02aca67155f88fa7e47594cce9402aab.ppt

- Количество слайдов: 63

BRIEFING EVERGREEN FIBREBOARD BERHAD 23 rd March 2010

1. INTRODUCTION PRINCIPAL INFORMATION FULL

1. 1 Principal Information The corporate structure of the EFB Group is as follows: -

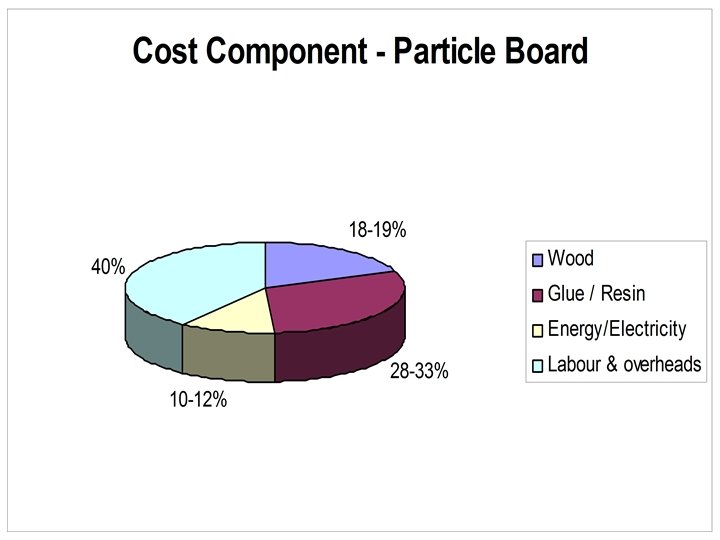

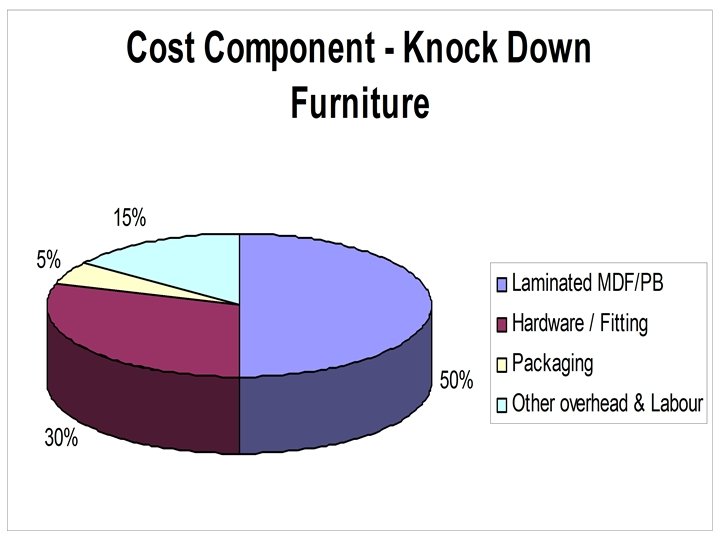

EVERGREEN FIBREBOARD BERHAD (HQ) (BATU PAHAT, JOHOR). ALLGREEN TIMBER PRODUCTS SDN BHD (SEGAMAT, JOHOR) Medium Density Fibreboard, Manufacturing of Particle Board from wood waste of various wood species. Currently 30% of its produce are being sent to Evergreen Fibreboard in Parit Raja for the production of Knock-down Wooden Furniture. CAPACITY : 120, 000 M 3/ANNUM value added downstream products such as Paper, Veneer, Coated/Emboss, Printed, Melamine Board Laminations & Knock Down wooden Furniture. CAPACITY : 250, 000 M 3/ANNUM EVERGREEN FIBREBOARD (JB) SDN BHD ( PASIR GUDANG ) A producer of thin MDF using Tropical and Acacia wood species. It produces thin E 1/E 0 panel too. CAPACITY : 120, 000 M 3/ANNUM

EVERGREEN FIBREBOARD BERHAD ( PASIR GUDANG) Involved in the secondary process of Medium Density Fibreboard which is supplied from our Parit Raja Plant , Plywood and Decorative Faced Veneer Sheets that are derived from purchase of imported logs by rotary and slicing. CAPACITY : 100 MILLION SQFT/ANNUM Evergreen Adhesive & Chemicals Sdn. Bhd A producer of Adhesive. CAPACITY : 96, 000 MT/ANNUM DAWA TIMBER PRODUCTS SDN BHD ( PASIR GUDANG ) An Associate Company of Evergreen Fibreboard Berhad that carries out similar activities with Evergreen Fibreboard Berhad in Pasir Gudang, Johor. CAPACITY : 24 MILLION SQFT/ANNUM Evergreen Fibreaboard (Nilai) Sdn. Bhd A producer of medium density fibreboard. CAPACITY : 250, 000 M 3/ANNUM

Evergreen Hevea Resources Sdn. Bhd. ( Malaysia ) Harvesting of Rubber Timber Consession. PT Hijau Lestari Raya Fibreboard ( Indonesia ) A producer of Plain MDF & adhesive. CAPACITY : 120, 000 M 3/ANNUM (MDF) 60, 000 MT/ANNUM (Adhesive)

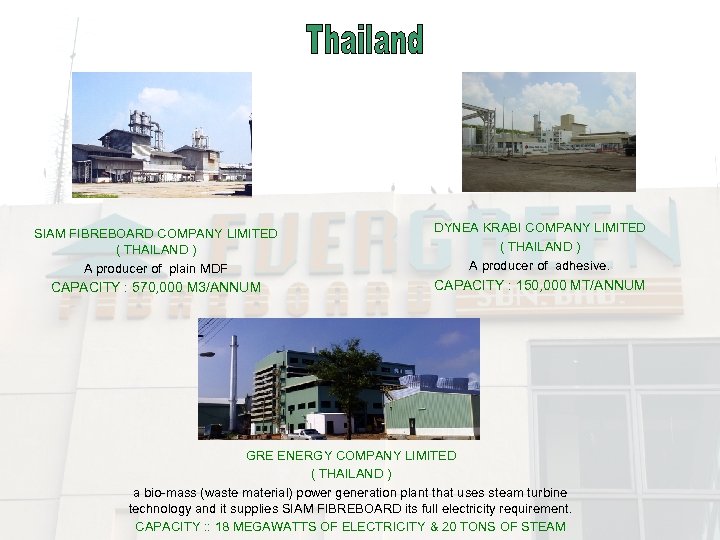

SIAM FIBREBOARD COMPANY LIMITED ( THAILAND ) A producer of plain MDF DYNEA KRABI COMPANY LIMITED ( THAILAND ) A producer of adhesive. CAPACITY : 570, 000 M 3/ANNUM CAPACITY : 150, 000 MT/ANNUM GRE ENERGY COMPANY LIMITED ( THAILAND ) a bio-mass (waste material) power generation plant that uses steam turbine technology and it supplies SIAM FIBREBOARD its full electricity requirement. CAPACITY : : 18 MEGAWATTS OF ELECTRICITY & 20 TONS OF STEAM

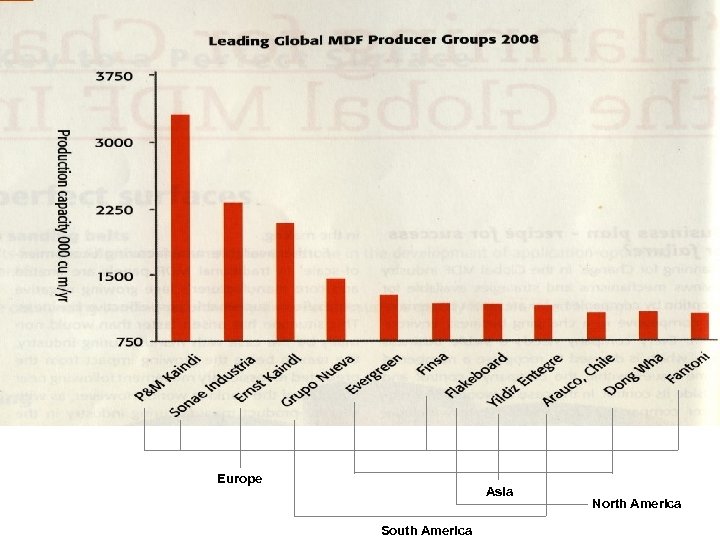

World Top 5 producer. Capacity of 1. 3 million m 3 MDF per annum. 10 MDF production lines & 1 Particleboard production line(120, 000 m 3 per annum). Total of 11 manufacturing plants. Presence in more than 40 countries worldwide.

