a08db28109217baa22bd833b3a7d632e.ppt

- Количество слайдов: 37

Bloomberg Fixed Income Issuance and Trading BALKAN REGION Robert Cutler Debt Market Trading Products r. cutler@bloomberg. net Dubrovnik, Croatia 12 May 2007 Multi-Dealer RFQ Firm Anonymous Orders Voice Trade Reporting No Transaction Fees Market Activity Displays STP Features Counterparty Credit Logic Market Oversight Tools

Bloomberg Overview Primary Markets Bloomberg Fixed Income Trading Platform Analytics Secondary Markets

Bloomberg Overview Subscription base Growth in Local Markets, 2006 245 000 35% 46% subscription base INCREASE in Croatia, for 2006 Fixed Income Volumes, 2006 – EMEA Volume Market Share Euro Govies 1225 bn 37% Credits 348 bn 81% IRS 1336 bn 79%

Primary Markets Bloomberg Bond Auction System 20 State Ministries/Treasuries use the Bond Auction System to Auction their Government Bills or Bonds Australia Netherlands Ireland Portugal Belgium Finland Israel Czechoslovakia Iceland Croatia South Africa Slovenia United Kingdom

Primary Markets Key Benefits Efficiency Time to release results to market dramatically reduced Transparency Robust Technology Plug & Play, Easy Deployment Free

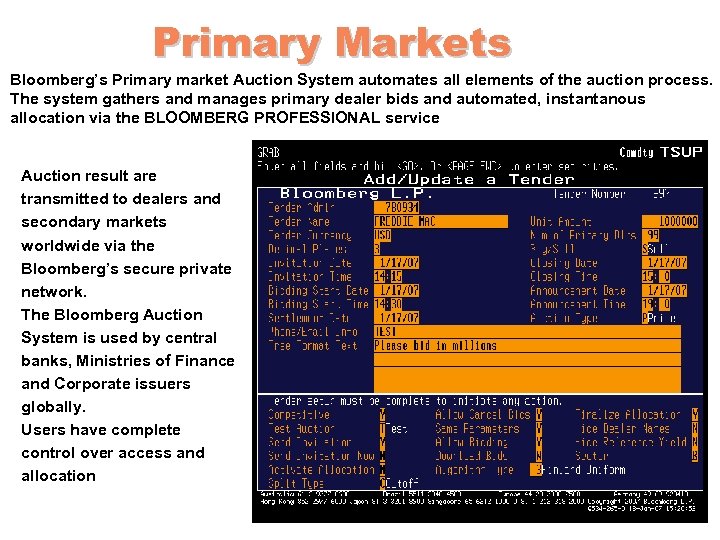

Primary Markets Bloomberg’s Primary market Auction System automates all elements of the auction process. The system gathers and manages primary dealer bids and automated, instantanous allocation via the BLOOMBERG PROFESSIONAL service Auction result are transmitted to dealers and secondary markets worldwide via the Bloomberg’s secure private network. The Bloomberg Auction System is used by central banks, Ministries of Finance and Corporate issuers globally. Users have complete control over access and allocation

