a07e7750dad3b1ba125d65b437cba110.ppt

- Количество слайдов: 24

Briefing on the Code of Practice for Competition in the Provision of Telecommunication Services 20 September 2000 www. ida. gov. sg Confidential © IDA Singapore 2000

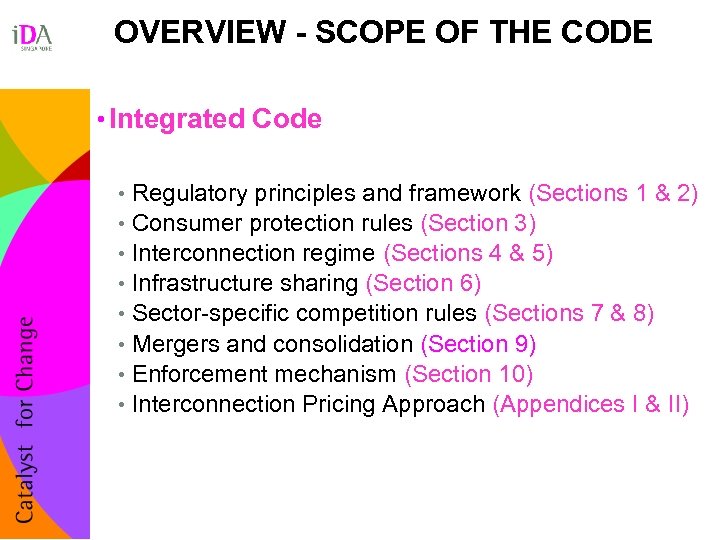

OVERVIEW - SCOPE OF THE CODE • Integrated Code • Regulatory principles and framework (Sections 1 & 2) • Consumer protection rules (Section 3) • Interconnection regime (Sections 4 & 5) • Infrastructure sharing (Section 6) • Sector-specific competition rules (Sections 7 & 8) • Mergers and consolidation (Section 9) • Enforcement mechanism (Section 10) • Interconnection Pricing Approach (Appendices I & II)

INTRODUCTION Formulation of Code • Further refinements based on feedback from industry (public forums & comments received) and consultants’ experience/expertise • Reflects international best practices, Singapore’s legal/regulatory environment and policy goals • Provisions for review as market develops (Triennial review)

INTRODUCTION • Goals of the Code • Promote int’l competitiveness of our info-comms industry • Ensure affordable access to wide range of quality telecom services • Promote and maintain fair and efficient market conduct • Encourage and facilitate industry self-regulation • Encourage investment in telecom infrastructure to enhance Singapore’s position as hub of choice • Regulatory Principles • Reliance on market forces and voluntary agreements, where feasible • Proportionate regulation • Technological neutrality • Open and reasoned decision-making

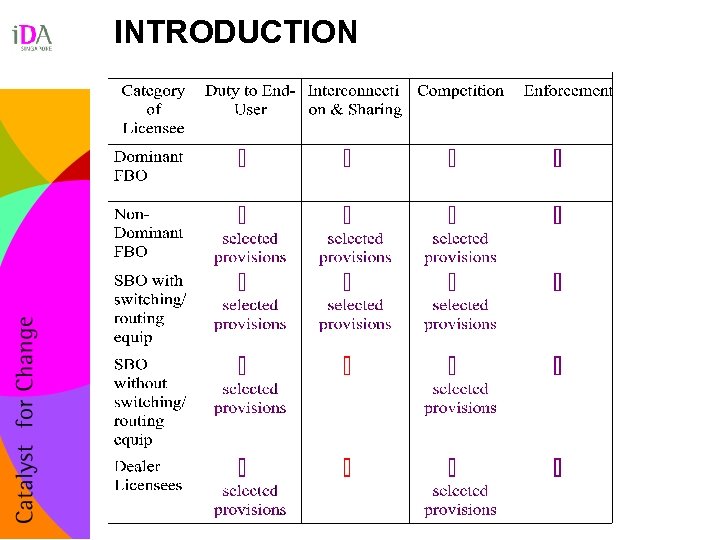

INTRODUCTION

CLASSIFICATION OF LICENSEES Asymmetric approach • Dominant licensees • Control facilities that provide a direct connection to end users and have: (a) ability to restrict output and raise prices; or (b) facilities too difficult and costly to replicate • can seek reclassification or exemption from obligations on a service/facility basis • required to comply with more stringent requirements on interconnection and consumer protection and exante tariffing/competition provisions • Non-dominant licensees • all other licensees • minimum “rules of the road” and ex-post enforcement

