aa3e5582211e42291ab566cfeaa43d05.ppt

- Количество слайдов: 22

Bio. Carbon Fund Rules of Engagement Bio. CF Project Training Seminar Washington, DC July 13, 2005 Harnessing the carbon market to sustain ecosystems and alleviate poverty

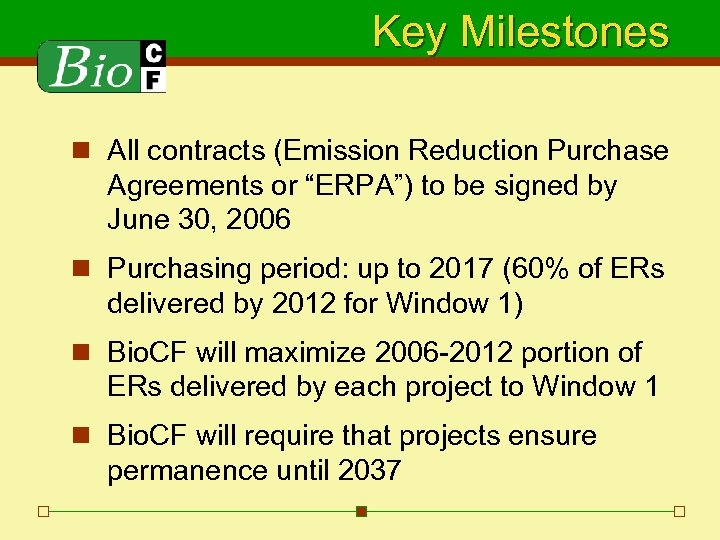

Key Milestones n All contracts (Emission Reduction Purchase Agreements or “ERPA”) to be signed by June 30, 2006 n Purchasing period: up to 2017 (60% of ERs delivered by 2012 for Window 1) n Bio. CF will maximize 2006 -2012 portion of ERs delivered by each project to Window 1 n Bio. CF will require that projects ensure permanence until 2037

Validation n Previous presentations by Lasse, Bernhard, Sandra n Assumption: Bio. CF Fund Management Unit (FMU) adds value to the project, especially in terms of methodological input n FMU requests to be involved in the methodological process n Before ERPA is signed n Methodologies must have been submitted to CDM Executive Board by Operational Entity hired by the FMU n FMU must have reviewed the draft submissions n Pre-validation report by Operational Entity must be available n Pre-validation assumes that submitted methodologies are approved

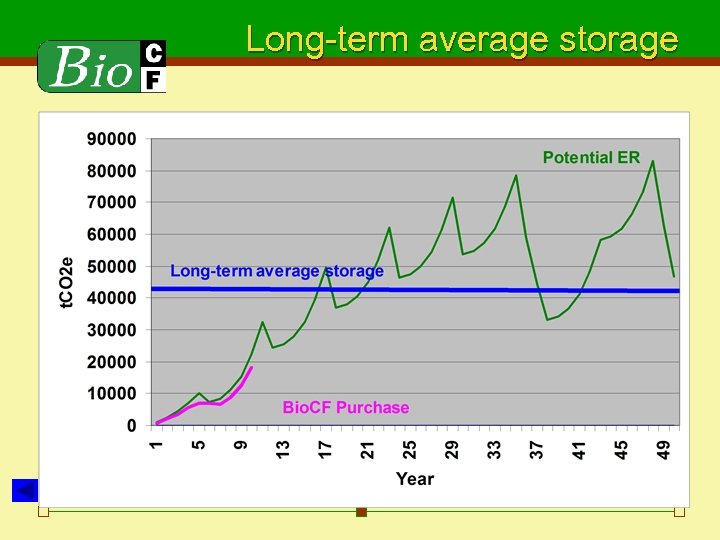

Permanence n Unlike climate change mitigation through energy activities, the climate impact of LULUCF activities only lasts as long as carbon is sequestered n “Permanence” = sequestration for the very long term n Bio. CF looks for long-term carbon sequestration n Bio. CF will pay annually based on increments in carbon stocks, but never above the long-term average storage n Co. P 9 rules on temporary crediting n Prices diverge from Co. P 9 implications (see later) n Liability for replacement: n Project bears replacement responsibility until 2037 n Bio. CF bears replacement responsibility thereafter

