3c8f70cc01abed67d3e6fa83577868e1.ppt

- Количество слайдов: 43

• Brother Bryson • Marriott School

• Jean Monet, Robert Schumann, Walter Hallstein and others dreamed, at the end of WWII and centuries of war in Europe, of a new era. • What if Europeans quit shooting at each other and begin to focus more on doing business with each other. • Trade and investment might make old political enemies new business partners

• If business went well, perhaps European nations could become more united. • Could the day come when there would be a United States of Europe, with all states living in harmony and peace? • So the effort began in 1950 with the establishment of the European Coal and Steel Community. See p. 305 of the King text for an outline of EU development.

1. The basic concept: Freedom for many economic agents to buy and sell beyond national frontiers

This freedom is often retracted by policymakers, who in the pursuit of special interests construct trade barriers opposed to the general, social interest.

Originally, tariffs were imposed to raise tariff revenues. Later, legislatures were approached for politically expedient protection of domestic industry.

Once such barriers are in place, they are not easily removed. Integration means removing barriers strictly on a regional basis. Integration is not a return to free trade.

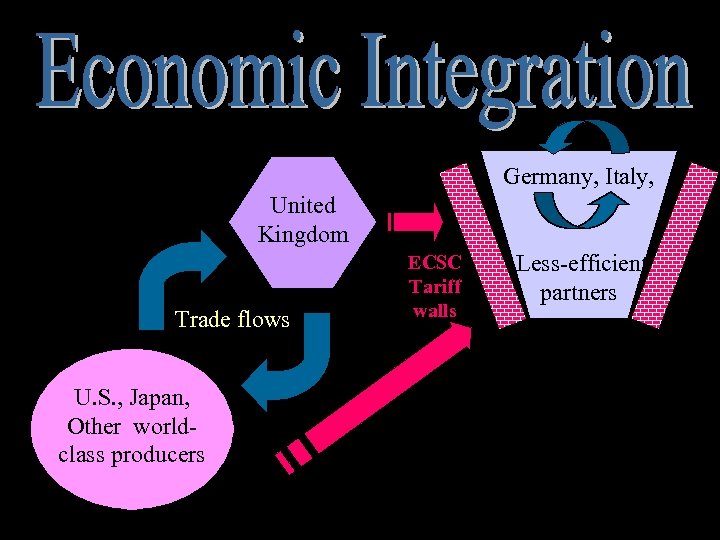

Germany, Italy, United Kingdom Trade flows U. S. , Japan, Other worldclass producers ECSC Tariff walls Less-efficient partners

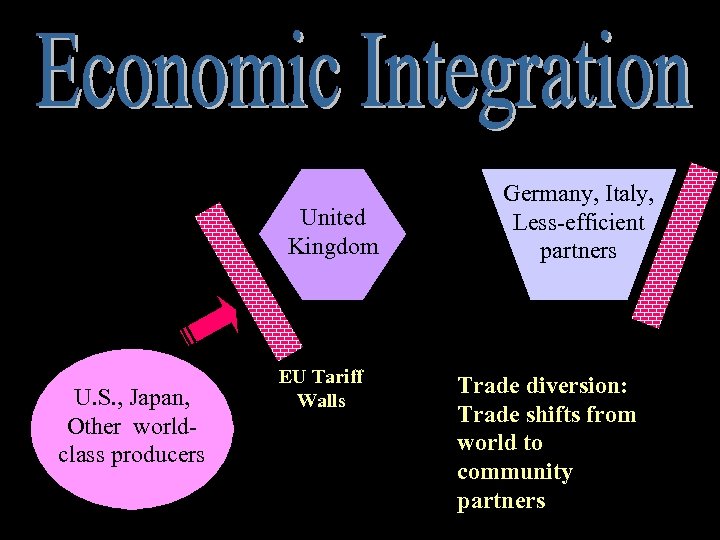

United Kingdom U. S. , Japan, Other worldclass producers EU Tariff Walls Germany, Italy, Less-efficient partners Trade diversion: Trade shifts from world to community partners