Europe Asia South America North America

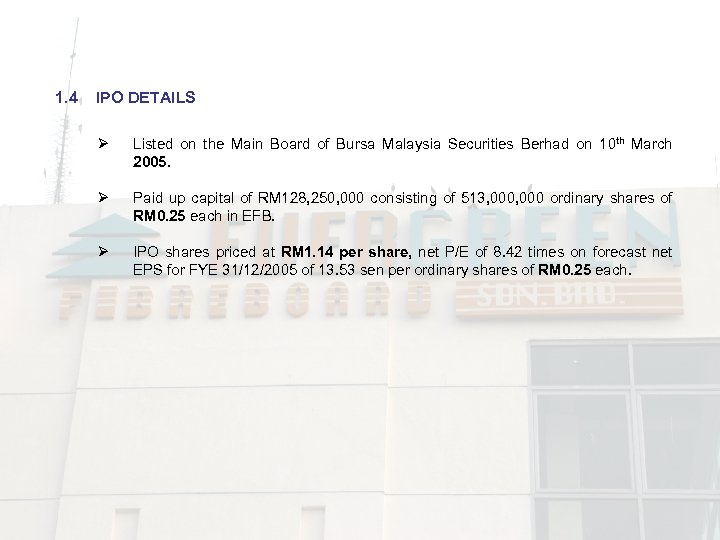

1. 4 IPO DETAILS Ø Listed on the Main Board of Bursa Malaysia Securities Berhad on 10 th March 2005. Ø Paid up capital of RM 128, 250, 000 consisting of 513, 000 ordinary shares of RM 0. 25 each in EFB. Ø IPO shares priced at RM 1. 14 per share, net P/E of 8. 42 times on forecast net EPS for FYE 31/12/2005 of 13. 53 sen per ordinary shares of RM 0. 25 each.

Percent of Foreign/Institution Investors participations ( Free Float Shares ) Foreign Investor Local Investor Institution Individual 1 st Quarter 2007 9. 467% 5. 566% 27. 729% 9. 238% 2 nd Quarter 2007 15. 249% 4. 506% 24. 572% 7. 673% 3 th Quarter 2007 15. 886% 4. 696% 22. 672% 8. 746% 4 th Quarter 2007 13. 7220% 5. 023% 24. 231% 9. 024% 1 st Quarter 2008 13. 4030% 4. 451% 24. 215% 9. 931% 2 nd Quarter 2008 13. 8630% 4. 526% 24. 047% 9. 564% 3 rd Quarter 2008 12. 577% 4. 043% 29. 375% 9. 005% 4 th Quarter 2008 11. 5450% 4. 202% 28. 961% 10. 292% 1 st Quarter 2009 13. 0650% 4. 231% 27. 294% 10. 410% 2 nd Quarter 2009 17. 5050% 4. 628% 21. 660% 11. 207% 3 rd Quarter 2009 16. 9850% 4. 437% 22. 198% 11. 380% Slide 10

2. BUSINESS OVERVIEW WHAT DOES THE EFB GROUP DO?

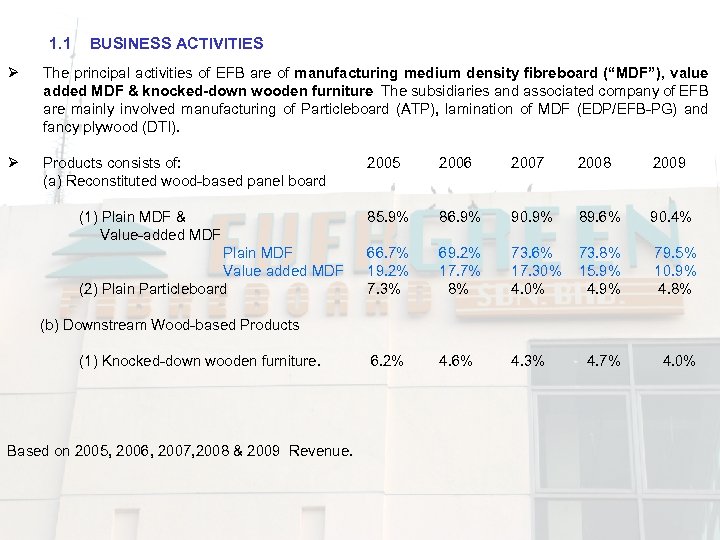

1. 1 BUSINESS ACTIVITIES Ø The principal activities of EFB are of manufacturing medium density fibreboard (“MDF”), value added MDF & knocked-down wooden furniture The subsidiaries and associated company of EFB are mainly involved manufacturing of Particleboard (ATP), lamination of MDF (EDP/EFB-PG) and fancy plywood (DTI). Ø Products consists of: (a) Reconstituted wood-based panel board Plain MDF Value added MDF (2) Plain Particleboard (b) Downstream Wood-based Products 2006 2007 2008 2009 85. 9% 86. 9% 90. 9% 89. 6% 90. 4% 66. 7% 19. 2% 7. 3% 69. 2% 17. 7% 8% 73. 6% 73. 8% 79. 5% 17. 30% 15. 9% 10. 9% 4. 0% 4. 9% 4. 8% 4. 6% 4. 3% 4. 7% 4. 0% (1) Knocked-down wooden furniture. 6. 2% Based on 2005, 2006, 2007, 2008 & 2009 Revenue. Slide (1) Plain MDF & Value-added MDF 2005

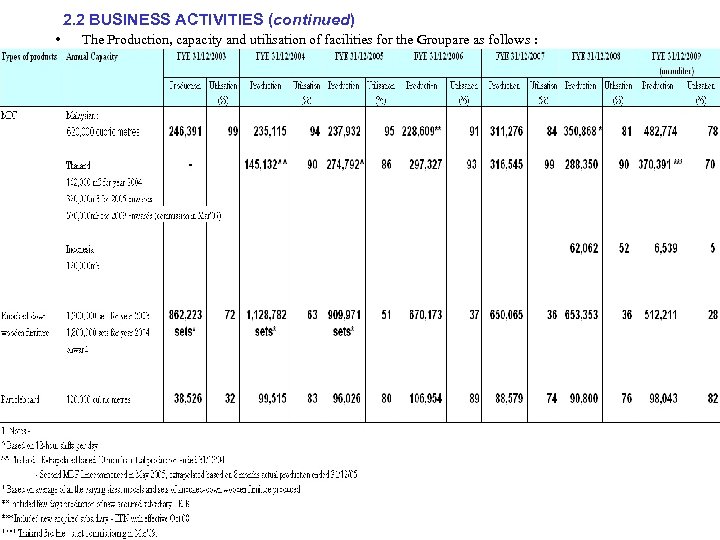

2. 2 BUSINESS ACTIVITIES (continued) • : The Production, capacity and utilisation of facilities for the Groupare as follows :

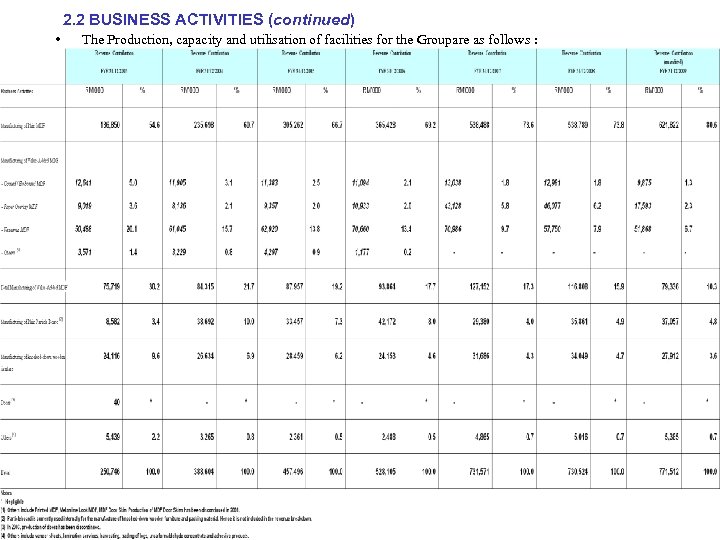

2. 2 BUSINESS ACTIVITIES (continued) • : The Production, capacity and utilisation of facilities for the Groupare as follows :

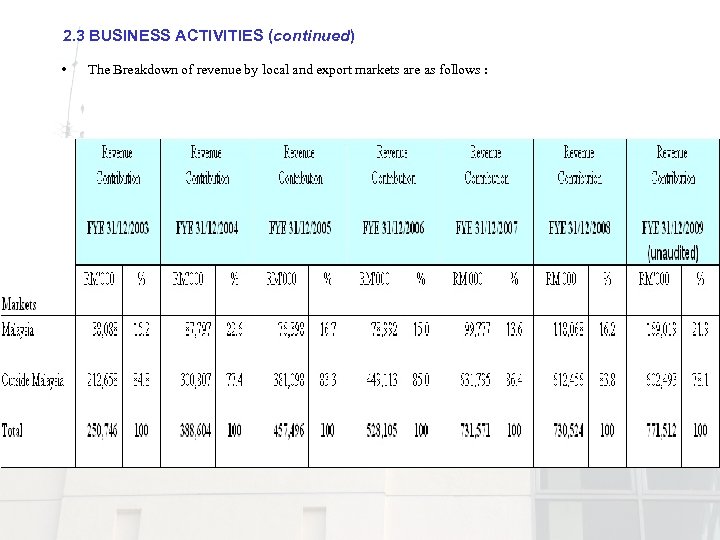

2. 3 BUSINESS ACTIVITIES (continued) • : The Breakdown of revenue by local and export markets are as follows :

