336334bdf1e8a1aa966f2b5a8c095c56.ppt

- Количество слайдов: 21

BG Group BG Norge UK Norway Share Fair – 20 April 2006

Legal Notice The following presentation includes "forward-looking information" within the meaning of Section 27 A of the US Securities Act of 1933, as amended, and Section 21 E of the US Securities Exchange Act of 1934, as amended. Certain statements included in this presentation, including without limitation those concerning (i) BG Group's strategy, outlook and growth opportunities; (ii) the 2006 long term growth targets; (iii) growth, and the sources of growth, to 2009 and beyond; (iv) the projects and assets expected to contribute to BG Group’s growth; (v) commercialisation and project delivery activities; (vi) BG Group's positioning to deliver its future plans and to realise its potential for growth; (vii) market development; (viii) the global economic outlook; (ix) the economic outlook for the gas and oil industries; (x) demand for gas as a source of energy and for imports of gas; (xi) BG’s competitive position; (xii) statements preceded by “believes”, “expects”, “anticipates”, “plans”, “intends” or similar expressions, contain certain forward-looking information concerning BG Group's operations, economic performance and financial performance. Although BG Group believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward looking statements, as a result of, among other factors (i) changes in economic, market and competitive conditions, including oil and gas prices; (ii) success in implementing business and operating initiatives; (iii) changes in the regulatory environment and other government actions, including UK and international corporation tax rates; (iv) the failure to ensure the safe operation of BG Group's assets worldwide; (v) implementation risk, being the challenges associated with delivering capital intensive projects on time and on budget, including the need to retain and motivate staff; (vi) commodity risk, being the risk of significant fluctuations in gas and/or oil prices from those assumed; (vii) a major recession or significant upheaval in the major markets in which BG Group operates; (viii) risks encountered in the gas and oil exploration and production sector in general; (ix) fluctuations in exchange rates; (x) business risk management; and (xi) the Risk Factors included in BG Group's Annual Report and Accounts 2003. BG Group undertakes no obligation to update any forward looking information. This presentation does not constitute or contain, and shall not be taken to constitute or contain, an invitation or inducement to any person to underwrite, subscribe for, otherwise acquire, or dispose of or invest in BG Group plc or any other entity, nor does it advise any person to do any of the foregoing. 2