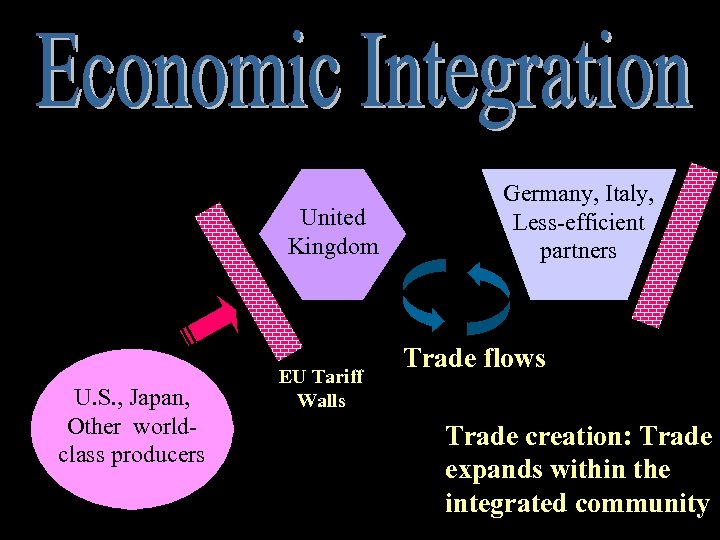

United Kingdom U. S. , Japan, Other worldclass producers EU Tariff Walls Germany, Italy, Less-efficient partners Trade flows Trade creation: Trade expands within the integrated community

Types of “capitalist” integration: A. The free trade area. ØA set of partners in a given region. ØMembers eliminate trade barriers among themselves Øeach member maintains its own set of (usually tariff) barriers against imports from non-member countries

B. Customs union. ØRegional membership ØMembers eliminate barriers among themselves ØBut also establish a common external tariff

C. Common Market. To the customs union tariff arrangements, this form adds full freedom of movement to production factors

D. Economic Union. ØLike customs union, plus… Øharmonization of member countries’ economic (especially monetary) policies.

We will limit our analysis to the customs union. Consider a protected industry before the customs union is formed. . . We return to the simple theory of a tariff, imposed as a tax added on to the world price…

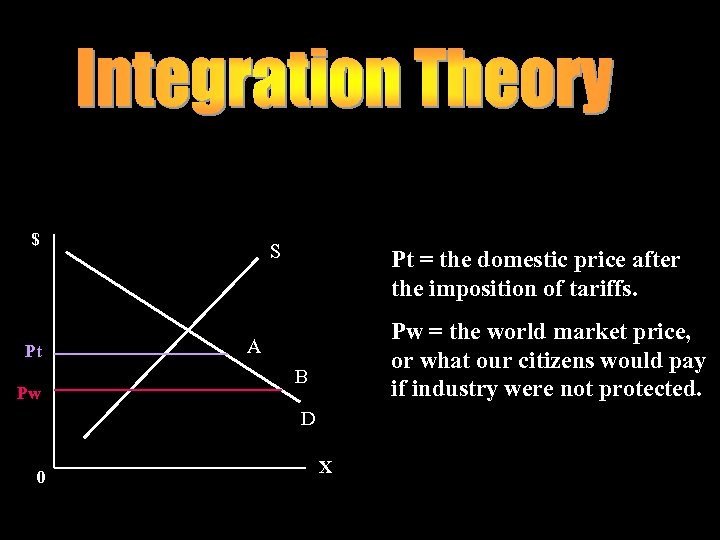

$ Pt Pw S Pt = the domestic price after the imposition of tariffs. Pw = the world market price, or what our citizens would pay if industry were not protected. A B D 0 X

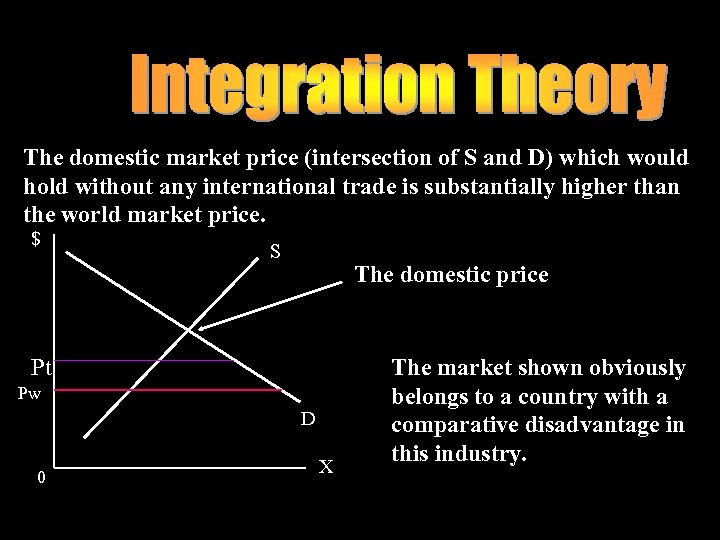

The domestic market price (intersection of S and D) which would hold without any international trade is substantially higher than the world market price. $ S The domestic price Pt Pw D 0 X The market shown obviously belongs to a country with a comparative disadvantage in this industry.

