af344f9fc98570e12bb23fe4badd3fc7.ppt

- Количество слайдов: 37

Benefits of Listing on NYSE Euronext Aaron Goldstein Head of Russia and CIS Business Development April 2008 1© 2007 NYSE Euronext. All Rights Reserved.

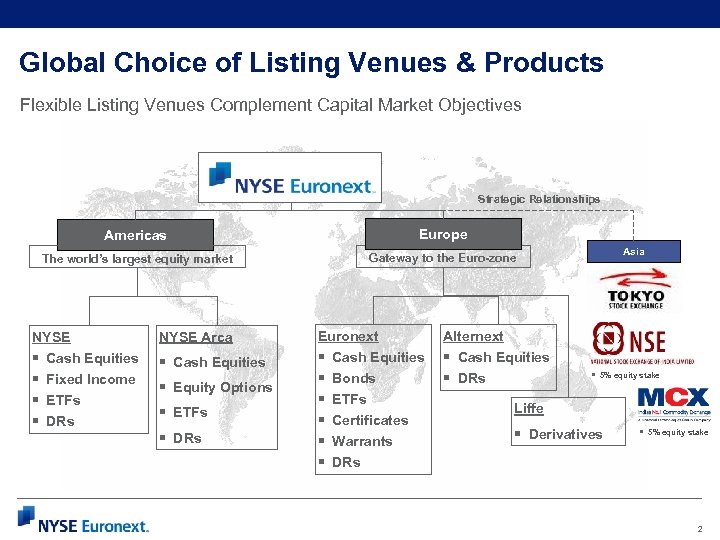

Global Choice of Listing Venues & Products Flexible Listing Venues Complement Capital Market Objectives NYSE Euronext Strategic Relationships Americas Europe The world’s largest equity market Gateway to the Euro-zone NYSE Arca Euronext Alternext § § § Cash Equities § DRs Asia Cash Equities Fixed Income ETFs DRs § Equity Options § ETFs § DRs Cash Equities Bonds ETFs Certificates Warrants DRs § 5% equity stake Liffe § Derivatives § 5% equity stake 2

NYSE Euronext – Global Exchange Leadership Global Exchange • • • 1 st Transatlantic Marketplace Largest exchange by market capitalization of listed companies: $30 trillion 80 of the 100 largest companies globally The world’s largest liquidity pool Daily trade in equity $142 billion(1/3 of the world’s trade)/Daily Derivative LIFFE Euro 1. 8 trillion Listing venue of choice: over 4, 000 listings from 55 countries Global Source of Capital Raising Premier Brand Diversified Product Offering Financial Strength • • A listed company: $20 bn market capitalization AA rated Investor Confidence - Sound Governance and Regulatory Framework 3

Value Proposition For Issuers Listing Venue Choice • • Multiple entry points for issuers of any size and geography Listing options complement issuer’s strategy over time Enhanced Liquidity • • Access to $ and € – the world’s two leading currencies Extended trading day Product extensions (ETFs, Indices, Options, Futures…) NYSE Euronext working towards fungible trading between US and Europe Broad Investor Pool • • • Global and local investor access Wide range of products (Equities, Bonds, ETFs, Derivatives…) Investor outreach programs Unique Global Visibility • • • Unparalleled Brand Association Superior service offering Superior peer alignment Advocacy on Behalf of Issuers 4