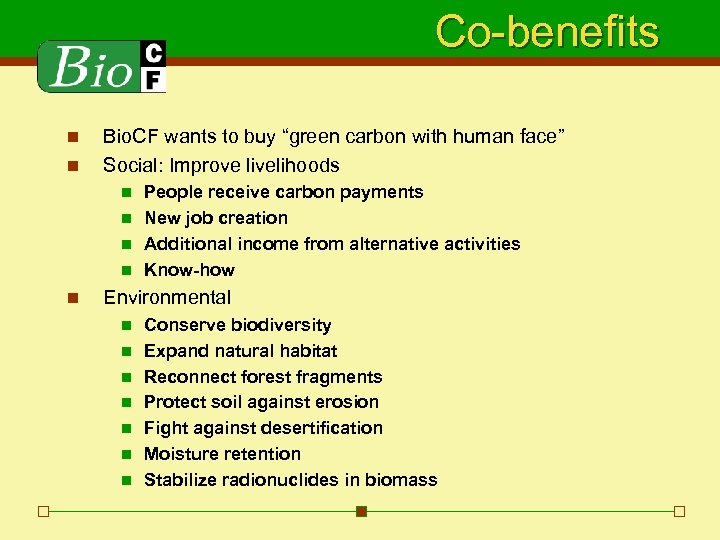

Co-benefits n n Bio. CF wants to buy “green carbon with human face” Social: Improve livelihoods People receive carbon payments n New job creation n Additional income from alternative activities n Know-how n n Environmental n n n n Conserve biodiversity Expand natural habitat Reconnect forest fragments Protect soil against erosion Fight against desertification Moisture retention Stabilize radionuclides in biomass

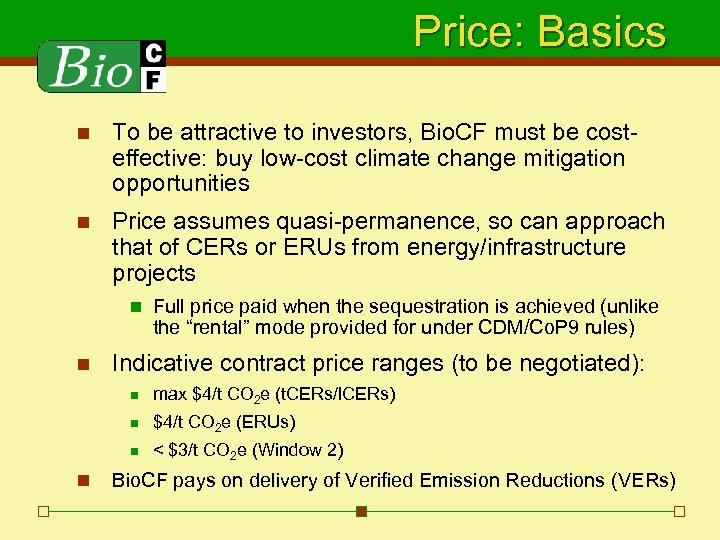

Price: Basics n To be attractive to investors, Bio. CF must be costeffective: buy low-cost climate change mitigation opportunities n Price assumes quasi-permanence, so can approach that of CERs or ERUs from energy/infrastructure projects n n Full price paid when the sequestration is achieved (unlike the “rental” mode provided for under CDM/Co. P 9 rules) Indicative contract price ranges (to be negotiated): n n $4/t CO 2 e (ERUs) n n max $4/t CO 2 e (t. CERs/l. CERs) < $3/t CO 2 e (Window 2) Bio. CF pays on delivery of Verified Emission Reductions (VERs)