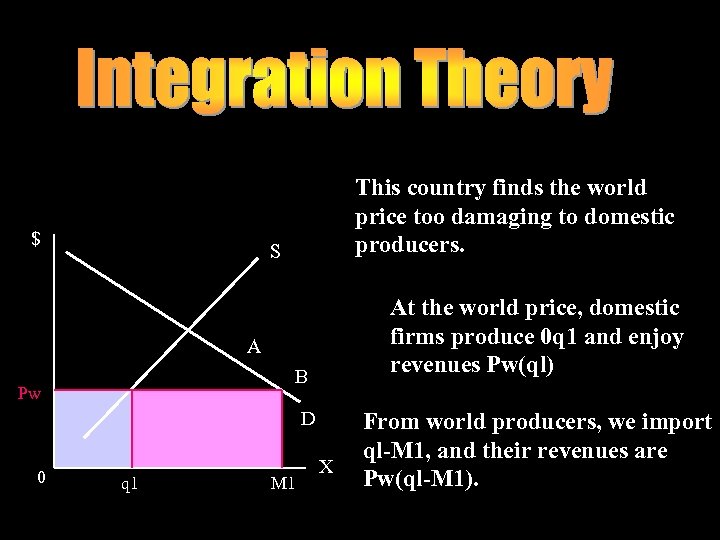

$ This country finds the world price too damaging to domestic producers. S At the world price, domestic firms produce 0 q 1 and enjoy revenues Pw(ql) A B Pw D 0 q 1 M 1 X From world producers, we import ql-M 1, and their revenues are Pw(ql-M 1).

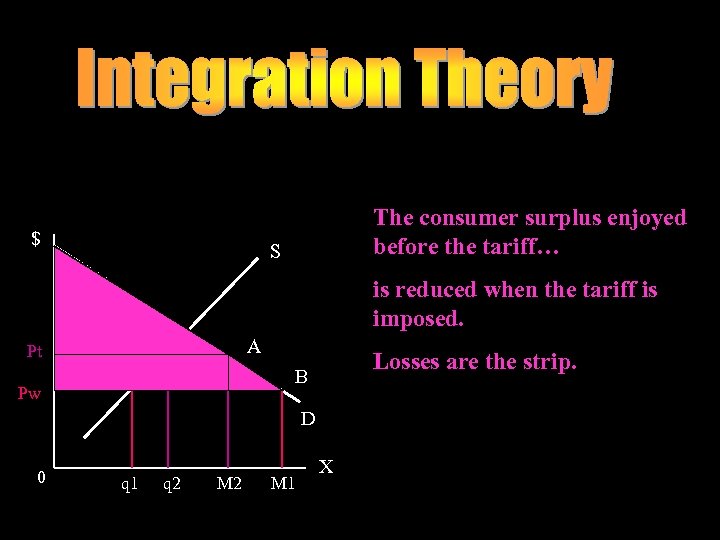

$ The consumer surplus enjoyed before the tariff… S is reduced when the tariff is imposed. A Pt Losses are the strip. B Pw D 0 q 1 q 2 M 1 X

