2d0d73e8db86e97ccc537c9a7b33fa9b.ppt

- Количество слайдов: 19

Breakeven Analysis Improving Productivity

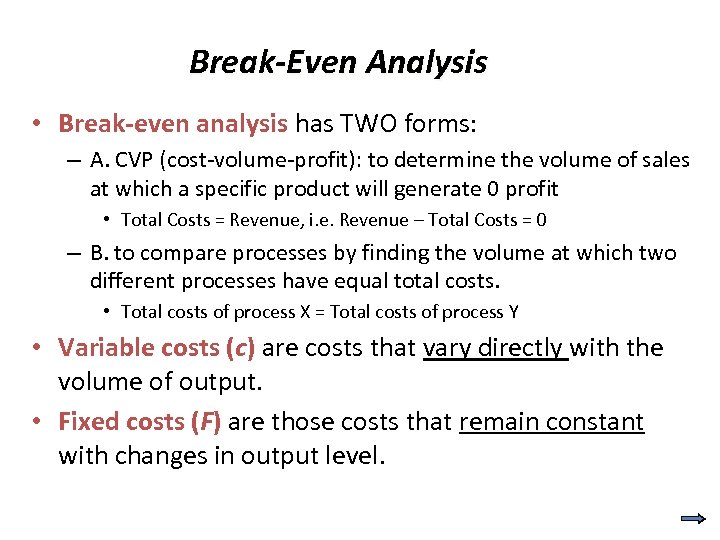

Break-Even Analysis • Break-even analysis has TWO forms: – A. CVP (cost-volume-profit): to determine the volume of sales at which a specific product will generate 0 profit • Total Costs = Revenue, i. e. Revenue – Total Costs = 0 – B. to compare processes by finding the volume at which two different processes have equal total costs. • Total costs of process X = Total costs of process Y • Variable costs (c) are costs that vary directly with the volume of output. • Fixed costs (F) are those costs that remain constant with changes in output level.

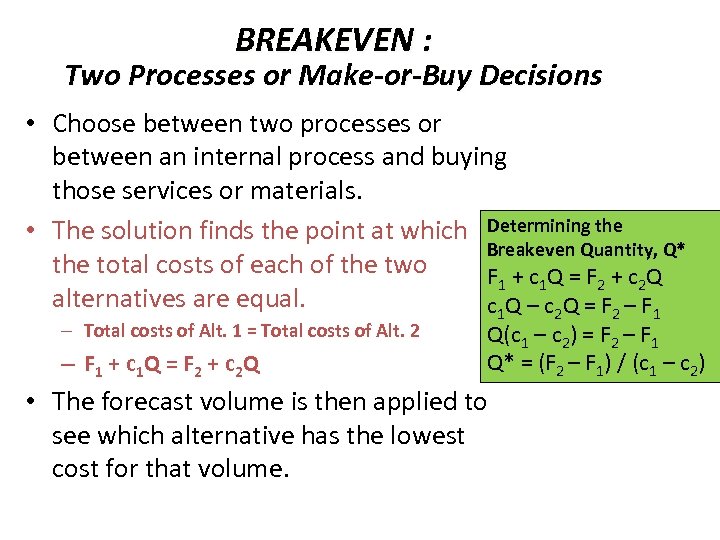

BREAKEVEN : Two Processes or Make-or-Buy Decisions • Choose between two processes or between an internal process and buying those services or materials. • The solution finds the point at which Determining the Breakeven Quantity, Q* the total costs of each of the two F 1 + c 1 Q = F 2 + c 2 Q alternatives are equal. c 1 Q – c 2 Q = F 2 – F 1 – Total costs of Alt. 1 = Total costs of Alt. 2 – F 1 + c 1 Q = F 2 + c 2 Q Q(c 1 – c 2) = F 2 – F 1 Q* = (F 2 – F 1) / (c 1 – c 2) • The forecast volume is then applied to see which alternative has the lowest cost for that volume.

