a13571227f13c81b7ecc9454b4c6fc71.ppt

- Количество слайдов: 76

Biannual Economic and Capacity Survey January - June 2009

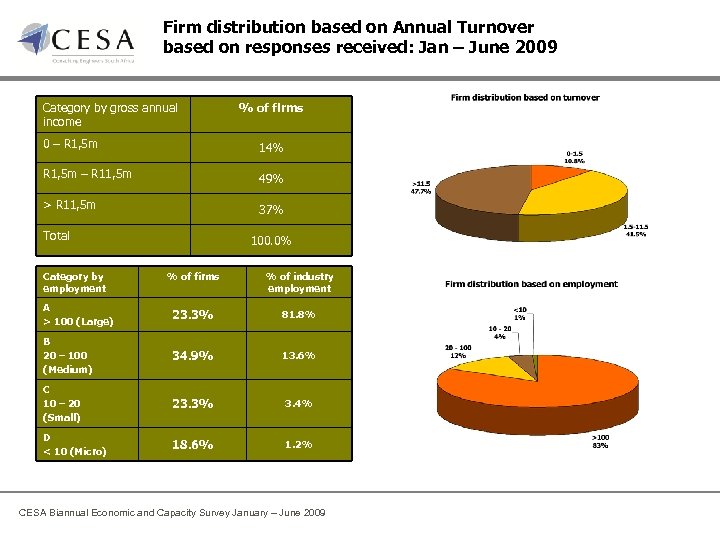

Firm distribution based on Annual Turnover based on responses received: Jan – June 2009 Category by gross annual income % of firms 0 – R 1, 5 m 14% R 1, 5 m – R 11, 5 m 49% > R 11, 5 m 37% Total Category by employment 100. 0% % of firms % of industry employment A > 100 (Large) 23. 3% 81. 8% B 20 – 100 (Medium) 34. 9% 13. 6% C 10 – 20 (Small) 23. 3% 3. 4% D < 10 (Micro) 18. 6% 1. 2% CESA Biannual Economic and Capacity Survey January – June 2009

Salient Features CESA Biannual Economic and Capacity Survey January – June 2009

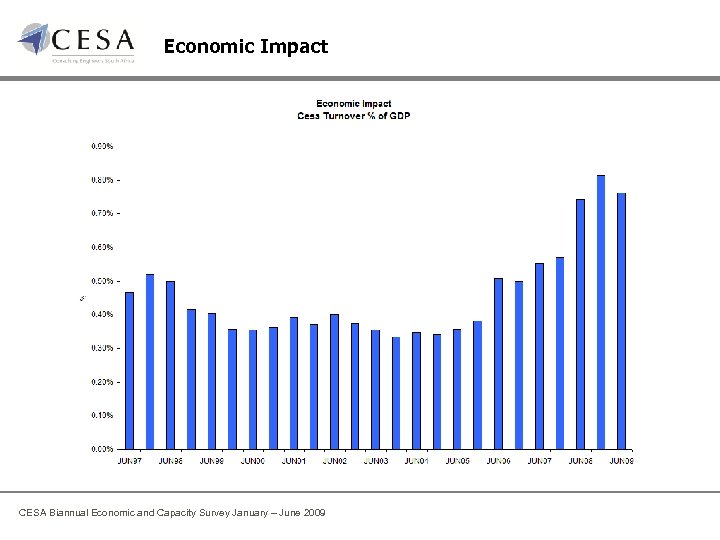

Economic Impact CESA Biannual Economic and Capacity Survey January – June 2009

Relationship to Gross Fixed Capital Formation CESA Biannual Economic and Capacity Survey January – June 2009

Consulting Engineering Industry Fee income, Rm Constant 2000 prices (CPI Deflated) Annualised CESA Biannual Economic and Capacity Survey January – June 2009

Consulting Engineering Industry Real Fee income (CPI deflated), 2000 prices: Annual Change CESA Biannual Economic and Capacity Survey January – June 2009

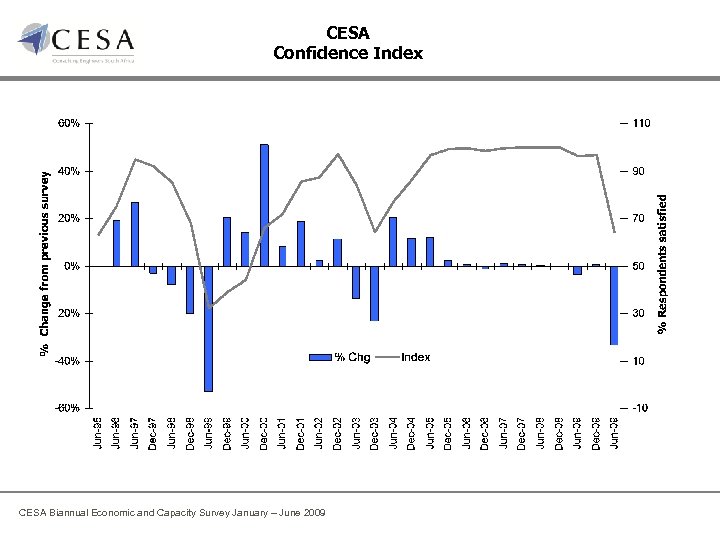

CESA Confidence Index CESA Biannual Economic and Capacity Survey January – June 2009

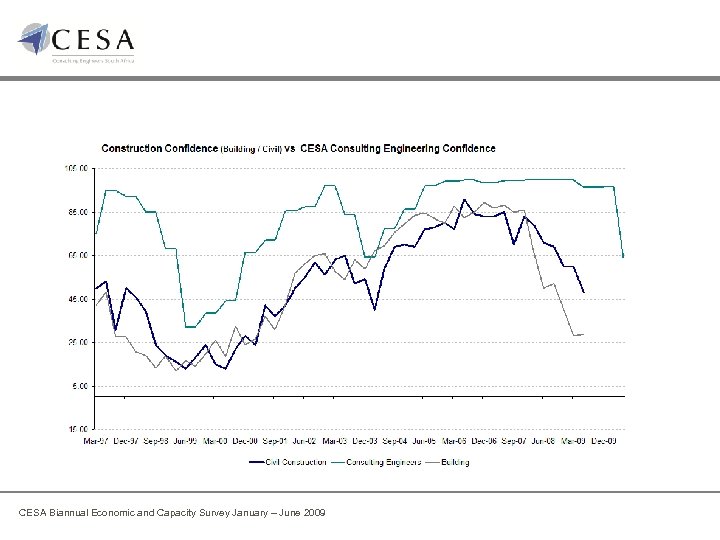

CESA Biannual Economic and Capacity Survey January – June 2009

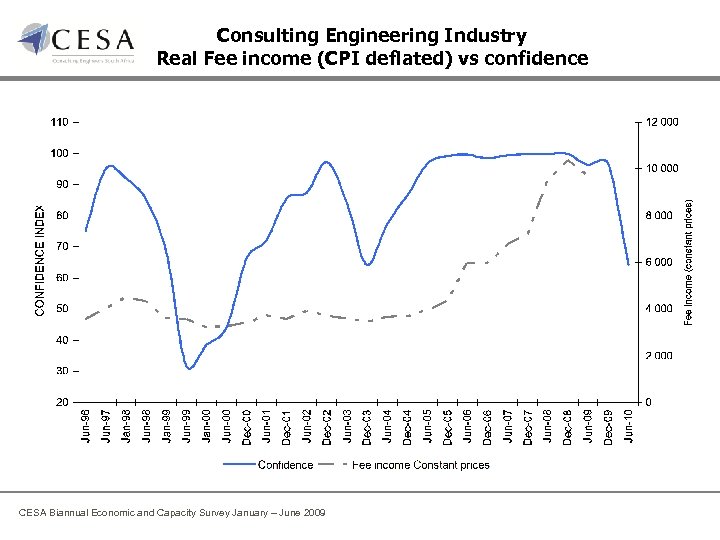

Consulting Engineering Industry Real Fee income (CPI deflated) vs confidence CESA Biannual Economic and Capacity Survey January – June 2009

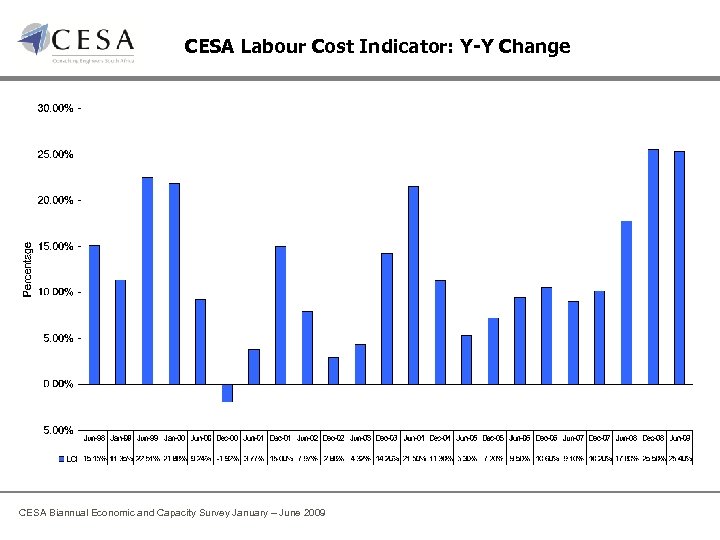

CESA Labour Cost Indicator: Y-Y Change CESA Biannual Economic and Capacity Survey January – June 2009