CLASSIFICATION OF LICENSEES This Approach è Reflects different market/bargaining positions of different licensees è Focuses IDA effort on areas where need for intervention is greatest given current market devt • Code provides three paths for reclassification • Petition for reclassification by licensee • Petition from application of relaxation from specific dominant licensee regulation • IDA’s triennal review of Code • Code specifies criteria and considerations IDA will apply; but no automatic quantitative “trigger” • IDA will encourage industry forums to work out detailed operational and technical processes and procedures

CLASSIFICATION OF LICENSEES • Initial Designation of Dominant Licensees • Singapore Telecommunications Ltd • does not include its subsidiaries such as Sing. Tel Mobile, Sing. Tel Paging, Sing. Net • Singapore Cable Vision Pte Ltd • temporary exemption from interconnection obligations given current technical difficulties of unbundling its network • still required to comply with tariffing/competition requirements • 1 -Net • classified as non-dominant

CONSUMER PROTECTION All Licensees • Provision of services to end users at just, reasonable and non-discriminatory terms • Advance disclosure of all prices, terms and conditions • Periodic, accurate and timely bills • No charges for unsolicited telecom services or equipment • Dispute resolution procedures • Protection of customer information • Additional duties of Dominant Licensees • Duty to provide services to any end user upon reasonable request and in a non-discriminatory manner • Duty to file tariffs with IDA • Duty to provide unbundled telecom services

INTERCONNECTION Greater emphasis placed on private commercial negotiations However, recognising that: • Dominant Licensees lack commercial incentives to voluntarily negotiate and given market situation now IDA will take more active role to ensure just, reasonable and non-discriminating Interconnection Agreements (IAs), including setting of prices for interconnection services for period of 3 -year subject to review if market conditions change

INTERCONNECTION • Interconnection with Non-dominant Licensees • Limited IDA role • Reliance on market forces and commercial negotiations to foster agreements • Confirm that agreements meet minimum requirements • Mediation • Private enforcement • Option to seek interconnection with Dominant Licensee: interconnection operator of last resort

INTERCONNECTION • Interconnection with Dominant Licensees • Dominant Licensee Interconnection Obligations • Must publish a “Reference Interconnection Offer”(RIO) • that addresses 18 categories of issues identified by IDA • Must negotiate in good faith with any Licensee requesting interconnection • Licensees may agree on any terms that meet minimum requirements & are non-discriminatory • Must provide designated services at IDA’ determined rates (dark fibre, IPLC)