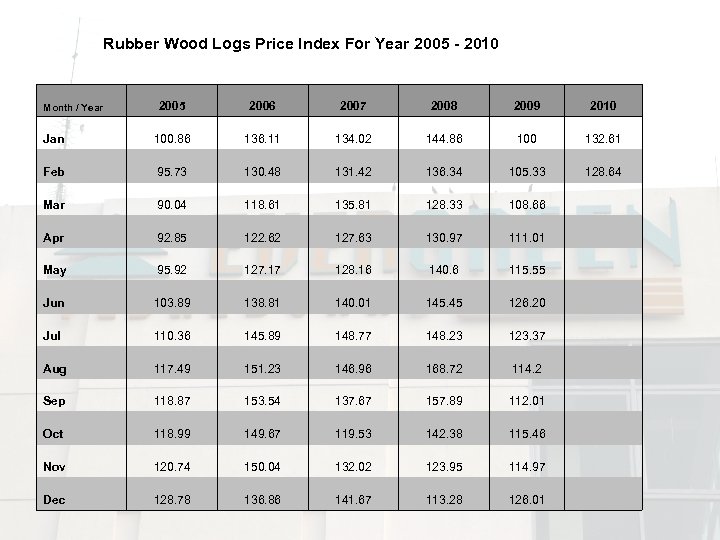

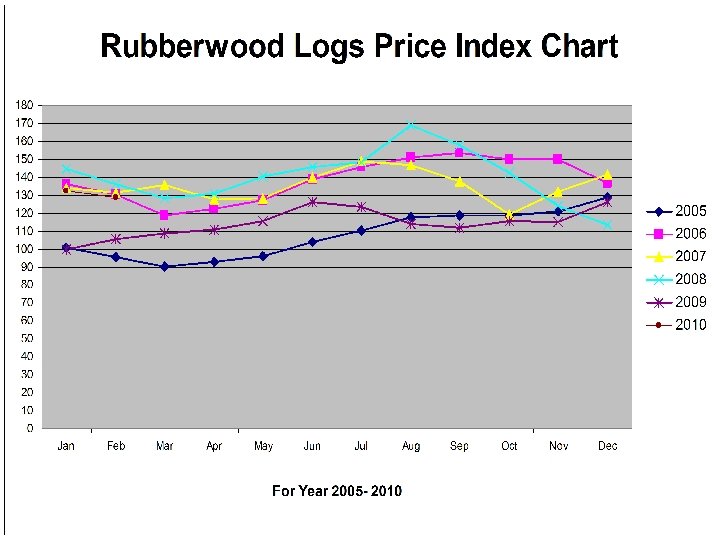

Rubber Wood Logs Price Index For Year 2005 - 2010 2005 2006 2007 2008 2009 2010 Jan 100. 86 136. 11 134. 02 144. 86 100 132. 61 Feb 95. 73 130. 48 131. 42 136. 34 105. 33 128. 64 Mar 90. 04 118. 61 135. 81 128. 33 108. 66 Apr 92. 85 122. 62 127. 63 130. 97 111. 01 May 95. 92 127. 17 128. 16 140. 6 115. 55 Jun 103. 89 138. 81 140. 01 145. 45 126. 20 Jul 110. 36 145. 89 148. 77 148. 23 123. 37 Aug 117. 49 151. 23 146. 96 168. 72 114. 2 Sep 118. 87 153. 54 137. 67 157. 89 112. 01 Oct 118. 99 149. 67 119. 53 142. 38 115. 46 Nov 120. 74 150. 04 132. 02 123. 95 114. 97 Dec 128. 78 136. 86 141. 67 113. 28 126. 01 Month / Year

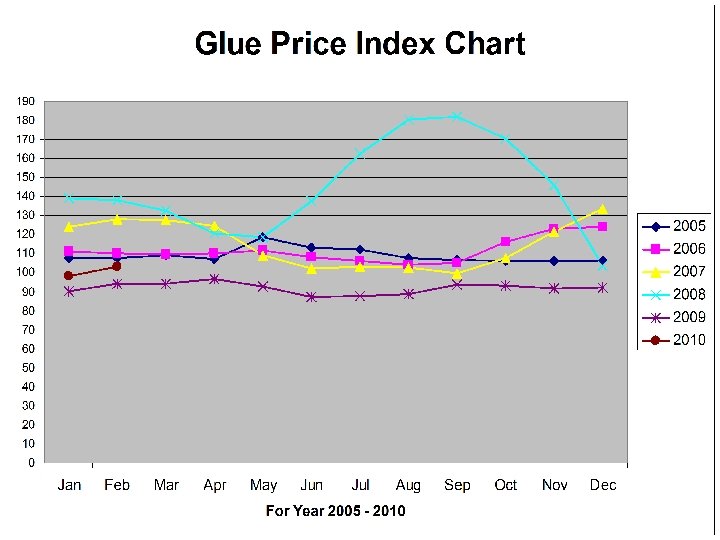

Glue Price Index For Year 2005 - 2010 2005 2006 2007 2008 2009 2010 Jan 107. 78 111. 09 124. 19 138. 96 90. 5 98. 34 Feb 107. 51 110. 18 127. 96 138. 34 94. 2 103. 26 Mar 108. 98 109. 96 127. 79 132. 82 94. 42 Apr 107. 3 110. 24 124. 44 120. 83 96. 95 May 118. 62 111. 89 108. 99 118. 86 92. 7 Jun 113. 16 108. 3 102. 04 137. 73 87. 46 Jul 112. 41 106. 42 103. 46 162. 52 87. 92 Aug 107. 8 104. 05 102. 59 180. 38 88. 7 Sep 106. 85 105. 32 99. 95 182. 21 93. 67 Oct 106. 34 116. 11 107. 59 170. 53 93. 11 Nov 106. 24 123. 2 121. 57 146. 21 91. 74 Dec 106. 36 124. 42 133. 73 103. 62 92. 25 Month / Year

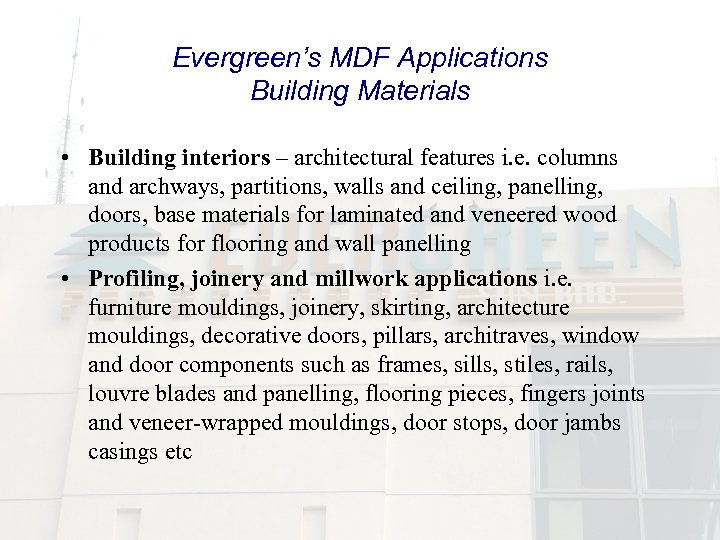

Evergreen’s MDF Applications Building Materials • Building interiors – architectural features i. e. columns and archways, partitions, walls and ceiling, panelling, doors, base materials for laminated and veneered wood products for flooring and wall panelling • Profiling, joinery and millwork applications i. e. furniture mouldings, joinery, skirting, architecture mouldings, decorative doors, pillars, architraves, window and door components such as frames, sills, stiles, rails, louvre blades and panelling, flooring pieces, fingers joints and veneer-wrapped mouldings, door stops, door jambs casings etc