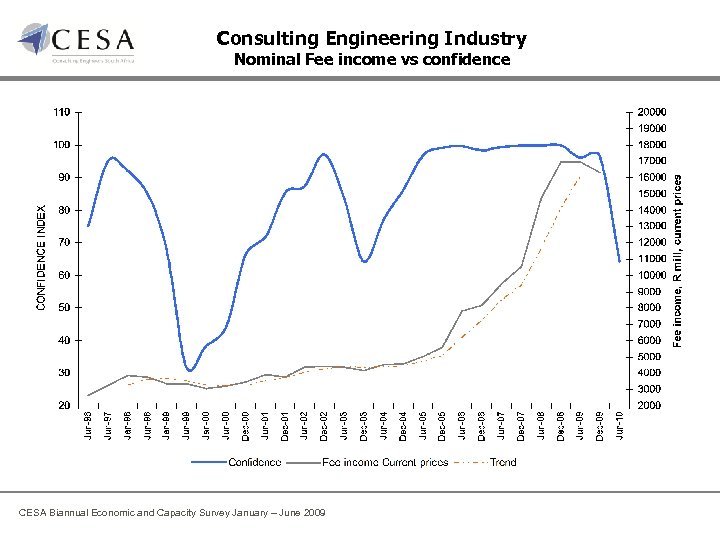

Consulting Engineering Industry Nominal Fee income vs confidence CESA Biannual Economic and Capacity Survey January – June 2009

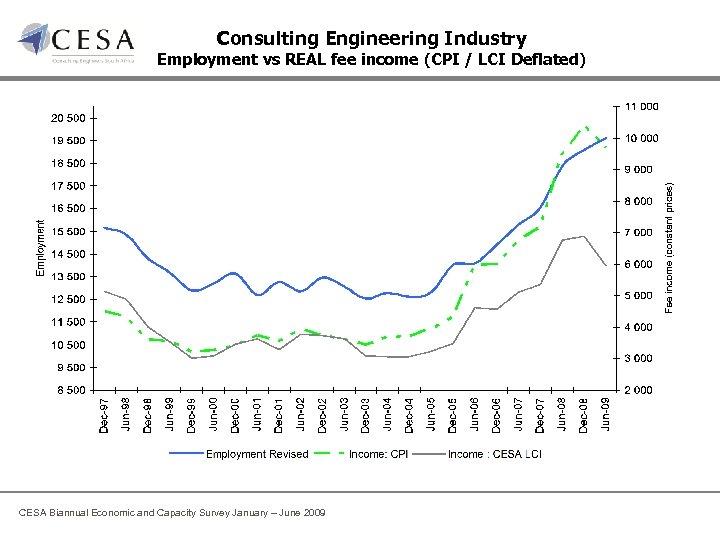

Consulting Engineering Industry Employment vs REAL fee income (CPI / LCI Deflated) CESA Biannual Economic and Capacity Survey January – June 2009

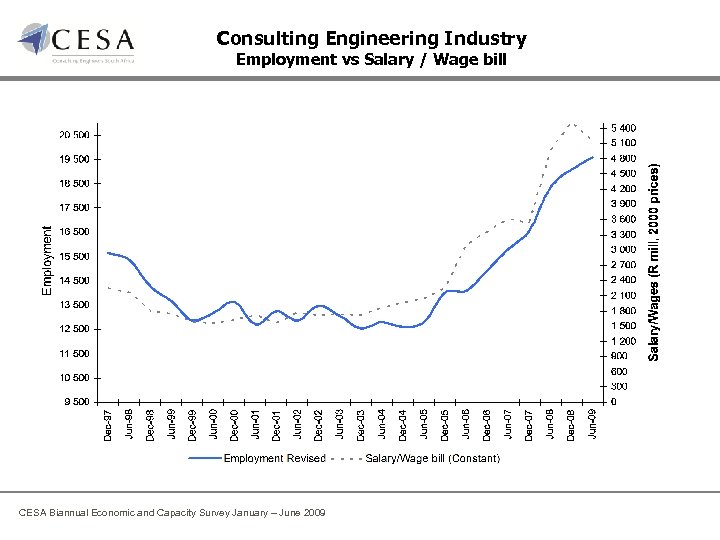

Consulting Engineering Industry Employment vs Salary / Wage bill CESA Biannual Economic and Capacity Survey January – June 2009

Discounting Question: What is the prevailing discount being offered in a tendering situation to clients by your firm, benchmarked against the ECSA Guideline Fee Scales? 37% of firms discounted by more than 20% CESA Biannual Economic and Capacity Survey January – June 2009

Disciplines CESA Biannual Economic and Capacity Survey January – June 2009

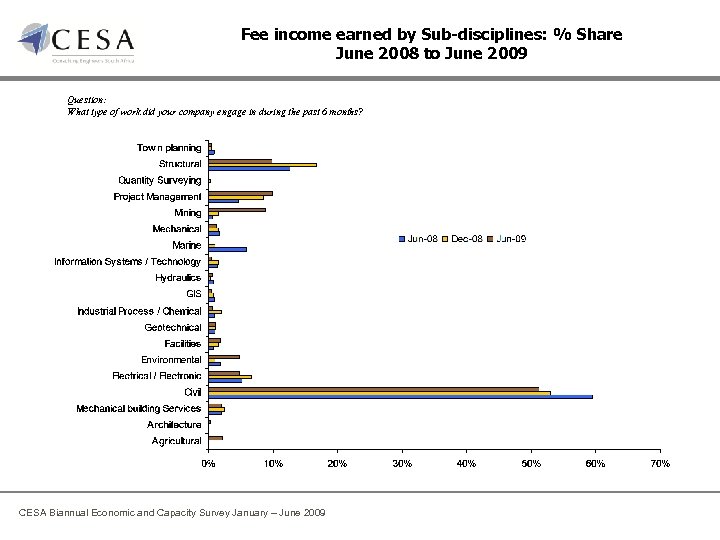

Fee income earned by Sub-disciplines: % Share June 2008 to June 2009 Question: What type of work did your company engage in during the past 6 months? CESA Biannual Economic and Capacity Survey January – June 2009

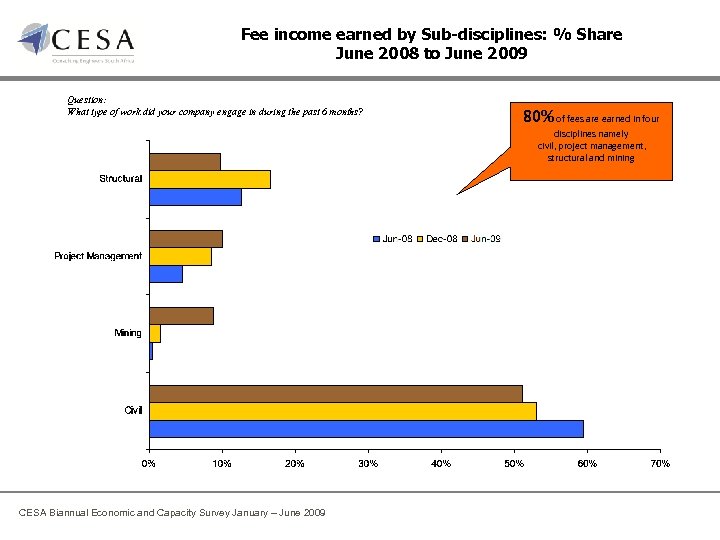

Fee income earned by Sub-disciplines: % Share June 2008 to June 2009 Question: What type of work did your company engage in during the past 6 months? 80% of fees are earned in four disciplines namely civil, project management, structural and mining CESA Biannual Economic and Capacity Survey January – June 2009

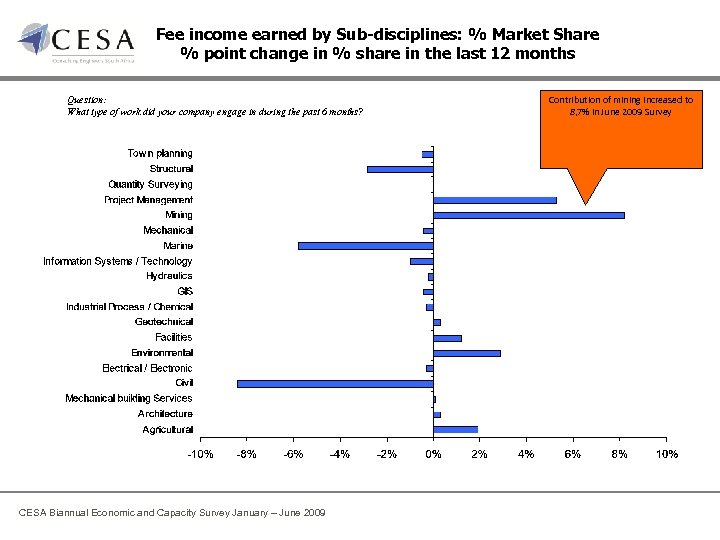

Fee income earned by Sub-disciplines: % Market Share % point change in % share in the last 12 months Question: What type of work did your company engage in during the past 6 months? CESA Biannual Economic and Capacity Survey January – June 2009 Contribution of mining increased to 8, 7% in June 2009 Survey

