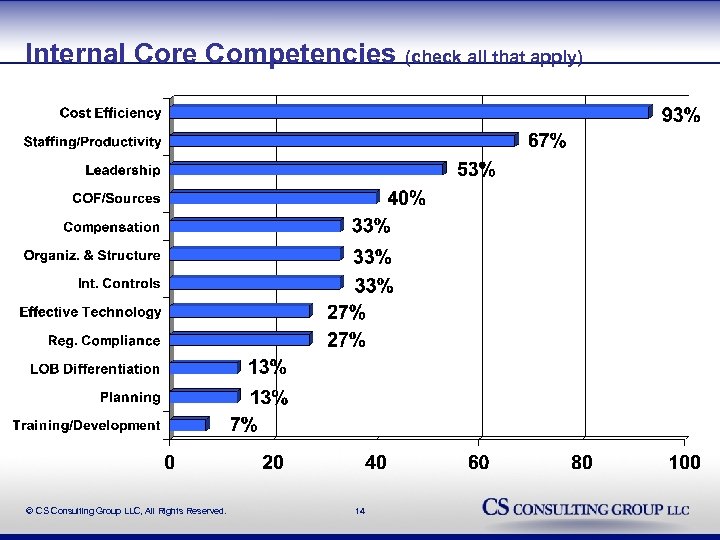

Internal Core Competencies (check all that apply) © CS Consulting Group LLC, All Rights Reserved. 14

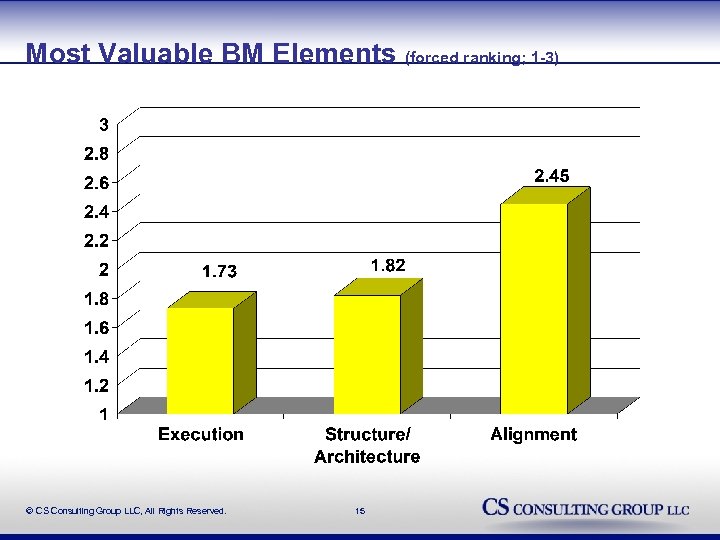

Most Valuable BM Elements (forced ranking; 1 -3) © CS Consulting Group LLC, All Rights Reserved. 15

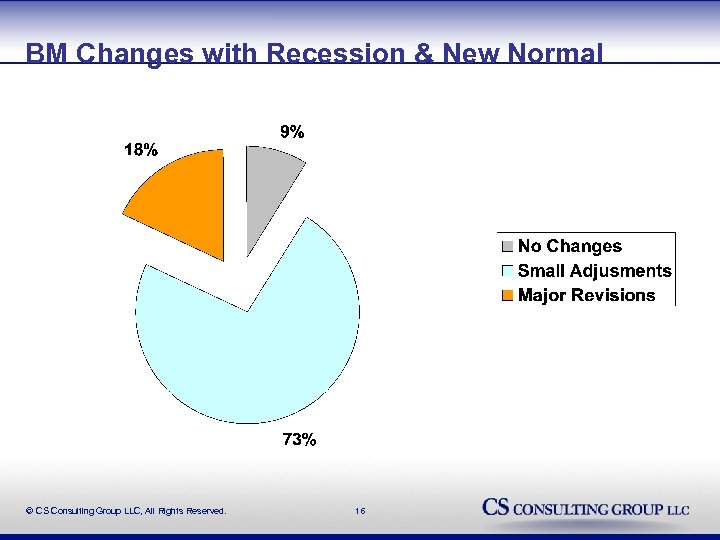

BM Changes with Recession & New Normal © CS Consulting Group LLC, All Rights Reserved. 16