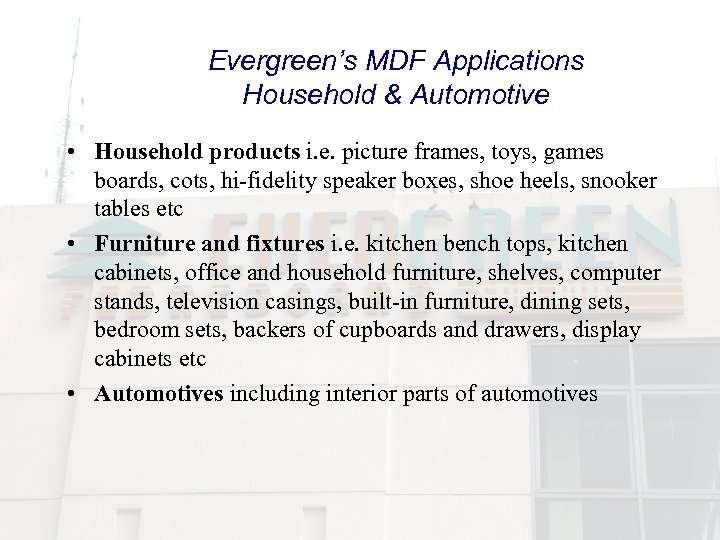

Evergreen’s MDF Applications Household & Automotive • Household products i. e. picture frames, toys, games boards, cots, hi-fidelity speaker boxes, shoe heels, snooker tables etc • Furniture and fixtures i. e. kitchen bench tops, kitchen cabinets, office and household furniture, shelves, computer stands, television casings, built-in furniture, dining sets, bedroom sets, backers of cupboards and drawers, display cabinets etc • Automotives including interior parts of automotives

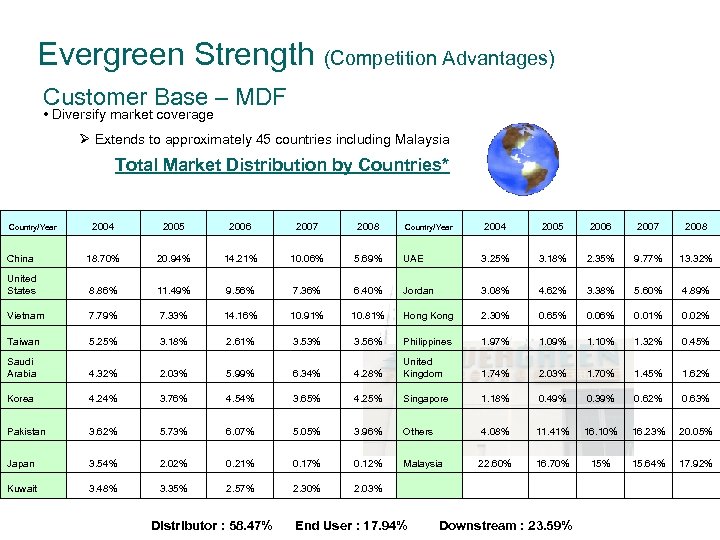

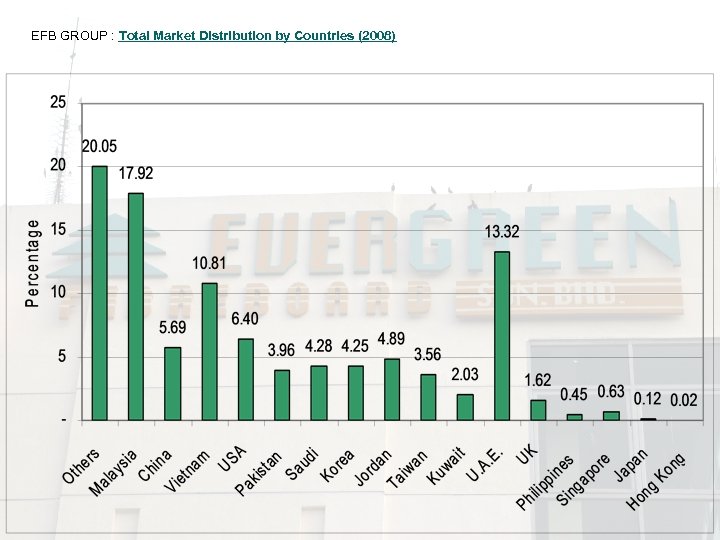

Evergreen Strength (Competition Advantages) Customer Base – MDF • Diversify market coverage Ø Extends to approximately 45 countries including Malaysia Total Market Distribution by Countries* 2004 2005 2006 2007 2008 China 18. 70% 20. 94% 14. 21% 10. 06% 5. 69% UAE 3. 25% 3. 18% 2. 35% 9. 77% 13. 32% United States 8. 86% 11. 49% 9. 56% 7. 36% 6. 40% Jordan 3. 08% 4. 62% 3. 38% 5. 60% 4. 89% Vietnam 7. 79% 7. 33% 14. 16% 10. 91% 10. 81% Hong Kong 2. 30% 0. 65% 0. 06% 0. 01% 0. 02% Taiwan 5. 25% 3. 18% 2. 61% 3. 53% 3. 56% Philippines 1. 97% 1. 09% 1. 10% 1. 32% 0. 45% Saudi Arabia 4. 32% 2. 03% 5. 99% 6. 34% 4. 28% United Kingdom 1. 74% 2. 03% 1. 70% 1. 45% 1. 62% Korea 4. 24% 3. 76% 4. 54% 3. 65% 4. 25% Singapore 1. 18% 0. 49% 0. 39% 0. 62% 0. 63% Pakistan 3. 62% 5. 73% 6. 07% 5. 05% 3. 96% Others 4. 08% 11. 41% 16. 10% 16. 23% 20. 05% Japan 3. 54% 2. 02% 0. 21% 0. 17% 0. 12% Malaysia 22. 60% 16. 70% 15. 64% 17. 92% Kuwait 3. 48% 3. 35% 2. 57% 2. 30% 2. 03% Country/Year Distributor : 58. 47% Country/Year End User : 17. 94% Downstream : 23. 59%

EFB GROUP : Total Market Distribution by Countries (2008)

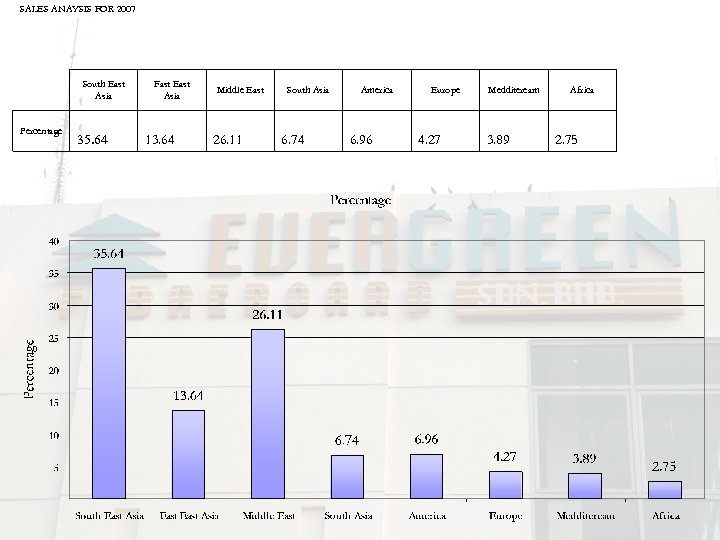

SALES ANAYSIS FOR 2007 South East Asia Percentage 35. 64 Fast East Asia 13. 64 Middle East 26. 11 South Asia 6. 74 America 6. 96 Europe 4. 27 Medditeream 3. 89 Africa 2. 75

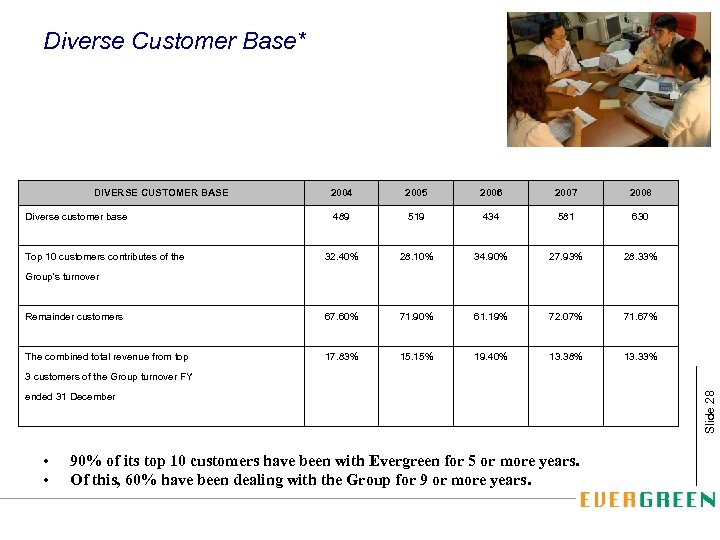

Diverse Customer Base* 2004 2005 2006 2007 2008 489 519 434 581 630 32. 40% 28. 10% 34. 90% 27. 93% 28. 33% Group's turnover 67. 60% 71. 90% 61. 19% 72. 07% 71. 67% The combined total revenue from top 17. 83% 15. 15% 19. 40% 13. 38% 13. 33% 3 customers of the Group turnover FY ended 31 December Diverse customer base Top 10 customers contributes of the Remainder customers • • 90% of its top 10 customers have been with Evergreen for 5 or more years. Of this, 60% have been dealing with the Group for 9 or more years. Slide 28 DIVERSE CUSTOMER BASE

Meeting International Standards & Certifications v SGS ISO 9001 : 2000 v SGS FSC (FOREST STEWARDSHIP COUNCIL) , (CHAIN OF CUSTODY) v FIRA BS EN 120 MDF QUALITY STANDARD v SCIENTIFIC CERTIFICATION SYSTEM (WOOD RECOVERY) v MALAYSIAN TIMBER INDUSTRY BOARD, SUSTAINABLE FOREST MANAGEMENT STATEMENT.

