48d45b9b77366b7f0a6c8580a7390344.ppt

- Количество слайдов: 63

Bonds 101 Presentation to AWWA by Zions Public Finance 1

Zions Public Finance

Our Primary Services o Financial Advisory Services o Municipal Studies o Underwriting Services o Direct Purchaser Services

Additional Services o Continuing Disclosure o Equipment Lease Financing o Bond Election Services o Capital Facilities Planning o Impact Fee Analysis o Special Assessment Area Administration

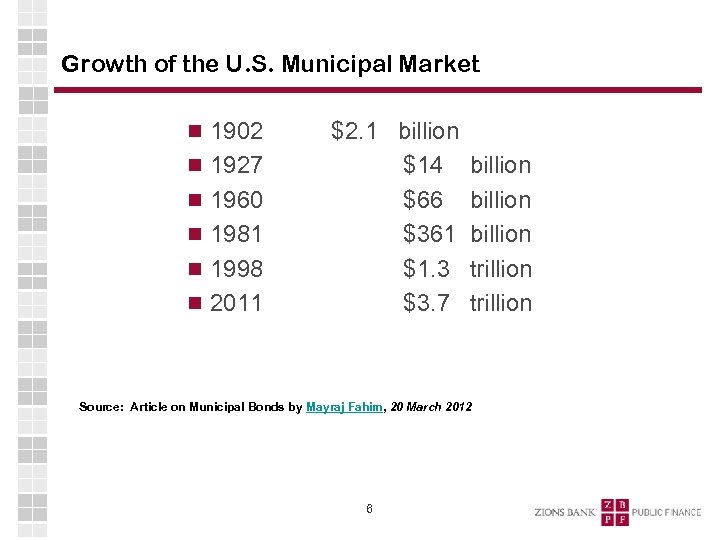

Growth of the U. S. Municipal Market 1902 1927 1960 1981 1998 2011 $2. 1 billion $14 $66 $361 $1. 3 $3. 7 billion trillion Source: Article on Municipal Bonds by Mayraj Fahim, 20 March 2012 6

1812 – First U. S. Municipal Bond The first U. S. municipal bond was issued in 1812 by New York City as a general obligation bond to construct a canal. 7

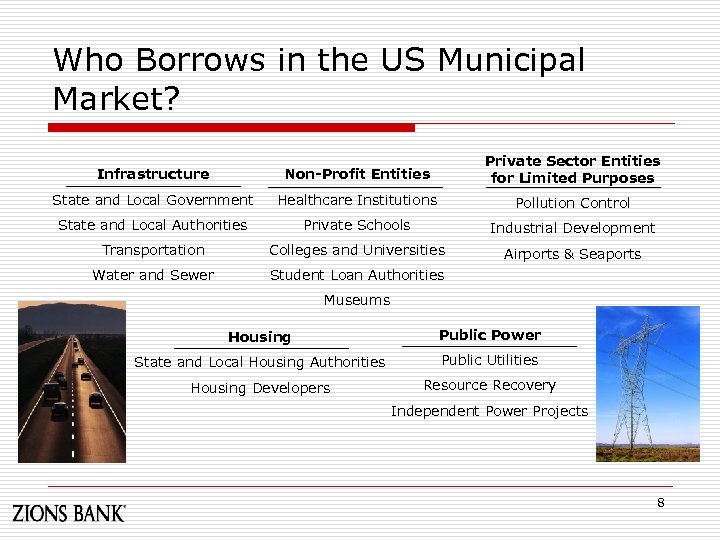

Who Borrows in the US Municipal Market? Infrastructure Non-Profit Entities Private Sector Entities for Limited Purposes State and Local Government Healthcare Institutions Pollution Control State and Local Authorities Private Schools Industrial Development Transportation Colleges and Universities Airports & Seaports Water and Sewer Student Loan Authorities Museums Housing Public Power State and Local Housing Authorities Public Utilities Housing Developers Resource Recovery Independent Power Projects 8

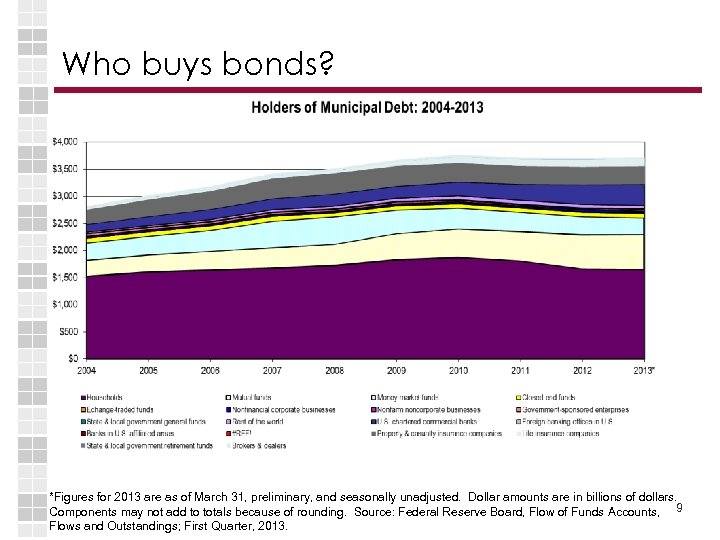

Who buys bonds? *Figures for 2013 are as of March 31, preliminary, and seasonally unadjusted. Dollar amounts are in billions of dollars. Components may not add to totals because of rounding. Source: Federal Reserve Board, Flow of Funds Accounts, 9 Flows and Outstandings; First Quarter, 2013.

