d80bb465cafa0b03ad13f5540a7a60eb.ppt

- Количество слайдов: 40

Bergesen Worldwide Gas ASA Roadshow Presentation October 2005

Disclaimer § This Roadshow Presentation has been produced by Bergesen Worldwide Gas ASA (the “Company”) solely for use at the presentation to investors held in connection with the proposed offering and may not be reproduced or redistributed to any other person § This document contains certain forward-looking statements relating to the business, financial performance and results of the Company and/or the industry in which it operates. Forward-looking statements concern future circumstances and results and other statements that are not historical facts, sometimes identified by the words “believes”, expects”, “predicts”, “intends”, “projects”, “plans”, “estimates”, “aims”, “foresees”, “anticipates”, “targets”, and similar expressions. The forward-looking statements , contained in this Roadshow Presentation, including assumptions, opinions and views of the Company or cited from third party sources are solely opinions and forecasts which are uncertain and subject to risks. A multitude of factors can cause actual events to differ significantly from any anticipated development. Neither the Company nor UBS Investment Bank or Carnegie ASA nor any of their parent or subsidiary undertakings or any such person’s officers or employees guarantees that the assumptions underlying such forward-looking statements are free from errors nor does either accept any responsibility for the future accuracy of the opinions expressed in this Roadshow Presentation or the actual occurrence of the forecasted developments § No representation or warranty (express or implied) is made as to, and no reliance should be placed on, any information, including projections, estimates, targets and opinions, contained herein, and no liability whatsoever is accepted as to any errors, omissions or misstatements contained herein, and, accordingly, none of the Company, UBS Investment Bank or Carnegie ASA or any of their parent or subsidiary undertakings or any such person’s officers or employees accepts any liability whatsoever arising directly or indirectly from the use of this document § By attending this Roadshow Presentation you acknowledge that you will be solely responsible for your own assessment of the market and the market position of the Company and that you will be solely responsible forming your own view of the potential future performance of the Company’s business § This Roadshow Presentation is being communicated in the United Kingdom to persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (such persons being referred to as “investment professionals"). This presentation is only directed at qualified investors and investment professionals and other persons should not rely on or act upon this presentation or any of its contents. This Roadshow Presentation (or any part of it) is not to be reproduced, distributed, passed on, or the contents otherwise divulged, directly or indirectly, to any other person (excluding an investment professional’s advisers) without the prior written consent of UBS Investment Bank, Carnegie ASA and the Company. This Roadshow Presentation and the information contained herein are not an offer of securities for sale in the United States and are not for publication or distribution to persons in the United States (within the meaning of Regulation S under the U. S. Securities Act of 1933, as amended (the “Securities Act”)). The securities proposed to be offered in the Company have not been and will not be registered under the Securities Act and may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act § The information contained in this Roadshow Presentation does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for or purchase the securities discussed herein in any jurisdiction. Neither this Roadshow Presentation nor any part of it shall form the basis of, or be relied upon in connection with any offer, or act as an inducement to enter into any contract or commitment whatsoever § This Roadshow Presentation speaks as of 7 October 2005. Neither the delivery of this Roadshow Presentation nor any further discussions of the Company with any of the recipients shall, under any circumstances, create any implication that there has been no change in the affairs of the Company since such date 3/16/2018 7: 43 PM salamboCommunicationAnalyst PresentationReceived from Jacqueline�3 ANALYSTE PRESENTATION 15 MAY 2005. ppt 2

Presentation overview Section 1: Introduction Section 2: Investment highlights Section 3: LPG shipping market Section 4: LNG shipping market Section 5: Financial review

Section 1: Introduction 4

Offering summary § IPO of Bergesen Worldwide Gas ASA (“GAS”) on the Oslo Stock Exchange – Base offering of up to 40% of company (secondary shares) – Greenshoe of up to 12. 5% of offering shares (secondary shares) § Price range – Price range of NOK 80 -90 per share – Equity value of NOK 10. 3 -11. 6 billion § Timing – Subscription period is between 12 th October - 24 th October – Planned listing date is Tuesday 25 th of October 5

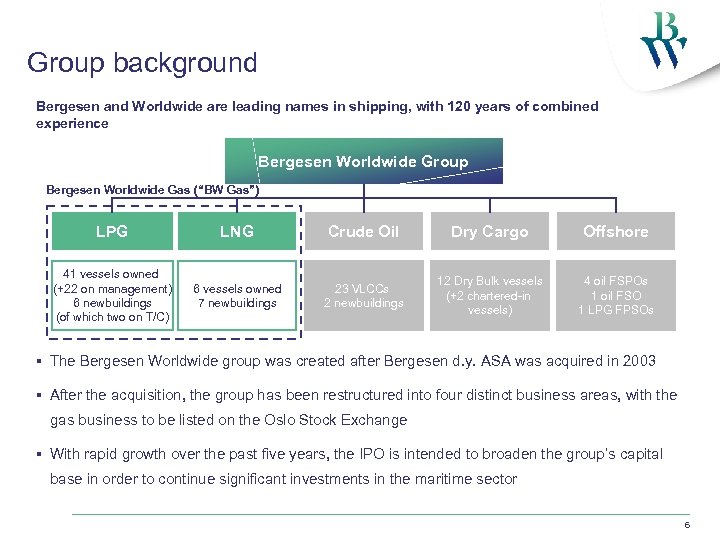

Group background Bergesen and Worldwide are leading names in shipping, with 120 years of combined experience Bergesen Worldwide Group Bergesen Worldwide Gas (“BW Gas”) LPG LNG Crude Oil Dry Cargo Offshore 41 vessels owned (+22 on management) 6 newbuildings (of which two on T/C) 6 vessels owned 7 newbuildings 23 VLCCs 2 newbuildings 12 Dry Bulk vessels (+2 chartered-in vessels) 4 oil FSPOs 1 oil FSO 1 LPG FPSOs § The Bergesen Worldwide group was created after Bergesen d. y. ASA was acquired in 2003 § After the acquisition, the group has been restructured into four distinct business areas, with the gas business to be listed on the Oslo Stock Exchange § With rapid growth over the past five years, the IPO is intended to broaden the group’s capital base in order to continue significant investments in the maritime sector 6

