9de3b7a126dc7627e3ff8b41d3d83193.ppt

- Количество слайдов: 16

Broadband Network Strategies June 4~5, 2002 Dr. Nae-Chan Lee nclee@kisdi. re. kr OECD Broadband Workshop 2000, Hotel Lotte World, Seoul, Korea Information Society Development Institute

Contents What is Broadband Internet Service ? Impact of Network Investment Patterns of Growth Demand Side Supply Side Network Strategies

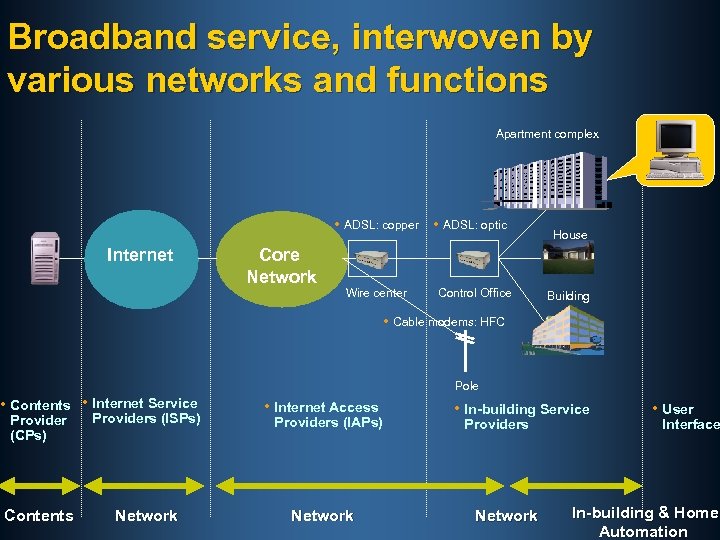

Broadband service, interwoven by various networks and functions Apartment complex • ADSL: copper • ADSL: optic Internet Core Network Wire center Control Office House Building • Cable modems: HFC Pole • Contents • Internet Service Provider (CPs) Providers (ISPs) Contents Network • Internet Access Providers (IAPs) Network • In-building Service Providers Network • User Interface In-building & Home Automation

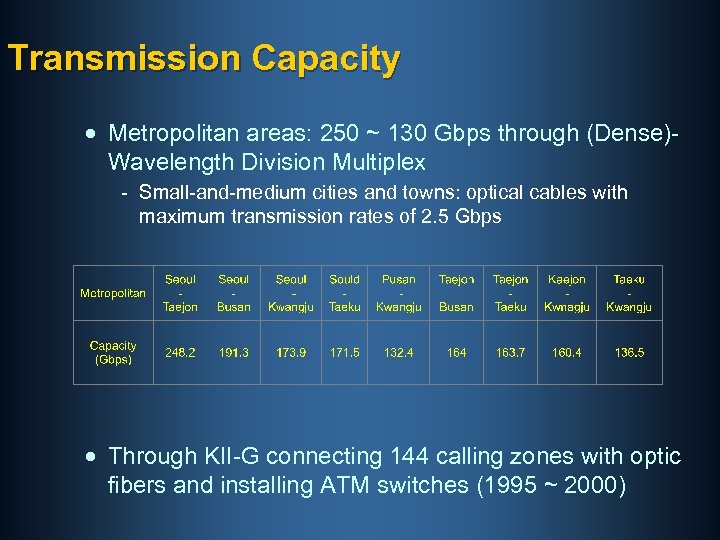

Transmission Capacity · Metropolitan areas: 250 ~ 130 Gbps through (Dense)Wavelength Division Multiplex - Small-and-medium cities and towns: optical cables with maximum transmission rates of 2. 5 Gbps · Through KII-G connecting 144 calling zones with optic fibers and installing ATM switches (1995 ~ 2000)

Investment as IT Booster · Total amount of investment by 2001: $ 4. 04 billion · Spillover effects: $ 7. 07 ~ $ 9. 46 billion · Job creation: 4, 900~8, 300

