3c43b7441d1e180cebb6db7a5a2fc6f3.ppt

- Количество слайдов: 73

BUDGET 2016 Chua Tia Guan 25. 10. 2015

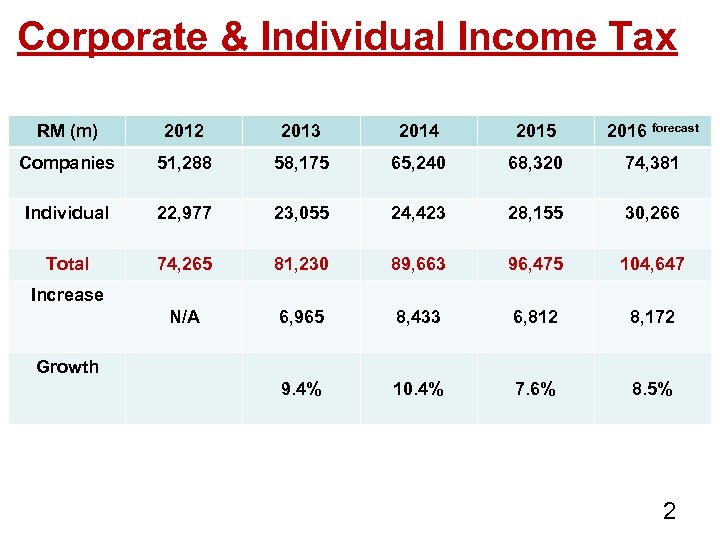

Corporate & Individual Income Tax RM (m) 2012 2013 2014 2015 2016 forecast Companies 51, 288 58, 175 65, 240 68, 320 74, 381 Individual 22, 977 23, 055 24, 423 28, 155 30, 266 Total 74, 265 81, 230 89, 663 96, 475 104, 647 N/A 6, 965 8, 433 6, 812 8, 172 9. 4% 10. 4% 7. 6% 8. 5% Increase Growth 2

Corporate & Individual Income Tax 3

Income tax changes affecting Companies

Tax incentives

Reinvestment allowance (RA) Current • 60% qualifying project for 15 years beginning from 1 st year RA claimed Proposed • Special RA for companies for 3 years after expiration of 15 years From Year of Assessment 2016 to 2018 6

Increased export allowance Current Exemption equivalent to • 10% value of increased exports with ≥ 30% value added • 15% value of increased exports with ≥ 50% value added Proposed For SME : • 10% value of increased exports with ≤ 20% value added • 15% value of increased exports with ≤ 40% value added From year of assessment 2016 to 2018 7

R&D project Current • Double deduction on R&D expenditure subject to IRB approval Proposed • SME – double deduction up to RM 50, 000 per year without approval requirement From year of assessment 2016 to 2018 8

Food production projects Current • Vegetables, fruits, kenaf, herbs, spices, cows, buffaloes, goat, sheep, acquaculture , deep sea fishing • Investment in subsidiary is given a tax deduction • New - 100% income tax exemption for 10 years • Expansion - 100% income tax exemption for 5 years 9

Food production projects Proposed • Extension of 5 years • Scope widen to include planting of coconuts, mushrooms & cash crops, rearing of deer, seaweed cultivation, rearing of honey, animal feed crops From 1 Jan 2016 to 31 Dec 2020 10

Tour operating companies Current • 100% income tax exemption for tour packages within Malaysia by ≥ 1, 500 local tourists per year • 100% income tax exemption for tour packages to Malaysia by ≥ 750 inbound tourists per year Proposed • Extension of 3 years From year of assessment 2016 to 2018 11

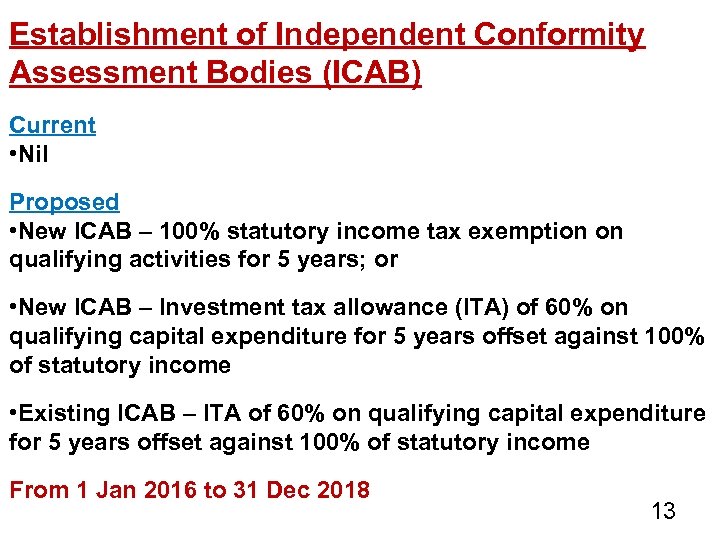

Establishment of Independent Conformity Assessment Bodies (ICAB) ICAB – Co that offers independent conformity assessment services to test products, materials, systems or services for conformance to international specifications or safety standards & other conformities Previously, labs testing medical devices given tax incentive. 12

Establishment of Independent Conformity Assessment Bodies (ICAB) Current • Nil Proposed • New ICAB – 100% statutory income tax exemption on qualifying activities for 5 years; or • New ICAB – Investment tax allowance (ITA) of 60% on qualifying capital expenditure for 5 years offset against 100% of statutory income • Existing ICAB – ITA of 60% on qualifying capital expenditure for 5 years offset against 100% of statutory income From 1 Jan 2016 to 31 Dec 2018 13

Establishment of Independent Conformity Assessment Bodies (ICAB) Qualifying Sectors Eligible activities • Machinery & equipment • Electrical & electronics • Chemicals • Aerospace • Medical devices • Fresh & processed food • Testing laboratories • Calibration • Certification • Inspection • Good laboratory 14

Establishment of Independent Conformity Assessment Bodies (ICAB) ICAB accreditated by : • Department of Standards Malaysia • Accreditation bodies recognised by International Laboratory Accreditation Cooperation • International Accreditation Forum • OECD Good Laboratory Practice Mutual Acceptance Data 15

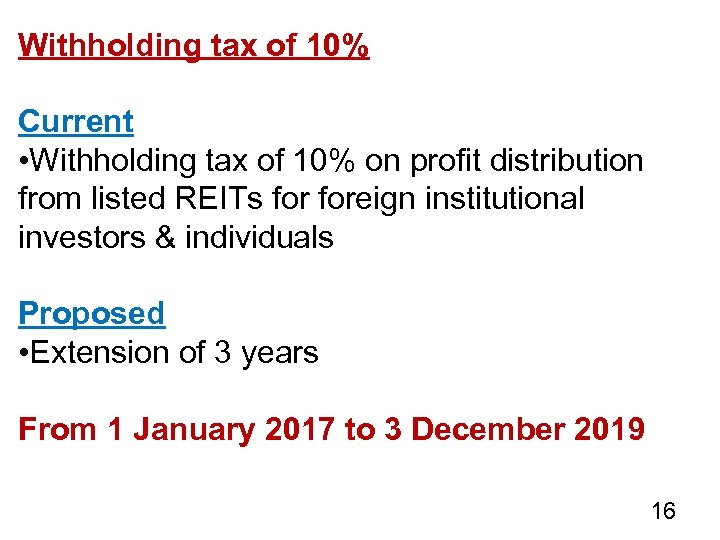

Withholding tax of 10% Current • Withholding tax of 10% on profit distribution from listed REITs foreign institutional investors & individuals Proposed • Extension of 3 years From 1 January 2017 to 3 December 2019 16

Funding

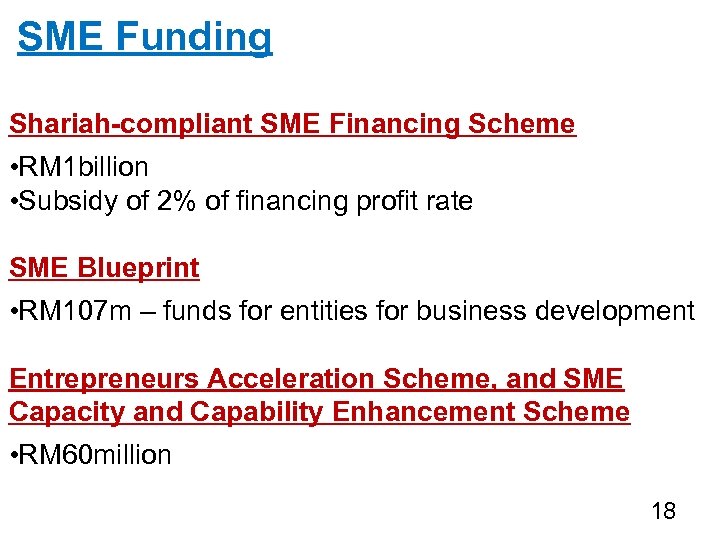

SME Funding Shariah-compliant SME Financing Scheme • RM 1 billion • Subsidy of 2% of financing profit rate SME Blueprint • RM 107 m – funds for entities for business development Entrepreneurs Acceleration Scheme, and SME Capacity and Capability Enhancement Scheme • RM 60 million 18