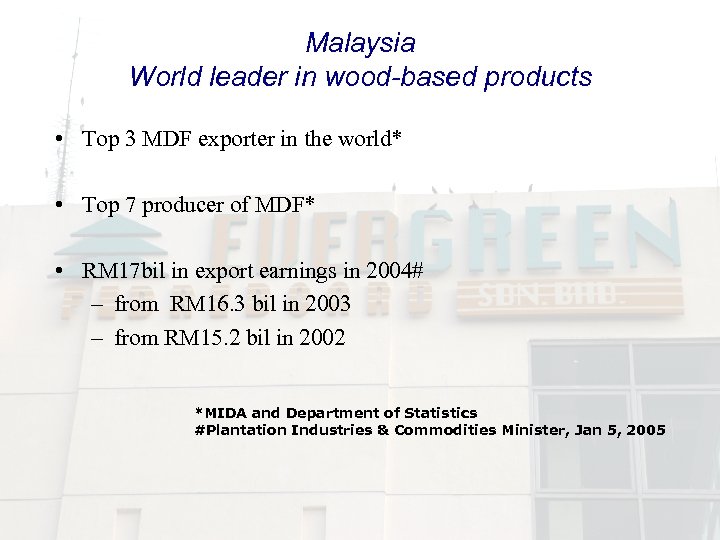

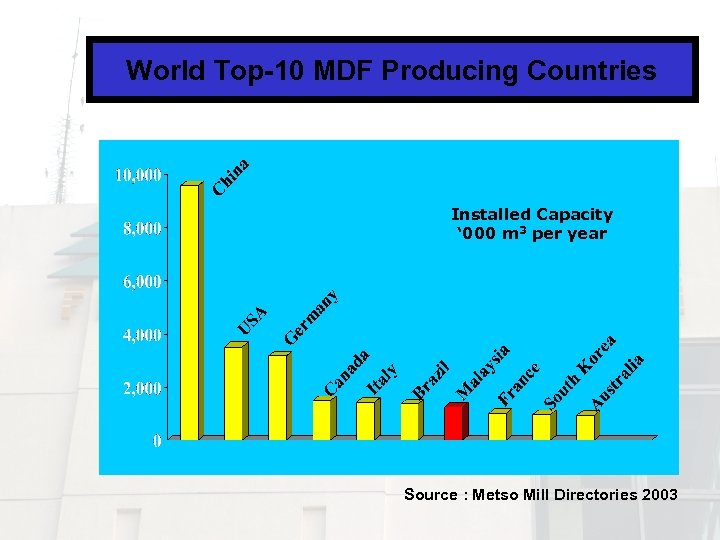

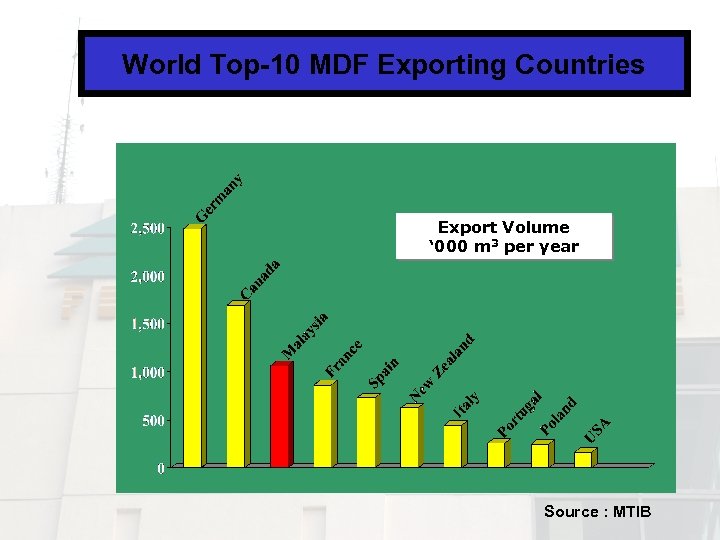

Malaysia World leader in wood-based products • Top 3 MDF exporter in the world* • Top 7 producer of MDF* • RM 17 bil in export earnings in 2004# – from RM 16. 3 bil in 2003 – from RM 15. 2 bil in 2002 *MIDA and Department of Statistics #Plantation Industries & Commodities Minister, Jan 5, 2005

World Top-10 MDF Producing Countries Installed Capacity ‘ 000 m 3 per year Source : Metso Mill Directories 2003

World Top-10 MDF Exporting Countries Export Volume ‘ 000 m 3 per year Source : MTIB

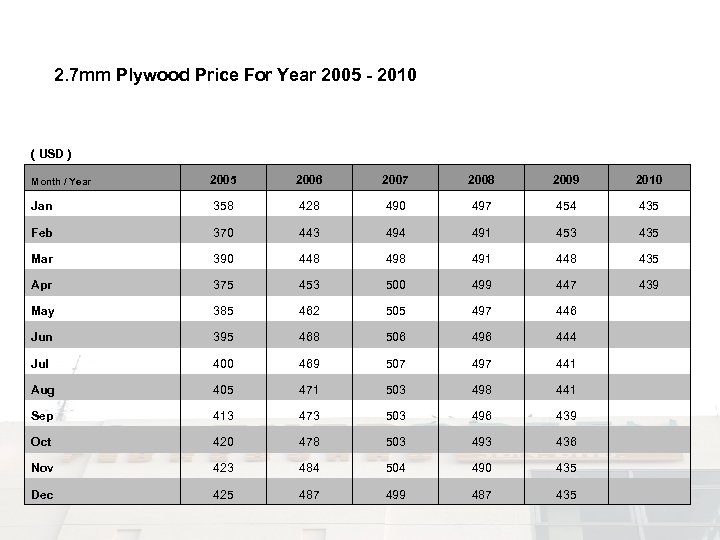

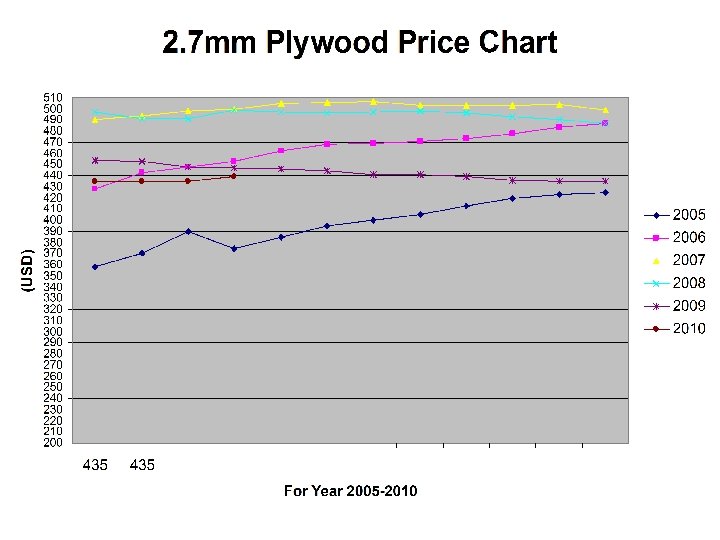

2. 7 mm Plywood Price For Year 2005 - 2010 ( USD ) 2005 2006 2007 2008 2009 2010 Jan 358 428 490 497 454 435 Feb 370 443 494 491 453 435 Mar 390 448 491 448 435 Apr 375 453 500 499 447 439 May 385 462 505 497 446 Jun 395 468 506 496 444 Jul 400 469 507 497 441 Aug 405 471 503 498 441 Sep 413 473 503 496 439 Oct 420 478 503 493 436 Nov 423 484 504 490 435 Dec 425 487 499 487 435 Month / Year