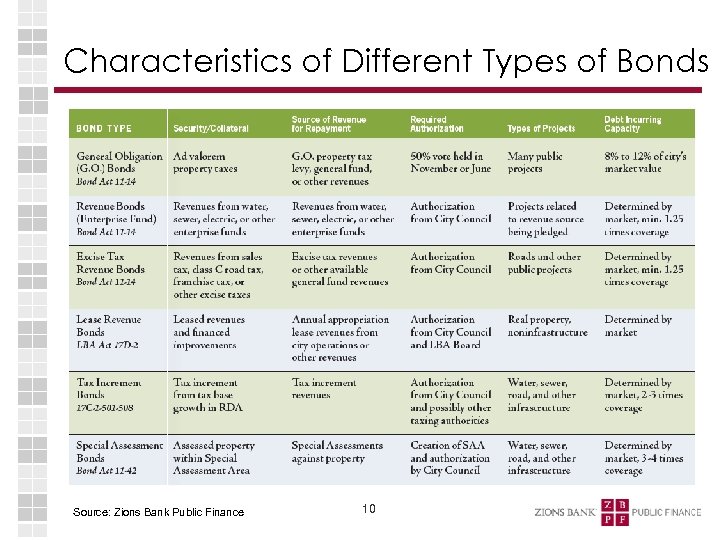

Characteristics of Different Types of Bonds Source: Zions Bank Public Finance 10

Constitution of Utah Article XIV, Public Debt o Section 3. [Debts of counties, cities, towns and school districts not to exceed revenue— Exception. ] No debt in excess of the taxes for the current year shall be created by any county or subdivision thereof, or by any school district therein, or by any city, town or village, or any subdivision thereof in this State; unless the proposition to create such debt, shall have been submitted to a vote of such qualified electors as shall have paid a property tax therein, in the year preceding such election, and a majority of those voting thereon shall have voted in favor of incurring such debt. o January 4, 1896 11

Constitution of Utah Article XIV, Public Debt o Section 3. [Certain debt of counties, cities, towns, school districts, and other political subdivisions not to exceed revenue—Exception. ] No debt issued by a county, city, town, school district, or other political subdivision of the State and directly payable from and secured by ad valorem property taxes levied by the issuer of the debt may be created in excess of the taxes for the current year unless the proposition to create the debt has been submitted to a vote of qualified voters at the time and in the manner provided by statute, and a majority of those voting thereon has voted in favor of incurring the debt. o November 6, 1999 12

Illegal Municipal Debt in Utah o Debt with payments beyond one fiscal year, unless: A majority of voters have approved it; Subject to annual appropriation; Secured by an Enterprise Fund’s revenues; 13

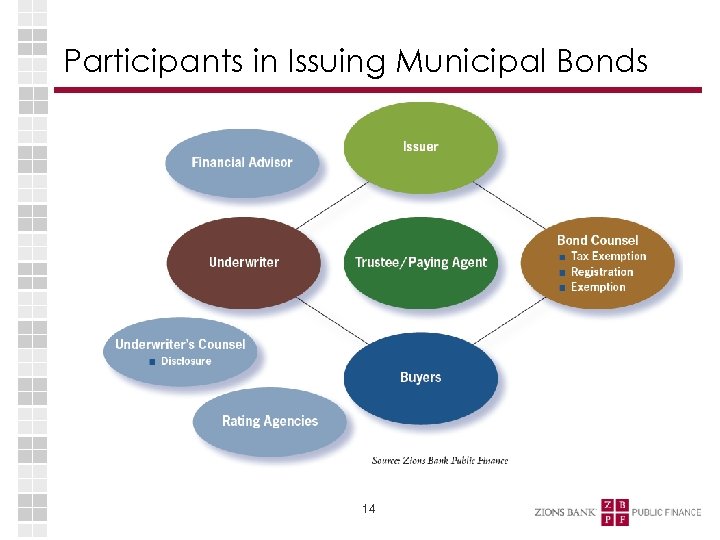

Participants in Issuing Municipal Bonds 14

Issuer (Borrower) Selects financing team members Approves financing terms and documents, and ultimately issues the debt instruments Responsible for repayment of debt (unless Issuer is “conduit” issuer) Responsible for the accuracy and completeness of the debt offering document (i. e. , Official Statement, Private Placement Memorandum) Responsible for complying with terms and covenants in financing documents 15

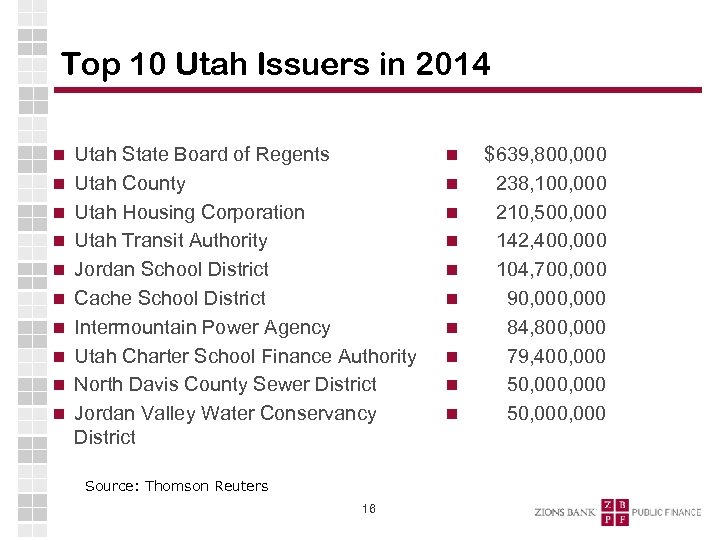

Top 10 Utah Issuers in 2014 Utah State Board of Regents Utah County Utah Housing Corporation Utah Transit Authority Jordan School District Cache School District Intermountain Power Agency Utah Charter School Finance Authority North Davis County Sewer District Jordan Valley Water Conservancy District Source: Thomson Reuters 16 $639, 800, 000 238, 100, 000 210, 500, 000 142, 400, 000 104, 700, 000 90, 000 84, 800, 000 79, 400, 000 50, 000, 000

Financial Advisor Has a fiduciary duty to the Issuer (acts in the Issuer’s best interests) (MSRB Rule G-17 and proposed Rule G 36) Assists Issuer in the selection of other financing team members Advises on wide range of financial issues; may be specific to an issuance of debt, or ongoing Quarterbacks the bond issuance process; runs the calendar; coordinates other team members 17

Financial Advisor Position of Trust Recent SEC definition of Municipal Advisor Strong GFOA Recommendation 18

