5693ffd45f946d1961fe080d70634b07.ppt

- Количество слайдов: 24

Briefing to Standing Appropriations Committee Budget Facility for Infrastructure 10 May 2017 National Treasury South Africa 1

Outline • Budget facility for infrastructure • Policy background and principles of effective public infrastructure management • Challenges in the current systems • Infrastructure procurement standards • Multi-year authority-to-spend law for mega-projects • Review of international best practices – Chile – United Kingdom – Ireland – Republic of Korea – China – Vietnam Ø 2

A budget facility for infrastructure § Government is proposing a new financing facility for large infrastructure projects that require funding or other state support, such as sovereign guarantees. § The aim is to address shortcomings in the planning and execution of infrastructure projects, particularly as they relate to life-cycle budgeting, operations and maintenance costs. The facility will help government build a pipeline of projects that have undergone rigorous technical analysis. § The budget facility for infrastructure is a reform to the budget process that creates institutional capacity to appraise and budget for national priority infrastructure projects and programmes funded from the fiscus. § The facility will put in place a mechanism to improve the rigor of planning and budgeting for large infrastructure projects through standardised appraisal methodologies that ensure that full life-cycle costs of projects are planned for, adequately budgeted and provided for in future budgets. § The facility will be established as a joint arrangement between National Treasury (NT), the Presidential Infrastructure Coordinating Committee secretariat (PICC) and the Department of Planning, Monitoring and Evaluation (DPME). It would develop recommendations to MTEC, the Ministers’ Committee on the Budget (MINCOMBUD) and Cabinet in respect of funding for large projects. § The first phase of the facility is expected to begin operating in 2017 with the establishment of a technical unit and governing board. § National Treasury, PICC, EDD and DPME are currently working on the project proposal to serve before cabinet. Following cabinet consideration a further briefing can be given to the committee Ø 3

Policy background § The New Growth Path (NGP), Industrial Policy Action Plan (IPAP) and the National Development Plan (NDP) – all anchored in a significant ramping of infrastructure expenditure § GFCF - to reach about 30 per cent of GDP by 2030, with public sector investment reaching 10 per cent of GDP, to realise a sustained impact on growth and services provision § The need for efficiency of investment choices in a savings constrained-economy § Given the weak economic outlook, domestic savings constraint – deliberate steps needs to be taken to achieve increased infrastructure investment § The capital budgeting framework should be designed to result in efficient investment choices § Optimal allocation of scarce resources and maximisation of value for money and service delivery outcomes. § Resources must be utilised efficiently and effectively towards the purpose for which they have been allocated 4

Principles that should guide public infrastructure investment (1) § Build in requirements for improvements in the efficiency of infrastructure investments throughout the investment cycle. ― Allocative efficiency - Resource allocations reflect the policies and priorities of government’s program ― Investment efficiency - Public sector investment expenditures should deliver value for money ― Productive efficiency – functioning of the physical stock should result in economic growth § Effective realisation of social goals: Coming up with the right balance between economic and social infrastructure will result in the right scale of public resources being allocated to meet social goals – health, education etc. Ø 5

Principles that should guide public infrastructure investment (2) Technical rigour in project appraisal and selection § Comprehensive investment appraisal, management and evaluation of projects § Ensuring good planning, selection and execution of capital projects Transparency § Transparency at all stages of the investment cycle to eliminate rent seeking and corruption § Decision making and information on public investments must be accessible to all relevant stakeholders Democratic approach to identify social preferences § Effective participation in making choices to undertake priority projects – process must be inclusive and participative § Enlightened participation - information should be availed to citizens and civil society on the relative costs and benefits so that they can engage in realistic debates about trade-offs, opportunity costs and value for money Ø 6

Benefits of capital appraisal framework § Consistent framework within which capital investments are appraised and evaluated. § Transparent and comparable basis for approval and funding of competing capital projects. § Budget process aware of total project costs by considering life-cycle costs § Comprehensive information reducing the risk of poor decision making. § In ranking and prioritising projects, the links between the project and government policy and priorities is clear; § Multi-year budgeting of infrastructure projects, improves the management of budget forward estimates § By emphasising procurement planning and delivery management the expected outcomes from projects are likely to be achieved. § Independent evaluation of feasibility studies reduces optimism bias by ensuring that underlying assumptions are validated. Ø 7

