cd2183068e1889738afb93e0ad5a98fb.ppt

- Количество слайдов: 68

Briefing on Bus Rapid Transit System (BRT) Project implementation in South African cities: Phase 1 Progress Update Portfolio Committee on Transport Tuesday 09 March 2010 1

CONTENTS 1. Progress in implementing Catalytic Projects: Integrated Public Transport Networks 2. Way Forward 2

Catalytic projects – Progress – IRPT Networks § Short-term (2009 -2011) Joburg, Cape Town & Tshwane planning full BRTs as part of long-term IRPT networks. § Nelson Mandela Bay planning a partial BRT as part of a citywide network. § ALL BRTs need to include existing directly affected operators & labour on contract as per NLTA § Other cities are in progress with Phase 1 IRPT network Operational Plans as base for full networks. § Need more interaction between cities & PRASA - joint planning of Priority Rail Corridors & feeders as part of IRPTN. § Inter-modal Planning Committees must be established 3

Catalyt ic projects – Progress Status of Planning & Implementation in 12 cities § Johannesburg – Rea Vaya § Cape Town - Integrated Rapid Transit § Nelson Mandela Transport System Bay– Integrated Public § Tshwane § Other cities 4

City of Johannesburg

Johannesburg - Starter BRT Service Good points of IRPTN to date – Rea Vaya § Positive response from commuters & general public § Excellence in many areas: customer support staff, security teams, station design, & system branding § Stations represent a high-quality effort § Stations appear well maintained & cleaned throughout day § Mostly high standard of infrastructure § Contract negotiations with Phase 1 A operators well advanced § Rea Vaya branding identity well-developed & executed § The branding livery for the Rea Vaya vehicles is particularly creative & has done much to support system identity 6

Rea Vaya Going Forward • Phase 1 A: • Refined Phase 1 B: – Introduce feeders in phases on 1 March and 1 May – Event service during 2010 – Will then have 143 buses in operation and 30 stations – 12 April is target date formation of BOC – Plan transition period with ‘shadow management’ – EMV compliant AFC to be implemented from October 2010 – Revised route from Noorgesig, Westbury, UJ, Wits, Metro Centre, Rissik street (no North route) – Construction will only be completed by August 2011 – Affected operators include Metrobus, Putco and mini-bus taxi industry – Will soon begin to work on new model including in respect of bus procurement and negotiations Further phases will rely on new sustainable source of public transport funding

Rea Vaya and the Taxi Industry. . . 1 § The Rea Vaya is set to affect the taxi industry positively - becoming the owners and operators of the first contracted bus operating company § Detailed consultation has been taking place with industry representatives - particularly the minibus taxi industry. § Negotiations with affected operators began in August 2009 and is nearing completion § There will then be a hand over and transition phase from the temporary bus operating company to an ex-taxi owned company § In January 2010, a Participation Framework Agreement was signed which sets out how operators who are affected will become beneficiaries and shareholders of the new bus operating company 9

Rea Vaya and the Taxi Industry… 2 §There is almost full agreement on the contents of the Bus Operating Contract which sets out how the Company will operate the services prescribed by the City. §The Bus Operating Contract has a number of innovative clauses including penalties if bus drivers does not drive safely or if the company does not maintain and clean the buses regularly. §There are still some issues under negotiations and once agreement is reached, a final agreement will be signed. §The City is also discussing with the negotiating team of affected operators a smooth transition and hand over period once agreement has been reached to ensure ongoing level of services especially as new routes are introduced and provide a service during the 2010 Soccer FIFA World Cup. 10

Rea Vaya and 2010 Soccer World Cup § § Rea Vaya will be ready to transport 20 000 spectators to both Ellis Park and Soccer City on match days The COJ is working speedily to complete the two stations at Soccer City. The one station is on top of the Soweto Highway and pedestrians will have to travel by the longest man-made tunnel in Joburg under the freeway into the North side of the Stadium 53 buses will be utilised The Soweto to Ellispark corridor will be fully operational on non match days

Johannesburg BRT Challenges 1. Need to ensure all affected operators can still join. 2. Requires sustained support for enforcement and to maintain safety and security of Rea Vaya 3. Conclusion of Phase 1 A negotiations & signing of BRT Operating Company Contract. 4. Improved governance & regulation of mini-bus taxi industry to ensure stability & integration between Rea Vaya & other modes 5. Enabling environment to ensure success i. e. community engagement & mobilisation in support of public transport 6. Appointment of dedicated staff to Contracting Authority. 7. Network expansion to cover Soweto etc. 8. Funds to complete Phase 1 B infrastructure 12

City of Cape Town

Cape Town Integrated Rapid Transit (IRT) Progress as at end February 2010. § High quality dedicated roadways and stations on first leg (CBD to Bay Side) nearing completion. § First BRT-related contract in South Africa concluded with company representing inner city taxi industry: vehicle services for World Cup using IRT infrastructure. § Two IRT posts recently advertised to lead dedicated IRT project office: IRT Implementation; and IRT Operations. § In view of new funding allocations: § Detailed operational plan review underway to determine most effective project roll-out. § Updated business plan in preparation. 14

Cape Town Integrated Rapid Transit Progress: Finances and tenders § Funding needed to complete Phase 1 a is substantially provided for in the new DORA allocation. § Provision in DORA now allows for funding to be committed into future years – will assist implementation. § R 668 m construction tenders awarded. Further contracts tendered but not awarded, awaiting funding: § Infrastructure: Another R 1 bn; Fare system and control centre: R 500 m § Tenders for control centre equipment & management, fare management evaluated and ready to be awarded. 15

Cape Town Integrated Rapid Transit Progress : Engagement with Taxi Industry 1. Engagement with 8 taxi associations and 2 bus companies to transform them into 2 IRT Vehicle Companies. 2. A comprehensive compensation model developed, giving effect to the promise that taxi industry “will not be worst off”. 3. Since Nov 2009, focus shifted to negotiating contract for the 2010 World Cup service using IRT and other vehicles. • In Feb contract signed with taxi company holding 75% of the existing inner city public transport market. 4. Consultation and negotiations will resume after review of system plan and business plan concluded, Apr / May. 16

