7b250e39d2c8e1e3e0e67ce1705389c7.ppt

- Количество слайдов: 15

Brady Bonds Pallavi Rao Morris Chen

Brady Bonds n n n n Buy Mexican par or discount bonds Buy Venezuela par or discount bonds Fair opening price of Costa Rican Principal Series A Hold or sell Mexican Brady Bond at Nov. 2003 Useful Diversification Tool? Method & estimate of country risk with Brady Bond Hedge Mexican exposure Probability of default in the Future

What is a Brady Bond? Principal collateral n Rolling-interest guarantee n Value recovery rights n n n bonds Par Discount bonds

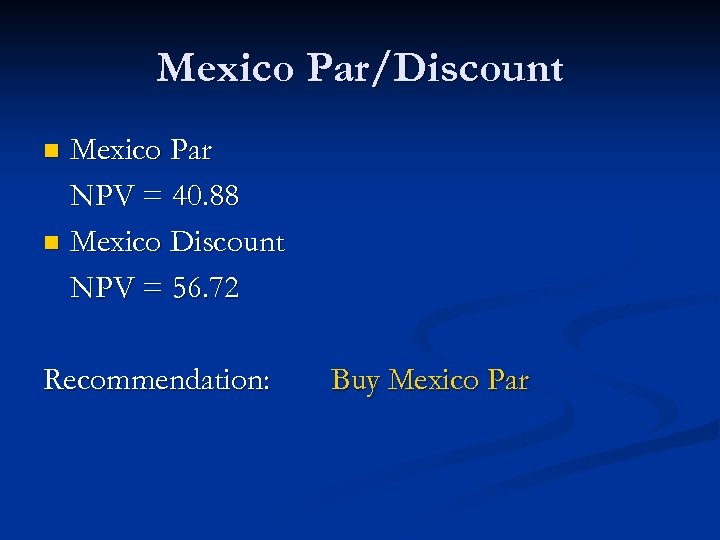

Mexico Par/Discount Par Data n n n n T-Bond 30 Yrs YTM T-Bill 1 Yr Country Risk CCC Bond YTM Coupon Interest Face Value Prob of Default Discount Data 8. 56% 8. 35% 5. 00% 13. 35% 6. 25% 100 4. 00% n n n n T-Bond 30 Yrs YTM T-Bill 1 Yr Country Risk CCC Bond YTM LIBOR + 13/16 Face Value Prob of Default 8. 56% 8. 35% 5. 00% 13. 35% 9. 31% 100 4. 00%

Mexico Par/Discount Mexico Par NPV = 40. 88 n Mexico Discount NPV = 56. 72 n Recommendation: Buy Mexico Par

Venezuela Par/Discount Par Data n n n n T-Bond 30 Yrs YTM T-Bill 1 Yr Country Risk C Bond YTM Coupon Interest Face Value Prob of Default Discount Data 8. 24% 7. 05% 8. 00% 15. 05% 6. 75% 100 6. 00% n n n n T-Bond 30 Yrs YTM T-Bill 1 Yr Country Risk C Bond YTM LIBOR + 13/16 Face Value Prob of Default 8. 24% 7. 05% 8. 00% 15. 05% 9. 31% 100 6. 00%

Venezuela Par/Discount Venezuela Par NPV = 36. 66 n Venezuela Discount NPV = 47. 03 n Recommendation: Buy Venezuela Par

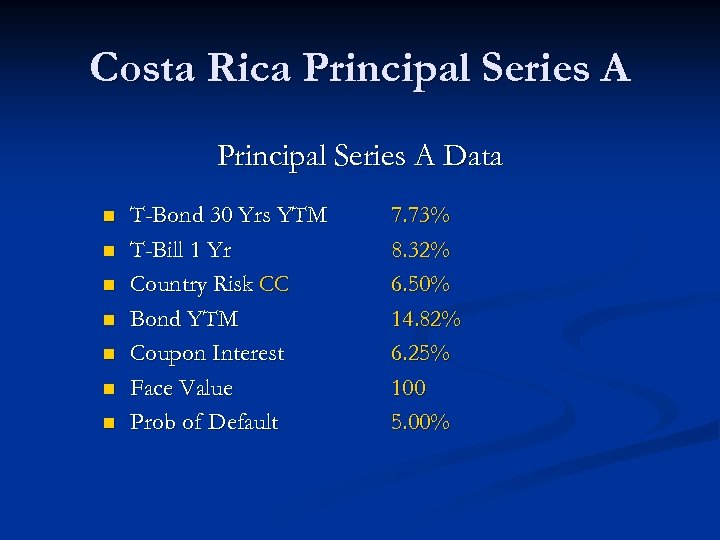

Costa Rica Principal Series A Data n n n n T-Bond 30 Yrs YTM T-Bill 1 Yr Country Risk CC Bond YTM Coupon Interest Face Value Prob of Default 7. 73% 8. 32% 6. 50% 14. 82% 6. 25% 100 5. 00%

