27a6de72968d44dc3ed95bce4e0aa960.ppt

- Количество слайдов: 18

Bio-pharma Opportunities in Moscow http: //moscow. e-regulations. org/ OCO Global

Contents 1. Why invest in Moscow 3 2. Bio-pharma sector: Overview 6 3. Moscow’s location advantages 12 4. Contact us 19

Why invest in Moscow? Critical investment drivers n Economic overview n

Why Moscow? Ø Educated and experience workforce § Labour force of 8. 5 million people - One of the largest concentrations of skilled labour in Europe § Over 24, 000 people employed in Pharma industry – more than the double that of Singapore § 9 Universities with Life Science courses Ø Extensive R & D community § Over 30 researchers per 1, 000 employment – higher than in Budapest and in Prague § 8 research instiutes specialised in Biotechnology Ø Access to the highly dynamic market § Consumer market of more than 10 million people (142. 8 million in Russia) § GDP per capita of more than USD 15, 000 – 2. 5 times higher than Russia’s average § Average income growth of more than 20% annualy Ø Moscow has modern, first class infrastructure § § Over 150 international destinations served from two airports 9 international schools 4. 4 million Internet users 1. 2 million Broadband subscribers

Why Moscow? Economic overview n n n n n GRP: US$ 1. 7 billion GRP growth: 9% Per capita GRP: US$ 15, 200 Inflation: 11. 9% Population: 10. 43 million Employment: 8. 48 million Unemployment rate: 1. 1% 2 airports serving around 160 international destinations Broadband subscribers: 1. 2 million Sources: Goskomstat, 2006; Moscow Government, 2006; ONG Guide, 2006; Reksoft, 2007

Bio-pharma Key facts n Leading players n Research capacities n Success cases n Business associations n

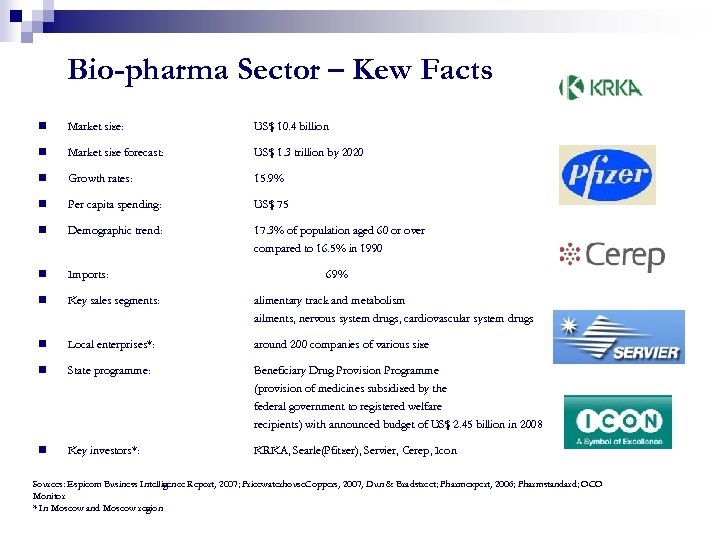

Bio-pharma Sector – Kew Facts n Market size: US$ 10. 4 billion n Market size forecast: US$ 1. 3 trillion by 2020 n Growth rates: 15. 9% n Per capita spending: US$ 75 n Demographic trend: 17. 3% of population aged 60 or over compared to 16. 5% in 1990 n Imports: n Key sales segments: alimentary track and metabolism ailments, nervous system drugs, cardiovascular system drugs n Local enterprises*: around 200 companies of various size n State programme: Beneficiary Drug Provision Programme (provision of medicines subsidized by the federal government to registered welfare recipients) with announced budget of US$ 2. 45 billion in 2008 n Key investors*: KRKA, Searle(Pfitzer), Servier, Cerep, Icon 69% Sources: Espicom Business Intelligence Report, 2007; Pricewaterhouse. Coppers, 2007, Dun & Bradstreet; Pharmexpert, 2006; Pharmstandard; OCO Monitor * In Moscow and Moscow region