Cape Town IRT and WC 2010 Status – Implementing Phase 1 a § IRT implementation postponed to post World Cup § Negotiated 2010 contract with Company A -First service: 6 Feb 2010

Cape Town Integrated Rapid Transit Challenges 1. Need SARS directive on whether VAT is payable re dedicated BRT infrastructure: significant impact on budget (in Cape Town for Phase 1 a: nearly R 500 m lost to VAT) 2. Additional PTIS funding allocated not adequate to complete Phase 1 a, especially if VAT payable. 3. Start operation of Phase 1 a starter service as soon as possible after World Cup to ensure early utilisation of infrastructure investment. 4. Investigating creative ways to minimise and deal with expected operating deficit in Phase 1 a. 18

Nelson Mandela Bay Status – Partial BRT but aiming to contract a full city-wide network by depending on taxi operator negotiations § A contracted public transport system incorporating both buses and taxis, with common ticketing § All current taxi & bus operations to be a single network– focus on Transformation of taxi industry first, full integration after 3 – 5 years § Network to comprise 5 contract packages § Due to current taxi negotiations, network will not be ready by 2010 – instead aiming for a pilot 25 bus event service for World Cup § Forming 5 co-ops to run interim years with Recap taxis § Need to fast-track new Business Plan that costs approach suggested by local taxi industry § Require Do. T & Treasury approval for costing of new approach & subsequent prioritisation of 2010/11&12/13 PTIS 19

Nelson Mandela Bay Challenges 1. Require clarity on Govt Guarantee no loss of profits – 2. 3. 4. demanding R 8000 per month per vehicle. Require guidelines as to how to include operators into “Value Chain” ito current procurement legislation. Proposing an interim 2 -5 year contract for transformation of taxi industry before entering full 12 year negotiated contract. Need to fast-track DOT support for the dedicated project team 20

Tshwane Status – Implementation of Line 1 of Phase 1 – designs are being finalised, discussions with PT industry progressing § Line 1: Mabopane Station to the CBD – 37 km of lanes and 17 stations prioritised for Phase 1 implementation § Station designs: station concepts launched – designs are proceeding § Infrastructure design – professional team appointed – designs are being fast tracked § Discussions with Do. T on full network design to take place § Financial Plan and Model development in an advanced stage – first output by mid March 2010 § Integrated Marketing and Communication Strategy developed 21 21

Tshwane BRT § Liaison with Public Transport Industry: § Meetings held with Taxi Councils, Bus Operators and Commuters § BRT Stakeholder Summit being planned for March/April 2010 – will set platform for further engagement and negotiations with affected operators § Tshwane BRT Team being further developed as part of realignment of departments – new Transport and Roads Department being established § Institutional Model – options are pursued as part of Business and Financial Plan – Section 78 in terms of MSA to be followed 22

Tshwane BRT § Intelligent Transport Systems (ITS) Roadmap completed – ITS tenders being developed § Vehicle specification being developed – funding of vehicles to be finalised after finalisation of Financial Plan 23

Tshwane BRT and WC 2010 § § Construct BRT lanes along some 6 - 11 kms of road of line 1 Construct BRT stations at Mabopane station and on DF Malan Drive near its intersection with Boom Street Provision of an event specific service and part of the overall 2010 FIFA© World Cup Transport Plan Utilising completed elements of the BRT network

Progress in other 8 IRPTN cities is still at early planning level § Buffalo City - has completed Draft Operational Plan § Polokwane & Rustenburg – Operational Plans in progress § Mbombela – IPTN Operational Plan complete – Business Plan in preparation. Need dedicated team and project leader! § Ekurhuleni & Ethekwini – Operational Plans in tender procurement process § Mangaung & Msunduzi – have Operational Plan tenders in preparation but need intervention to motivate city officials to move faster and take on the responsibility § Operational network planning will commence in 2010/11 in the Rural districts 25

National Joint Working Group…. 1 § § NJWG’s role is to advise the Minister and Minmec and to propose National frameworks and guidelines. NJWG BRT sub committee’s terms of reference is to develop a National Framework for BRT implementation that will apply to current and future projects. NJWG does not replace the need for local level business negotiations between cities and affected operators It was agreed that NJWG would prioritise BRT and report back to Minister within 3 months of initiation 26

National Joint Working Group…. 2 § Need to drive and focus NJWG taxi process to finally set up a mechanism of local/regional, provincial and national co-operatives or companies as legal entities which can: § Restructure local taxi operations along more profitable lines § Participate in Government public transport contracting opportunities (for both city IRPTNs but also in future rural periodic public transport service contracts etc) § Participate in supporting value chain opportunities and § Any other ventures that are deemed appropriate 27

IPTN/BRT linkages to NLTA & National Public Transport Regulator § The provisions of the NLTA - which is an instrument of the PTS ensure that the necessary “integration” takes place through: § the statutory Intermodal Planning Committees (IPCs) that are to be established in respect of the preparation of the public transport component of the Integrated Transport Plans (ITPs) and complementary Operational Plans § cities taking the responsibility for integrating all public transport in their areas under a single locus of accountability which will hold planning, funding and regulatory powers/ functions § The Department will urgently drive the assignment of the § regulatory function to local level where capacity exists. A viability exercise in assigning the function will be undertaken. Issues around capacity shortages at local level will be looked into Need to ensure the implementation of the National Transport Regulator to enhance the delivery of public transport services 28

2. WAY FORWARD 2. 1 Implementation challenges • All the foregoing problems can be addressed through system adjustments • Monitoring is essential to identify problems and ensure timely remedies 2. 2 The way forward • Cities must share experience & benefit from each others successes & mistakes 29