SME Funding SME Technology Transformation Scheme • RM 200 million under SME bank • Softloan at 4% interest Small Retailer Transformation Programme (TUKAR) & Automotive Workshop Modernisation (ATOM) • RM 18 million 19

Other Funding MATRADE • RM 235 million • 1 Malaysia Promotion Program • Service Export Fund • Export Promotion Fund IBS Promotion Fund • RM 500 million – Industrial Building System Agriculture • RM 450 million • High impact projects • Fruit & vegetable cultivation • Matching grants for herbal products, fish cage farming 20

GST changes

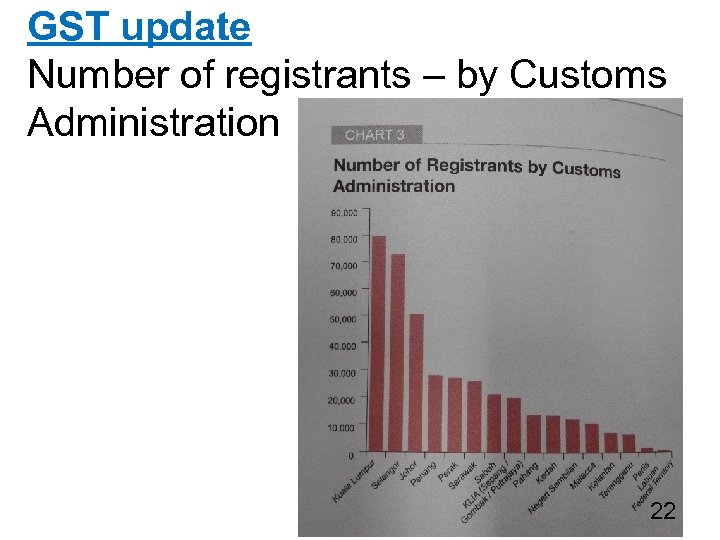

GST update Number of registrants – by Customs Administration 22

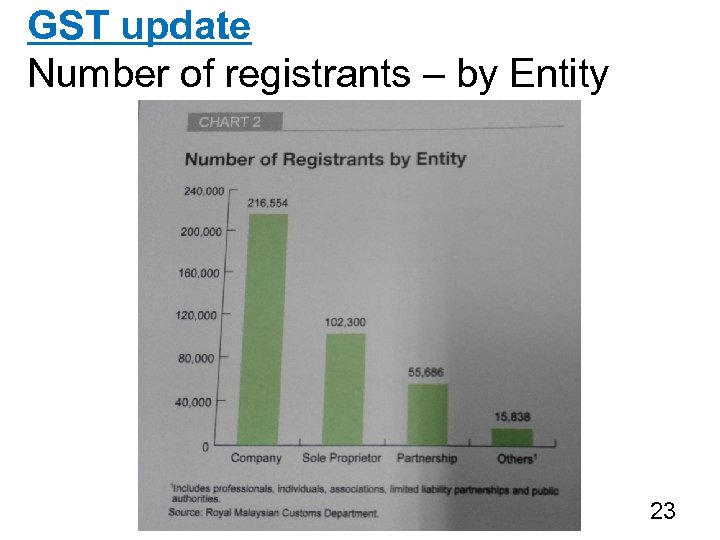

GST update Number of registrants – by Entity 23

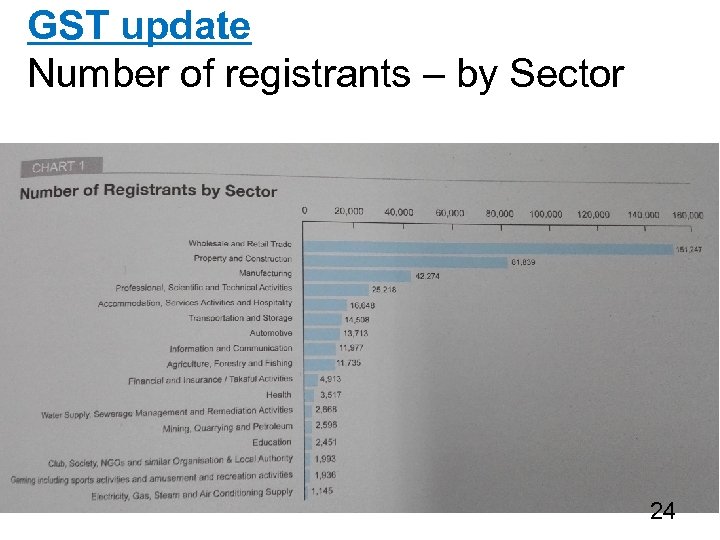

GST update Number of registrants – by Sector 24

Zero rated Food items - addition Proposed • Organic-based milk for infant & children • Soy bean based milk for infant & children • Dhal bean include chickpeas and green & white bean • Vegetables include lotus root and water chestnut • Spices include mustard seeds • Sugar include jaggery powder • Noodle products include “mi kolok” From 1 January 2016 25

Zero rated Drugs / medicine addition Proposed • All types of Controlled Drugs in Poison Groups A, B, C & D under Poisons Act 1952 • Expansion of Over the Counter Medicine from 1, 013 brand of drugs to 1, 105 • Medical devices under NEML expanded from 125 brands to 128 From 1 January 2016 26

Zero rated Domestic air transport - addition Proposed • Domestic air transportation for passengers within and between Sabah, Sarawak & Labuan From 1 January 2016 27

GST special scheme Flat rate scheme - farmers Current • Threshold for registration- RM 100, 000 Proposed • Threshold for registration- RM 50, 000 From 1 January 2016 28

GST incentive – GST relief Reimportation of goods temporarily exported for promotion, research or exhibition Proposed • Relief from GST payment From 1 January 2016 29

GST incentive – GST relief Reimportation of goods temporarily exported for rental & lease Proposed • Relief from GST payment From 1 January 2016 30

Income tax changes affecting Individuals

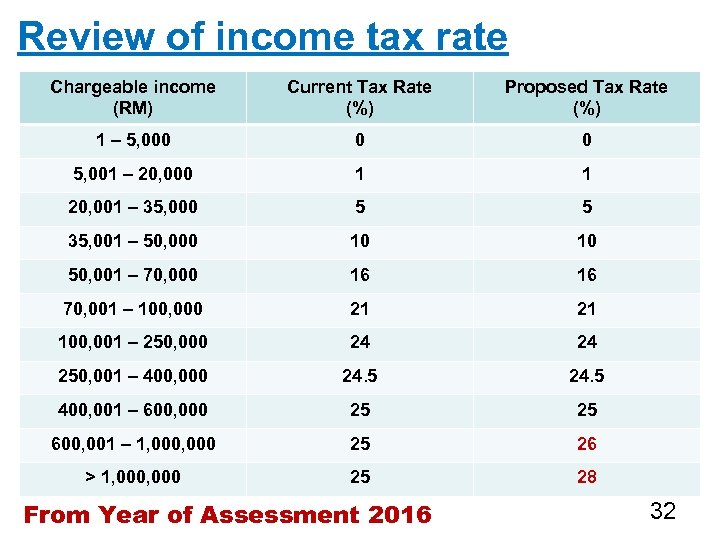

Review of income tax rate Chargeable income (RM) Current Tax Rate (%) Proposed Tax Rate (%) 1 – 5, 000 0 0 5, 001 – 20, 000 1 1 20, 001 – 35, 000 5 5 35, 001 – 50, 000 10 10 50, 001 – 70, 000 16 16 70, 001 – 100, 000 21 21 100, 001 – 250, 000 24 24 250, 001 – 400, 000 24. 5 400, 001 – 600, 000 25 25 600, 001 – 1, 000 25 26 > 1, 000 25 28 From Year of Assessment 2016 32