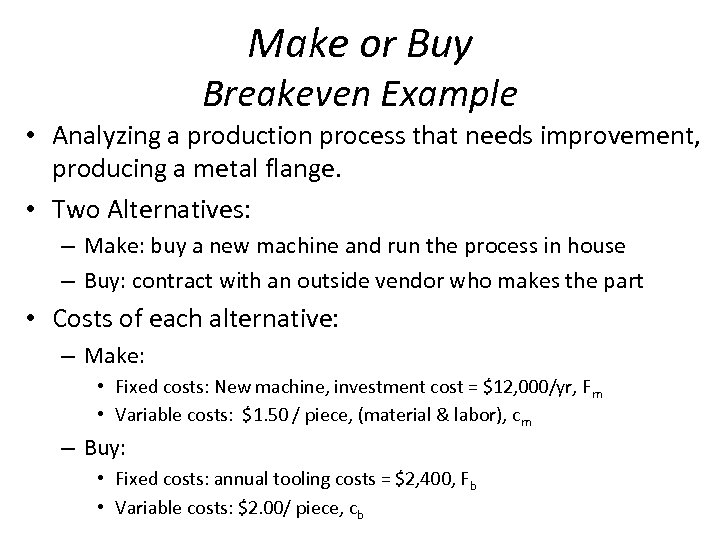

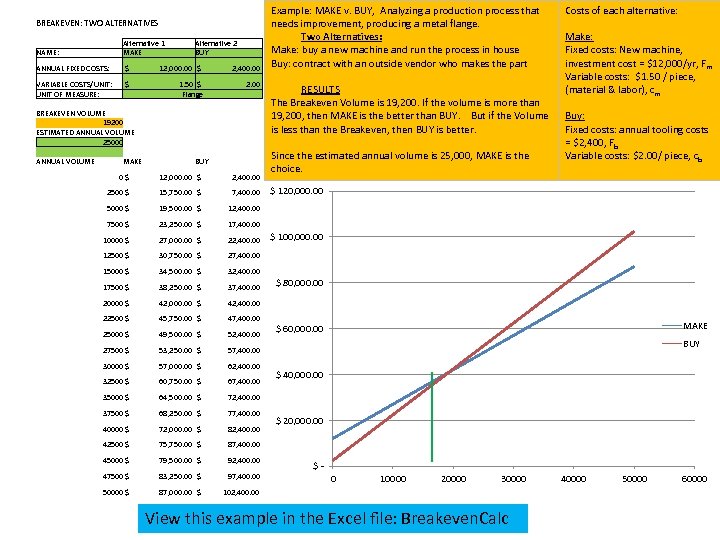

Make or Buy Breakeven Example • Analyzing a production process that needs improvement, producing a metal flange. • Two Alternatives: – Make: buy a new machine and run the process in house – Buy: contract with an outside vendor who makes the part • Costs of each alternative: – Make: • Fixed costs: New machine, investment cost = $12, 000/yr, Fm • Variable costs: $1. 50 / piece, (material & labor), cm – Buy: • Fixed costs: annual tooling costs = $2, 400, Fb • Variable costs: $2. 00/ piece, cb