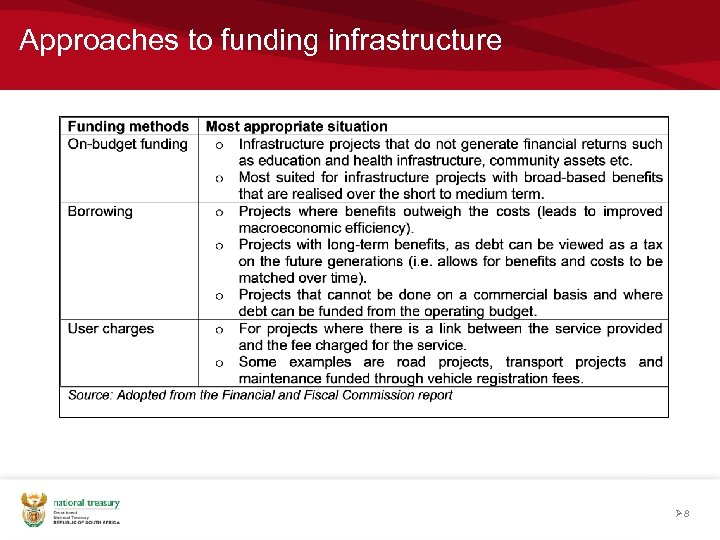

Approaches to funding infrastructure Ø 8

Challenges with current planning and budgeting systems § Some of the current challenges in infrastructure delivery include weaknesses in project preparation and technical aspects of infrastructure planning, execution and delivery which result in the following: ― Poor estimation of life-cycle costs ― Failure to budget effectively for capital, operating and maintenance costs ― Poor implementation and management ― Lack of uniform decision making framework across government ― Lack of adequate integration between the budget process with capital budget expenditure budgets resulting in inadequate provision for operation and maintenance costs. § Given the priority afforded by government to infrastructure projects and the special capabilities required to appraise them, the current processes are sub-optimal. Ø 9