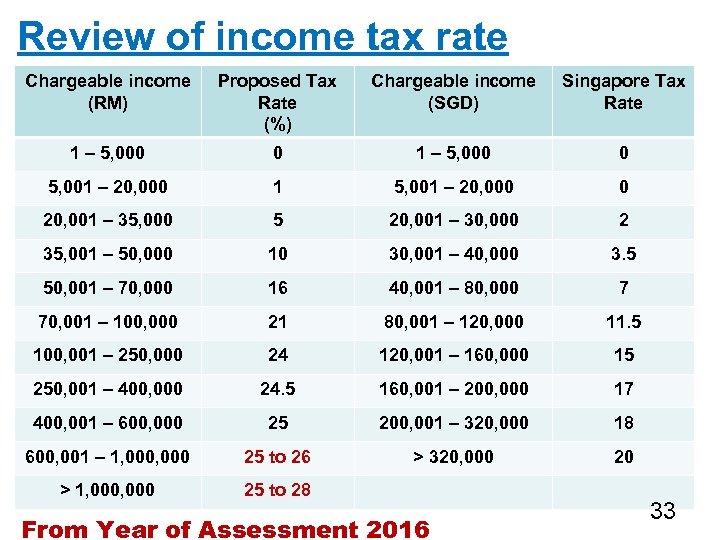

Review of income tax rate Chargeable income (RM) Proposed Tax Rate (%) Chargeable income (SGD) Singapore Tax Rate 1 – 5, 000 0 5, 001 – 20, 000 1 5, 001 – 20, 000 0 20, 001 – 35, 000 5 20, 001 – 30, 000 2 35, 001 – 50, 000 10 30, 001 – 40, 000 3. 5 50, 001 – 70, 000 16 40, 001 – 80, 000 7 70, 001 – 100, 000 21 80, 001 – 120, 000 11. 5 100, 001 – 250, 000 24 120, 001 – 160, 000 15 250, 001 – 400, 000 24. 5 160, 001 – 200, 000 17 400, 001 – 600, 000 25 200, 001 – 320, 000 18 600, 001 – 1, 000 25 to 26 > 320, 000 20 > 1, 000 25 to 28 From Year of Assessment 2016 33

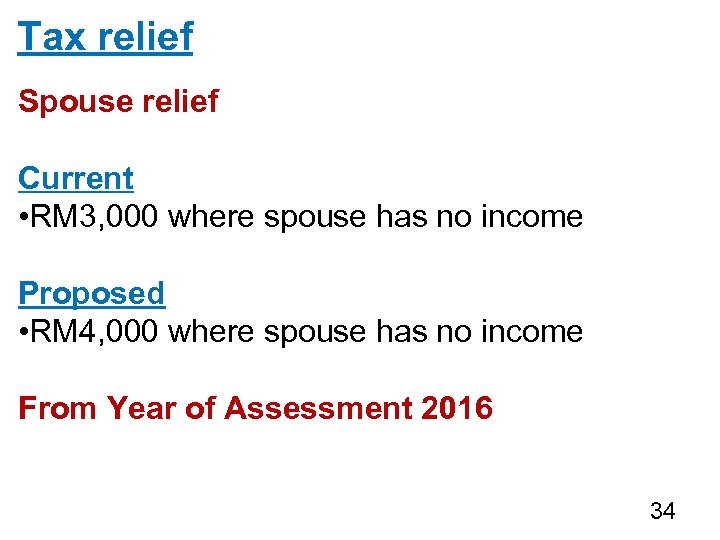

Tax relief Spouse relief Current • RM 3, 000 where spouse has no income Proposed • RM 4, 000 where spouse has no income From Year of Assessment 2016 34

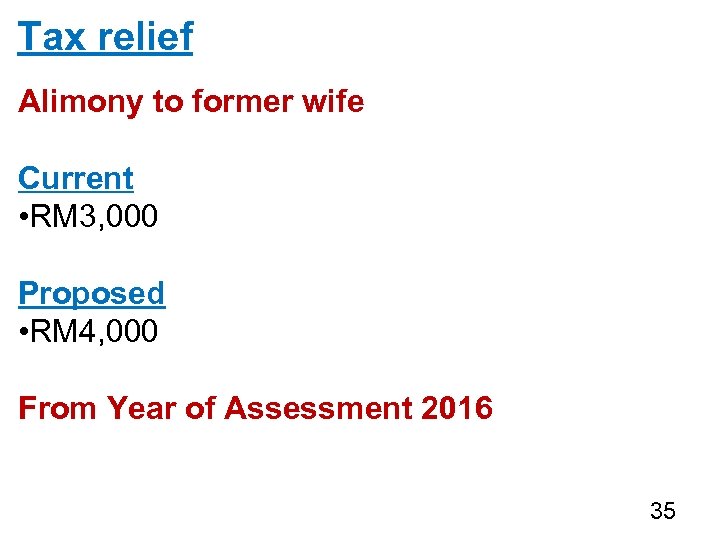

Tax relief Alimony to former wife Current • RM 3, 000 Proposed • RM 4, 000 From Year of Assessment 2016 35

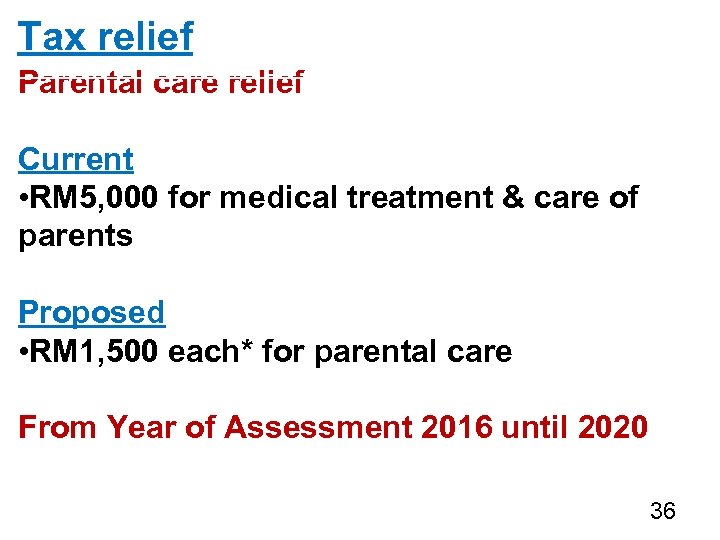

Tax relief Parental care relief Current • RM 5, 000 for medical treatment & care of parents Proposed • RM 1, 500 each* for parental care From Year of Assessment 2016 until 2020 36

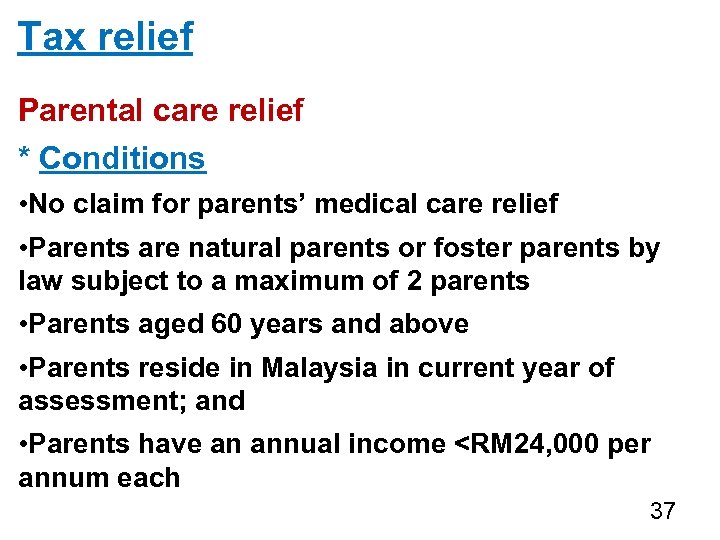

Tax relief Parental care relief * Conditions • No claim for parents’ medical care relief • Parents are natural parents or foster parents by law subject to a maximum of 2 parents • Parents aged 60 years and above • Parents reside in Malaysia in current year of assessment; and • Parents have an annual income <RM 24, 000 per annum each 37

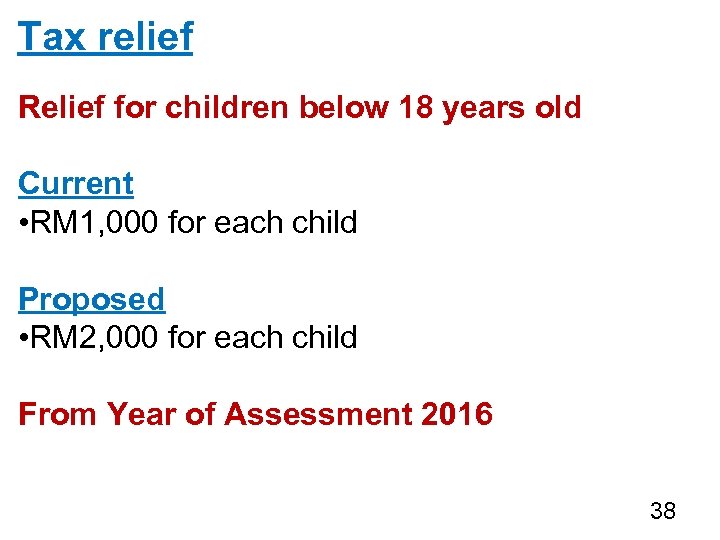

Tax relief Relief for children below 18 years old Current • RM 1, 000 for each child Proposed • RM 2, 000 for each child From Year of Assessment 2016 38