Fee income earned by Top four disciplines: R mill 2000 prices Annual average: 2000 – June 2009 (annualised) Civil CESA Biannual Economic and Capacity Survey January – June 2009

Economic Sector CESA Biannual Economic and Capacity Survey January – June 2009

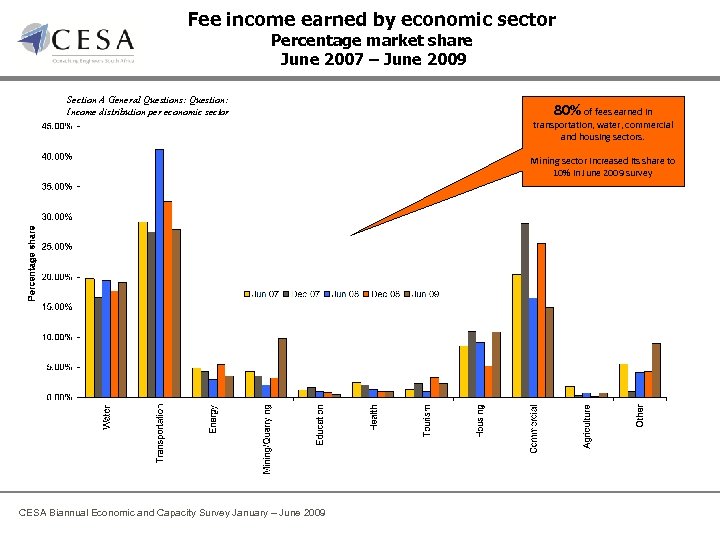

Fee income earned by economic sector Percentage market share June 2007 – June 2009 Section A General Questions: Question: Income distribution per economic sector 80% of fees earned in transportation, water, commercial and housing sectors. Mining sector increased its share to 10% in June 2009 survey CESA Biannual Economic and Capacity Survey January – June 2009

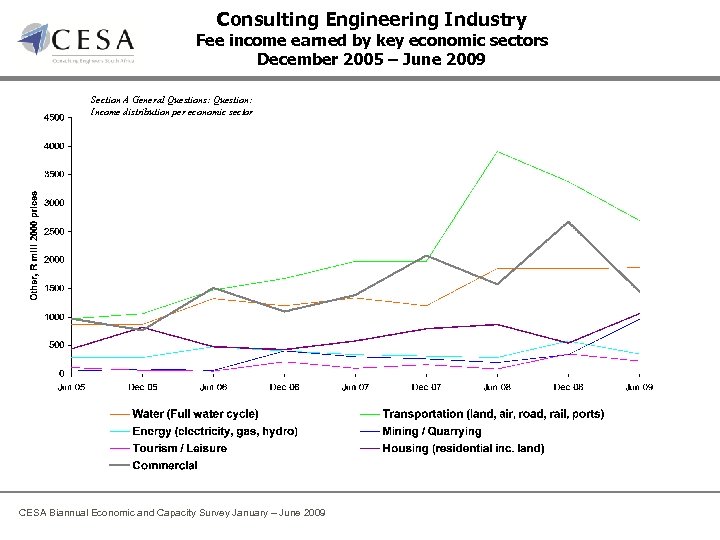

Consulting Engineering Industry Fee income earned by key economic sectors December 2005 – June 2009 Section A General Questions: Question: Income distribution per economic sector CESA Biannual Economic and Capacity Survey January – June 2009

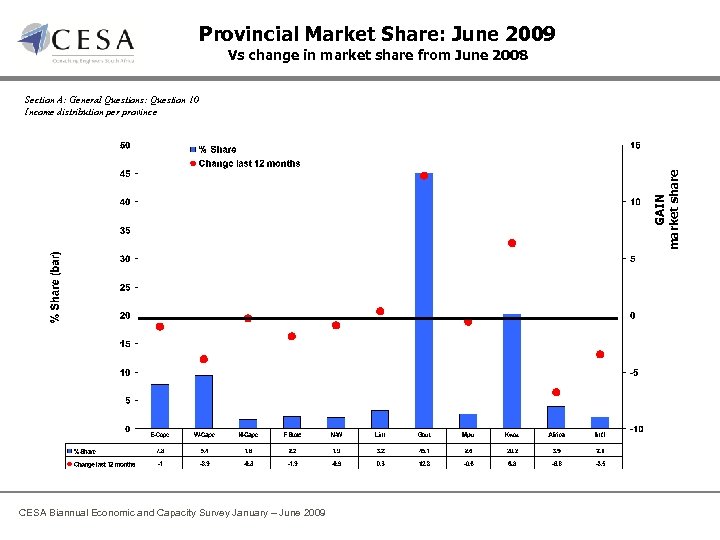

Provincial Market Share: June 2009 Vs change in market share from June 2008 GAIN market share Section A: General Questions: Question 10 Income distribution per province CESA Biannual Economic and Capacity Survey January – June 2009

Provincial Market Share 2005 – June 2009 (Annual Avg) Section A: General Questions: Question 10 Income distribution per province CESA Biannual Economic and Capacity Survey January – June 2009

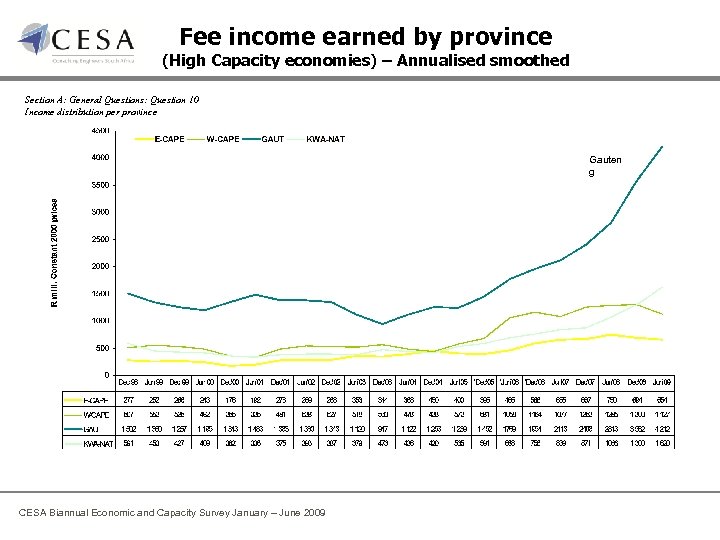

Fee income earned by province (High Capacity economies) – Annualised smoothed Section A: General Questions: Question 10 Income distribution per province Gauten g CESA Biannual Economic and Capacity Survey January – June 2009

Fee income earned (Constant 2000 prices) High Capacity vs lower capacity provincial economies (Smoothed) Section A: General Questions: Question 10 Income distribution per province High Capacity: WC, EC, GAU, KZN = 80% of total fee earnings (December 2007 survey) CESA Biannual Economic and Capacity Survey January – June 2009

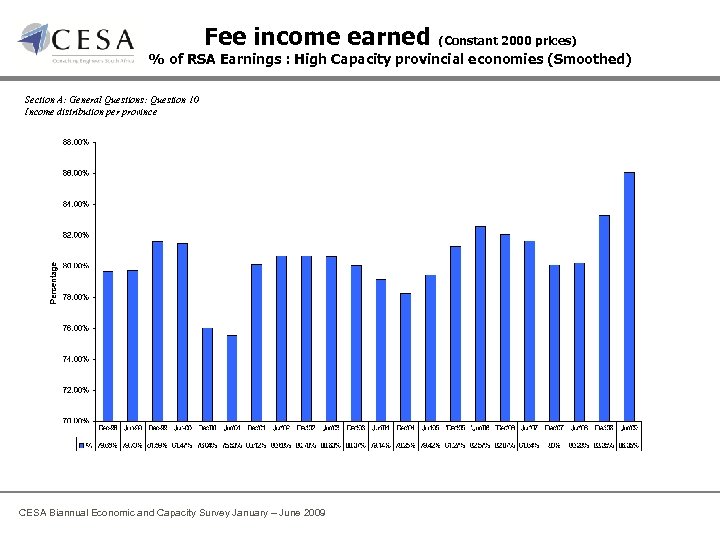

Fee income earned (Constant 2000 prices) % of RSA Earnings : High Capacity provincial economies (Smoothed) Section A: General Questions: Question 10 Income distribution per province CESA Biannual Economic and Capacity Survey January – June 2009