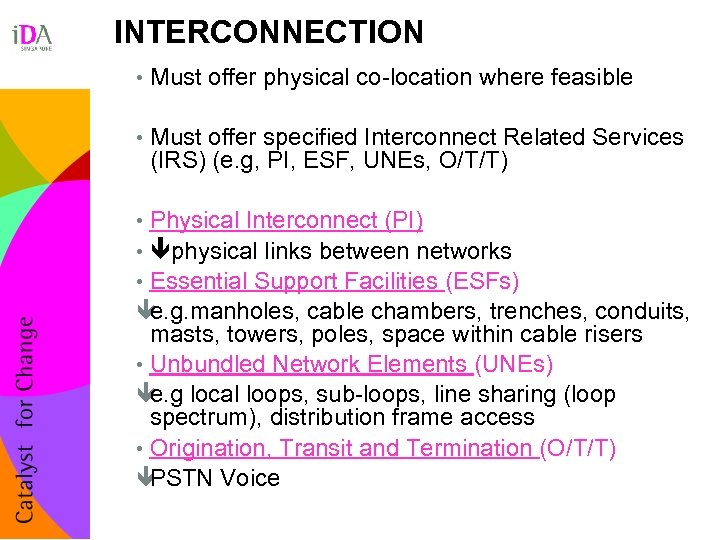

INTERCONNECTION • Must offer physical co-location where feasible • Must offer specified Interconnect Related Services (IRS) (e. g, PI, ESF, UNEs, O/T/T) • Physical Interconnect (PI) • physical links between networks • Essential Support Facilities (ESFs) e. g. manholes, cable chambers, trenches, conduits, masts, towers, poles, space within cable risers • Unbundled Network Elements (UNEs) e. g local loops, sub-loops, line sharing (loop spectrum), distribution frame access • Origination, Transit and Termination (O/T/T) PSTN Voice

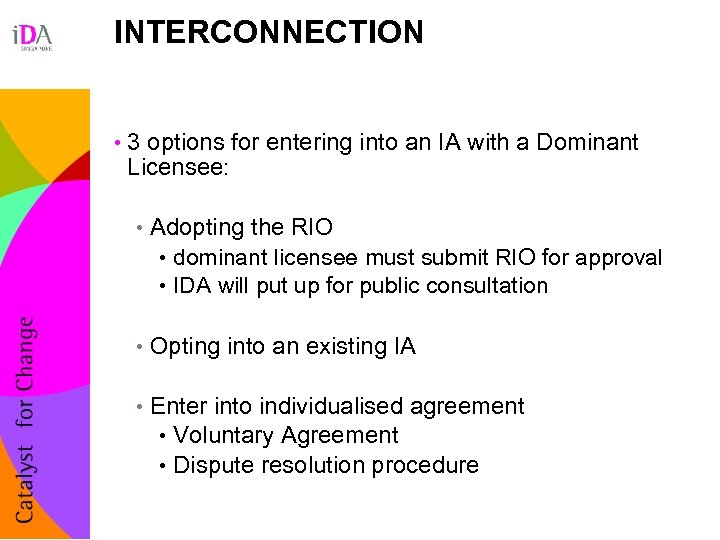

INTERCONNECTION • 3 options for entering into an IA with a Dominant Licensee: • Adopting the RIO • dominant licensee must submit RIO for approval • IDA will put up for public consultation • Opting into an existing IA • Enter into individualised agreement • Voluntary Agreement • Dispute resolution procedure

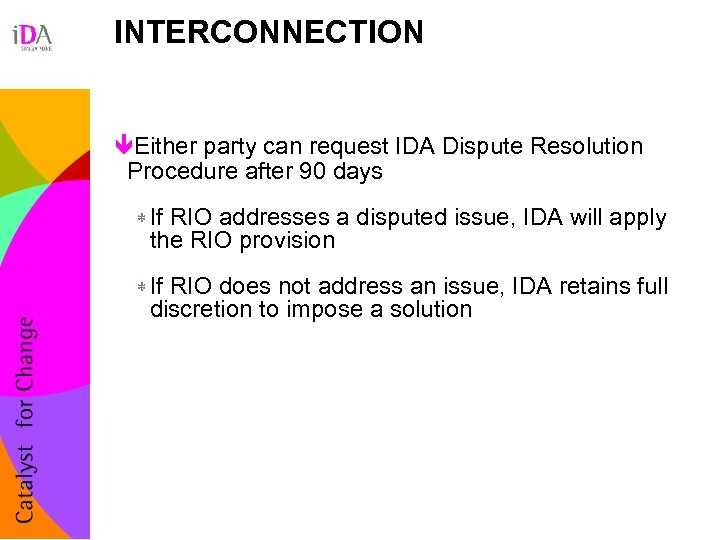

INTERCONNECTION Either party can request IDA Dispute Resolution Procedure after 90 days * If RIO addresses a disputed issue, IDA will apply the RIO provision * If RIO does not address an issue, IDA retains full discretion to impose a solution

