3805398114a6245a045b0108288cc68c.ppt

- Количество слайдов: 24

Building taxpayer cultures in Mozambique, Tanzania and Zambia: Achievements, challenges and recommendations for Norwegian support Odd-Helge Fjeldstad & Kari Heggstad Chr. Michelsen Institute & International Centre for Tax and Development www. cmi. no Lusaka, 19 April 2011 1

Purposes of the study: (1) Examine strategies and measures on how to build taxpayer cultures through constructive engagement between governments and citizens over tax issues in Mozambique, Tanzania and Zambia (2) Advice Norwegian authorities on how this knowledge can be translated into practical, effective and concrete development policies

Outline of the report: 1. Introduction 2. Conceptual framework 3. Tax policy: clarification, simplification and fairness 4. Tax administration: facilitating, monitoring and improving compliance 5. Interventions outside the tax system 6. Recommendations for Norwegian support 7. Concluding remarks

Factors influencing citizens’ tax behavior 1. Opportunities 2. Deterrence 3. 4. 5. • • • Perceived probability of detection and size of sanctions Affordability ‘Tax burden’ Compliance costs Benefits of registering as taxpayer Perceptions of the tax system’s fairness Provision of services in return for taxes paid Practises/procedures for revenue collection Others’ tax behaviour Tax moral Personal norms Social norms

“In a society where tax morale is high, there are low levels of tax evasion and avoidance. It is only in a social culture where citizens generally appreciate their responsibility for sustaining state services and where they have a trust in their state institutions and leaders that a tax moral evolves” ADB (2010: 6) Rwanda Case Study

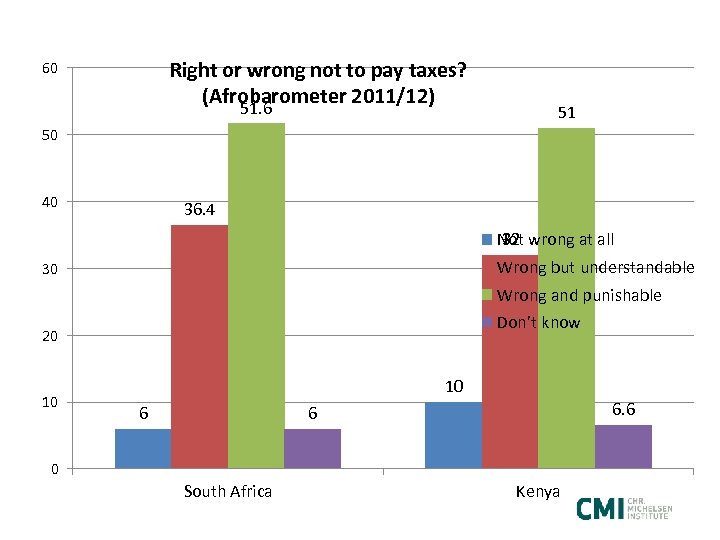

Right or wrong not to pay taxes? (Afrobarometer 2011/12) 51. 6 60 51 50 40 36. 4 32 Not wrong at all Wrong but understandable 30 Wrong and punishable Don’t know 20 10 10 6 6 0 South Africa Kenya