Bio-pharma Sector – Leading players § § § Pharmstandart holding – Established in 2003 in Moscow. The leading Russian pharmaceutical company accounting for over 15% of domestic pharma production. Five manufacturing facilities in Russia with 2 of which comply with EU GMP certification. The company produces 5 out of 15 top selling domestic brands with main therapeutics segments including cough and cold, vitamins, antiviral and analgesics. IPO of the company took place in 2007. http: //eng. phstd. ru Otechestvennye Lekarstva – Established in 1997 in Moscow, the company now has over 5, 000 employees. Produces over 200 brands in its 3 locations in Russia. The company provides for over 16% of Russia’s pharma exports. Overseas expansions include Ukraine, Kazakhstan and Vietnam. http: //www. hotlek. ru/about_comp. php Microgene – Established in 2003 in Moscow. Producing over 70% of all vaccines in Russia the company is the leading developer and producer of immuno-biological medicines. It has established links to the leading research institutes in Russia specialising in vaccines and biotechnology. In its 17 branches across Russia the company employs 7, 500 staff. Veropharm – Established in 1997 in Moscow. Russia’s leading producer of oncological medicines. The company has 3 manufactuiring facilities in Russia and employs over 3, 000 people. Company’s IPO took place in 2006. http: //www. veropharm. ru/eng/index. wbp Leading Russian distributors: SIA International, Protech, Katren NPK, ROSTA, Genesis, Biotech

Bio-pharma Sector- Research Capacities* n n n Institute of Immunological Engineering - Was founded in 1979 and has a remit to develop specific means of protection against dangerous diseases and to undertake research in the fields of immunology, microbiology, bioengineering and biotechnology. The Institute’s staff consists of 65 research officers, 36 are researchers, including 6 doctors of science (5 professors) and 21 Ph. Ds. A. N. Bach Institute of Biochemistry – Established in 1934. The institute’s focus is on the research of the biochemical foundations of vital processes and application to production. http: //www. inbi. ras. ru/english/structeng. html Research Institute of Epidimology and Microbiology named after N. F. Gamalei – Established in 1891. Main focus is on the fundamental research in the field of epidimology, molecular microbiology and infectious immunology. http: //www. gamaleya. ru/content/institute/index. htm Institute of Biomedical chemistry is a structural subdivision of Russian Academy of Medical Sciences. It has 200 research staff in its 8 laboratories. The Institute carries out study of genetic, molecular, biochemical, physiological and morphological principals of vital activity to prevent diseases and renew unsound functions. http: //ibmc. msk. ru Gause Institute of New Antibiotics - Established in 1953. Has 7 scientific laboritories and 147 staff inclduing 74 scientists and 33 doctors. The Institute is invoved in new antibiotics discovery with the focus on antibacterial, antitumoral and antivirus antibiotics, ray fungus taxonomy researches, development of new methods for the most complete microbe diversity detection, etc. It also carries out pre-clinical trials. http: //www. gauseinst. ru/e_main. html * Examples of bio-pharma research organisations in Moscow

Bio-pharma Sector – Recent Success Cases n Cerep (France) : Opened its operation in Moscow in 2007 through the fully owned subsidiary Hesperion Ltd. The office located in Orbita Technopark Business Center and offers Clinical Operations and Regulatory Affairs services as well as Project Management and Drug Storage. The staff members of the new Russian office are highly qualified and multilingual and will cover the Eastern Europe area. n Servier (France): Established its manufacturing facility in 2007 in Sophyno (near Moscow) with the investment of € 40 million. By 2012 Servier plans to produce 60 million boxes of medicines per year and to employ 180 staff. n JB Chemicals & Pharmaceuticals Ltd (India): In 2005 invested $3 million in a wholly-owned subsidiary in Moscow. Creation of Moscow sub-division strengthened the company position on pharmaceutical markets of Russia and other countries of the former USSR, which provide together 45% of “JB Chemicals & Pharmaceuticals” profits. n Icon Clinical (Ireland): In 2005 opened a R&D center in Moscow for its clinical operations.

