9649d9993e6e7bf112f5dd08c9fb78e4.ppt

- Количество слайдов: 58

Briefing to the Portfolio Committee South African Tourism 5 Year Strategic Plan And Annual Performance Plan 20 March 2015

Contents • Vision, Mandate and Governance • Strategic Objectives and Performance Measurements • SA Tourism Budget • • • Slide no. 1 SA Tourism Strategy o National Convention Bureau o Leisure Tourism – Global, Africa and Domestic Tourism o Tourism Grading Alignment with Key Stakeholders SA Tourism HR Strategy Concluding Remarks

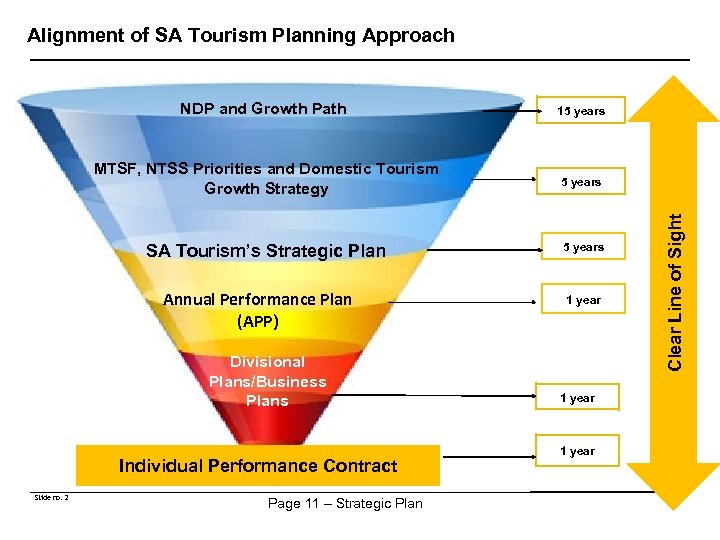

Alignment of SA Tourism Planning Approach 15 years MTSF, NTSS Priorities and Domestic Tourism Growth Strategy 5 years SA Tourism’s Strategic Plan 5 years Annual Performance Plan (APP) Divisional Plans/Business Plans Individual Performance Contract Slide no. 2 Page 11 – Strategic Plan 1 year Clear Line of Sight NDP and Growth Path

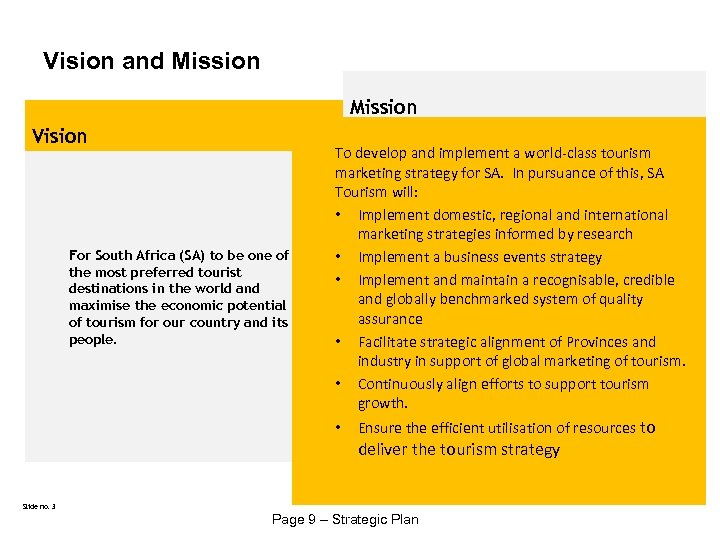

Vision and Mission Vision For South Africa (SA) to be one of the most preferred tourist destinations in the world and maximise the economic potential of tourism for our country and its people. To develop and implement a world-class tourism marketing strategy for SA. In pursuance of this, SA Tourism will: • Implement domestic, regional and international marketing strategies informed by research • Implement a business events strategy • Implement and maintain a recognisable, credible and globally benchmarked system of quality assurance • Facilitate strategic alignment of Provinces and industry in support of global marketing of tourism. • Continuously align efforts to support tourism growth. • Ensure the efficient utilisation of resources to deliver the tourism strategy Slide no. 3 Page 9 – Strategic Plan

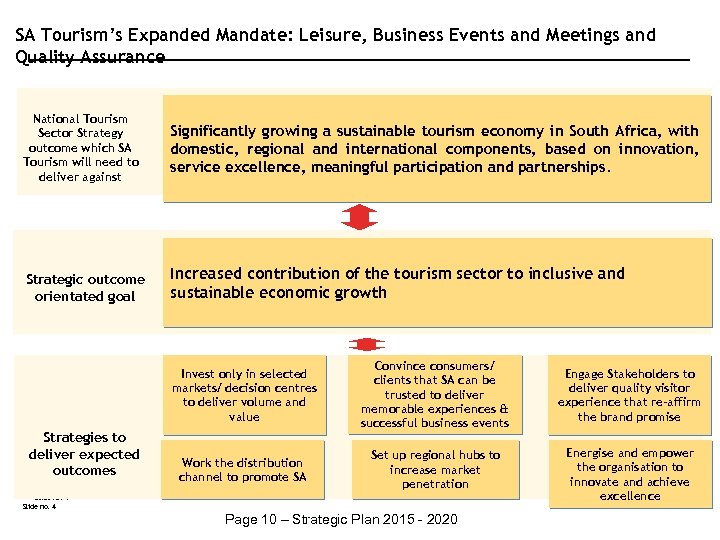

SA Tourism’s Expanded Mandate: Leisure, Business Events and Meetings and Quality Assurance National Tourism Sector Strategy outcome which SA Tourism will need to deliver against Significantly growing a sustainable tourism economy in South Africa, with domestic, regional and international components, based on innovation, service excellence, meaningful participation and partnerships. Strategic outcome orientated goal Increased contribution of the tourism sector to inclusive and sustainable economic growth Invest only in selected markets/ decision centres to deliver volume and value Strategies to deliver expected outcomes Convince consumers/ clients that SA can be trusted to deliver memorable experiences & successful business events Engage Stakeholders to deliver quality visitor experience that re-affirm the brand promise Work the distribution channel to promote SA Set up regional hubs to increase market penetration Energise and empower the organisation to innovate and achieve excellence Slide no. 4 Page 10 – Strategic Plan 2015 - 2020

• Slide no. 5 Strategic Objectives Page 25 -34: Strategic Plan

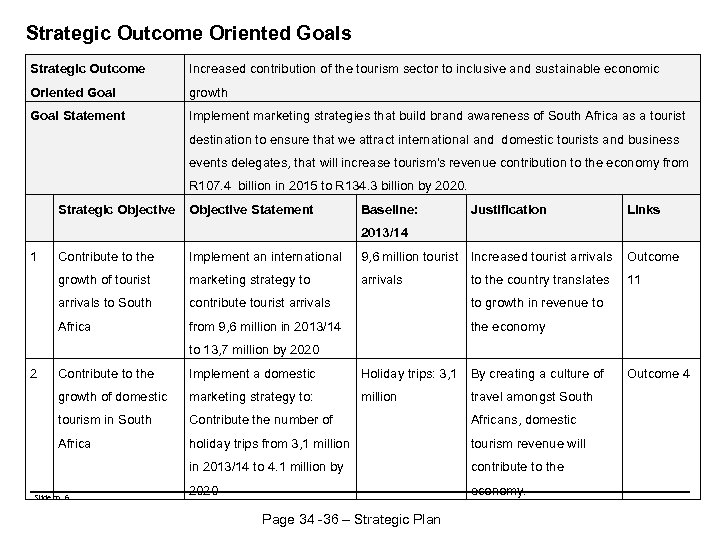

Strategic Outcome Oriented Goals Strategic Outcome Increased contribution of the tourism sector to inclusive and sustainable economic Oriented Goal growth Goal Statement Implement marketing strategies that build brand awareness of South Africa as a tourist destination to ensure that we attract international and domestic tourists and business events delegates, that will increase tourism's revenue contribution to the economy from R 107. 4 billion in 2015 to R 134. 3 billion by 2020. Strategic Objective Statement Baseline: Justification Links 2013/14 1 Contribute to the Implement an international 9, 6 million tourist Increased tourist arrivals Outcome growth of tourist marketing strategy to arrivals to South contribute tourist arrivals to growth in revenue to Africa from 9, 6 million in 2013/14 the economy to the country translates 11 to 13, 7 million by 2020 2 Contribute to the Implement a domestic Holiday trips: 3, 1 By creating a culture of growth of domestic marketing strategy to: million tourism in South Contribute the number of Africans, domestic Africa holiday trips from 3, 1 million tourism revenue will in 2013/14 to 4. 1 million by contribute to the 2020 economy. Slide no. 6 Page 34 -36 – Strategic Plan travel amongst South Outcome 4