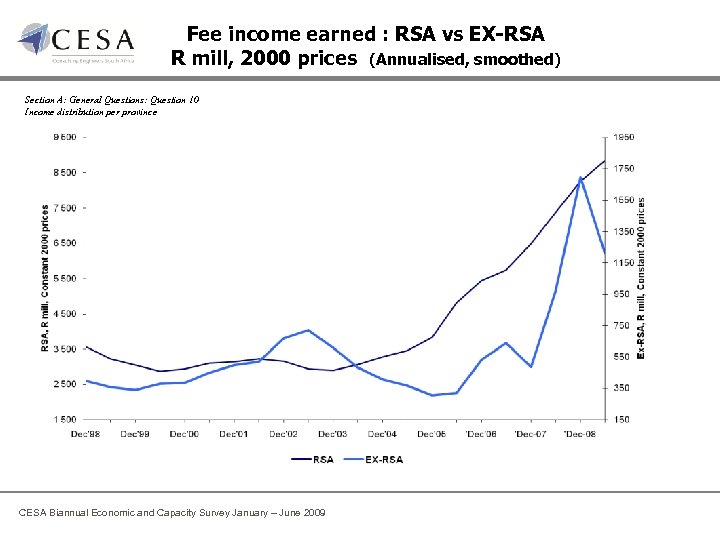

Fee income earned : RSA vs EX-RSA R mill, 2000 prices (Annualised, smoothed) Section A: General Questions: Question 10 Income distribution per province CESA Biannual Economic and Capacity Survey January – June 2009

Client CESA Biannual Economic and Capacity Survey January – June 2009

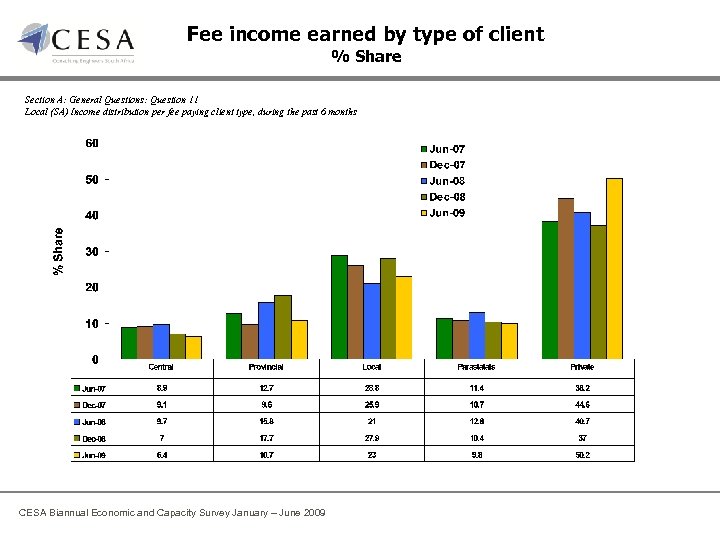

Fee income earned by type of client % Share Section A: General Questions: Question 11 Local (SA) Income distribution per fee paying client type, during the past 6 months CESA Biannual Economic and Capacity Survey January – June 2009

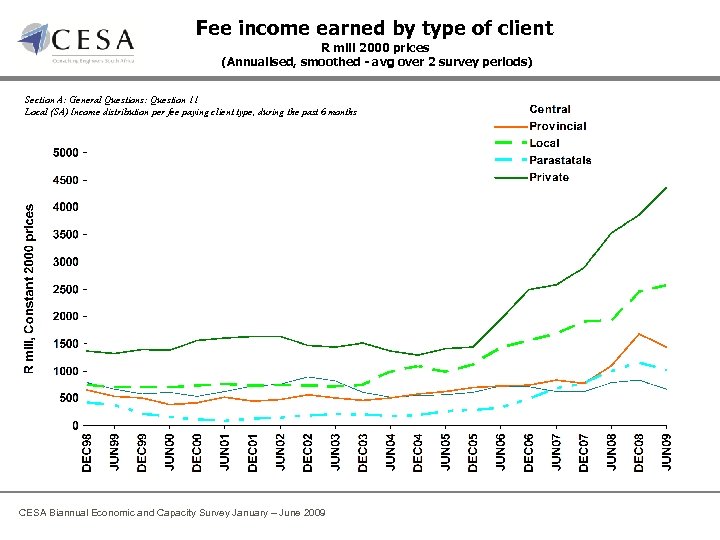

Fee income earned by type of client R mill 2000 prices (Annualised, smoothed - avg over 2 survey periods) Section A: General Questions: Question 11 Local (SA) Income distribution per fee paying client type, during the past 6 months CESA Biannual Economic and Capacity Survey January – June 2009

Fee income earned by type of client Constant 2000 prices (Annualised, smoothed - avg over 2 survey periods) Section A: General Questions: Question 11 Local (SA) Income distribution per fee paying client type, during the past 6 months Fees earned working in the public fell by CESA Biannual Economic and Capacity Survey January – June 2009 sector 14% y/y in the June 2009 survey

Competition CESA Biannual Economic and Capacity Survey January – June 2009

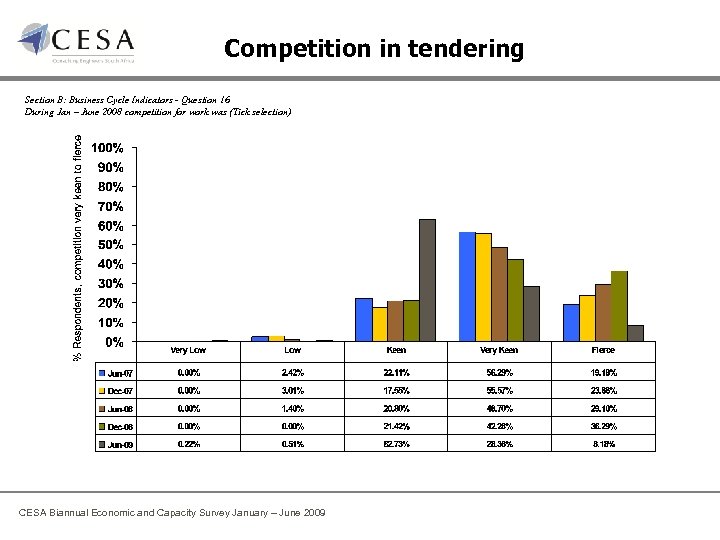

Competition in tendering Section B: Business Cycle Indicators - Question 16 During Jan – June 2008 competition for work was (Tick selection) CESA Biannual Economic and Capacity Survey January – June 2009

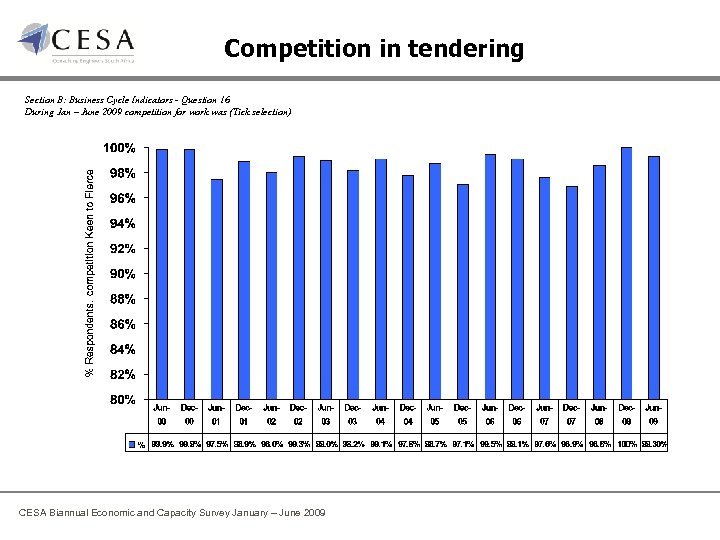

Competition in tendering Section B: Business Cycle Indicators - Question 16 During Jan – June 2009 competition for work was (Tick selection) CESA Biannual Economic and Capacity Survey January – June 2009

Recruitment CESA Biannual Economic and Capacity Survey January – June 2009

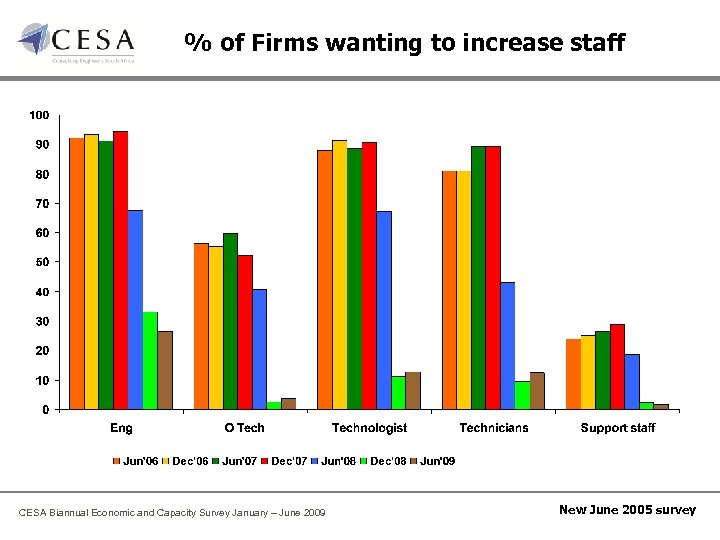

% of Firms wanting to increase staff CESA Biannual Economic and Capacity Survey January – June 2009 New June 2005 survey