Section 2: Investment highlights 7

Investment highlights 1 BW Gas is well placed to benefit from its leading market position Key part of the gas valuein underlying demand for both LNG and LPG – Substantial growth chain – Significant investment opportunities going forward 2 LPG shipping is at an attractive point in the cycle 3 Attractive mix of LPG and LNG 4 Proven management team focused on delivering profitability and returns 8

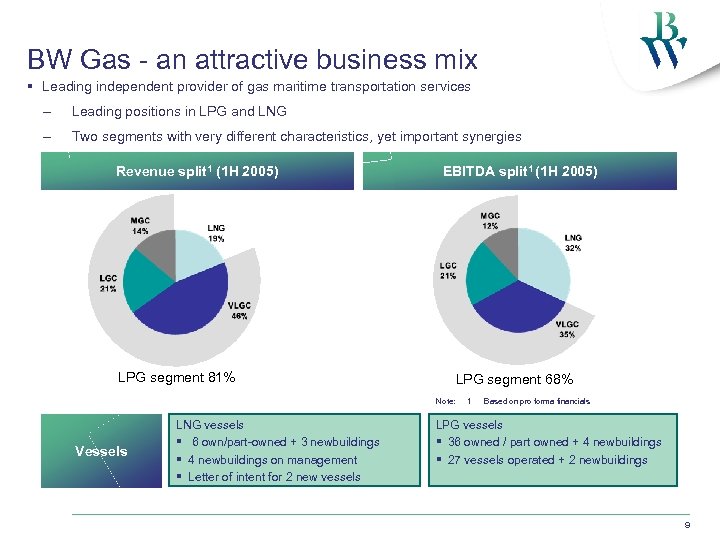

BW Gas - an attractive business mix § Leading independent provider of gas maritime transportation services – Leading positions in LPG and LNG – Two segments with very different characteristics, yet important synergies Revenue split 1 (1 H 2005) EBITDA split 1 (1 H 2005) LPG segment 81% LPG segment 68% Note: Vessels LNG vessels § 6 own/part-owned + 3 newbuildings § 4 newbuildings on management § Letter of intent for 2 new vessels 1 Based on pro forma financials LPG vessels § 36 owned / part owned + 4 newbuildings § 27 vessels operated + 2 newbuildings 9

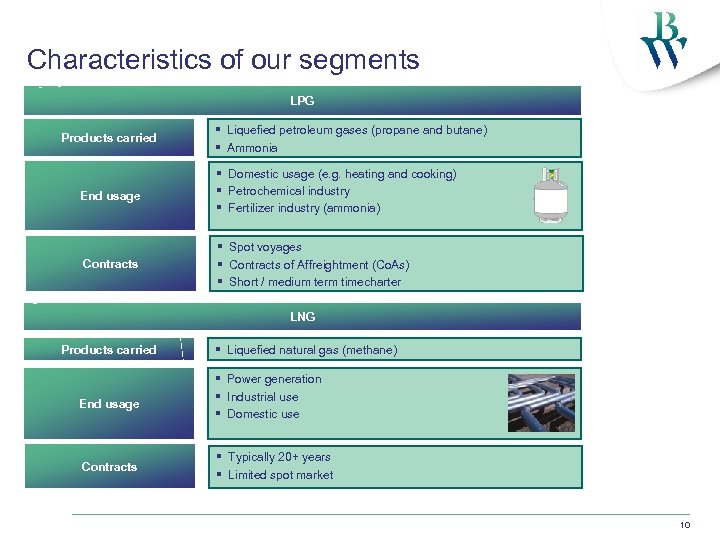

Characteristics of our segments LPG Products carried § Liquefied petroleum gases (propane and butane) § Ammonia End usage § Domestic usage (e. g. heating and cooking) § Petrochemical industry § Fertilizer industry (ammonia) Contracts § Spot voyages § Contracts of Affreightment (Co. As) § Short / medium term timecharter LNG Products carried End usage Contracts § Liquefied natural gas (methane) § Power generation § Industrial use § Domestic use § Typically 20+ years § Limited spot market 10

Our core strategies 1 Use existing critical mass in LPG to enhance returns – Significant shift in LPG business mix to Contracts of Affreightment 2 Invest in growth opportunities in LPG and LNG – US$ 1. 5 billion committed to LPG and LNG since 2000 3 High quality vessel operations at reasonable cost – BW Gas long recognised for operating excellence and technical standard of fleet 4 Financial strength and flexibility to support growth Our vision is to be the world’s leading provider in gas shipping based on customer satisfaction and shareholder returns 11

Attractive exposure to global gas growth 1 The industrialisation of China and India drives an increase in demand for energy—and the transportation of it 2 Natural gas, the cleanest fossil fuel, forecast to be the fastest growing primary energy source – A large number of new gas projects announced 3 LNG shipping forecast to take an increasing share of natural gas trade from pipelines 4 New LPG volumes largely associated with increase in natural gas production 12

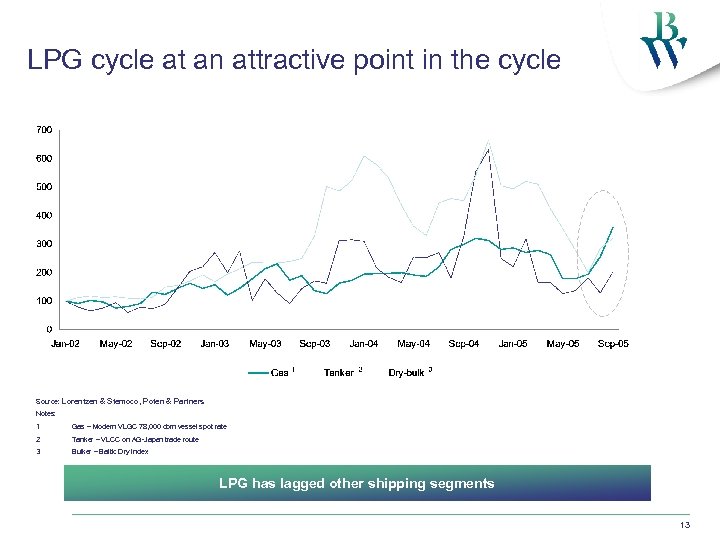

LPG cycle at an attractive point in the cycle Source: Lorentzen & Stemoco, Poten & Partners Notes: 1 Gas – Modern VLGC 78, 000 cbm vessel spot rate 2 Tanker – VLCC on AG-Japan trade route 3 Bulker – Baltic Dry Index LPG has lagged other shipping segments 13