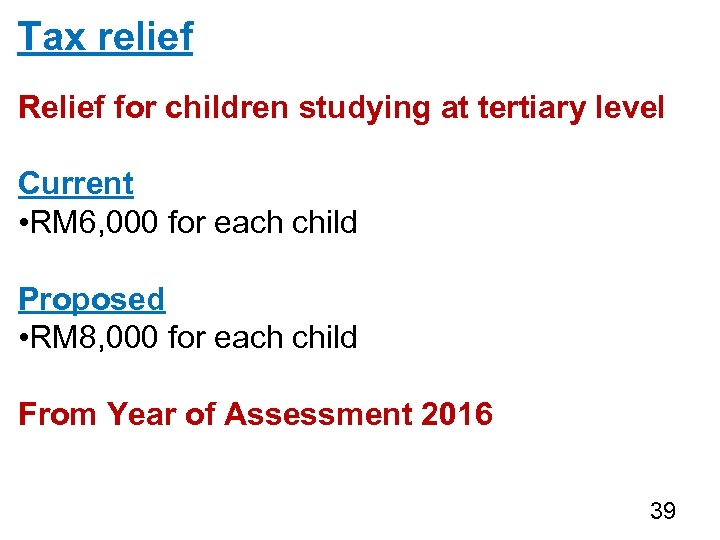

Tax relief Relief for children studying at tertiary level Current • RM 6, 000 for each child Proposed • RM 8, 000 for each child From Year of Assessment 2016 39

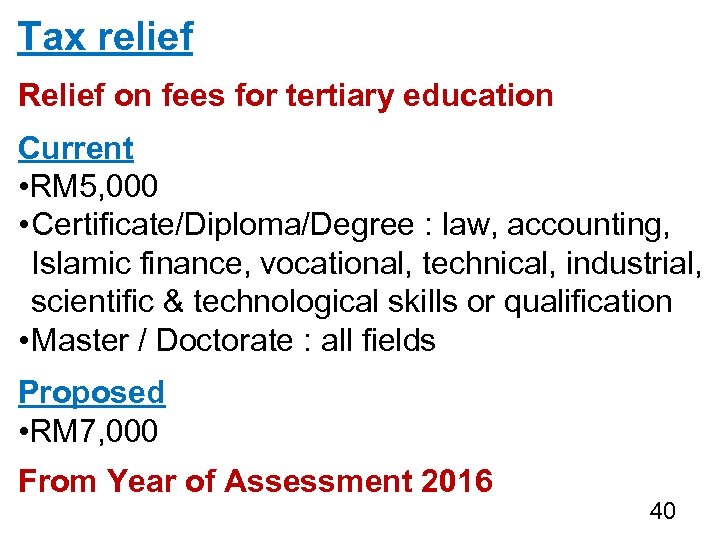

Tax relief Relief on fees for tertiary education Current • RM 5, 000 • Certificate/Diploma/Degree : law, accounting, Islamic finance, vocational, technical, industrial, scientific & technological skills or qualification • Master / Doctorate : all fields Proposed • RM 7, 000 From Year of Assessment 2016 40

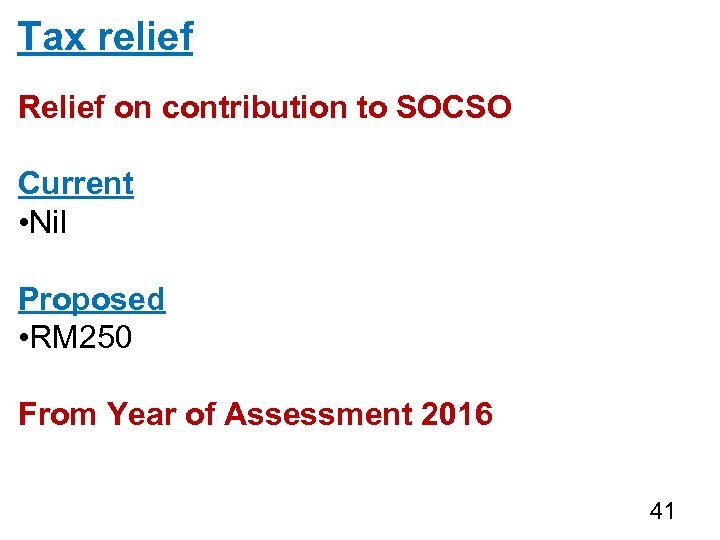

Tax relief Relief on contribution to SOCSO Current • Nil Proposed • RM 250 From Year of Assessment 2016 41

Other changes

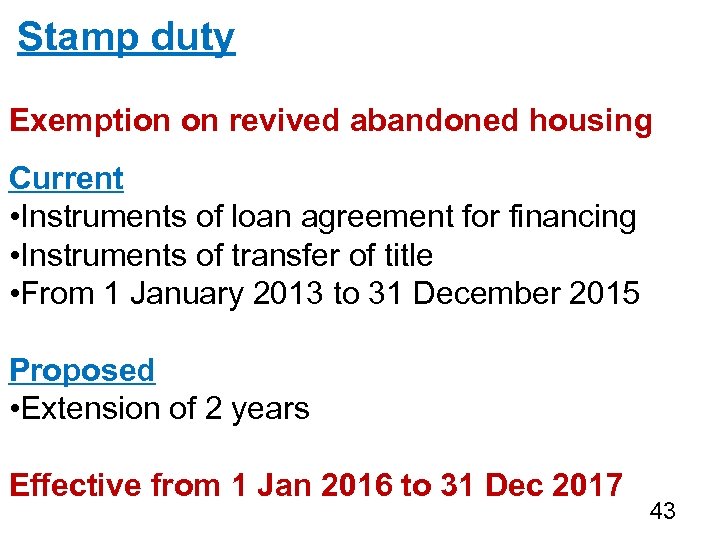

Stamp duty Exemption on revived abandoned housing Current • Instruments of loan agreement for financing • Instruments of transfer of title • From 1 January 2013 to 31 December 2015 Proposed • Extension of 2 years Effective from 1 Jan 2016 to 31 Dec 2017 43

Stamp duty Exemption on Shariah financing Current • 20% exemption on housing financing instruments • From 2 September 2006 to 31 December 2015 Proposed • Extension of 2 years Effective from 1 Jan 2016 to 31 Dec 2017 44

Thank You

Vision 2020 = RAKYAT + quality of life High Income, Inclusiveness, Sustainability 11 th MP = Anchoring Growth on People • Enhancing inclusiveness towards an equitable society • Improve well being for all • Accelerate human capital development for an advance nation • Pursuing green growth sustainability and resilience • Re-engineering economic growth for great prosperity Budget 2016 Prospering The Rakyat 46

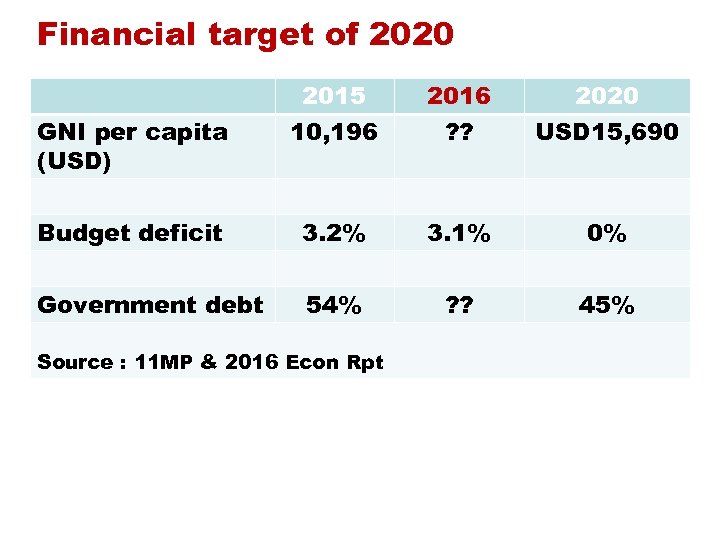

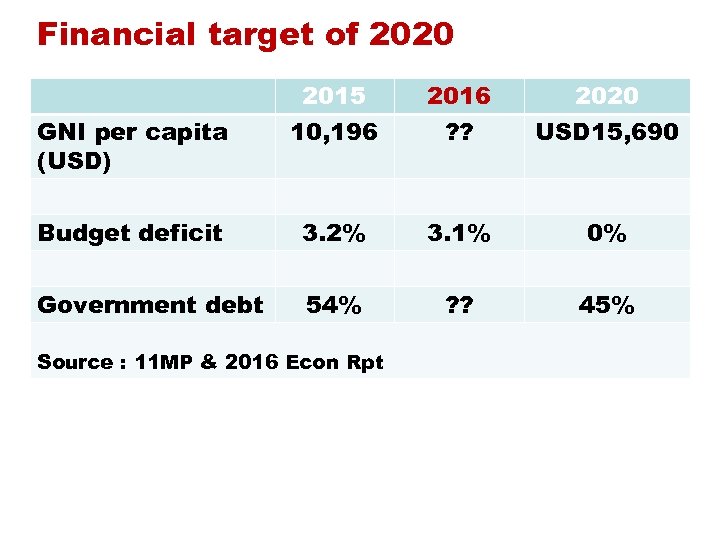

Financial target of 2020 2015 10, 196 2016 ? ? 2020 USD 15, 690 Budget deficit 3. 2% 3. 1% 0% Government debt 54% ? ? 45% GNI per capita (USD) Source : 11 MP & 2016 Econ Rpt