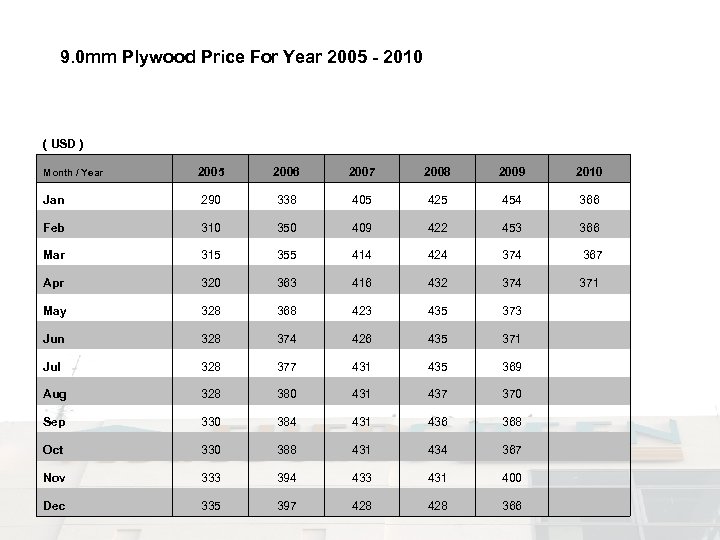

9. 0 mm Plywood Price For Year 2005 - 2010 ( USD ) 2005 2006 2007 2008 2009 2010 Jan 290 338 405 425 454 366 Feb 310 350 409 422 453 366 Mar 315 355 414 424 374 367 Apr 320 363 416 432 374 371 May 328 368 423 435 373 Jun 328 374 426 435 371 Jul 328 377 431 435 369 Aug 328 380 431 437 370 Sep 330 384 431 436 368 Oct 330 388 431 434 367 Nov 333 394 433 431 400 Dec 335 397 428 366 Month / Year

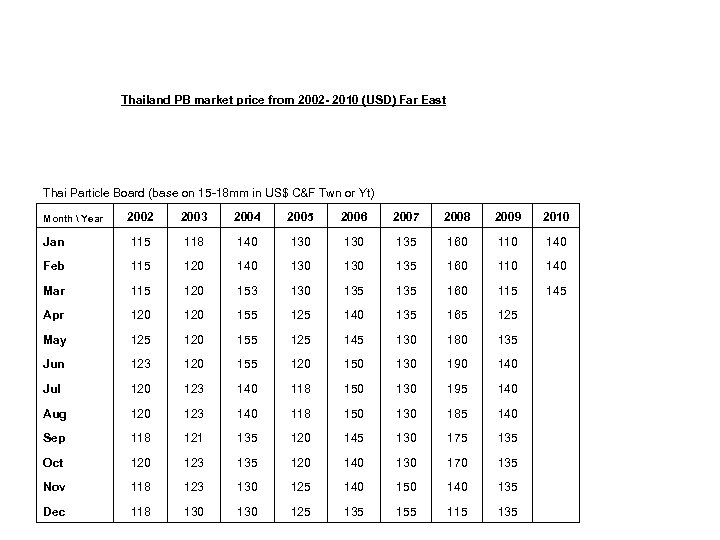

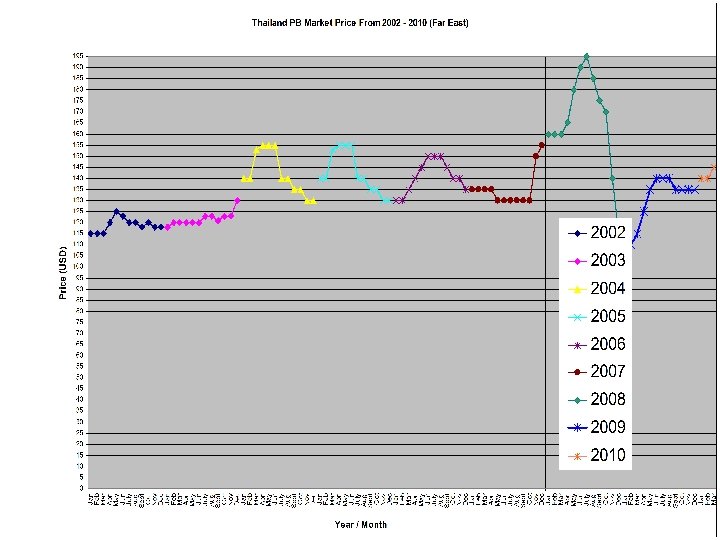

Thailand PB market price from 2002 - 2010 (USD) Far East Thai Particle Board (base on 15 -18 mm in US$ C&F Twn or Yt) 2002 2003 2004 2005 2006 2007 2008 2009 2010 Jan 115 118 140 130 135 160 110 140 Feb 115 120 140 130 135 160 110 140 Mar 115 120 153 130 135 160 115 145 Apr 120 155 125 140 135 165 125 May 125 120 155 125 145 130 180 135 Jun 123 120 155 120 150 130 190 140 Jul 120 123 140 118 150 130 195 140 Aug 120 123 140 118 150 130 185 140 Sep 118 121 135 120 145 130 175 135 Oct 120 123 135 120 140 130 170 135 Nov 118 123 130 125 140 150 140 135 Dec 118 130 125 135 155 115 135 Month Year

