bf22e5d26a18cdd1bcd79a190ac9b86b.ppt

- Количество слайдов: 27

Building Financial Systems for the Poor

GLOBAL TRENDS IN MICROFINANCE: COMMERCIALIZATION AND FOREIGN INVESTMENT Baku, Azerbaijan May 27, 2006 Olga Tomilova, CGAP-MFC Central Asia Microfinance Center 2

CGAP – Consultative Group to Assist the Poor l Microfinance Consortium of 31 public and private development agencies working together to expand access to financial services for the poor in developing countries. l Resource center and standard setting body for the entire microfinance industry. l CGAP serves four groups of clients: l development agencies, l financial institutions including microfinance institutions (MFIs), l government policymakers and regulators, and l other service providers, such as auditors and rating agencies. l Specialized services: advisory services, training, research and development, consensus building on standards, and information dissemination. 3

MF and Access to Finance MF has made a relatively rapid impact, has achieved significant outreach, and can become sustainable within relatively short period of time Access to finance enhances growth and helps reduce poverty MF is now a real industry BUT: Big differences between regions (LAC, SA, ECA, MENA), and between countries 2 billion people still lack access to formal financial services 4

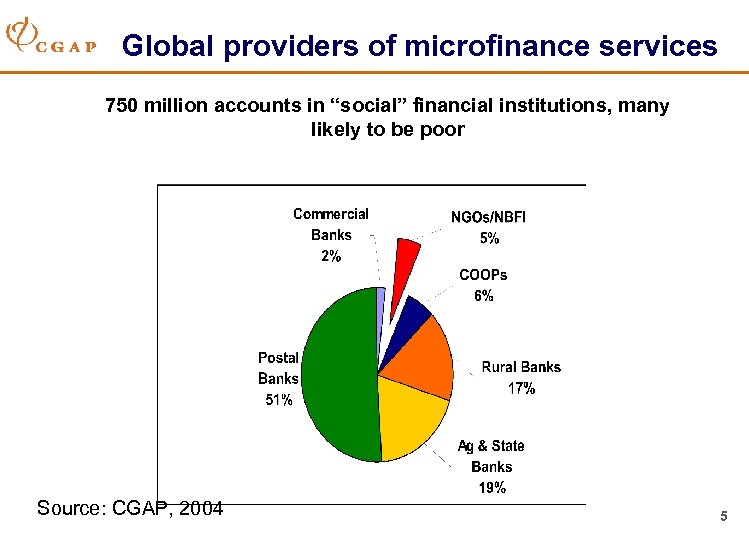

Global providers of microfinance services 750 million accounts in “social” financial institutions, many likely to be poor Source: CGAP, 2004 5

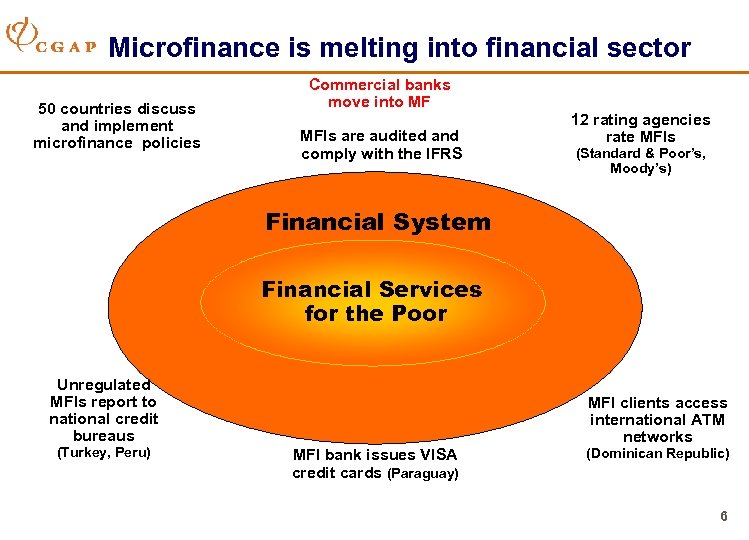

Microfinance is melting into financial sector 50 countries discuss and implement microfinance policies Commercial banks move into MF MFIs are audited and comply with the IFRS 12 rating agencies rate MFIs (Standard & Poor’s, Moody’s) Financial System Financial Services Microfinance for the Poor Unregulated MFIs report to national credit bureaus (Turkey, Peru) MFI clients access international ATM networks MFI bank issues VISA credit cards (Paraguay) (Dominican Republic) 6