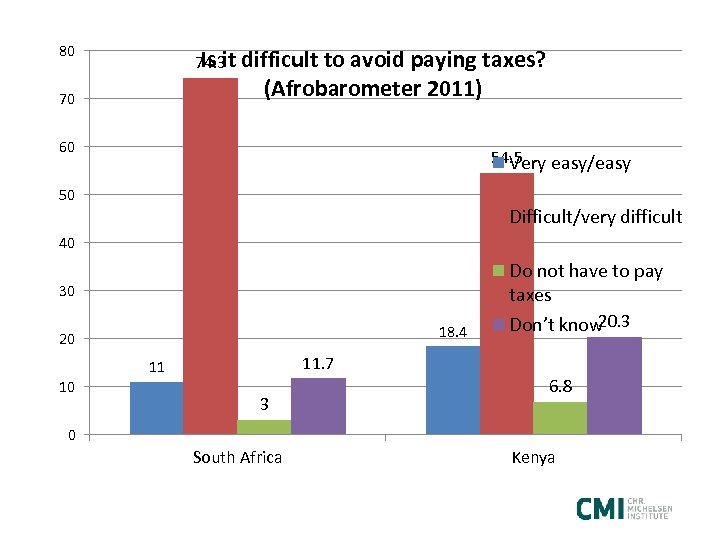

80 Is it difficult to avoid paying taxes? 74. 3 (Afrobarometer 2011) 70 60 54. 5 Very easy/easy 50 Difficult/very difficult 40 30 18. 4 20 11. 7 11 10 Do not have to pay taxes 20. 3 Don’t know 3 6. 8 0 South Africa Kenya

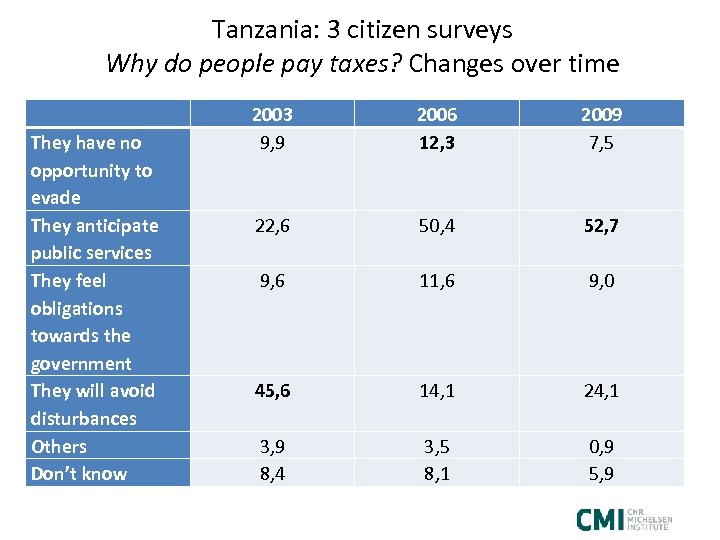

Tanzania: 3 citizen surveys Why do people pay taxes? Changes over time They have no opportunity to evade They anticipate Why do people pay taxes? public services They feel obligations towards the government They will avoid disturbances Others Don’t know 2003 9, 9 2006 12, 3 2009 7, 5 22, 6 50, 4 52, 7 9, 6 11, 6 9, 0 45, 6 14, 1 24, 1 3, 9 8, 4 3, 5 8, 1 0, 9 5, 9

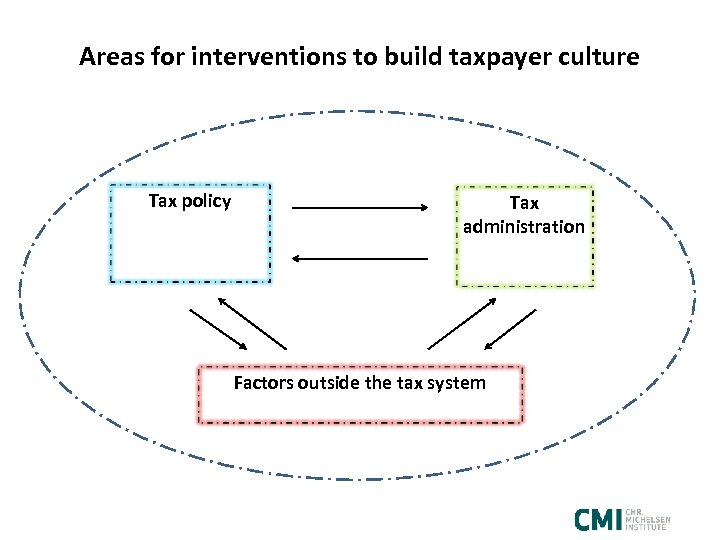

Areas for interventions to build taxpayer culture Tax policy Tax administration Factors outside the tax system

