7630dfcded86a1fdc2062d682a19f01b.ppt

- Количество слайдов: 71

Bond Dealers of America National Fixed Income Conference Chapter 9 Update: As the World Turns Hot Topic – Municipalities in Distress? James E. Spiotto Chapman and Cutler LLP October 11, 2013 © 2013 by James E. Spiotto. All rights reserved. This is part of a presentation to the U. S. Securities and Exchange Commission field hearing at Birmingham, Alabama on July 29, 2011 on the State of the Municipal Securities Market, Remarks of James E. Spiotto of Chapman and Cutler LLP, and a book entitled MUNICIPALITIES IN DISTRESS? published by Chapman and Cutler LLP which is a 50 -State Survey of State Laws Dealing with Financial Emergencies of Local Governments, Rights and Remedies Provided by States to Investors in Financially Distressed Local Government Debt, and State Authorization of Municipalities to File Chapter 9 Bankruptcy, which is available from Chapman and Cutler LLP or on Amazon. com, PRIMER ON MUNICIPAL DEBT ADJUSTMENT, published by Chapman and Cutler LLP, which is available from Chapman and Cutler LLP, “The Role of the State in Supervising and Assisting Municipalities, Especially in Times of Financial Distress, ” by James E. Spiotto in the MUNICIPAL FINANCE JOURNAL, Winter/Spring 2013 and “All Eyes on Detroit: What Happens to Unfunded Pension Liabilities When a Municipality Files for Bankruptcy? ” MUNINET GUIDE (August 21, 2013), http: /www. muninetguide. com/print/php? id=604. 1 3472105

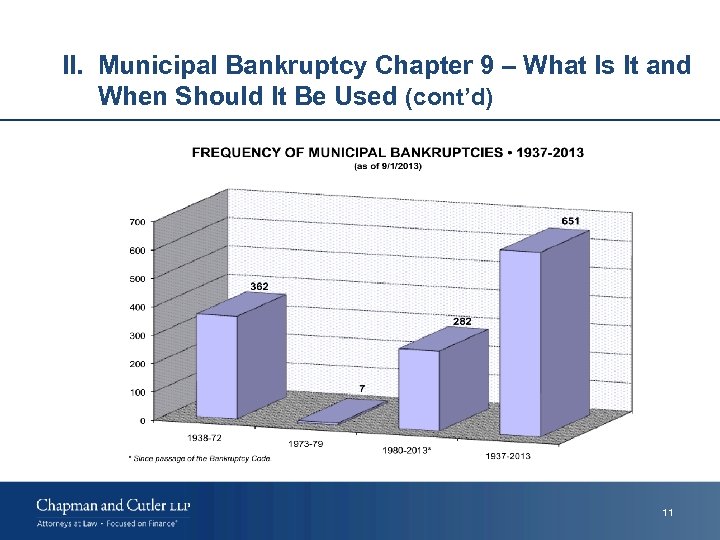

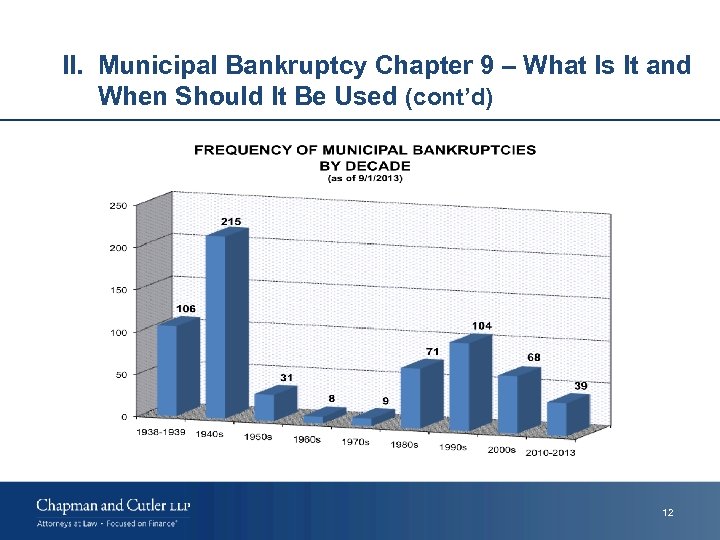

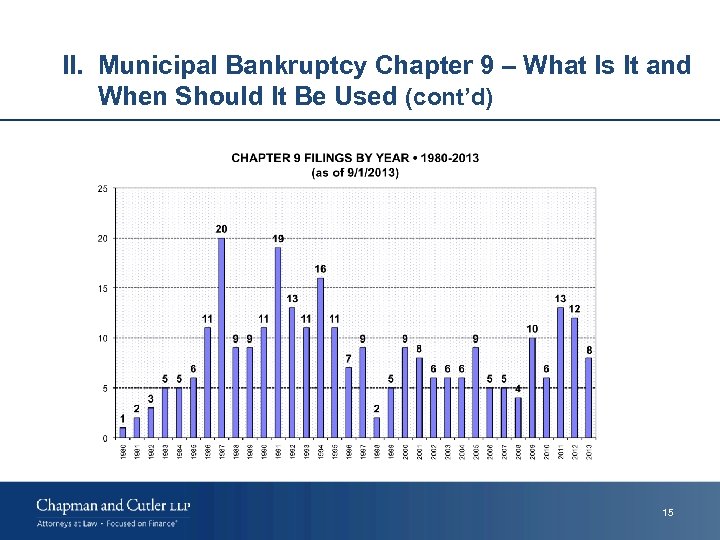

I. Summary of Significant Chapter 9 Related Events during 2012 and So Far in 2013 No Tsunami of Chapter 9 filings in 2012. • Only 12 Chapter 9 filings in 2012 and 8 so far in 2013. • Only 3 cities, towns, counties or villages in 2012, namely Stockton, San Bernardino and Mammoth Lakes (which was dismissed that year) and only 1 so far in 2013 – namely Detroit. • Total Chapter 9 filings since 1937 – 651 and 282 chapter 9 filings since 1980 (less than 9 per year on average). • Still RARE and mainly small special tax districts, municipal utilities. 2

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used A. What is Chapter 9? • Exclusive chapter of the Bankruptcy Code that provides a method for municipalities to adjust debt. • Not a tool for elimination of municipal debt. • It is voluntary, a municipality cannot be forced into bankruptcy. • States cannot also co-equal Sovereign with the federal Government cannot file for a Chapter 9 bankruptcy. 3

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) B. For What Purpose Has It Been Used? • To adjust the level of debt obligations of a municipality so the debt is sustainable and affordable. • To restructure burdensome labor contracts. • To avoid or restructure legal settlements and judgments. • Losses on or poor investment strategies. • To restructure pension and health care related liabilities. 4

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) • To restructure contractual obligations. • To restructure debt on a failed enterprise or proprietary project. • To restructure tax-exempt debt. • To be used as a last resort when all other compromise and restructuring efforts fail to reduce debt obligations of municipalities so that essential governmental services can continue to be provided. 5

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) C. Chapter 9 is not a tool for elimination of municipal debt: • Since a municipal unit is intended to continue to provide governmental services in perpetuity and is not intended to liquidate its assets to satisfy creditors but rather continue to function as a municipality, the primary purpose of Chapter 9 is to allow the municipality to continue operating and keep creditors away while it adjusts or refinances creditor claims. • Adjustment of the debts of a municipality is typically accomplished either by extending debt maturities, reducing the amount of principal or interest, or refinancing the debt by obtaining a new loan. • More appropriate to refer to Chapter 9 as municipal debt adjustment rather than municipal bankruptcy. It is voluntary, a municipality cannot be forced into bankruptcy. 6