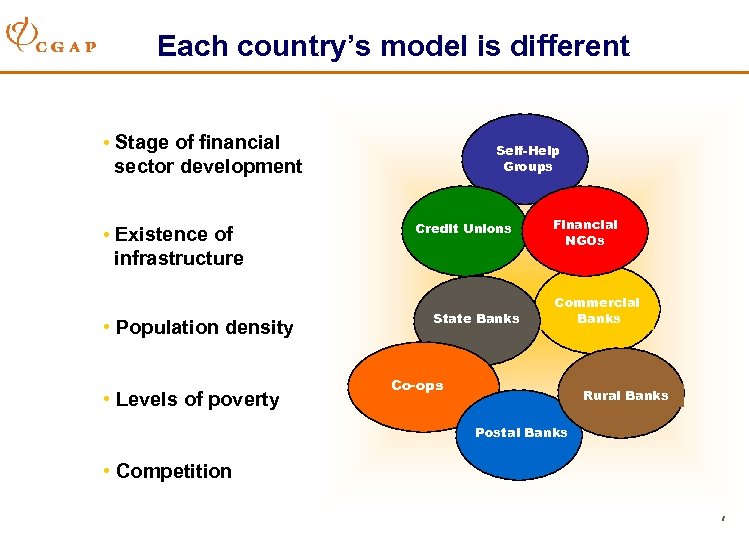

Each country’s model is different • Stage of financial Self-Help Groups sector development • Existence of Credit Unions infrastructure • Population density • Levels of poverty State Banks Financial NGOs Commercial Banks Co-ops Rural Banks Postal Banks • Competition 7

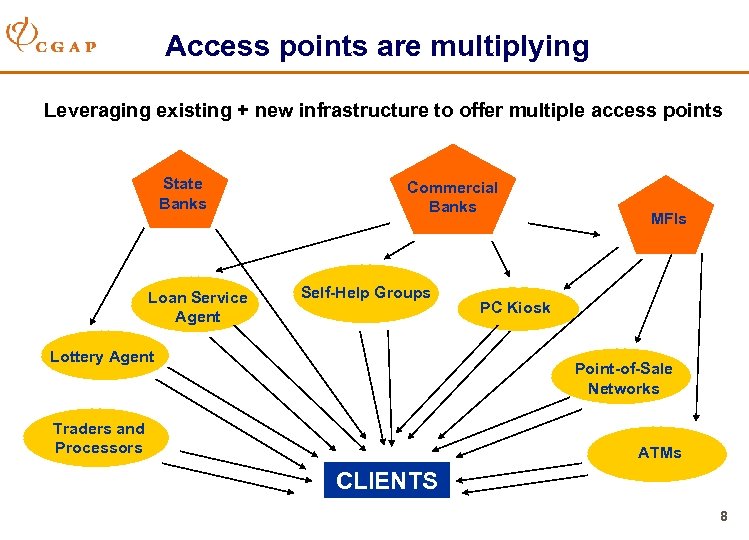

Access points are multiplying Leveraging existing + new infrastructure to offer multiple access points State Banks Loan Service Agent Commercial Banks Self-Help Groups Lottery Agent MFIs PC Kiosk Point-of-Sale Networks Traders and Processors ATMs CLIENTS 8