Bio-pharma Sector – Useful Links n Ministry of Healthcare and Social Development of Russian Federation www. mzsrrf. ru n Association of International Pharmaceuticals Manufacturers http: //www. aipm. org/eng/ n Association of Russian Pharmaceutical Manufacturers http: //associaciya. arfp. ru/ n Association of European Business in Russia (Healthcare and Pharmaceuticals Committee) http: //www. aebrus. ru/committees/industrial/health/ n American Chamber of Commerce in Russia (Healthcare Committee) http: //www. amcham. ru/committees/healthcare n Pharmexpert (research company specialising in the pharma industry) www. pharmexpert. ru n DSM Group (marketing research and advertising service on the Russian pharmaceutical market) http: //www. dsm. ru/en/about_us/

Moscow’s location advantages Competitive position n Economic growth n Market growth n Employment/skills n R&D capacities n Infrastructure n

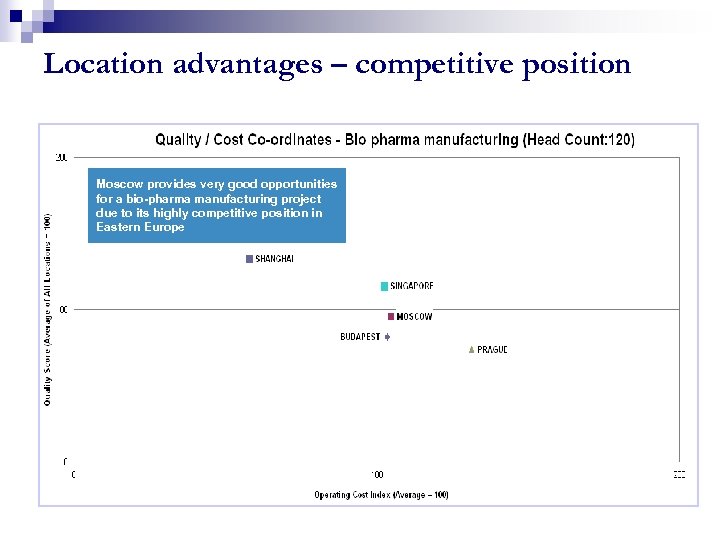

Location advantages – competitive position Moscow provides very good opportunities for a bio-pharma manufacturing project due to its highly competitive position in Eastern Europe

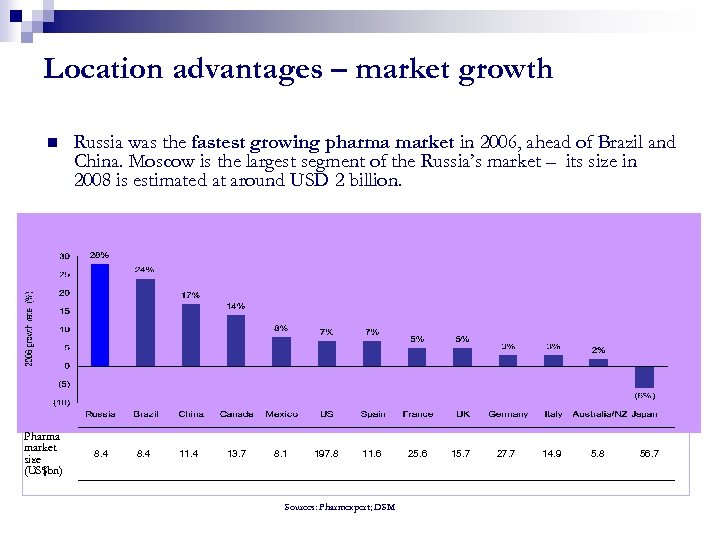

Location advantages – market growth n Pharma market size (US$bn) Russia was the fastest growing pharma market in 2006, ahead of Brazil and China. Moscow is the largest segment of the Russia’s market – its size in 2008 is estimated at around USD 2 billion. 8. 4 11. 4 13. 7 8. 1 197. 8 11. 6 Sources: Pharmexpert; DSM 25. 6 15. 7 27. 7 14. 9 5. 8 56. 7