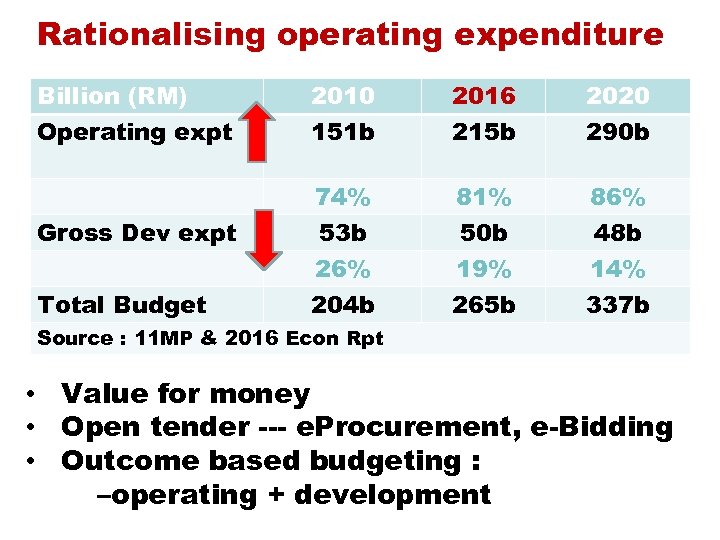

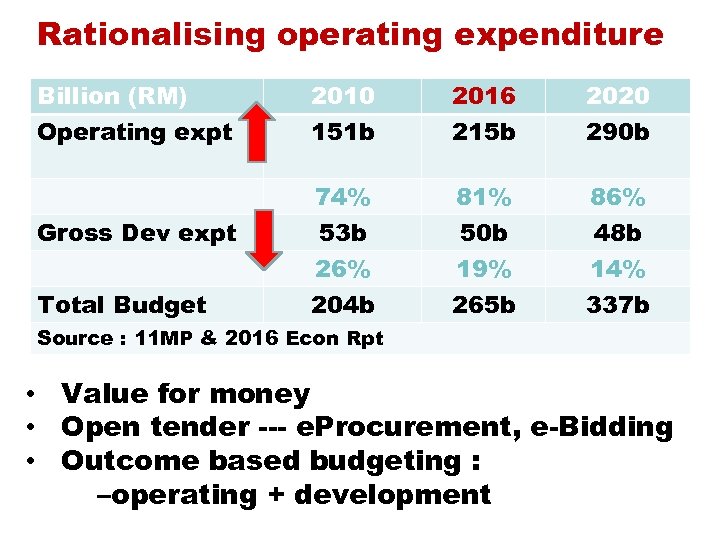

Rationalising operating expenditure Billion (RM) Operating expt Total Budget 2016 215 b 2020 290 b 74% Gross Dev expt 2010 151 b 81% 86% 53 b 26% 204 b 50 b 19% 265 b 48 b 14% 337 b Source : 11 MP & 2016 Econ Rpt • Value for money • Open tender --- e. Procurement, e-Bidding • Outcome based budgeting : –operating + development

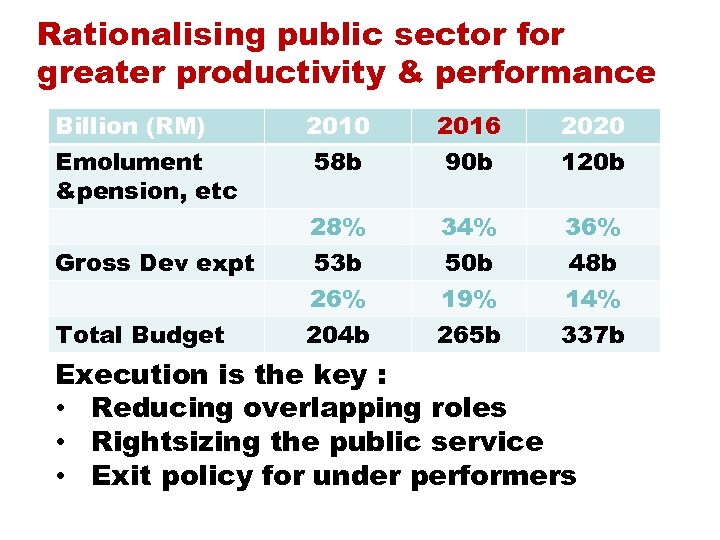

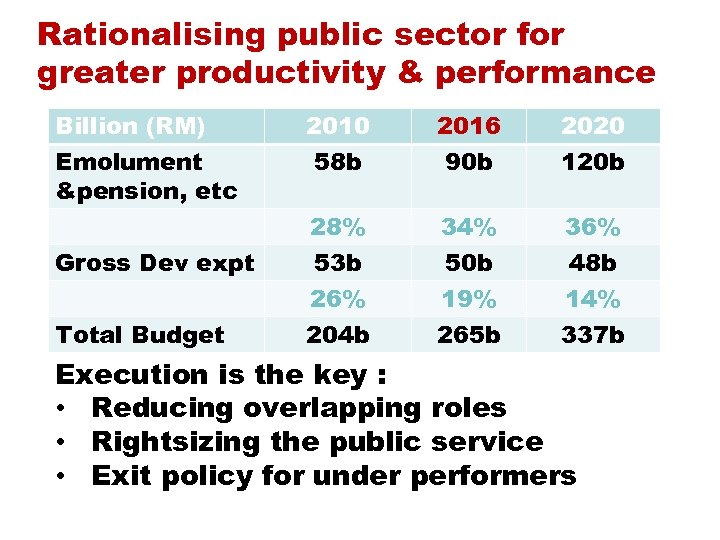

Rationalising public sector for greater productivity & performance Billion (RM) Emolument &pension, etc Gross Dev expt Total Budget 2010 58 b 2016 90 b 2020 120 b 28% 53 b 26% 204 b 34% 50 b 19% 265 b 36% 48 b 14% 337 b Execution is the key : • Reducing overlapping roles • Rightsizing the public service • Exit policy for under performers

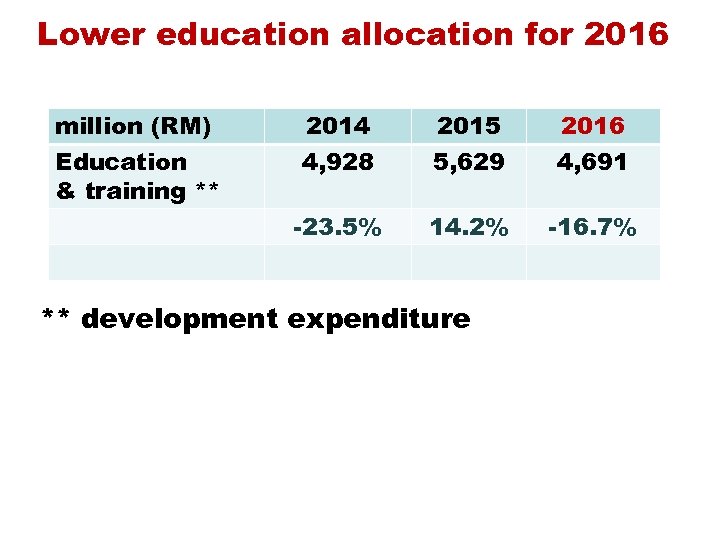

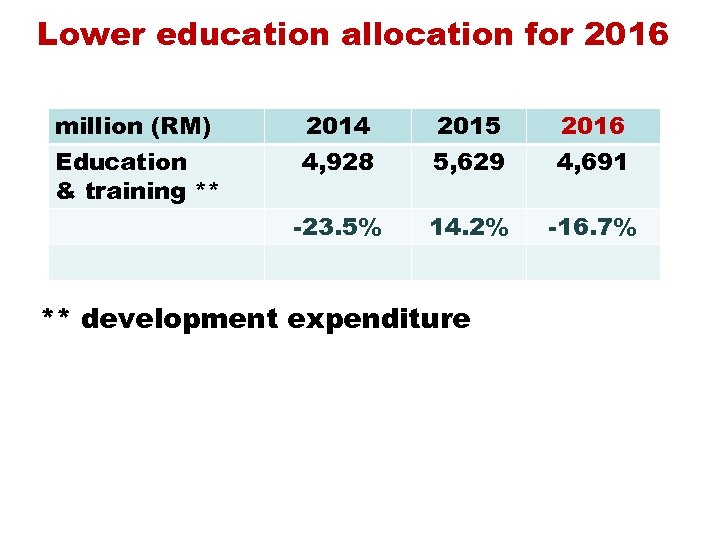

Lower education allocation for 2016 million (RM) Education & training ** 2014 4, 928 2015 5, 629 2016 4, 691 -23. 5% 14. 2% -16. 7% ** development expenditure