2. 1 Implementation challenges 1. Insufficient ongoing funding a major concern. BRTs are mass transit network projects needing sustained funding for 10 -20 years. 2. Delays incurred as a result of the initially slow national engagement and negotiations with the taxi industry. 3. A need exists to fast-track engagement with SABOA and its members 4. Environmental & heritage impacts and protests from car-using residents must be managed resolutely. 5. Cities need to set up dedicated project teams as a condition for further funding. 6. Cities & PRASA need to integrate planning of IRPTNs/BRTs and Priority Rail Corridors much better. 7. Cities need to insist on viable network designs that maximise coverage & speed - not designs that least impact car users! 30

2. 2 Way Forward 1. Do. T, National Treasury and DTI, Provinces and cities have established an Inter Departmental Forum under the leadership of Deputy Minister to discuss, coordinate and agree on way forward concerning current issues and challenges related to Integrated Public Transport and BRT implementation: § PTIS Funding –covering transitional costs § Compensation model for taxi and bus industry § Bus and Rail Procurement - explore local funding (IDC, PIC and DBSA) and local manufacturing and assembly of buses in support of the Industrial Policy Action Plan § Assigning planning, funding and regulatory powers and functions to municipalities where capacity exists § Alignment with Bus subsidies and Taxi Recap programmes § Etc 2. Do. T will embark on Roadshows with Deputy Minister to all cities - engaging also cities that are lagging behind 31

2. 2 Way Forward 3. Focus of PTIS Grant is on funding IRPTN implementation. 4. Work continues to align PTO Grant with IRPTN rollout. 5. PTOG funds from subsidised services “replaced” by IRPTN, can be used for IRPTN development. 6. Cities & PRASA must develop an integrated operational plan for presentation to MINMEC in June 2010 7. Mass communication required to inform stakeholders about transformation of Public Transport 8. Enforcement to protect new infrastructure & stations is essential 9. Do. T to tackle under-capacity of provinces & municipalities (secondments, training, project-based mentoring led by international and local experts) 32

Thank You Dankie Enkosi 33

Overview of BRT starter service Current Starter Service § Trunk route (T 1) service from Thokoza Park to Ellis Park only § Smaller CBD circle routes C 3 & C 4 withdrawn Nov 09 due to poor patronage § 25. 5 Kilometre journey, 23 Stations on round trip § From 11 800 passengers per day to 17 000 § 28 Articulated and 6 Complementary buses in use § 203 Trips per day § Services from 04: 50 to 21: 00 weekdays § Clidet Special Purpose Vehicle doing services with 75 retrained ex taxi drivers § Operational budget of R 103 million for 09/10 financial year § Biggest challenge is keeping to timetable with road works and congestion

Roll out of full Rea Vaya Phase 1 A from 1 st of March 2010. . . 1 § The complete phase 1 A will be rolled out between 1 March and 3 May § 1 March 2010 - A new complementary service running directly from Dobsonville to the Johanneburg CBD and Ellis Park Station and feeder services are planned to be implemented: § § § Dobsonville to Ellis Park Complementary service (21 buses) Naledi to Thokoza Park Station (3 buses) Jabavu to Lake View Station (4 buses) Mofolo to Boomtown Station (2 buses) Services introduced on 1 March 2010 will operate the same first and last bus times as the current starter service 35

Roll out of full Rea Vaya Phase 1 A from 1 st of March 2010. . . 2 § 3 May 2010 - The final services scheduled for introduction will include an additional complementary service directly from Dobsonville to Maponya Mall and feeder services § A CBD distribution service will be reintroduced to link the trunk services with Braamfontein, Wits University and Hillbrow. § All service times will be extended: § The last buses will depart at 22: 40 § Sunday services will also be introduced on all routes § The feeder and complementary buses will stop at over 170 bus stops along the routes 36

Roll out of full Rea Vaya Phase 1 A from 1 st of March 2010. . . 3 § § Drivers are already being trained Bus stops are being erected More staff will be employed Full Phase 1 a service will include: § real-time tracking of bus movements and communication between driver and Control Room § next station announcements on bus, announcements to passengers on bus, both verbally and through the use of variable message signs § Additional Depos are being constructed § 37

Progress on negotiations • Significant capacity building and information sharing including reports from Clidet CEO • 95% agreement on the Bus Operating Contract • Signed agreement in November on compensation for 167 vehicles that had been affected by starter service • Signed a “Framework Participation Agreement” in January which: – Defines beneficiaries – Determines process to arrive at agreed list of beneficiaries – Increases number of beneficiaries from 575 to 585 – Agrees that vehicles to be handed over to the City for scrapping or resale after stringent verification process • Both parties have determined their initial proposed ‘fee per km’

Fee per km • City proposed fee per km which is based on international best practice financial model, experience to date on starter service and reasonable profit is R 20. 97 and R 24. 62 per km for 13 and 18 m buses • To provide this fee per km, tariffs will need to be adjusted by 18% and then will increase in terms of an agreed escalation formula. • Taxi industry’s proposed fee per km is R 14 higher than ours (R 36. 35 and R 38. 85 for two different size buses • Negotiations at the moment are trying to narrow difference – Key variance is in profit margin (ours is 15%) – based on a ‘restraint of trade’ payment to shareholders because they re taking their taxis off the road – Also have input costs which are higher than ours including a management fee per bus of R 3000. • Bus Operating Contract requires that COJ is satisfied that the new Company can manage satisfactorily

Issues in respect of the fee per km • Rea Vaya has proposed to the City a budget for 09/10 based on our proposed fee per km and tariff adjustment • If we have to settle on greater than this, funds must come from: – Tariff increase (in an election year? ) – City (with significant budget constraints: 2010 and election year) – ? Operational subsidy or capital grant from national government • Estimated amounts required are: – If agree to TI proposal of R 9 000 ‘restraint of trade monthly payment’ and there ‘mark up’ of 20%, we will require R 120 million per annum – If agree to settle with TI at mid point between our and their current offers: shortfall is R 50 million per annum. • Another option is to replace ‘restraint of trade amount’ with one off compensation so as not to inflate the fee per km.