3. FINANCIAL HIGHLIGHTS & EARNINGS OUTLOOK

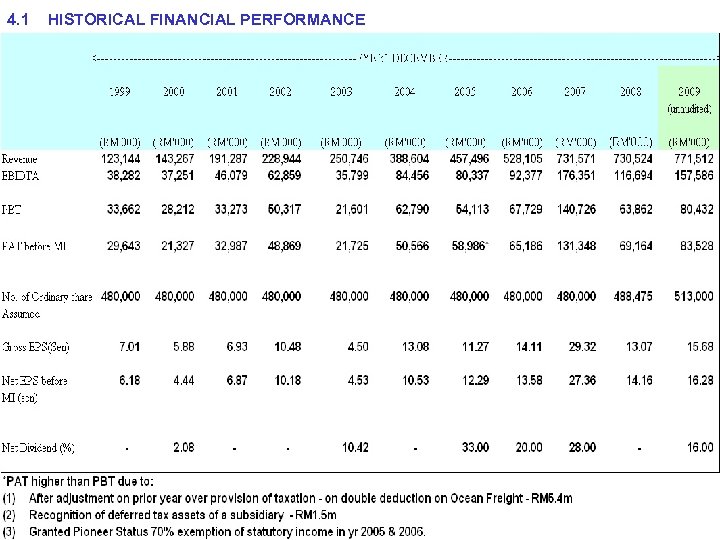

4. 1 HISTORICAL FINANCIAL PERFORMANCE

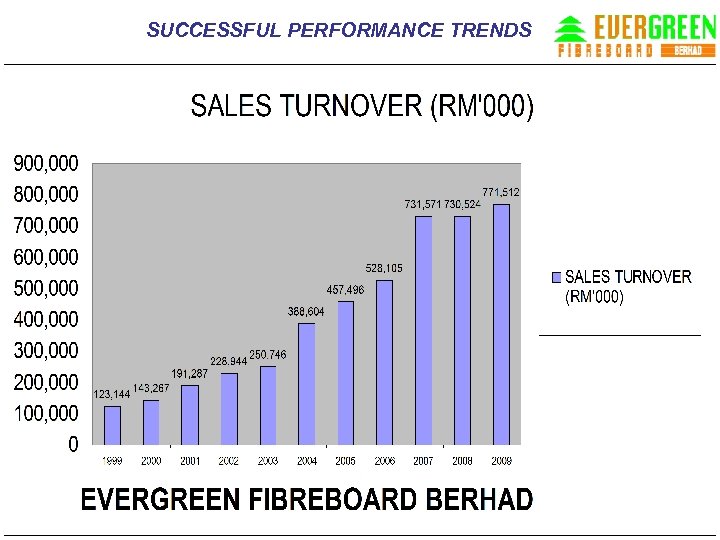

SUCCESSFUL PERFORMANCE TRENDS

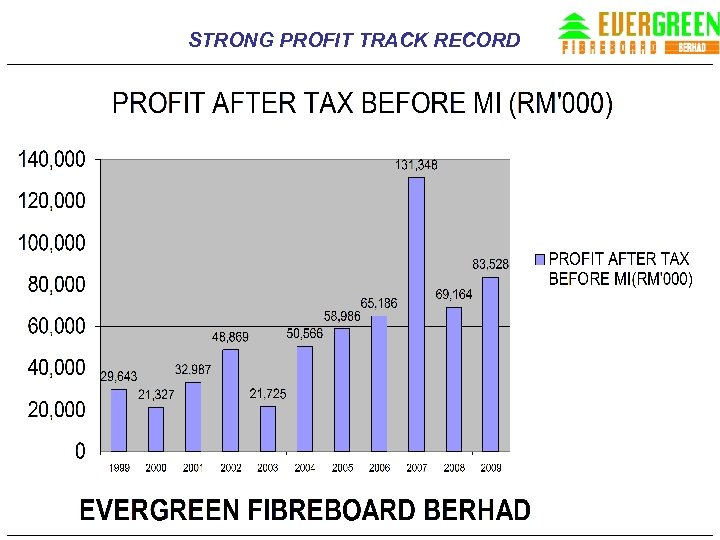

STRONG PROFIT TRACK RECORD

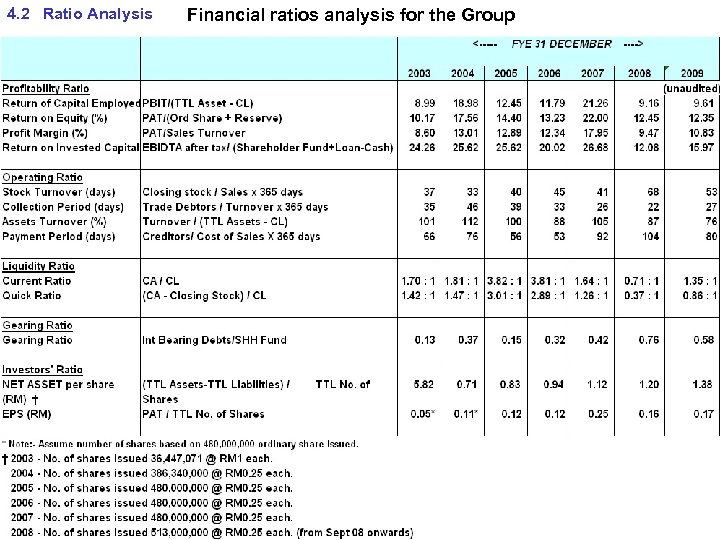

4. 2 Ratio Analysis Financial ratios analysis for the Group

3. 3 Tax incentives EFB has obtained its Pioneer Certificate on the 26 th May 2005 certifying the pioneer period from 24 th December 2004 until 23 rd December 2009 for income tax exemption of 70% on its income for this period. EJB – New acquired company, Evergreen Fibreboard (JB) Sdn Bhd has obtain Investment Tax allowance. ( ITA) GRE – New acquired company, GRE was granted tax exemption for 8 years ending in 2014. SFC - Siam Fibreboard new 3 rd line was granted tax exemption for 8 years.

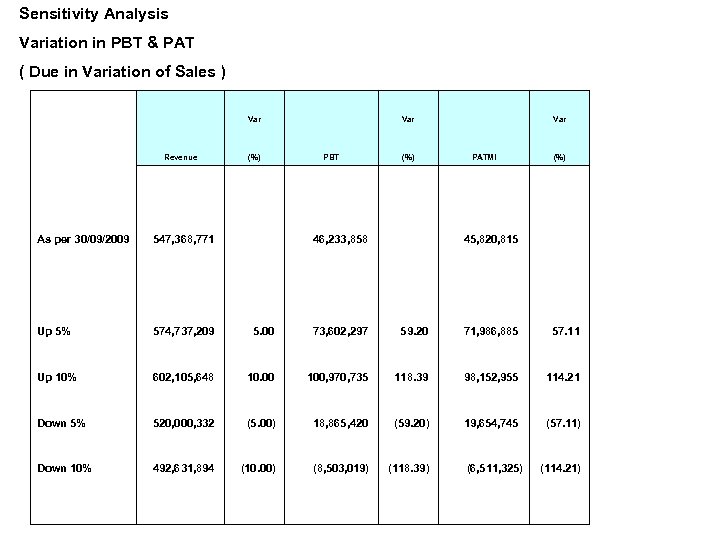

Sensitivity Analysis Variation in PBT & PAT ( Due in Variation of Sales ) Var Var Revenue (%) PBT (%) PATMI (%) As per 30/09/2009 547, 368, 771 46, 233, 858 45, 820, 815 Up 5% 574, 737, 209 5. 00 73, 602, 297 59. 20 71, 986, 885 57. 11 Up 10% 602, 105, 648 10. 00 100, 970, 735 118. 39 98, 152, 955 114. 21 Down 5% 520, 000, 332 (5. 00) 18, 865, 420 (59. 20) 19, 654, 745 (57. 11) Down 10% 492, 631, 894 (10. 00) (8, 503, 019) (118. 39) (6, 511, 325) (114. 21)

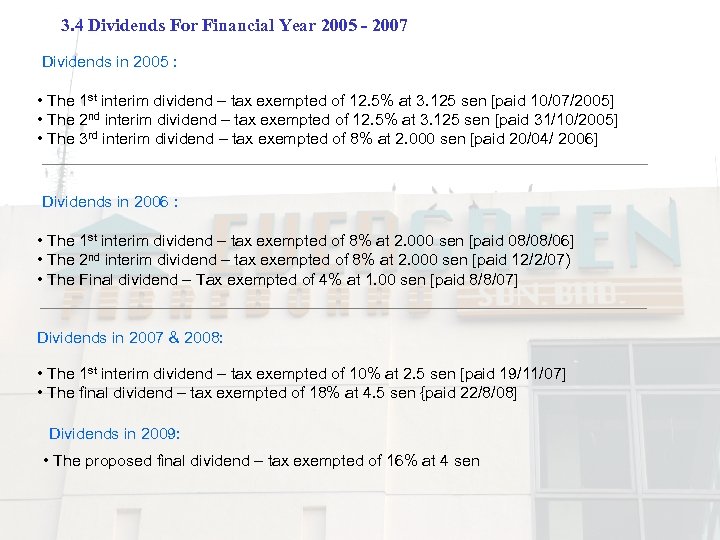

3. 4 Dividends For Financial Year 2005 - 2007 Dividends in 2005 : • The 1 st interim dividend – tax exempted of 12. 5% at 3. 125 sen [paid 10/07/2005] • The 2 nd interim dividend – tax exempted of 12. 5% at 3. 125 sen [paid 31/10/2005] • The 3 rd interim dividend – tax exempted of 8% at 2. 000 sen [paid 20/04/ 2006] Dividends in 2006 : • The 1 st interim dividend – tax exempted of 8% at 2. 000 sen [paid 08/08/06] • The 2 nd interim dividend – tax exempted of 8% at 2. 000 sen [paid 12/2/07) • The Final dividend – Tax exempted of 4% at 1. 00 sen [paid 8/8/07] Dividends in 2007 & 2008: • The 1 st interim dividend – tax exempted of 10% at 2. 5 sen [paid 19/11/07] • The final dividend – tax exempted of 18% at 4. 5 sen {paid 22/8/08] Dividends in 2009: • The proposed final dividend – tax exempted of 16% at 4 sen