BG Group 3

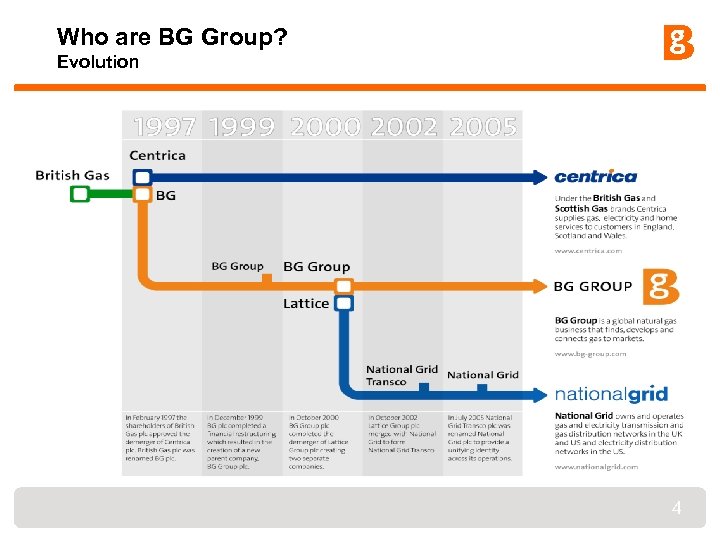

Who are BG Group? Evolution 4

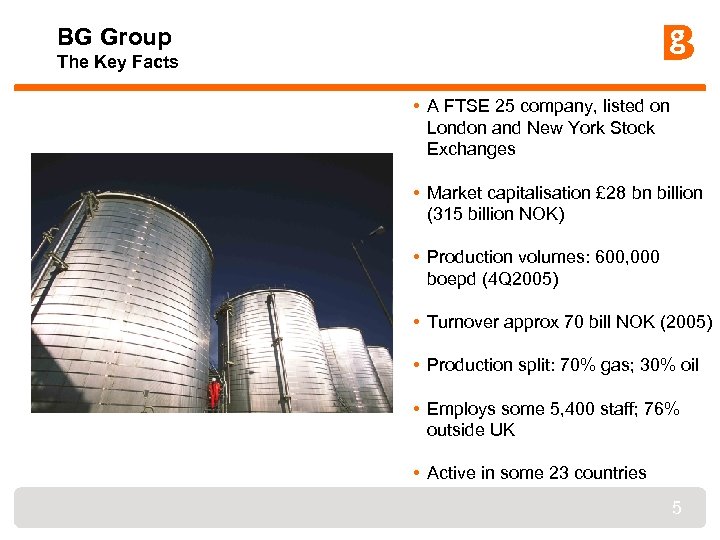

BG Group The Key Facts • A FTSE 25 company, listed on London and New York Stock Exchanges • Market capitalisation £ 28 bn billion (315 billion NOK) • Production volumes: 600, 000 boepd (4 Q 2005) • Turnover approx 70 bill NOK (2005) • Production split: 70% gas; 30% oil • Employs some 5, 400 staff; 76% outside UK • Active in some 23 countries 5

BG Group Where We Operate Active in Some 23 Countries 6

BG Group Integrated Gas Major Connect gas to high value markets • Build and access markets • Serve customers Secure low cost resources • Equity reserves • Contracted resources Skills to succeed across the gas chain BG Group – a growth company 7

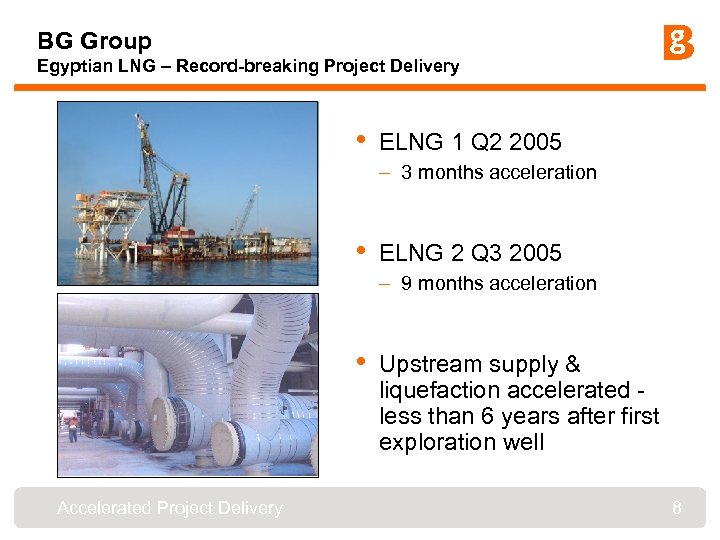

BG Group Egyptian LNG – Record-breaking Project Delivery • ELNG 1 Q 2 2005 – 3 months acceleration • ELNG 2 Q 3 2005 – 9 months acceleration • Accelerated Project Delivery Upstream supply & liquefaction accelerated - less than 6 years after first exploration well 8