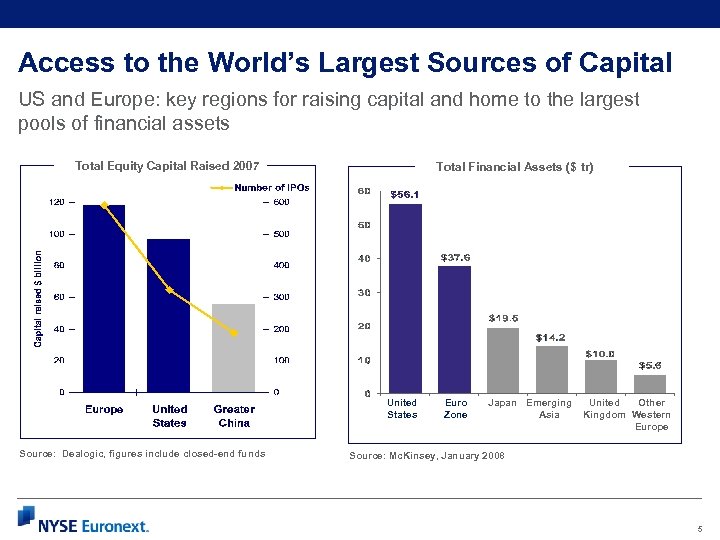

Access to the World’s Largest Sources of Capital US and Europe: key regions for raising capital and home to the largest pools of financial assets Total Equity Capital Raised 2007 Total Financial Assets ($ tr) United States Source: Dealogic, figures include closed-end funds Euro Zone Japan Emerging Asia United Other Kingdom Western Europe Source: Mc. Kinsey, January 2008 5

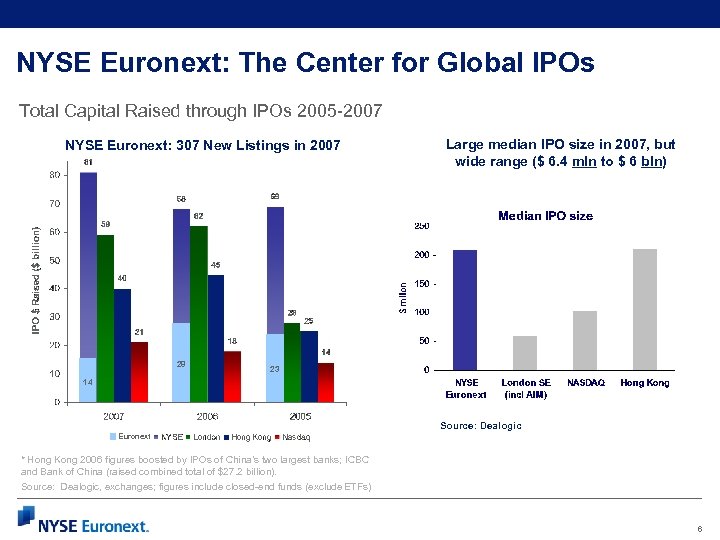

NYSE Euronext: The Center for Global IPOs Total Capital Raised through IPOs 2005 -2007 NYSE Euronext: 307 New Listings in 2007 28 Large median IPO size in 2007, but wide range ($ 6. 4 mln to $ 6 bln) 23 14 Source: Dealogic Euronext * Hong Kong 2006 figures boosted by IPOs of China’s two largest banks; ICBC and Bank of China (raised combined total of $27. 2 billion). Source: Dealogic, exchanges; figures include closed-end funds (exclude ETFs) 6

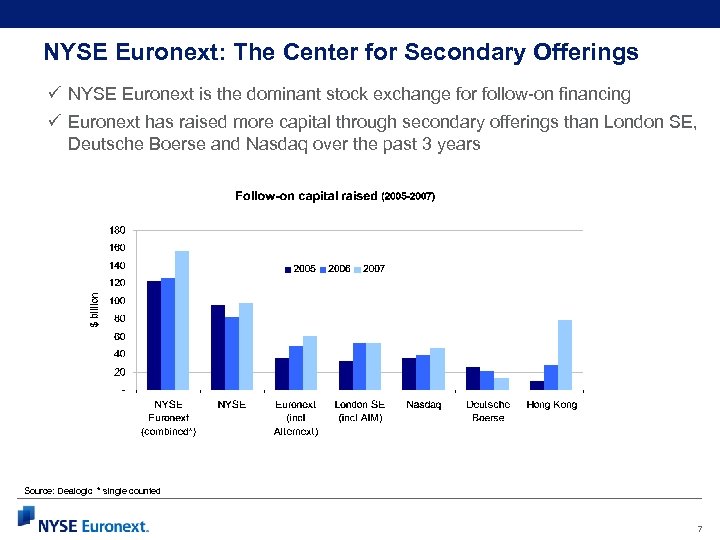

NYSE Euronext: The Center for Secondary Offerings ü NYSE Euronext is the dominant stock exchange for follow-on financing ü Euronext has raised more capital through secondary offerings than London SE, Deutsche Boerse and Nasdaq over the past 3 years Source: Dealogic * single counted 7