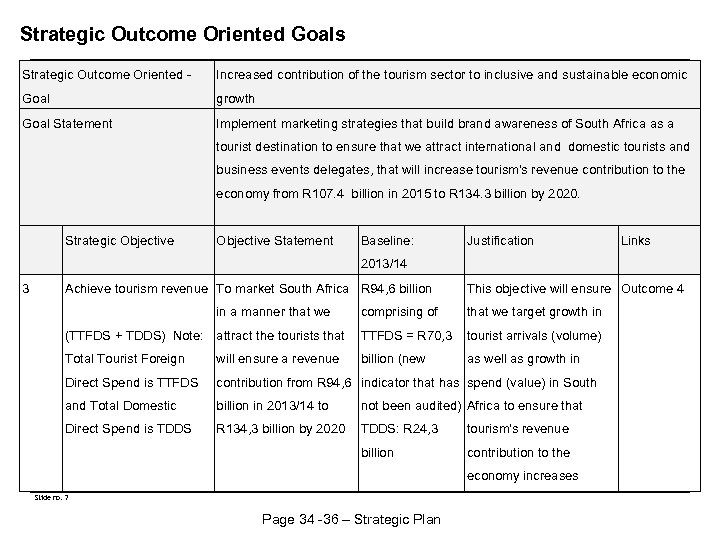

Strategic Outcome Oriented Goals Strategic Outcome Oriented - Increased contribution of the tourism sector to inclusive and sustainable economic Goal growth Goal Statement Implement marketing strategies that build brand awareness of South Africa as a tourist destination to ensure that we attract international and domestic tourists and business events delegates, that will increase tourism's revenue contribution to the economy from R 107. 4 billion in 2015 to R 134. 3 billion by 2020. Strategic Objective Statement Baseline: Justification Links 2013/14 3 Achieve tourism revenue To market South Africa R 94, 6 billion in a manner that we comprising of This objective will ensure Outcome 4 that we target growth in (TTFDS + TDDS) Note: attract the tourists that TTFDS = R 70, 3 tourist arrivals (volume) Total Tourist Foreign will ensure a revenue billion (new as well as growth in Direct Spend is TTFDS contribution from R 94, 6 indicator that has spend (value) in South and Total Domestic billion in 2013/14 to not been audited) Africa to ensure that Direct Spend is TDDS R 134, 3 billion by 2020 TDDS: R 24, 3 tourism's revenue billion contribution to the economy increases Slide no. 7 Page 34 -36 – Strategic Plan

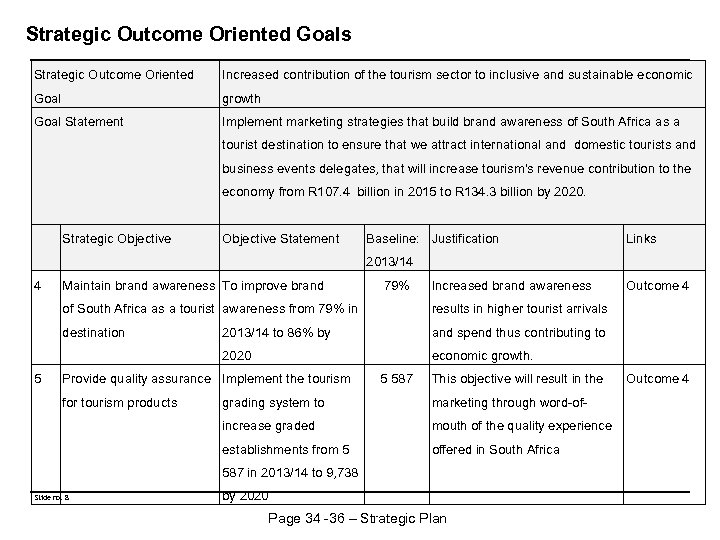

Strategic Outcome Oriented Goals Strategic Outcome Oriented Increased contribution of the tourism sector to inclusive and sustainable economic Goal growth Goal Statement Implement marketing strategies that build brand awareness of South Africa as a tourist destination to ensure that we attract international and domestic tourists and business events delegates, that will increase tourism's revenue contribution to the economy from R 107. 4 billion in 2015 to R 134. 3 billion by 2020. Strategic Objective Statement Baseline: Justification Links 2013/14 4 Maintain brand awareness To improve brand 79% Increased brand awareness of South Africa as a tourist awareness from 79% in 2013/14 to 86% by and spend thus contributing to 2020 5 results in higher tourist arrivals destination Outcome 4 economic growth. Provide quality assurance Implement the tourism for tourism products 5 587 This objective will result in the grading system to marketing through word-of- increase graded mouth of the quality experience establishments from 5 offered in South Africa 587 in 2013/14 to 9, 738 Slide no. 8 by 2020 Page 34 -36 – Strategic Plan Outcome 4

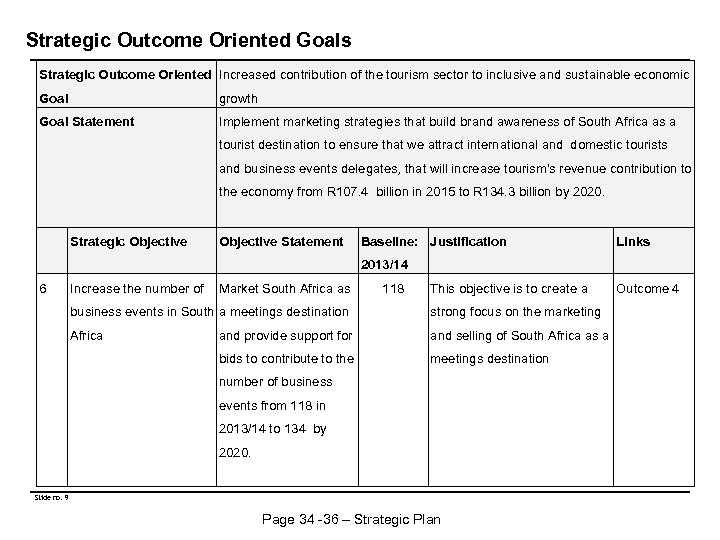

Strategic Outcome Oriented Goals Strategic Outcome Oriented Increased contribution of the tourism sector to inclusive and sustainable economic Goal growth Goal Statement Implement marketing strategies that build brand awareness of South Africa as a tourist destination to ensure that we attract international and domestic tourists and business events delegates, that will increase tourism's revenue contribution to the economy from R 107. 4 billion in 2015 to R 134. 3 billion by 2020. Strategic Objective Statement Baseline: Justification Links 2013/14 6 Increase the number of Market South Africa as 118 This objective is to create a business events in South a meetings destination strong focus on the marketing Africa and provide support for and selling of South Africa as a bids to contribute to the meetings destination number of business events from 118 in 2013/14 to 134 by 2020. Slide no. 9 Page 34 -36 – Strategic Plan Outcome 4

• Slide no. 10 Annual Performance Targets 2015/16 and beyond Page 25 -34: Strategic Plan