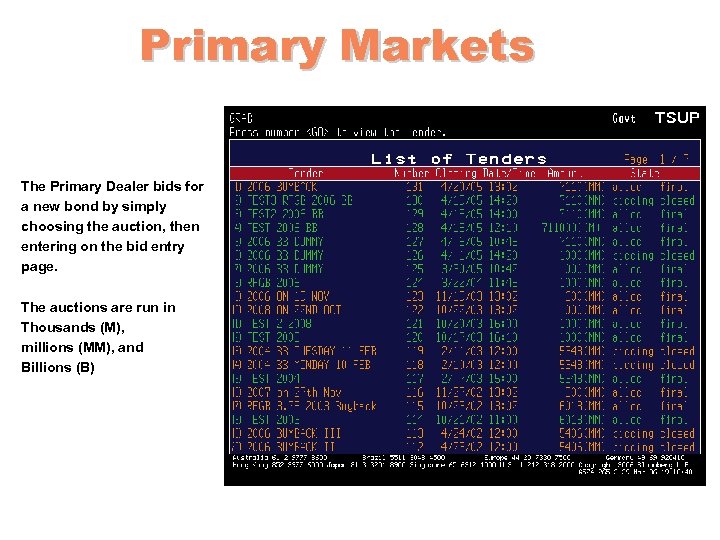

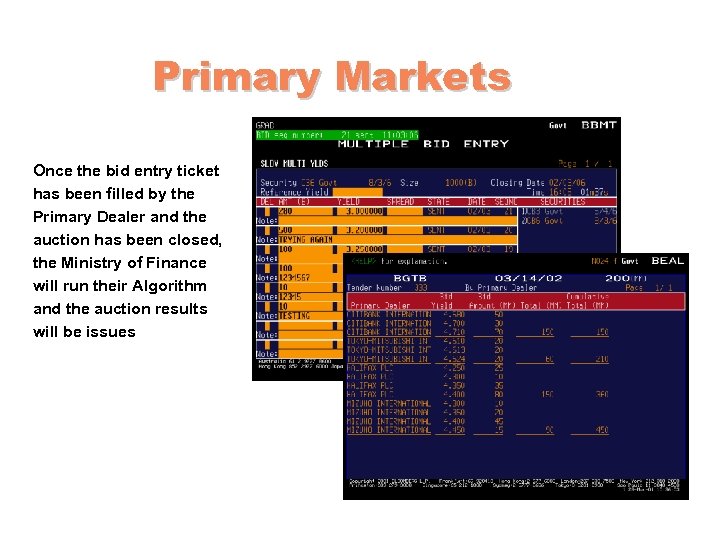

Primary Markets The Primary Dealer bids for a new bond by simply choosing the auction, then entering on the bid entry page. The auctions are run in Thousands (M), millions (MM), and Billions (B)

Primary Markets Once the bid entry ticket has been filled by the Primary Dealer and the auction has been closed, the Ministry of Finance will run their Algorithm and the auction results will be issues

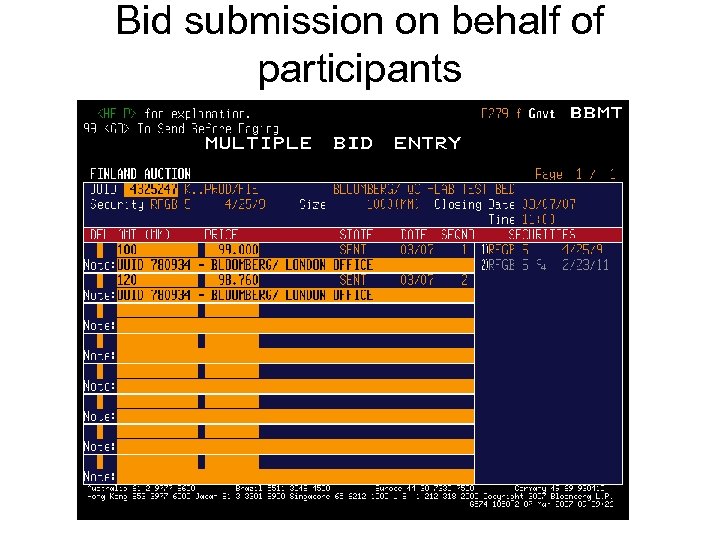

Bid submission on behalf of participants • Issuers can enter bids on behalf of participants should a participant have a technical problem. (optional) – The bid appears in the participants BLOT. The trade detail shows how enter the bid for the participant.

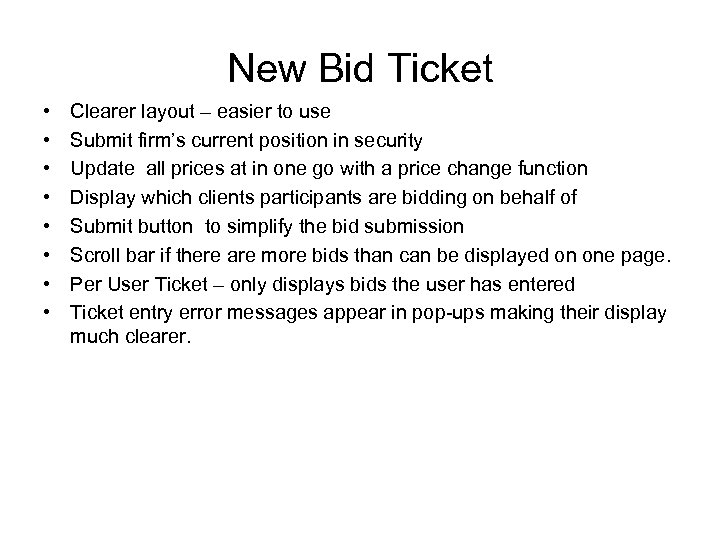

New Bid Ticket

New Bid Ticket • • Clearer layout – easier to use Submit firm’s current position in security Update all prices at in one go with a price change function Display which clients participants are bidding on behalf of Submit button to simplify the bid submission Scroll bar if there are more bids than can be displayed on one page. Per User Ticket – only displays bids the user has entered Ticket entry error messages appear in pop-ups making their display much clearer.