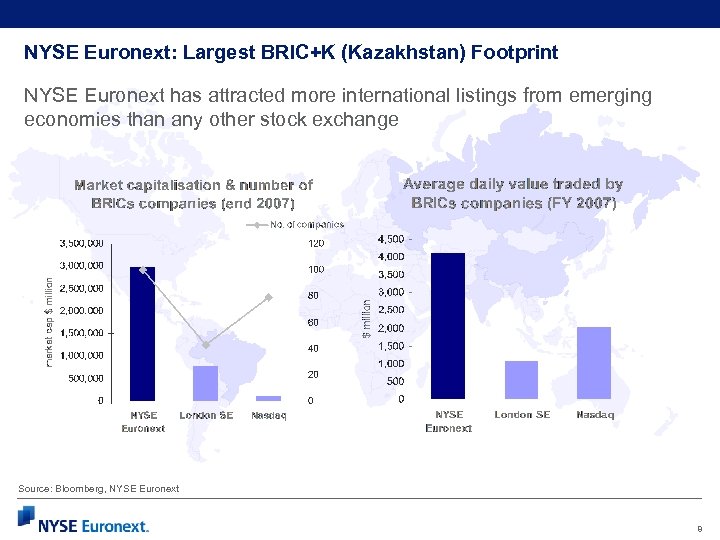

NYSE Euronext: Largest BRIC+K (Kazakhstan) Footprint NYSE Euronext has attracted more international listings from emerging economies than any other stock exchange Source: Bloomberg, NYSE Euronext 8

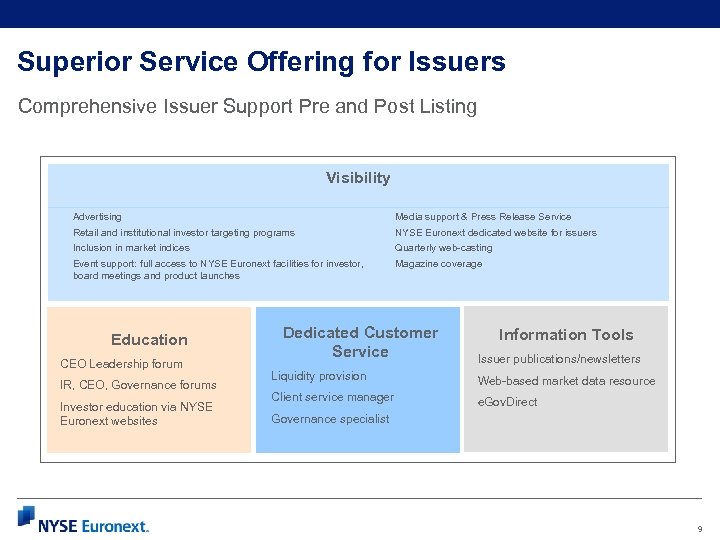

Superior Service Offering for Issuers Comprehensive Issuer Support Pre and Post Listing Visibility Advertising Media support & Press Release Service Retail and institutional investor targeting programs NYSE Euronext dedicated website for issuers Inclusion in market indices Quarterly web-casting Event support: full access to NYSE Euronext facilities for investor, board meetings and product launches Magazine coverage Education CEO Leadership forum IR, CEO, Governance forums Investor education via NYSE Euronext websites Dedicated Customer Service Information Tools Issuer publications/newsletters Liquidity provision Web-based market data resource Client service manager e. Gov. Direct Governance specialist 9

NYSE Euronext European Platform 1© 2007 NYSE Euronext. All Rights Reserved.