BREAKEVEN: TWO ALTERNATIVES NAME: Alternative 1 MAKE ANNUAL FIXED COSTS: $ 12, 000. 00 $ 2, 400. 00 VARIABLE COSTS/UNIT: UNIT OF MEASURE: $ 1. 50 $ 2. 00 Flange BREAKEVEN VOLUME 19200 ESTIMATED ANNUAL VOLUME 25000 ANNUAL VOLUME MAKE Alternative 2 BUY 0 $ 12, 000. 00 $ 2, 400. 00 2500 $ 15, 750. 00 $ 7, 400. 00 Example: MAKE v. BUY, Analyzing a production process that needs improvement, producing a metal flange. Two Alternatives: Make: buy a new machine and run the process in house Buy: contract with an outside vendor who makes the part RESULTS The Breakeven Volume is 19, 200. If the volume is more than 19, 200, then MAKE is the better than BUY. But if the Volume is less than the Breakeven, then BUY is better. Since the estimated annual volume is 25, 000, MAKE is the choice. Costs of each alternative: Make: Fixed costs: New machine, investment cost = $12, 000/yr, Fm Variable costs: $1. 50 / piece, (material & labor), cm Buy: Fixed costs: annual tooling costs = $2, 400, Fb Variable costs: $2. 00/ piece, cb $ 120, 000. 00 5000 $ 19, 500. 00 $ 12, 400. 00 7500 $ 23, 250. 00 $ 17, 400. 00 10000 $ 27, 000. 00 $ 22, 400. 00 $ 100, 000. 00 12500 $ 30, 750. 00 $ 27, 400. 00 15000 $ 34, 500. 00 $ 32, 400. 00 17500 $ 38, 250. 00 $ 37, 400. 00 $ 80, 000. 00 20000 $ 42, 000. 00 $ 42, 400. 00 22500 $ 45, 750. 00 $ 47, 400. 00 25000 $ 49, 500. 00 $ 52, 400. 00 MAKE $ 60, 000. 00 BUY 27500 $ 53, 250. 00 $ 57, 400. 00 30000 $ 57, 000. 00 $ 62, 400. 00 32500 $ 60, 750. 00 $ 67, 400. 00 $ 40, 000. 00 35000 $ 64, 500. 00 $ 72, 400. 00 37500 $ 68, 250. 00 $ 77, 400. 00 40000 $ 72, 000. 00 $ 82, 400. 00 $ 20, 000. 00 42500 $ 75, 750. 00 $ 87, 400. 00 45000 $ 79, 500. 00 $ 92, 400. 00 47500 $ 83, 250. 00 $ 97, 400. 00 $ 0 10000 20000 30000 50000 $ 87, 000. 00 $ 102, 400. 00 View this example in the Excel file: Breakeven. Calc 40000 50000 60000

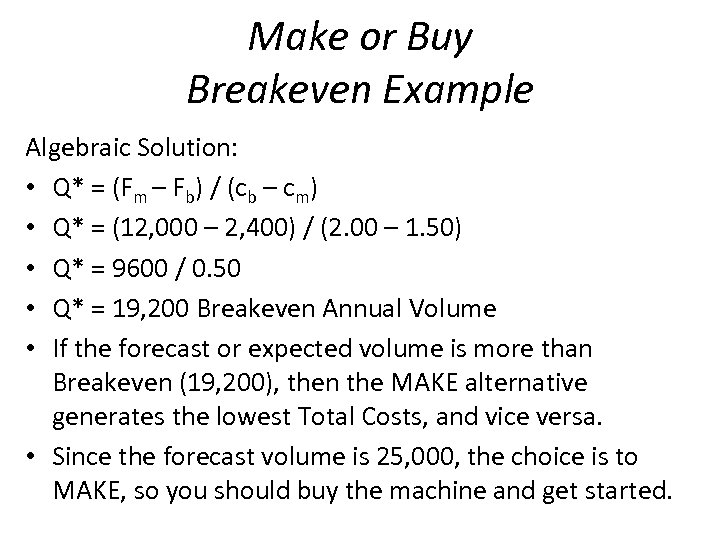

Make or Buy Breakeven Example Algebraic Solution: • Q* = (Fm – Fb) / (cb – cm) • Q* = (12, 000 – 2, 400) / (2. 00 – 1. 50) • Q* = 9600 / 0. 50 • Q* = 19, 200 Breakeven Annual Volume • If the forecast or expected volume is more than Breakeven (19, 200), then the MAKE alternative generates the lowest Total Costs, and vice versa. • Since the forecast volume is 25, 000, the choice is to MAKE, so you should buy the machine and get started.