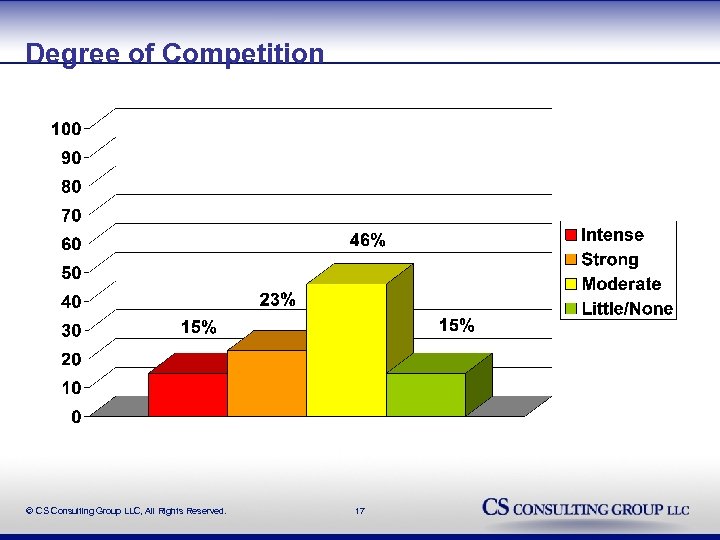

Degree of Competition © CS Consulting Group LLC, All Rights Reserved. 17

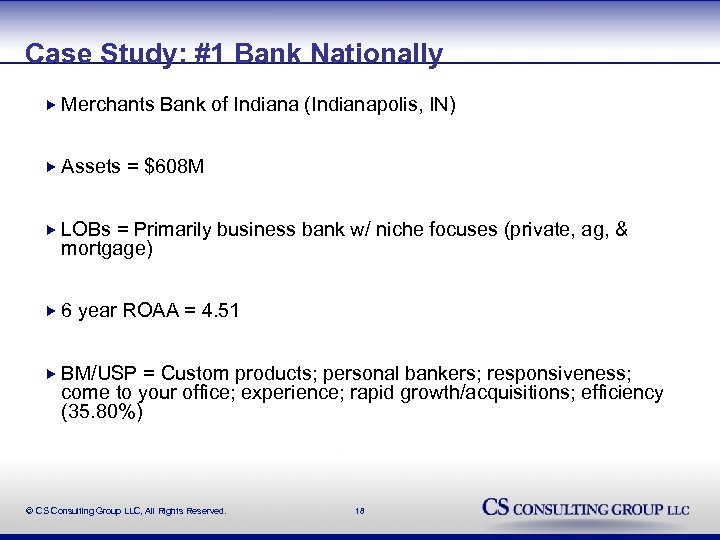

Case Study: #1 Bank Nationally Merchants Assets Bank of Indiana (Indianapolis, IN) = $608 M LOBs = Primarily business bank w/ niche focuses (private, ag, & mortgage) 6 year ROAA = 4. 51 BM/USP = Custom products; personal bankers; responsiveness; come to your office; experience; rapid growth/acquisitions; efficiency (35. 80%) © CS Consulting Group LLC, All Rights Reserved. 18

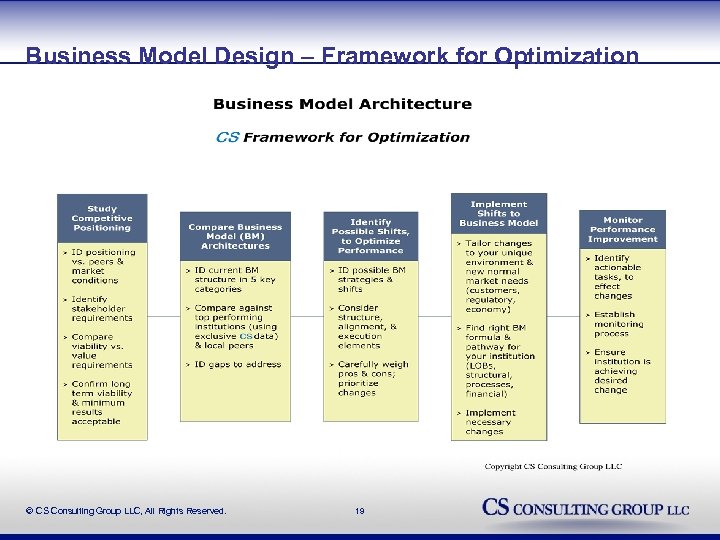

Business Model Design – Framework for Optimization © CS Consulting Group LLC, All Rights Reserved. 19