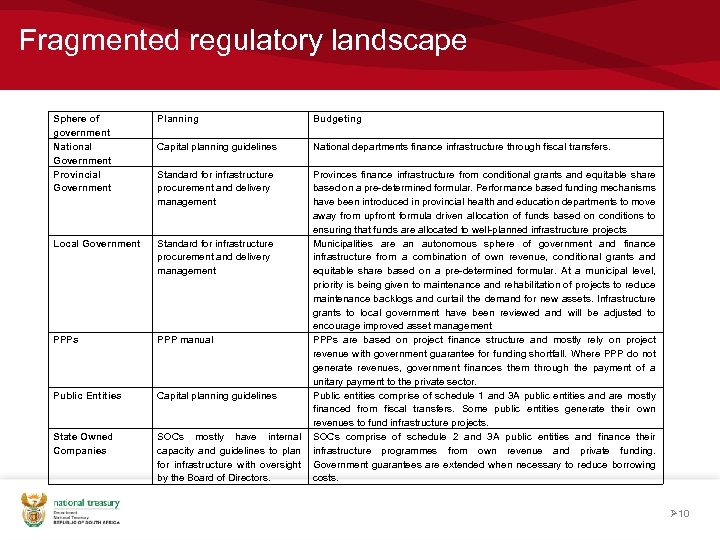

Fragmented regulatory landscape Sphere of government National Government Provincial Government Planning Budgeting Capital planning guidelines National departments finance infrastructure through fiscal transfers. Standard for infrastructure procurement and delivery management Local Government Standard for infrastructure procurement and delivery management PPPs PPP manual Public Entities Capital planning guidelines State Owned Companies SOCs mostly have internal capacity and guidelines to plan for infrastructure with oversight by the Board of Directors. Provinces finance infrastructure from conditional grants and equitable share based on a pre-determined formular. Performance based funding mechanisms have been introduced in provincial health and education departments to move away from upfront formula driven allocation of funds based on conditions to ensuring that funds are allocated to well-planned infrastructure projects Municipalities are an autonomous sphere of government and finance infrastructure from a combination of own revenue, conditional grants and equitable share based on a pre-determined formular. At a municipal level, priority is being given to maintenance and rehabilitation of projects to reduce maintenance backlogs and curtail the demand for new assets. Infrastructure grants to local government have been reviewed and will be adjusted to encourage improved asset management PPPs are based on project finance structure and mostly rely on project revenue with government guarantee for funding shortfall. Where PPP do not generate revenues, government finances them through the payment of a unitary payment to the private sector. Public entities comprise of schedule 1 and 3 A public entities and are mostly financed from fiscal transfers. Some public entities generate their own revenues to fund infrastructure projects. SOCs comprise of schedule 2 and 3 A public entities and finance their infrastructure programmes from own revenue and private funding. Government guarantees are extended when necessary to reduce borrowing costs. Ø 10

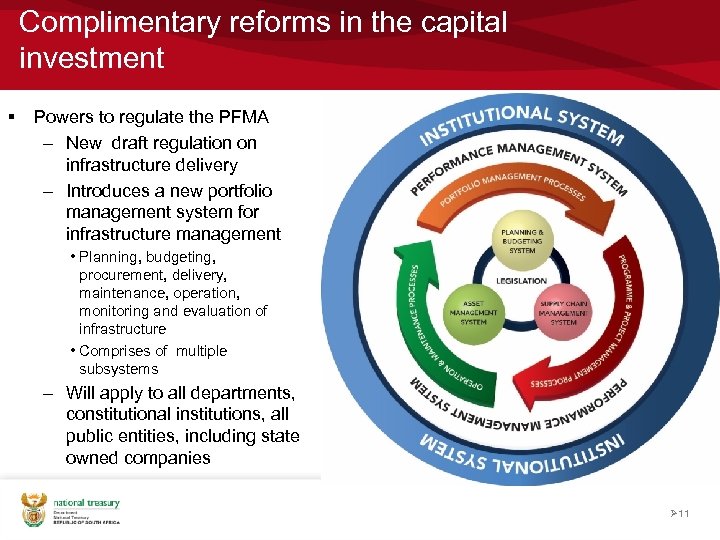

Complimentary reforms in the capital investment § Powers to regulate the PFMA – New draft regulation on infrastructure delivery – Introduces a new portfolio management system for infrastructure management • Planning, budgeting, procurement, delivery, maintenance, operation, monitoring and evaluation of infrastructure • Comprises of multiple subsystems – Will apply to all departments, constitutional institutions, all public entities, including state owned companies Ø 11

