0cd86ecd1f4efcff02267fc1a77d45cc.ppt

- Количество слайдов: 9

Building a Strong Microfinance Team

Where Is Strong Teamwork Most Needed? • Client selection Ø Members of the team should share information they may know about loan applicants • Loan Collection Ø Teamwork in collecting from “hardened” delinquent borrowers is more effective • Product Development Ø Members of the team should regularly meet to discuss ways to make their product more competitive, and operations more efficient.

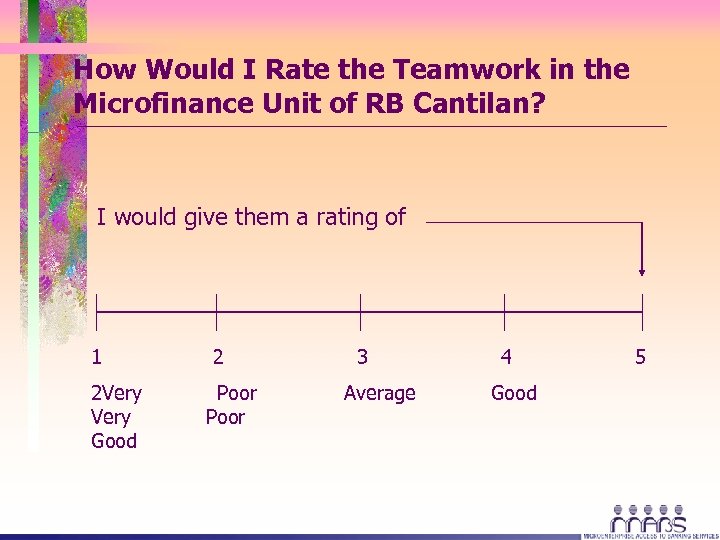

How Would I Rate the Teamwork in the Microfinance Unit of RB Cantilan? I would give them a rating of 1 2 Very Good 2 Poor 3 Average 4 Good 5

Why Do I Consider Teamwork Within the Microfinance Unit to be Very Good? • If an Account Officer has difficulty collecting from a hardened borrower, other members of the team immediately volunteer to accompany the concerned AO in collecting from the borrower, or to do the collection, themselves. • Before CIBI, all Account Officers meet to review the list of loan applicants and share information they may know about these applicants • When an Account Officer has difficulty completing all his/her tasks because of increasing workload, the team meets to brainstorm on how he/she can manage his/her time better.

What are the Results of Strong Teamwork Within the Microfinance Unit? • Loan delinquency, as measured by Portfolio At Risk (PAR), is very low (at most, 1% PAR). • Growth in loan portfolio and number of outstanding borrowers are impressive. The bank is the biggest microfinance player among MFIs providing loans to individual microenterprises in the areas where it operates • The bank was chosen by RBAP-MABS as its best performing bank among its 20 participating banks in the entire Mindanao

What Did We Do To Build Strong Teamwork Within the Microfinance Unit? 1. Strong, dynamic leadership at the top Ø Committed to microfinance, and fully supportive of the plans of the microfinance unit Ø Branch Managers also proactive in Microfinance 2. Clear and unified direction Ø Objectives of microfinance clearly understood; “buy-in” Ø Operational plan Ø Target-setting and evaluation 3. Careful screening of field and supervisory staff Ø Interested in serving the poorer sector, hardworking, and with good moral character Ø Field staff: mostly new graduates and new to banking

What Did We Do To Build Strong Teamwork Within the Microfinance Unit? 4. Paradigm shifting Ø Teamwork emphasized in the new culture (“best practices and zero tolerance”) that has been adopted by the bank 5. Staff training and motivation Ø Teamwork also emphasized always in all staff training activities Ø Most outstanding microfinance teams are held as models by everyone in the bank 6. Constant and open communications between MFU staff and management 7. Staff incentive scheme is also based on team performance

Strong, dynamic leadership at the top Clear and unified direction STRONG MF TEAM Careful screening of field & supervisory staff Paradigm Sifting

Okey pas Alright!!!! Salamat Karadjaw

0cd86ecd1f4efcff02267fc1a77d45cc.ppt