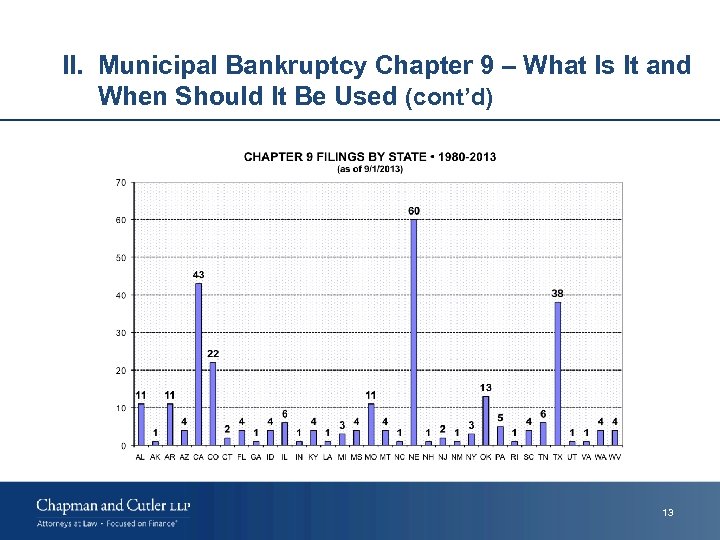

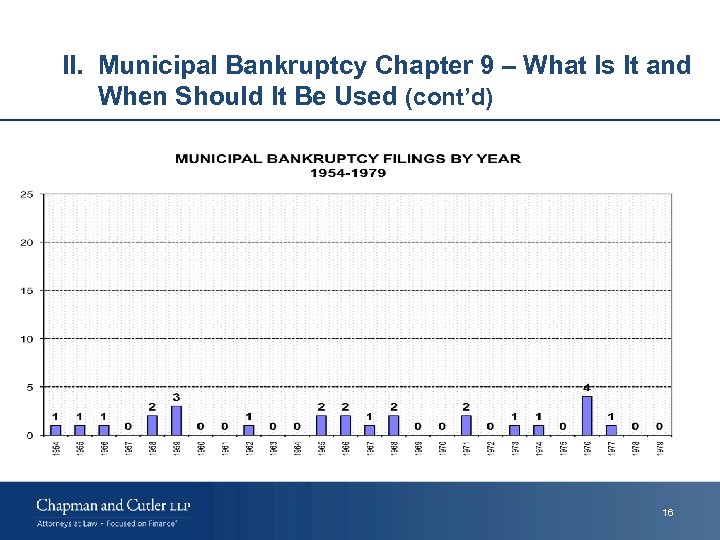

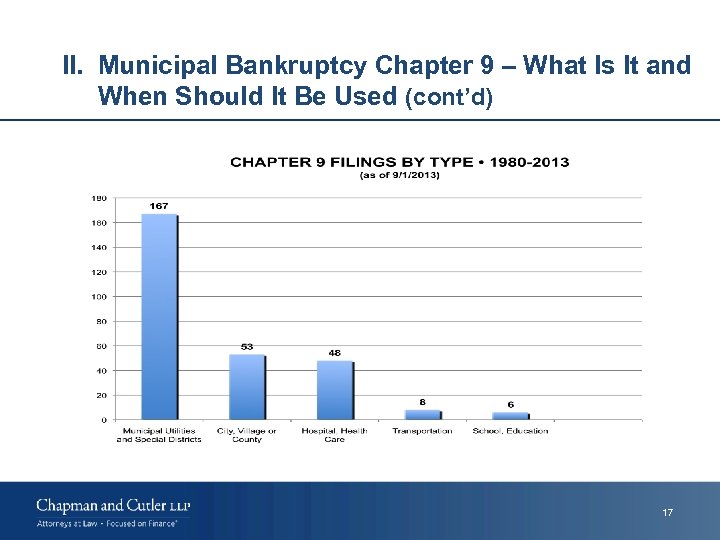

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) D. Historically the use of bankruptcy by municipalities has been rare: 1. Unlike corporations local governments rarely use Bankruptcy, Chapter 9 – generally only special tax districts and small municipalities file. No large issuers of municipal debt (with the exception of Orange County, California in 1994, Bridgeport, Connecticut in 1991, Vallejo, California in 2008, Jefferson County in 2011, Stockton, California in June, 2012, San Bernardino, California in August, 2012 and Detroit in in July of 2013) have filed in the last 30 years. There have been only 651 Chapter 9 filings since 1937. In 2008, 2009, 2010 and 2011 there were 4, 10, 6 and 13 respectively, municipal Chapter 9 filings. In 2012 there have been 12 Chapter 9 filings of which only 3 have been cities, towns or counties (Stockton, Mammoth Lakes and San Bernardino). There were 58, 721 business (14, 745 Chapter 11) filings in the year ending September 30, 2009 and 58, 322 business bankruptcy (14, 191 Chapter 11) filing in the year ending September 30, 2010. 7

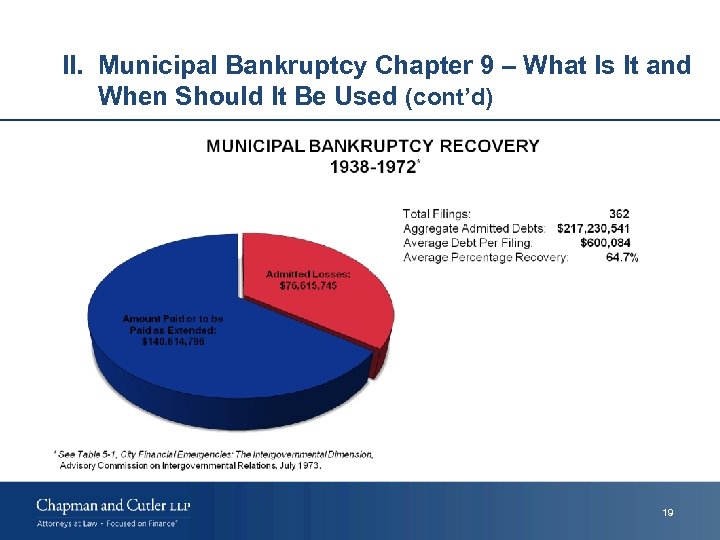

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 2. Comparing Chapter 11 corporate reorganization filings to Chapter 9 municipal debt adjustment filings reveals the historical strength, willingness to pay and credit quality of municipal bond debt. In 2009 and 2010, there were over 14, 000 Chapter 11 corporate reorganizations filed each year. Since 1937, there have only been 651 Chapter 9 cases filed, most of which have been small special tax district and entities that did not issue municipal bonds. 3. Further, of the 651 Chapter 9 municipal bankruptcy filings since 1937, 163 have been dismissed or closed without a plan of adjustment filed. Since 1980, there have been 282 Chapter 9 filings by municipalities and, of those, 84 have been dismissed or closed without a plan and only 53 of the 282 have been traditional local governments (town, cities, villages and counties). 8

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 4. Since 1954, virtually all of those municipalities that filed Chapter 9 were small or not major issuers of Bond Debt except for Bridgeport, Ct. in 1991, Orange County in 1994, Vallejo, Ca. in 2008, Jefferson County, Al. in 2011, Stockton and San Bernardino, Ca. in 2012 and Detroit in 2013. Both Harrisburg, Pa. and Boise County, Id. In 2011 were dismissed as was Bridgeport in 1991. 9

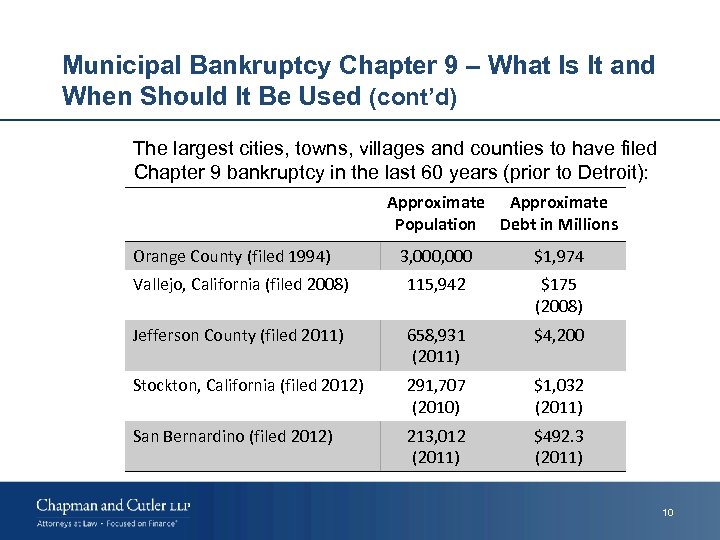

Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) The largest cities, towns, villages and counties to have filed Chapter 9 bankruptcy in the last 60 years (prior to Detroit): Approximate Population Debt in Millions Orange County (filed 1994) 3, 000 $1, 974 Vallejo, California (filed 2008) 115, 942 $175 (2008) Jefferson County (filed 2011) 658, 931 (2011) $4, 200 Stockton, California (filed 2012) 291, 707 (2010) $1, 032 (2011) San Bernardino (filed 2012) 213, 012 (2011) $492. 3 (2011) 10