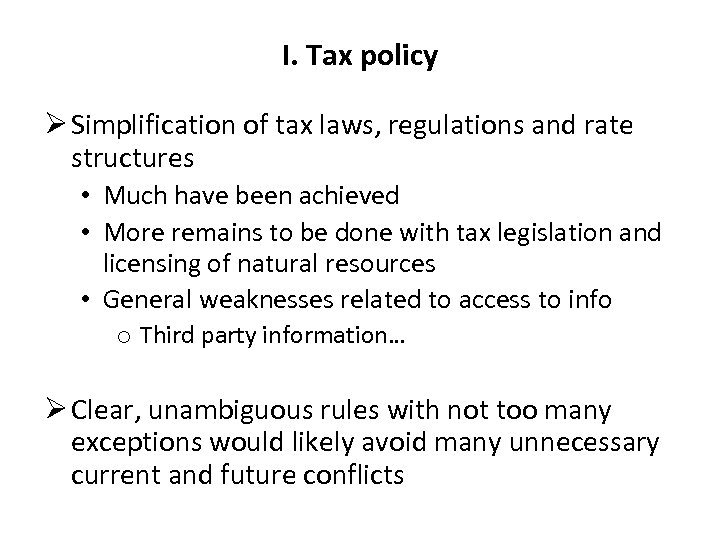

I. Tax policy Ø Simplification of tax laws, regulations and rate structures • Much have been achieved • More remains to be done with tax legislation and licensing of natural resources • General weaknesses related to access to info o Third party information… Ø Clear, unambiguous rules with not too many exceptions would likely avoid many unnecessary current and future conflicts

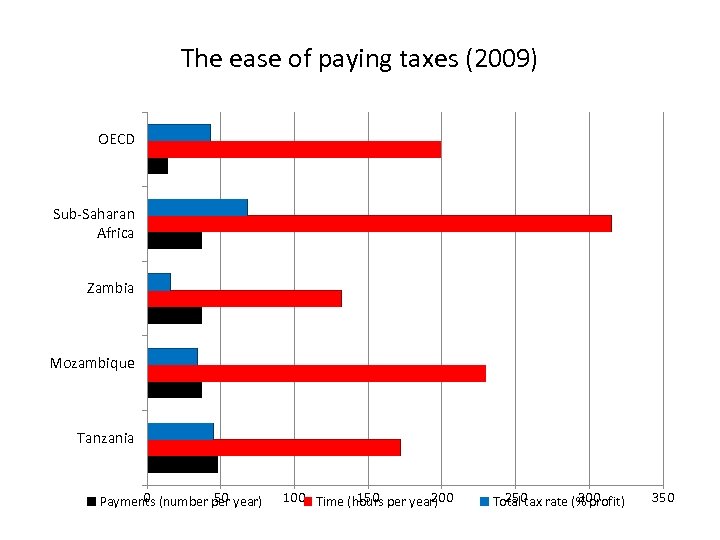

The ease of paying taxes (2009) OECD Sub-Saharan Africa Zambia Mozambique Tanzania 0 50 Payments (number per year) 100 Time (hours per year) 150 200 250 300 Total tax rate (% profit) 350