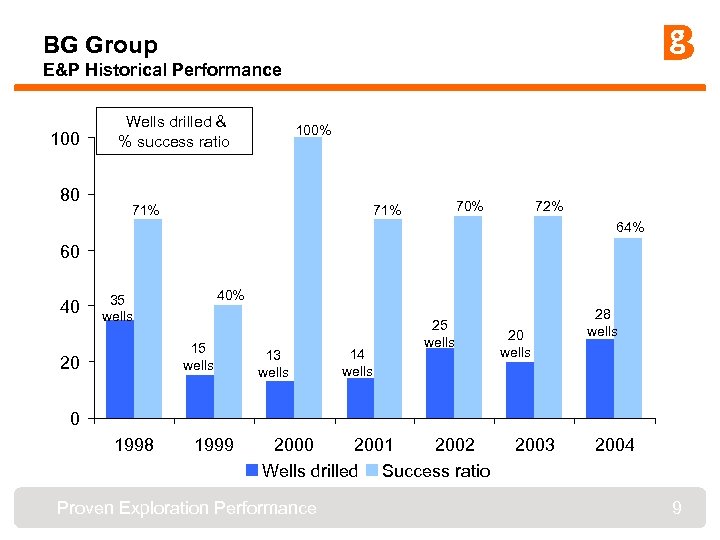

BG Group E&P Historical Performance 100 80 Wells drilled & % success ratio 100% 71% 72% 64% 60 40 40% 35 wells 15 wells 20 13 wells 14 wells 25 wells 20 wells 28 wells 0 1998 1999 2000 2001 2002 Wells drilled Success ratio Proven Exploration Performance 2003 2004 9

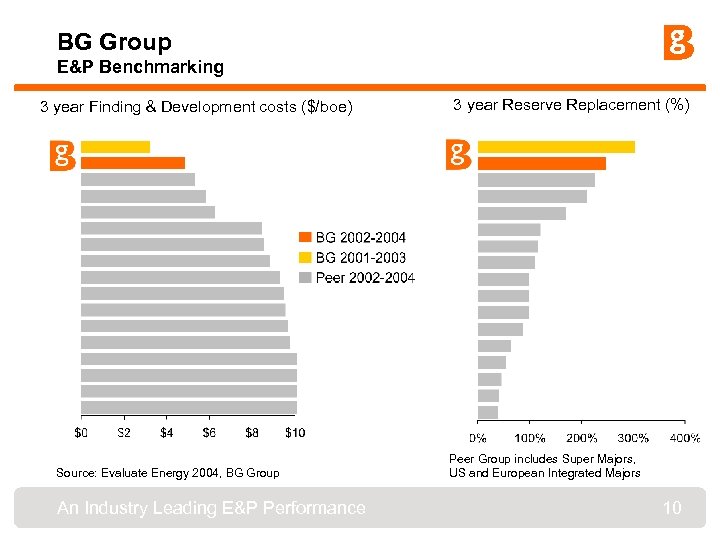

BG Group E&P Benchmarking 3 year Finding & Development costs ($/boe) Source: Evaluate Energy 2004, BG Group An Industry Leading E&P Performance 3 year Reserve Replacement (%) Peer Group includes Super Majors, US and European Integrated Majors 10

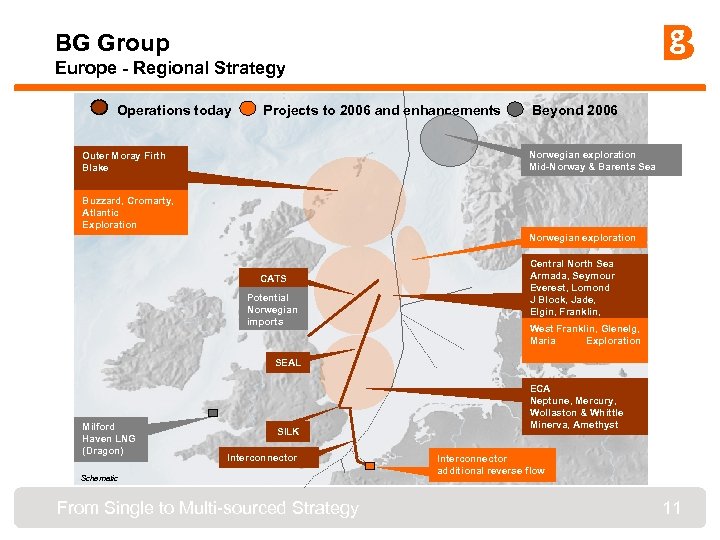

BG Group Europe - Regional Strategy Operations today Projects to 2006 and enhancements Beyond 2006 Norwegian exploration Mid-Norway & Barents Sea Outer Moray Firth Blake Buzzard, Cromarty, Atlantic Exploration Norwegian exploration CATS Potential Norwegian imports Central North Sea Armada, Seymour Everest, Lomond J Block, Jade, Elgin, Franklin, West Franklin, Glenelg, Maria Exploration SEAL Milford Haven LNG (Dragon) SILK Interconnector Schematic From Single to Multi-sourced Strategy ECA Neptune, Mercury, Wollaston & Whittle Minerva, Amethyst Interconnector additional reverse flow 11