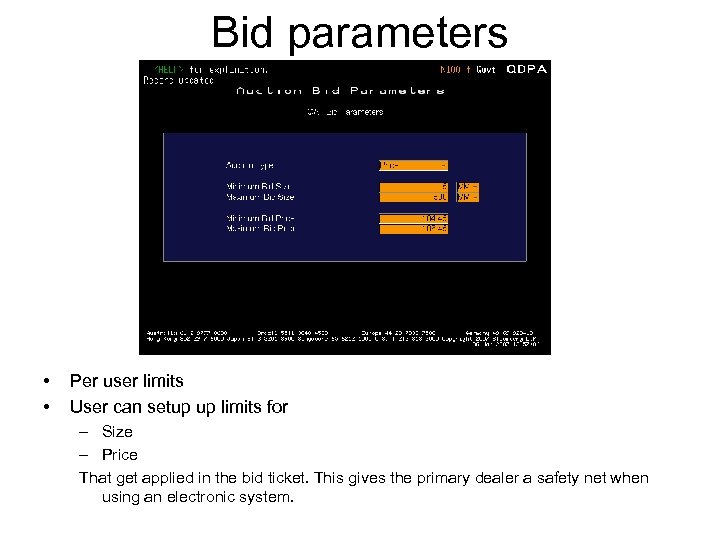

Bid parameters • • Per user limits User can setup up limits for – Size – Price That get applied in the bid ticket. This gives the primary dealer a safety net when using an electronic system.

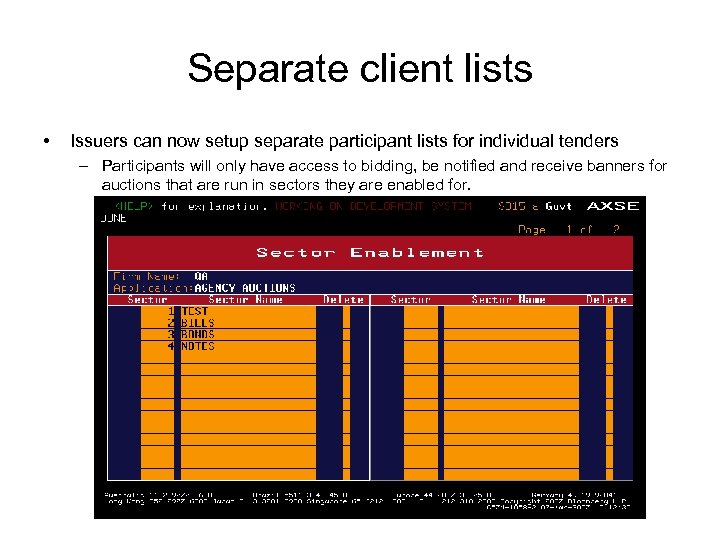

Separate client lists • Issuers can now setup separate participant lists for individual tenders – Participants will only have access to bidding, be notified and receive banners for auctions that are run in sectors they are enabled for.

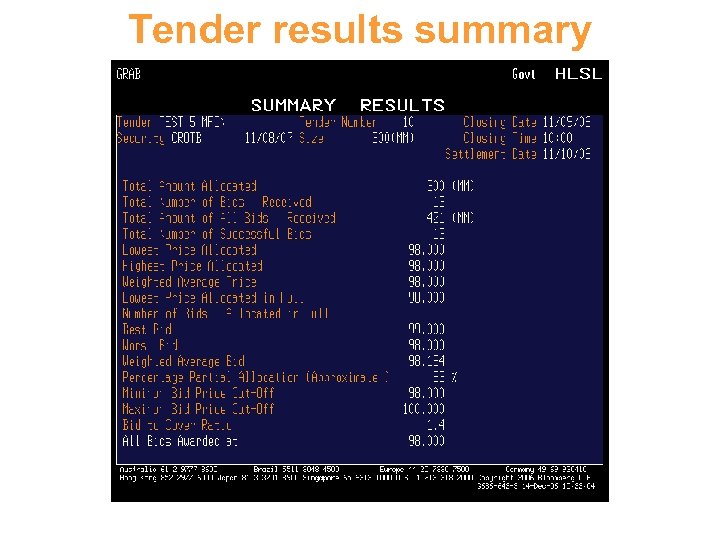

Tender results summary

Fixed Income Electronic Trading Platform Key Asset Classes Governments, Credit, Convertibles, Swaps, Credit Default Swaps, ECP, Repos, Structured Products Dealing Methods Click & Deal Request for Quote