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 11

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 12

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 13

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 14

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 15

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 16

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 17

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 18

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 19

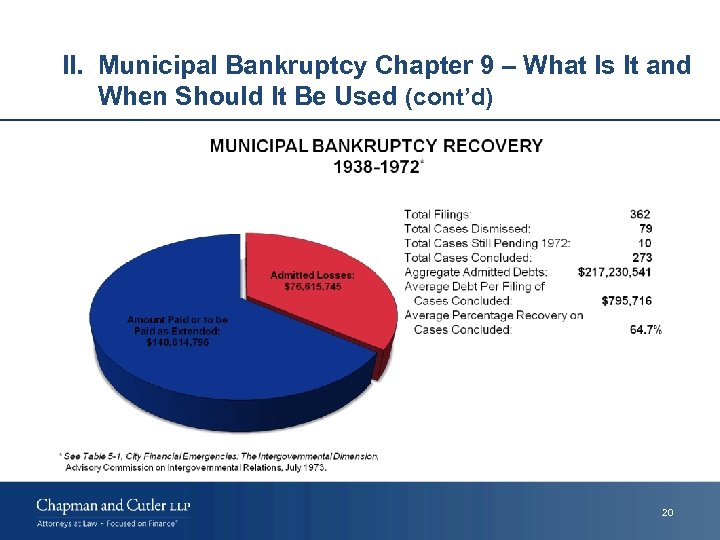

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 20

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 21

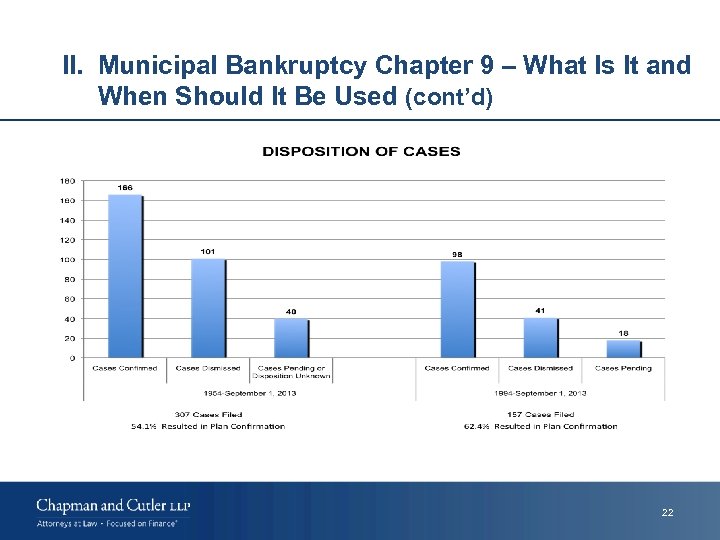

II. Municipal Bankruptcy Chapter 9 – What Is It and When Should It Be Used (cont’d) 22

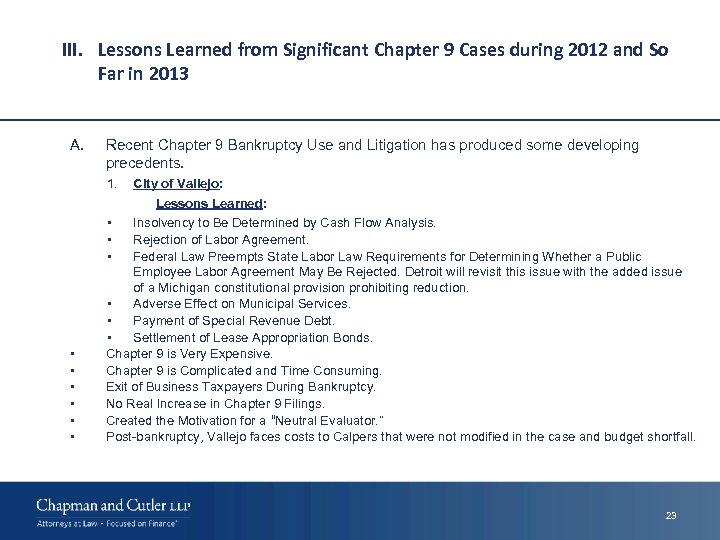

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 A. Recent Chapter 9 Bankruptcy Use and Litigation has produced some developing precedents. 1. City of Vallejo: Lessons Learned: • • • Insolvency to Be Determined by Cash Flow Analysis. Rejection of Labor Agreement. Federal Law Preempts State Labor Law Requirements for Determining Whether a Public Employee Labor Agreement May Be Rejected. Detroit will revisit this issue with the added issue of a Michigan constitutional provision prohibiting reduction. • Adverse Effect on Municipal Services. • Payment of Special Revenue Debt. • Settlement of Lease Appropriation Bonds. Chapter 9 is Very Expensive. Chapter 9 is Complicated and Time Consuming. Exit of Business Taxpayers During Bankruptcy. No Real Increase in Chapter 9 Filings. Created the Motivation for a “Neutral Evaluator. ” Post-bankruptcy, Vallejo faces costs to Calpers that were not modified in the case and budget shortfall. 23

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) 2. Jefferson County, AL: (a) Legal Issues Raised: § Special Revenues Decision – Special Revenues are not to be impaired in Chapter 9, are as defined in the Indenture and the authorizing resolution and cannot be reduced or impaired by the municipality in Chapter 9. (Presently a dispute over the sufficiency of rates charged to sewer customers and the efficacy of the rate covenant and whether the pledge of Special Revenues can be valued. ) § Eligibility – Challenges to authorization to file under state law clarified by Bankruptcy Court and Alabama Supreme Court ruling. Compliance of the County with the Indenture Rate Covenants being sufficient to pay debt service and capital expenditure and operating expenses is being litigated in the Trustee’s lift stay motion. 24

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) (b) Lessons Learned from Jefferson County, AL: § § § Refinancing Cures All Ills. § Terms of the Indenture Defined and Limited Operating Expenses the Pledge of Revenues Subject to. § § Role of the Bankruptcy Court in Adjudicating Inter-creditor Issues. § Plan Developed Based on Consensus of Major Creditor Groups Helps Disclosure Statement and Confirmation Process. Can a Feasible Plan Be Proposed. A Municipality Needs the Power to Legislate and Levy Needed Taxes. Special Revenues Are to Be Unimpaired by a Chapter 9 Filing. Benefits of Statutory Lien and Special Revenue Status. Also Raise Issue of General Obligation Debt, Willingness and Ability to Pay and Role of State to Provide General Fund Relief. Trustee Declines to Make Interest Payment Despite Available Funds and Seeks Court Declaration to Resolve Inter-creditor Issues. 25

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) 3. Stockton, CA: (a) Legal Issues Raised: § Eligibility – Growing trend of challenging the authorization to file but, unlike dismissal in Boise County, Idaho in 2011, court held Stockton’s filing was in good faith and it was insolvent. § Pension Priority – Calpers with city support asserted a priority of pension payments under state law but both deny same priority to bonds and credit enhancers used to finance that obligation. § Impairment of Contract and the Bankruptcy Code – On a preliminary basis, the Stockton court has held that a State constitutional provision prohibiting the impairment of contracts is trumped by the Bankruptcy Clause of the U. S. Constitution and that retired city employees’ health benefits can be impaired. (No specific California provision directed to retiree benefits. ) § Settlement – The Court recently ruled in the Stockton case that Bankruptcy Rule 9019 does not apply to post-petition settlements made between creditors and Chapter 9 Debtors as municipalities (Section 904 of Bankruptcy Court imposes limitations on Court’s jurisdiction. No Bankruptcy Court jurisdiction over property, revenues, political or governmental powers or debtor’s use and enjoyment of income producing property. Can such agreement withstand the test of “fair and equitable” at the time of confirmation of a plan? 26

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) (b) Lessons Learned from Stockton, CA: § § Neutral Evaluator Did Not Result in Out-of-Court Resolution. City Still Filed. § Largest Unsecured Creditor, Calpers Followed by Trustee for Pension Obligation Bonds and Another Trustee for Three Other Sets of Bondholders. § Bankruptcy Court Holds that Rule 9019 Does Not Apply to Chapter 9 Debtors and Debtor Is Free to Make Settlement Payments to Prepetition Creditors during a Chapter 9 Based upon Section 904 of the Bankruptcy Code. § Although City Negotiated Deals with Other Unions Over Pension Benefits, Obligations to Calpers Remains Essentially Untouched in City Proposal. § Stockton’s city council has approved a plan to adjust the debt. The draft plan reflects agreed upon settlements with bond insurers, primarily through a proposed sales tax increase, that includes a certain reductions, stretching out some payments and taking over properties. The plan appears to leave untouched the obligations to Calpers. Objections by Bond Insurers that City Ineligible to File Chapter 9 as It Failed to Negotiate Prepetition in Good Faith and Did Not Meet the Definition of “Insolvency” Unsuccessful. 27