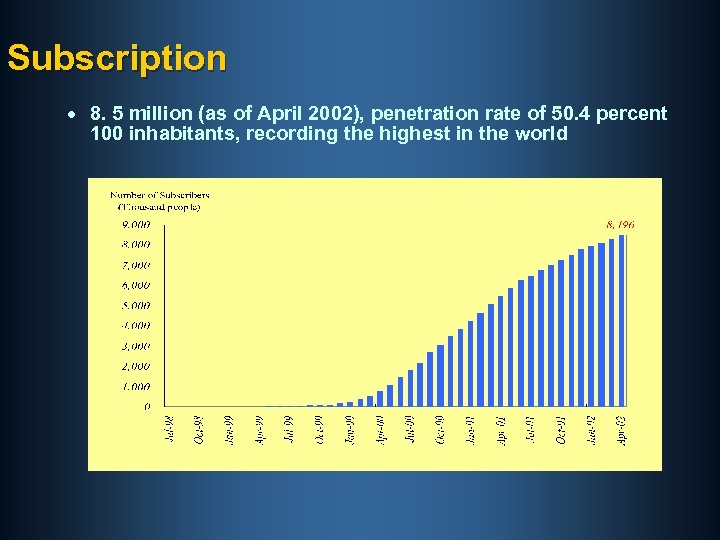

Subscription · 8. 5 million (as of April 2002), penetration rate of 50. 4 percent 100 inhabitants, recording the highest in the world

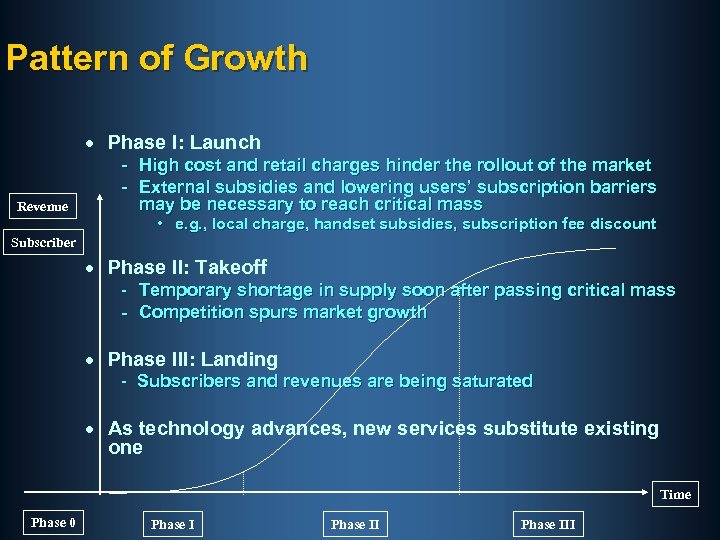

Pattern of Growth · Phase I: Launch Revenue - High cost and retail charges hinder the rollout of the market - External subsidies and lowering users’ subscription barriers may be necessary to reach critical mass • e. g. , local charge, handset subsidies, subscription fee discount Subscriber · Phase II: Takeoff - Temporary shortage in supply soon after passing critical mass - Competition spurs market growth · Phase III: Landing - Subscribers and revenues are being saturated · As technology advances, new services substitute existing one Time Phase 0 Phase III