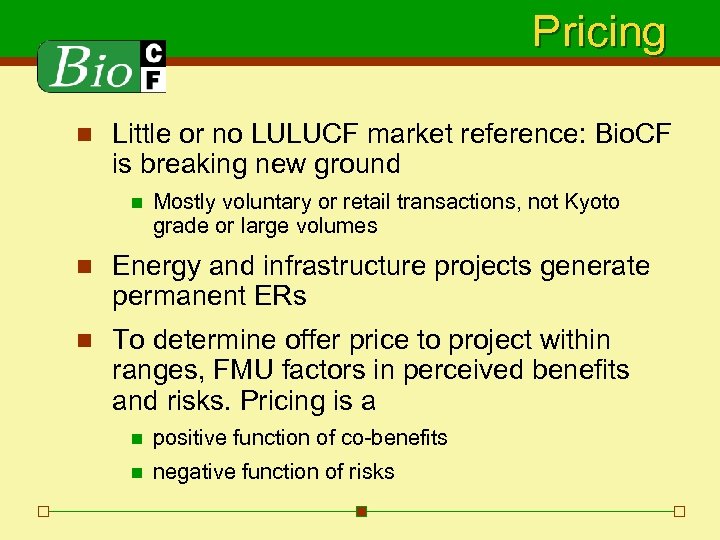

Pricing n Little or no LULUCF market reference: Bio. CF is breaking new ground n Mostly voluntary or retail transactions, not Kyoto grade or large volumes n Energy and infrastructure projects generate permanent ERs n To determine offer price to project within ranges, FMU factors in perceived benefits and risks. Pricing is a n positive function of co-benefits n negative function of risks

Benefit and Risk Analysis (1) n Several categories of risks n Regulatory risks n Project risks n Country risks n Market risks n Principle: allocate risk to party best able to bear it (seller or buyer) n Most risks affect both the seller and buyer

Benefit and Risk Analysis (2) n Regulatory risks At methodology submission: methodology rejected (Seller + Buyer) n At project registration: project found not to be additional (Buyer) n n Project risks n Lower-than-expected ER potential (Seller + Buyer, depending on ERPA) n Technological failure n Non-permanence n Leakage n n No financial closure (Seller + Buyer) Country risks Legal challenges to sale of ERs (Buyer + Seller) n Host Country rejection: no Letter of Approval (Seller + Buyer) n Expropriation of assets (Seller + Buyer) n n Market risks n n Lack of tradability (CDM, EU ETS) (Buyer) Reputational risks Environmental (Buyer + Seller) n Social (Buyer + Seller) n

Benefit and Risk Analysis (3) n Co-benefits n Environmental n Social n Need to include a couple of relevant but simple indicators of environmental and social improvements in the Monitoring Plan and track them during project implementation n Benefits command premium embedded in the price of an ER n To the extent possible, co-benefits will be disclosed in the ER certificate to educate buyers

Benefit and Risk Analysis (4) n Need to achieve some consistency in ER pricing across the Bio. CF portfolio n FMU will quantify the perceived co-benefits and risks of each project n Quantification will be discussed with project entity as prelude to ERPA negotiations and within limits of provisions of Letter of Intent

Cost Recovery n 100% of project preparation costs pre-financed by the Bio. CF will be charged back to projects in the form of withholdings from ER payments n Negotiated item n Never a negative transfer back to Bio. CF n Costs capped in the Letter of Intent and ERPA n If Bio. CF also prefinances implementation costs (supervision and certification) these will also be charged back n Same rule as for preparation costs n Apply for Japanese PHRD grant or other grants to finance some preparation costs

Payment Schedule n On delivery, not in advance: annual payments (in accordance with Monitoring Plan) upon receipt of a verification report that a certain number of tons of CO 2 have been sequestered = Verified Emission Reductions (VERs) n Other resources must be found to cover the investment cost n Bio. CF will pay for VERs even if project is not registered by the market regulator n If project entity requested an advance payment n Proof would have to be given that there is no alternative n Would be limited to max 25% of the ERPA value n Price per ton would be discounted to reflect the risk of non-delivery n Bank guarantee would be requested