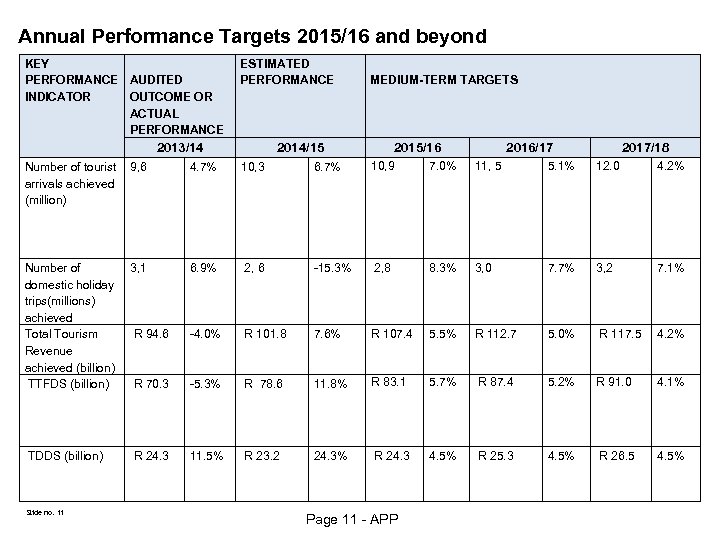

Annual Performance Targets 2015/16 and beyond KEY PERFORMANCE AUDITED INDICATOR OUTCOME OR ACTUAL PERFORMANCE ESTIMATED PERFORMANCE 2013/14 2014/15 MEDIUM-TERM TARGETS 2015/16 2016/17 2017/18 Number of tourist 9, 6 arrivals achieved (million) 4. 7% 10, 3 6. 7% 10, 9 7. 0% 11, 5 5. 1% 12. 0 4. 2% Number of domestic holiday trips(millions) achieved Total Tourism Revenue achieved (billion) TTFDS (billion) 3, 1 6. 9% 2, 6 -15. 3% 2, 8 8. 3% 3, 0 7. 7% 3, 2 7. 1% R 94. 6 -4. 0% R 101. 8 7. 6% R 107. 4 5. 5% R 112. 7 5. 0% R 117. 5 4. 2% R 70. 3 -5. 3% R 78. 6 11. 8% R 83. 1 5. 7% R 87. 4 5. 2% R 91. 0 4. 1% TDDS (billion) R 24. 3 11. 5% R 23. 2 24. 3% R 24. 3 4. 5% R 25. 3 4. 5% R 26. 5 4. 5% Slide no. 11 Page 11 - APP

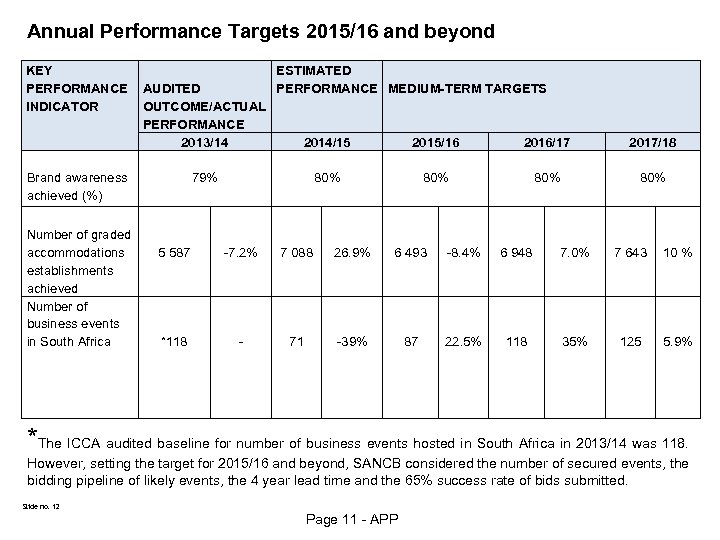

Annual Performance Targets 2015/16 and beyond KEY PERFORMANCE INDICATOR ESTIMATED AUDITED PERFORMANCE MEDIUM-TERM TARGETS OUTCOME/ACTUAL PERFORMANCE 2013/14 2014/15 2015/16 2016/17 Brand awareness 79% 80% 80% achieved (%) Number of graded accommodations establishments achieved Number of business events in South Africa 2017/18 80% 5 587 -7. 2% 7 088 26. 9% 6 493 -8. 4% 6 948 7. 0% 7 643 10 % *118 - 71 -39% 87 22. 5% 118 35% 125 5. 9% *The ICCA audited baseline for number of business events hosted in South Africa in 2013/14 was 118. However, setting the target for 2015/16 and beyond, SANCB considered the number of secured events, the bidding pipeline of likely events, the 4 year lead time and the 65% success rate of bids submitted. Slide no. 12 Page 11 - APP

• Slide no. 13 Budget Allocation Page 25 -34: Strategic Plan

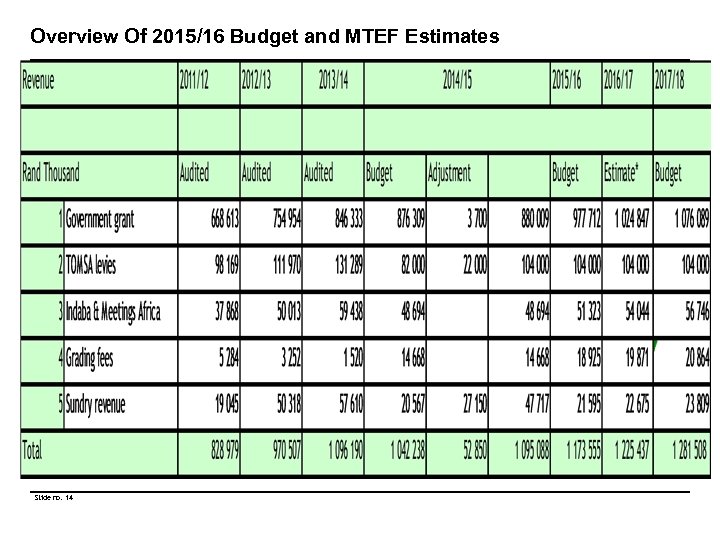

Overview Of 2015/16 Budget and MTEF Estimates Slide no. 14

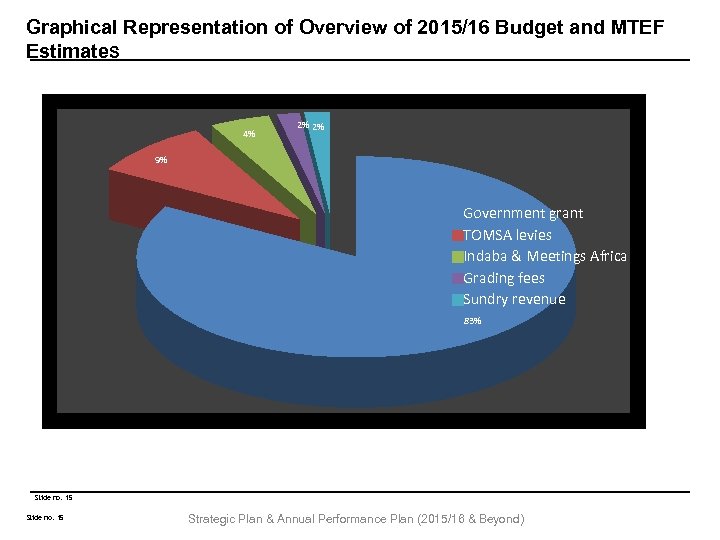

Graphical Representation of Overview of 2015/16 Budget and MTEF Estimate. S 4% 2% 2% 9% Government grant TOMSA levies Indaba & Meetings Africa Grading fees Sundry revenue 83% Slide no. 15 Strategic Plan & Annual Performance Plan (2015/16 & Beyond)