Compensation for loss of income • Short term compensation for loss of income due to the operations of Rea Vaya – We have already paid R 3 167 000 for loss of income to operators of 167 vehicles for an assumed period of time from November to end Jan/February – Already indications that more money is going to be asked for and difficult to refuse if BOC is not up by 1 March 2010 – Since there needs to be a phase out of taxis and phase in of buses, it is likely that a further call for compensation for loss of income will be made – This is not yet costed • We have not been asked for ‘compensation to exit the industry’ but ‘restraint of trade’ could be seen as an ‘equivalent demand’

Transitional and transformation costs • About 50% of our operational budget for 09/10 could be regarded as transitional and transformational costs including: – Taxi industry capacitation and negotiation support – Independent facilitators – Security costs – Additional communication costs • We have agreed to pay for training but industry also want us to remunerate their drivers while under training • We have found budget from ‘converting PTIS CAPEX to OPEX’ in 09/10 financial year and have asked City for total Opex R 213 million budget for 10/11 but are not certain of getting it

Bus procurement

Background • After extensive discussions and an international road show, City decided: – Approach BNDES ECA to funds buses – Contracted HSBC as fund arrangers and advisors • Reasons for going for international loan funding included: – Explore and pilot alternative and competitive sources of funding – Possible legislative obstacles to vehicle financing for such a long period – HSBC and BNDES familiar with BRT systems – Offered very good interest rates (4 - 6%)

Bus procurement process • City procured buses on behalf of still to be formed BOC on understanding that BOC once established would take over bus company and loan financing • This has not happened to date. Consequences are as follows: – Contingent liability/possible liability for the City of about R 420 million – City has had to arrange guarantees at significant costs (approaching R 5 million) • At the moment HSBC issued guarantee until end 26 February 2010. Are holding R 88 million of City cash as collateral. • COJ and HSBC planned that funds for bus procurement and working capital for new Bus Company would come from: – BNDES: 100% of bus purchase price and 85% of ECA financing costs – Local funding from DBSA, PIC, IDC: $18 million – Equity from taxi beneficiaries (small amount: 575 x R 54 000 = R 31 million – currently under negotiations)

Where we are to date • Colleagues are in Brazil finalising BNDES loan • BNDES loan will need to be repaid in dollars – New BOC and ultimately City will be exposed to significant FOREX and interest rate fluctuation risk – Requires hedging strategy which also requires extra funds and ‘extra’ guarantees from the City • City approached NT re managing these risks and we are now working with them and talking to them about: – Possible local funding (DBSA and others) for entire deal – Desirability of buses being owned by City vs BOC – Next phase would need to draw on lessons of this phase.

Conclusion and issues • Funding issues arising from the taxi industry negotiations include: – Operational subsidy for fee per km – Transitional and transformation costs – Funding compensation for loss of income • Funding issues arising from the bus procurement process include: – Local vs. foreign funding – How to deal with foreign exchange and interest rate risks with off shore funding

Nelson Mandela Bay - Model • • • The operations themselves will be under the command control of the professional managers of the cooperatives. Services will be scheduled, operated almost entirely with recap-compliant vehicles, which will be subject to a strict maintenance programme. Drivers will be trained, employed in terms of the Taxi Industry Sectoral Determination of the Department of Labour, and subject to disciplinary control and sanctions similar to those of the big bus companies. The transformation process • The Forum, representing the taxi industry in the area has proposed the following transformation process for the taxi industry: • Phase 1: Preparation and start-up (Year 1) • This Phase will include obtaining stakeholder buy-in, planning and registration of the requisite co-operatives. This process has in fact already commenced.

Nelson Mandela Bay - - Model Nelson Mandela Bay Model Phase 2: Co-operative management (Year 2) • During this Phase each co-operatives will become responsible for providing the public transport service required from it in terms of the contract to be concluded with the NMBM. Ownership of the vehicles will however remain with the existing owners. The taxi industry’s rationale for this is that it provides/allows for individual operators to withdraw from the system should the need arise (i. e. if their involvement in the new system results in a loss of profits). • It is envisaged that the co-operatives will formally employ the requisite staff and procure the necessary systems necessary to provide the contracted service. • The taxi industry’s view is that during this Phase, the members of the co-operatives will begin to receive payments from Government (‘profit guarantee’) in keeping with the guarantee of no loss of legitimate profits. The interpretation of this guarantee and accordingly its application is however still subject to debate (please refer to Section 12 below). • In accordance with the envisaged ‘gross’ contract to be concluded with the NMBM, the co-operatives will be remunerated on a per kilometre, rather than a per passenger basis.

Nelson Mandela Bay - Model Phase 3: Co-operative ownership (Year 2) • The taxi industry proposes that during this Phase, the cooperatives will become the owners of the fleet necessary to provide the contracted service. The co-operatives will either procure new vehicles or purchase vehicles from its members. • The taxi industry’s view is that the co-operatives will purchase the required vehicles from its members, however this raises potential financial implications, as well as issue as to vehicle age and fleet composition (see Section 8 below for a discussion of the highlevel costing). • Phase 4: End-state • During this Phase the Forum proposes that the co-operatives will consider the formation of a fully integrated IPTS.