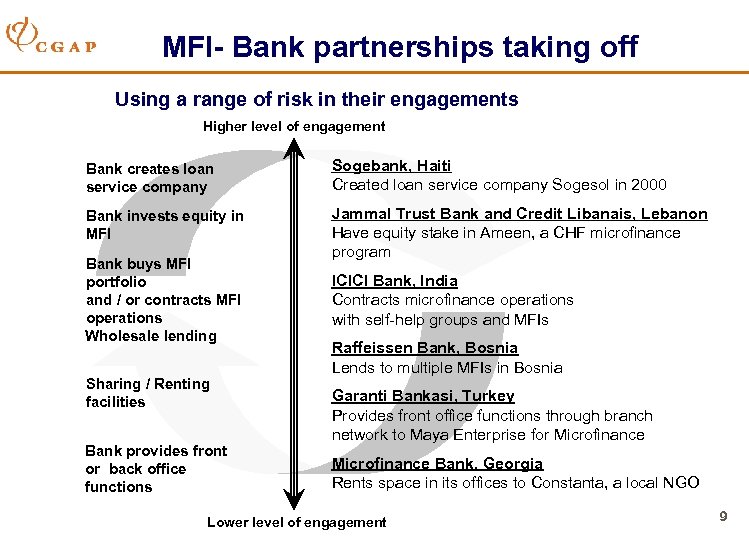

MFI- Bank partnerships taking off Using a range of risk in their engagements Higher level of engagement Bank creates loan service company Sogebank, Haiti Created loan service company Sogesol in 2000 Bank invests equity in MFI Jammal Trust Bank and Credit Libanais, Lebanon Have equity stake in Ameen, a CHF microfinance program Bank buys MFI portfolio and / or contracts MFI operations Wholesale lending Sharing / Renting facilities Bank provides front or back office functions ICICI Bank, India Contracts microfinance operations with self-help groups and MFIs Raffeissen Bank, Bosnia Lends to multiple MFIs in Bosnia Garanti Bankasi, Turkey Provides front office functions through branch network to Maya Enterprise for Microfinance Bank, Georgia Rents space in its offices to Constanta, a local NGO Lower level of engagement 9

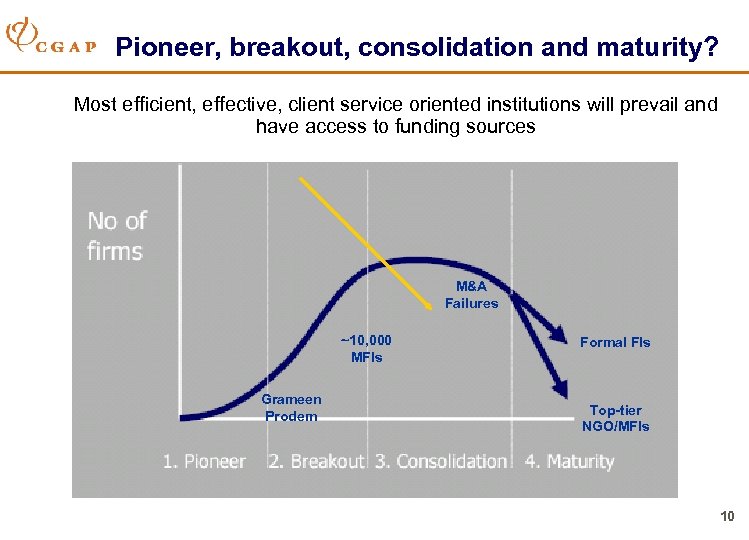

Pioneer, breakout, consolidation and maturity? Most efficient, effective, client service oriented institutions will prevail and have access to funding sources M&A Failures ~10, 000 MFIs Grameen Prodem Formal FIs Top-tier NGO/MFIs 10