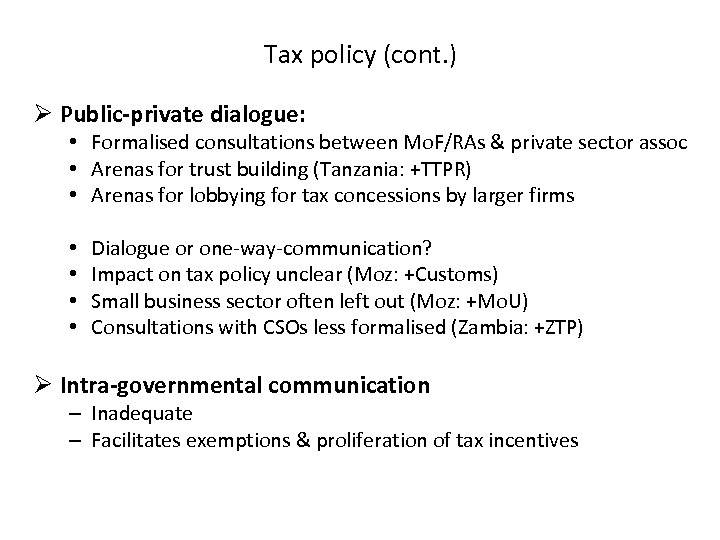

Tax policy (cont. ) Ø Public-private dialogue: • Formalised consultations between Mo. F/RAs & private sector assoc • Arenas for trust building (Tanzania: +TTPR) • Arenas for lobbying for tax concessions by larger firms • • Dialogue or one-way-communication? Impact on tax policy unclear (Moz: +Customs) Small business sector often left out (Moz: +Mo. U) Consultations with CSOs less formalised (Zambia: +ZTP) Ø Intra-governmental communication – Inadequate – Facilitates exemptions & proliferation of tax incentives

Tax policy (cont. ) Ø Extensive tax exemptions • • • Lost revenues Creates room for bribery and corruption Increases loopholes for tax evasion Distorts competition Donors: Preaching tax moral, but practicing tax avoidance… Ø Perceptions of an unfair tax system Ø Difficult to build a taxpaying culture characterised by broad-based voluntary compliance without substantial reforms of the exemption and tax incentive regime

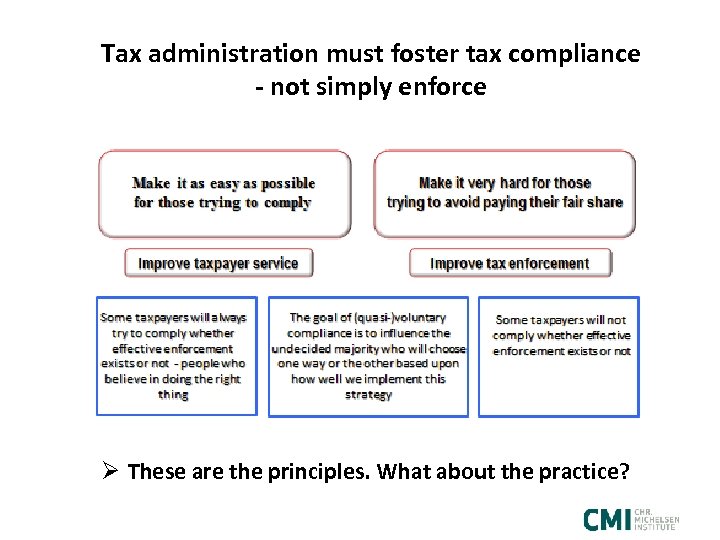

Tax administration must foster tax compliance - not simply enforce Ø These are the principles. What about the practice?