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) 4. San Bernardino Bankruptcy: (a) Legal Issues Raised: • Exception to Neutral Evaluator – Ability of municipalities to bypass neutral evaluator by claiming a “fiscal emergency” by adopting a resolution at a noticed public hearing that includes findings that financial state of the municipality jeopardizes the health, safety or well being of its residents absent bankruptcy protection and the municipality is or will not be able to meet its obligations within the next 60 days. • Pension Issues – Calpers’ actions to seek permission to sue the City to force it to make pension payments post petition based on Calpers’ state rights and argument that such action by Calpers is contrary to the Supremacy Law and Federal Law pre-emption. • Eligibility – Calpers has raised Chapter 9 eligibility of San Bernardino (eligibility appears to be the regular question raised by creditors in a Chapter 9). • Ruling – Court finally ruled in August of 2013 that San Bernardino was eligible to file for Chapter 9. 28

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) (b) Lessons Learned from San Bernardino, CA: § § § Neutral Evaluator Bypassed Because of “Fiscal Emergency”. § Bond Insurers Countered with Reference to the Supremacy Clause and the Argument that the Bankruptcy Code Preempts and Supersedes Inconsistent State Law. § Bankruptcy Court Denies Calpers Request to Lift the Automatic Stay to Sue City in California State Court. § Chapter 9 Eligibility Issue Raised by Calpers Decided by the Bankruptcy Court in Favor of City Officials Stopped Paying into the State Pension Fund after Filing. Calpers Asserted City’s Action Violated State Law Protecting Pensions of Public Employees and Requested the Bankruptcy Court for Permission to Sue the City to Force It to Make Pension Payments. 29

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) 5. Central Falls, RI Bankruptcy: (a) Legal Issues Raised: • Use of Receiver – City’s Attempt Pre-filing to Have a Court Appoint a Receiver Was a Shock to the Market. • Public Debt First Lien – Statutory Lien for All Public Debt of Municipalities to Prevent Negative Contagion. (b) Lessons Learned from Central Falls, RI: • Expedited Process – Confirmed Plan and Exited Chapter 9 Proceedings in 15 Month – Fastest Chapter 9 for a City, Town and County in Last 10 Years. • Can the Municipality Survive Without Pension Adjustments – Issues Related to State Pension Funds and Ability to Adjust Municipal Obligations. • Removing the Hostage – The First Lien Position of Public Debt-Focus the Remaining Parties on What Is Sustainable and Affordable. 30

III. Lessons Learned from Significant Chapter 9 Cases during 2012 and So Far in 2013 (cont’d) 6. Detroit, RI: • Need For Help Early– Major Cities in Distress Need Help from the State and Financial Problems of Major Cities Only Get Worse if Not Addressed. • Labor Costs – Labor Costs Must be Sustainable and Affordable and Not Interfere with Providing Essential Governmental Services. • Should the Municipality Shoulder All the Costs – The Need to Transfer Burdensome Costs of Certain Services to Other Governmental Bodies. • Buy-Ins – Local “Buy-In” Is Necessary for a Successful Recovery Plan. • Hot Issues – Bankruptcy filing of Detroit raises Eligibility and Federal Bankruptcy Court Jurisdiction Issues: Does the “Do not impair or diminish” provision of Michigan Constitution for Public workers’ pensions create an obstacle to eligibility to file or Confirmation of a Plan? (On September 24, 2013, Puerto Rico Supreme Court ruled Pensions can be impaired for a higher public purpose. ) • Should the Bankruptcy Court determine whether the Financing Manager Law in Michigan is constitutional as a impediment to Eligibility to file? • To What Extent should the Bankruptcy Court review settlement with “secured” creditors? • Can the Bankruptcy Court determine Federal and State Constitution Issues and determine State Law? 31

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 A. Alternatives to Chapter 9 and solutions to Pension Underfunding are still being developed and used. • Central Falls and Rhode Island demonstrate protection of financing credibility by granting a first lien to public bonds and notes; protect financing and use of receiver can help expedite a Chapter 9 filing if necessary. • Michigan voted out Public Law 4 – Emergency Manager with extraordinary power on November 6, 2012 and passed in December 2012 the Local Financial Stability and Choice, which gives a financially distressed municipality a choice of (1) entering into Consent Decree with the State (2) agreeing to the appointment of a Emergency Manager (3) agreeing to a neutral evaluation process or (4) filing a chapter 9 bankruptcy petition if so approved by the governor. Ultimately, in 2013, an Emergency Manager was appointed and, with the agreement of Michigan’s Governor, a Chapter 9 was filed. 32

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • Indiana enacted legislation under which emergency manager may be appointed to oversee a distressed political subdivision in the State. The municipal manager may assume and exercise the authority of the executive or board of the municipality including approving the budget, making expenditures and loans, negotiating labor contracts and reducing or suspending employee salaries and entering into agreements with other municipalities but does not have the power to impose taxes and fees. • Consideration and use of receivers, manager or “supervising adults” increasing in popularity. 33

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • Consideration by numerous state legislatures of increased supervision and oversight protocols, use of neutral evaluators, assistance to municipalities. • Success in litigation to reduce COLA and labor benefits out of financial necessity following court victories in Minnesota, Colorado and South Dakota. New Jersey and Rhode Island have also passed legislation limiting COLA and labor benefits. • State legislatures considering legislation to address pension and OPEB under-funding. 34

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • No increase in authorization to file Chapter 9. • Current (2013) litigation in the San Bernardino and Detroit Chapter 9 proceedings may determine the priority of and extent to which Chapter 9 can adjust pension obligations and therefore whether a potential source of financial distress can be reduced or eliminated. Detroit presents the issue of the impact of State constitutional provisions prohibiting the reduction in pension benefits. 35

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • The Pension Funding Issues: • California League of Cities has noted that pension costs have risen 25% or more in the last three years for most California municipalities. • By 2013 -2014, it will be common for California municipalities to pay 50% of a policeman’s salary, 40% of a firefighter’s salary and 25% of other workers salaries for pensions. • Most cities, since 2007 and the economic recession, have had to resort to layoffs, furloughs, reductions in work force, deferral of preventative maintenance on infrastructure and use of one time reserve to get by. 36

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • If pension costs are not mitigated and are underfunded and if pension obligations are not reduced, cities will be fiscally unsustainable and politically untenable. • Stockton, San Bernardino and Detroit are only the tip of the iceberg if relief from unaffordable pension costs is not obtained. • State Pension Funds demand full payment and if a city tries to withdraw, like Santa Rosa in 2009 or City of San Jose City Council, the cost of withdraw is two or three times ongoing costs because of the penalty rate for withdrawal. 37

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • Support for reform is growing, including the following proposals from the California League of Cities: • Employees should pay the employee’s share of Calpers costs, 7 to 8% generally and 8 to 9% for safety employees. • Retiree benefits should be based on average as opposed to single highest annual salary. • New hybrid pension or defined contribution plan for new hires – which is more a long-term cure. • Disability should be carefully scrutinized. • Retirement age should be extended and percentages of benefits reduced. 38

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • COLA 3% annual increase in retirement benefit should be reduced to CPI or eliminated. • Limit maximum retiree benefit to 70% of eligible base pay. • There is recognition that benefits are far more generous than private sector and are not sustainable or affordable. 39

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • Pension Fund alternatives: • Remember the tree that does not bend in the wind will be uprooted. • Pension Funds can insist municipalities pay everything required without adjustment and watch municipalities struggle and fail. • Rather than demand payment of more than can be paid, Pension Funds should help determine what is sustainable and affordable and can be paid by the municipalities while providing essential governmental services. 40

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • Without adjustments, municipalities will be doomed to be asked to pay more than is affordable, leading to underfunding or reduced services and the eventual meltdown of the municipalities. • Also, change now will avoid the growing revolts by municipalities like Pacific Grove who have raised the question of Pension Fund mismanagement and claim they should not have to pay for Pension Fund failures. 41