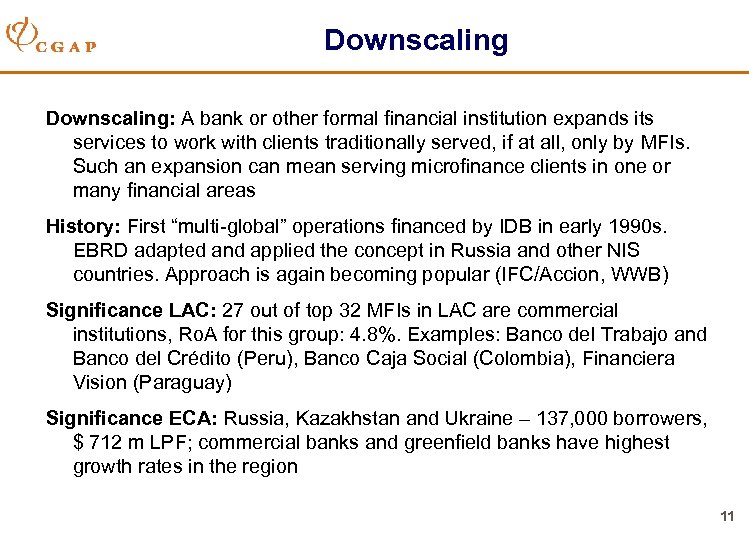

Downscaling: A bank or other formal financial institution expands its services to work with clients traditionally served, if at all, only by MFIs. Such an expansion can mean serving microfinance clients in one or many financial areas History: First “multi-global” operations financed by IDB in early 1990 s. EBRD adapted and applied the concept in Russia and other NIS countries. Approach is again becoming popular (IFC/Accion, WWB) Significance LAC: 27 out of top 32 MFIs in LAC are commercial institutions, Ro. A for this group: 4. 8%. Examples: Banco del Trabajo and Banco del Crédito (Peru), Banco Caja Social (Colombia), Financiera Vision (Paraguay) Significance ECA: Russia, Kazakhstan and Ukraine – 137, 000 borrowers, $ 712 m LPF; commercial banks and greenfield banks have highest growth rates in the region 11

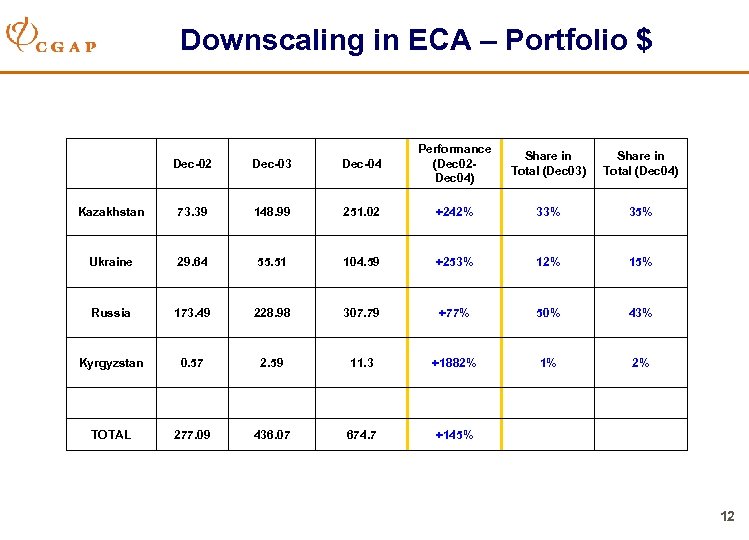

Downscaling in ECA – Portfolio $ Dec-02 Dec-03 Dec-04 Performance (Dec 02 Dec 04) Share in Total (Dec 03) Share in Total (Dec 04) Kazakhstan 73. 39 148. 99 251. 02 +242% 33% 35% Ukraine 29. 64 55. 51 104. 59 +253% 12% 15% Russia 173. 49 228. 98 307. 79 +77% 50% 43% Kyrgyzstan 0. 57 2. 59 11. 3 +1882% 1% 2% TOTAL 277. 09 436. 07 674. 7 +145% 12