National FA Rankings - 2014 Firm Volume (000 s) 1 2 Public Financial Management Inc. Public Resources Advisory Group 48, 517. 2 27, 663. 7 3 First Southwest 26, 763. 3 4 5 6 7 8 9 Estrada Hinojosa & Co 8, 748. 6 KNN Inc. , ZBPF ID, ZBPF NV, ZBPF UT 7, 471. 4 Acacia Financial Group Corp. 6, 368. 6 A C Advisory 5, 773. 0 Piper Jaffray 5, 105. 2 Lamont Financial Services Corp. 4, 167. 7 10 RBC Capital Markets 19 3, 942. 2 (Source: Thomson Reuters. )

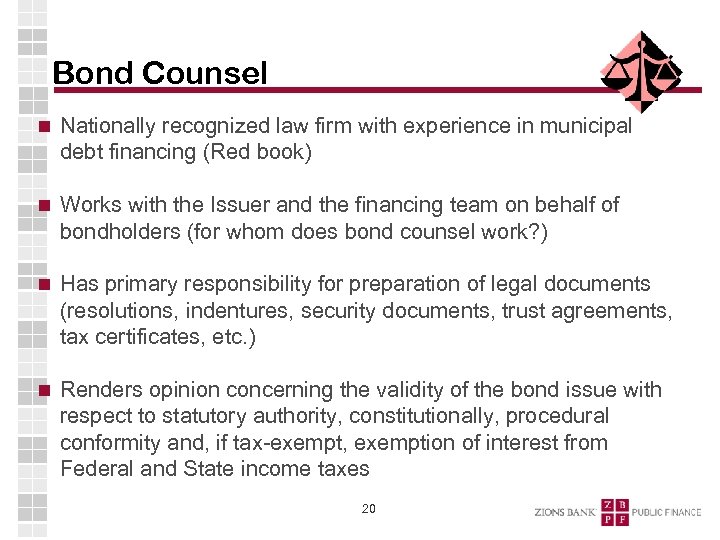

Bond Counsel Nationally recognized law firm with experience in municipal debt financing (Red book) Works with the Issuer and the financing team on behalf of bondholders (for whom does bond counsel work? ) Has primary responsibility for preparation of legal documents (resolutions, indentures, security documents, trust agreements, tax certificates, etc. ) Renders opinion concerning the validity of the bond issue with respect to statutory authority, constitutionally, procedural conformity and, if tax-exempt, exemption of interest from Federal and State income taxes 20

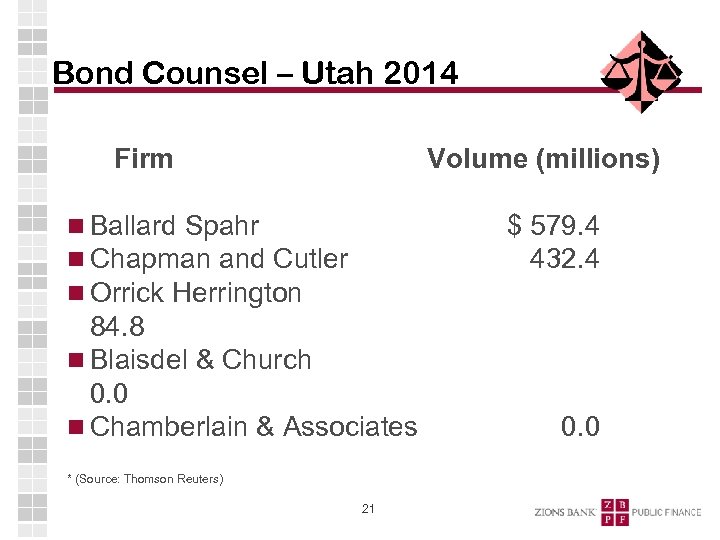

Bond Counsel – Utah 2014 Firm Volume (millions) Ballard Spahr Chapman and Cutler Orrick Herrington $ 579. 4 432. 4 84. 8 Blaisdel & Church 0. 0 Chamberlain & Associates * (Source: Thomson Reuters) 21 0. 0

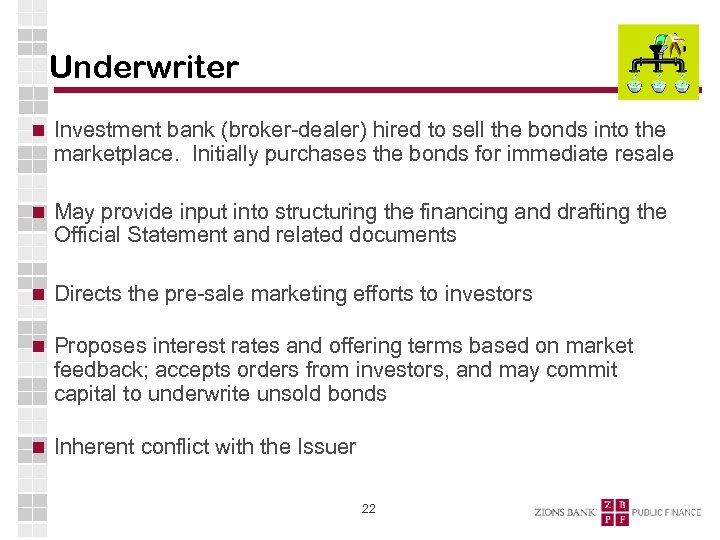

Underwriter Investment bank (broker-dealer) hired to sell the bonds into the marketplace. Initially purchases the bonds for immediate resale May provide input into structuring the financing and drafting the Official Statement and related documents Directs the pre-sale marketing efforts to investors Proposes interest rates and offering terms based on market feedback; accepts orders from investors, and may commit capital to underwrite unsold bonds Inherent conflict with the Issuer 22