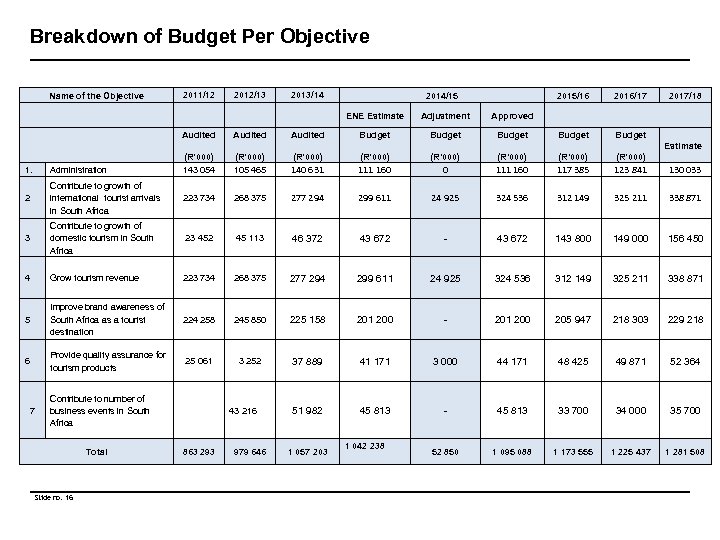

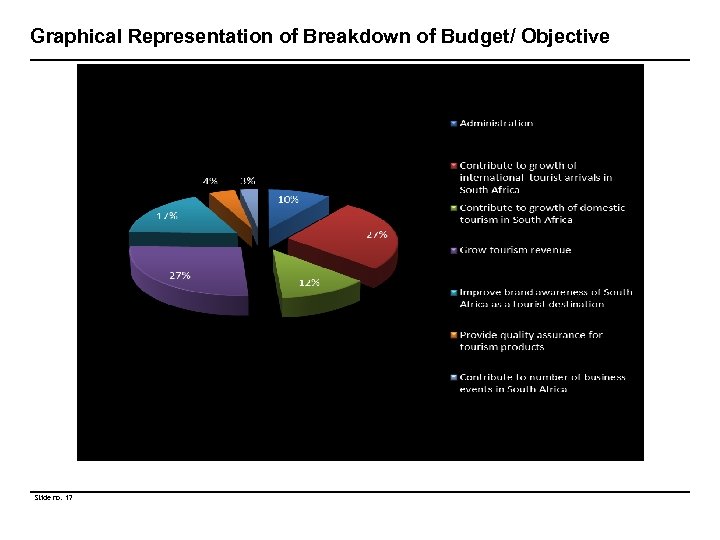

Breakdown of Budget Per Objective 2011/12 Name of the Objective 2012/13 2013/14 2014/15 2015/16 ENE Estimate Adjustment 2016/17 2017/18 Approved Audited Budget Budget (R’ 000) 143 054 (R’ 000) 105 465 (R’ 000) (R’ 000) 140 631 111 160 0 111 160 117 385 123 841 130 033 Estimate 1. Administration 2 Contribute to growth of international tourist arrivals in South Africa 223 734 268 375 277 294 299 611 24 925 324 536 312 149 325 211 338 871 3 Contribute to growth of domestic tourism in South Africa 23 452 45 113 46 372 43 672 - 43 672 143 800 149 000 156 450 4 Grow tourism revenue 223 734 268 375 277 294 299 611 24 925 324 536 312 149 325 211 338 871 5 Improve brand awareness of South Africa as a tourist destination 224 258 245 850 225 158 201 200 - 201 200 205 947 218 303 229 218 6 Provide quality assurance for tourism products 25 061 3 252 37 889 41 171 3 000 44 171 48 425 49 871 52 364 51 982 45 813 - 45 813 33 700 34 000 35 700 52 850 1 095 088 1 173 555 1 225 437 1 281 508 7 Contribute to number of business events in South Africa Total Slide no. 16 43 216 863 293 979 646 1 057 203 1 042 238

Graphical Representation of Breakdown of Budget/ Objective Slide no. 17

Budget Interventions • Upfront payment to foreign country budgets to manage the risk of currency exposure • Request budget rate from Treasury • Budget in foreign countries Slide no. 18 © South African Tourism 2012

• SA Tourism’s strategy is to: – convince consumers/ clients that South Africa can be trusted to deliver memorable experiences and successful business events. Slide no. 19 Page 25 -34: Strategic Plan

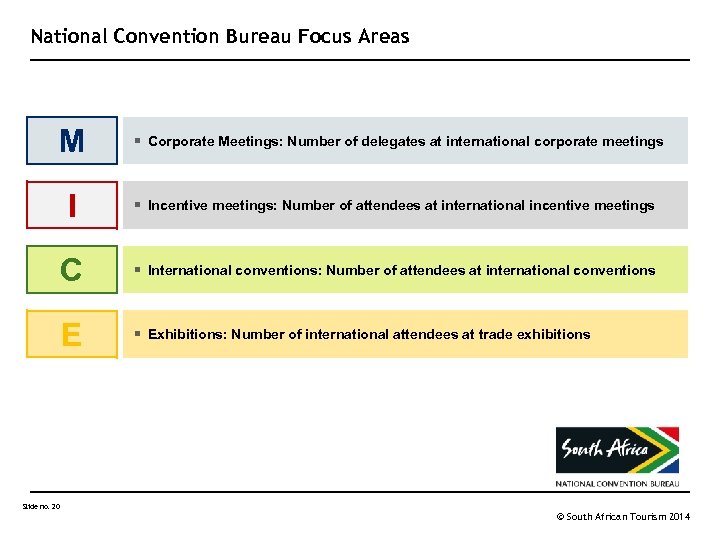

National Convention Bureau Focus Areas M § Corporate Meetings: Number of delegates at international corporate meetings I § Incentive meetings: Number of attendees at international incentive meetings C § International conventions: Number of attendees at international conventions E § Exhibitions: Number of international attendees at trade exhibitions Slide no. 20 © South African Tourism 2014

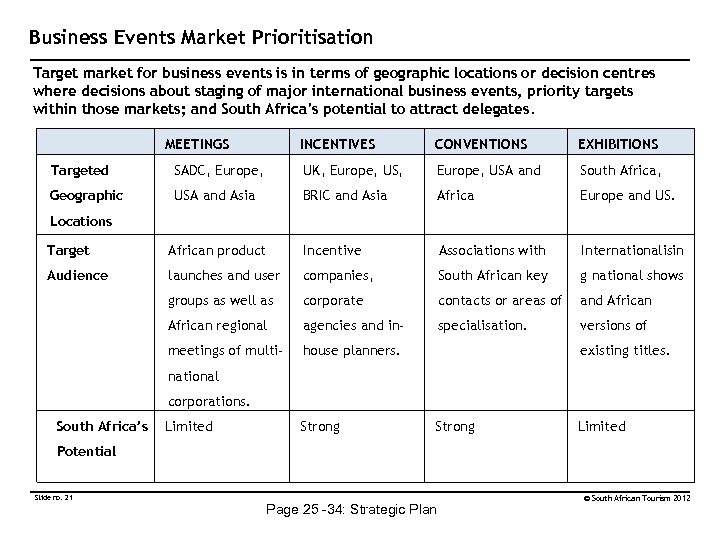

Business Events Market Prioritisation Target market for business events is in terms of geographic locations or decision centres where decisions about staging of major international business events, priority targets within those markets; and South Africa’s potential to attract delegates. MEETINGS INCENTIVES CONVENTIONS EXHIBITIONS Targeted SADC, Europe, UK, Europe, US, Europe, USA and South Africa, Geographic USA and Asia BRIC and Asia Africa Europe and US. Locations Target African product Incentive Associations with Internationalisin Audience launches and user companies, South African key g national shows groups as well as corporate contacts or areas of and African regional agencies and in- specialisation. versions of meetings of multi- house planners. existing titles. national corporations. South Africa’s Limited Strong Limited Potential Slide no. 21 Page 25 -34: Strategic Plan © South African Tourism 2012

Sales Model for Business Meetings and Events • Following best international practice, SANCB has adopted a hybrid sales model where sales in some regions are generated using a Sales Representation Model and in others, in-house sales teams. • The intrinsic benefits associated with the Sales Representation Model are cost effectiveness and the ability to reach a wider audience in the regions where it is used. • Performance of the independent sales representatives is managed via the Sales Representation Agreements. Slide no. 22 Page 25 -34: Strategic Plan