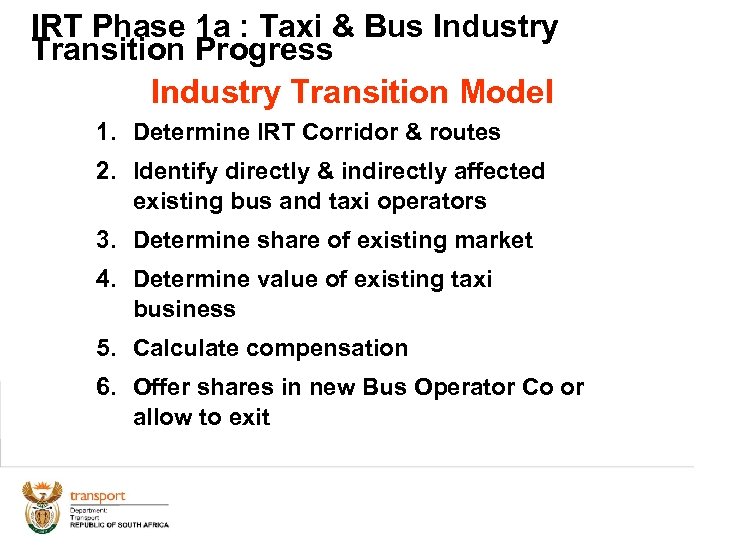

IRT Phase 1 a : Taxi & Bus Industry Transition Progress Industry Transition Model 1. Determine IRT Corridor & routes 2. Identify directly & indirectly affected existing bus and taxi operators 3. Determine share of existing market 4. Determine value of existing taxi business 5. Calculate compensation 6. Offer shares in new Bus Operator Co or allow to exit

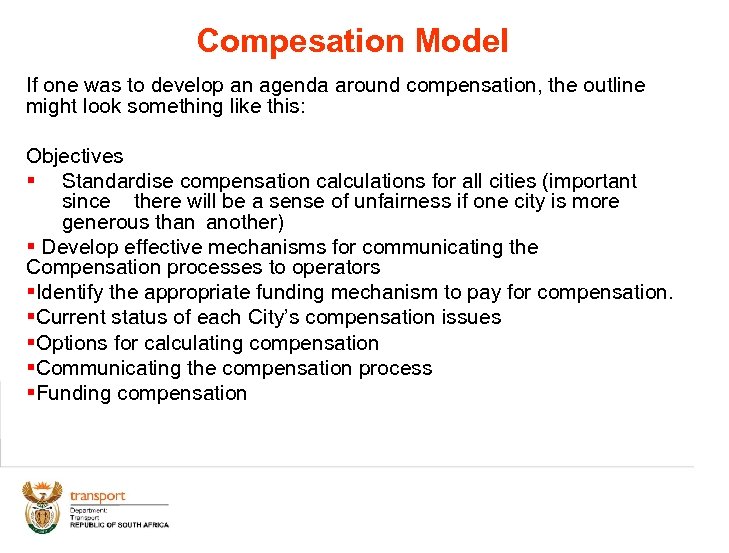

Compesation Model If one was to develop an agenda around compensation, the outline might look something like this: Objectives § Standardise compensation calculations for all cities (important since there will be a sense of unfairness if one city is more generous than another) § Develop effective mechanisms for communicating the Compensation processes to operators §Identify the appropriate funding mechanism to pay for compensation. §Current status of each City’s compensation issues §Options for calculating compensation §Communicating the compensation process §Funding compensation

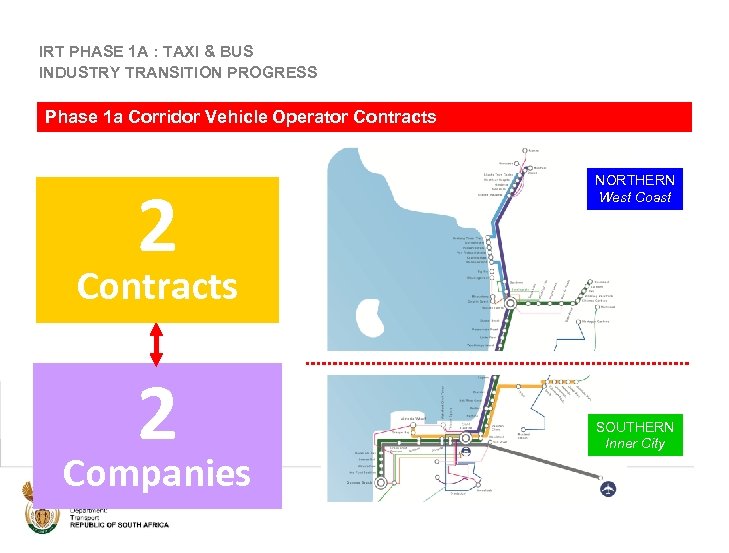

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS Phase 1 a Corridor Vehicle Operator Contracts 2 NORTHERN West Coast Contracts 2 Companies SOUTHERN Inner City

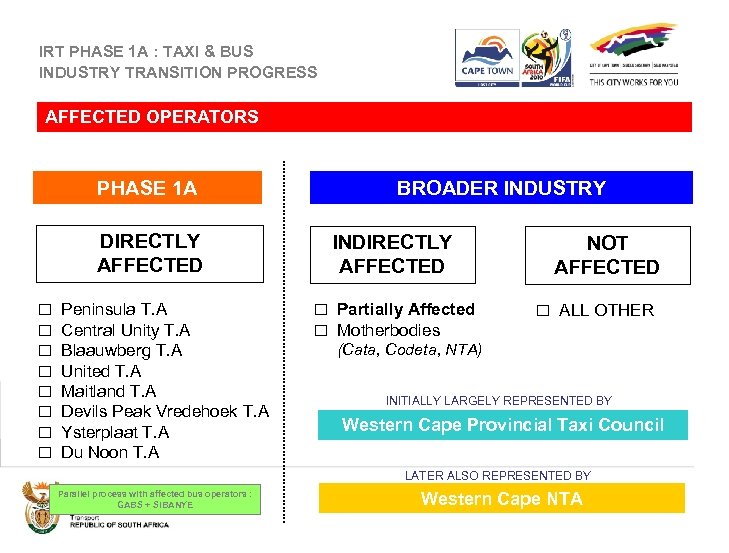

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS AFFECTED OPERATORS PHASE 1 A DIRECTLY AFFECTED ¨ ¨ ¨ ¨ Peninsula T. A Central Unity T. A Blaauwberg T. A United T. A Maitland T. A Devils Peak Vredehoek T. A Ysterplaat T. A Du Noon T. A BROADER INDUSTRY INDIRECTLY AFFECTED ¨ Partially Affected ¨ Motherbodies (Cata, Codeta, NTA) NOT AFFECTED ¨ ALL OTHER INITIALLY LARGELY REPRESENTED BY Western Cape Provincial Taxi Council LATER ALSO REPRESENTED BY Parallel process with affected bus operators : GABS + SIBANYE Western Cape NTA