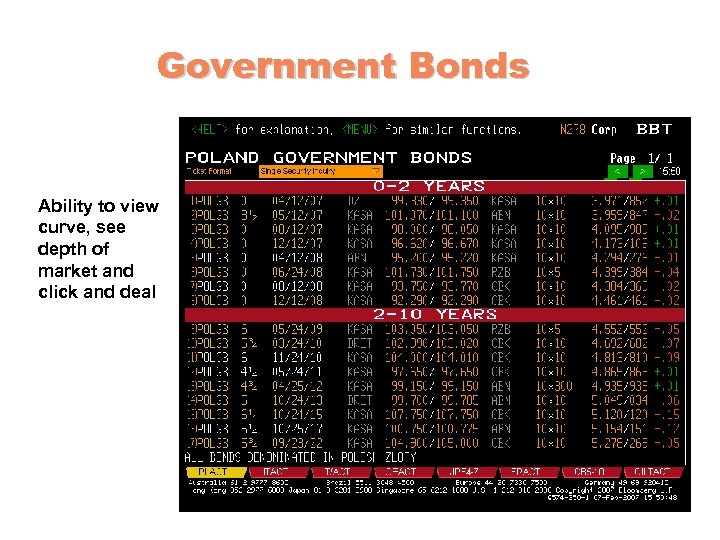

Government Bonds Ability to view curve, see depth of market and click and deal

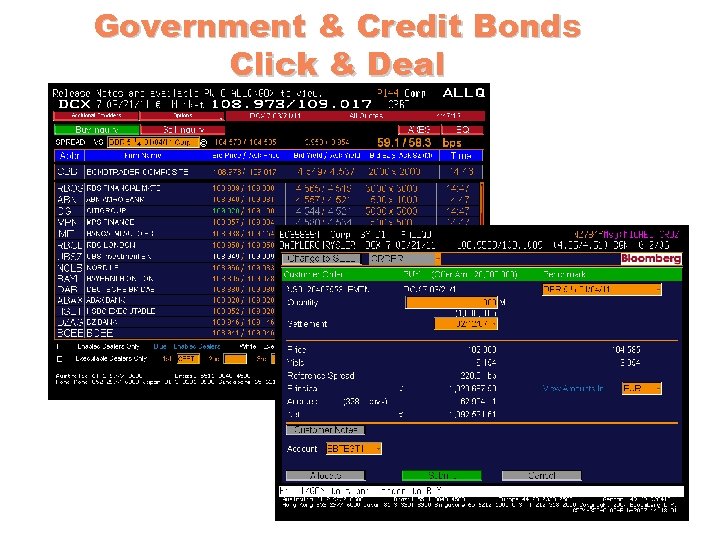

Government & Credit Bonds Click & Deal

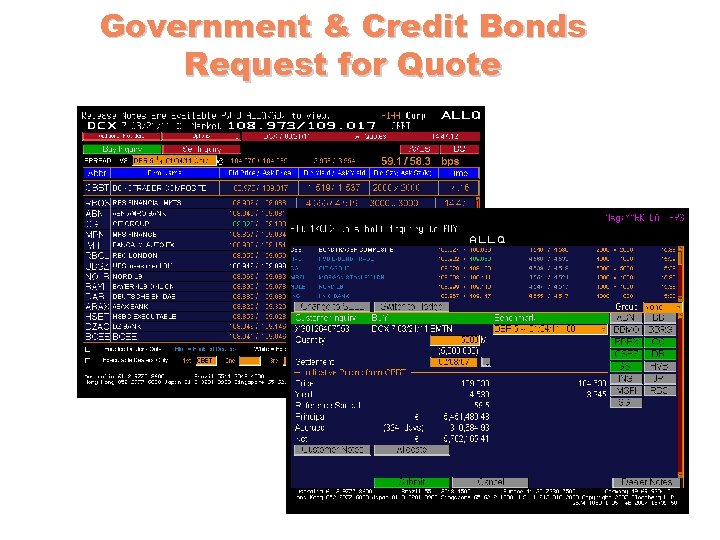

Government & Credit Bonds Request for Quote

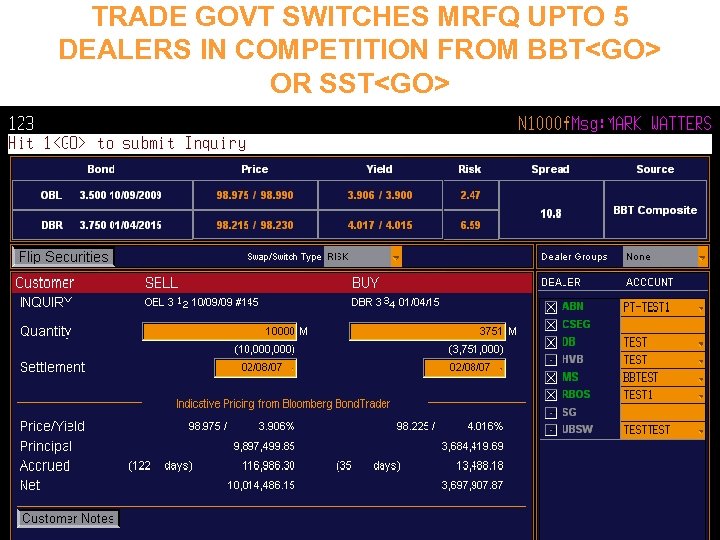

TRADE GOVT SWITCHES MRFQ UPTO 5 DEALERS IN COMPETITION FROM BBT<GO> OR SST<GO>

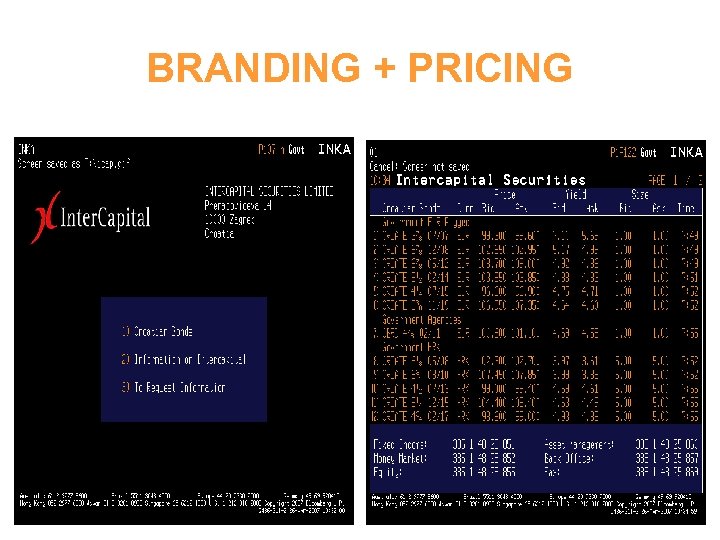

BRANDING + PRICING

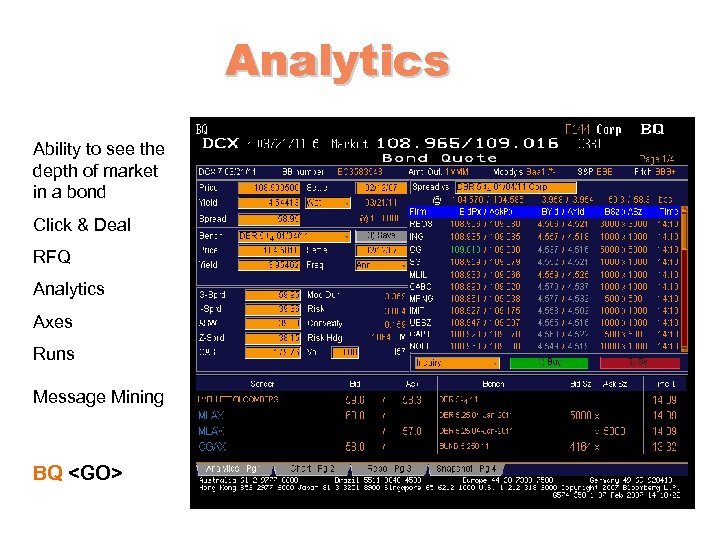

Analytics Runs Manager Axes Message Mining

Analytics Ability to see the depth of market in a bond Click & Deal RFQ Analytics Axes Runs Message Mining BQ <GO>

EBND <GO> • Key Benefits 1) UNIFICATION OF VARIOUS SOURCES OF LIQUIDITY 2) IMPROVED PRICE DISCOVERY 3) EASIER AND MORE EFFICIENT TRADE EXECUTION 5) STP PROCESSING TO SETTLEMENT AND CLEARING 6) LOW OVERALL COST AND NO FEES 7) MORE EFFICIENT MARKET OVERSIGHT CAPACITY

Key Features • All you need is your Bloomberg (no additional hardware or software required) • No additional charges/costs • Integration/connectivity available to other systems – ‘straight-through-processing’ of trades • Market information reporting available – e. g. SGSM<GO> • Ability to submit 2 -way request-for-quote to dealers • Dealers have access/enablement controls for counterparties • Ability for aggressor to trade on all prices received back in any inquiry • Ability to enter firm, anonymous orders (where enabled) as well as counterparty credit limits • Ability to handle more complex order types such as ‘iceberg’, ‘all-ornothing’ etc • Ability to receive requests-for-quote when not quoting on a bond EBND<GO>