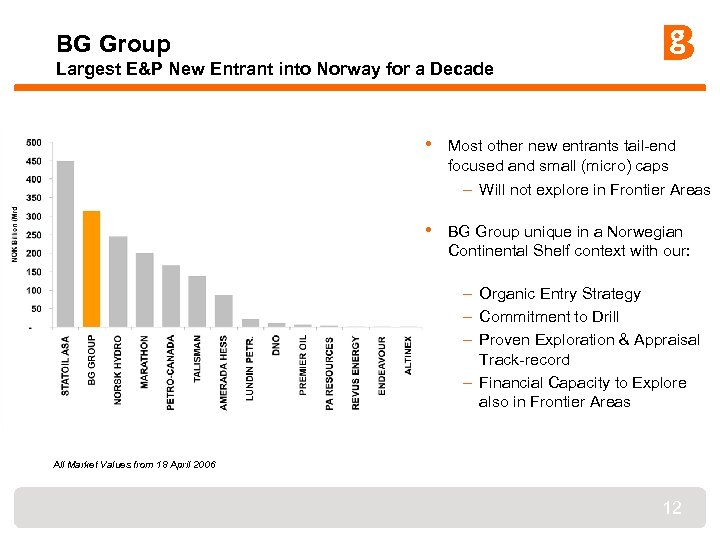

BG Group Largest E&P New Entrant into Norway for a Decade • Most other new entrants tail-end focused and small (micro) caps – Will not explore in Frontier Areas • BG Group unique in a Norwegian Continental Shelf context with our: – Organic Entry Strategy – Commitment to Drill – Proven Exploration & Appraisal Track-record – Financial Capacity to Explore also in Frontier Areas All Market Values from 18 April 2006 12

BG Norge 13

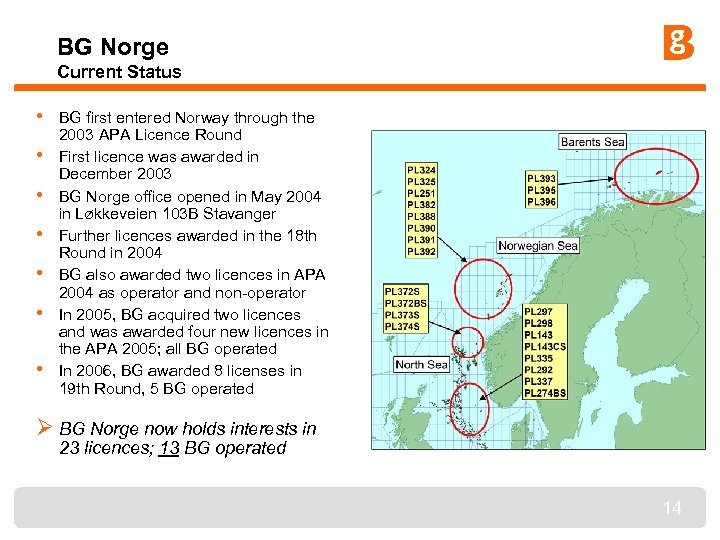

BG Norge Current Status • • BG first entered Norway through the 2003 APA Licence Round First licence was awarded in December 2003 BG Norge office opened in May 2004 in Løkkeveien 103 B Stavanger Further licences awarded in the 18 th Round in 2004 BG also awarded two licences in APA 2004 as operator and non-operator In 2005, BG acquired two licences and was awarded four new licences in the APA 2005; all BG operated In 2006, BG awarded 8 licenses in 19 th Round, 5 BG operated Ø BG Norge now holds interests in 23 licences; 13 BG operated 14