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • Simple Solution. • Determine and pay what is sustainable and affordable by the municipality. • Require annual payments of what is sustainable and affordable to have dedicated and sufficient source of annual payment that will be made and cannot be altered. • No increase pension or OPED benefits without sufficient identifiable source of payment. • As municipality improves based on sound recovery plan, periodic review of what is sustainable and affordable and adjustments so that all that can be paid will be paid. 42

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) • In exchange for this adjustment and flexibility provide ongoing Safety Net, of at least equivalent to Social Security Benefits to public worker who do not currently have Social Security Benefits, by means of public or private insurance 43

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) B. A Current Hot Issue: Determine Eligibility to File • To be a Debtor in a Chapter 9, an entity must be: • • • An entity that is a municipality (political subdivision, public agency or instrumentality of State – States are a co-Sovereign with the Federal Government and cannot file for Chapter 9). Specifically authorized under State law to be a Debtor. Insolvent: • Proving insolvency can be challenging. As Municipality has to prove it is not paying its debts or is unable to pay its debts when they come due. • Willing to effectuate a plan. • Either have obtained the agreement of creditors holding majority amount of the claim of each class that the municipality intends to impair or have attempted to negotiate in good faith, but was unable to do so or it was impractical to negotiate with creditors or a creditor is attempting to obtain a preference. 44

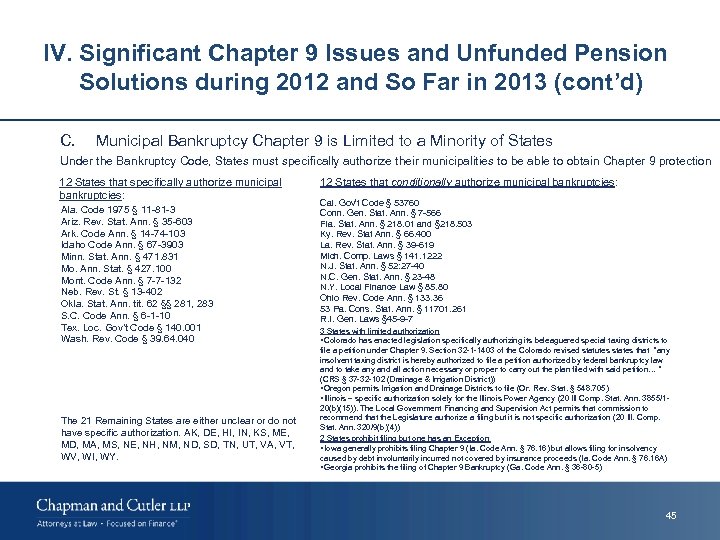

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) C. Municipal Bankruptcy Chapter 9 is Limited to a Minority of States Under the Bankruptcy Code, States must specifically authorize their municipalities to be able to obtain Chapter 9 protection 12 States that specifically authorize municipal bankruptcies: Ala. Code 1975 § 11 -81 -3 Ariz. Rev. Stat. Ann. § 35 -603 Ark. Code Ann. § 14 -74 -103 Idaho Code Ann. § 67 -3903 Minn. Stat. Ann. § 471. 831 Mo. Ann. Stat. § 427. 100 Mont. Code Ann. § 7 -7 -132 Neb. Rev. St. § 13 -402 Okla. Stat. Ann. tit. 62 §§ 281, 283 S. C. Code Ann. § 6 -1 -10 Tex. Loc. Gov’t Code § 140. 001 Wash. Rev. Code § 39. 64. 040 The 21 Remaining States are either unclear or do not have specific authorization. AK, DE, HI, IN, KS, ME, MD, MA, MS, NE, NH, NM, ND, SD, TN, UT, VA, VT, WV, WI, WY. 12 States that conditionally authorize municipal bankruptcies: Cal. Gov’t Code § 53760 Conn. Gen. Stat. Ann. § 7 -566 Fla. Stat. Ann. § 218. 01 and § 218. 503 Ky. Rev. Stat Ann. § 66. 400 La. Rev. Stat. Ann. § 39 -619 Mich. Comp. Laws § 141. 1222 N. J. Stat. Ann. § 52: 27 -40 N. C. Gen. Stat. Ann. § 23 -48 N. Y. Local Finance Law § 85. 80 Ohio Rev. Code Ann. § 133. 36 53 Pa. Cons. Stat. Ann. § 11701. 261 R. I. Gen. Laws § 45 -9 -7 3 States with limited authorization §Colorado has enacted legislation specifically authorizing its beleaguered special taxing districts to file a petition under Chapter 9. Section 32 -1 -1403 of the Colorado revised statutes states that “any insolvent taxing district is hereby authorized to file a petition authorized by federal bankruptcy law and to take any and all action necessary or proper to carry out the plan filed with said petition… ” (CRS § 37 -32 -102 (Drainage & Irrigation District)) §Oregon permits Irrigation and Drainage Districts to file (Or. Rev. Stat. § 548. 705) §Illinois – specific authorization solely for the Illinois Power Agency (20 Ill Comp. Stat. Ann. 3855/120(b)(15)). The Local Government Financing and Supervision Act permits that commission to recommend that the Legislature authorize a filing but it is not specific authorization (20 Ill. Comp. Stat. Ann. 320/9(b)(4)) 2 States prohibit filing but one has an Exception §Iowa generally prohibits filing Chapter 9 (Ia. Code Ann. § 76. 16) but allows filing for insolvency caused by debt involuntarily incurred not covered by insurance proceeds (Ia. Code Ann. § 76. 16 A) §Georgia prohibits the filing of Chapter 9 Bankruptcy (Ga. Code Ann. § 36 -80 -5) 45

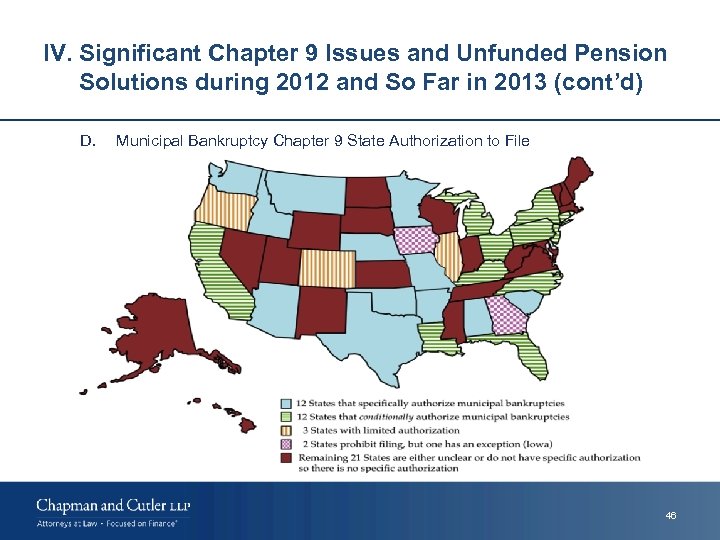

IV. Significant Chapter 9 Issues and Unfunded Pension Solutions during 2012 and So Far in 2013 (cont’d) D. Municipal Bankruptcy Chapter 9 State Authorization to File 46

V. Alternatives to Chapter 9 and Debt Resolution Mechanisms A. Alternatives to Chapter 9 still being developed and used – Receivers, Financial Managers, Financial Control and Oversight Boards: • Receiver – Central Falls and Rhode Island demonstrate protection of financing credibility by granting a first lien to public bonds and notes; protect financing and use of receiver can help expedite a Chapter 9 filing if necessary. • Financial Manager – Michigan voted out Public Law 4 – Emergency Manager with extraordinary power on November 6, 2012 and passed in December 2012 the Local Financial Stability and Choice, which gives a financially distressed municipality a choice of (1) entering into Consent Decree with the State (2) agreeing to the appointment of a Emergency Manager (3) agreeing to a neutral evaluation process or (4) filing a chapter 9 bankruptcy petition if so approved by the governor. Ultimately, in 2013, an Emergency Manager was appointed and, with the agreement of Michigan’s Governor, a Chapter 9 was filed. • Supervision Without a Chapter 9 Alternative – Indiana enacted legislation under which emergency manager may be appointed to oversee a distressed political subdivision in the State: • • Consideration and use of receivers, manager or “supervising adults” increasing in popularity. Consideration by numerous state legislatures of increased supervision and oversight protocols, use of neutral evaluators, assistance to municipalities and legislation to address pension and OPEB under-funding. 47