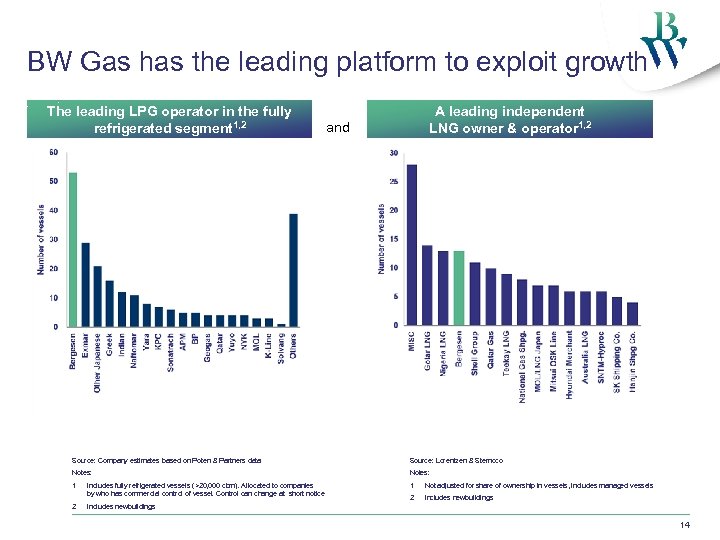

BW Gas has the leading platform to exploit growth The leading LPG operator in the fully refrigerated segment 1, 2 A leading independent LNG owner & operator 1, 2 and Source: Company estimates based on Poten & Partners data Source: Lorentzen & Stemoco Notes: 1 Includes fully refrigerated vessels (>20, 000 cbm). Allocated to companies by who has commercial control of vessel. Control can change at short notice 1 Not adjusted for share of ownership in vessels, includes managed vessels 2 Includes newbuildings 14

Experienced management team Jan Håkon Pettersen, CEO 13 years with BW Gas 34 years of work experience 1 Garup Meidell, CFO 7 years with BW Gas 24 years of work experience 1 Jens Ismar, Commercial Director 4 years with BW Gas 25 years of work experience 1 Rebekka Glasser, Business Development Director 6 years with BW Gas 11 years of work experience 1 Leif Arthur Andersen, Technical Director 16 years with BW Gas 33 years of work experience 1 Hans Ditlef Martens, Legal Director 17 years with BW Gas 34 years of work experience 1 Note: 1 Includes shipping and non-shipping experience 15

Berge Danuta (2000) loading at Mongstad, Norway Section 3: LPG shipping market 16

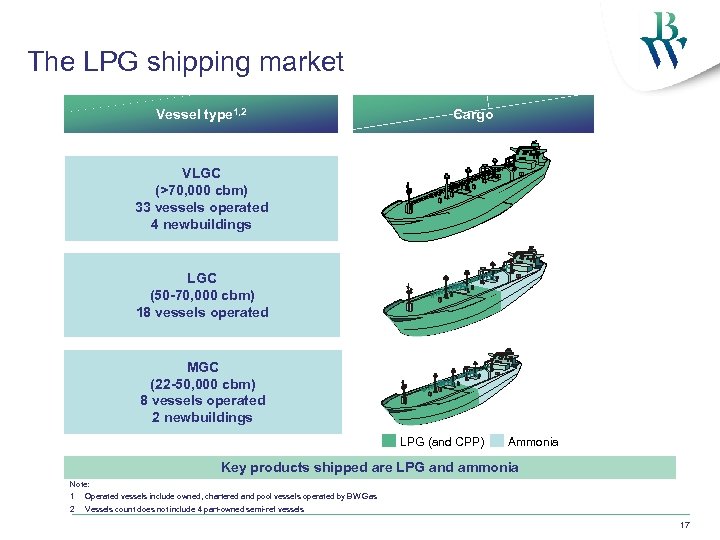

The LPG shipping market Vessel type 1, 2 Cargo VLGC (>70, 000 cbm) 33 vessels operated 4 newbuildings LGC (50 -70, 000 cbm) 18 vessels operated MGC (22 -50, 000 cbm) 8 vessels operated 2 newbuildings LPG (and CPP) Ammonia Key products shipped are LPG and ammonia Note: 1 Operated vessels include owned, chartered and pool vessels operated by BW Gas 2 Vessels count does not include 4 part-owned semi-ref vessels 17

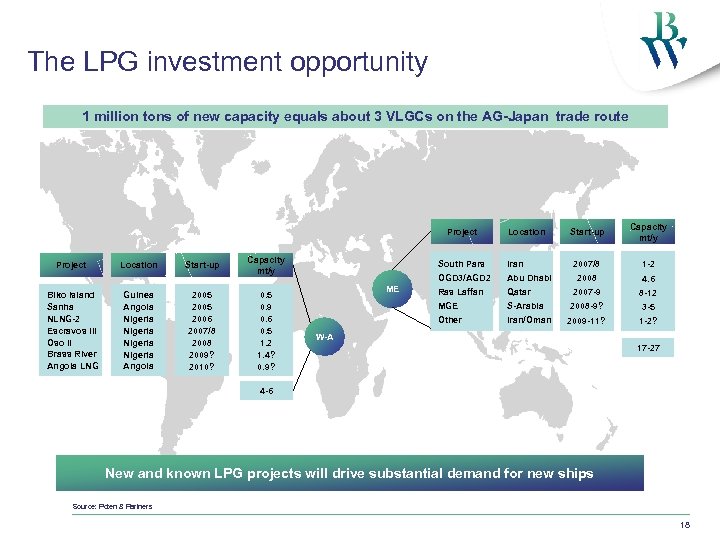

The LPG investment opportunity 1 million tons of new capacity equals about 3 VLGCs on the AG-Japan trade route Project Biko Island Sanha NLNG-2 Escravos III Oso II Brass River Angola LNG Location Guinea Angola Nigeria Angola Start-up 2005 2006 2007/8 2009? 2010? Capacity mt/y 0. 5 0. 9 0. 6 0. 5 1. 2 1. 4? 0. 9? Location Start-up Capacity mt/y 2007/8 1 -2 South Pars OGD 3/AGD 2 Abu Dhabi Ras Laffan Qatar MGE S-Arabia 2008 -9? 3 -5 Other ME Iran/Oman 2009 -11? 1 -2? 2008 4. 6 2007 -9 8 -12 W-A 17 -27 4 -6 New and known LPG projects will drive substantial demand for new ships Source: Poten & Partners 18