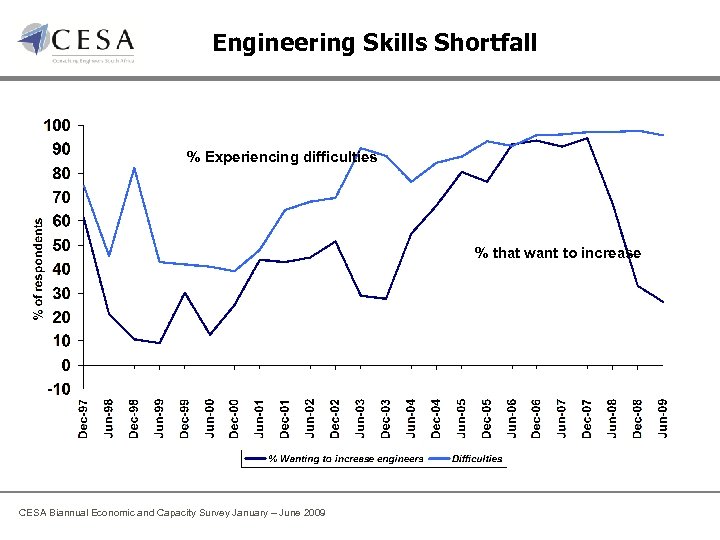

Engineering Skills Shortfall % Experiencing difficulties % that want to increase CESA Biannual Economic and Capacity Survey January – June 2009

Recruitment problems CESA Biannual Economic and Capacity Survey January – June 2009

Training / Bursaries CESA Biannual Economic and Capacity Survey January – June 2009

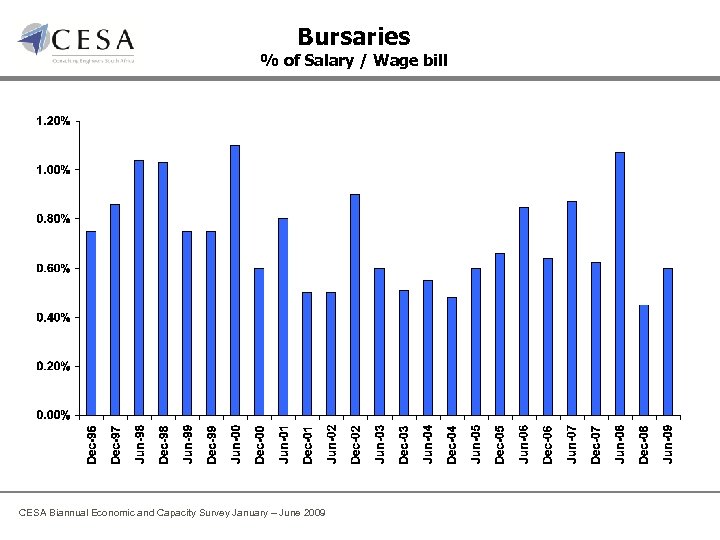

Bursaries % of Salary / Wage bill CESA Biannual Economic and Capacity Survey January – June 2009

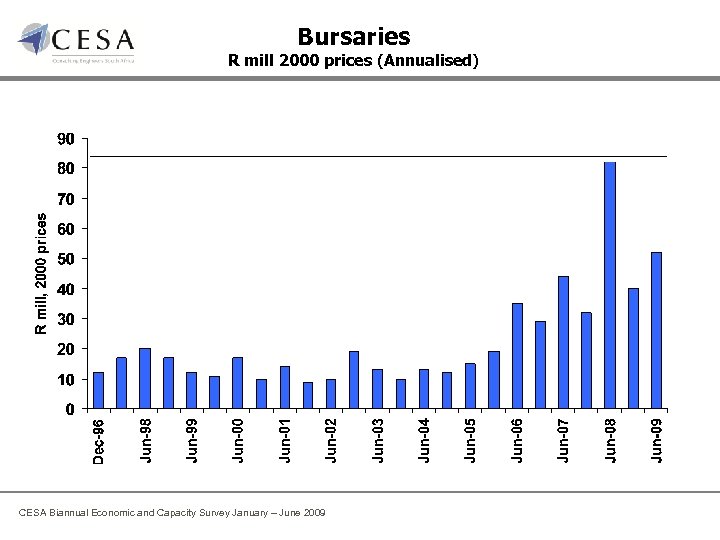

Bursaries R mill 2000 prices (Annualised) CESA Biannual Economic and Capacity Survey January – June 2009

Training (Salaries and Direct Training Costs) % of Payroll Data not available Large % of respondents did not complete information on salaries in December 2008 survey CESA Biannual Economic and Capacity Survey January – June 2009

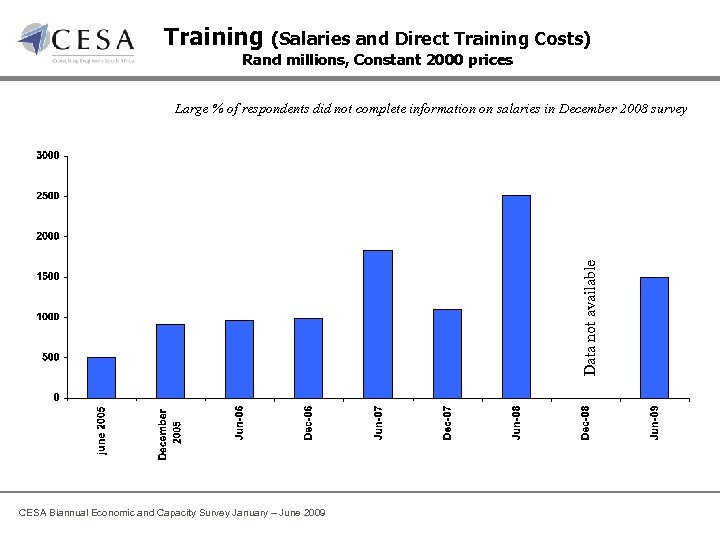

Training (Salaries and Direct Training Costs) Rand millions, Constant 2000 prices Data not available Large % of respondents did not complete information on salaries in December 2008 survey CESA Biannual Economic and Capacity Survey January – June 2009

Training (Direct costs only) % of Payroll CESA Biannual Economic and Capacity Survey January – June 2009

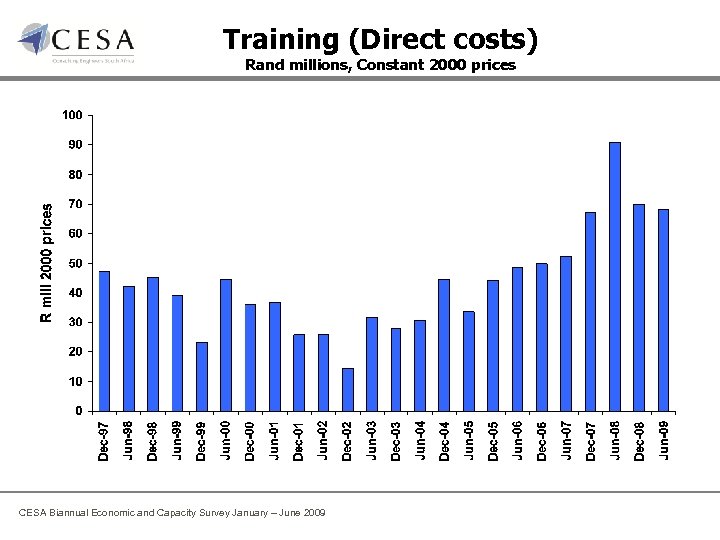

Training (Direct costs) Rand millions, Constant 2000 prices CESA Biannual Economic and Capacity Survey January – June 2009

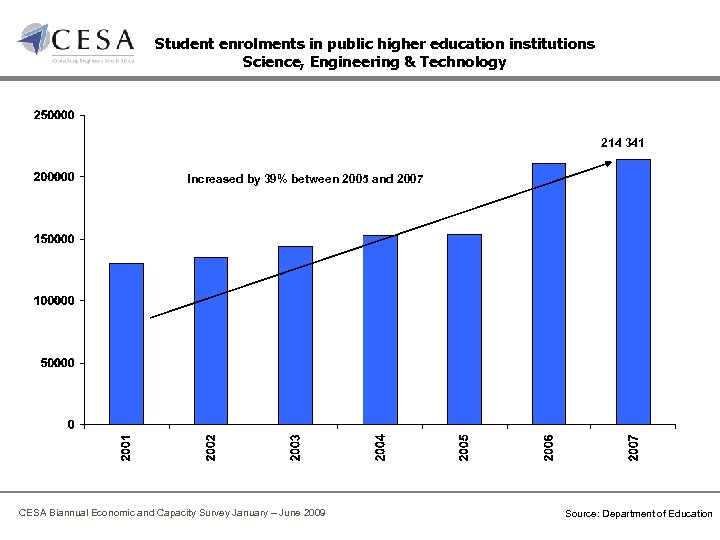

Student enrolments in public higher education institutions Science, Engineering & Technology 214 341 Increased by 39% between 2005 and 2007 CESA Biannual Economic and Capacity Survey January – June 2009 Source: Department of Education