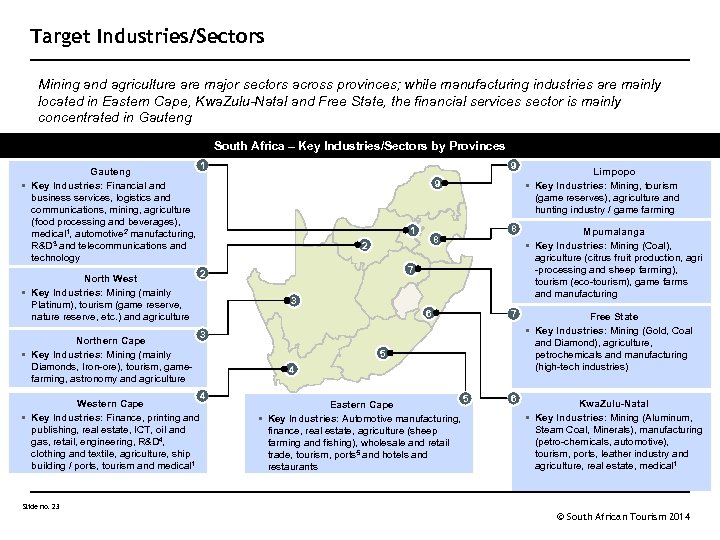

Target Industries/Sectors Mining and agriculture are major sectors across provinces; while manufacturing industries are mainly located in Eastern Cape, Kwa. Zulu-Natal and Free State, the financial services sector is mainly concentrated in Gauteng South Africa – Key Industries/Sectors by Provinces Gauteng § Key Industries: Financial and business services, logistics and communications, mining, agriculture (food processing and beverages), medical 1, automotive 2 manufacturing, R&D 3 and telecommunications and technology North West § Key Industries: Mining (mainly Platinum), tourism (game reserve, nature reserve, etc. ) and agriculture Northern Cape § Key Industries: Mining (mainly Diamonds, Iron-ore), tourism, gamefarming, astronomy and agriculture 1 9 1 8 2 Mpumalanga § Key Industries: Mining (Coal), agriculture (citrus fruit production, agri -processing and sheep farming), tourism (eco-tourism), game farms and manufacturing 7 Free State § Key Industries: Mining (Gold, Coal and Diamond), agriculture, petrochemicals and manufacturing (high-tech industries) 6 Kwa. Zulu-Natal § Key Industries: Mining (Aluminum, Steam Coal, Minerals), manufacturing (petro-chemicals, automotive), tourism, ports, leather industry and agriculture, real estate, medical 1 3 6 3 5 4 5 Eastern Cape § Key Industries: Automotive manufacturing, finance, real estate, agriculture (sheep farming and fishing), wholesale and retail trade, tourism, ports 5 and hotels and restaurants Limpopo § Key Industries: Mining, tourism (game reserves), agriculture and hunting industry / game farming 8 7 2 4 Western Cape § Key Industries: Finance, printing and publishing, real estate, ICT, oil and gas, retail, engineering, R&D 4, clothing and textile, agriculture, ship building / ports, tourism and medical 1 Slide no. 23 9 © South African Tourism 2014

National Convention Bureau Services SANCB SUPPORT SERVICES Bidding Support • Bid Strategy • Bid Document • Lobbying • Bid promotion • Bid Presentations Slide no. 24 Site Inspection Support • Bidding Site Inspections • Convention Planning Site Inspections Convention Planning Support • Planning support • Venue and supplier recommendations • Final decision with client Delegate Boosting Support • Marketing support to promote the SA conference • Delegate attendance promotion On Site Event Services • Support toward on site elements of the event

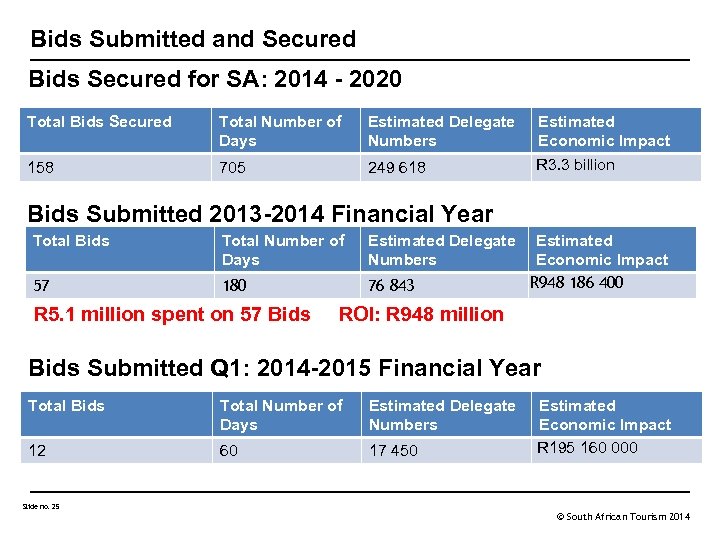

Bids Submitted and Secured Bids Secured for SA: 2014 - 2020 Total Bids Secured Total Number of Days Estimated Delegate Numbers 158 705 249 618 Estimated Economic Impact R 3. 3 billion Bids Submitted 2013 -2014 Financial Year Total Bids Total Number of Days 57 180 Estimated Delegate Estimated Numbers Economic Impact R 948 186 400 76 843 R 5. 1 million spent on 57 Bids ROI: R 948 million Bids Submitted Q 1: 2014 -2015 Financial Year Total Bids Total Number of Days Estimated Delegate Numbers 12 60 17 450 Slide no. 25 Estimated Economic Impact R 195 160 000 © South African Tourism 2014

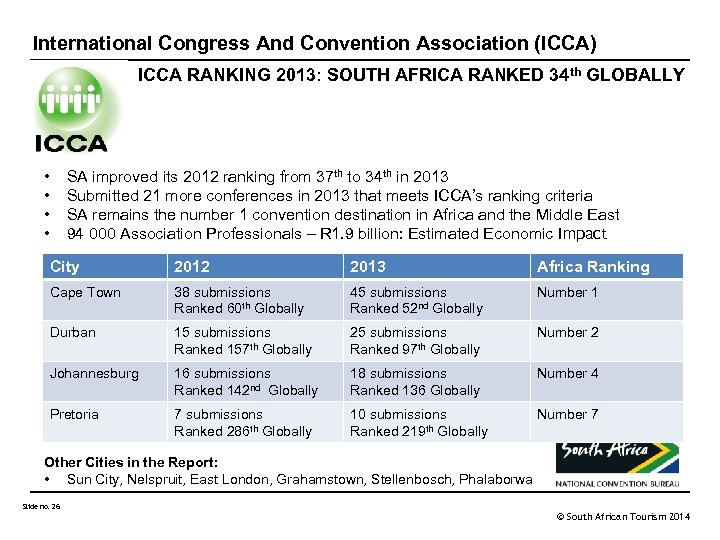

International Congress And Convention Association (ICCA) ICCA RANKING 2013: SOUTH AFRICA RANKED 34 th GLOBALLY • • SA improved its 2012 ranking from 37 th to 34 th in 2013 Submitted 21 more conferences in 2013 that meets ICCA’s ranking criteria SA remains the number 1 convention destination in Africa and the Middle East 94 000 Association Professionals – R 1. 9 billion: Estimated Economic Impact City 2012 2013 Africa Ranking Cape Town 38 submissions Ranked 60 th Globally 45 submissions Ranked 52 nd Globally Number 1 Durban 15 submissions Ranked 157 th Globally 25 submissions Ranked 97 th Globally Number 2 Johannesburg 16 submissions Ranked 142 nd Globally 18 submissions Ranked 136 Globally Number 4 Pretoria 7 submissions Ranked 286 th Globally 10 submissions Ranked 219 th Globally Number 7 Other Cities in the Report: • Sun City, Nelspruit, East London, Grahamstown, Stellenbosch, Phalaborwa Slide no. 26 © South African Tourism 2014

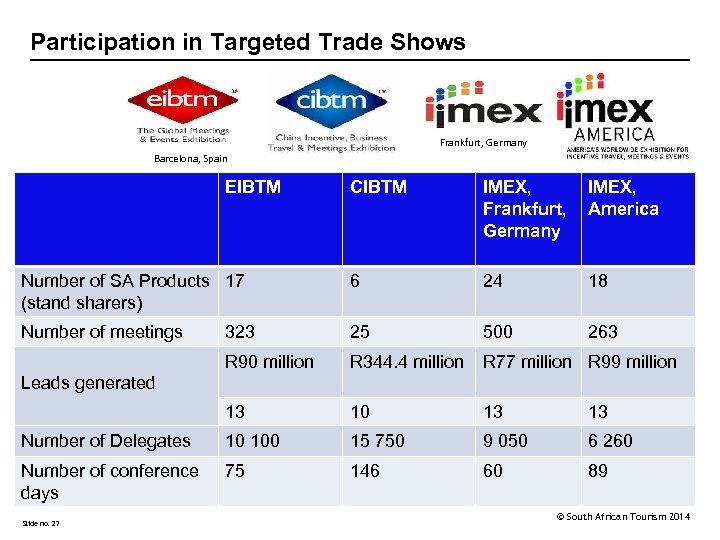

Participation in Targeted Trade Shows Frankfurt, Germany Barcelona, Spain EIBTM CIBTM IMEX, Frankfurt, America Germany Number of SA Products 17 (stand sharers) 6 24 18 Number of meetings 323 25 500 263 R 90 million R 344. 4 million R 77 million R 99 million 13 10 13 13 Number of Delegates 10 100 15 750 9 050 6 260 Number of conference days 75 146 60 89 Leads generated Slide no. 27 © South African Tourism 2014