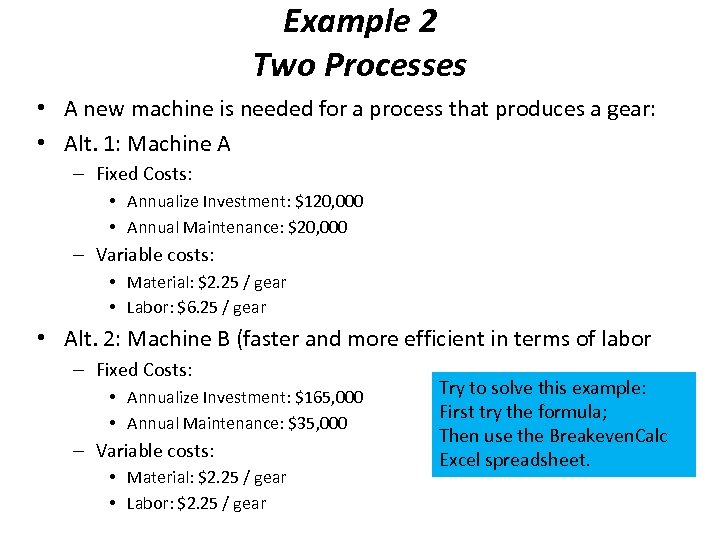

Example 2 Two Processes • A new machine is needed for a process that produces a gear: • Alt. 1: Machine A – Fixed Costs: • Annualize Investment: $120, 000 • Annual Maintenance: $20, 000 – Variable costs: • Material: $2. 25 / gear • Labor: $6. 25 / gear • Alt. 2: Machine B (faster and more efficient in terms of labor – Fixed Costs: • Annualize Investment: $165, 000 • Annual Maintenance: $35, 000 – Variable costs: • Material: $2. 25 / gear • Labor: $2. 25 / gear Try to solve this example: First try the formula; Then use the Breakeven. Calc Excel spreadsheet.

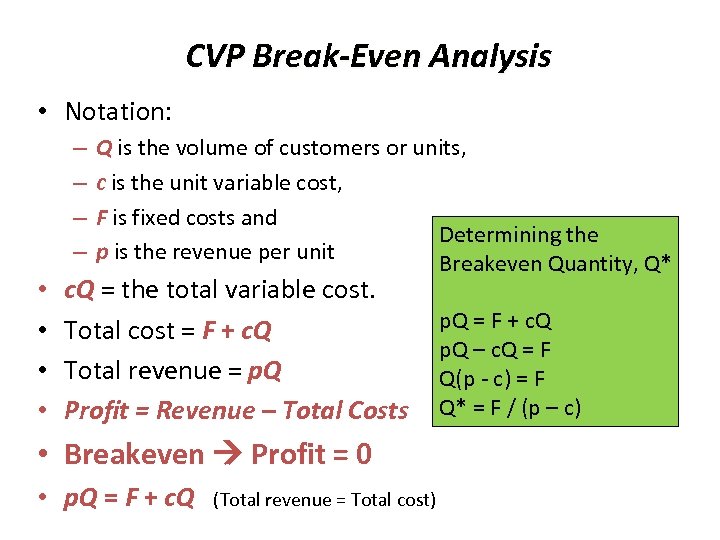

CVP Break-Even Analysis • Notation: – – • • Q is the volume of customers or units, c is the unit variable cost, F is fixed costs and Determining the p is the revenue per unit Breakeven Quantity, Q* c. Q = the total variable cost. Total cost = F + c. Q Total revenue = p. Q Profit = Revenue – Total Costs • Breakeven Profit = 0 • p. Q = F + c. Q (Total revenue = Total cost) p. Q = F + c. Q p. Q – c. Q = F Q(p - c) = F Q* = F / (p – c)

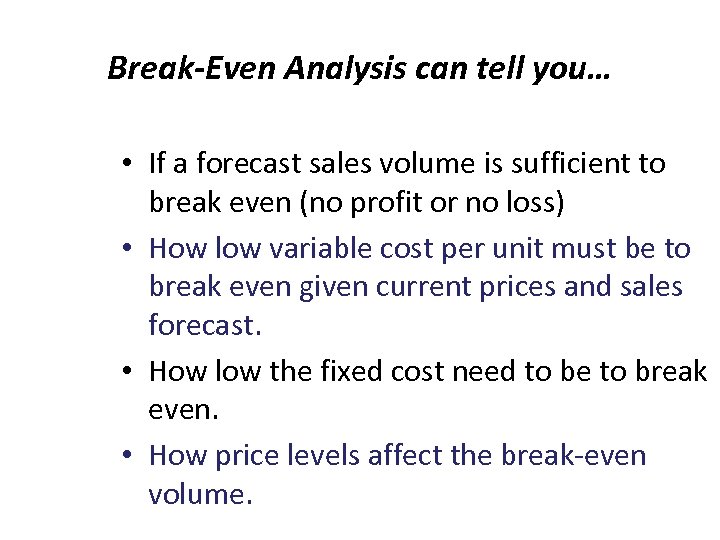

Break-Even Analysis can tell you… • If a forecast sales volume is sufficient to break even (no profit or no loss) • How low variable cost per unit must be to break even given current prices and sales forecast. • How low the fixed cost need to be to break even. • How price levels affect the break-even volume.