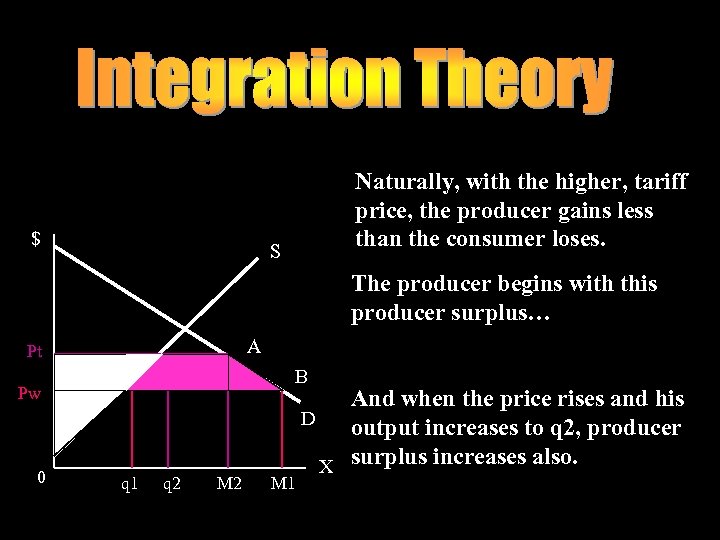

$ Naturally, with the higher, tariff price, the producer gains less than the consumer loses. S The producer begins with this producer surplus… A Pt B Pw 0 q 1 q 2 M 1 And when the price rises and his D output increases to q 2, producer X surplus increases also.

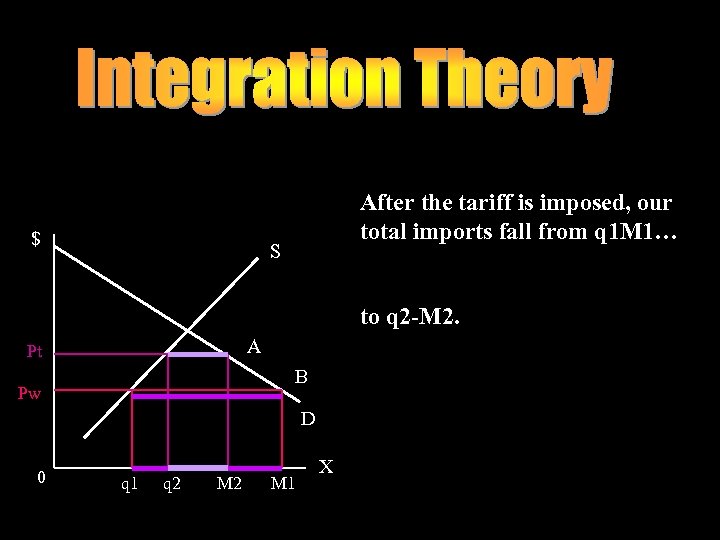

$ After the tariff is imposed, our total imports fall from q 1 M 1… S to q 2 -M 2. A Pt B Pw D 0 q 1 q 2 M 1 X