Euronext – key features One single cross-border trading platform • Integrated across four countries • Former stock exchanges of Paris, Amsterdam, Brussels and Lisbon Global footprint • NYSE Euronext is the world’s first truly global marketplace Listed instruments • Shares • Corporate bonds • Depositary Receipts (GDR, ADR, EDR) • Derivative instruments, including Convertibles, Options, Warrants and Futures Currency of listing • Euro - the world’s second most important currency • Or any other major currency Indices • CAC 40, AEX 25, Euronext 100, FTSEurofirst… 11

Euronext’s Competitive Position in Europe MARKET CAPITALISATION European cash equity market capitalisation TRADING VOLUMES (2007) (end 2007) • Largest equity market in Europe • Largest trading platform in Europe Source: Federation of European Securities Exchanges (FESE) Figures include domestic & primary international listings 12

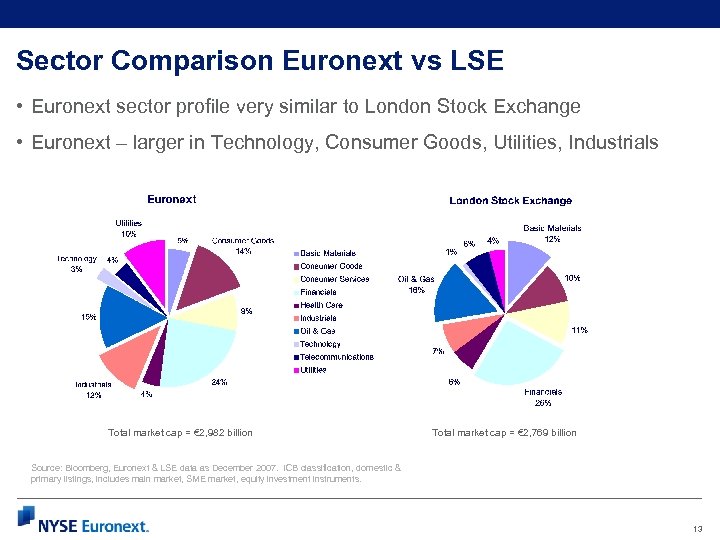

Sector Comparison Euronext vs LSE • Euronext sector profile very similar to London Stock Exchange • Euronext – larger in Technology, Consumer Goods, Utilities, Industrials Total market cap = € 2, 982 billion Total market cap = € 2, 769 billion Source: Bloomberg, Euronext & LSE data as December 2007. ICB classification, domestic & primary listings, includes main market, SME market, equity investment instruments. 13

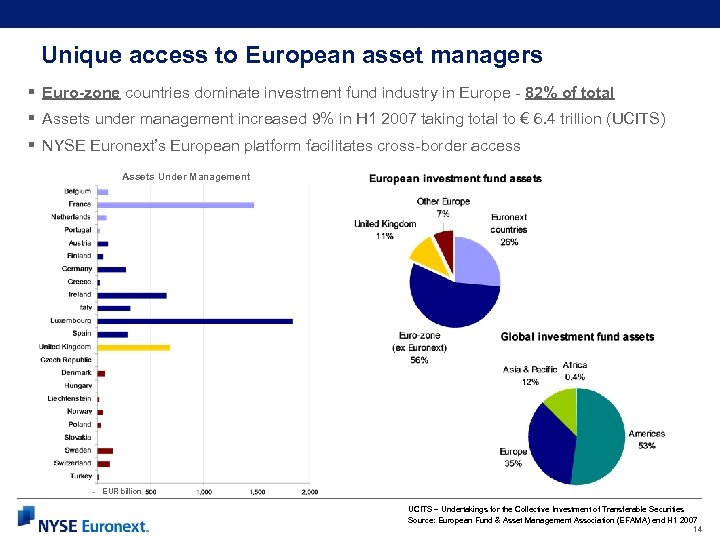

Unique access to European asset managers § Euro-zone countries dominate investment fund industry in Europe - 82% of total § Assets under management increased 9% in H 1 2007 taking total to € 6. 4 trillion (UCITS) § NYSE Euronext’s European platform facilitates cross-border access Assets Under Management EUR billion UCITS – Undertakings for the Collective Investment of Transferable Securities Source: European Fund & Asset Management Association (EFAMA) end H 1 2007 14

Euronext is dominated by high quality broker-dealers & listing agents • Bulge bracket and pan. European banks dominate the marketplace Top 25 broker-dealers and listing agents • Euronext gives access to the Euro-zone…as well as US & UK based investors: all major London based investment banks are active members • Over 50% of trading by London based brokerdealers 15