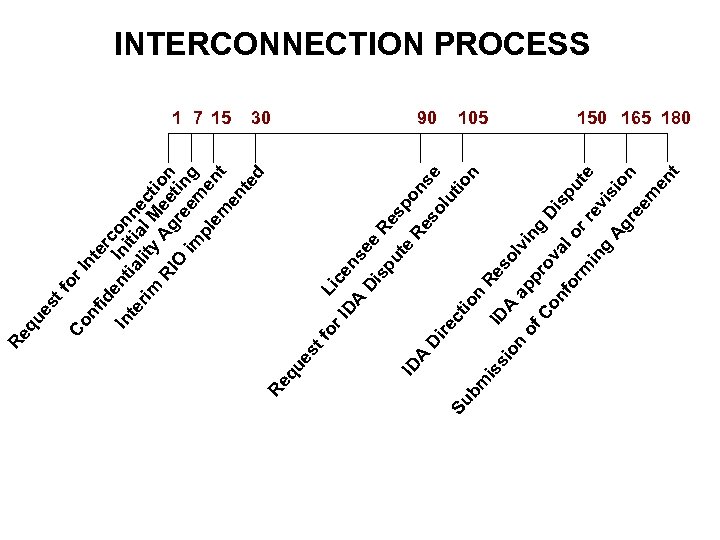

r. I fo DA Li ce ns Di ee sp Re ut e spo ID Re n A so se Di re lu ct tio Su io n bm n is ID Res si A ol on ap vi of ng pr Co ov Di nf al s or or put m e re in vi g Ag sio n re em en t es t nt 1 7 15 Re qu r. I fo e en In rco In te tia itia nne rim lit l c y M t RI Ag ee ion O r ti im eem ng pl em ent en te d fid Co n es t Re qu INTERCONNECTION PROCESS 30 90 105 150 165 180

INFRASTRUCTURE SHARING • FBOs may request right to share at cost-based prices “Critical Support Infrastructure” (e. g. masts, poles, ducts, poles, towers) which are • necessary to provide a service • cannot efficiently be replicated • sharing technically and economically feasible • Voluntary negotiations, supplemented by IDA dispute resolution procedure

COMPETITION REGIME • Over-view • Sector-specific rules • Based on economic principles and international best practices • ex ante regulation where competition not developed • ex post regulation and enforcement as competition takes root

COMPETITION REGIME Prohibitions against • Abuse of Dominant Position such as • Pricing abuses • Predatory pricing (price cutting) • Price squeezes (pricing inputs too high) • Monopoly leveraging • Cross-subsidisation (monopoly profits to subsidise a competitive svs) • Discrimination (treating own affiliates more favourably)

COMPETITION REGIME • Agreements Between Licensees That Unreasonably Restrict Competition (applicable to all Licensees) • Price fixing (collude to fix a price / output) • Bid rigging (collude for scarce resources or rights) • Customer allocation (agree not to compete for specific customers / markets) • Group boycotts (refusal to serve a customer)

ENFORCEMENT MECHANISMS • Process • Notice given with opportunity to respond • Enforcement actions • Warnings • Cease and desist orders • Monetary sanctions, proportionate to the contravention (Up to S$1, 000 per contravention) • In imposing financial penalties, IDA will consider aggravating or mitigating factors of the circumstances IDA will be reviewing monetary sanctions

Interconnection Pricing • Costing generally based on FLEC/LRAIC principle • ensure no distortion of “build vs buy” decision • facilitate rapid entry whilst encouraging infrastructure investment • wholesale prices for some elements based on retail-minus, and benchmarked against other countries for reasonableness meant to facilitate rapid entry & competition by entrants in end-user markets and address bottleneck situations when the market is first liberalised • IDA worked with Sing. Tel to specify availability and pricing of core group of IRS

Interconnection Pricing • Prices valid for 3 years, but IDA reserves the right to review and modify prices prior to the end of the period to ensure continued relevance • IRS applicable to FBOs but SBOs only for OTT • List of Prices Available include: • IPLC & Dark fibre • O/T/T charges • UNEs • ESFs • For strategic reasons, Interested FBO licensees should write in to IDA directly for this pricing list which will be released subject to confidentiality undertaking

Thank You www. ida. gov. sg Policy & Regulation Codes of Practices Telecom Competition Code

a07e7750dad3b1ba125d65b437cba110.ppt