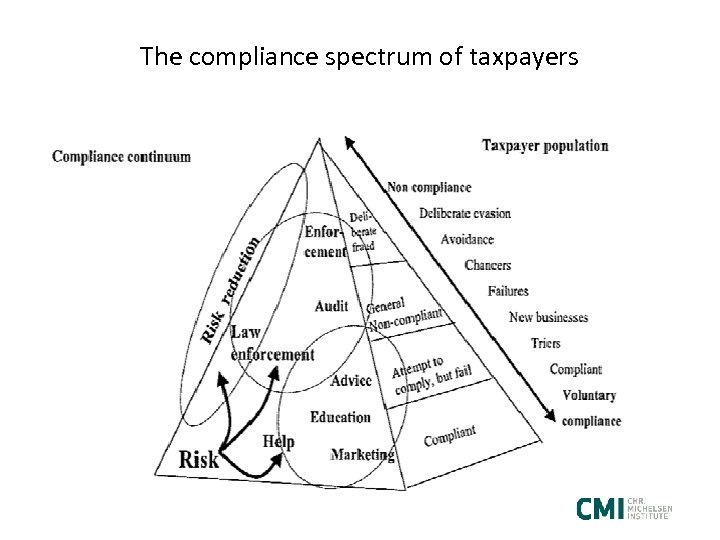

The compliance spectrum of taxpayers

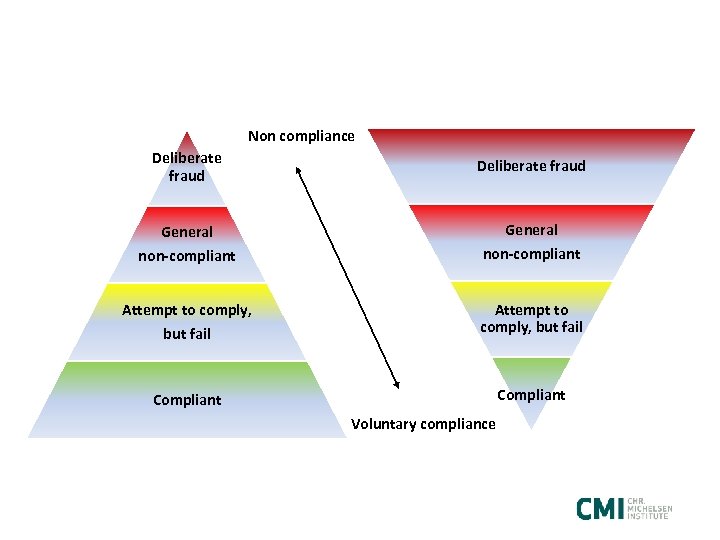

Non compliance Deliberate fraud General non-compliant Attempt to comply, but fail Attempt to comply, but fail Compliant Voluntary compliance

Tax administration (cont. ) Ø Taxpayer education and outreach • No uniform strategy • Tailored to the specific segment of taxpayers • Meet (potential) taxpayers where they are and in ways they understand • SMEs regard their knowledge of the tax system as ‘poor’ • Educate future generations of taxpayers: ‘Tax clubs’

Tax administration (cont. ) Ø Taxpayer services • Reducing compliance costs • Simplifying registration, procedures and processes • Kenya: Single Business Permit (SMP) • Tanzania: Block Management System (BMS) v. Capturing new taxpayers and evaders • Integrated approach to taxpayer services (SARS) v. Segmentation v. Risk based processing v. Introduction of electronic and self-service channels v. Simplification of tax forms v. Single forms

Tax administration (cont. ) Ø Deterrence and enforcement • Reasons to question the credibility of the enforcement mechanisms • Risk management generally not focused • Inadequate access to data and weak integration of data from multiple source, incl. with ICT-systems in other parts of public sector • Highly skilled officers in areas such as ICT, accounting, auditing, and legal issues in short supply • Tax appeals boards and tax tribunals costly and inefficient • Transparent procedures to address tax disputes required • Integrity: Still challenges

Interventions outside the tax system Ø Linking tax and expenditures • Efforts to broaden the tax base intimately connected to public service delivery • The social fiscal contract • Earmarking of taxes in a second best world… v. Strategy to build trust & public engagement around tax Ø Create broader citizen engagement around tax and public expenditures • Knowledge based engagement by CSOs

Are Norwegian tax experiences relevant? Yes and no • Clear, unambiguous rules with not too many exceptions • Petroleum tax regime • • Advanced use of data and statistics Online tax services and information to taxpayers Large parts of tax returns delivered electronically Third-party information • Use of media • Clear connection between tax payment and public services

Some recommendations for Norwegian support to building taxpaying culture: Do they make sense in accordance to your needs? 1. Support to strengthening tax policy making • • • TA to PADs in Mo. Finance (collaboration with IMF’s RTAC) Advisory, training and research support to MPs (ZEA, NCA, PWYP, RAs) Document the costs of tax exemptions 2. Support to tax administration • Continue building expertise on specialised tax audit functions • Strengthen research & analytical capacity of the RAs (ICTD, ATAF, ATI) 3. Support to create broader citizen engagement around taxation • • More emphasis on the ‘demand side’ to strengthen citizen engagement A broader approach than natural resource taxation (ZTP) Build local research capacity (AERC, domestic research institutions) Inspire students to focus on tax topics 4. A general warning • Avoid unhealthy ‘competition’ among different aid and development agencies • Donor coordination and cooperation should be emphasised

Asante sana! Muito obrigado! THANK YOU FOR YOUR ATTENTION!

3805398114a6245a045b0108288cc68c.ppt