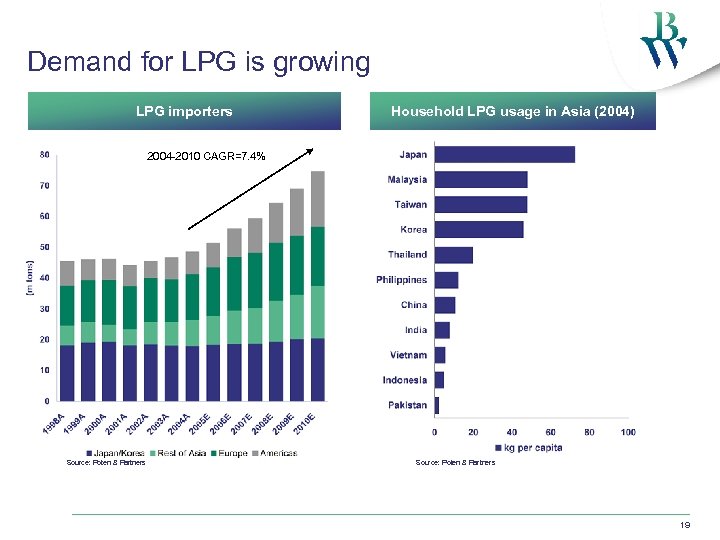

Demand for LPG is growing LPG importers Household LPG usage in Asia (2004) 2004 -2010 CAGR=7. 4% Source: Poten & Partners 19

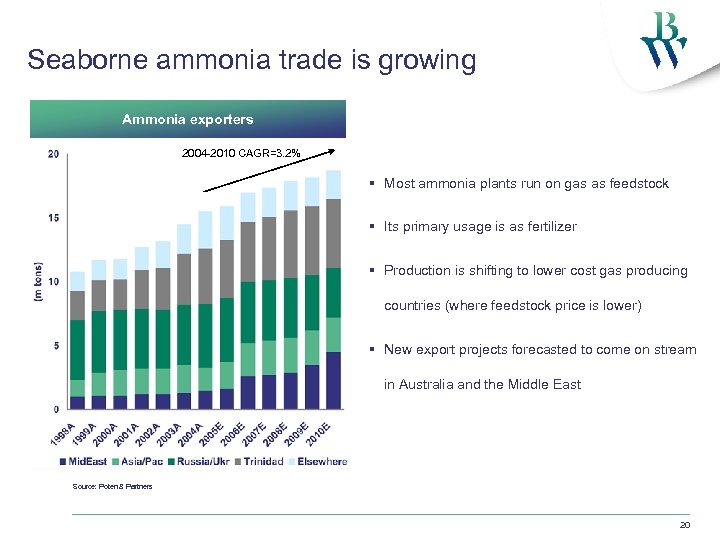

Seaborne ammonia trade is growing Ammonia exporters 2004 -2010 CAGR=3. 2% § Most ammonia plants run on gas as feedstock § Its primary usage is as fertilizer § Production is shifting to lower cost gas producing countries (where feedstock price is lower) § New export projects forecasted to come on stream in Australia and the Middle East Source: Poten & Partners 20

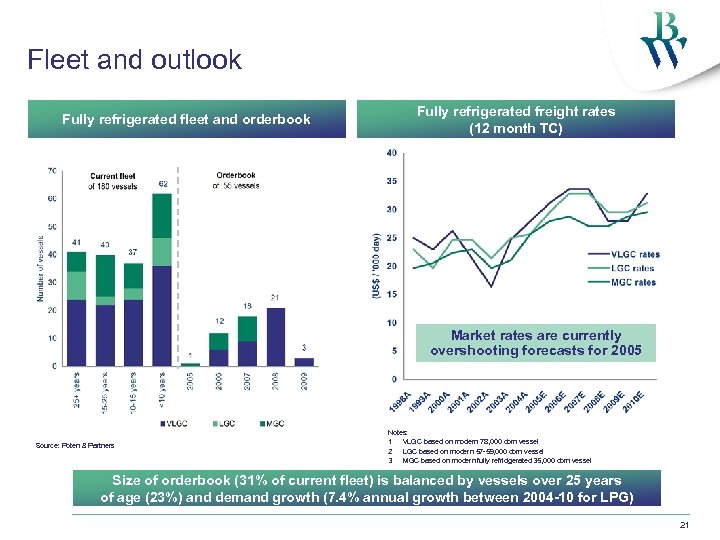

Fleet and outlook Fully refrigerated fleet and orderbook Fully refrigerated freight rates (12 month TC) Market rates are currently overshooting forecasts for 2005 Source: Poten & Partners Notes: 1 VLGC based on modern 78, 000 cbm vessel 2 LGC based on modern 57 -59, 000 cbm vessel 3 MGC based on modern fully refridgerated 35, 000 cbm vessel Size of orderbook (31% of current fleet) is balanced by vessels over 25 years of age (23%) and demand growth (7. 4% annual growth between 2004 -10 for LPG) 21