BG Norge Why now? • Licensing authorities encouraging new entrants; • Introduction of exploration tax credit in 2005; • UK-Norway treaty addressing median line issues; • Opportunities to bring Norwegian gas to UK via existing UK infrastructure; • GFU, Statoil, Petoro, Gassco/Gassled reform. Material Improvements to Investment Climate 15

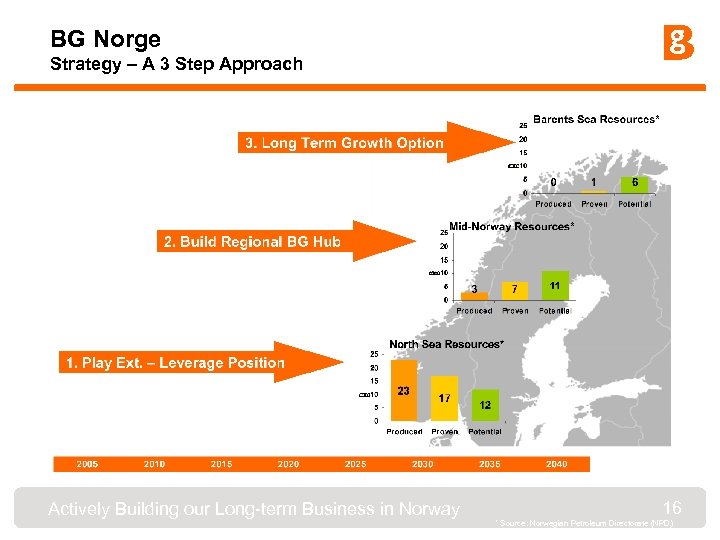

BG Norge Strategy – A 3 Step Approach Actively Building our Long-term Business in Norway 16 * Source: Norwegian Petroleum Directorate (NPD)

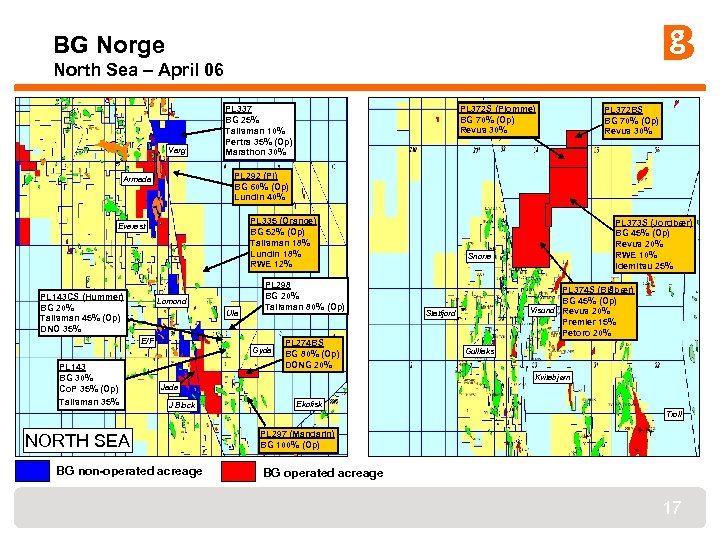

BG Norge North Sea – April 06 Varg PL 335 (Orange) BG 52% (Op) Talisman 18% Lundin 18% RWE 12% Everest Lomond Ula E/F PL 143 BG 30% Co. P 35% (Op) Talisman 35% PL 372 BS BG 70% (Op) Revus 30% PL 292 (Pi) BG 60% (Op) Lundin 40% Armada PL 143 CS (Hummer) BG 20% Talisman 45% (Op) DNO 35% PL 372 S (Plomme) BG 70% (Op) Revus 30% PL 337 BG 25% Talisman 10% Pertra 35% (Op) Marathon 30% PL 298 BG 20% Talisman 80% (Op) Gyda PL 274 BS BG 80% (Op) DONG 20% PL 373 S (Jordbær) BG 45% (Op) Revus 20% RWE 10% Idemitsu 25% Snorre PL 374 S (Blåbær) BG 45% (Op) Visund Revus 20% Premier 15% Petoro 20% Statfjord Gullfaks Kvitebjørn Jade J Block NORTH SEA BG non-operated acreage Ekofisk Troll PL 297 (Mandarin) BG 100% (Op) BG operated acreage 17