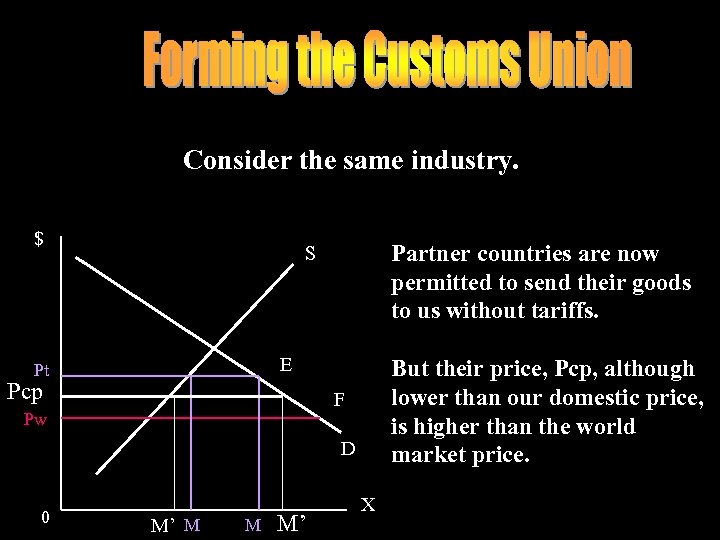

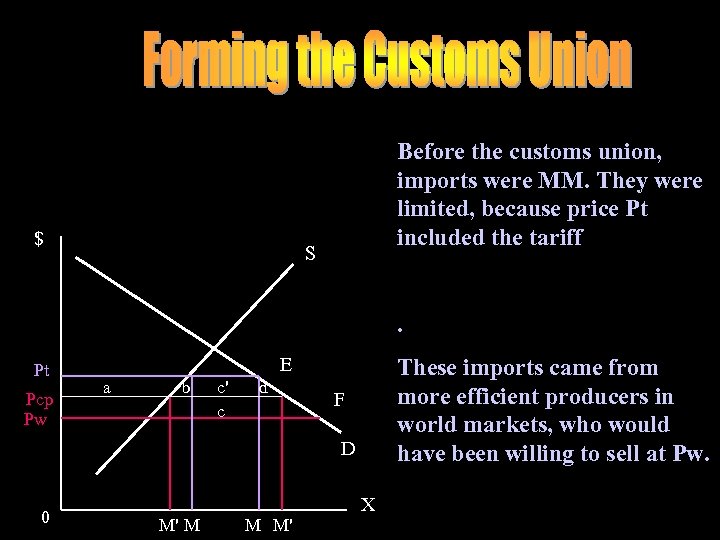

Consider the same industry. $ Partner countries are now permitted to send their goods to us without tariffs. S E Pt Pcp But their price, Pcp, although lower than our domestic price, is higher than the world market price. F Pw D 0 M’ M M M’ X

$ Before the customs union, imports were MM. They were limited, because price Pt included the tariff S . Pt Pcp Pw E a b c' c d These imports came from more efficient producers in world markets, who would have been willing to sell at Pw. F D 0 M' M M M' X

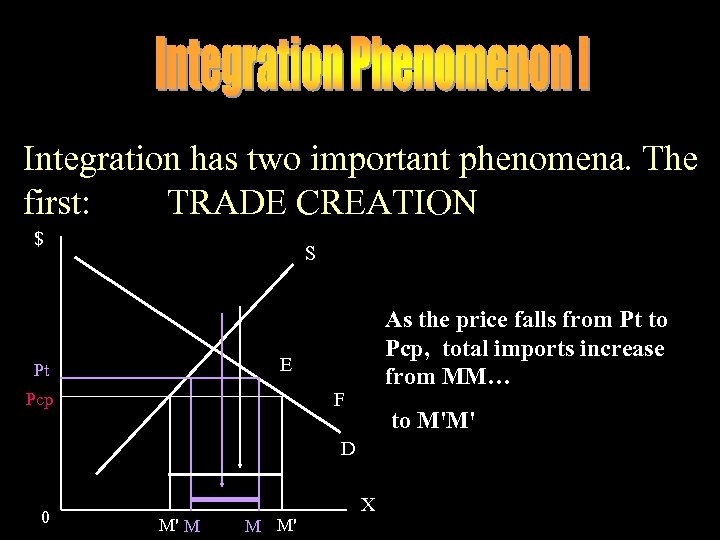

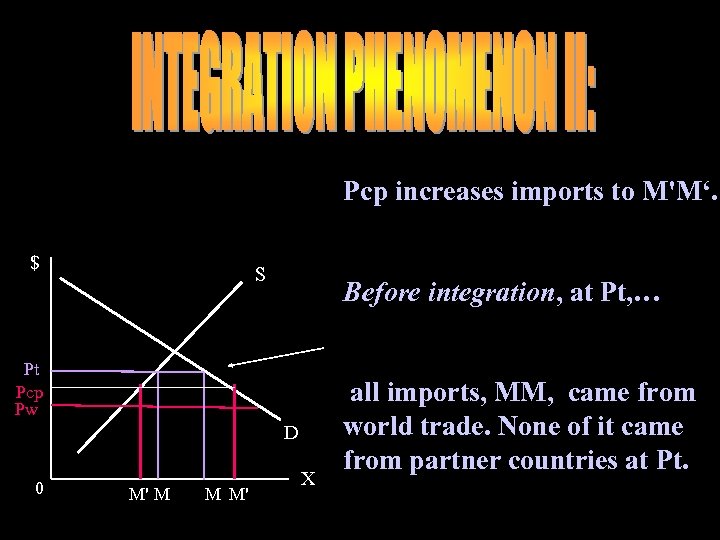

Integration has two important phenomena. The first: TRADE CREATION $ S As the price falls from Pt to Pcp, total imports increase from MM… E Pt F Pcp to M'M' D 0 M' M M M' X

Note: the tariff is still in effect, so the price is still Pt for countries outside this community. But at this high price, hardly anyone in the country is willing to purchase from this general world market, even though its producers are more effective than those of our country or of our customs union partners. Pcp is not a price which incorporates a tariff. It is simply the price of our integration partners. They can produce more cheaply than we can at Pt, but there commodities are more costly to produce than the best producers in the world market.