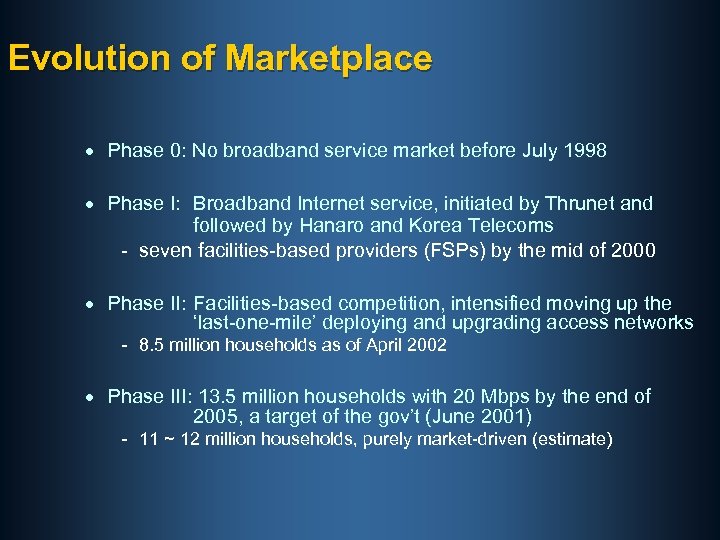

Evolution of Marketplace · Phase 0: No broadband service market before July 1998 · Phase I: Broadband Internet service, initiated by Thrunet and followed by Hanaro and Korea Telecoms - seven facilities-based providers (FSPs) by the mid of 2000 · Phase II: Facilities-based competition, intensified moving up the ‘last-one-mile’ deploying and upgrading access networks - 8. 5 million households as of April 2002 · Phase III: 13. 5 million households with 20 Mbps by the end of 2005, a target of the gov’t (June 2001) - 11 ~ 12 million households, purely market-driven (estimate)

Demand Side · D-1: Few in Phase I, increase after passing by critical mass - Customers keep in mind the level of charge first and foremost! · D-2: Customers’ subscription, influenced by word-of-mouth(50%) and mass media(25%) · D-3: Customers, less inclined to churn(93%) · D-4: No network externality unlike voice services - packet flows between each customer’s PC and web servers (no onnet calls between customers like local or mobile services) · D-5: One-line with dynamic IP for residential use, Multi-line with fixed IP for small-and-medium sized business · Conditions D-2 and D-3 and competition accelerate marketing costs(Ad, incentive payment), recording the highest portion among costs

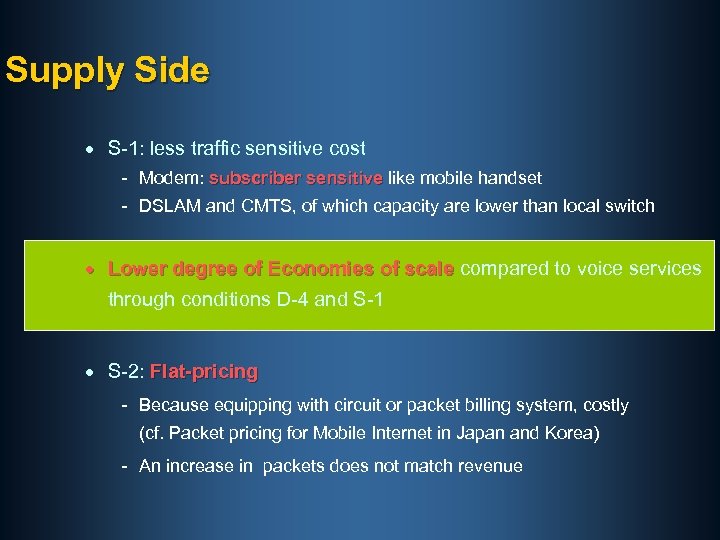

Supply Side · S-1: less traffic sensitive cost - Modem: subscriber sensitive like mobile handset - DSLAM and CMTS, of which capacity are lower than local switch · Lower degree of Economies of scale compared to voice services through conditions D-4 and S-1 · S-2: Flat-pricing - Because equipping with circuit or packet billing system, costly (cf. Packet pricing for Mobile Internet in Japan and Korea) - An increase in packets does not match revenue