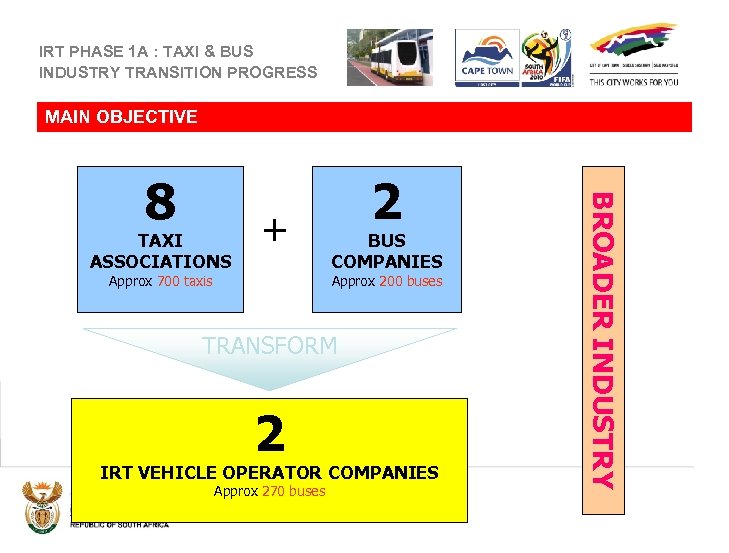

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS MAIN OBJECTIVE TAXI ASSOCIATIONS + Approx 700 taxis 2 BUS COMPANIES Approx 200 buses TRANSFORM 2 IRT VEHICLE OPERATOR COMPANIES Approx 270 buses BROADER INDUSTRY 8

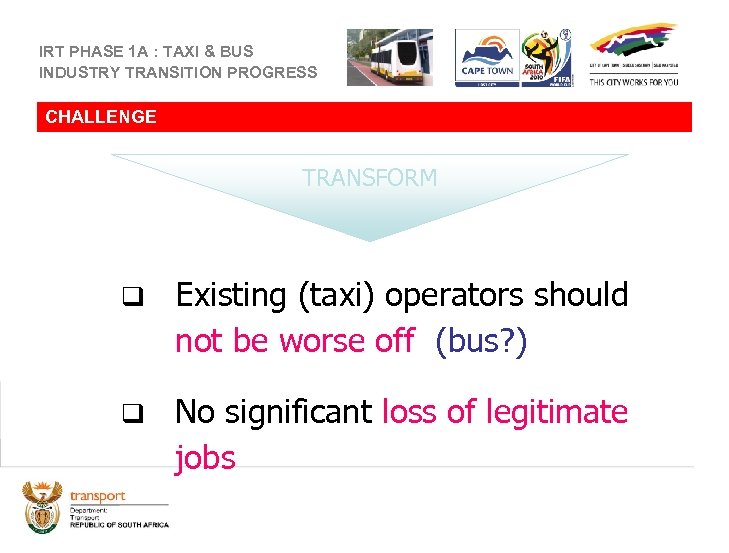

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS CHALLENGE TRANSFORM q Existing (taxi) operators should not be worse off (bus? ) q No significant loss of legitimate jobs