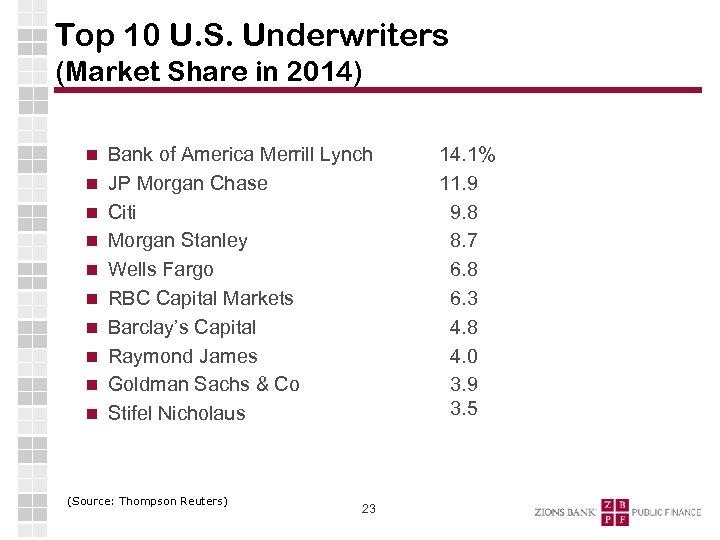

Top 10 U. S. Underwriters (Market Share in 2014) Bank of America Merrill Lynch JP Morgan Chase Citi Morgan Stanley Wells Fargo RBC Capital Markets Barclay’s Capital Raymond James Goldman Sachs & Co Stifel Nicholaus (Source: Thompson Reuters) 23 14. 1% 11. 9 9. 8 8. 7 6. 8 6. 3 4. 8 4. 0 3. 9 3. 5

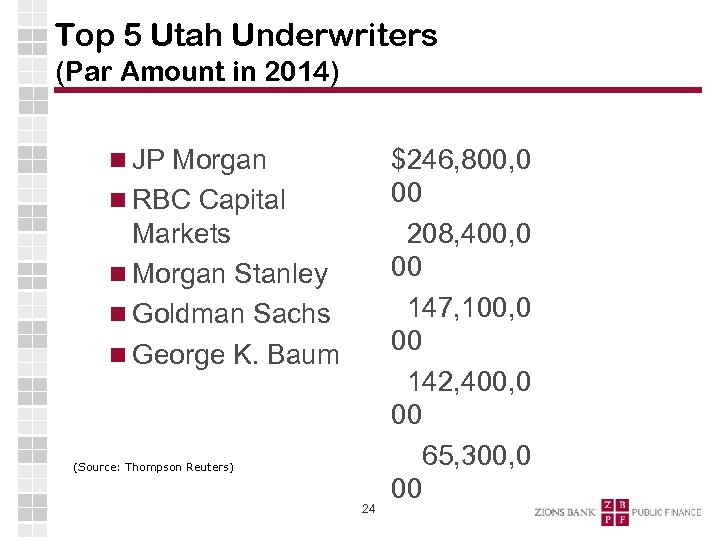

Top 5 Utah Underwriters (Par Amount in 2014) JP Morgan RBC Capital Markets Morgan Stanley Goldman Sachs George K. Baum (Source: Thompson Reuters) 24 $246, 800, 0 00 208, 400, 0 00 147, 100, 0 00 142, 400, 0 00 65, 300, 0 00

GFOA Recommended Practices o “There is a lack of understanding among many debt issuers about the appropriate roles of underwriters and financial advisers and the fiduciary relationship that each has, or does not have, with respect to state and local government issuers. ” GFOA Debt Committee Draft “Best Practices” Document Dated June 9, 2007 25

GFOA Recommended Practices o “The relationship between issuer and financial advisor is one of ‘trust and confidence’ which is in the ‘nature of a fiduciary relationship’. This is in contrast to the relationship between the issuer and underwriter where the relationship is one of some common purposes but also some competing objectives, especially at the time of bond pricing. ” GFOA Debt Committee Draft “Best Practices” Document Dated June 9, 2007 26

Municipal Bond Teeter Totter Price Interest Rate 27

Underwriters o An Underwriter is not necessarily your friend! Their interests are not aligned with yours Prohibition from Financial Advisors underwriting your bonds in a negotiated sale (Rule G-23) Underwriters may push you into a negotiated sale. Why? Follow GFOA recommendations: o Use a Financial Advisor to look out for your interests o Hire underwriters using RFPs o Use Competitive Sales whenever possible o Don’t use the same underwriter over and over 28

Trustee/Paying Agent/Registrar Retained by Issuer, but represents bondholders’ interests Manages trustee-held bond funds (reserves, construction funds, etc. ) Receives interest and principal payments from Issuer/Borrower and distributes to Bondholders Maintains the list of owners of the bonds Holds liens and security interests and exercises remedies, for bondholders, in the event of a default 29

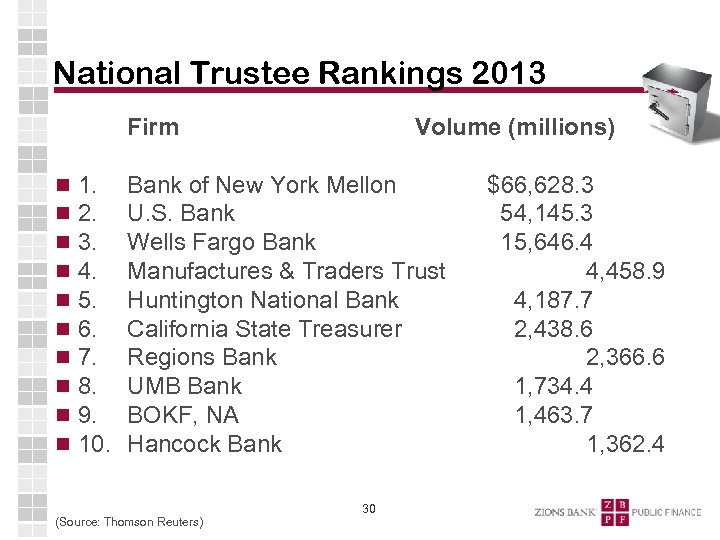

National Trustee Rankings 2013 Firm 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Volume (millions) Bank of New York Mellon U. S. Bank Wells Fargo Bank Manufactures & Traders Trust Huntington National Bank California State Treasurer Regions Bank UMB Bank BOKF, NA Hancock Bank (Source: Thomson Reuters) 30 $66, 628. 3 54, 145. 3 15, 646. 4 4, 458. 9 4, 187. 7 2, 438. 6 2, 366. 6 1, 734. 4 1, 463. 7 1, 362. 4