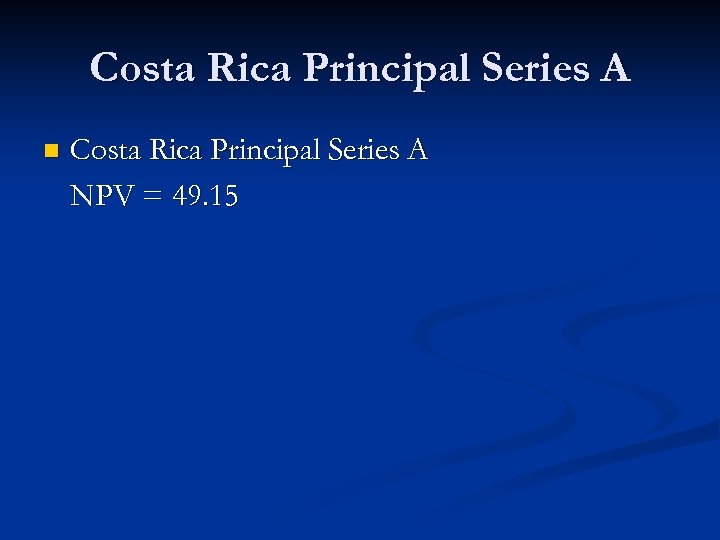

Costa Rica Principal Series A n Costa Rica Principal Series A NPV = 49. 15

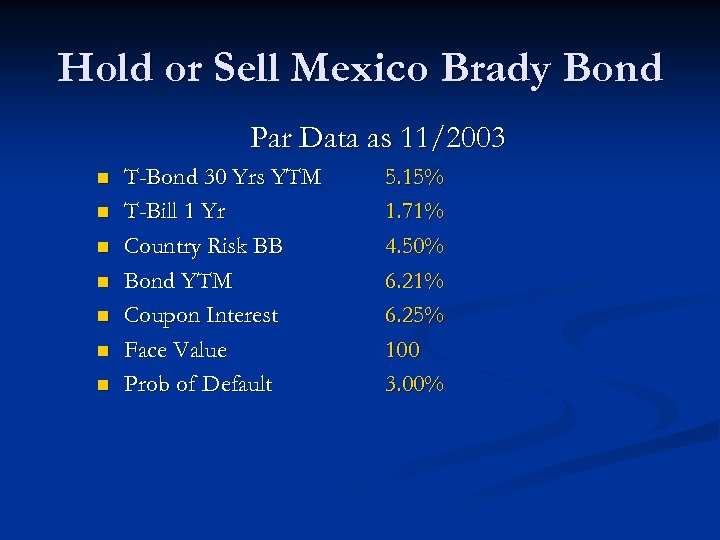

Hold or Sell Mexico Brady Bond Par Data as 11/2003 n n n n T-Bond 30 Yrs YTM T-Bill 1 Yr Country Risk BB Bond YTM Coupon Interest Face Value Prob of Default 5. 15% 1. 71% 4. 50% 6. 21% 6. 25% 100 3. 00%

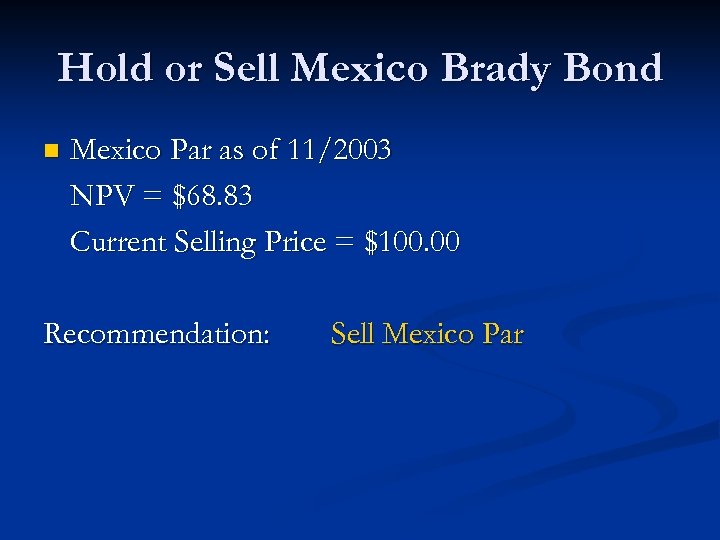

Hold or Sell Mexico Brady Bond n Mexico Par as of 11/2003 NPV = $68. 83 Current Selling Price = $100. 00 Recommendation: Sell Mexico Par

Useful Diversification Tool? n Approx. 60% variance in Mexican par prices is attributable to changes in US Treasury. Conclusion: High correlation between Mexican Brady Bonds and US Treasury. Therefore, not a good diversification tool.

Estimate Country Risk with Brady Bond n Brady Bond YTM = US T-bill + Spread Therefore, Country Risk = Brady Bond YTM – Risk Free YTM

Hedge Mexican Exposure n Brady Bond has two risk components Sovereign Risk (Country’s political & econ. Risk) Interest Rate Risk (US Interest rate fluctuations) Solution: Hedge Interest Rate Risk with CBOT bond futures Hedge Sovereign Risk with put options in Mexico

Probability of Default Country Risk Ranking = 47 (100 most risky) n Brady Bond buybacks n Political Risks = C n Economic Policy Risk = B n Economic Structure Risk = C n Liquidity Risk = C n Overall Risk = C n

7b250e39d2c8e1e3e0e67ce1705389c7.ppt