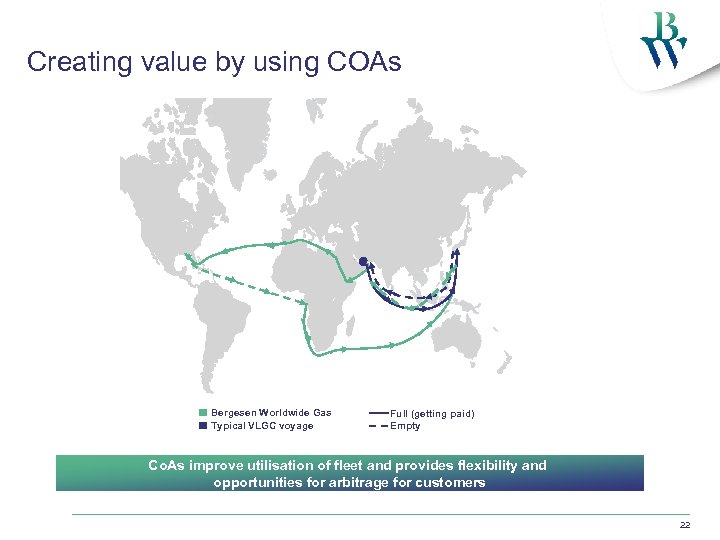

Creating value by using COAs Bergesen Worldwide Gas Typical VLGC voyage Full (getting paid) Empty Co. As improve utilisation of fleet and provides flexibility and opportunities for arbitrage for customers 22

In July 2005 Berge Arzew delivered the first load of LNG to the UK in 20 years at the Isle of Grain LNG terminal Section 4: LNG shipping market 23

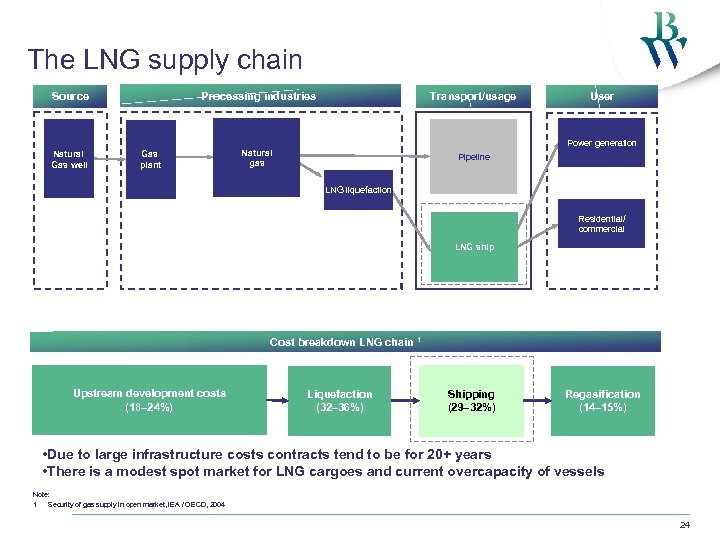

The LNG supply chain Processing industries Source Natural Gas well Transport/usage Natural gas Pipeline Gas plant User Power generation LNG liquefaction Residential/ commercial LNG ship Cost breakdown LNG chain 1 Upstream development costs (18– 24%) Liquefaction (32– 36%) Shipping (29– 32%) Regasification (14– 15%) • Due to large infrastructure costs contracts tend to be for 20+ years • There is a modest spot market for LNG cargoes and current overcapacity of vessels Note: 1 Security of gas supply in open market, IEA / OECD, 2004 24

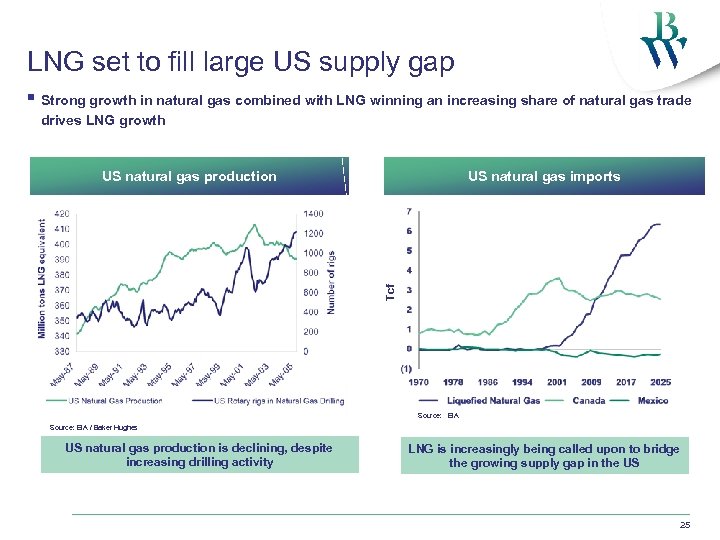

LNG set to fill large US supply gap § Strong growth in natural gas combined with LNG winning an increasing share of natural gas trade drives LNG growth US natural gas imports Tcf US natural gas production Source: EIA / Baker Hughes US natural gas production is declining, despite increasing drilling activity LNG is increasingly being called upon to bridge the growing supply gap in the US 25

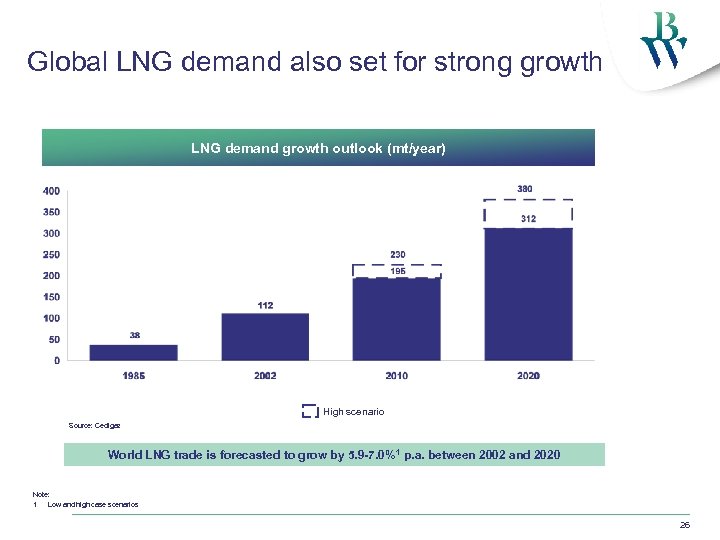

Global LNG demand also set for strong growth LNG demand growth outlook (mt/year) High scenario Source: Cedigaz World LNG trade is forecasted to grow by 5. 9 -7. 0% 1 p. a. between 2002 and 2020 Note: 1 Low and high case scenarios 26

