cbf41ef7a6d252e1b18aa852ab572aef.ppt

- Количество слайдов: 29

BRIEFING TO SCOPA INTERGRATING THE WORK OF OAG TO THE SCHEDULE OF SCOPA National Treasury: Republic of South Africa 22 March 2006

Contents • Purpose & Mission • Stakeholders • Functions & Powers • Structure & specific functions • Role of Scopa • Conclusion

Purpose of the OAG • ACCOUNTABILITY THROUGH TRANSPARENCY • To achieve accountability by promoting transparency and effective management in respect of revenue, expenditure, assets and liabilities in SA public sector. • Contribute to the enhancement of service delivery capability of govt

OAG Mission Statement To provide Financial Management information and provide regulatory services to empower oversight bodies to ensure public transparency through accountability. To empower team members to become the leading knowledge repository in best practice risk management, internal audit, financial reporting and accounting services across the South African Public Sector. To provide a learning environment with fair and non -discriminatory practices, thereby becoming the employer of choice for finance professionals. To strive for clean audit reports in public sector.

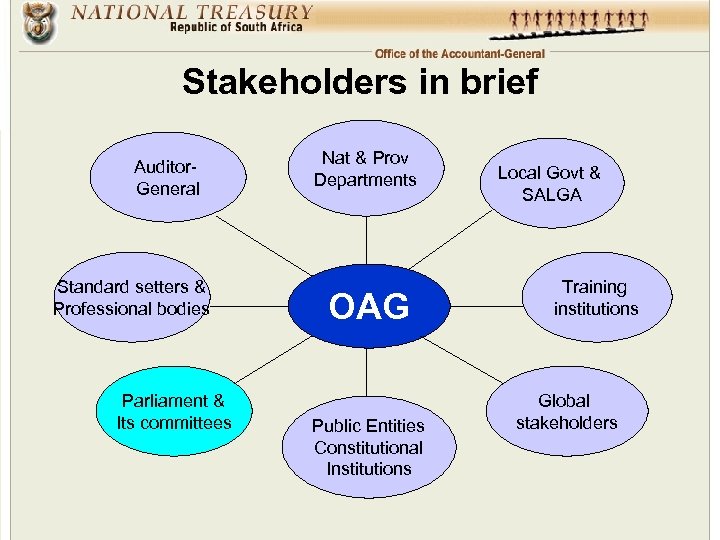

Stakeholders in brief Auditor. General Standard setters & Professional bodies Parliament & Its committees Nat & Prov Departments OAG Public Entities Constitutional Institutions Local Govt & SALGA Training institutions Global stakeholders

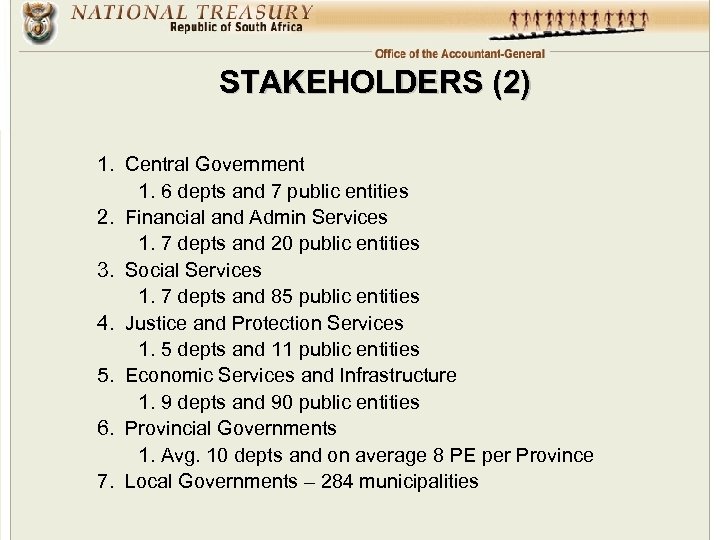

STAKEHOLDERS (2) 1. Central Government 1. 6 depts and 7 public entities 2. Financial and Admin Services 1. 7 depts and 20 public entities 3. Social Services 1. 7 depts and 85 public entities 4. Justice and Protection Services 1. 5 depts and 11 public entities 5. Economic Services and Infrastructure 1. 9 depts and 90 public entities 6. Provincial Governments 1. Avg. 10 depts and on average 8 PE per Province 7. Local Governments – 284 municipalities