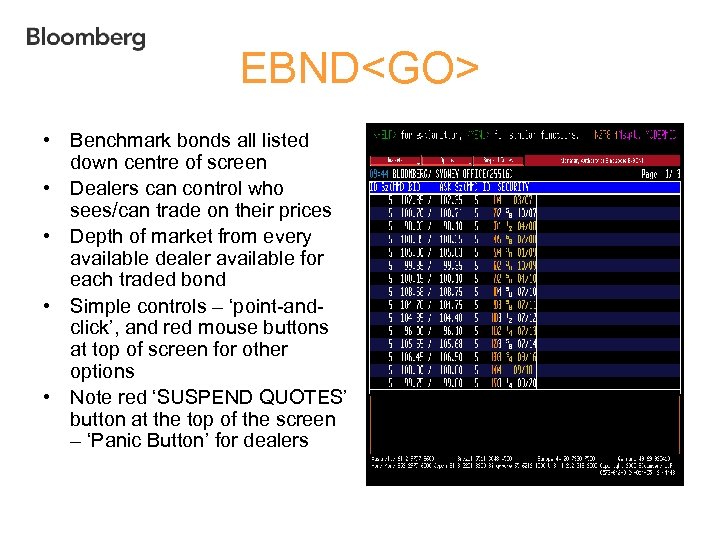

EBND<GO> • Benchmark bonds all listed down centre of screen • Dealers can control who sees/can trade on their prices • Depth of market from every available dealer available for each traded bond • Simple controls – ‘point-andclick’, and red mouse buttons at top of screen for other options • Note red ‘SUSPEND QUOTES’ button at the top of the screen – ‘Panic Button’ for dealers

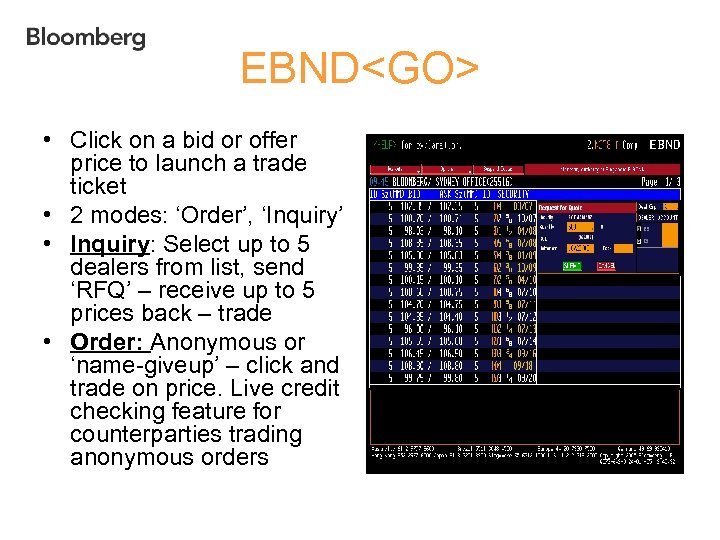

EBND<GO> • Click on a bid or offer price to launch a trade ticket • 2 modes: ‘Order’, ‘Inquiry’ • Inquiry: Select up to 5 dealers from list, send ‘RFQ’ – receive up to 5 prices back – trade • Order: Anonymous or ‘name-giveup’ – click and trade on price. Live credit checking feature for counterparties trading anonymous orders

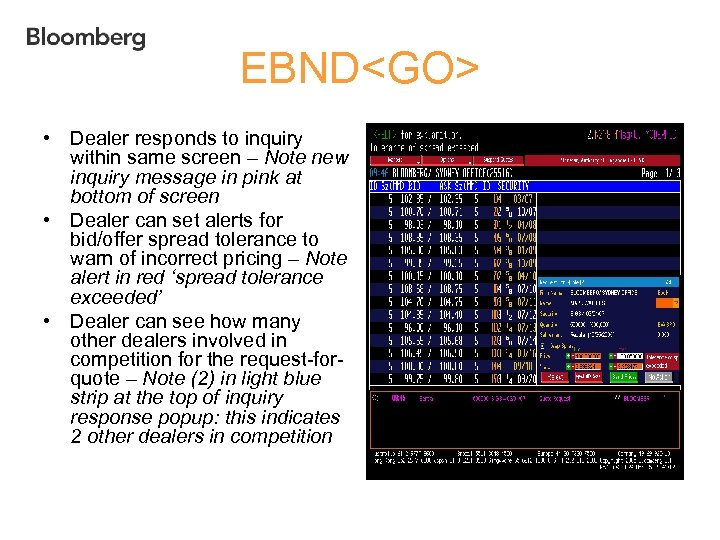

EBND<GO> • Dealer responds to inquiry within same screen – Note new inquiry message in pink at bottom of screen • Dealer can set alerts for bid/offer spread tolerance to warn of incorrect pricing – Note alert in red ‘spread tolerance exceeded’ • Dealer can see how many other dealers involved in competition for the request-forquote – Note (2) in light blue strip at the top of inquiry response popup: this indicates 2 other dealers in competition