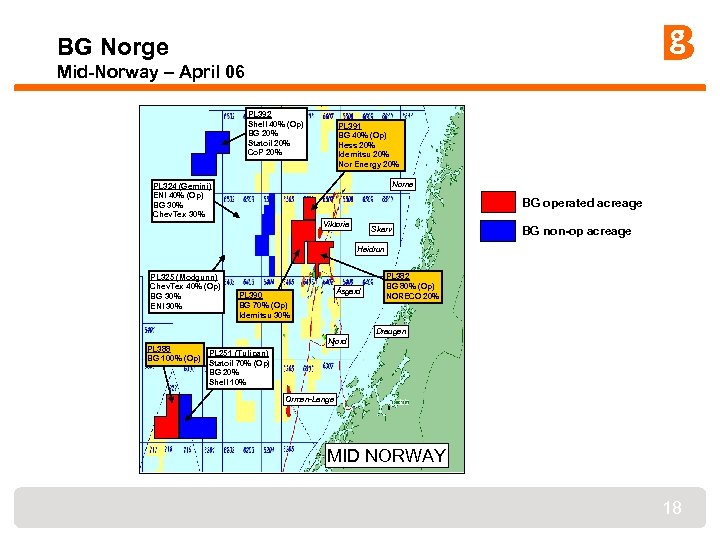

BG Norge Mid-Norway – April 06 PL 392 Shell 40% (Op) BG 20% Statoil 20% Co. P 20% PL 391 BG 40% (Op) Hess 20% Idemitsu 20% Nor Energy 20% Norne PL 324 (Gemini) ENI 40% (Op) BG 30% Chev. Tex 30% BG operated acreage Viktoria Skarv BG non-op acreage Heidrun PL 325 (Modgunn) Chev. Tex 40% (Op) BG 30% ENI 30% Åsgard PL 390 BG 70% (Op) Idemitsu 30% PL 382 BG 80% (Op) NORECO 20% Draugen PL 388 BG 100% (Op) Njord PL 251 (Tulipan) Statoil 70% (Op) BG 20% Shell 10% Ormen-Lange MID NORWAY 18

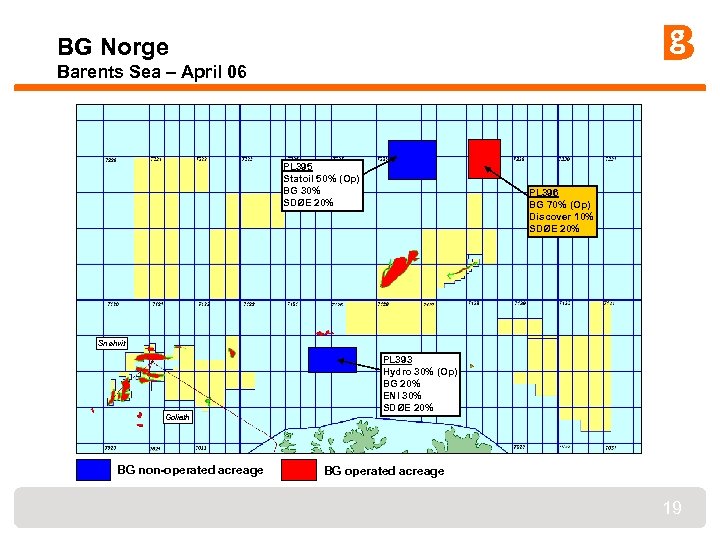

BG Norge Barents Sea – April 06 PL 395 Statoil 50% (Op) BG 30% SDØE 20% PL 396 BG 70% (Op) Discover 10% SDØE 20% Snøhvit Goliath BG non-operated acreage PL 393 Hydro 30% (Op) BG 20% ENI 30% SDØE 20% BG operated acreage 19