Counsel to the Issuer May be internal (City Attorney, County DA, AG’s Office) or outside or general counsel; not hired specifically for bond issue Reviews all legal documents on behalf of Issuer May assist in drafting an Offering Statement and additional disclosure documents, and may opine as to accuracy Issues the required local counsel’s opinion 31

Underwriter’s Counsel Nationally recognized law firm representing the underwriters, with experience in debt financing Advises and opines on matters relating to the Offering Statement, including matters relating to disclosure under SEC regulations and other standards; may have the principal role in drafting Offering Statement Prepares underwriting documents – Blue Sky Survey, Legal Investment Memorandum, Agreement Among Underwriters, Selling Group Agreement, and the Bond Purchase Contract Responsible for participating in “due diligence” before the bond issue is offered to investors 32

Rating Agencies National organizations that provide rating on debt of public and private organizations q q q Standard & Poor’s Corporation Moody’s Investor Service, Inc. Fitch Ratings Authoritative sources that assess a borrower’s ability to repay Ratings have direct impact on cost of borrowing 33

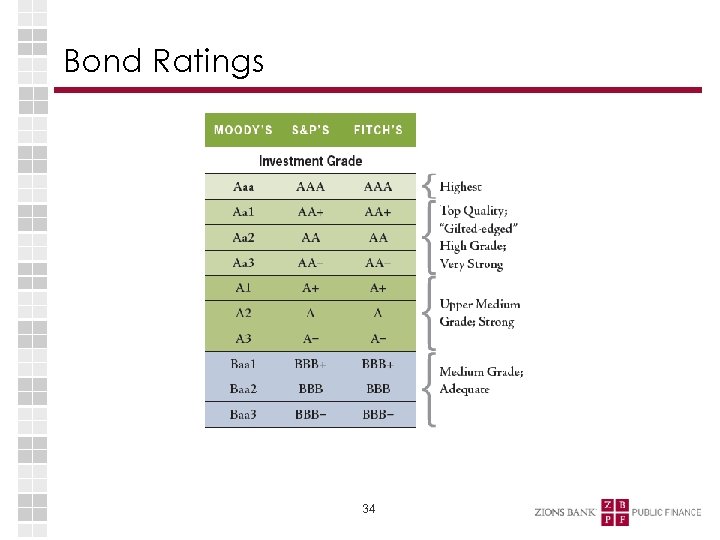

Bond Ratings 34

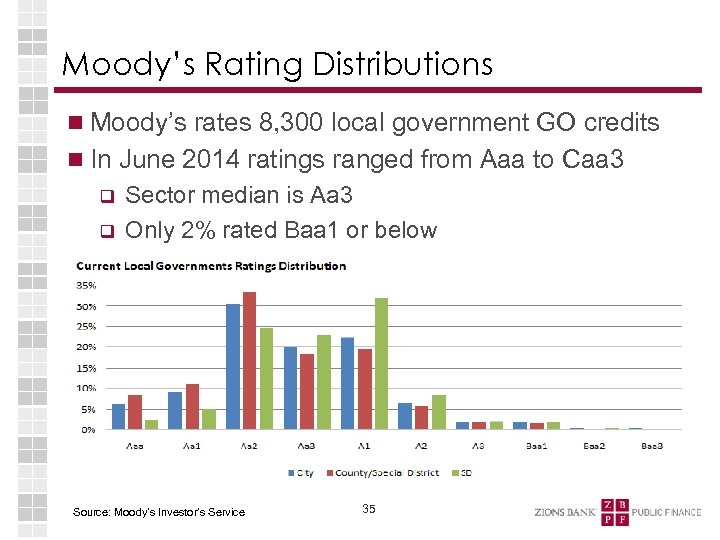

Moody’s Rating Distributions Moody’s rates 8, 300 local government GO credits In June 2014 ratings ranged from Aaa to Caa 3 q q Sector median is Aa 3 Only 2% rated Baa 1 or below Source: Moody’s Investor’s Service 35