LNG - a focused strategy 1 Commitments totalling US$ 1 billion in last five years. Current DCF value is substantially higher 2 Long term charters for all new LNG vessels, not exposed to the currently weak spot markets 3 Repeat business with all customers – Customers include Suez Energy, Sonatrach and Nigeria LNG 4 Returns on long term charters have declined recently – Use of financial management to provide satisfactory returns – Recently signed letter of intent with Suez Energy for 2 new LNG vessels 5 Expect to follow low-risk, but expansionary, policy going forward 27

Section 5: Financial review 28

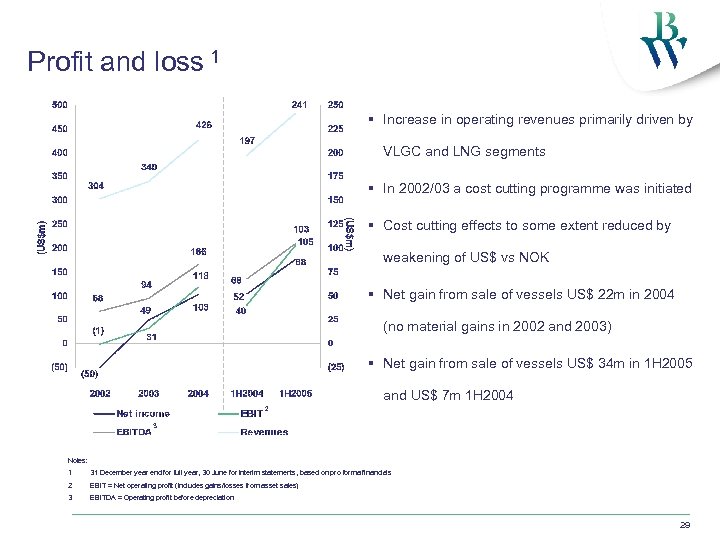

Profit and loss 1 § Increase in operating revenues primarily driven by VLGC and LNG segments § In 2002/03 a cost cutting programme was initiated § Cost cutting effects to some extent reduced by weakening of US$ vs NOK § Net gain from sale of vessels US$ 22 m in 2004 (no material gains in 2002 and 2003) § Net gain from sale of vessels US$ 34 m in 1 H 2005 and US$ 7 m 1 H 2004 2 3 Notes: 1 31 December year end for full year, 30 June for interim statements, based on pro forma financials 2 EBIT = Net operating profit (includes gains/losses from asset sales) 3 EBITDA = Operating profit before depreciation 29

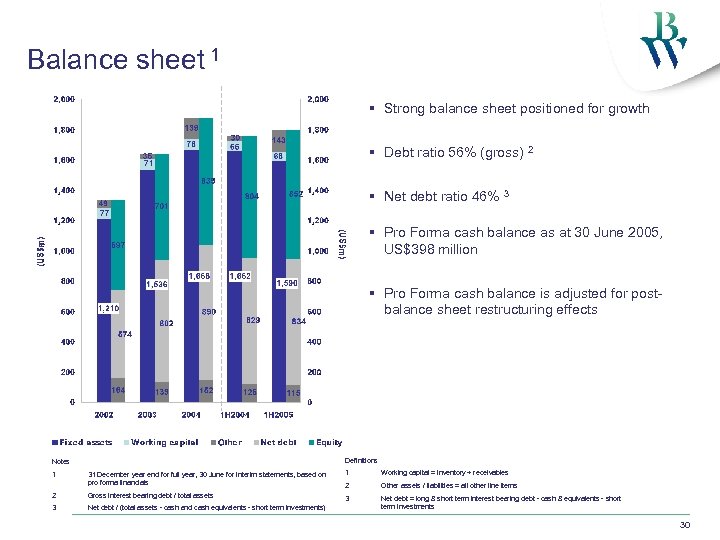

Balance sheet 1 § Strong balance sheet positioned for growth § Debt ratio 56% (gross) 2 § Net debt ratio 46% 3 1 § Pro Forma cash balance as at 30 June 2005, US$398 million § Pro Forma cash balance is adjusted for postbalance sheet restructuring effects Definitions Notes 31 December year end for full year, 30 June for interim statements, based on pro forma financials 1 Working capital = inventory + receivables 2 Other assets / liabilities = all other line items 2 Gross interest bearing debt / total assets 3 3 Net debt / (total assets - cash and cash equivalents - short term investments) Net debt = long & short term interest bearing debt - cash & equivalents - short term investments 1 30

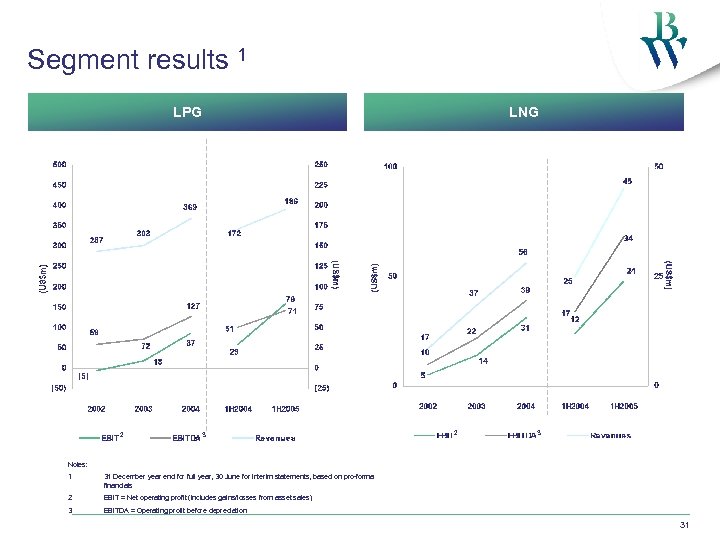

Segment results 1 LPG 2 LNG 3 2 3 Notes: 1 31 December year end for full year, 30 June for interim statements, based on pro-forma financials 2 EBIT = Net operating profit (includes gains/losses from asset sales) 3 EBITDA = Operating profit before depreciation 31