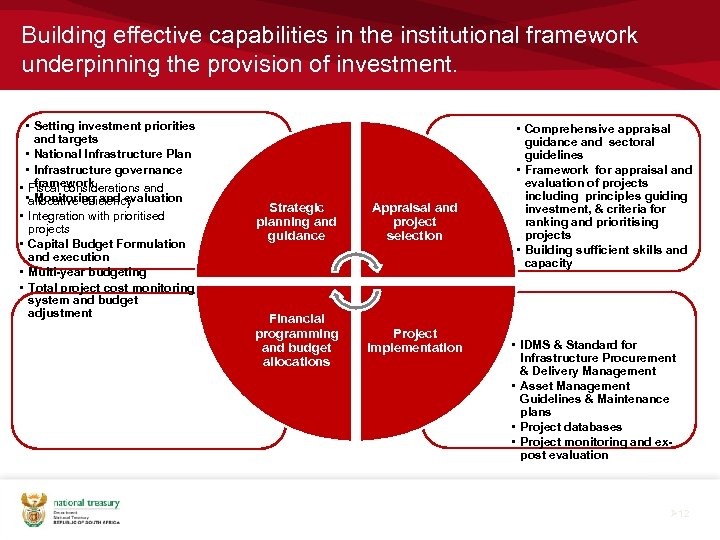

Building effective capabilities in the institutional framework underpinning the provision of investment. • Setting investment priorities and targets • National Infrastructure Plan • Infrastructure governance framework • Fiscal considerations and • allocative efficiency Monitoring and evaluation • Integration with prioritised projects • Capital Budget Formulation and execution • Multi-year budgeting • Total project cost monitoring system and budget adjustment Strategic planning and guidance Appraisal and project selection Financial programming and budget allocations Project implementation • Comprehensive appraisal guidance and sectoral guidelines • Framework for appraisal and evaluation of projects including principles guiding investment, & criteria for ranking and prioritising projects • Building sufficient skills and capacity • IDMS & Standard for Infrastructure Procurement & Delivery Management • Asset Management Guidelines & Maintenance plans • Project databases • Project monitoring and expost evaluation Ø 12

Multi-year authority-to-spend law for megaprojects (1) § A complementary reform to the budget facility, would be for parliament to consider stand-alone legislation for mega projects. § Very large projects are highly complex, implemented over several years (or even decades), very risky and politically controversial. § Such projects should ideally be subject to even closer public scrutiny, and proponents should be encouraged to negotiate broad social support for their implementation. § One way of ensuring this takes place is by requiring mega-projects to gain the support of Parliament. § Once a project is approved by cabinet, standalone “authority-to-spend” legislation could be tabled in Parliament to govern the implementation and funding of a project where its size and duration are particularly large. Ø 13

Multi-year authority-to-spend law for mega-projects (2) § Be tabled in Parliament together with the project’s feasibility study and the recommendation report from the joint technical committee. § Establish a total capital amount and an estimated project implementation time-line, which may extend beyond the three-year horizon of the MTEF. § Estimate an indicative budget for operational, maintenance and other recurrent costs to be ring-fenced through the departmental baseline. § Provide broad parameters and procedures through which to deal with large unforeseen variations and cost escalations or overruns. § Establish a framework for periodic monitoring and review of the project. § Establish any other quantitative elements associated with the project that may be warranted at the discretion of parliament. § Clearly establish accountability for the various aspects of the project, including procurement, project management, payment management, etc. § Would not itself appropriate resources from the national revenue fund. Funds would still need to be appropriated each year (through an appropriation act). § Appropriations for these programmes would constitute a main division with a vote in the appropriation act, classified (in some cases) as a transfer to the budget facility for infrastructure. Ø 14

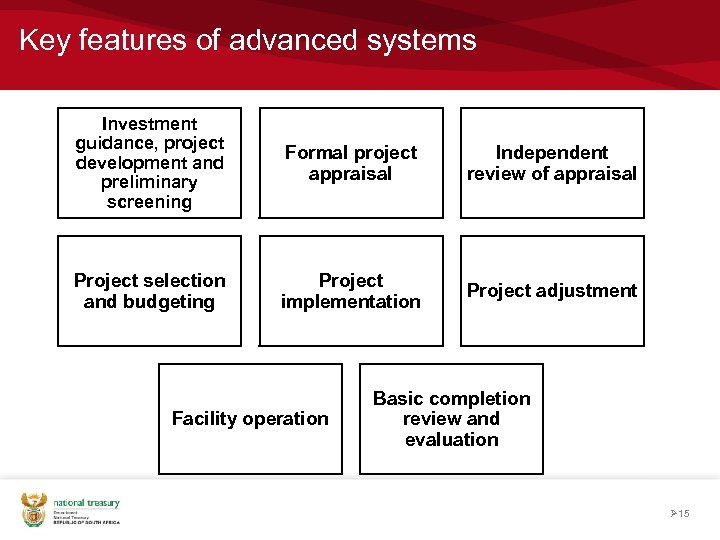

Key features of advanced systems Investment guidance, project development and preliminary screening Formal project appraisal Independent review of appraisal Project selection and budgeting Project implementation Project adjustment Facility operation Basic completion review and evaluation Ø 15