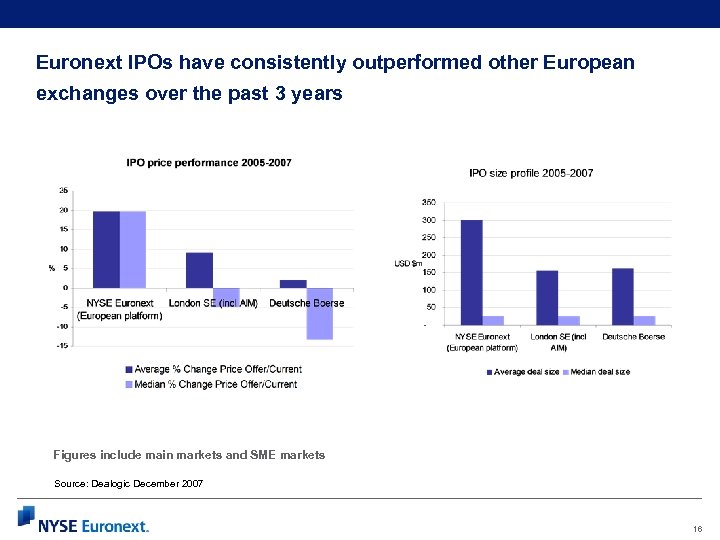

Euronext IPOs have consistently outperformed other European exchanges over the past 3 years m Figures include main markets and SME markets Source: Dealogic December 2007 16

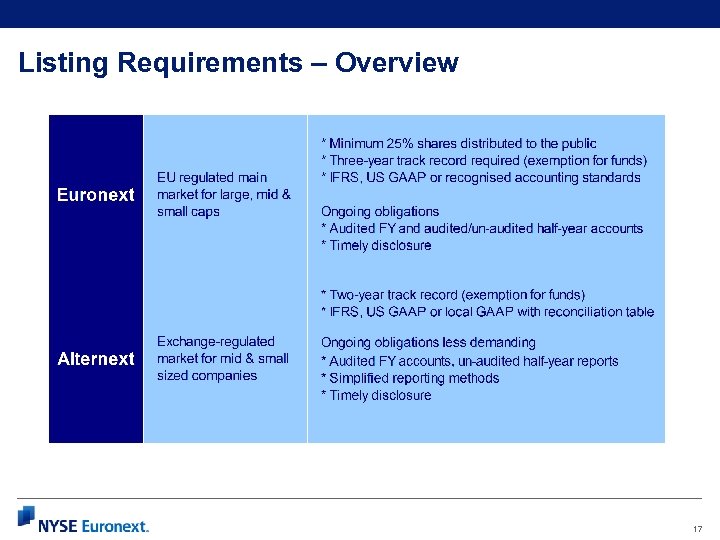

Listing Requirements – Overview 17

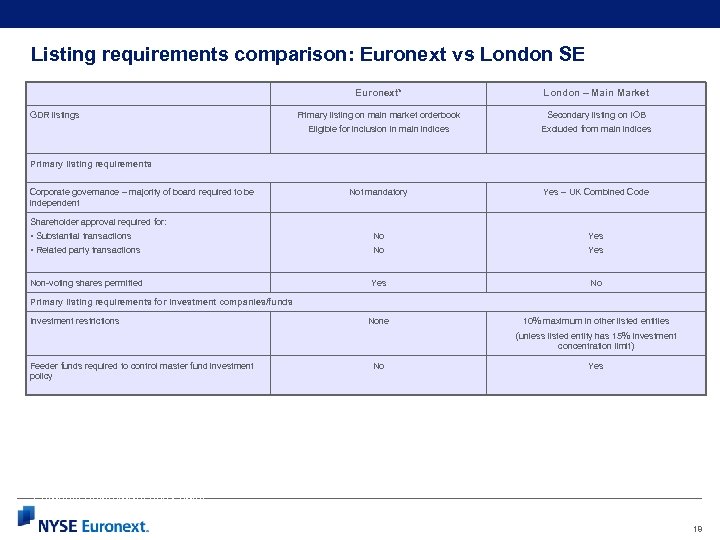

Listing requirements comparison: Euronext vs London SE Euronext* London – Main Market Primary listing on main market orderbook Secondary listing on IOB Eligible for inclusion in main indices Excluded from main indices Not mandatory Yes – UK Combined Code • Substantial transactions • Related party transactions No Yes Non-voting shares permitted Yes No GDR listings Primary listing requirements Corporate governance – majority of board required to be independent Shareholder approval required for: Primary listing requirements for investment companies/funds Investment restrictions None 10% maximum in other listed entities (unless listed entity has 15% investment concentration limit) Feeder funds required to control master fund investment policy No Yes * Euronext Amsterdam entry point 18