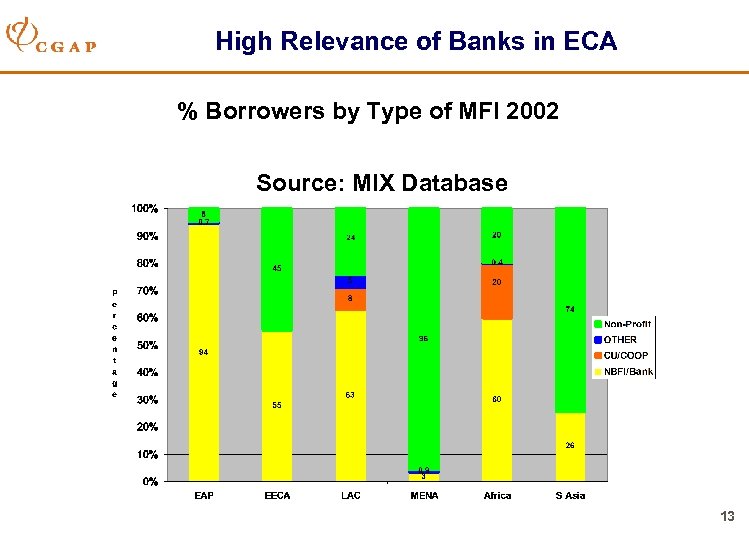

High Relevance of Banks in ECA % Borrowers by Type of MFI 2002 Source: MIX Database 13

Downscaling – Summary l Downscaling model is one (but increasingly important) element in sensible approach to access to finance l Secured lending and credit bureaus will make positive impact l Commercial banks unlikely to reach the poorest segments of potential retail customers l Commercial banks unlikely to solve rural finance dilemma l Other (complementary) approaches: -Greenfield banks -CUs -Upgrading NGOs -Linking (cooperation between MFIs and Banks) 14

Downscaling – Summary l Access to Finance and especially downscaling can and should be integral part of successful regional development strategy l. Government support is needed to ensure conducive environment for investment and growth of financial services industry l. Don’t subsidize interest rates, don’t cap interest rates l. Subsidize TA l. Don’t build monopolies, enhance competition 15

Predictions l. Multiplying points of service allows exponential growth l. Technology and infrastructure are key drivers to scale l. Commercial and state banks will become core providers l. Major consolidation of MFIs will occur through buy outs by banks, mergers, partnerships, and wind-downs l. Domestic sources of funds will become even more important (savings, commercial debt) l. Donors will focus on frontier markets (very poor and rural) 16

FOREIGN INVESTMENT IN MICROFINANCE 17

CGAP Foreign Investors Survey l Survey of 54 foreign microfinance investors conducted by CGAP, MIX and ADA (June – September 2004) l Purpose – ascertain legal structures, investment focus and history, availability of uncommitted funds, and financial performance l Data on “direct” investments in 505 MFIs and “indirect” investments in 25 MF funds l Amount of foreign investments (disbursed and committed): l $1. 2 billion – direct l $611 million - indirect 18

Where is the Foreign Investment Going? l Foreign investment in MFIs takes the form of: l Equity l Debt l Guarantees l Only regulated MFIs are legally structured to receive all three forms of investments – non-regulated cannot receive equity investments l Among 505 MFIs surveyed, 166, or 33% are regulated institutions l Heavy concentration of foreign investment in certain regions – 87% in Latin America and Eastern Europe/Central Asia 19

Where is the Foreign Investment Going? By instrument: l Debt – 69% l Equity – 24% l Guarantees – 8% l By legal status – 82% to regulated MFIs l By size of investment – 89% over $1 million l By suppliers – nearly half of all investment is provided by four IFIs: IFC, EBRD, Kf. W and USAID’s Development Credit Authority l Two thirds of investment is provided by 6 of 54 funds 20