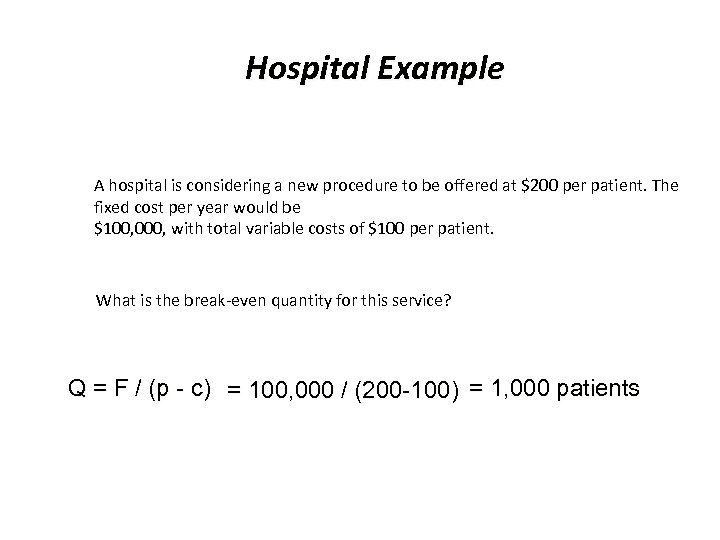

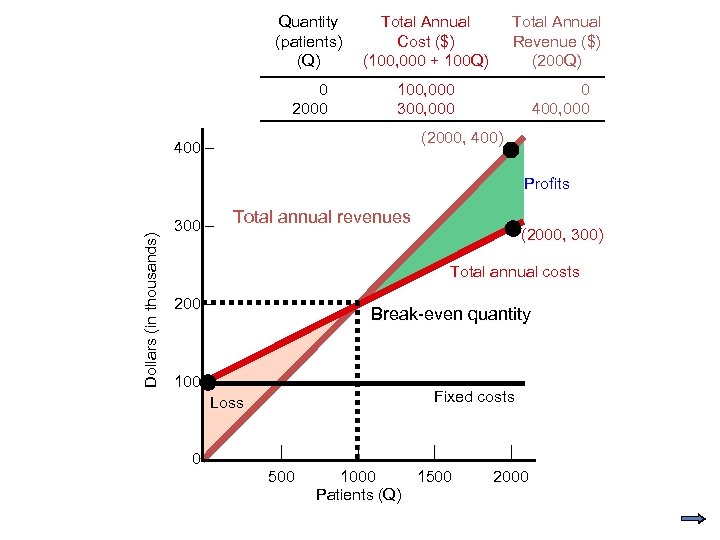

Hospital Example A hospital is considering a new procedure to be offered at $200 per patient. The fixed cost per year would be $100, 000, with total variable costs of $100 per patient. What is the break-even quantity for this service? Q = F / (p - c) = 100, 000 / (200 -100) = 1, 000 patients