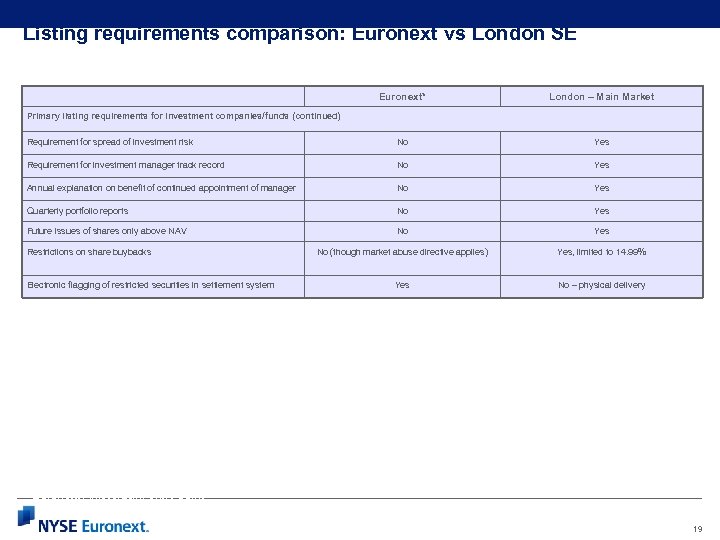

Listing requirements comparison: Euronext vs London SE Euronext* London – Main Market Requirement for spread of investment risk No Yes Requirement for investment manager track record No Yes Annual explanation on benefit of continued appointment of manager No Yes Quarterly portfolio reports No Yes Future issues of shares only above NAV No Yes No (though market abuse directive applies) Yes, limited to 14. 99% Yes No – physical delivery Primary listing requirements for investment companies/funds (continued) Restrictions on share buybacks Electronic flagging of restricted securities in settlement system * Euronext Amsterdam entry point 19

Euronext – The Main Board 1© 2007 NYSE Euronext. All Rights Reserved.

Euronext – The Main Board One cross-border EU regulated market – one rule book • Choice of regulatory entry point to cross-border platform Borderless • Companies are classified according to sector and market capitalization rather than geographical location Equal opportunity for international companies to join key indices Companies from over 30 countries listed Sound regulatory framework (but no Sarbanes Oxley!) 21

Top 10 Euronext IPOs 2007 Capital raised (EUR) Market cap (EUR) Non ferrous Metals 2, 000 GGY Equity Investment Instruments 1, 314 Bureau Veritas FRA Business Support Services 1, 078 4, 378 Rexel FRA Industrial Suppliers 1, 056 4, 224 Lehman Brothers Private Equity GGY Equity Investment Instruments 363 REN PRT Electricity 324 1, 469 AMG Advanced Metallurgical Group NLD Non ferrous Metals 314 643 Arseus NLD/BEL Medical Supplies 302 320 Leo Capital Growth SPC CYM Equity Investment Instruments 261 Paris Re CHF Reinsurance 225 1, 656 Company Nationality Sector Nyrstar BEL/AUS Conversus Capital 22