Communication with Regulator n CFB reserves right to communicate with CDM Executive Board and Art. 6 Supervisory Committee VERs on behalf of project entities to increase chance of VER conversion to t. CERs/l. CERs, ERUs n Logical corollary of payment for VERs

Project Cycle 1 Preparation • Project Idea Note (PIN) and reviewed by Fund Management Unit (FMU) • Carbon Finance Document (CFD) prepared by project sponsor • CFD reviewed by Fund Management Committee and Participants’ Committee • Start of World Bank technical, financial, environmental and social due diligence (identification + preparation) • Host Country endorsement (letter of no-objection) • Inclusion in portfolio • FMU signals intention to purchase ERs: Letter of Intent 6 m

Project Cycle 2 Methodology • Project Design Document (sponsor/FMU) • Baseline Study (BLS) & Monitoring Plan (MP) for carbon, environmental and social benefits and ER calculation prepared by project sponsor/consultant + FMU quality control • [FMU submits new methodology submission (NMB and NMM through Operational Entity)] • World Bank due diligence continues (preparation) 6 m 6 m

Project Cycle 3 Validation • [Pre-validation of BLS / MP for carbon, environmental and social benefits by Operational Entity (DOE/AE) (before methodologies are approved)] • Pre-validation Report • DOE/AE assesses ERS • Host Country Letter of Approval • Validation Report (after methodologies are approved) • World Bank appraisal 6 m 6 m 2 m

Project Cycle 4 Negotiation • • • 6 m [FMU drafts Term Sheet (main clauses of a future contract in plain English)] Consultations/negotiations with sponsor Term Sheet signature World Bank lawyers draft contract (Emission Reductions Purchase Agreement, or ERPA) ERPA negotiations ERPA signature (by June 2006) 6 m 2 m 3 m

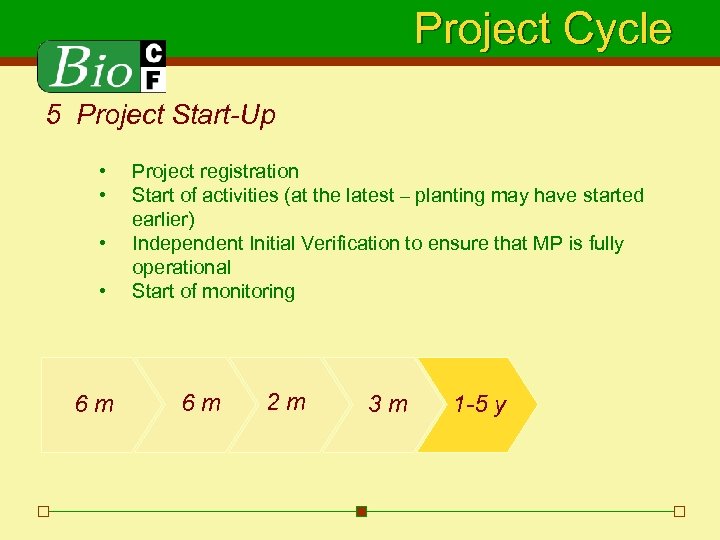

Project Cycle 5 Project Start-Up • • 6 m Project registration Start of activities (at the latest – planting may have started earlier) Independent Initial Verification to ensure that MP is fully operational Start of monitoring 6 m 2 m 3 m 1 -5 y

Project Cycle 6 Implementation • • • 6 m Periodic verification & certification reports (sponsor + DOE/AE, in accordance with MP and contract) Bio. CF pays project sponsor for verified ERs distributed to Bio. CF investors pro rata to their share of the fund Bio. CF buys a certain tonnage, not for a certain period of time Purchase up to 2017 World Bank supervision (until forest established) 6 m 2 m 3 m 1 -5 y 12 y

Long-term average storage

www. biocarbonfund. org www. carbonfinance. org

aa3e5582211e42291ab566cfeaa43d05.ppt