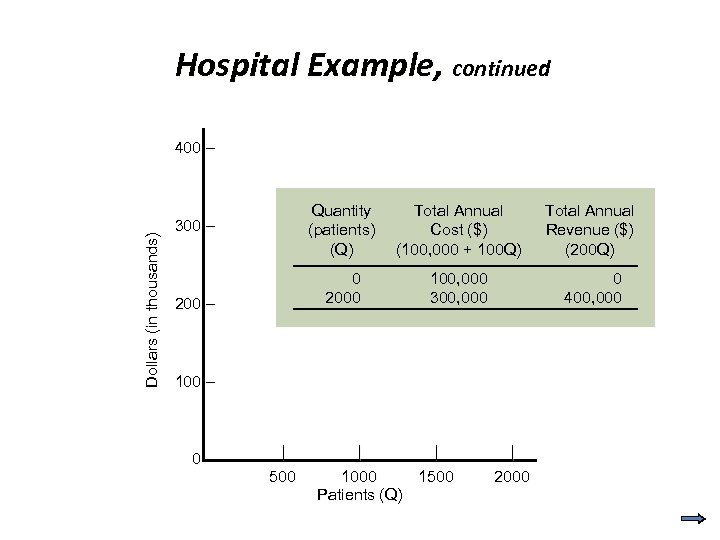

Hospital Example, continued Dollars (in thousands) 400 – Quantity (patients) (Q) 200 – Total Annual Cost ($) (100, 000 + 100 Q) Total Annual Revenue ($) (200 Q) 0 2000 300 – 100, 000 300, 000 0 400, 000 100 – 0– | 500 | | 1000 1500 Patients (Q) | 2000

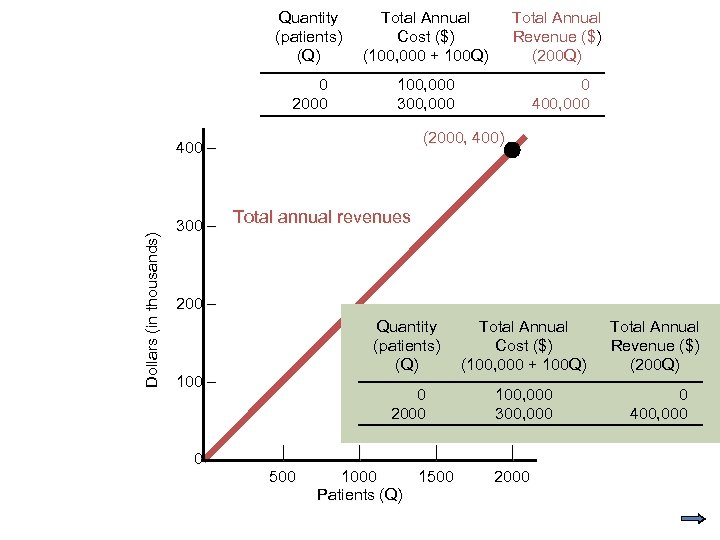

Quantity (patients) (Q) Total Annual Cost ($) (100, 000 + 100 Q) Total Annual Revenue ($) (200 Q) 0 2000 100, 000 300, 000 0 400, 000 (2000, 400) Dollars (in thousands) 400 – 300 – Total annual revenues 200 – Quantity (patients) (Q) 0– | 500 | Total Annual Revenue ($) (200 Q) 0 2000 100 – Total Annual Cost ($) (100, 000 + 100 Q) 100, 000 300, 000 0 400, 000 | 1000 1500 Patients (Q) | 2000

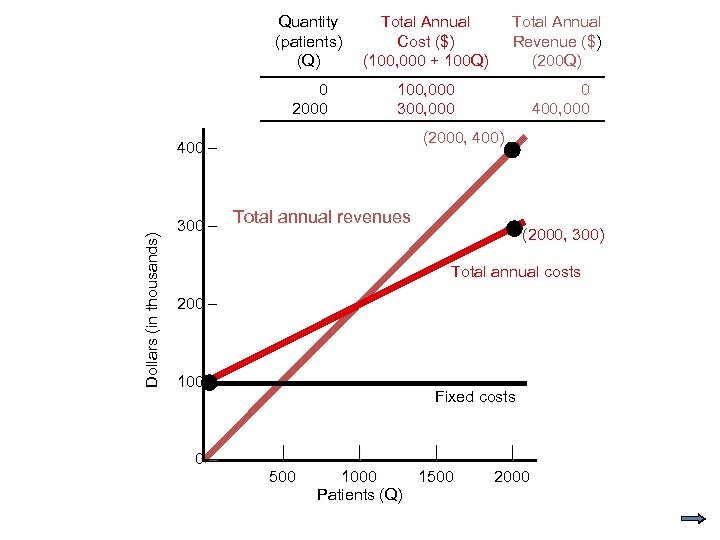

Quantity (patients) (Q) Total Annual Cost ($) (100, 000 + 100 Q) Total Annual Revenue ($) (200 Q) 0 2000 100, 000 300, 000 0 400, 000 (2000, 400) Dollars (in thousands) 400 – 300 – Total annual revenues (2000, 300) Total annual costs 200 – 100 – 0– Fixed costs | 500 | | 1000 1500 Patients (Q) | 2000

