b42ab7ba0c4d7e165cab57ada45c0e4d.ppt

- Количество слайдов: 12

Bonds & The Stock Market Game TM

Bonds in General l Universe of domestic bonds is greater than 3 million bonds l l l US Treasuries Municipals (State & Local) Agencies Corporates Bonds don’t trade everyday l Prices are a function of: ratings, federal interest rate, and availability

Bonds in General l Bonds are identified by a 9 digit cusip # l Treasury bonds sell in increments of $100 l Municipals and corporates trade in increments of $1, 000

Bonds in General l Buy a bond you also pay for the accrued interest plus commission l Sell a bond you also get accrued interest less commission less SEC fee l Accrued interest for treasuries is calculated differently than for municipals and corporates (see handout)

Bonds in General l Bonds are priced per $100 of bond principal A $4, 000 bond with a price of $99. 50/$100 will cost you: (40 x 99. 50 = $3, 980) + accrued interest + commission If you sell a $4, 000 bond you will receive: (40 x 99. 50 = $3, 980) + accrued interest – commission – SEC fee

Bonds in General l Bonds come in many flavors l l l l Fixed and variable interest rates Tax deductibles Convertibles Callable and non-callable Puts Interest compounding Various coupon frequencies Inflation adjusted

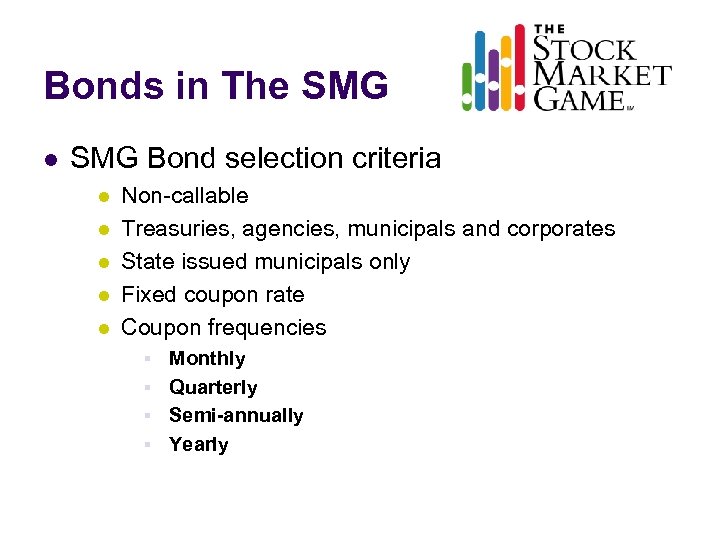

Bonds in The SMG l SMG Bond selection criteria l l l Non-callable Treasuries, agencies, municipals and corporates State issued municipals only Fixed coupon rate Coupon frequencies Monthly § Quarterly § Semi-annually § Yearly §

Bonds in The SMG l SMG Bond selection criteria cont… l l No puts No bonds indexed to inflation S & P designated investment grade (BBB or greater) Bonds with maturity date greater than 5 years Reduced # of bonds from 3 million to 8 thousand

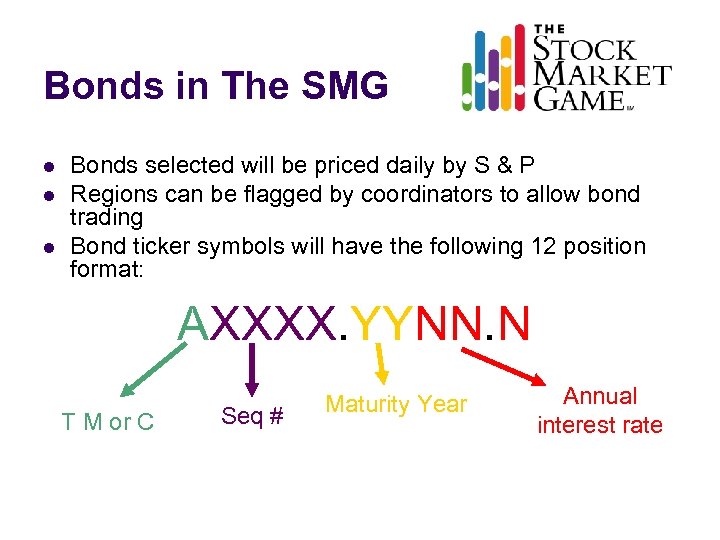

Bonds in The SMG l l l Bonds selected will be priced daily by S & P Regions can be flagged by coordinators to allow bond trading Bond ticker symbols will have the following 12 position format: AXXXX. YYNN. N T M or C Seq # Maturity Year Annual interest rate

Bonds in The SMG l l Bonds can not be short sold Bonds like mutual funds trade real time (no cancellations) Coupon payments are posted when due Bonds can be traded 00: 00 to 23: 00 Hours except when system is unavailable

Bonds in The SMG l l l Trades entered on weekends and holidays will post next business day. Trades, as usual, will reside in pending until then Diversity rule applies to bonds also Margin requirements l l Stocks and mutual funds at 50% Corporate bonds at 75% Municipal bonds at 90% Treasury bonds at 96% So buying power calculation is slightly more complex

b42ab7ba0c4d7e165cab57ada45c0e4d.ppt