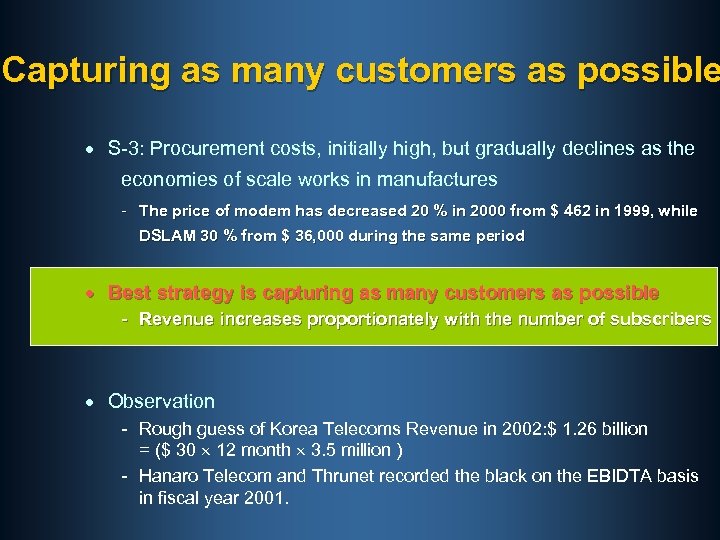

Capturing as many customers as possible · S-3: Procurement costs, initially high, but gradually declines as the economies of scale works in manufactures - The price of modem has decreased 20 % in 2000 from $ 462 in 1999, while DSLAM 30 % from $ 36, 000 during the same period · Best strategy is capturing as many customers as possible - Revenue increases proportionately with the number of subscribers · Observation - Rough guess of Korea Telecoms Revenue in 2002: $ 1. 26 billion = ($ 30 12 month 3. 5 million ) - Hanaro Telecom and Thrunet recorded the black on the EBIDTA basis in fiscal year 2001.

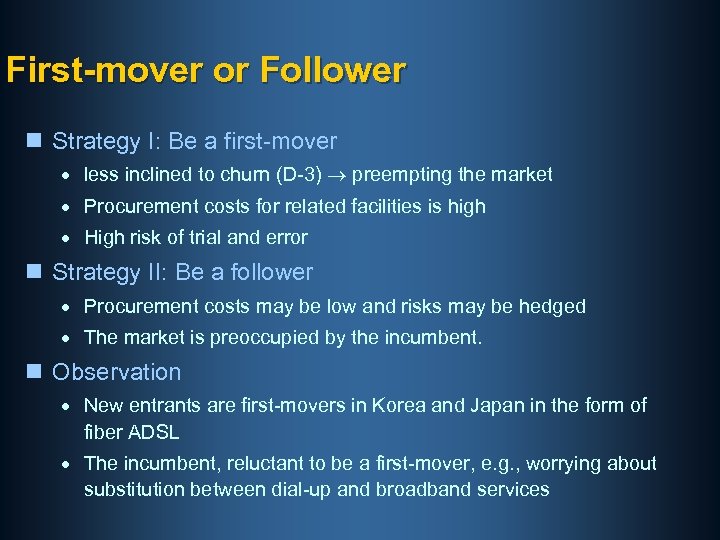

First-mover or Follower n Strategy I: Be a first-mover · less inclined to churn (D-3) preempting the market · Procurement costs for related facilities is high · High risk of trial and error n Strategy II: Be a follower · Procurement costs may be low and risks may be hedged · The market is preoccupied by the incumbent. n Observation · New entrants are first-movers in Korea and Japan in the form of fiber ADSL · The incumbent, reluctant to be a first-mover, e. g. , worrying about substitution between dial-up and broadband services