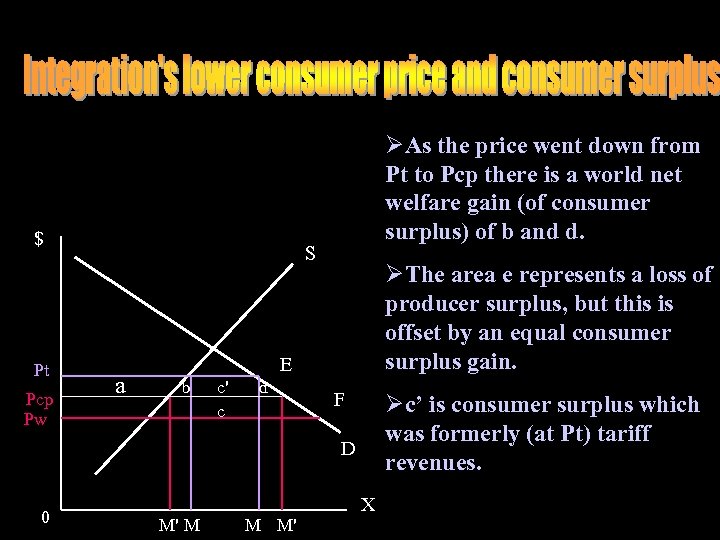

$ Pt Pcp Pw ØAs the price went down from Pt to Pcp there is a world net welfare gain (of consumer surplus) of b and d. S ea ØThe area e represents a loss of producer surplus, but this is offset by an equal consumer surplus gain. E b c' c d F Øc’ is consumer surplus which was formerly (at Pt) tariff revenues. D 0 M' M M M' X

Pcp increases imports to M'M‘. $ S Before integration, at Pt, … Pt Pcp Pw D 0 M' M M M' X all imports, MM, came from world trade. None of it came from partner countries at Pt.

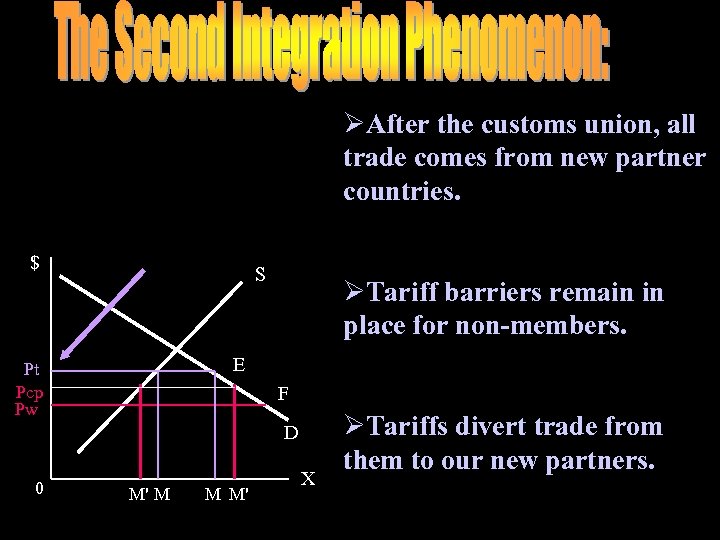

ØAfter the customs union, all trade comes from new partner countries. $ S ØTariff barriers remain in place for non-members. E Pt Pcp Pw F D 0 M' M M M' X ØTariffs divert trade from them to our new partners.

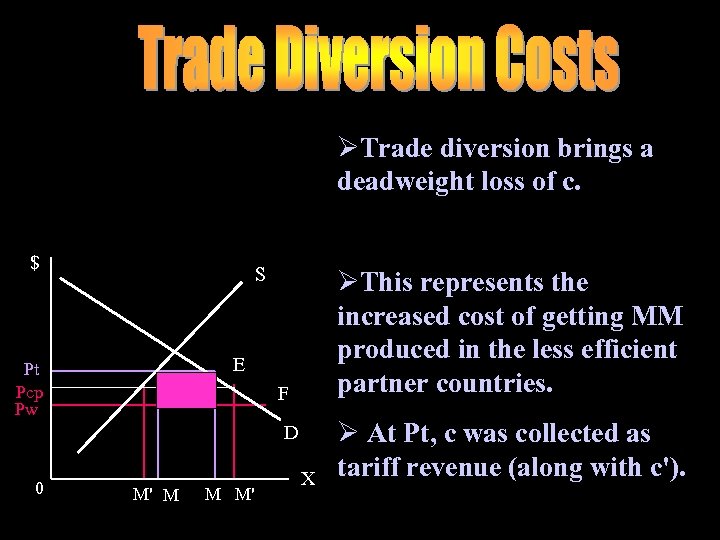

ØTrade diversion brings a deadweight loss of c. $ S Pt Pcp Pw c' c ØThis represents the increased cost of getting MM produced in the less efficient partner countries. E F D 0 M' M M M' X Ø At Pt, c was collected as tariff revenue (along with c').