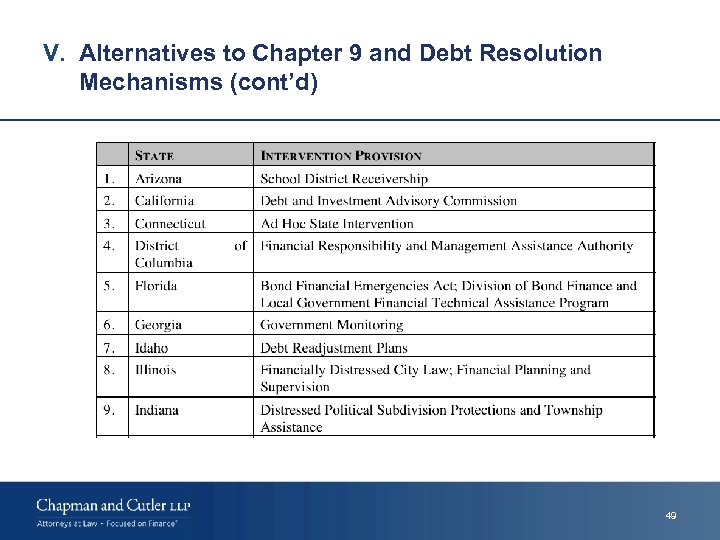

V. Alternatives to Chapter 9 and Debt Resolution Mechanisms (cont’d) B. At least twenty-five States have implemented some form of municipal debt supervision or restructuring mechanism to aid municipalities: • These range from Debt Advisory Commission (e. g. California) and Technical Assistance Programs (Florida) which provide guidance for and keep records of issuance of municipal debt to the layered approach of Rhode Island Michigan of oversight, commission and fiscal manager or receiver. • Examples of State Oversight, Supervision and Assistance for Fiscal Emergencies of Local Government. 48

V. Alternatives to Chapter 9 and Debt Resolution Mechanisms (cont’d) 49

V. Alternatives to Chapter 9 and Debt Resolution Mechanisms (cont’d) 50

V. Alternatives to Chapter 9 and Debt Resolution Mechanisms (cont’d) 51

V. Alternatives to Chapter 9 and Debt Resolution Mechanisms (cont’d) C. States recognize the use of a Municipal Receiver: • The Rhode Island Experience and The City of Central Falls: • Overseers. • Budget Commission. • Receiver. • Chapter 9. • Texas’ use of judicially appointed Receiver vs. Financial Control Board, emergency financial managers, coordination overseers and Refinance. 52

V. Alternatives to Chapter 9 and Debt Resolution Mechanisms (cont’d) D. Financial Control Boards and Active Supervision Examples: • The New York Experience. • The Pennsylvania Experience. • The Michigan Experience. • The Massachusetts Ad Hoc Experience. • The California Experience – Neutral Evaluator. 53

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments A. The Structure for Oversight Protection Financing: • Grants from Federal, State and Regional Governmental Bodies. • Loans from Federal, State and Regional Governmental Bodies. • State Intercepts of Tax Revenue. • Involvement in Local Government Budget Process. • Required Financial Performance and Targeted Levels of Essential Governmental Services. 54

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments (cont’d) • State Legislative Assistance in Tax Revenue and Powers. • Backup by Moral Obligations of the State. • Considerations Regarding the Appointment of Authority Members. • Acceleration of Loans and Obligations if Performance Triggers Are Violated. • Dealing with the Press. • What Powers Are Essential for State Oversight and Assistance. • Exploration of Transfer of Certain Governmental Services (and related costs) to other Governmental Bodies. • Consolidation of Regional Essential Governmental Services. 55

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments (cont’d) B. A State Municipal Refinancing or Restructuring Board (could be pursuant to special legislation) Would Supervise a Distressed Local Government and Be Able to: • Require balanced budgets, provide economic discipline and reporting; • Issue debt in state name or separate entity to obtain market credibility and access; • Have power to negotiate debt restructuring and quasijudicial jurisdiction; 56

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments (cont’d) • Review services or costs that can be transferred to other governmental bodies; • Have right to intercept tax revenue and ensure payment for essential services and necessary operating costs; • Have power to authorize Chapter 9 if needed; • Bridge financing or refinancing of troubled debt; • Transfer certain services to other governmental agencies to reduce expenditures; • Grant funds to the municipality to bridge the financial crisis; 57

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments (cont’d) • Loan funds to the municipality on terms that are realistic or payable from out-of-state tax sources that can be offset; • Use intercept of state tax payable to municipality to ensure essential municipal service; • Private Public Partnerships - Lease and Sale of Municipal Properties to provide bridge financing and cash flow relief; 58

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments (cont’d) • Vendor Assistance Program – Providing Vendor Payments through securitization financing of payables. Payment from dedicated tax revenues over time. Provide current cash flow relief from current or future Vendor payments; • Explore Consolidation on a Regional Basis of Certain Governmental Services; and • Monitor compliance with any restructuring plan to ensure compliance and prevent financial erosion. 59

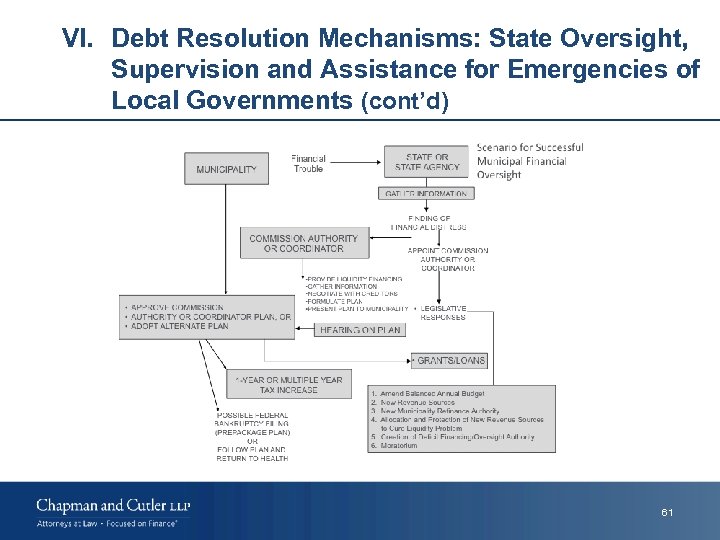

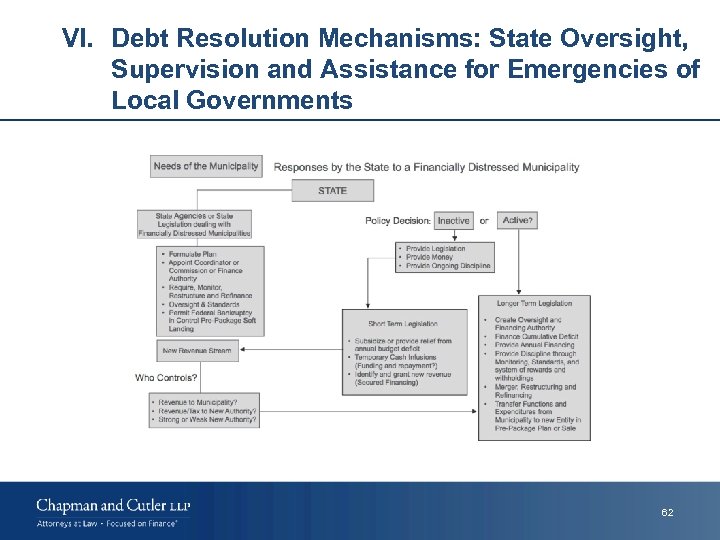

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments (cont’d) C. Examples of Structure for Municipal Financial Oversight and State Supervision of Financially Distressed Municipal. 60