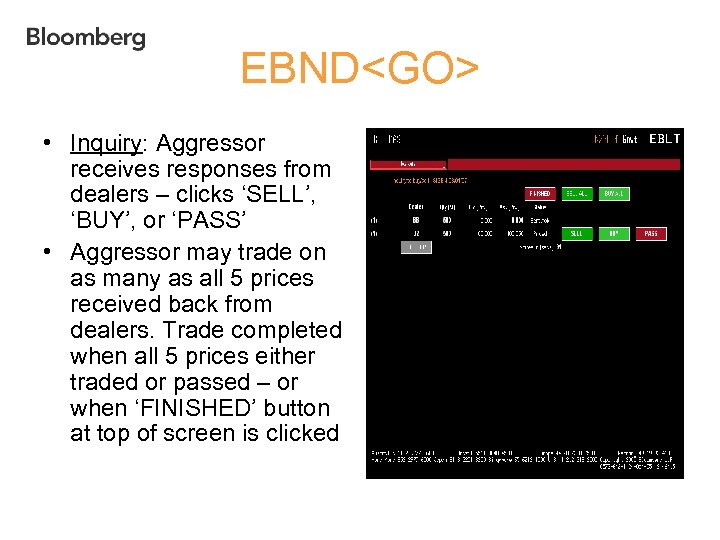

EBND<GO> • Inquiry: Aggressor receives responses from dealers – clicks ‘SELL’, ‘BUY’, or ‘PASS’ • Aggressor may trade on as many as all 5 prices received back from dealers. Trade completed when all 5 prices either traded or passed – or when ‘FINISHED’ button at top of screen is clicked

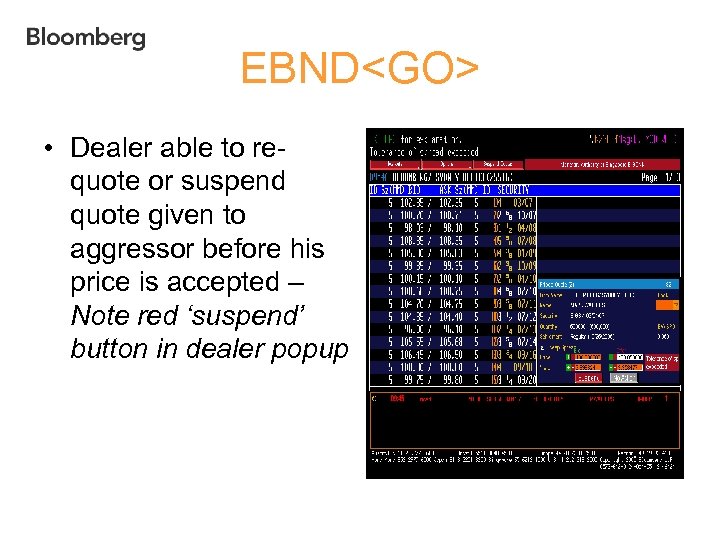

EBND<GO> • Dealer able to requote or suspend quote given to aggressor before his price is accepted – Note red ‘suspend’ button in dealer popup

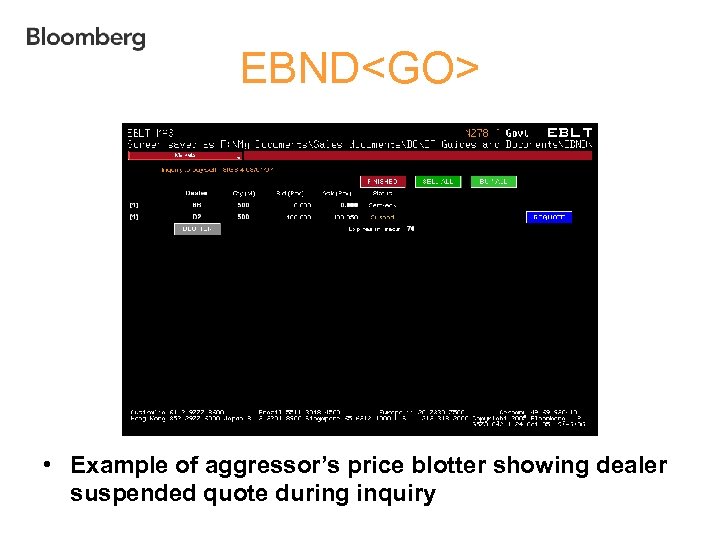

EBND<GO> • Example of aggressor’s price blotter showing dealer suspended quote during inquiry