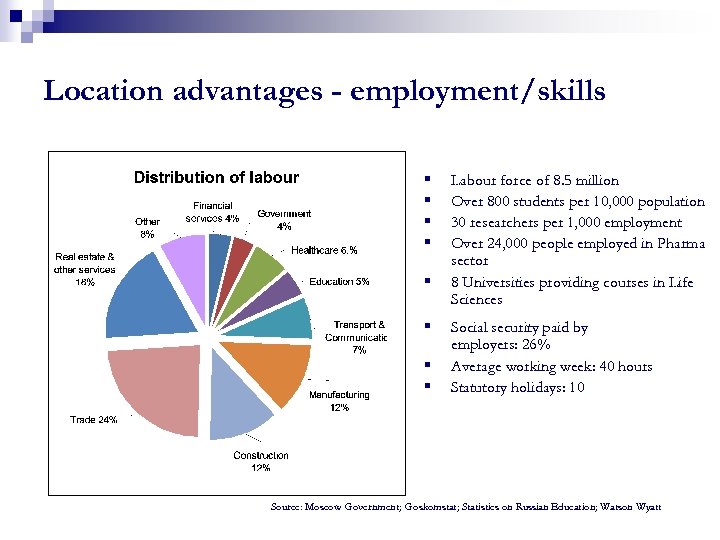

Location advantages - employment/skills § § § § Labour force of 8. 5 million Over 800 students per 10, 000 population 30 researchers per 1, 000 employment Over 24, 000 people employed in Pharma sector 8 Universities providing courses in Life Sciences Social security paid by employers: 26% Average working week: 40 hours Statutory holidays: 10 Source: Moscow Government; Goskomstat; Statistics on Russian Education; Watson Wyatt

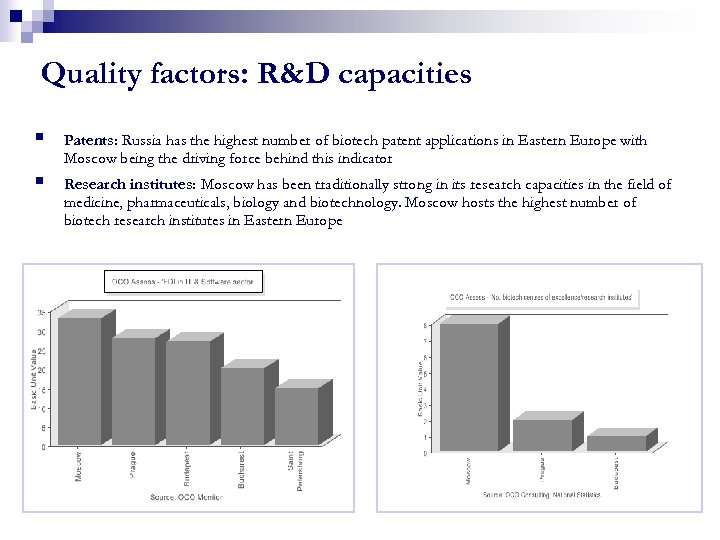

Quality factors: R&D capacities § § Patents: Russia has the highest number of biotech patent applications in Eastern Europe with Moscow being the driving force behind this indicator Research institutes: Moscow has been traditionally strong in its research capacities in the field of medicine, pharmaceuticals, biology and biotechnology. Moscow hosts the highest number of biotech research institutes in Eastern Europe

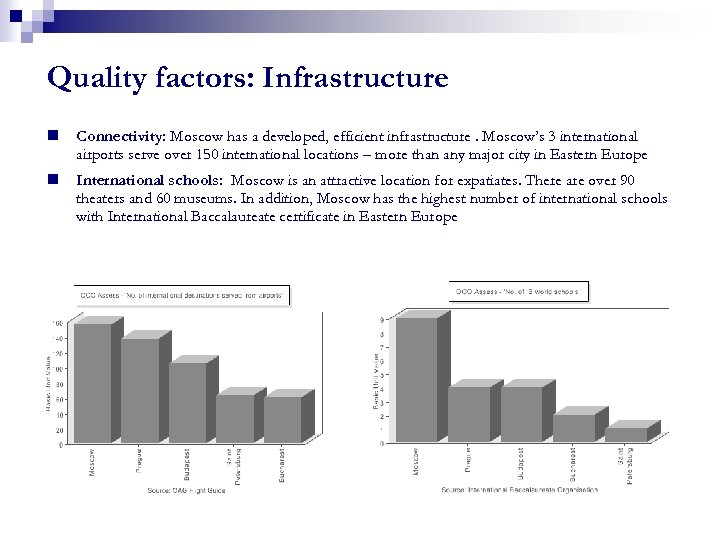

Quality factors: Infrastructure n Connectivity: Moscow has a developed, efficient infrastructure. Moscow’s 3 international airports serve over 150 international locations – more than any major city in Eastern Europe n International schools: Moscow is an attractive location for expatiates. There are over 90 theaters and 60 museums. In addition, Moscow has the highest number of international schools with International Baccalaureate certificate in Eastern Europe

Contact us http: //moscow. e-regulations. org/ info@miepa. org T. : +7 (495) 431 3898

27a6de72968d44dc3ed95bce4e0aa960.ppt