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments (cont’d) 61

VI. Debt Resolution Mechanisms: State Oversight, Supervision and Assistance for Emergencies of Local Governments 62

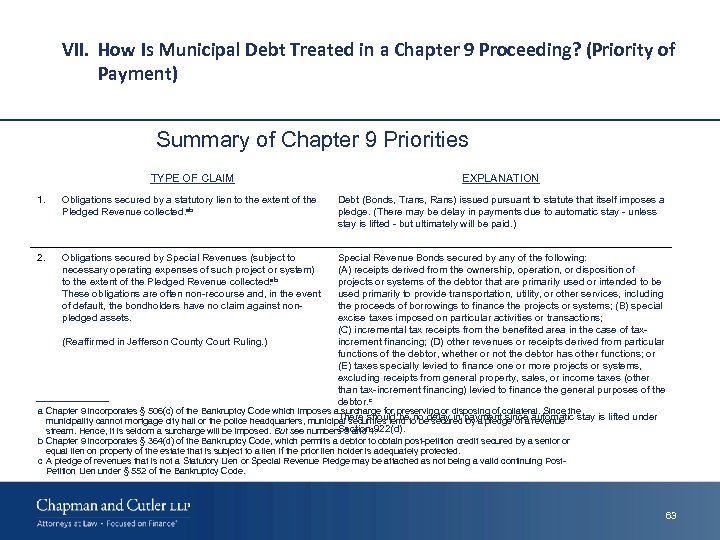

VII. How Is Municipal Debt Treated in a Chapter 9 Proceeding? (Priority of Payment) Summary of Chapter 9 Priorities TYPE OF CLAIM EXPLANATION 1. Obligations secured by a statutory lien to the extent of the Pledged Revenue collected. ab Debt (Bonds, Trans, Rans) issued pursuant to statute that itself imposes a pledge. (There may be delay in payments due to automatic stay - unless stay is lifted - but ultimately will be paid. ) 2. Obligations secured by Special Revenues (subject to necessary operating expenses of such project or system) to the extent of the Pledged Revenue collected. ab These obligations are often non-recourse and, in the event of default, the bondholders have no claim against nonpledged assets. Special Revenue Bonds secured by any of the following: (A) receipts derived from the ownership, operation, or disposition of projects or systems of the debtor that are primarily used or intended to be used primarily to provide transportation, utility, or other services, including the proceeds of borrowings to finance the projects or systems; (B) special excise taxes imposed on particular activities or transactions; (C) incremental tax receipts from the benefited area in the case of tax(Reaffirmed in Jefferson County Court Ruling. ) increment financing; (D) other revenues or receipts derived from particular functions of the debtor, whether or not the debtor has other functions; or (E) taxes specially levied to finance one or more projects or systems, excluding receipts from general property, sales, or income taxes (other than tax-increment financing) levied to finance the general purposes of the debtor. c a Chapter 9 incorporates § 506(c) of the Bankruptcy Code which imposes a surcharge for preserving or disposing of collateral. Since the There should be no delay in payment since automatic stay is lifted under municipality cannot mortgage city hall or the police headquarters, municipal securities tend to be secured by a pledge of a revenue Section 922(d). stream. Hence, it is seldom a surcharge will be imposed. But see numbers 3 and 4. b Chapter 9 incorporates § 364(d) of the Bankruptcy Code, which permits a debtor to obtain post-petition credit secured by a senior or equal lien on property of the estate that is subject to a lien if the prior lien holder is adequately protected. c A pledge of revenues that is not a Statutory Lien or Special Revenue Pledge may be attached as not being a valid continuing Post. Petition Lien under § 552 of the Bankruptcy Code. 63

VII. How Is Municipal Debt Treated in a Chapter 9 Proceeding? (Priority of Payment) (cont’d) TYPE OF CLAIM EXPLANATION 3. Secured Lien based on Bond Resolution or contractual provisions that does not meet test of Statutory Lien or Special Revenues to the extent perfected prepetition, subject to the value of prepetition property or proceeds thereof. c Under language of Sections 522 and 958, liens on such collateral would not continue postpetition. After giving value to the prepetition lien on property or proceeds, there is an unsecured claim to the extent there is recourse to the municipality or Debtor. You may expect the creditor to argue that pursuant to Section 904, the Court cannot interfere with the property or revenues of the Debtor, and that includes the grant of security to such secured creditor. 4. Obligations secured by a municipal facility lease financing. Under Section 929 of the Bankruptcy Code, even if the transaction is styled as a municipal lease, a financing lease will be treated as long-term debt and secured to the extent of the value of the facility. 5. Administrative Expenses (which would include Pursuant to Section 943, all amounts must be disclosed expenses incurred in connection with the Chapter and be reasonable for a Plan of Adjustment to be 9 case itself). d Chapter 9 incorporates Section confirmed. 507(a)(2) which, by its terms, provides a priority for administrative expenses allowed under Section 503(b). These would include the expenses of a committee or indenture trustee making a substantial contribution in a Chapter 9 d These expenses strictly relate to the costs of the bankruptcy. Because the bankruptcy court cannot interfere with the government and affairs of the municipality, general operating expenses of the municipality are not within the control of the court, are not discharged and will case. remain liabilities of the municipality after the confirmation of a plan or dismissal of the case. 64

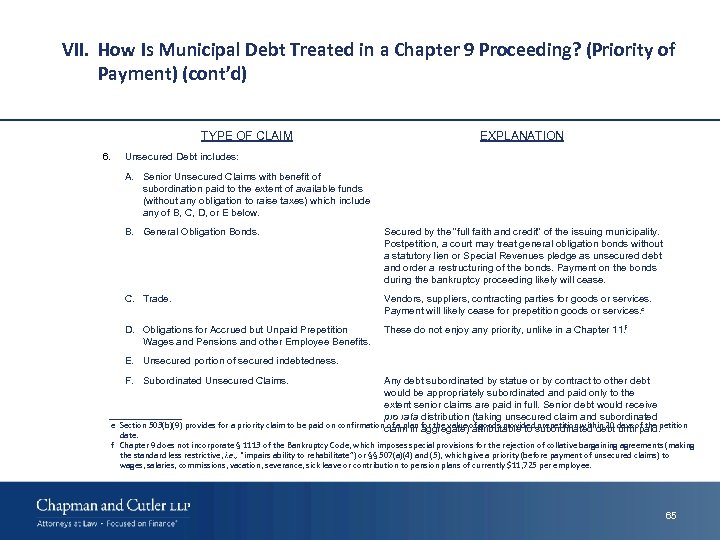

VII. How Is Municipal Debt Treated in a Chapter 9 Proceeding? (Priority of Payment) (cont’d) TYPE OF CLAIM 6. EXPLANATION Unsecured Debt includes: A. Senior Unsecured Claims with benefit of subordination paid to the extent of available funds (without any obligation to raise taxes) which include any of B, C, D, or E below. B. General Obligation Bonds. Secured by the “full faith and credit” of the issuing municipality. Postpetition, a court may treat general obligation bonds without a statutory lien or Special Revenues pledge as unsecured debt and order a restructuring of the bonds. Payment on the bonds during the bankruptcy proceeding likely will cease. C. Trade. Vendors, suppliers, contracting parties for goods or services. Payment will likely cease for prepetition goods or services. e D. Obligations for Accrued but Unpaid Prepetition Wages and Pensions and other Employee Benefits. These do not enjoy any priority, unlike in a Chapter 11. f E. Unsecured portion of secured indebtedness. F. Subordinated Unsecured Claims. Any debt subordinated by statue or by contract to other debt would be appropriately subordinated and paid only to the extent senior claims are paid in full. Senior debt would receive pro rata distribution (taking unsecured claim and subordinated e Section 503(b)(9) provides for a priority claim to be paid on confirmation of a plan for the value of goods provided prepetition within 20 days of the petition claim in aggregate) attributable to subordinated debt until paid. date. f Chapter 9 does not incorporate § 1113 of the Bankruptcy Code, which imposes special provisions for the rejection of collative bargaining agreements (making the standard less restrictive, i. e. , “impairs ability to rehabilitate”) or §§ 507(a)(4) and (5), which give a priority (before payment of unsecured claims) to wages, salaries, commissions, vacation, severance, sick leave or contribution to pension plans of currently $11, 725 per employee. 65

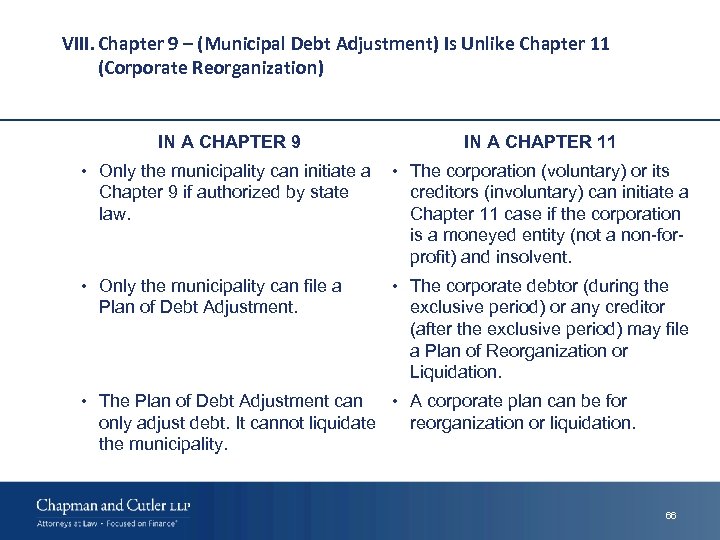

VIII. Chapter 9 – (Municipal Debt Adjustment) Is Unlike Chapter 11 (Corporate Reorganization) IN A CHAPTER 9 IN A CHAPTER 11 • Only the municipality can initiate a • The corporation (voluntary) or its Chapter 9 if authorized by state creditors (involuntary) can initiate a law. Chapter 11 case if the corporation is a moneyed entity (not a non-forprofit) and insolvent. • Only the municipality can file a Plan of Debt Adjustment. • The corporate debtor (during the exclusive period) or any creditor (after the exclusive period) may file a Plan of Reorganization or Liquidation. • The Plan of Debt Adjustment can • A corporate plan can be for only adjust debt. It cannot liquidate reorganization or liquidation. the municipality. 66