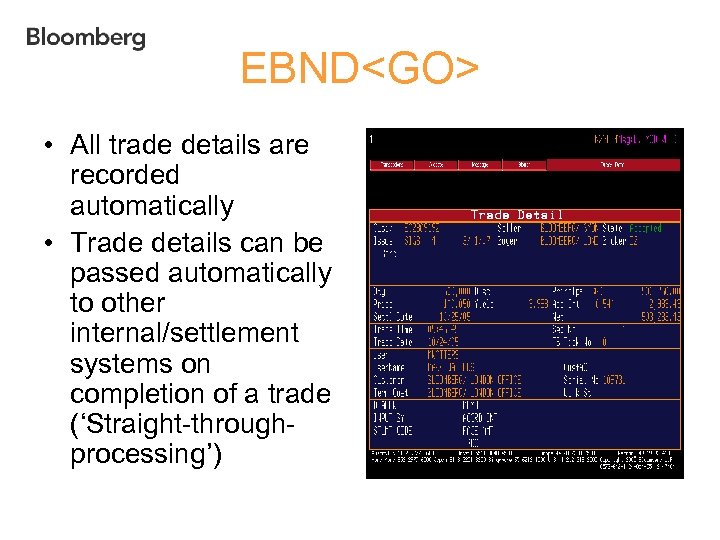

EBND<GO> • All trade details are recorded automatically • Trade details can be passed automatically to other internal/settlement systems on completion of a trade (‘Straight-throughprocessing’)

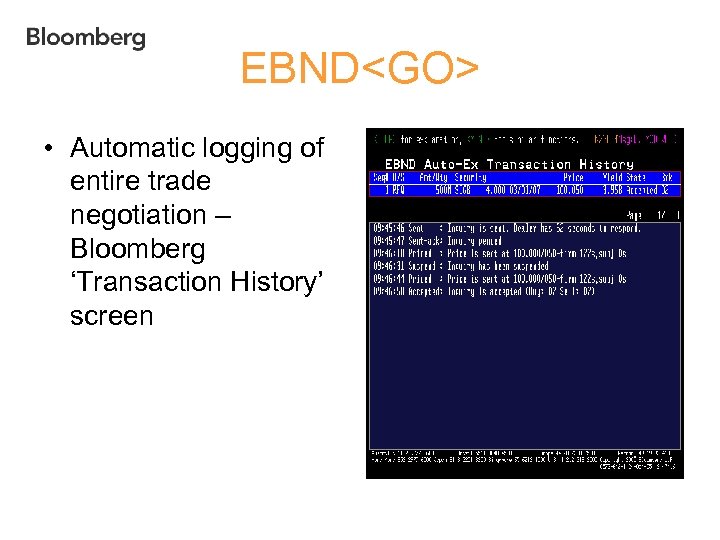

EBND<GO> • Automatic logging of entire trade negotiation – Bloomberg ‘Transaction History’ screen

EBND<GO> • Counterparty credit limit management tools to allow a dealer to create limits for anonymous order trading for each counterparty

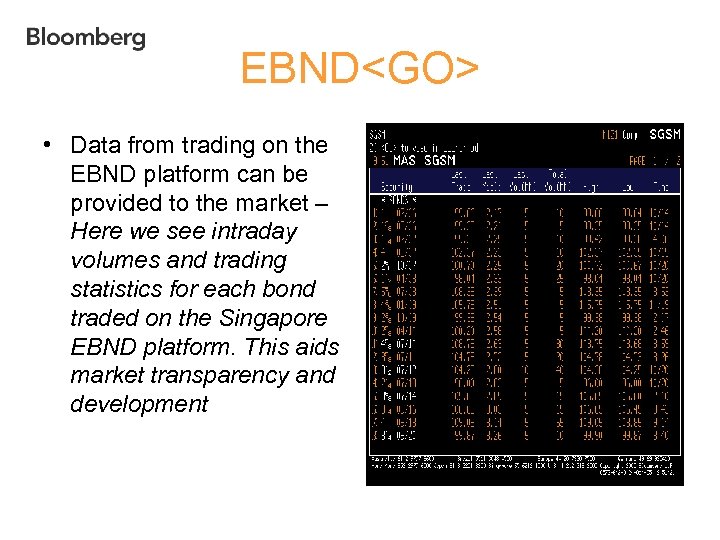

EBND<GO> • Data from trading on the EBND platform can be provided to the market – Here we see intraday volumes and trading statistics for each bond traded on the Singapore EBND platform. This aids market transparency and development

What is Bloomberg’s Goal? Central place for all market liquidity Benchmark system for all market data in established and local markets Facilitate efficiency and transparency in local markets Make Bloomberg the preferred solution in Primary & Secondary Bond Markets

Contacts: • Robert Cutler - +44 20 7330 7494 • Ebru Boysan - +44 20 7330 7691 • Bloomberg Help Desk • Bloomberg Electronic Trading Team: +44 20 7330 7476

a08db28109217baa22bd833b3a7d632e.ppt