Quantity (patients) (Q) Total Annual Cost ($) (100, 000 + 100 Q) Total Annual Revenue ($) (200 Q) 0 2000 100, 000 300, 000 0 400, 000 (2000, 400) 400 – Dollars (in thousands) Profits 300 – Total annual revenues (2000, 300) Total annual costs 200 – Break-even quantity 100 – Loss 0– Fixed costs | 500 | | 1000 1500 Patients (Q) | 2000

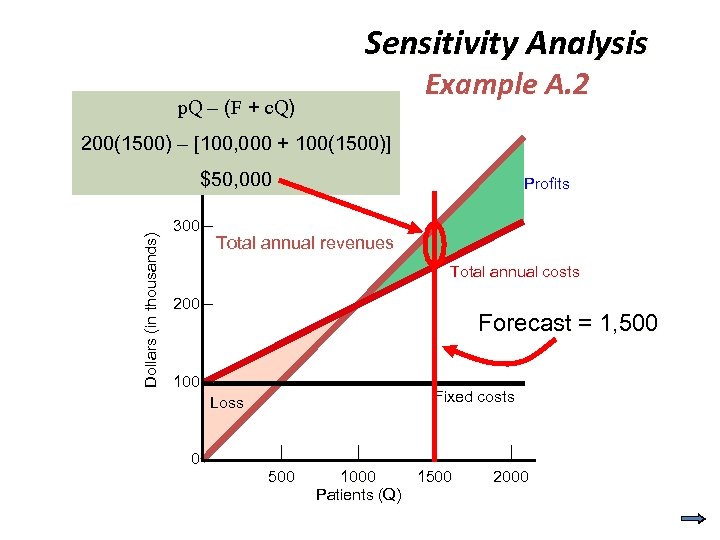

Sensitivity Analysis Example A. 2 p. Q – (F + c. Q) 200(1500) 400 – – [100, 000 + 100(1500)] Dollars (in thousands) $50, 000 300 – Profits Total annual revenues Total annual costs 200 – Forecast = 1, 500 100 – Loss 0– Fixed costs | 500 | | 1000 1500 Patients (Q) | 2000

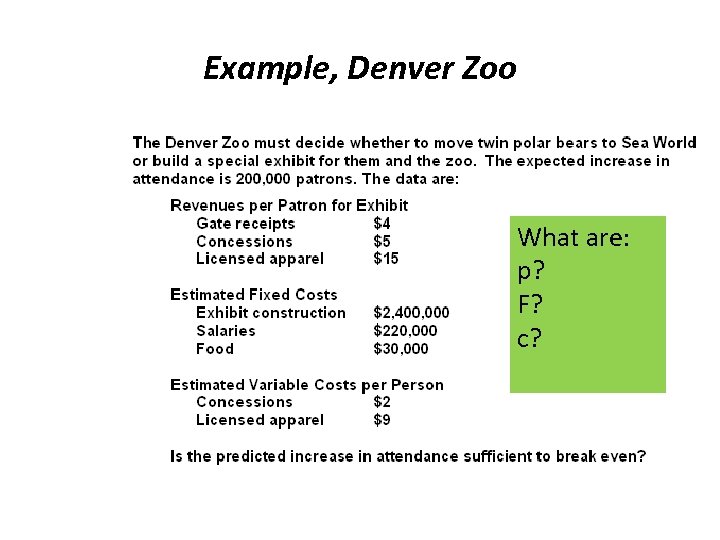

Example, Denver Zoo What are: p? F? c?