Capacity CESA Biannual Economic and Capacity Survey January – June 2009

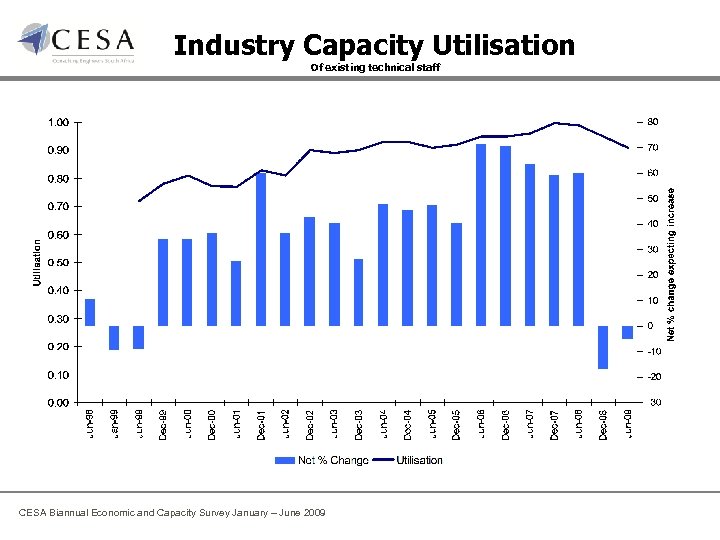

Industry Capacity Utilisation Of existing technical staff CESA Biannual Economic and Capacity Survey January – June 2009

Delayed Payments CESA Biannual Economic and Capacity Survey January – June 2009

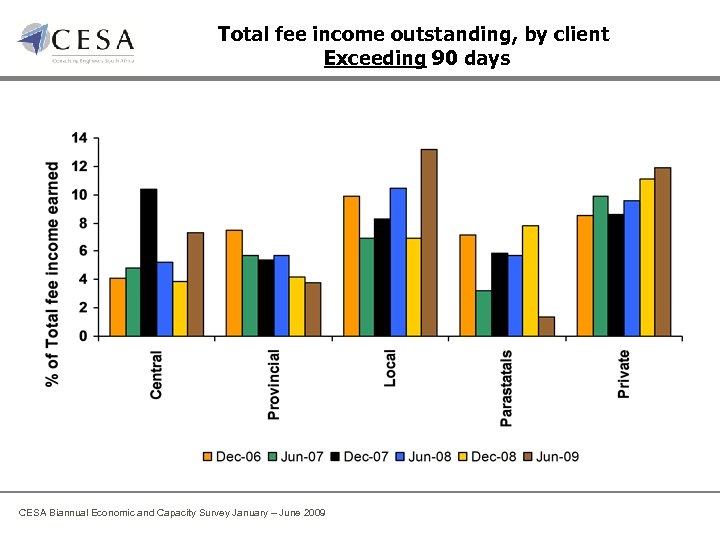

Total fee income outstanding, by client Exceeding 90 days CESA Biannual Economic and Capacity Survey January – June 2009

Fee income outstanding for longer than 90 days June 2009 CESA Biannual Economic and Capacity Survey January – June 2009

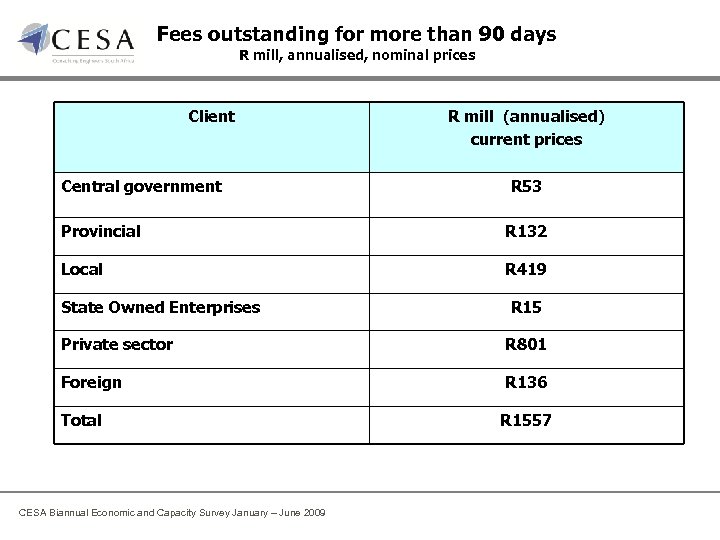

Fees outstanding for more than 90 days R mill, annualised, nominal prices Client Central government R mill (annualised) current prices R 53 Provincial R 132 Local R 419 State Owned Enterprises R 15 Private sector R 801 Foreign R 136 Total CESA Biannual Economic and Capacity Survey January – June 2009 R 1557

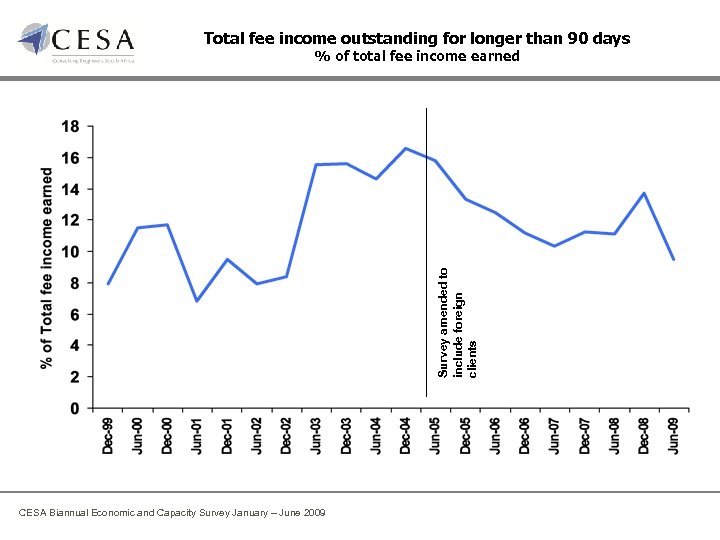

Total fee income outstanding for longer than 90 days Survey amended to include foreign clients % of total fee income earned CESA Biannual Economic and Capacity Survey January – June 2009

Inflation CESA Biannual Economic and Capacity Survey January – June 2009

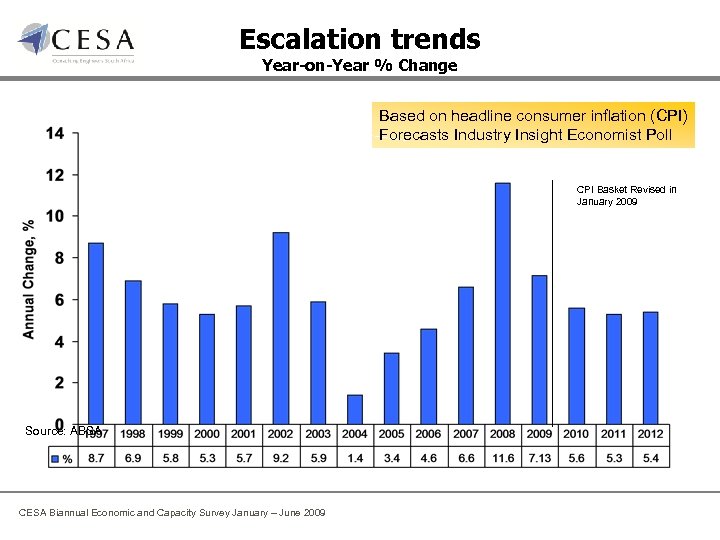

Escalation trends Year-on-Year % Change Based on headline consumer inflation (CPI) Forecasts Industry Insight Economist Poll CPI Basket Revised in January 2009 Source: ABSA CESA Biannual Economic and Capacity Survey January – June 2009

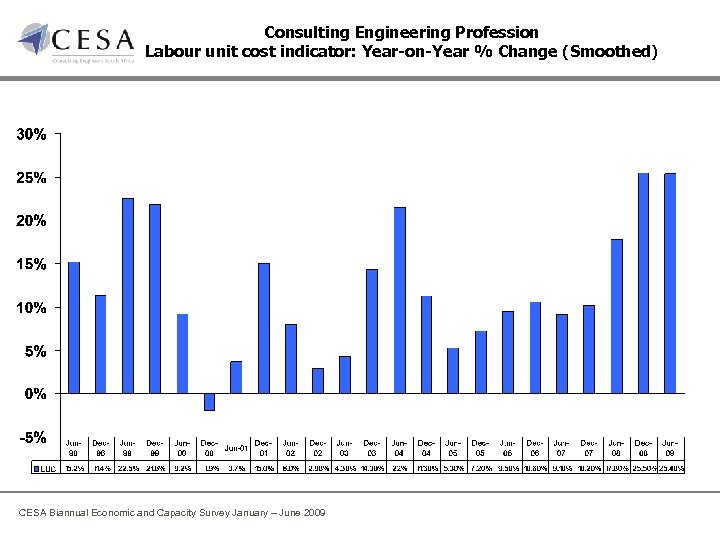

Consulting Engineering Profession Labour unit cost indicator: Year-on-Year % Change (Smoothed) CESA Biannual Economic and Capacity Survey January – June 2009