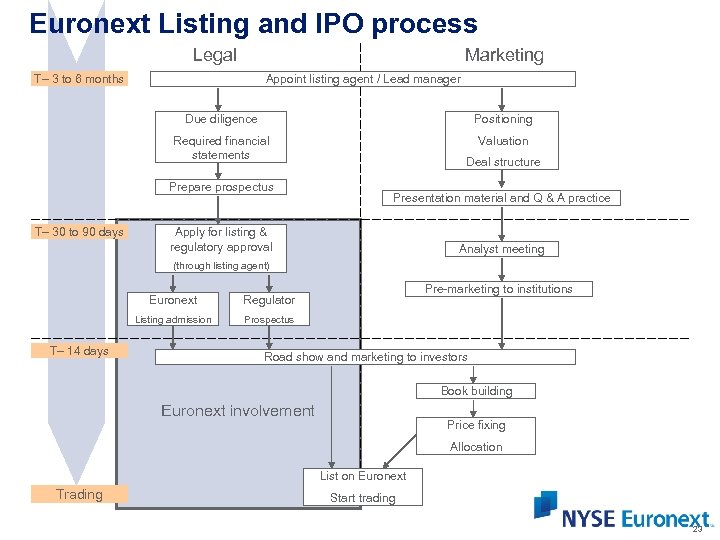

Euronext Listing and IPO process Legal Marketing T– 3 to 6 months Appoint listing agent / Lead manager Due diligence Positioning Required financial statements Valuation Prepare prospectus T– 30 to 90 days Deal structure Presentation material and Q & A practice Apply for listing & regulatory approval Analyst meeting (through listing agent) Euronext Listing admission T– 14 days Pre-marketing to institutions Regulator Prospectus Road show and marketing to investors Book building Euronext involvement Price fixing Allocation List on Euronext Trading Start trading 23

NYSE Alternext: the SME Market 1© 2007 NYSE Euronext. All Rights Reserved.

Alternext – The SME Market Why Alternext? • More than 1 m €uro-zone SMEs eligible… …but substantially fewer than 1% listed! Alternext is an exchange-regulated market; • Designed for small and mid sized companies • Simplified listing rules and ongoing obligations • Open for companies from all sectors and countries • Launched mid-2005 • Broad €uro-zone access • Same 4 -country trading platform for Euronext and Alternext 25

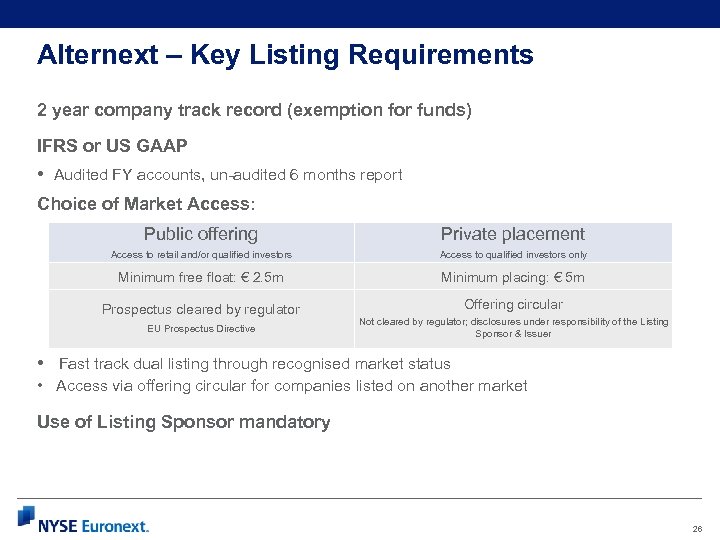

Alternext – Key Listing Requirements 2 year company track record (exemption for funds) IFRS or US GAAP • Audited FY accounts, un-audited 6 months report Choice of Market Access: Public offering Private placement Access to retail and/or qualified investors Access to qualified investors only Minimum free float: € 2. 5 m Minimum placing: € 5 m Prospectus cleared by regulator Offering circular EU Prospectus Directive Not cleared by regulator; disclosures under responsibility of the Listing Sponsor & Issuer • Fast track dual listing through recognised market status • Access via offering circular for companies listed on another market Use of Listing Sponsor mandatory 26