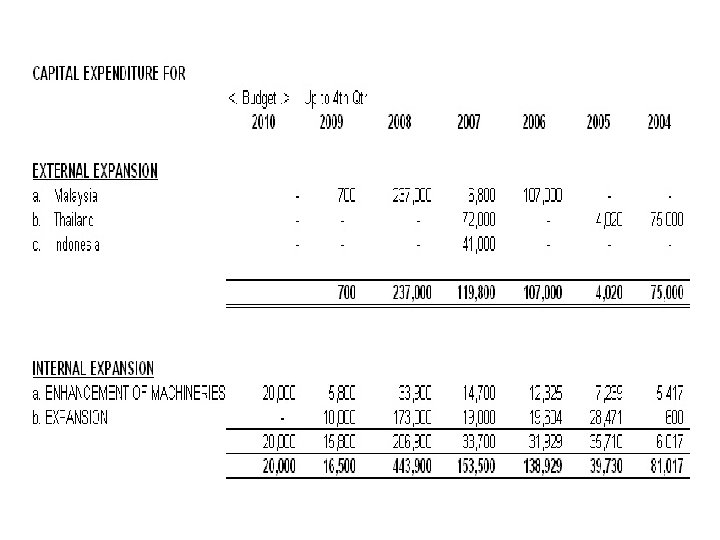

4. CORPORATE STRATEGY STRATEGIC POSITIONING

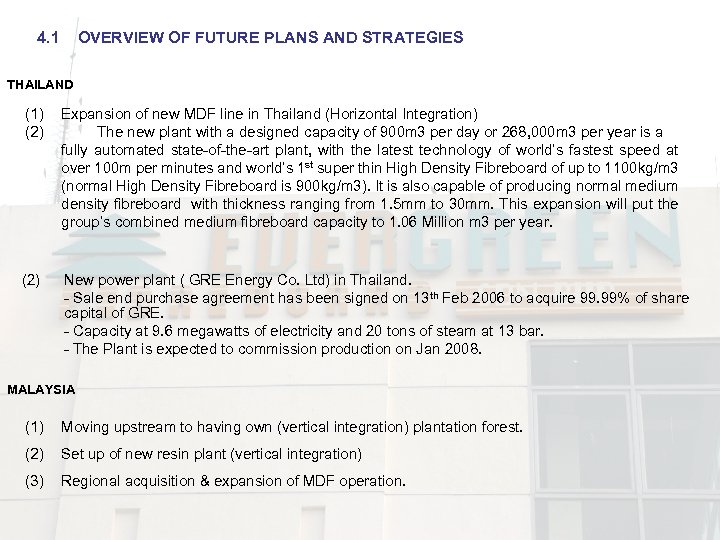

4. 1 OVERVIEW OF FUTURE PLANS AND STRATEGIES THAILAND (1) (2) Expansion of new MDF line in Thailand (Horizontal Integration) The new plant with a designed capacity of 900 m 3 per day or 268, 000 m 3 per year is a fully automated state-of-the-art plant, with the latest technology of world’s fastest speed at over 100 m per minutes and world’s 1 st super thin High Density Fibreboard of up to 1100 kg/m 3 (normal High Density Fibreboard is 900 kg/m 3). It is also capable of producing normal medium density fibreboard with thickness ranging from 1. 5 mm to 30 mm. This expansion will put the group’s combined medium fibreboard capacity to 1. 06 Million m 3 per year. (2) New power plant ( GRE Energy Co. Ltd) in Thailand. - Sale end purchase agreement has been signed on 13 th Feb 2006 to acquire 99. 99% of share capital of GRE. - Capacity at 9. 6 megawatts of electricity and 20 tons of steam at 13 bar. - The Plant is expected to commission production on Jan 2008. MALAYSIA (1) Moving upstream to having own (vertical integration) plantation forest. (2) Set up of new resin plant (vertical integration) (3) Regional acquisition & expansion of MDF operation.

4. 2 INDUSTRY OUTLOOK • The engineered wood-based products industry is a 13 billion USD industry ● Wood based panels International Aug 2004 & Nov 2004 issue. • • MDF global consumption ( Approaching 50 million m 3 ) – projected to grow at an average annual rate of 7 -9% until 2008 MDF consumption in Asia Pacific – projected to increase by 51% to 20. 1 mil m 3 by 2006 & 30. 8 million by 2008 + BIS shrapnel Global Business Research & Forecasting ( 2001 – 2006 , 2004 – 2008 ) • Particleboard global consumption – quickly approaching 100 mil m 3 # • BIS Shrapnel 2003 – 2007 & Wood Based Panels International Nov 2003 & Dec 2004 Issue Particleboard demand in Asia Pacific – more than 12 mil m 3 with China becoming the fastest growing market * THE STAR ( Biz Week ) 9 th Aug 2003

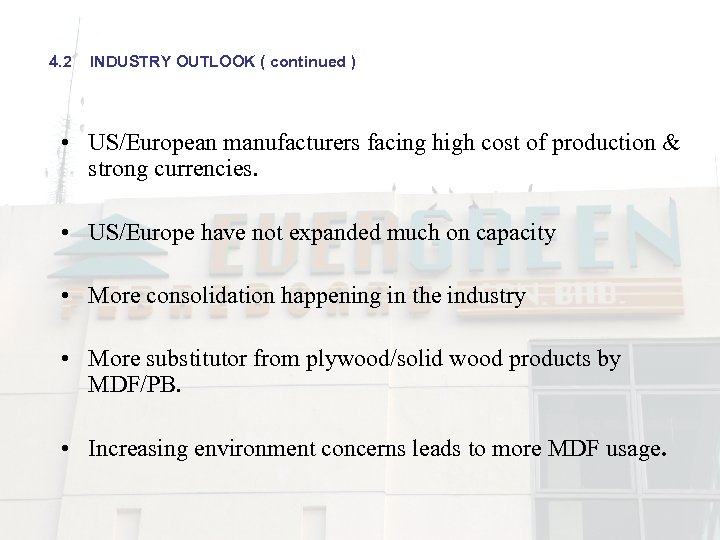

4. 2 INDUSTRY OUTLOOK ( continued ) • US/European manufacturers facing high cost of production & strong currencies. • US/Europe have not expanded much on capacity • More consolidation happening in the industry • More substitutor from plywood/solid wood products by MDF/PB. • Increasing environment concerns leads to more MDF usage.

4. 3 FUTURE PROSPECTS OF THE EFB GROUP Ø Demand for MDF products is expected to increase, driven by fundamentals such as global environmental protection & government regulation restrict excessive logging, reducing availability of natural wood products. Ø MDF is a relatively newly developed sector in the timber industry, most of the mills in Thailand, Indonesia, & Malaysia were only established in the 1990 s. This reaffirms the industry is still in its growth and development phase. Ø The growth in the performance of the user industry sectors (especially Middle East & Far East regions having double digit growth) will continue to generate demand for Reconstituted Wood-based Panel Board including MDF based products and applications. Being geographically located on the centre of the growth markets, EFB is taking advantage & continue to expand to meet market needs. Ø Malaysia, Thailand & Indonesia are low cost MDF producing countries with 3 fairly competitive cost elements, ie. Wood, electricity & labor cost as compared to the world.

5. EVERGREEN’S STRENGTH 1. Economical of scale being a major MDF manufacturer. 2. One-stop supplier for full product range. * various range of MDF sizes & thicknesses. *various types of MDF i. e. . E 2, E 1, E 0, Super E 0 – low formaldehyde, HMR – high moisture resistance. *countries of manufacturing – 3. (with total of 8 production lines) 3. Market Diversification. *Countries of export – more than 40 countries. (with good marketing team) *Huge customer base – more than 500 customers. 4. Strong R&D. *Product quality & international accreditations (ie, ISO 9001, FSC, working on JIS Japan Certification) 5. Strong , dynamic & enthusiastic production. *with 90% up time in production.

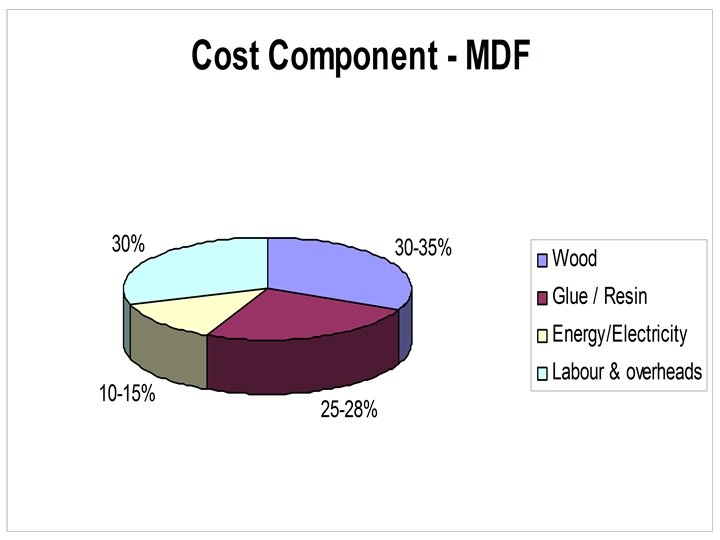

5. EVERGREEN’S STRENGTH 6. Strong cost down team. *Generates own power & water supply *Own glue resin production *Both Thailand & Indonesia mills are situated at the heart of wood supply zone. *Looking at own forest plantations in Malaysia’s operations. 7. Hands on management with integrity. *good experiences of more than 15 years in MDF business.

6. Challenges & Uncertainties ahead The Uncertainties ahead : 1) Possible contraction of glue/log costs uptrend. 2) Higher oil price impacting ocean freight and transport cost. 3) Power cost increased. 4) Currencies appreciation.

7. Evergreen strategies Vertical & Horizontal Growth a) i) Increase production capacity through organic expansion and M&A growth. I. e. . Organic : Siam Fibreboard, 3 rd Line, M&A growth : Acquisition of Merbok Subsidiary (Takeuchi MDF ) : Acquisition of PT. Hutrindo ( Indonesia) ii) Integrating raw material production. (ie, Glue : own glue production, Wood : secure chip supply & venture into chipping operation, working on with government on plantation land. Electricity & Water : self generation). Financial b) Maintain strong cash balance and increase banking facility to take advantage of ensuing M&A opportunities – evaluating a few proposals now. c) Minimized forex exquisite through usage & forex hedging tools. Labour d) Recruitment and training of capable management to ensure the efficient running of expected expansion. e) Continuous automation to reduce reliance of labour. R & D f) Continue on cost cutting measures thru’ new projects & equipment enhancement. g) Diverse (stream) energy source through conversion to Biomass boiler & LPG.

8. Goals a) EFB will emerge from the current industry consolidation to become a dominant world class player. ( Aim to be the top 10 producers in the world ) b) Most efficient and cost competitive producer in the region. c) Most profitable MDF player base on Return on Equity (ROE) and Return on Assets (ROA) benchmark.

THANK YOU Company Website http: //evergreengroup. com. my

02aca67155f88fa7e47594cce9402aab.ppt