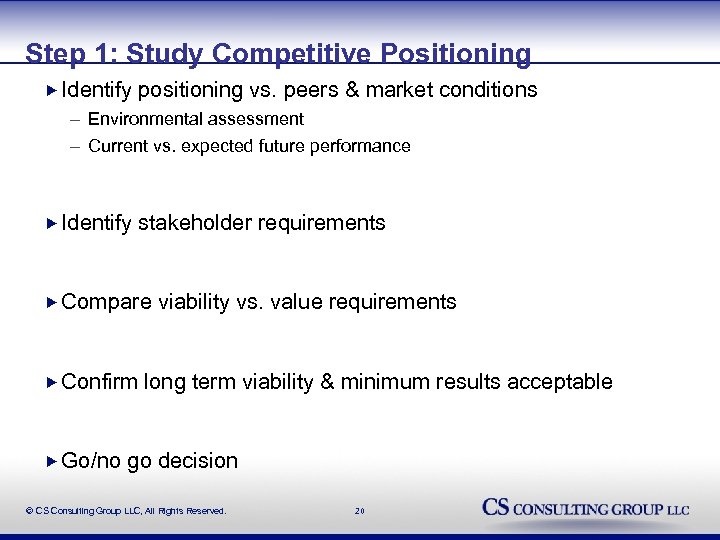

Step 1: Study Competitive Positioning Identify positioning vs. peers & market conditions – Environmental assessment – Current vs. expected future performance Identify stakeholder requirements Compare Confirm Go/no viability vs. value requirements long term viability & minimum results acceptable go decision © CS Consulting Group LLC, All Rights Reserved. 20

Step 2: Compare Business Model Architectures Identify your current BM structure in 5 key categories – Map it! Compare against top performing institutions – See CS study data – Local peers (similar size & LOB market) Identify gaps to address – Running vs. changing vs. reimagining your bank © CS Consulting Group LLC, All Rights Reserved. 21

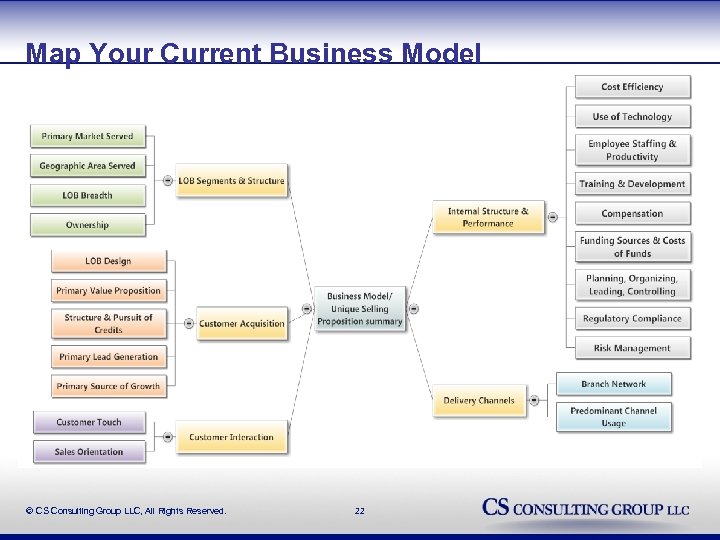

Map Your Current Business Model © CS Consulting Group LLC, All Rights Reserved. 22

Step 2: Compare Business Model Architectures Identify your current BM structure in 5 key categories – Map it! Compare against top performing institutions – See CS study data – Local peers (similar size & LOB market) Identify gaps to address – Running vs. changing vs. reimagining your bank – Bank of the future: What do my customers want? © CS Consulting Group LLC, All Rights Reserved. 23

What’s Important for Being the Best Customer Highly Best closeness; going the extra mile (key performance driver) efficient & productive (key performance driver) at your niche Strong Avoid leadership; passion intense competition Control asset quality Strong margins Strong referral network © CS Consulting Group LLC, All Rights Reserved. 24

![What’s Not So Important Lowest loan rates & best terms (price leader) [Deloitte study] What’s Not So Important Lowest loan rates & best terms (price leader) [Deloitte study]](https://present5.com/presentation/b73a3c3295ffd04a1999ccd7a23573f1/image-25.jpg)

What’s Not So Important Lowest loan rates & best terms (price leader) [Deloitte study] Aggressive Most M structure & pursuit of credits convenient & A; external growth Retail/consumer Custom bank in urban areas products & services; multiple/bundled Extensive staff training & development Employee stock ownership Frequent, significant shifts to business model © CS Consulting Group LLC, All Rights Reserved. 25