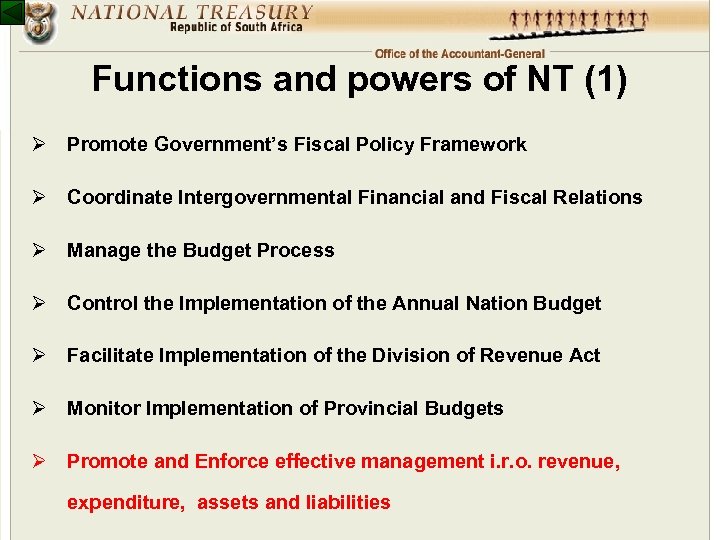

Functions and powers of NT (1) Ø Promote Government’s Fiscal Policy Framework Ø Coordinate Intergovernmental Financial and Fiscal Relations Ø Manage the Budget Process Ø Control the Implementation of the Annual Nation Budget Ø Facilitate Implementation of the Division of Revenue Act Ø Monitor Implementation of Provincial Budgets Ø Promote and Enforce effective management i. r. o. revenue, expenditure, assets and liabilities

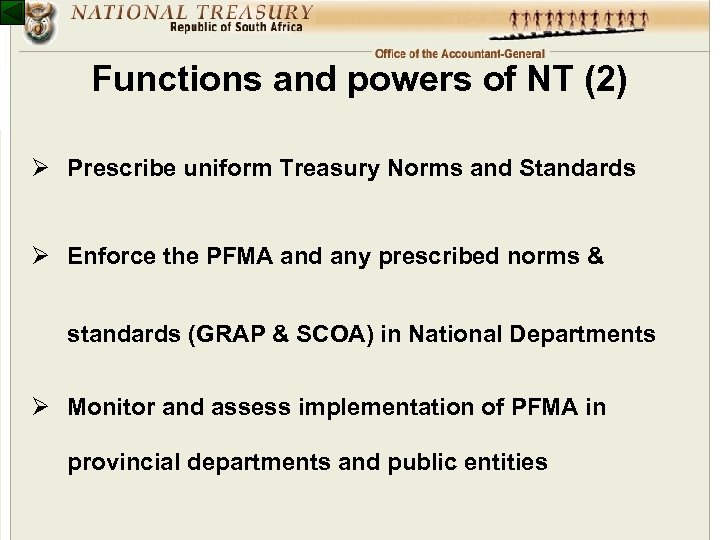

Functions and powers of NT (2) Ø Prescribe uniform Treasury Norms and Standards Ø Enforce the PFMA and any prescribed norms & standards (GRAP & SCOA) in National Departments Ø Monitor and assess implementation of PFMA in provincial departments and public entities

Functions and powers of NT (3) Ø Assist Departments in building capacity for efficient, effective and transparent financial management Ø Investigate any system of financial management and internal control Ø Intervene by taking appropriate steps to address a serious or persistent material breach of the PFMA Ø May do anything that is necessary to fulfill its responsibilities

Prescribe uniform Treasury Norms and Standards Issuing of Treasury Regulations Ø Audit coms, internal audit and internal controls (CH 3 of TR) Ø Revenue and expenditure management (part 4 of TR) Ø Asset Management (Chapter 10 of TR) Ø Management of debtors (Chapter 11 of TR) Ø Money & property held in trust (Chapter 14 of TR) Ø Banking, cash management and investment (Chapter 15 of TR) Ø Accounting and reporting requirements (part 7 of TR) Ø Government payroll deductions (chapter 23 of TR) Ø Other Issuing of Treasury Instructions (Practice Notes) Issuing of Frameworks

Enforce the PFMA and prescripts Ø Ensure that Departments meet reporting requirements Ø Ensure that financial statements are compiled in accordance with standards set for purposes of compiling consolidated statements Ø Conduct regular surveys on compliance with PFMA and Treasury Regulations (appointment of CFO, effective internal audit units, etc) Ø Follow-up on issues in audit reports regarding internal controls, accounting, reporting and asset management

Assist in capacity building Ø Issued best practice guidelines (internal controls) Ø Prepare guidelines concerning standards for GRAP Ø Facilitate knowledge sharing Ø Facilitate & Provide training on relevant topics IT systems, GRAP, IA & RM function Ø Training strategy for development of FM, IA & RM staff

Investigate any system of FM & IC Ø Conduct investigations regarding the effectiveness of internal audit functions Ø Regular visits to departments to determine whether internal control and financial management systems are effective Ø Commission investigations regarding revenue and expenditure management systems Ø Request support from Auditor-General to conduct investigations regarding Internal Control Systems

Interventions where PFMA is breached Ø Report to Cabinet on the extent of failure by an institution and stating steps to rectify Ø Ensure that accounting officer initiate disciplinary proceedings against officials Ø Ensure that executive authority initiate appropriate disciplinary proceedings against accounting officers

Structure of the OAG • 4 Chief Directorates – Internal Audit – Risk Management – National Accounts – Accounting Services

Functions: Internal Audit • Develop internal audit policy framework • Assist departments with internal audit capacity building • Provide support and guidance on internal audit practices • Influence the state of governance through participating on oversight and governance structures • Review and report on status of internal audit and audit committees in govt.