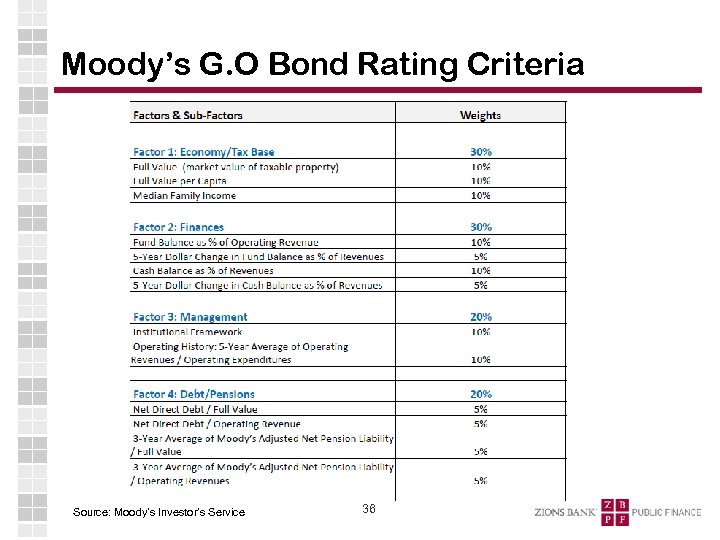

Moody’s G. O Bond Rating Criteria Source: Moody’s Investor’s Service 36

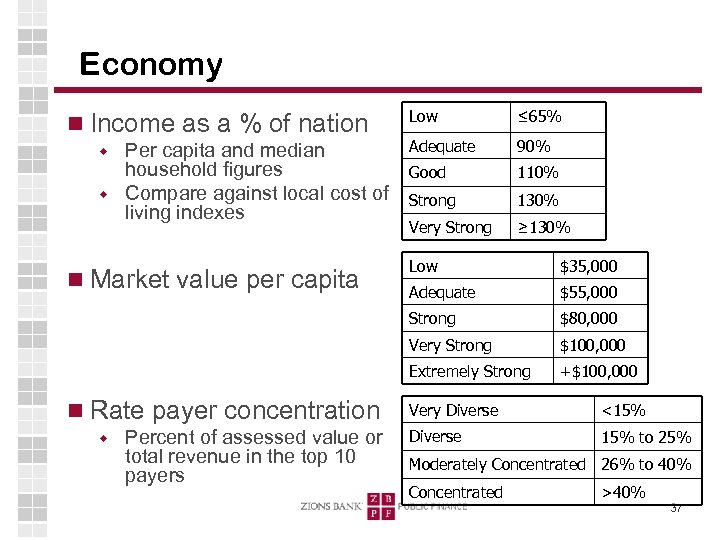

Economy Income as a % of nation w w Per capita and median household figures Compare against local cost of living indexes Low ≤ 65% Adequate 90% Good 110% Strong 130% Very Strong ≥ 130% Percent of assessed value or total revenue in the top 10 payers $55, 000 $80, 000 $100, 000 Extremely Strong w Adequate Very Strong Rate payer concentration $35, 000 Strong Market value per capita Low +$100, 000 Very Diverse <15% Diverse 15% to 25% Moderately Concentrated 26% to 40% Concentrated >40% 37

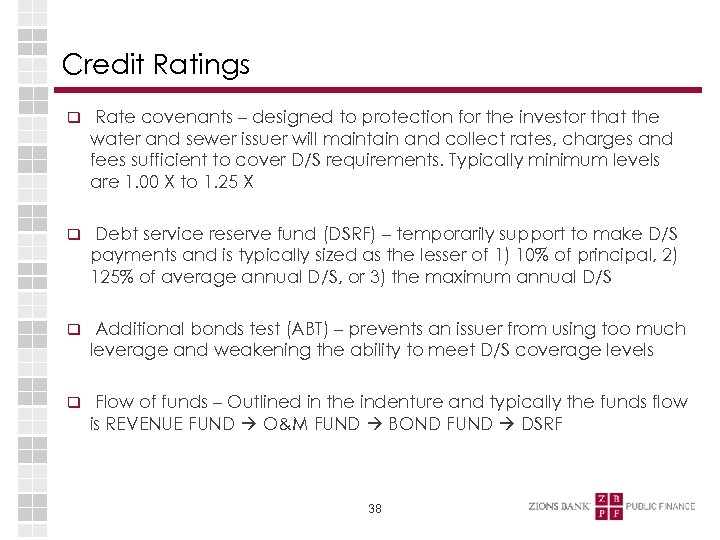

Credit Ratings q Rate covenants – designed to protection for the investor that the water and sewer issuer will maintain and collect rates, charges and fees sufficient to cover D/S requirements. Typically minimum levels are 1. 00 X to 1. 25 X q Debt service reserve fund (DSRF) – temporarily support to make D/S payments and is typically sized as the lesser of 1) 10% of principal, 2) 125% of average annual D/S, or 3) the maximum annual D/S q Additional bonds test (ABT) – prevents an issuer from using too much leverage and weakening the ability to meet D/S coverage levels q Flow of funds – Outlined in the indenture and typically the funds flow is REVENUE FUND O&M FUND BOND FUND DSRF 38

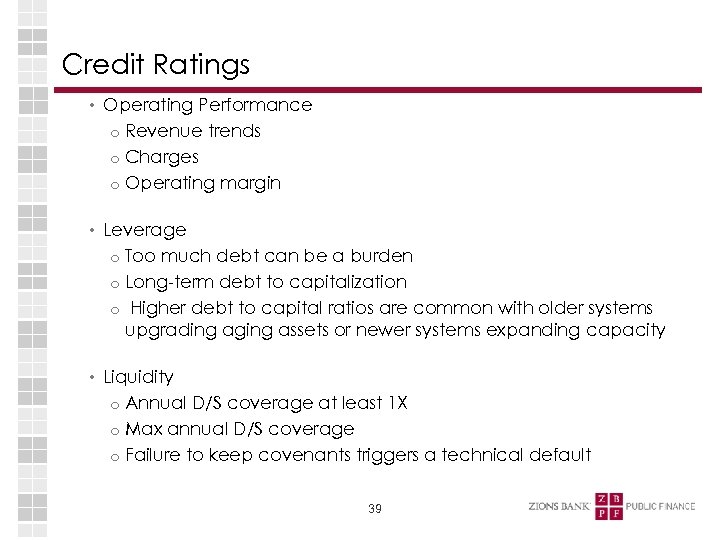

Credit Ratings • Operating Performance o Revenue trends o Charges o Operating margin • Leverage o Too much debt can be a burden o Long-term debt to capitalization o Higher debt to capital ratios are common with older systems upgrading aging assets or newer systems expanding capacity • Liquidity o Annual D/S coverage at least 1 X o Max annual D/S coverage o Failure to keep covenants triggers a technical default 39

Strong Ratings for Water/Sewer Bonds Debt Profile q q q q Debt per customer is $1, 500 or less Debt per capita is $500 or less Debt funding of capital projects is 50% or less 90% of more of debt is amortized in 20 years Rate covenant is 1. 25 x annual debt service (or more) Additional Bonds Test is 1. 25 x maximum annual debt service (or more) Cash-funded debt service reserve fund is at its legal maximum 40

Strong Ratings for Water/Sewer Bonds Financial Profile q q Total debt service coverage is 2. 0 x or more 365 days (or more) of cash on hand Residential charges for utilities are less than 1. 2% of median household income Significant percentage of revenues are recovered through base charges (rather than volumetric charges) 41

Strong Ratings for Water/Sewer Bonds Operating Profile q q q Number of customers is stable or growing at less than 1% annually Top 10 customers account for less than 5% of total revenues No single customer accounts for more than 2% of revenues Treatment capacity is greater than 40% of demand Annual renewal of 100% or more of depreciated assets Full compliance with regulations 42

Strong Ratings for Water/Sewer Bonds Management q q q Extensive utility sector experience Objective, engaged, knowledgeable board Strong communication skills from management For wholesalers – coordinated members Frequent and accurate forecasting/planning Well-developed and documented policies and procedures 43

Disclosure 44

Disclosure Preliminary & Final Official Statement Legal Documents– Resolutions, General and Supplemental Indentures, etc. Continuing Disclosure 45

Disclosure Preliminary (“POS”) and Final Official Statements (“OS”) Distributed to “Wall Street” via email and web sites 46