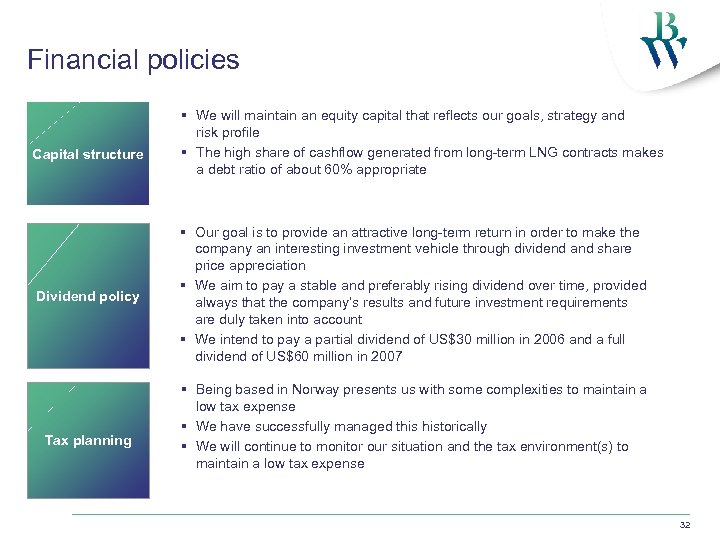

Financial policies Capital structure Dividend policy Tax planning § We will maintain an equity capital that reflects our goals, strategy and risk profile § The high share of cashflow generated from long-term LNG contracts makes a debt ratio of about 60% appropriate § Our goal is to provide an attractive long-term return in order to make the company an interesting investment vehicle through dividend and share price appreciation § We aim to pay a stable and preferably rising dividend over time, provided always that the company’s results and future investment requirements are duly taken into account § We intend to pay a partial dividend of US$30 million in 2006 and a full dividend of US$60 million in 2007 § Being based in Norway presents us with some complexities to maintain a low tax expense § We have successfully managed this historically § We will continue to monitor our situation and the tax environment(s) to maintain a low tax expense 32

Summary 1 BW Gas is well placed to benefit from its leading market position – Substantial growth in underlying demand – Significant investment opportunities in LNG and LPG 2 LPG cycle at an attractive entry point 3 Attractive mix of LPG and LNG 4 Proven management team focused on improving profitability and returns 33

Appendix 34

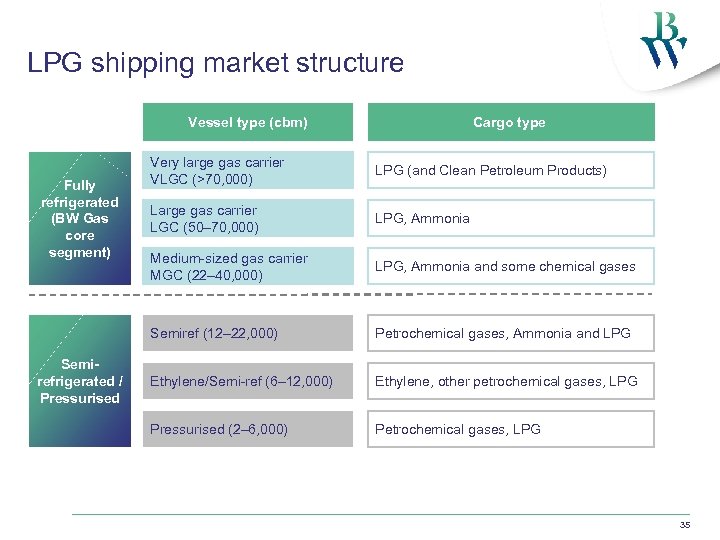

LPG shipping market structure Vessel type (cbm) Cargo type Semirefrigerated / Pressurised LPG (and Clean Petroleum Products) Large gas carrier LGC (50– 70, 000) LPG, Ammonia Medium-sized gas carrier MGC (22– 40, 000) LPG, Ammonia and some chemical gases Semiref (12– 22, 000) Fully refrigerated (BW Gas core segment) Very large gas carrier VLGC (>70, 000) Petrochemical gases, Ammonia and LPG Ethylene/Semi-ref (6– 12, 000) Ethylene, other petrochemical gases, LPG Pressurised (2– 6, 000) Petrochemical gases, LPG 35

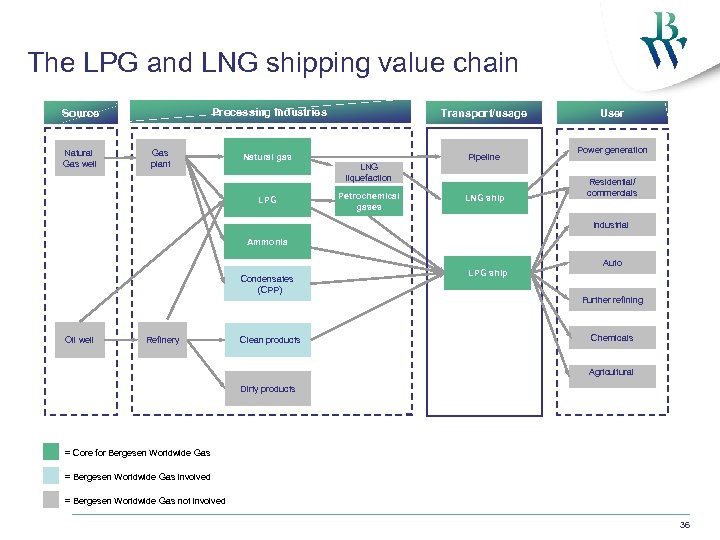

The LPG and LNG shipping value chain Processing industries Source Natural Gas well Transport/usage Natural gas Pipeline Gas plant LNG liquefaction LPG Petrochemical gases LNG ship User Power generation Residential/ commercials Industrial Ammonia Auto Condensates (CPP) LPG ship Further refining Oil well Refinery Clean products Chemicals Agricultural Dirty products = Core for Bergesen Worldwide Gas = Bergesen Worldwide Gas involved = Bergesen Worldwide Gas not involved 36