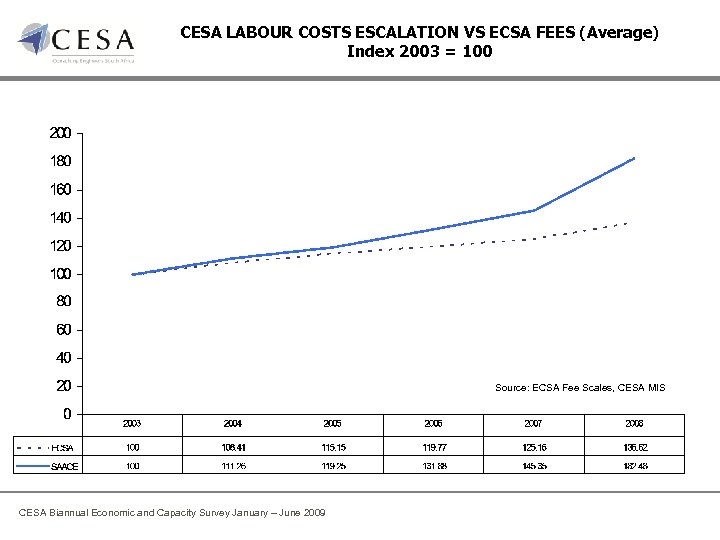

CESA LABOUR COSTS ESCALATION VS ECSA FEES (Average) Index 2003 = 100 Source: ECSA Fee Scales, CESA MIS CESA Biannual Economic and Capacity Survey January – June 2009

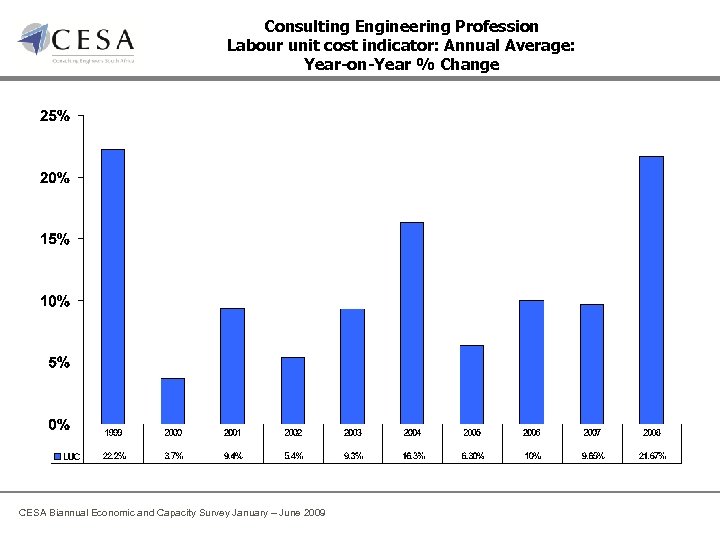

Consulting Engineering Profession Labour unit cost indicator: Annual Average: Year-on-Year % Change CESA Biannual Economic and Capacity Survey January – June 2009

Employment Profile CESA Biannual Economic and Capacity Survey January – June 2009

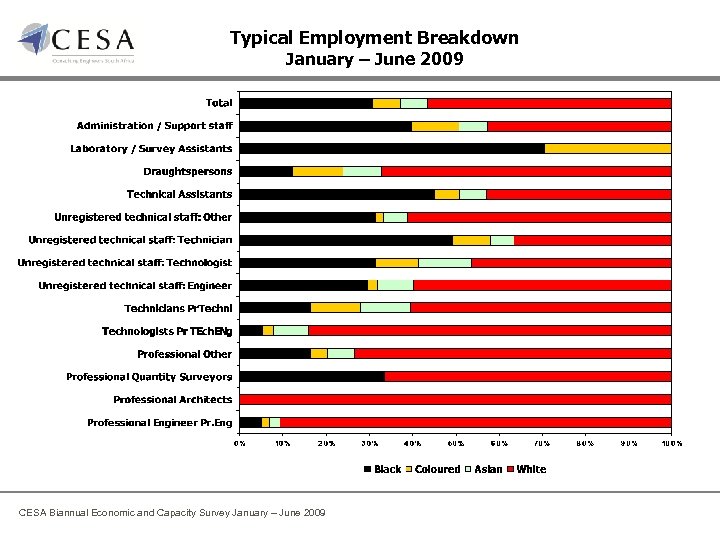

Typical Employment Breakdown January – June 2009 CESA Biannual Economic and Capacity Survey January – June 2009

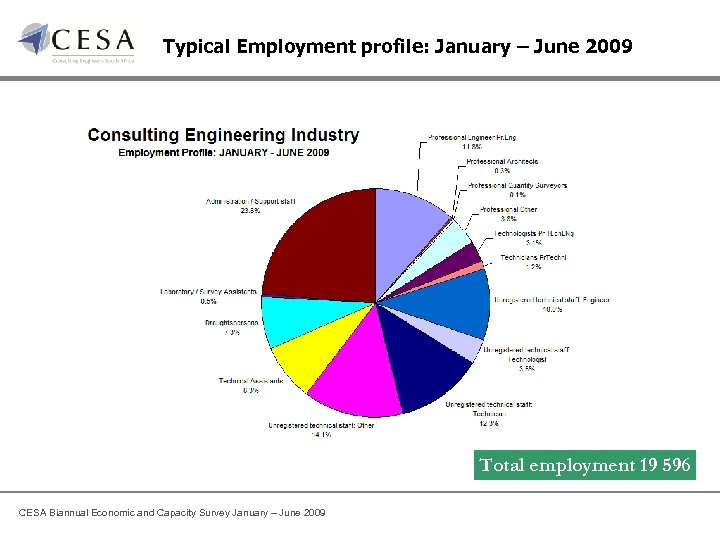

Typical Employment profile: January – June 2009 Total employment 19 596 CESA Biannual Economic and Capacity Survey January – June 2009

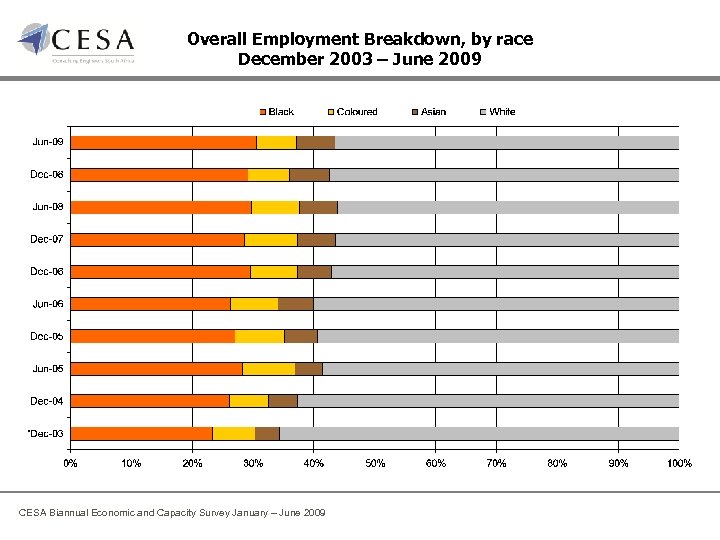

Overall Employment Breakdown, by race December 2003 – June 2009 CESA Biannual Economic and Capacity Survey January – June 2009

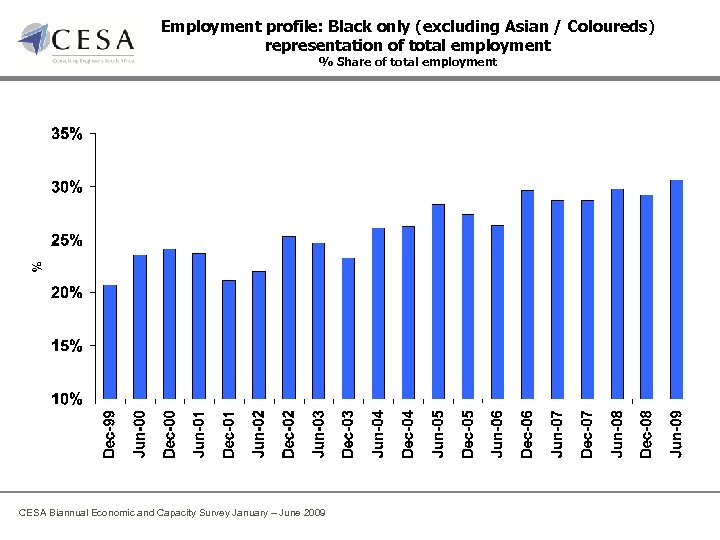

Employment profile: Black only (excluding Asian / Coloureds) representation of total employment % Share of total employment CESA Biannual Economic and Capacity Survey January – June 2009