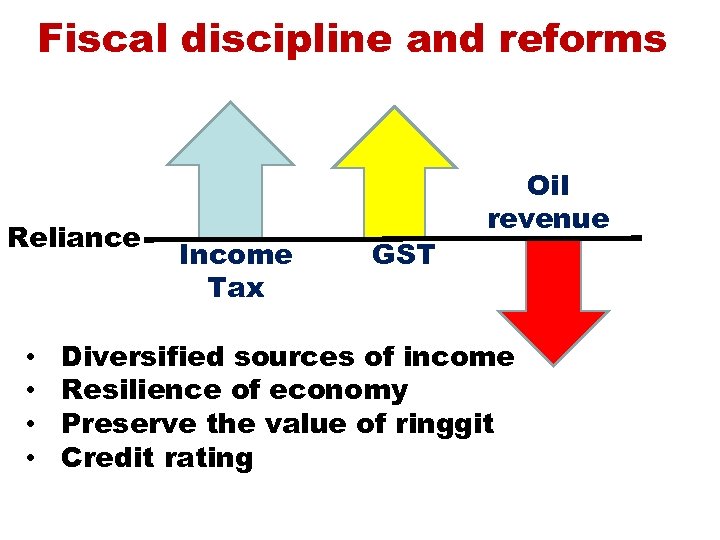

Fiscal discipline and reforms Reliance • • Income Tax GST Oil revenue Diversified sources of income Resilience of economy Preserve the value of ringgit Credit rating