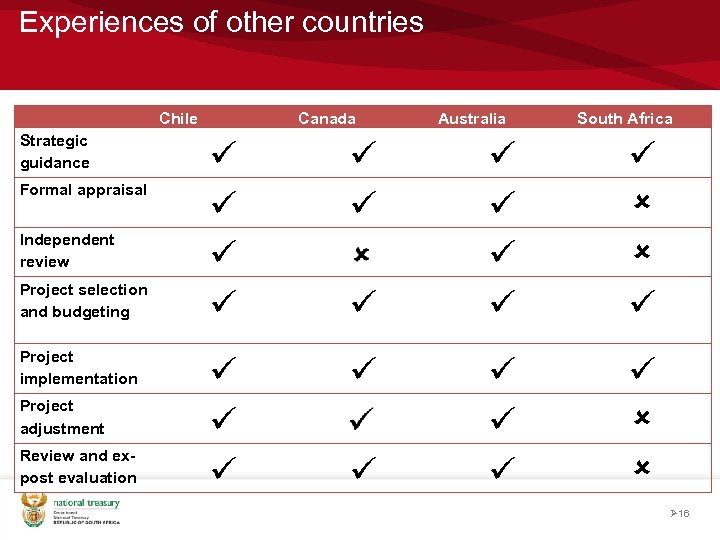

Experiences of other countries Strategic guidance Formal appraisal Independent review Project selection and budgeting Project implementation Project adjustment Review and expost evaluation Chile Canada Australia South Africa Ø 16

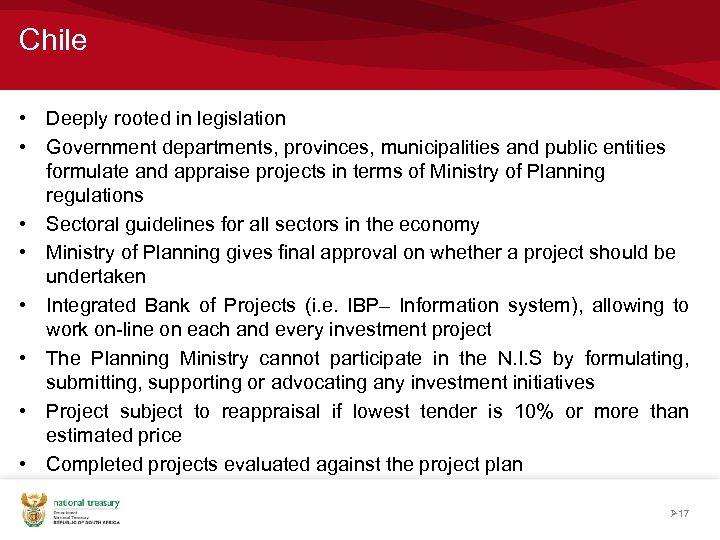

Chile • Deeply rooted in legislation • Government departments, provinces, municipalities and public entities formulate and appraise projects in terms of Ministry of Planning regulations • Sectoral guidelines for all sectors in the economy • Ministry of Planning gives final approval on whether a project should be undertaken • Integrated Bank of Projects (i. e. IBP– Information system), allowing to work on-line on each and every investment project • The Planning Ministry cannot participate in the N. I. S by formulating, submitting, supporting or advocating any investment initiatives • Project subject to reappraisal if lowest tender is 10% or more than estimated price • Completed projects evaluated against the project plan Ø 17