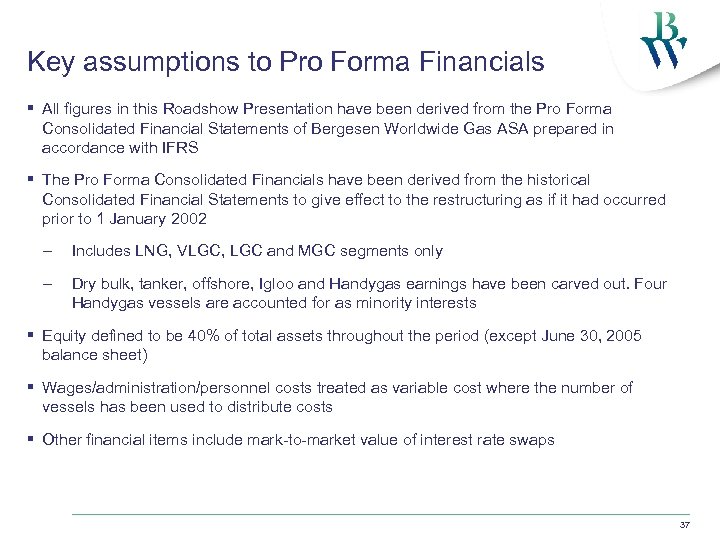

Key assumptions to Pro Forma Financials § All figures in this Roadshow Presentation have been derived from the Pro Forma Consolidated Financial Statements of Bergesen Worldwide Gas ASA prepared in accordance with IFRS § The Pro Forma Consolidated Financials have been derived from the historical Consolidated Financial Statements to give effect to the restructuring as if it had occurred prior to 1 January 2002 – Includes LNG, VLGC, LGC and MGC segments only – Dry bulk, tanker, offshore, Igloo and Handygas earnings have been carved out. Four Handygas vessels are accounted for as minority interests § Equity defined to be 40% of total assets throughout the period (except June 30, 2005 balance sheet) § Wages/administration/personnel costs treated as variable cost where the number of vessels has been used to distribute costs § Other financial items include mark-to-market value of interest rate swaps 37

LPG fleet list VLGCs 38

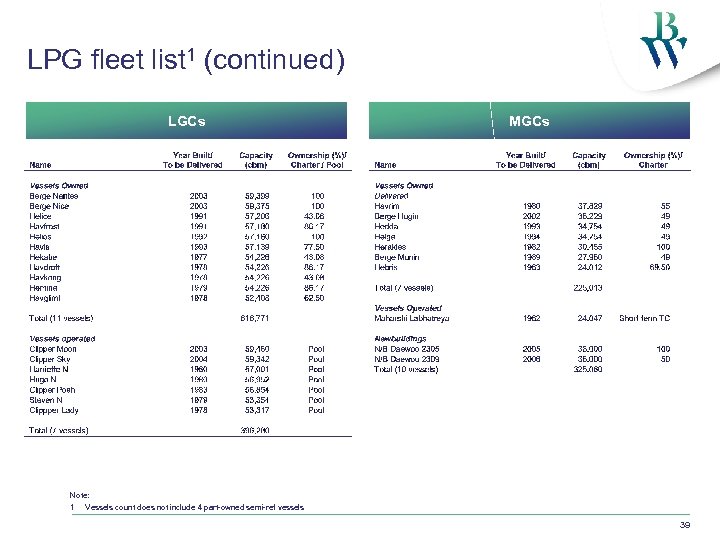

LPG fleet list 1 (continued) LGCs MGCs Note: 1 Vessels count does not include 4 part-owned semi-ref vessels 39

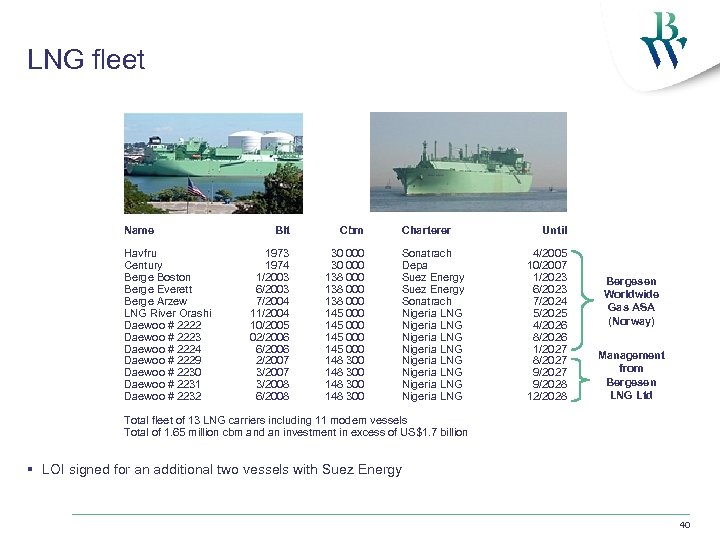

LNG fleet Name Havfru Century Berge Boston Berge Everett Berge Arzew LNG River Orashi Daewoo # 2222 Daewoo # 2223 Daewoo # 2224 Daewoo # 2229 Daewoo # 2230 Daewoo # 2231 Daewoo # 2232 Blt Cbm 1973 1974 1/2003 6/2003 7/2004 11/2004 10/2005 02/2006 6/2006 2/2007 3/2008 6/2008 30 000 138 000 145 000 148 300 Charterer Sonatrach Depa Suez Energy Sonatrach Nigeria LNG Nigeria LNG Until 4/2005 10/2007 1/2023 6/2023 7/2024 5/2025 4/2026 8/2026 1/2027 8/2027 9/2028 12/2028 Bergesen Worldwide Gas ASA (Norway) Management from Bergesen LNG Ltd Total fleet of 13 LNG carriers including 11 modern vessels Total of 1. 65 million cbm and an investment in excess of US$1. 7 billion § LOI signed for an additional two vessels with Suez Energy 40

d80bb465cafa0b03ad13f5540a7a60eb.ppt