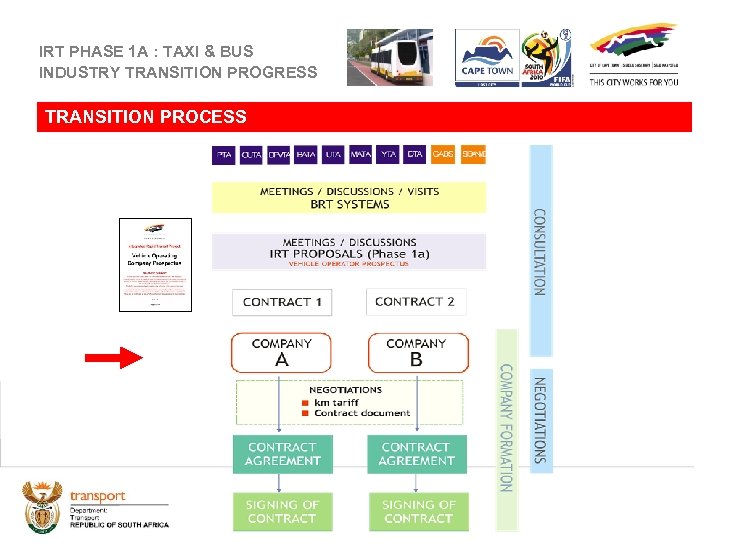

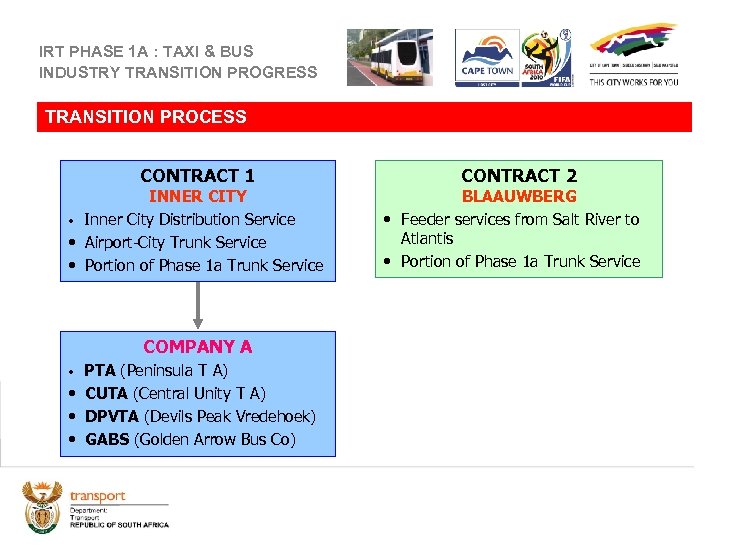

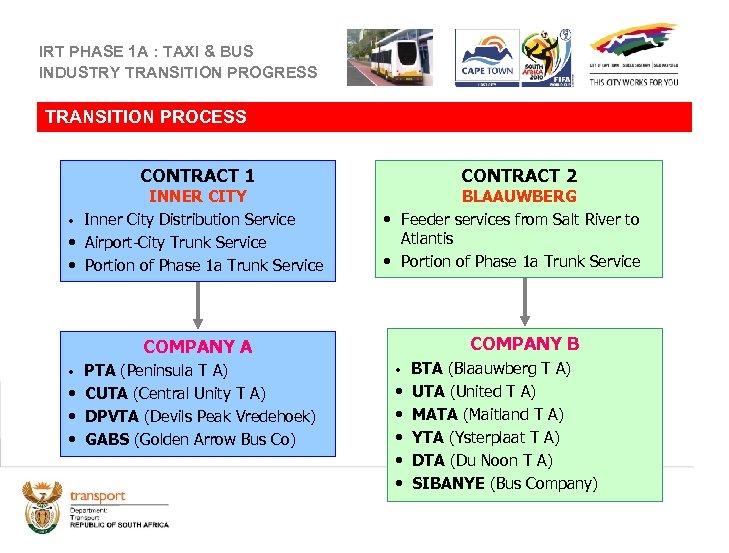

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS TRANSITION PROCESS

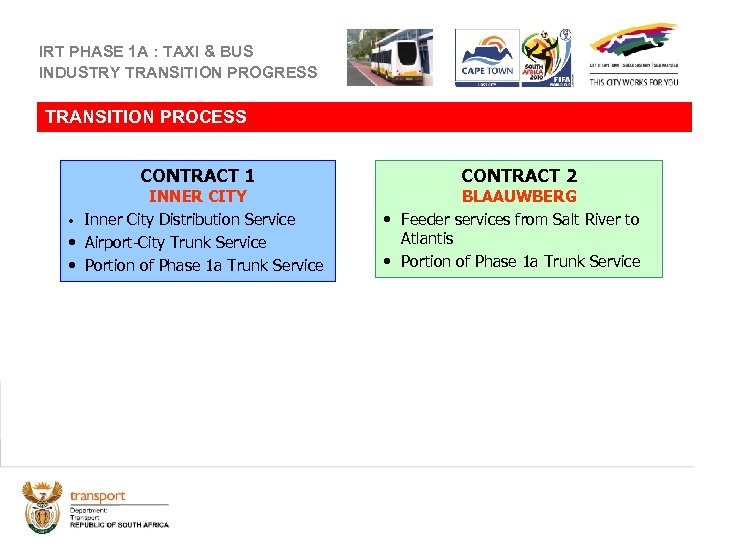

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS TRANSITION PROCESS CONTRACT 1 INNER CITY • Inner City Distribution Service • Airport-City Trunk Service • Portion of Phase 1 a Trunk Service CONTRACT 2 BLAAUWBERG

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS TRANSITION PROCESS CONTRACT 1 INNER CITY • Inner City Distribution Service • Airport-City Trunk Service • Portion of Phase 1 a Trunk Service CONTRACT 2 BLAAUWBERG • Feeder services from Salt River to Atlantis • Portion of Phase 1 a Trunk Service

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS TRANSITION PROCESS CONTRACT 1 INNER CITY • Inner City Distribution Service • Airport-City Trunk Service • Portion of Phase 1 a Trunk Service COMPANY A PTA (Peninsula T A) • CUTA (Central Unity T A) • DPVTA (Devils Peak Vredehoek) • GABS (Golden Arrow Bus Co) • CONTRACT 2 BLAAUWBERG • Feeder services from Salt River to Atlantis • Portion of Phase 1 a Trunk Service

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS TRANSITION PROCESS CONTRACT 1 INNER CITY • Inner City Distribution Service • Airport-City Trunk Service • Portion of Phase 1 a Trunk Service CONTRACT 2 BLAAUWBERG • Feeder services from Salt River to Atlantis • Portion of Phase 1 a Trunk Service COMPANY B COMPANY A PTA (Peninsula T A) • CUTA (Central Unity T A) • DPVTA (Devils Peak Vredehoek) • GABS (Golden Arrow Bus Co) • • BTA (Blaauwberg T A) UTA (United T A) MATA (Maitland T A) YTA (Ysterplaat T A) DTA (Du Noon T A) SIBANYE (Bus Company)

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS FACILITATORS Sedick Crombie Nico Mc. Lachlan COMPANY A COMPANY B

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS PARTICIPATION Sedick Crombie Nico Mc. Lachlan COMPANY A COMPANY B PTA (Peninsula T A) • CUTA (Central Unity T A) • DPVTA (Devils Peak Vredehoek) • GABS (Golden Arrow Bus Co) • • BTA (Blaauwberg T A) UTA (United T A) MATA (Maitland T A) YTA (Ysterplaat T A) DTA (Du Noon T A) SIBANYE (Bus Company)