Step 3: Identify Possible Shifts, to Optimize Performance Identify possible business model strategies & shifts Consider structure, alignment, & execution elements Carefully weigh pros & cons; prioritize changes Reconcile LOBs vs. customer requirements vs. core competencies – Produce value? – Avoid complacency – Substitution risk? Internal or outsourcing/partnering functions © CS Consulting Group LLC, All Rights Reserved. 26

Step 4: Implement Shifts to Business Model Tailor changes to your unique environment & new normal market needs (customers, regulatory, economy) Find – – right BM formula & pathway for your institution LOBs Structural Processes & systems Financial Implement necessary changes – Map it! © CS Consulting Group LLC, All Rights Reserved. 27

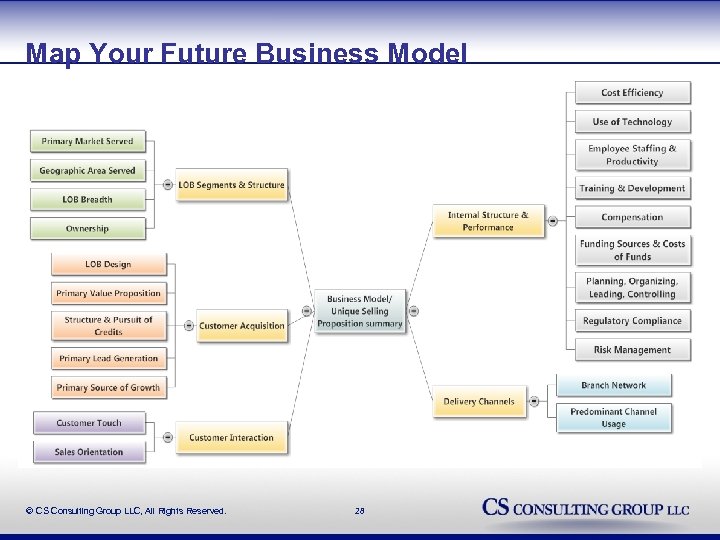

Map Your Future Business Model © CS Consulting Group LLC, All Rights Reserved. 28

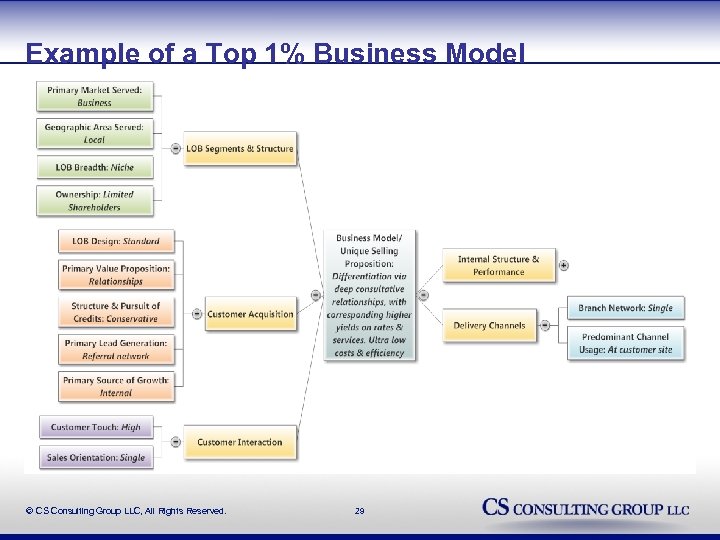

Example of a Top 1% Business Model © CS Consulting Group LLC, All Rights Reserved. 29

Step 5: Monitor Performance Improvement Identify actionable tasks, to effect changes Establish Ensure monitoring process institution is achieving desired change © CS Consulting Group LLC, All Rights Reserved. 30

Final Considerations Not final word on business models Must No tailor solutions (e. g. , relationships or niche focus) magical solutions or reinvention or one BM fits all Use 5 step process to build your own best business model Easy work now done (cost cutting, LOB shifts) Tough work now ahead: Being a more effective competitor Benefits Which of being the best; and costs of being ordinary path for your bank? © CS Consulting Group LLC, All Rights Reserved. 31

For More Information… Joseph Cady CS Consulting Group LLC (858) 530 -8250 jcady@csconsultinggroup. com www. CSConsulting. Group. com © CS Consulting Group LLC, All Rights Reserved. 32

b73a3c3295ffd04a1999ccd7a23573f1.ppt