BG Norge Rig Status • October 05: BG Norge signed rig contract with Mærsk for heavy duty jack-up rig, Mærsk Guardian (80 days) Ø Bringing the unit back (from Australia) to the Norwegian Continental Shelf in a very tight rig market Ø Programme of five wells with consortium members BP and Dong • December 05: BG Norge exercised an additional 150 days option on the Mærsk Guardian Ø Future exploration drilling on the Norwegian Continental Shelf • Mærsk Guardian January 06: BG Norge contracted Bredford Dolphin for 100 days Ø Contract to commence 2 Q 07 • March 06: BG Group signed contract on Rowan Gorilla VI – Unit may be upgraded to NCS drilling ü Fortunately, despite a tight market, BG Norge has secured a total of 330 firm rig days in Norway over the next 24 months Bredford Dolphin 20

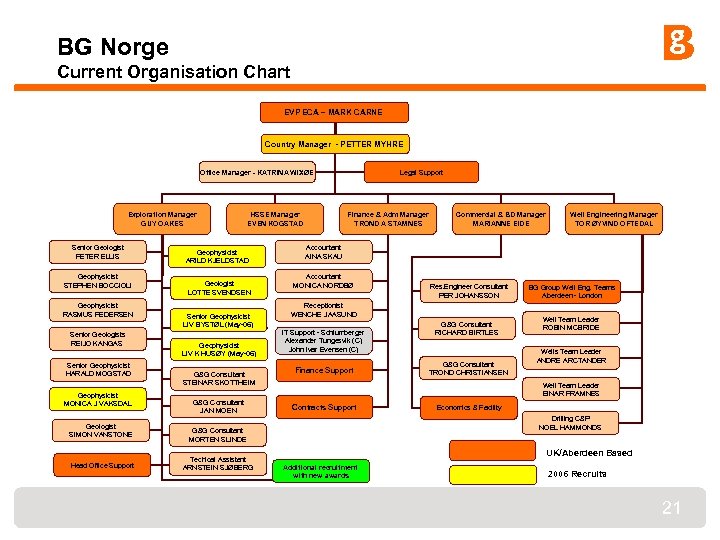

BG Norge Current Organisation Chart EVP ECA – MARK CARNE Country Manager - PETTER MYHRE Legal Support Office Manager - KATRINA WIXØE Exploration Manager GUY OAKES Senior Geologist PETER ELLIS Geophysicist STEPHEN BOCCIOLI Geophysicist RASMUS PEDERSEN Senior Geologists REIJO KANGAS Senior Geophysicist HARALD MOGSTAD Geophysicist MONICA J VAKSDAL Geologist SIMON VANSTONE Head Office Support HSSE Manager EVEN KOGSTAD Geophysicist ARILD KJELDSTAD Geologist LOTTE SVENDSEN Senior Geophysicist LIV BYSTØL (May-06) Geophysicist LIV K HUSØY (May-06) G&G Consultant STEINAR SKOTTHEIM G&G Consultant JAN MOEN Finance & Adm Manager TROND A STAMNES Well Engineering Manager TOR ØYVIND OFTEDAL Accountant AINA SKAU Accountant MONICA NORDBØ Res. Engineer Consultant PER JOHANSSON Receptionist WENCHE JAASUND IT Support - Schlumberger Alexander Tungesvik (C) John Ivar Evensen (C) Finance Support G&G Consultant RICHARD BIRTLES G&G Consultant TROND CHRISTIANSEN BG Group Well Eng. Teams Aberdeen - London Well Team Leader ROBIN MCBRIDE Wells Team Leader ANDRE ARCTANDER Well Team Leader EINAR FRAMNES Contracts Support Economics & Facility Drilling C&P NOEL HAMMONDS G&G Consultant MORTEN SLINDE Techical Assistant ARNSTEIN SJØBERG Commercial & BD Manager MARIANNE EIDE UK/Aberdeen Based Additional recruitment with new awards 2006 Recruits 21

336334bdf1e8a1aa966f2b5a8c095c56.ppt