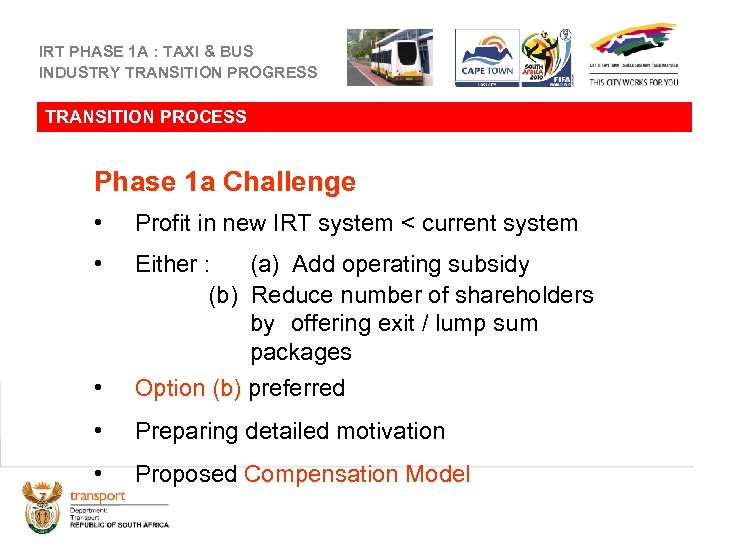

IRT PHASE 1 A : TAXI & BUS INDUSTRY TRANSITION PROGRESS TRANSITION PROCESS Phase 1 a Challenge • Profit in new IRT system < current system • • Either : (a) Add operating subsidy (b) Reduce number of shareholders by offering exit / lump sum packages Option (b) preferred • Preparing detailed motivation • Proposed Compensation Model

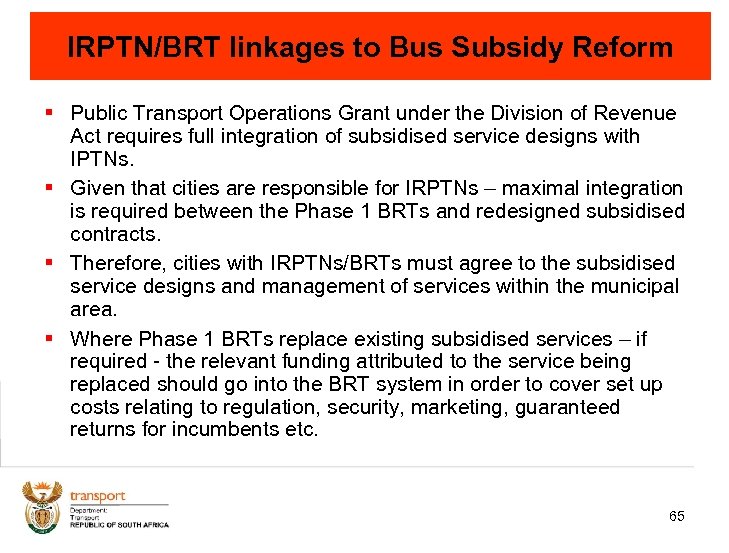

IRPTN/BRT linkages to Bus Subsidy Reform § Public Transport Operations Grant under the Division of Revenue Act requires full integration of subsidised service designs with IPTNs. § Given that cities are responsible for IRPTNs – maximal integration is required between the Phase 1 BRTs and redesigned subsidised contracts. § Therefore, cities with IRPTNs/BRTs must agree to the subsidised service designs and management of services within the municipal area. § Where Phase 1 BRTs replace existing subsidised services – if required - the relevant funding attributed to the service being replaced should go into the BRT system in order to cover set up costs relating to regulation, security, marketing, guaranteed returns for incumbents etc. 65

IRPTN/BRT linkages to Taxi Recapitalisation § Those operators affected by a BRT/IRPTN and who have a vehicle that is eligible for scrapping – should be prioritised in terms of taxi recapitalisation. § Cities will then negotiate with local affected operators who qualify for the scrapping subsidy with regard to investing all or some of it as equity in a BRT operating company. § Those operators who have already recapitalised and are affected by BRTs/IRPTNs need to negotiate with cities as to facilitating the sale of their vehicles - if they are not required in the new system. § The Do. T should be mandated to urgently develop a scheme for qualifying already recapitalised vehicles that are affected by BRTs and IRPTNs in which these could possibly qualify for a scrapping subsidy – if they are resold to an unaffected taxi operator as part of the normal scrapping process. 66

IRPTN/BRT linkages to Priority Rail Corridors § There needs to be a greater sharing of operational plan information between PRASA and cities with a view to developing integrated BRT and Rail trunk services of a similar standard – with both served by an integrated, formal, high quality feeder service. § Priority Rail Corridors should have a similar operating standard as BRT in terms of schedules, frequencies, marketing, journey times per distance, security, customer service and information, station experience, special needs access, etc. § Standardising the quality of both Rail Priority Corridors and BRT networks is the first step to full integration in the medium term. § The 3 cities planning full BRTs and PRASA need to be given 6 months to come back to Minmec with integrated and detailed operational plans for standardising quality and for developing common feeder services that includes at least one Rail Priority corridor, one BRT trunk corridor and a common feeder service to both in each of the 3 cities. 67

IRPTN/BRT linkages to PTIS Grant § It is therefore vital that IRPTNs/BRTs received sustained funding over at least 5 to 10 years in order to cover transitional costs, to maximise network coverage and to generate additional income from new users, advertising, new levies on car use etc. § Sustained funding from the PTIS and PTO Grants in the Division of Revenue Act should be linked to a set of stringent criteria such as: § High quality network operational plan that is approved by City Government § Dedicated project team with an innovative focus on reprioritising existing road and parking space § Sufficient network coverage and passenger revenue to at least cover all direct operating costs. § Indirect public investment costs like security, guaranteed returns to incumbents, regulatory costs, etc. being the preferred areas for budgetary support. § Medium term plans to raise system income through car and parking levies, advertising and sponsorship, raising ridership levels etc. § The national guarantee of “no loss of legitimate business” by affected operators and workers who shift to BRT places an additional burden on costs. 68

cd2183068e1889738afb93e0ad5a98fb.ppt