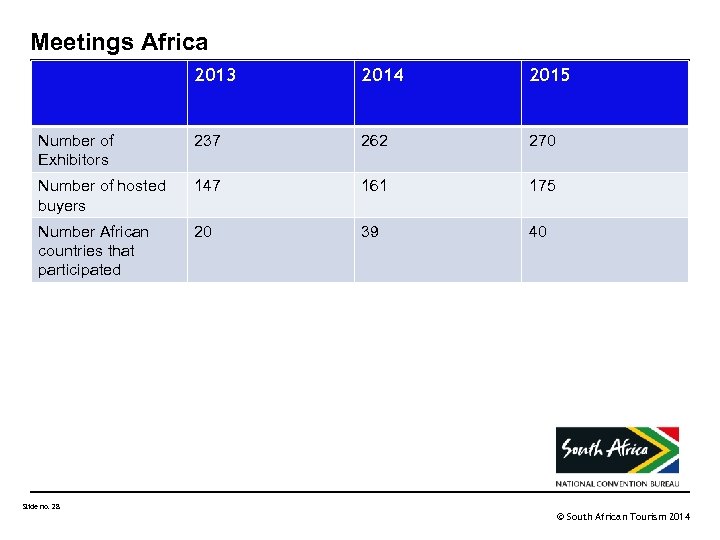

Meetings Africa 2013 2014 2015 Number of Exhibitors 237 262 270 Number of hosted buyers 147 161 175 Number African countries that participated 20 39 40 Slide no. 28 © South African Tourism 2014

• SA Tourism’s strategy is to: – invest only in selected markets/ decision centres to deliver volume and value. Slide no. 29 Page 25 -34: Strategic Plan

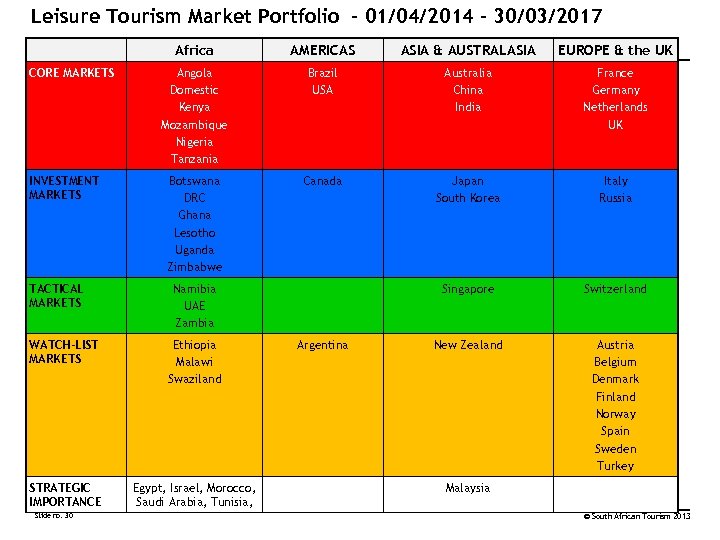

Leisure Tourism Market Portfolio - 01/04/2014 – 30/03/2017 Africa CORE MARKETS INVESTMENT MARKETS TACTICAL MARKETS AMERICAS ASIA & AUSTRALASIA EUROPE & the UK Angola Domestic Kenya Mozambique Nigeria Tanzania Brazil USA Australia China India France Germany Netherlands UK Botswana DRC Ghana Lesotho Uganda Zimbabwe Canada Japan South Korea Italy Russia Singapore Switzerland New Zealand Austria Belgium Denmark Finland Norway Spain Sweden Turkey Namibia UAE Zambia WATCH-LIST MARKETS Ethiopia Malawi Swaziland STRATEGIC IMPORTANCE Egypt, Israel, Morocco, Saudi Arabia, Tunisia, Slide no. 30 Argentina Malaysia © South African Tourism 2013

• SA Tourism’s strategy is to: – set up regional hubs to increase market penetration. Page 25 -34: Strategic Plan

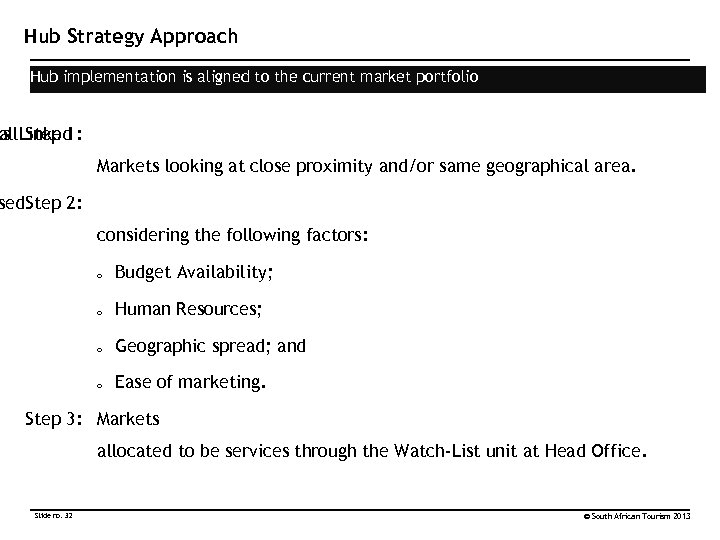

Hub Strategy Approach Hub implementation is aligned to the current market portfolio ts Linked all Step 1: Markets looking at close proximity and/or same geographical area. sed. Step 2: considering the following factors: o Budget Availability; o Human Resources; o Geographic spread; and o Ease of marketing. Step 3: Markets allocated to be services through the Watch-List unit at Head Office. Slide no. 32 © South African Tourism 2013

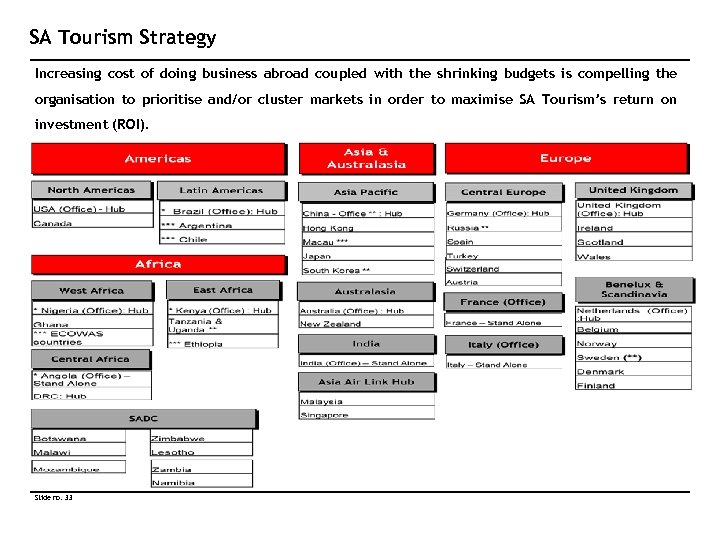

SA Tourism Strategy Increasing cost of doing business abroad coupled with the shrinking budgets is compelling the organisation to prioritise and/or cluster markets in order to maximise SA Tourism’s return on investment (ROI). Slide no. 33

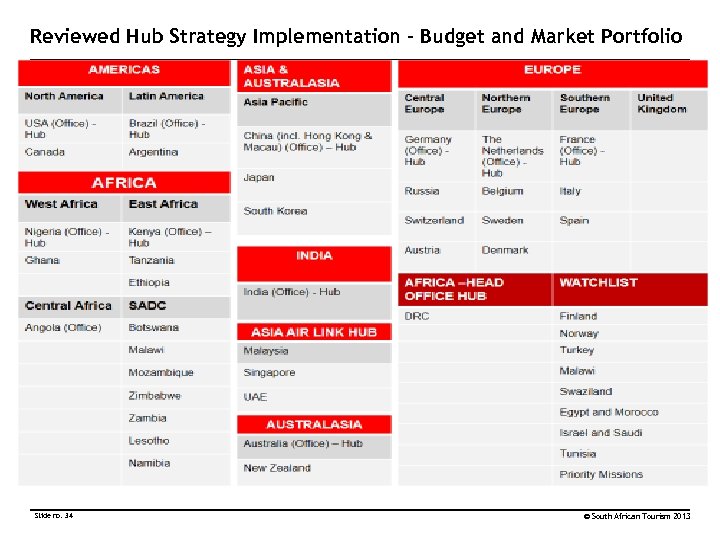

Reviewed Hub Strategy Implementation – Budget and Market Portfolio Slide no. 34 © South African Tourism 2013

• SA Tourism’s strategy is to: – work the distribution channel to promote South Africa. Slide no. 35 Page 25 -34: Strategic Plan