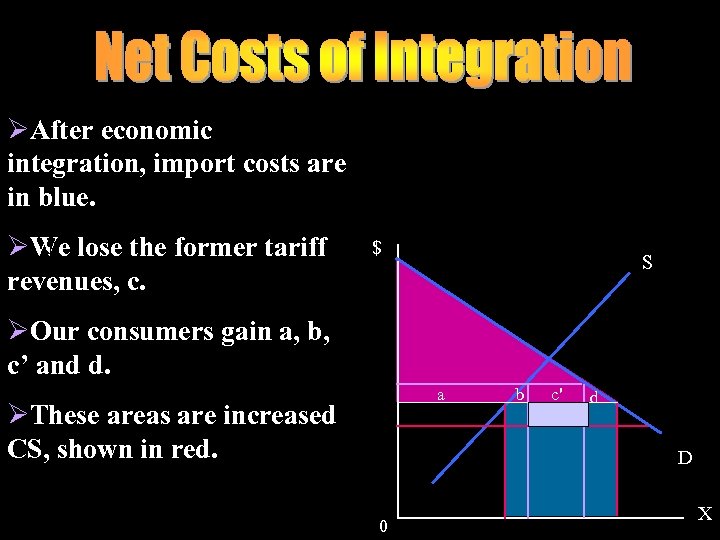

ØAfter economic integration, import costs are in blue. $ ØWe lose the former tariff revenues, c. $ S ØOur consumers gain a, b, c’ and d. a ØThese areas are increased CS, shown in red. 0 b c' c d D 0 X

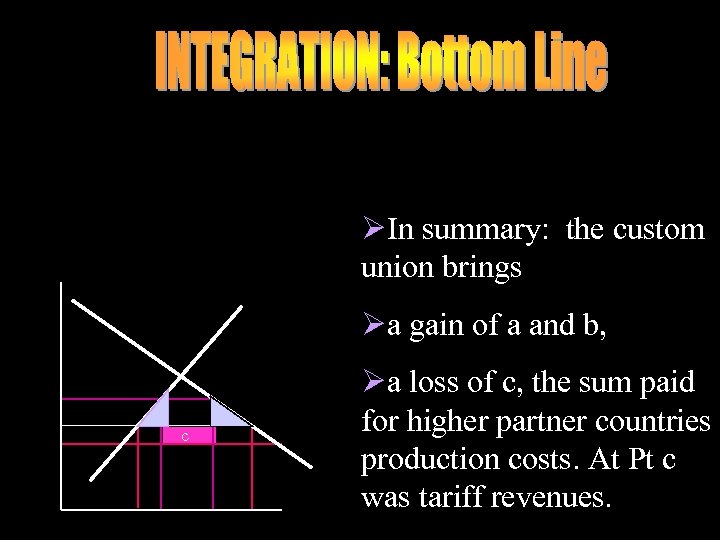

ØIn summary: the custom union brings Øa gain of a and b, a c b Øa loss of c, the sum paid for higher partner countries production costs. At Pt c was tariff revenues.

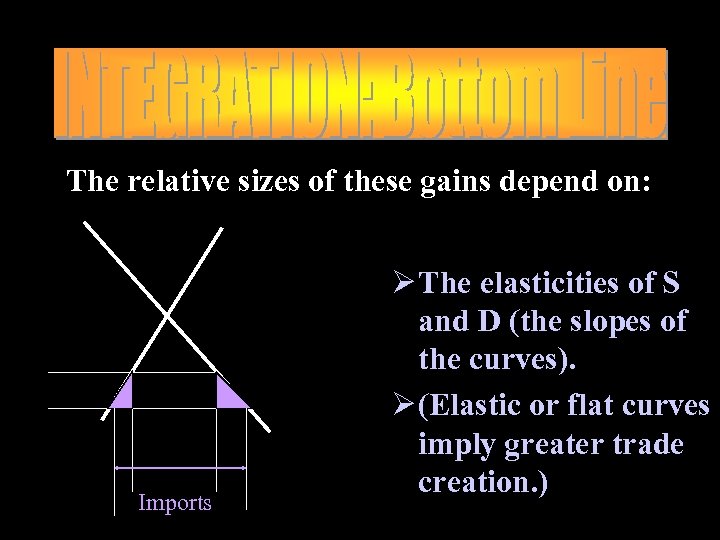

The relative sizes of these gains depend on: Imports Ø The elasticities of S and D (the slopes of the curves). Ø (Elastic or flat curves imply greater trade creation. )