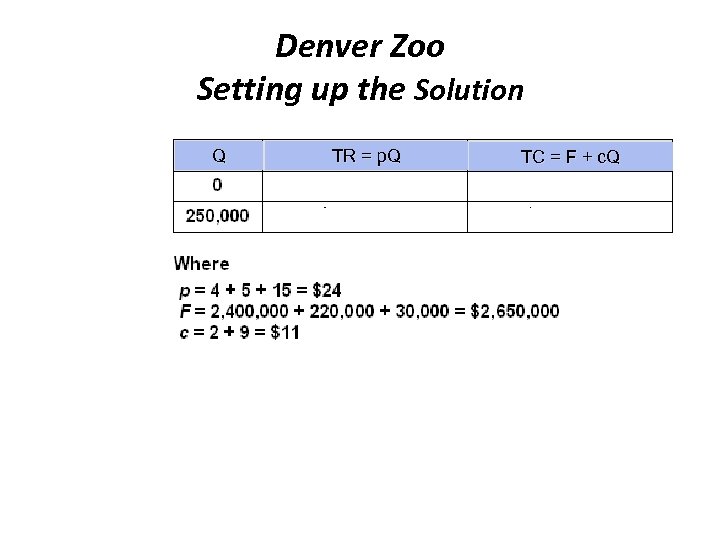

Denver Zoo Setting up the Solution Q TR = p. Q TC = F + c. Q

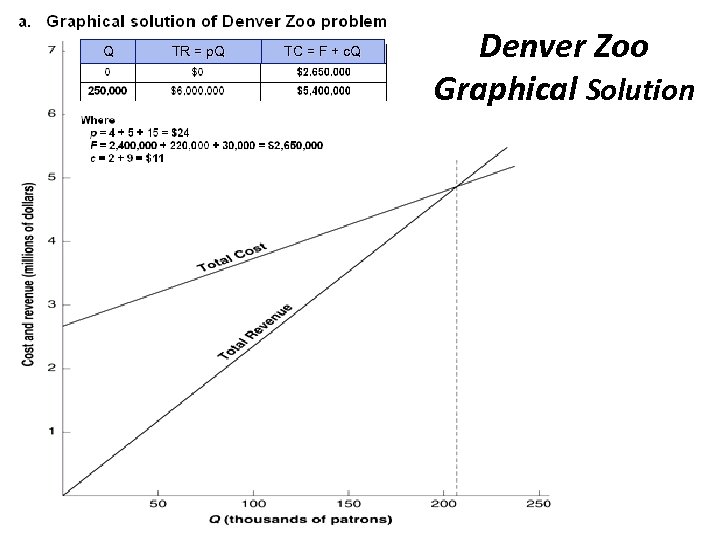

Q TR = p. Q TC = F + c. Q Denver Zoo Graphical Solution

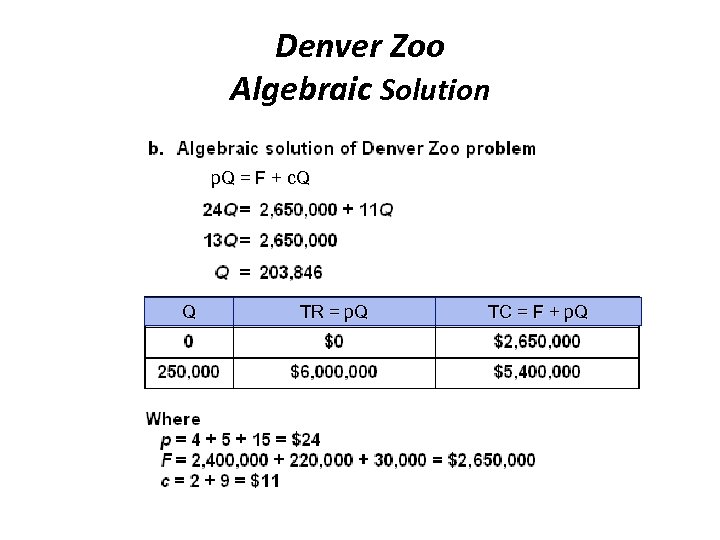

Denver Zoo Algebraic Solution p. Q = F + c. Q Q TR = p. Q TC = F + p. Q

2d0d73e8db86e97ccc537c9a7b33fa9b.ppt