Functions: Risk Management • Develop uniform risk management policy framework • Provide support and guidance on development of risk management strategies and policies • Assist departments build capacity and attain operational excellence in risk management. • Influence the state of governance through participating on oversight and governance structures • Evaluate the state of risk management in government and report to various stakeholders

Functions: National Accounts • Train stakeholders on reporting format for financial and non-financial information • Consolidate government’s annual financial information • Manage National Revenue and RDP Funds • Provide support and guidance on financial reporting • Assist in capacity building in departments • Support the implementation of new policies

Functions: Accounting Services • Develop broad accounting policies • Investigate the appropriate reporting basis for govt • Prescribe the reporting frameworks annually • Spearhead financial management reforms • Facilitate discussions on accounting standards in govt • Facilitate implementation of the GRAP standards • Advise on the implementation of GRAP standards

OAG Challenges • Capacity within OAG to respond to demand • Staff retention • Capacity of stakeholders • Accessibility of critical & strategic stakeholders • Sufficient buy-in • Skills availability • Information systems • Strengthening governance & oversight

Mitigating strategies • Recruitment • Internship, TOPP and talent pool • Marketing of OAG services • Strengthen stakeholder relationships • Continued professional development/education • Knowledge-sharing initiatives • Participate in the IFMS project • Formalise OAG link to SCOPA & PCs

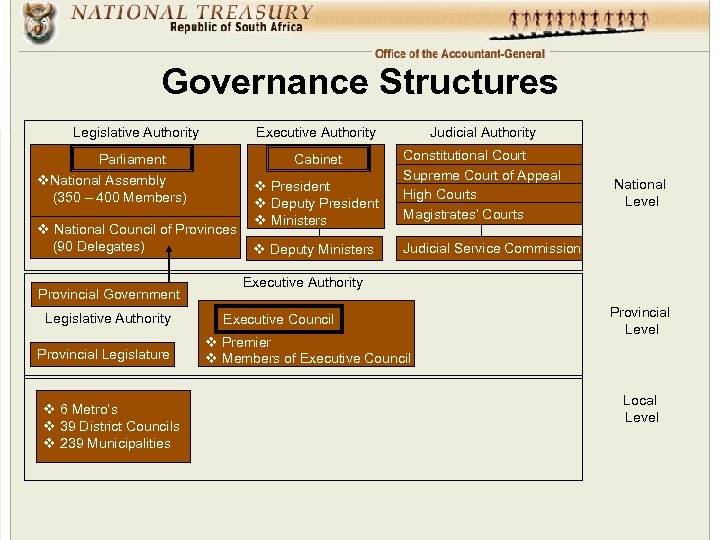

Governance Structures Legislative Authority Executive Authority Judicial Authority Parliament Cabinet v President v Deputy President v Ministers Constitutional Court Supreme Court of Appeal High Courts Magistrates’ Courts v Deputy Ministers Judicial Service Commission v. National Assembly (350 – 400 Members) v National Council of Provinces (90 Delegates) Provincial Government Legislative Authority Provincial Legislature v 6 Metro’s v 39 District Councils v 239 Municipalities National Level Executive Authority Executive Council v Premier v Members of Executive Council Provincial Level Local Level

Role of SCOPA Committee should continue to fulfill its important role of “Protector of the Public Purse” Consider Annual Reports focusing on: • Issues raised in reports of the Auditor. General/External Audits • Interrogation and evaluation of instances of unauthorised expenditure • Pronounce on unauthorised expenditure timeously • Interrogation of instances relating to Irregular and Fruitless and Wasteful Expenditure

Role of SCOPA (2) • Risk Management, Financial management, Internal Control (Including Internal Audit) and Personnel Management Systems • Supply Chain Management (particularly large tenders and PPP deals) • Disposal of significant assets and major financial or related losses suffered • Corporate Governance issues within Departments and Entities • Consolidated Financial Statements of Government

Role of the Portfolio Committees should consider Annual Reports focusing on: • Technical quality of Annual Reports produced by Departments and Entities • Actual performance (non financial ) against targets specified in Budgets and Strategic Plans • Quality of performance information as highlighted by an audit of performance information • The Economy, Efficiency and Effectiveness on Service Delivery • Impact of under- or over-expenditure on Service Delivery

Link Between PCs and SCOPA • Oversight process should give a complete picture of entities performance • Committees of Parliament should not work in silos • SCOPA should bring key issues to the attention of Portfolio Committees • Portfolio Committees should share info with SCOPA • Primary linkage should run from Portfolio Committee to SCOPA

Proposed interface • Regular (Quarterly? ) meeting between SCOPA and National Treasury • Participate in Oversight Hearings and Supply Information (Reporting requirements, Accounting Policies, etc) • Respond to SCOPA Resolutions of a general nature regarding financial management (AG recommendations) • Submission of Quarterly Consolidated Internal Audit Reports (Including Risks Identified)

Proposed interface (2) • Reports on Unauthorised Expenditure – Approval/Non approval – Additional Funding/Available Funds • Interaction with SCOPA regarding Consolidated Financial Statements • Review & prioritisation of audit issues

THANK YOU

cbf41ef7a6d252e1b18aa852ab572aef.ppt