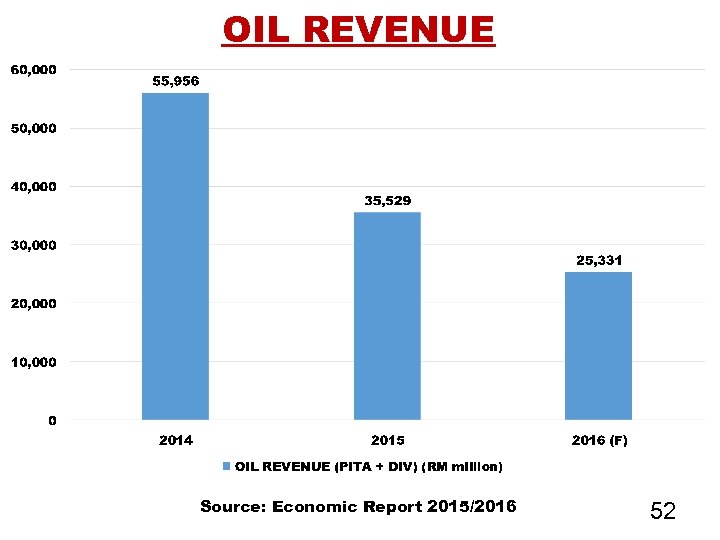

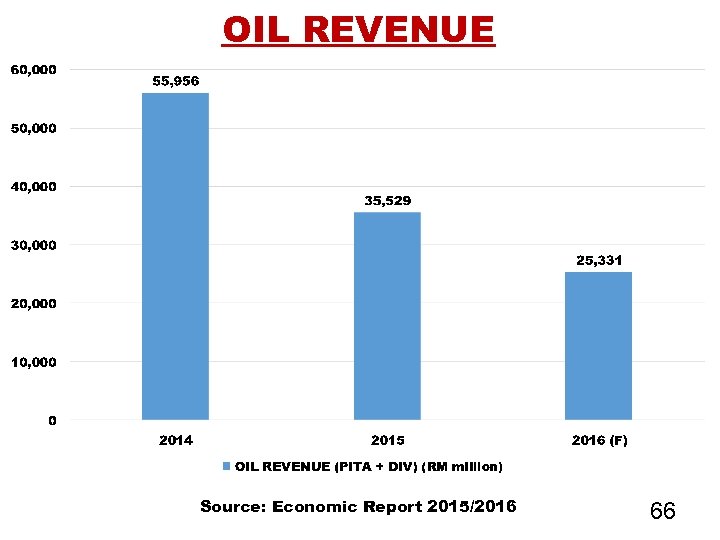

OIL REVENUE Source: Economic Report 2015/2016 52

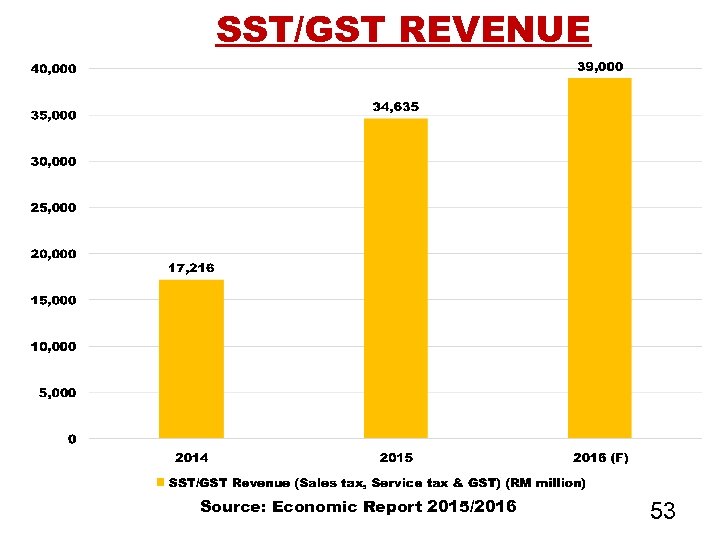

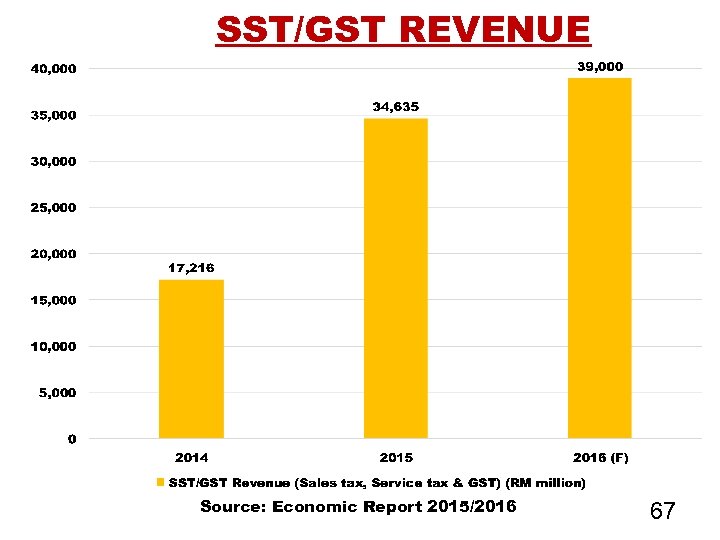

SST/GST REVENUE Source: Economic Report 2015/2016 53

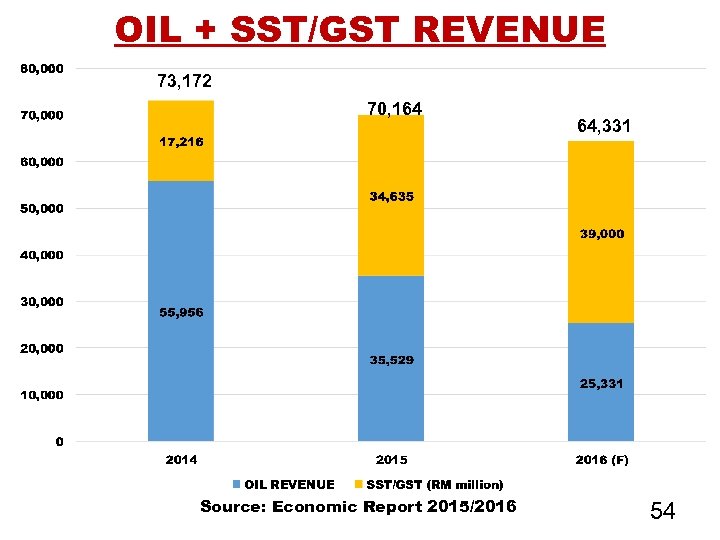

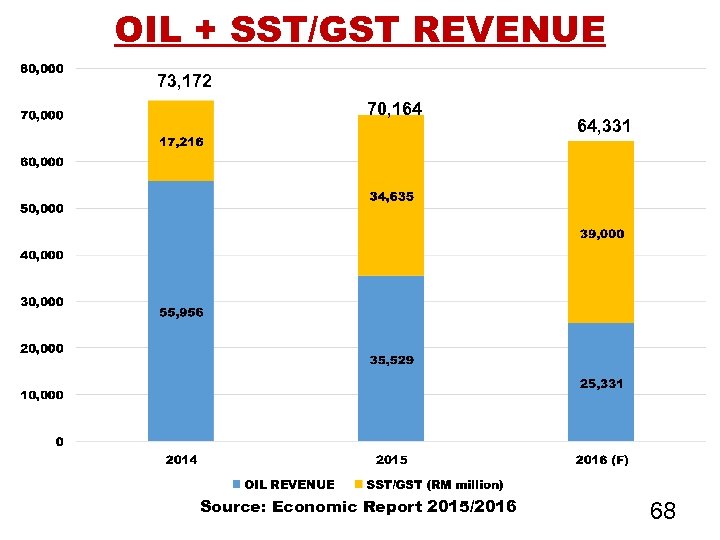

OIL + SST/GST REVENUE 73, 172 70, 164 Source: Economic Report 2015/2016 64, 331 54

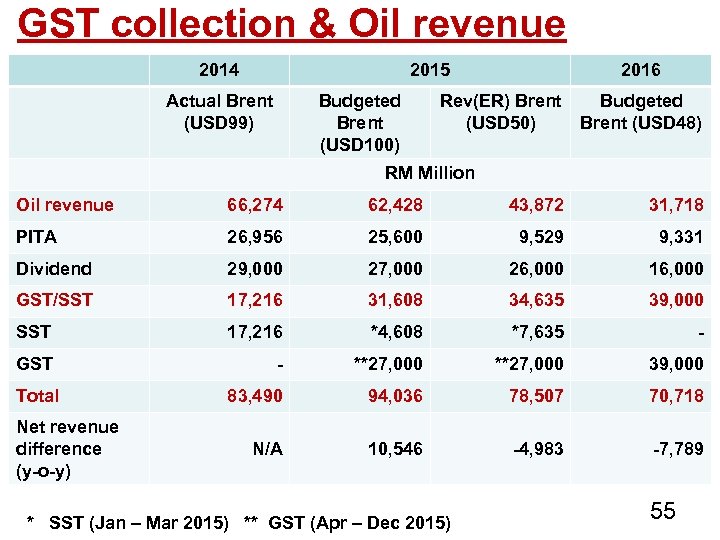

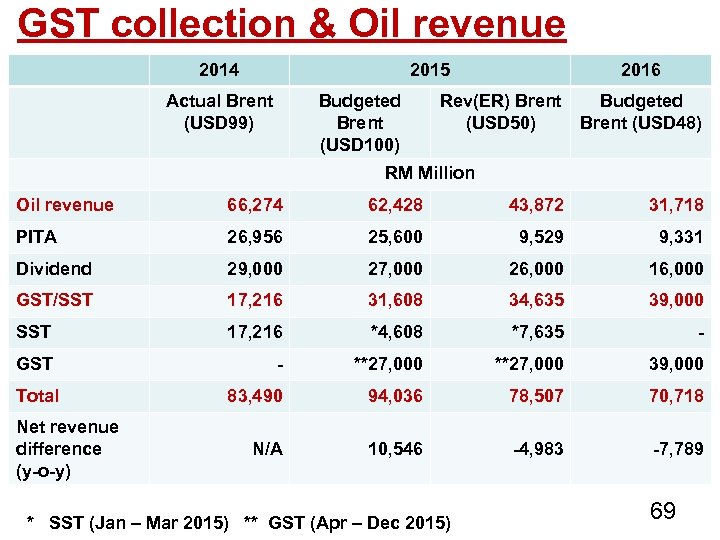

GST collection & Oil revenue 2014 2015 Actual Brent (USD 99) Budgeted Brent (USD 100) 2016 Rev(ER) Brent (USD 50) Budgeted Brent (USD 48) RM Million Oil revenue 66, 274 62, 428 43, 872 31, 718 PITA 26, 956 25, 600 9, 529 9, 331 Dividend 29, 000 27, 000 26, 000 16, 000 GST/SST 17, 216 31, 608 34, 635 39, 000 SST 17, 216 *4, 608 *7, 635 - GST - **27, 000 39, 000 83, 490 94, 036 78, 507 70, 718 N/A 10, 546 -4, 983 -7, 789 Total Net revenue difference (y-o-y) * SST (Jan – Mar 2015) ** GST (Apr – Dec 2015) 55

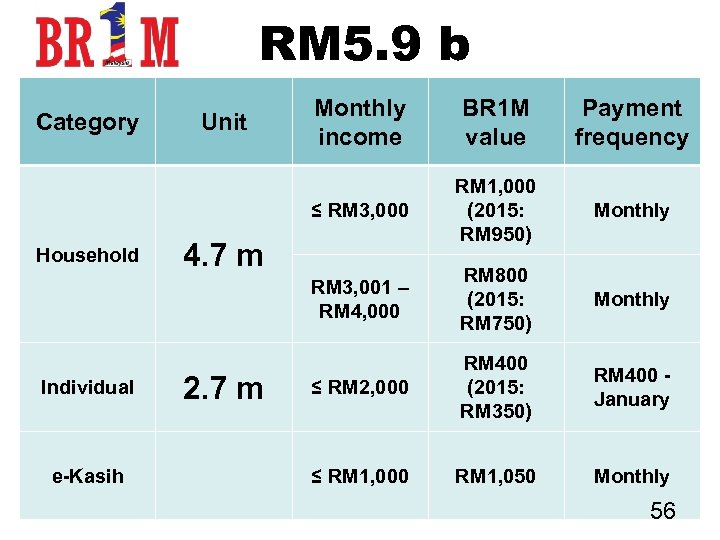

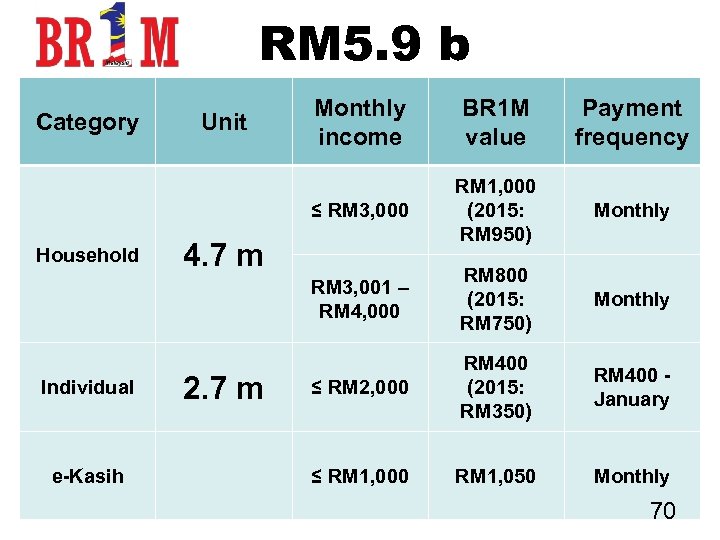

RM 5. 9 b Individual e-Kasih BR 1 M value Payment frequency RM 1, 000 (2015: RM 950) Monthly RM 3, 001 – RM 4, 000 Household Unit Monthly income ≤ RM 3, 000 Category RM 800 (2015: RM 750) Monthly ≤ RM 2, 000 RM 400 (2015: RM 350) RM 400 January ≤ RM 1, 000 RM 1, 050 Monthly 4. 7 m 2. 7 m 56