Disclosure What does the OS contain? 47

Disclosure Continuing Disclosure q Beginning in January 1996, municipal entities issuing debt (subject to certain exemptions) were required to comply with Rule 15 c 2 -12, Municipal Securities Disclosure of the Securities Exchange Act of 1934 Internet web site, www. emma. msrb. org 48

Tax Exemption 49

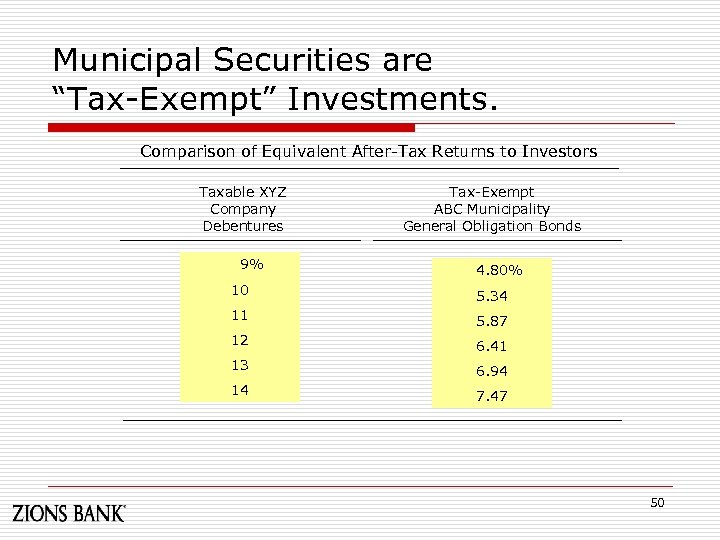

Municipal Securities are “Tax-Exempt” Investments. Comparison of Equivalent After-Tax Returns to Investors Taxable XYZ Company Debentures 9% Tax-Exempt ABC Municipality General Obligation Bonds 4. 80% 10 5. 34 11 5. 87 12 6. 41 13 6. 94 14 7. 47 50

1819 - The Roots of Tax Exemption Hamilton Jefferson Mc. Cullough 51 Marshall

1819 - The Roots of Tax Exemption Mc. Cullough –vs- Maryland “The power to tax is the power to destroy…” John Marshall Chief Justice, US Supreme Court Initiated the doctrine of “intergovernmental tax immunity”. 52

1895 - Pollock v. Farmer’s Loan & Trust Co. The U. S. Supreme Court held in 1895 that the federal government had no power under the U. S. Constitution to tax interest on municipal bonds. (In 1988, the Supreme Court stated that Congress could tax interest income on municipal bonds if it so desired on the basis that tax exemption of municipal bonds is not protected by the Constitution. In South Carolina v. Baker, the Supreme Court stated that the contrary decision of the Court 1895 in the case of Pollock v. Farmers' Loan & Trust Co. had been "effectively overruled by subsequent case law. “) 53

The Threat to Tax-Exemption Most hostile threat since the 1986 Tax Act Factors include: q Deficit reduction q Tax reform (simplification) q Progressive argument about fairness (Obama administration’s proposed cap of 28%) 54

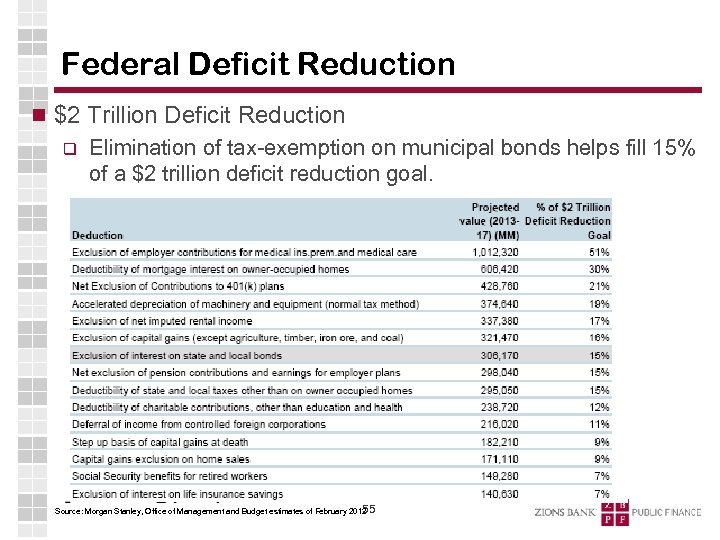

Federal Deficit Reduction $2 Trillion Deficit Reduction q Elimination of tax-exemption on municipal bonds helps fill 15% of a $2 trillion deficit reduction goal. 55 Source: Morgan Stanley, Office of Management and Budget estimates of February 2012

The Threat to Tax-Exemption What would be the effect on local governments? q Higher borrowing rates (about 1/3) q Fewer public projects (not enough revenue) q Tax increases to pay for new projects? 56

Current Rates 57

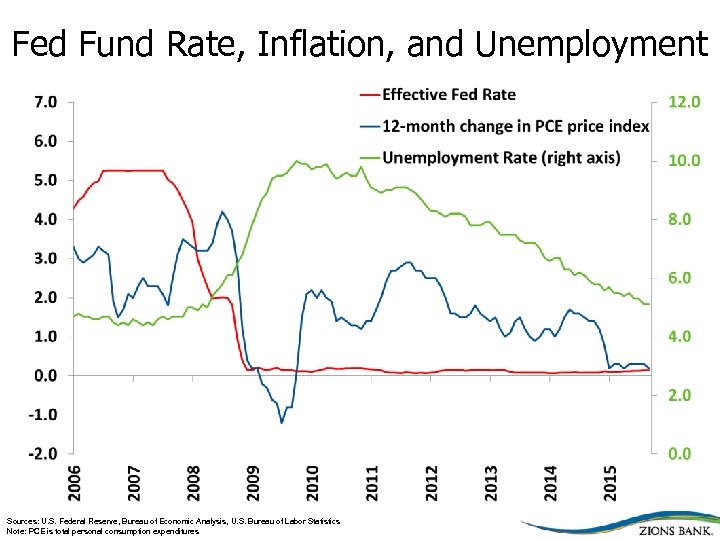

Fed Fund Rate, Inflation, and Unemployment Sources: U. S. Federal Reserve, Bureau of Economic Analysis, U. S. Bureau of Labor Statistics Note: PCE is total personal consumption expenditures