Are Foreign Investments Competing to Find MFIs to Invest in? l Numerous anecdotal suggestions that investors are not finding it easy to place funds in MFIs that meet their standards l Tendency for multiple investors to invest in a single MFI – for example, 20 out 54 funded Banco Solidario (Ecuador), 15 funded Confianza (Peru), and 11 funded Fundacion Nieberowski (Nicaragua) l The reason is not small investment amounts, but rather excess of supply over demand from suitable MFIs, i. e. those that meet the investors’ quality and risk profile l Instances of a single investor funding the same institution through several indirect channels 21

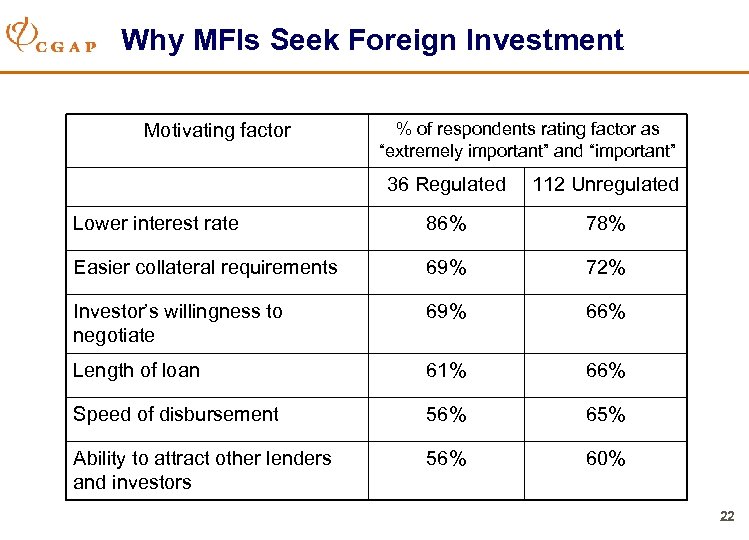

Why MFIs Seek Foreign Investment Motivating factor % of respondents rating factor as “extremely important” and “important” 36 Regulated 112 Unregulated Lower interest rate 86% 78% Easier collateral requirements 69% 72% Investor’s willingness to negotiate 69% 66% Length of loan 61% 66% Speed of disbursement 56% 65% Ability to attract other lenders and investors 56% 60% 22

Uncertain Demand for Equity – Regulated MFIs l Regulated MFIs will continue to seek more debt than equity from foreign sources: l High levels of equity capital greater interest in increasing liabilities l Most MFIs have lower levels of legally allowed leverage l Council of MF Equity Funds revealed that only 115 out of several thousands of MFIs would be candidates foreign equity investments, given their legal status, profitability and size l. Regulated MFIs are increasingly seeking domestic deposits to fund their liabilities 23

Uncertain Demand for Equity – Unregulated MFIs l. Unregulated MFIs – more numerous, but are not structured to take equity investments more likely to seek foreign debt than regulated MFIs: l Less access to domestic banks l Generally prohibited from taking deposits l Foreign lenders will be attractive if they would lend beyond 1 -to-1 debt-to-equity ratio and lower collateral requirements l Unregulated MFIs may have a relatively greater interest in foreign debt investment compared to regulated MFIs 24

Foreign Debt and Currency Risk l Most of MFI assets tend to be denominated in local currency creates foreign exchange risk if they borrow foreign currency loans l Local currency in many developing countries is more likely to devalue than to appreciate l 92% of debt issued to MFIs is in hard currency l Many MFIs are not alert to this issue – out of 105 MFIs surveyed, only 25 fully hedged their currency risk l In most developing countries, adequate hedging mechanisms are not available or too expensive 25

Conclusions: Practical Lessons l Foreign investors would add more value to the market if they were able to tolerate more risk, and thus work with less-well-established MFIs l Regulated MFIs should be helped to access more local funding use of guarantee mechanisms; improving credibility of MFIs with local funding sources l MFIs and investors need to be alert to the foreign exchange risk entailed by hard-currency loans 26

Building Financial Systems for the Poor Thank you! UNCDF

bf22e5d26a18cdd1bcd79a190ac9b86b.ppt