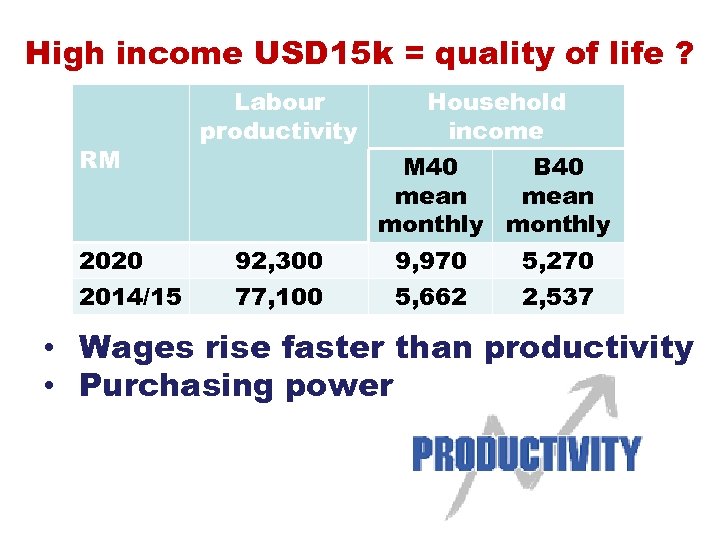

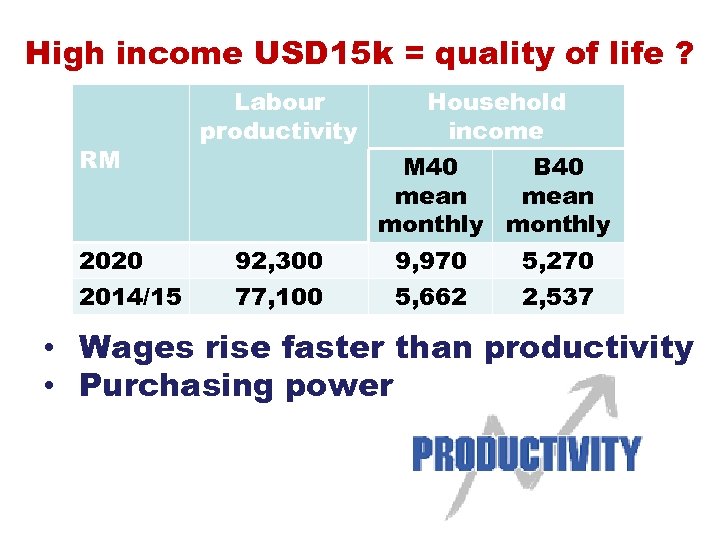

High income USD 15 k = quality of life ? RM 2020 2014/15 Labour productivity 92, 300 77, 100 Household income M 40 B 40 mean monthly 9, 970 5, 662 5, 270 2, 537 • Wages rise faster than productivity • Purchasing power

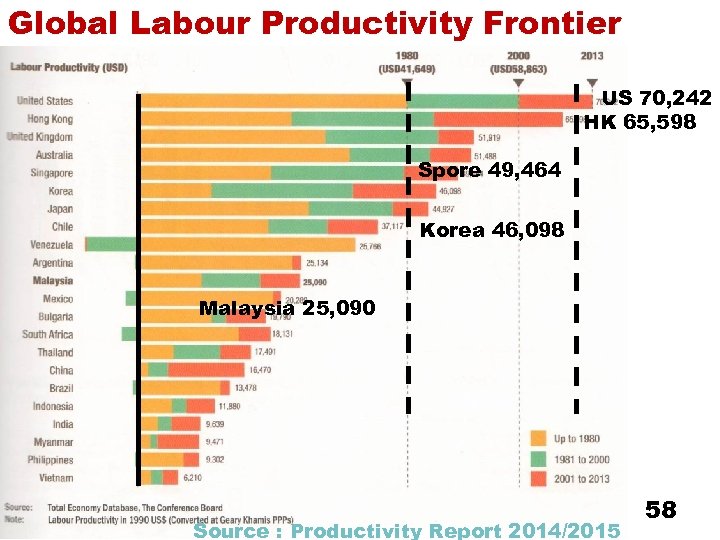

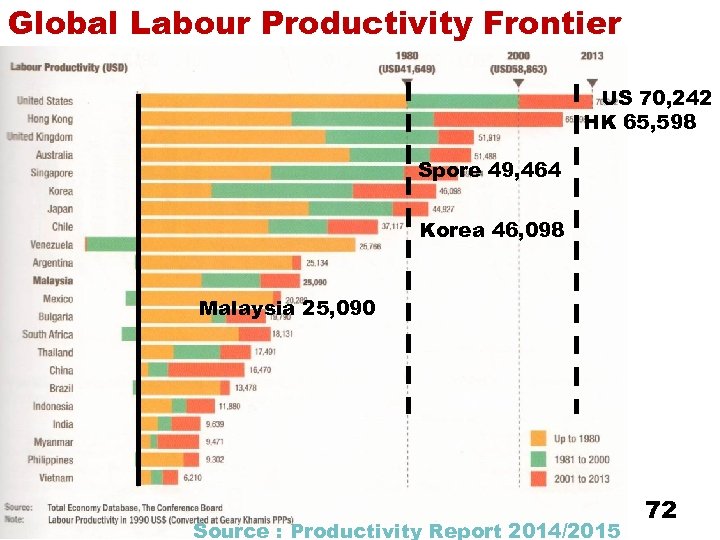

Global Labour Productivity Frontier US 70, 242 HK 65, 598 Spore 49, 464 Korea 46, 098 Malaysia 25, 090 Source : Productivity Report 2014/2015 58

B 40 SL 1 M Up-skill Re - skill Multi-skill TVET PLWS

Vision 2020 = RAKYAT + quality of life High Income, Inclusiveness, Sustainability 11 th MP = Anchoring Growth on People • Enhancing inclusiveness towards an equitable society • Improve well being for all • Accelerate human capital development for an advance nation • Pursuing green growth sustainability and resilience • Re-engineering economic growth for great prosperity Budget 2016 Prospering The Rakyat 60

Financial target of 2020 2015 10, 196 2016 ? ? 2020 USD 15, 690 Budget deficit 3. 2% 3. 1% 0% Government debt 54% ? ? 45% GNI per capita (USD) Source : 11 MP & 2016 Econ Rpt

Rationalising operating expenditure Billion (RM) Operating expt Total Budget 2016 215 b 2020 290 b 74% Gross Dev expt 2010 151 b 81% 86% 53 b 26% 204 b 50 b 19% 265 b 48 b 14% 337 b Source : 11 MP & 2016 Econ Rpt • Value for money • Open tender --- e. Procurement, e-Bidding • Outcome based budgeting : –operating + development

Rationalising public sector for greater productivity & performance Billion (RM) Emolument &pension, etc Gross Dev expt Total Budget 2010 58 b 2016 90 b 2020 120 b 28% 53 b 26% 204 b 34% 50 b 19% 265 b 36% 48 b 14% 337 b Execution is the key : • Reducing overlapping roles • Rightsizing the public service • Exit policy for under performers

Lower education allocation for 2016 million (RM) Education & training ** 2014 4, 928 2015 5, 629 2016 4, 691 -23. 5% 14. 2% -16. 7% ** development expenditure

Fiscal discipline and reforms Reliance • • Income Tax GST Oil revenue Diversified sources of income Resilience of economy Preserve the value of ringgit Credit rating

OIL REVENUE Source: Economic Report 2015/2016 66

SST/GST REVENUE Source: Economic Report 2015/2016 67

OIL + SST/GST REVENUE 73, 172 70, 164 Source: Economic Report 2015/2016 64, 331 68

GST collection & Oil revenue 2014 2015 Actual Brent (USD 99) Budgeted Brent (USD 100) 2016 Rev(ER) Brent (USD 50) Budgeted Brent (USD 48) RM Million Oil revenue 66, 274 62, 428 43, 872 31, 718 PITA 26, 956 25, 600 9, 529 9, 331 Dividend 29, 000 27, 000 26, 000 16, 000 GST/SST 17, 216 31, 608 34, 635 39, 000 SST 17, 216 *4, 608 *7, 635 - GST - **27, 000 39, 000 83, 490 94, 036 78, 507 70, 718 N/A 10, 546 -4, 983 -7, 789 Total Net revenue difference (y-o-y) * SST (Jan – Mar 2015) ** GST (Apr – Dec 2015) 69

RM 5. 9 b Individual e-Kasih BR 1 M value Payment frequency RM 1, 000 (2015: RM 950) Monthly RM 3, 001 – RM 4, 000 Household Unit Monthly income ≤ RM 3, 000 Category RM 800 (2015: RM 750) Monthly ≤ RM 2, 000 RM 400 (2015: RM 350) RM 400 January ≤ RM 1, 000 RM 1, 050 Monthly 4. 7 m 2. 7 m 70

High income USD 15 k = quality of life ? RM 2020 2014/15 Labour productivity 92, 300 77, 100 Household income M 40 B 40 mean monthly 9, 970 5, 662 5, 270 2, 537 • Wages rise faster than productivity • Purchasing power

Global Labour Productivity Frontier US 70, 242 HK 65, 598 Spore 49, 464 Korea 46, 098 Malaysia 25, 090 Source : Productivity Report 2014/2015 72

B 40 SL 1 M Up-skill Re - skill Multi-skill TVET PLWS

3c43b7441d1e180cebb6db7a5a2fc6f3.ppt