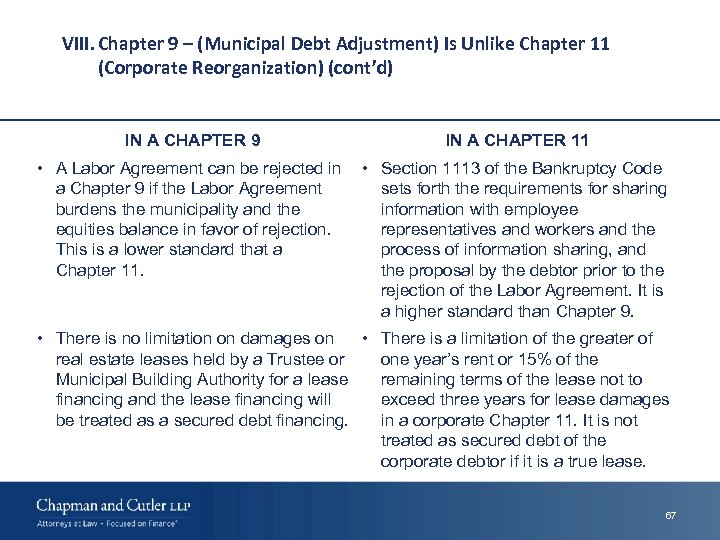

VIII. Chapter 9 – (Municipal Debt Adjustment) Is Unlike Chapter 11 (Corporate Reorganization) (cont’d) IN A CHAPTER 9 IN A CHAPTER 11 • A Labor Agreement can be rejected in • Section 1113 of the Bankruptcy Code a Chapter 9 if the Labor Agreement sets forth the requirements for sharing burdens the municipality and the information with employee equities balance in favor of rejection. representatives and workers and the This is a lower standard that a process of information sharing, and Chapter 11. the proposal by the debtor prior to the rejection of the Labor Agreement. It is a higher standard than Chapter 9. • There is no limitation on damages on • There is a limitation of the greater of real estate leases held by a Trustee or one year’s rent or 15% of the Municipal Building Authority for a lease remaining terms of the lease not to financing and the lease financing will exceed three years for lease damages be treated as a secured debt financing. in a corporate Chapter 11. It is not treated as secured debt of the corporate debtor if it is a true lease. 67

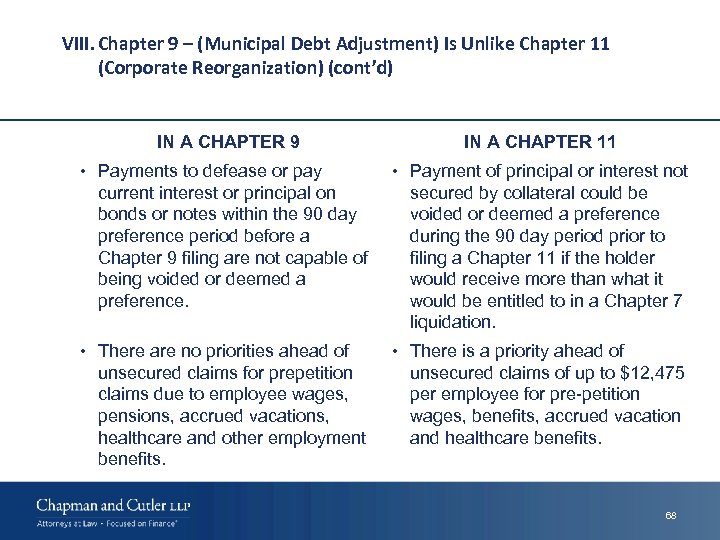

VIII. Chapter 9 – (Municipal Debt Adjustment) Is Unlike Chapter 11 (Corporate Reorganization) (cont’d) IN A CHAPTER 9 IN A CHAPTER 11 • Payments to defease or pay current interest or principal on bonds or notes within the 90 day preference period before a Chapter 9 filing are not capable of being voided or deemed a preference. • Payment of principal or interest not secured by collateral could be voided or deemed a preference during the 90 day period prior to filing a Chapter 11 if the holder would receive more than what it would be entitled to in a Chapter 7 liquidation. • There are no priorities ahead of unsecured claims for prepetition claims due to employee wages, pensions, accrued vacations, healthcare and other employment benefits. • There is a priority ahead of unsecured claims of up to $12, 475 per employee for pre-petition wages, benefits, accrued vacation and healthcare benefits. 68

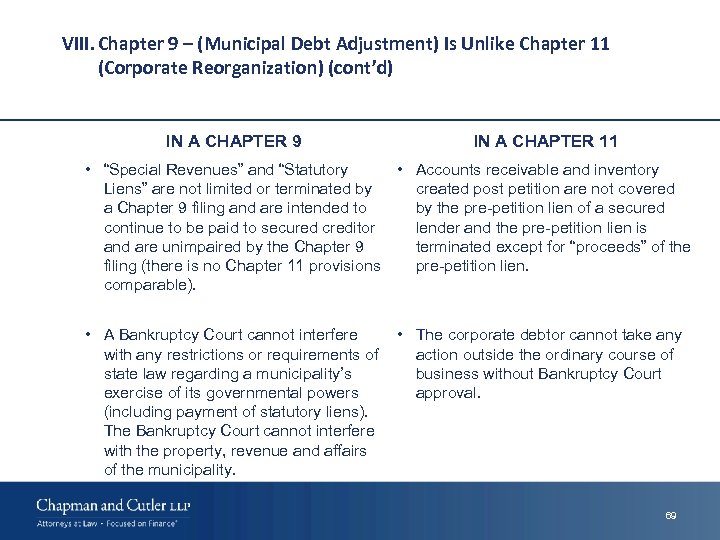

VIII. Chapter 9 – (Municipal Debt Adjustment) Is Unlike Chapter 11 (Corporate Reorganization) (cont’d) IN A CHAPTER 9 IN A CHAPTER 11 • “Special Revenues” and “Statutory • Accounts receivable and inventory Liens” are not limited or terminated by created post petition are not covered a Chapter 9 filing and are intended to by the pre-petition lien of a secured continue to be paid to secured creditor lender and the pre-petition lien is and are unimpaired by the Chapter 9 terminated except for “proceeds” of the filing (there is no Chapter 11 provisions pre-petition lien. comparable). • A Bankruptcy Court cannot interfere • The corporate debtor cannot take any with any restrictions or requirements of action outside the ordinary course of state law regarding a municipality’s business without Bankruptcy Court exercise of its governmental powers approval. (including payment of statutory liens). The Bankruptcy Court cannot interfere with the property, revenue and affairs of the municipality. 69

VIII. Chapter 9 – (Municipal Debt Adjustment) Is Unlike Chapter 11 (Corporate Reorganization) (cont’d) IN A CHAPTER 9 IN A CHAPTER 11 • The municipality can sell its assets, • The corporate debtor cannot incur debt, borrow money and borrow money, sell assets or engage in governmental affairs expand or contract its business without the necessity of having to without Bankruptcy Court approval. obtain the approval of the Bankruptcy Court. 70

This document has been prepared by Chapman and Cutler LLP attorneys for informational purposes only. It is general in nature and based on authorities that are subject to change. It is not intended as legal advice. Accordingly, readers should consult with, and seek the advice of, their own counsel with respect to any individual situation that involves the material contained in this document, the application of such material to their specific circumstances, or any questions relating to their own affairs that may be raised by such material. © 2013 Chapman and Cutler LLP 71

7630dfcded86a1fdc2062d682a19f01b.ppt