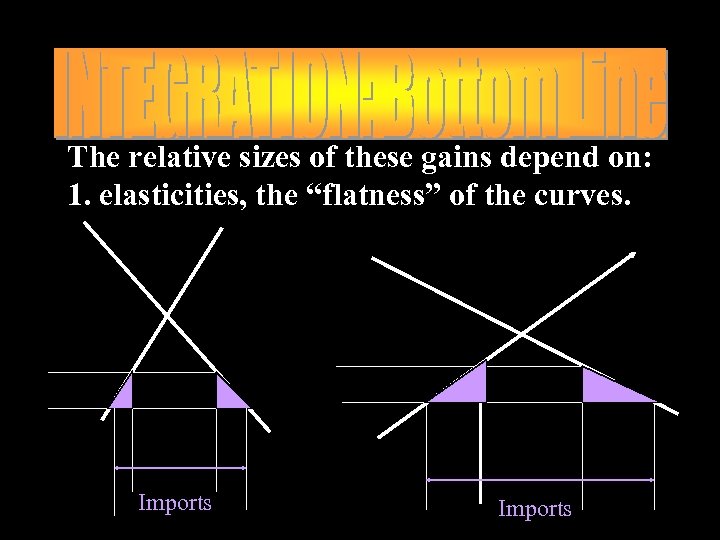

The relative sizes of these gains depend on: 1. elasticities, the “flatness” of the curves. Imports

The relative sizes of these gains depend on: 1. elasticities, the “flatness” of the curves, 2. The cost differences between domestic partners and world producers. Gains are greatest when the difference is great between home and partner and small between partner and world. (The partner country is much more efficient than we are, and nearly as efficient as the world’s best producers. )

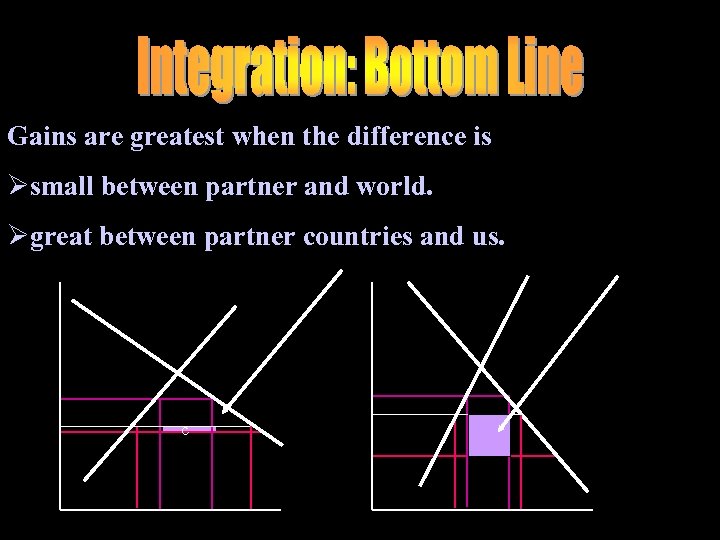

Gains are greatest when the difference is Øsmall between partner and world. Øgreat between partner countries and us. c c

The dynamic effects of customs unions ØThe static effects of customs unions (as we have seen: a + b - c) may be small as a fraction of the total national income, Øbut dynamic effects are very important.

The dynamic effects of customs unions include: 1. Economies of scale (similar to having a large internal market). To serve a large market, firms can begin to expand, if they have economies of scale, the very process of expansion causes their unit production costs to fall, increasing their competitiveness in global and domestic markets.

The dynamic effects of customs unions include: 2. Stimulus of competition ØLarge companies now less protected must compete ØSmall companies must merge, combine, become efficient

The dynamic effects of customs unions include: 3. Stimulus to invest. Øto take advantage of export opportunities, or Øto meet new import competition.

3c8f70cc01abed67d3e6fa83577868e1.ppt