SA Tourism Strategic Approach • SA Tourism through its marketing strategy will continue to focus on its core consumer segments of Wanderluster and next-stop-South Africa. • The success of this strategy will be through engaging visitors with the diversity, possibility and ubuntu in our people, place, heritage and culture, breathtakingly enriching memories and life changing experiences. • The key elements of this strategy are to: – inspire: authentically showcasing South Africa through her people, and how we can provide a unique experience that you will never forget; – engage: by communicating that underpinning the experiences one could have with South Africans as do-able and accessible to the traveller; and – convert: by conveying the message to travellers that South Africa is beyond price and measure. To improve conversion, we will engage primarily with key trade and media partners in-country to activate travel to South Africa. Page 25 -34: Strategic Plan

Leisure Tourism Marketing – Global, Africa and Domestic Tourism GLOBAL Slide no. 37

Global Marketing Approach • • Fully integrated marketing channels, considered globally implemented locally Global partners: o National Geographic – 458 million households; 172 Countries; 38 Languages (Dutch, English, Chinese, French, German, Italian, Spanish) o CNN Global distribution – 484 million households, hotel rooms & airports worldwide • #Meet. South. Africa campaign rolled out across most Core Markets • #Reconsider. South. Africa campaign rolled out across most Core Markets • Numerous global awards won for excellent destination marketing execution • Successful Joint Marketing Agreements (JMAs to facilitate fulfilment of objectives) Slide no. 38 © South African Tourism 2012

Leisure Tourism – Global, Africa and Domestic Tourism AFRICA

Regional Africa • • In the past three years, Regional Africa was prioritised to the extent that there was ringfenced budget SA Tourism wants to achieve increased market presence in the following targeted markets/ hubs: o SA Tourism Nigeria office opened - positioned to service the West Africa hub o SA Tourism Angola Office is scheduled to be opened by 31 March 2015 and launched by the Minister on 20 -21 April 2015 o Kenya Office opening is planned for 2015/16 Top six source air markets in Regional Africa where marketing efforts are focused are Nigeria, Kenya, Ghana, Tanzania, DRC and Angola. SA Tourism marketing initiatives include: o Integrated media buy from media houses with a wider reach for content generation. o Partner with, train and host trade with an aim to improve how they package South Africa. Slide no. 40 © South African Tourism 2012

Leisure Tourism – Global, Africa and Domestic Tourism DOMESTIC

Domestic Tourism • • Domestic Tourism seeks to encourage the culture of travel, discovery of hidden gems and encouraging South Africans to take short breaks Domestic is a high priority market for SA Tourism, as a result additional budget is allocated. Engagement with trade, airline and media partners to drive conversion. Partnership with Provincial and Cities Tourism Agencies to drive alignment of campaigns, media buy and other marketing initiatives. Partnership with influencers in order to enhance tourism brand equity. Increased number of tailored and affordable experience packages on the ‘Shot. Left’ deals dashboard. Inspire holiday travel through partnerships with loyalty programmes. Improved awareness and culture of travel through extensive PR and 360º Media engagement Slide no. 42

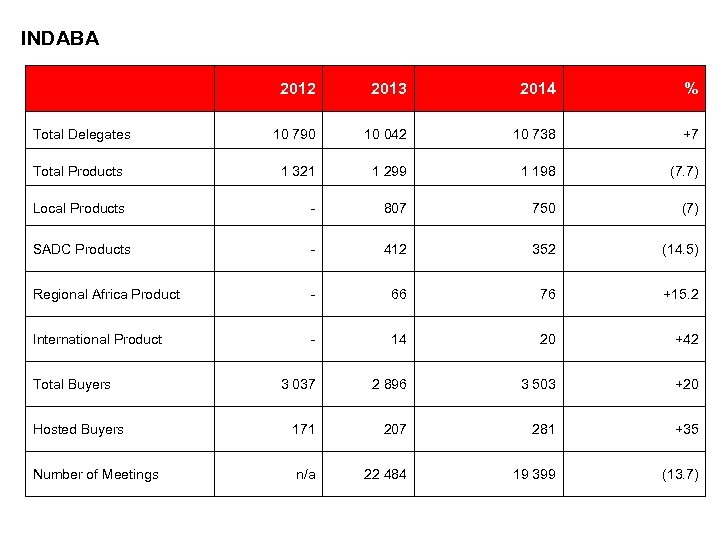

INDABA 2012 2013 2014 % Total Delegates 10 790 10 042 10 738 +7 Total Products 1 321 1 299 1 198 (7. 7) Local Products - 807 750 (7) SADC Products - 412 352 (14. 5) Regional Africa Product - 66 76 +15. 2 International Product - 14 20 +42 3 037 2 896 3 503 +20 Hosted Buyers 171 207 281 +35 Number of Meetings n/a 22 484 19 399 (13. 7) Total Buyers

• SA Tourism’s strategy is to: – engage stakeholders and partners to deliver quality visitor experience that re-affirm the brand promise. Page 25 -34: Strategic Plan

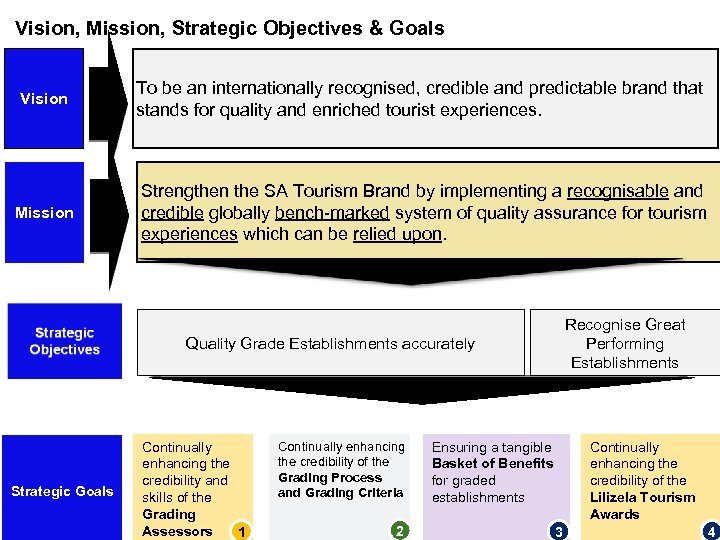

Vision, Mission, Strategic Objectives & Goals Vision To be an internationally recognised, credible and predictable brand that stands for quality and enriched tourist experiences. Mission Strengthen the SA Tourism Brand by implementing a recognisable and credible globally bench-marked system of quality assurance for tourism experiences which can be relied upon. Quality Grade Establishments accurately Strategic Goals Continually enhancing the credibility and skills of the Grading Assessors 1 Continually enhancing the credibility of the Grading Process and Grading Criteria 2 Recognise Great Performing Establishments Ensuring a tangible Basket of Benefits for graded establishments 3 Continually enhancing the credibility of the Lilizela Tourism Awards 4

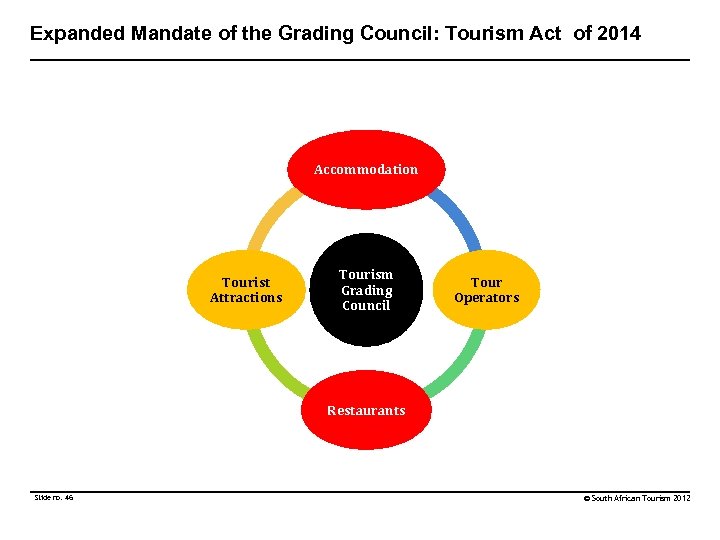

Expanded Mandate of the Grading Council: Tourism Act of 2014 Accommodation Tourist Attractions Tourism Grading Council Tour Operators Restaurants Slide no. 46 © South African Tourism 2012