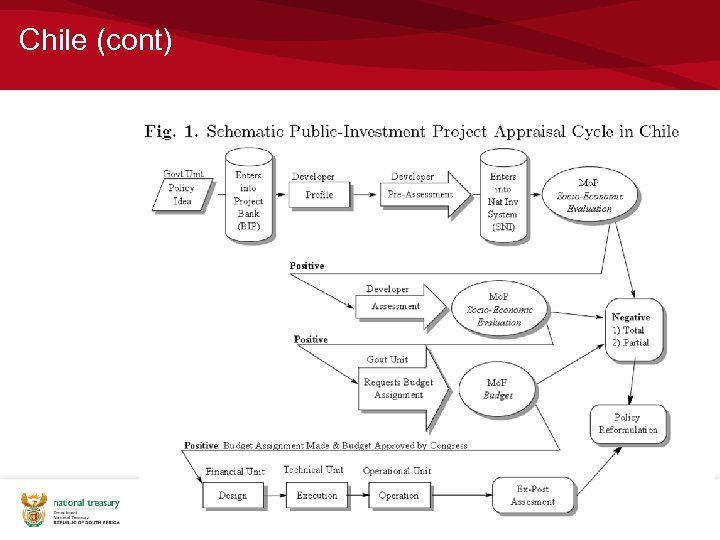

Chile (cont) Ø 18

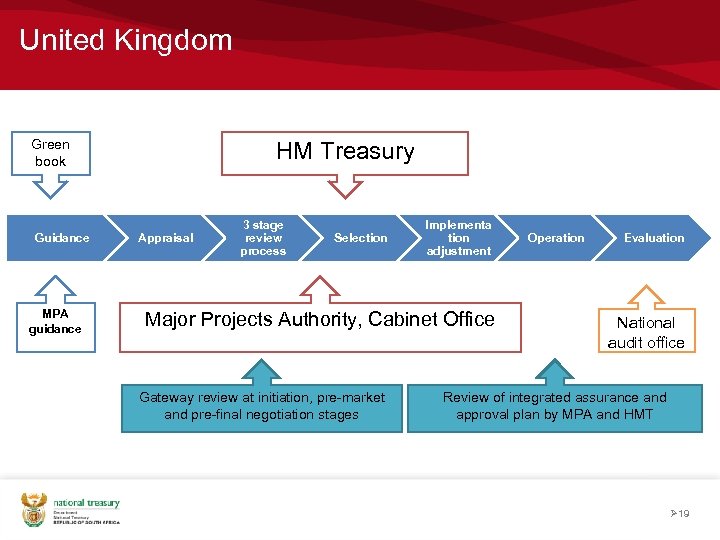

United Kingdom Green book Guidance MPA guidance HM Treasury Appraisal 3 stage review process Selection Implementa tion adjustment Major Projects Authority, Cabinet Office Gateway review at initiation, pre-market and pre-final negotiation stages Operation Evaluation National audit office Review of integrated assurance and approval plan by MPA and HMT Ø 19

Ireland • • 5 year plan and 5 year rolling capital budget Guidelines for project appraisals and PPPs 2 stage review – screening and detailed project appraisal Techniques vary – simple appraisal to MCA to CBA Independent review by central agency/consultants Project selection as part of budget process Implementation monitored through spot check on compliance/cost overruns and can trigger project termination • Post project evaluations by sponsoring agency Ø 20

Republic of Korea • Introduced after Asian crisis – From a budget guideline in 1999 to introduction of National Finance Act in 2004 • 2014 amendment of NFA revises roles of institutions and increased minimum requirements for feasibility studies • All feasibility studies above threshold is conducted by PIMAC/KDI in the Mo. SF • Ex-post review confined to completed assets vs. project plan Ø 21

China • National Development and Reform Commission controls investment planning and approval • Focus shifting from physical inputs and outputs to location, cost, funding source • Economic and social benefits not well assessed in the project planning • No independent review of project appraisal • Mo. F established investment appraisal commission to examine project from a budget perspective • No systematic oversight of the implementation and implementing agency manages cost overruns without the need for review or re-appraisal • Continuous process to rationalise and reform public investment and to define roles and responsibilities Ø 22

Vietnam • Projects approved at various stages by National Assembly, the Prime Minister or Minister of Planning and Investment, and the State Appraisal Council • Decentralised system, capex largely at local level – Poor coordination between budget approval and project approval • Introduction of regulations to guide public investments – Weak in key areas such as environmental screening, project preparation, procurement and project evaluation • Limited technical capacity and no independent review of project appraisals • No regulations on maintaining asset registers • No ex-post evaluations • Adopted new law on public investments in 2014 Ø 23

Prepared by: Dorcas Kayo Dorcas. Kayo@treasury. gov. za Director infrastructure Finance Budget Office Telephone: 012 395 6715 Mobile: 071 382 0970 Ø 24

5693ffd45f946d1961fe080d70634b07.ppt