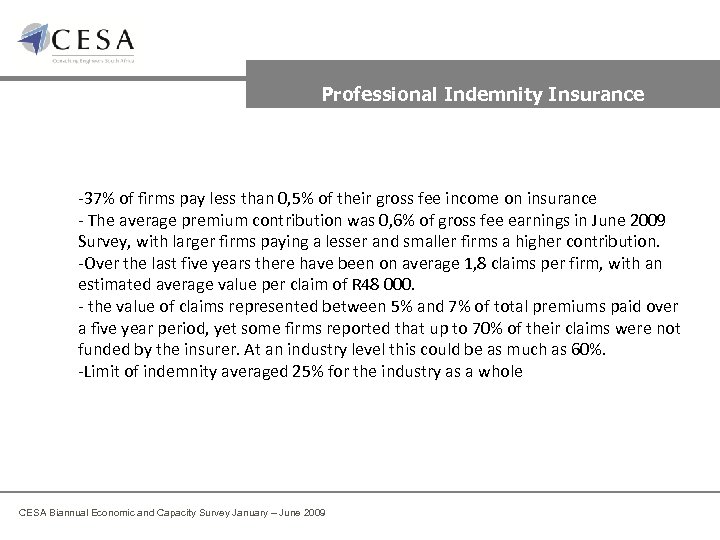

Professional Indemnity Insurance -37% of firms pay less than 0, 5% of their gross fee income on insurance - The average premium contribution was 0, 6% of gross fee earnings in June 2009 Survey, with larger firms paying a lesser and smaller firms a higher contribution. -Over the last five years there have been on average 1, 8 claims per firm, with an estimated average value per claim of R 48 000. - the value of claims represented between 5% and 7% of total premiums paid over a five year period, yet some firms reported that up to 70% of their claims were not funded by the insurer. At an industry level this could be as much as 60%. -Limit of indemnity averaged 25% for the industry as a whole CESA Biannual Economic and Capacity Survey January – June 2009

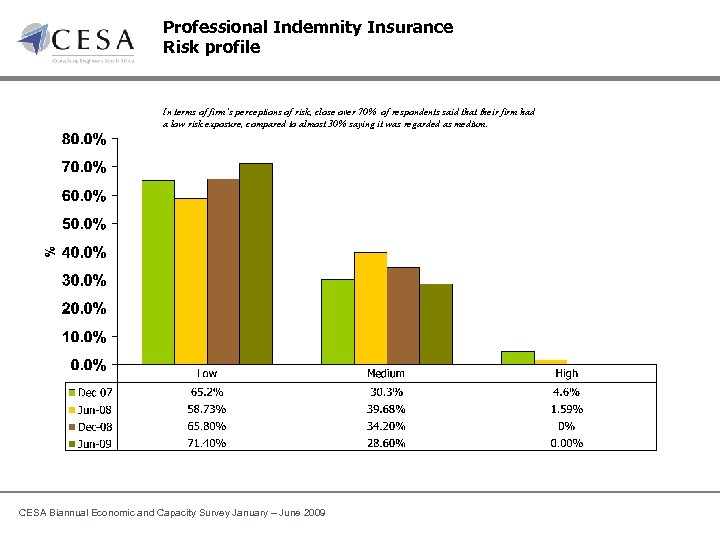

Professional Indemnity Insurance Risk profile In terms of firm’s perceptions of risk, close over 70% of respondents said that their firm had a low risk exposure, compared to almost 30% saying it was regarded as medium. CESA Biannual Economic and Capacity Survey January – June 2009

Equity / Ownership CESA Biannual Economic and Capacity Survey January – June 2009

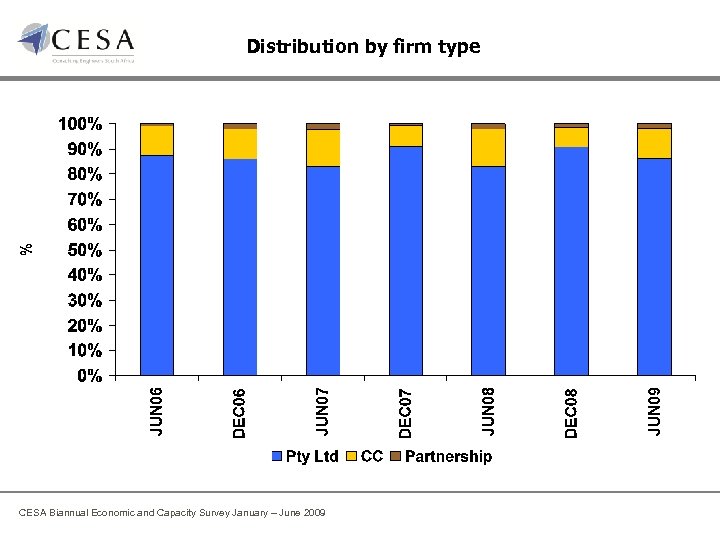

Distribution by firm type CESA Biannual Economic and Capacity Survey January – June 2009

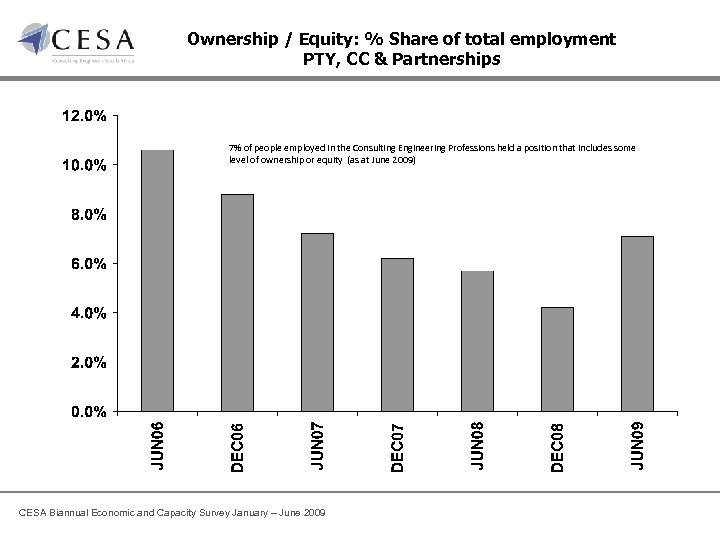

Ownership / Equity: % Share of total employment PTY, CC & Partnerships 7% of people employed in the Consulting Engineering Professions held a position that includes some level of ownership or equity (as at June 2009) CESA Biannual Economic and Capacity Survey January – June 2009

Black Ownership / Equity: % Share of total ownership / equity PTY, CC & Partnerships -Women represented 6% of total ownership / equity compared to 4, 3% in the December 2007 survey -Black women represented 3, 5% of total ownership / equity compared to 2, 8% in the December 2007 survey CESA Biannual Economic and Capacity Survey January – June 2009 Black, including Asian & Coloured

Black ownership / equity as % of total ownership / equity by type of company June 2006 – December 2008 Black includes Asian and Coloureds CESA Biannual Economic and Capacity Survey January – June 2009

Quality Management CESA Biannual Economic and Capacity Survey January – June 2009

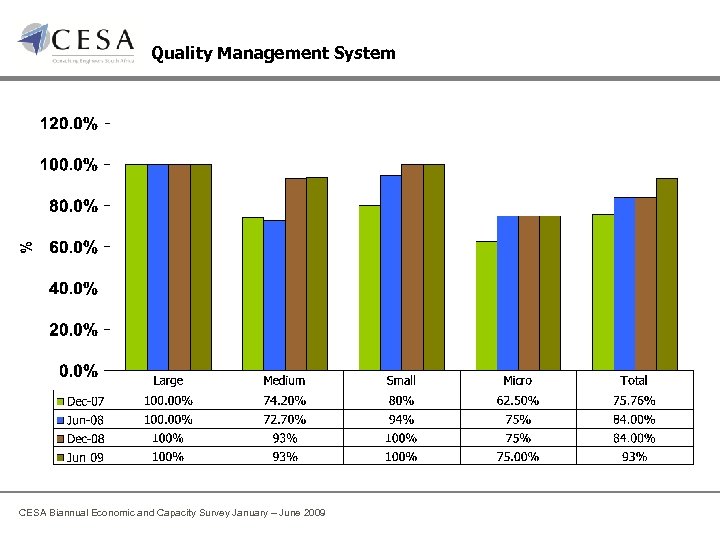

Quality Management System CESA Biannual Economic and Capacity Survey January – June 2009

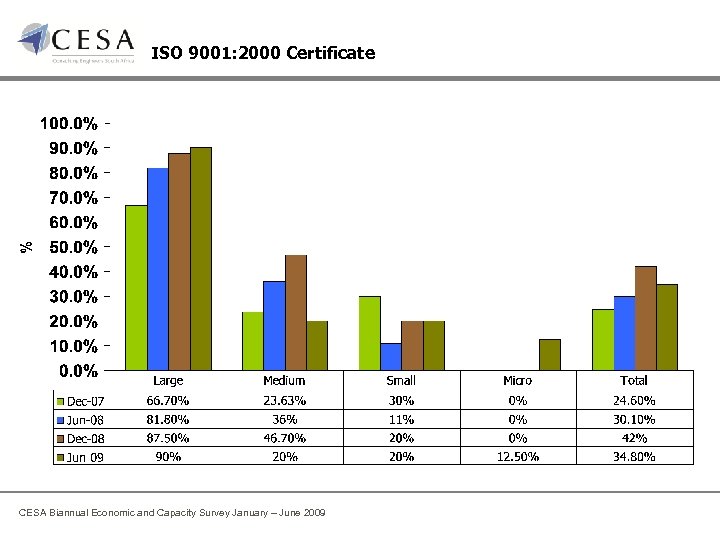

ISO 9001: 2000 Certificate CESA Biannual Economic and Capacity Survey January – June 2009

Thank you www. cesa. co. za Tel: 011 463 2022

a13571227f13c81b7ecc9454b4c6fc71.ppt