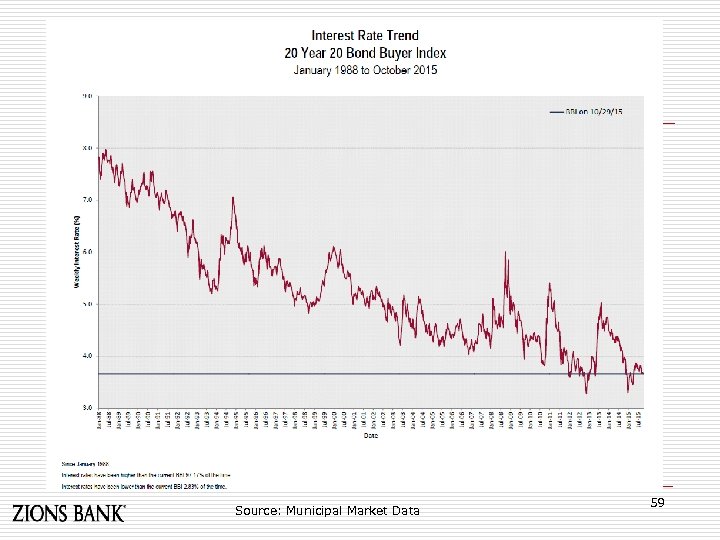

Source: Municipal Market Data 59

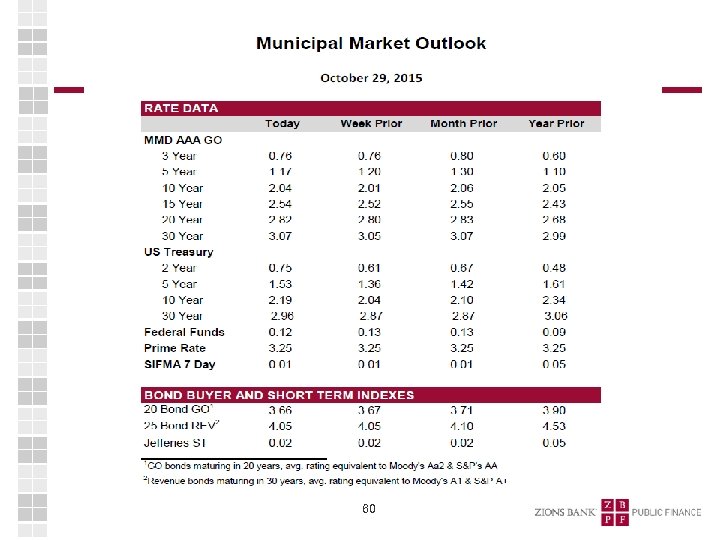

60

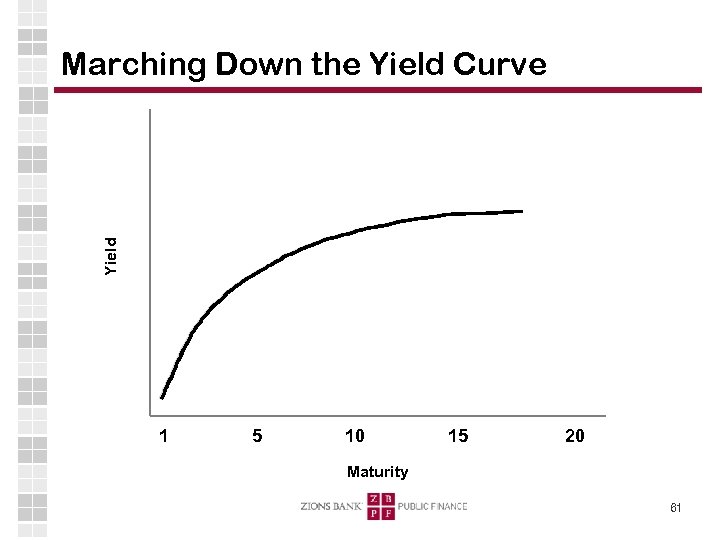

Yield Marching Down the Yield Curve 1 5 10 15 20 Maturity 61

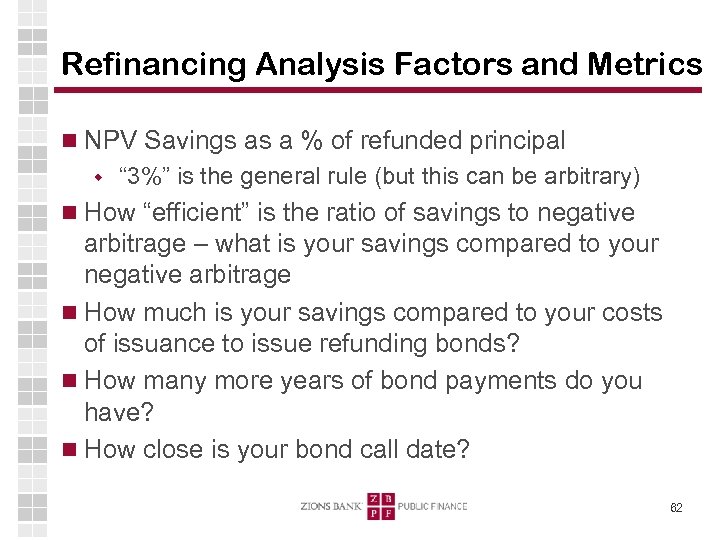

Refinancing Analysis Factors and Metrics NPV Savings as a % of refunded principal w “ 3%” is the general rule (but this can be arbitrary) How “efficient” is the ratio of savings to negative arbitrage – what is your savings compared to your negative arbitrage How much is your savings compared to your costs of issuance to issue refunding bonds? How many more years of bond payments do you have? How close is your bond call date? 62

Zions Bank Public Finance One South Main Street, 18 th Floor Salt Lake City, UT 84111 -1904 801 -844 -7373 jon. bronson@zionsbank. com 63

48d45b9b77366b7f0a6c8580a7390344.ppt