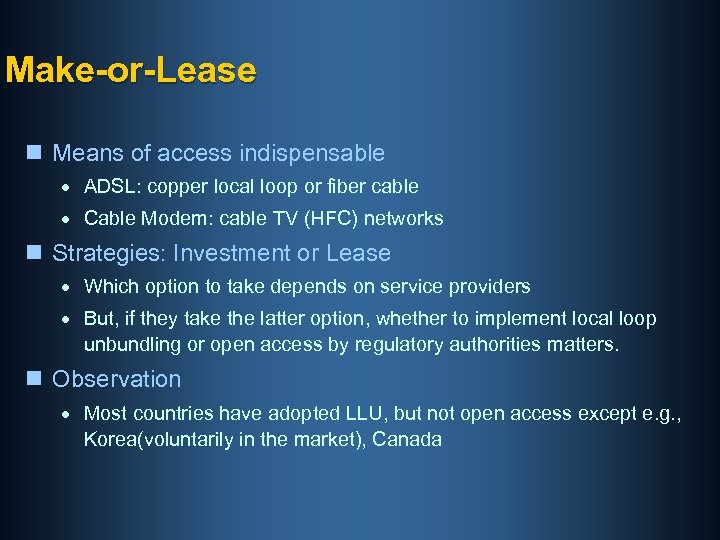

Make-or-Lease n Means of access indispensable · ADSL: copper local loop or fiber cable · Cable Modem: cable TV (HFC) networks n Strategies: Investment or Lease · Which option to take depends on service providers · But, if they take the latter option, whether to implement local loop unbundling or open access by regulatory authorities matters. n Observation · Most countries have adopted LLU, but not open access except e. g. , Korea(voluntarily in the market), Canada

Skipping over Technologies n Advances in Technology and Speedy Migration · Broadband: Dial-up ISDN ADSL VDSL or x. DSL n Strategies · Strategy I: Taking the opportunity of grabbing the market now - foregone sunk costs and burdens of new tech. investment in the future · Strategy II: Wait until tomorrow, skipping to new technology. - Foregone present market opportunity n Observation · Korea Telecom has skipped over ISDN and jumped to ADSL, while Japan has devoted on ISDN. Japan, hopping onto VDSL ?

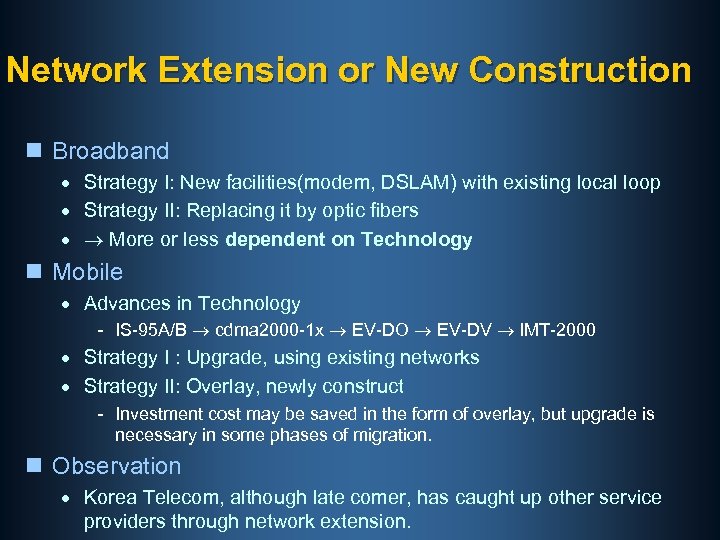

Network Extension or New Construction n Broadband · Strategy I: New facilities(modem, DSLAM) with existing local loop · Strategy II: Replacing it by optic fibers · More or less dependent on Technology n Mobile · Advances in Technology - IS-95 A/B cdma 2000 -1 x EV-DO EV-DV IMT-2000 · Strategy I : Upgrade, using existing networks · Strategy II: Overlay, newly construct - Investment cost may be saved in the form of overlay, but upgrade is necessary in some phases of migration. n Observation · Korea Telecom, although late comer, has caught up other service providers through network extension.

Thanks for Listening ! For more details on Broadband Internet Service in Korea “ Broadband Internet Service in Korea (2002)” For more details on Info and Telecom Services in Korea broadbandkorea. kisdi. re. kr

9de3b7a126dc7627e3ff8b41d3d83193.ppt