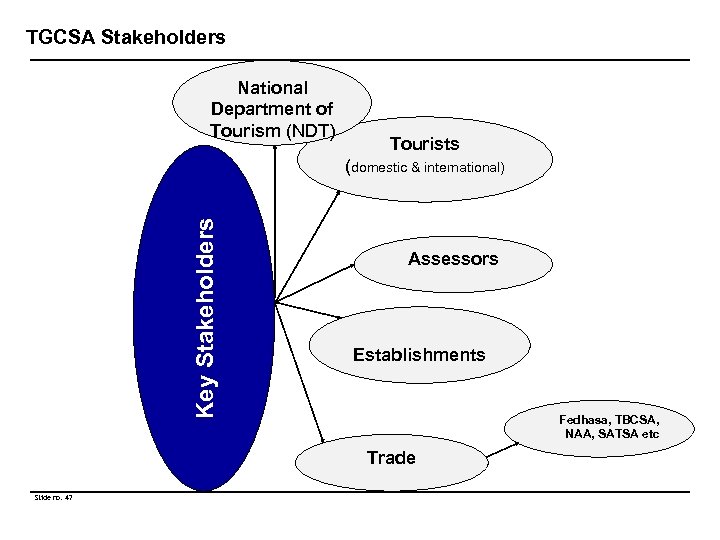

TGCSA Stakeholders National Department of Tourism (NDT) Tourists Key Stakeholders (domestic & international) Assessors Establishments Fedhasa, TBCSA, NAA, SATSA etc Trade Slide no. 47

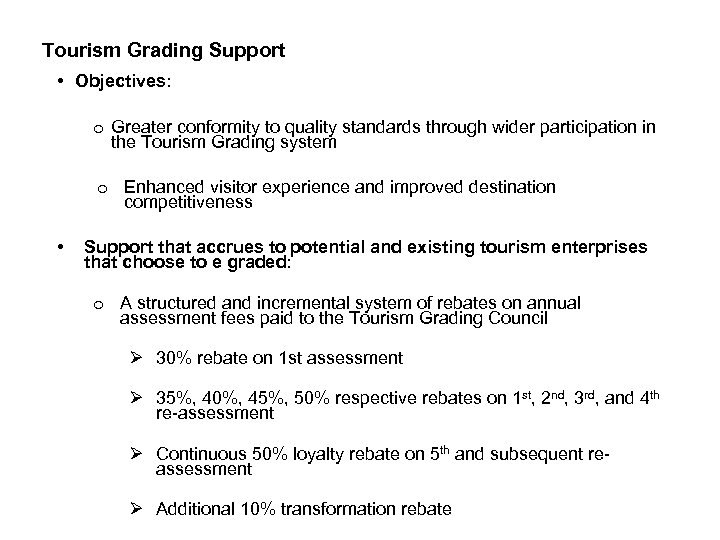

Tourism Grading Support • Objectives: o Greater conformity to quality standards through wider participation in the Tourism Grading system o Enhanced visitor experience and improved destination competitiveness • Support that accrues to potential and existing tourism enterprises that choose to e graded: o A structured and incremental system of rebates on annual assessment fees paid to the Tourism Grading Council Ø 30% rebate on 1 st assessment Ø 35%, 40%, 45%, 50% respective rebates on 1 st, 2 nd, 3 rd, and 4 th re-assessment Ø Continuous 50% loyalty rebate on 5 th and subsequent reassessment Ø Additional 10% transformation rebate

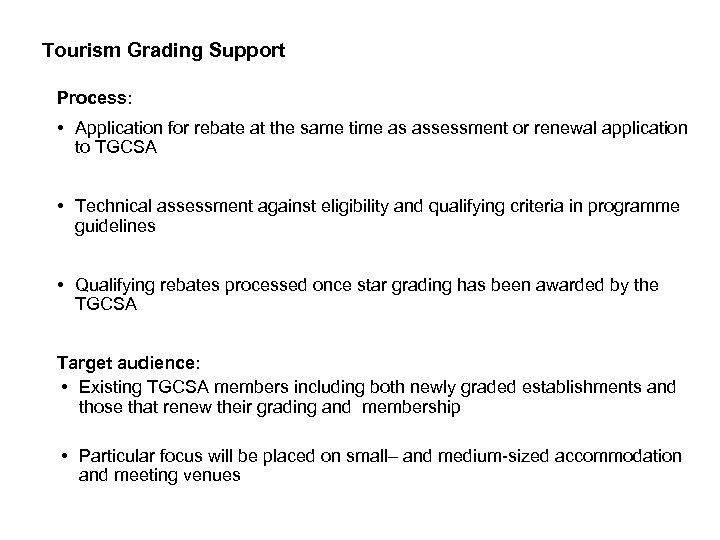

Tourism Grading Support Process: • Application for rebate at the same time as assessment or renewal application to TGCSA • Technical assessment against eligibility and qualifying criteria in programme guidelines • Qualifying rebates processed once star grading has been awarded by the TGCSA Target audience: • Existing TGCSA members including both newly graded establishments and those that renew their grading and membership • Particular focus will be placed on small– and medium-sized accommodation and meeting venues

Lilizela Tourism Awards – 8 Categories Minister’s Award Service Excellence • • • Accommodation Visitor Experience Tourist Guides Sustainable Development • • • Imvelo Universal Accessibility B-BBEE Entrepreneurship • Slide no. 50 ETEYA © South African Tourism 2012

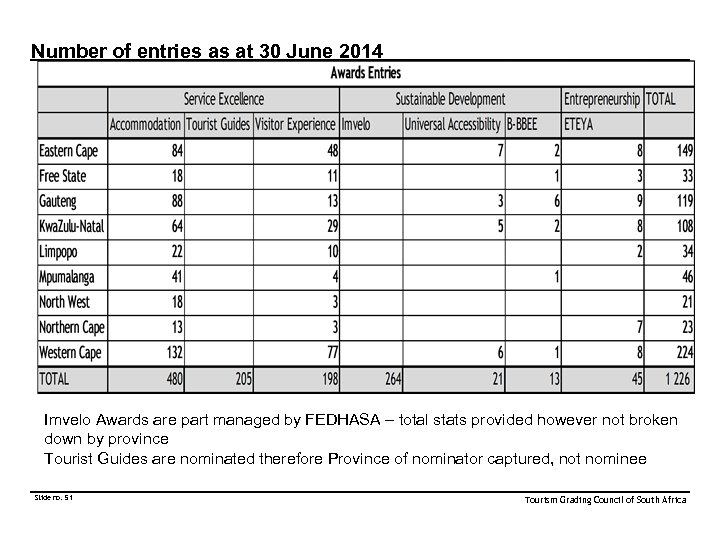

Number of entries as at 30 June 2014 Imvelo Awards are part managed by FEDHASA – total stats provided however not broken down by province Tourist Guides are nominated therefore Province of nominator captured, not nominee Slide no. 51 Tourism Grading Council of South Africa

• SA Tourism’s strategy is to: – engage stakeholders and partners to deliver quality visitor experience that re-affirm the brand promise. Page 25 -34: Strategic Plan

Alignment with Key Stakeholders • SA Tourism will implement its strategy through engaging its partners and stakeholders to deliver quality visitor experience that re-affirms the brand promise. • SA Tourism, through Tourism Grading Council, will continue contributing towards enhancing visitor experience and consumer confidence in the tourism products of South Africa by encouraging establishments to participate and remain members of the grading system. • SA Tourism will work in a collaborative approach with partners and stakeholders to unlock the following barriers to tourism growth – amongst others: – Safety and Security – Ground transport - integrated public transport – Price competitiveness – Ease of access – air routes, visas – Cohesive, good, destination marketing (understand our consumers) and branding – Public private sector trust and cooperation – Skills development Page 25 -34: Strategic Plan

• SA Tourism’s strategy is to: – energise and empower the organisation to innovate and achieve excellence. Page 25 -34: Strategic Plan

SA Tourism HR Strategy • • Leadership Development: Develop strong, inspiring and effective leaders with the vision and energy to deliver on SA Tourism’s objectives. Learning and Development: Reposition SA Tourism as an employer of choice that develops its people. Integrated Talent Management: Implement Integrated Talent Management to promote acquisition and retention of talent and skills as well as implement succession planning. Brand Ambassador Programme launched and being rolled out. This programme will deal with issues of redefining the company DNA, values and organisational culture to cater for the diverse needs of the growing global organisation. Slide no. 64

Concluding Remarks • Non-availability of tourism statistics for planning, strategy formulation and organisational performance reporting. • Implementation and the impact of the visa regulations on tourism • Benchmarking study in process. Slide no. 65 © South African Tourism 2012

Thank You

9649d9993e6e7bf112f5dd08c9fb78e4.ppt