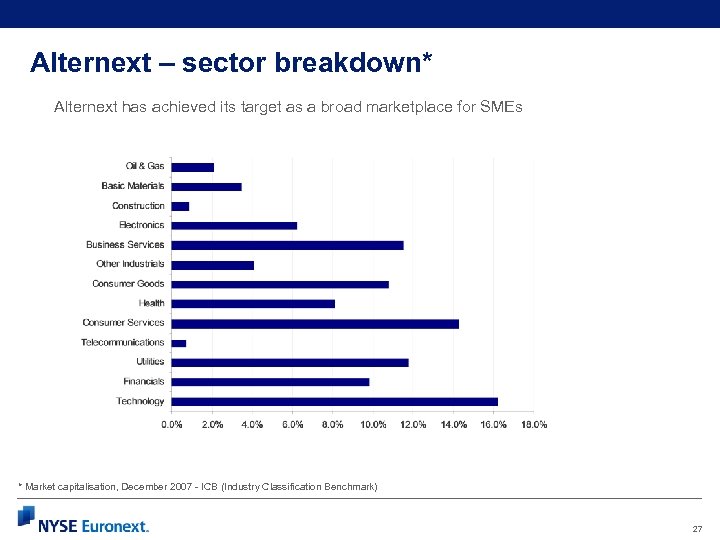

Alternext – sector breakdown* Alternext has achieved its target as a broad marketplace for SMEs * Market capitalisation, December 2007 - ICB (Industry Classification Benchmark) 27

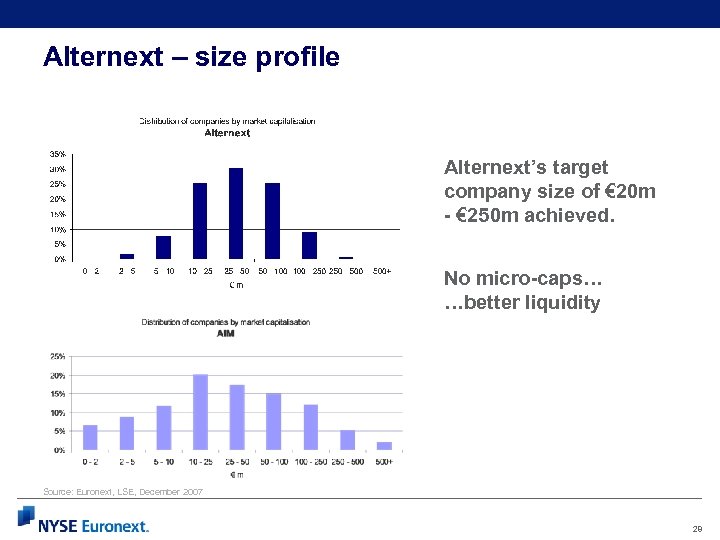

Alternext – size profile Alternext’s target company size of € 20 m - € 250 m achieved. No micro-caps… …better liquidity Source: Euronext, LSE, December 2007 28

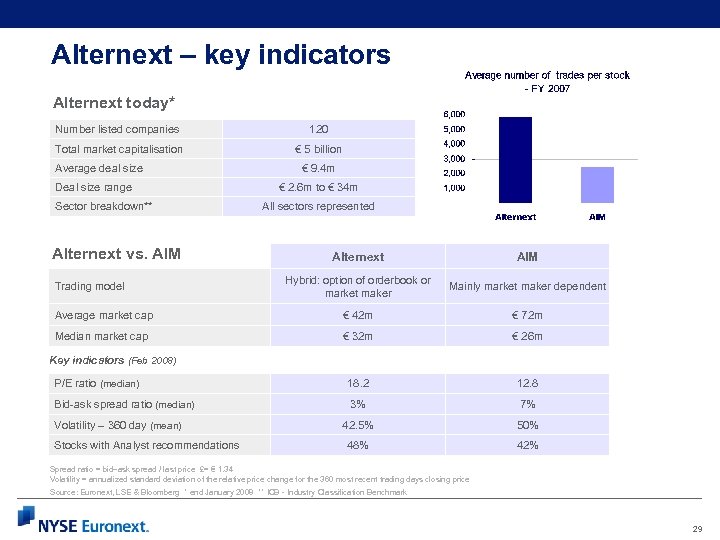

Alternext – key indicators Alternext today* Number listed companies 120 Total market capitalisation € 5 billion Average deal size Deal size range Sector breakdown** Alternext vs. AIM € 9. 4 m € 2. 6 m to € 34 m All sectors represented Alternext AIM Hybrid: option of orderbook or market maker Mainly market maker dependent Average market cap € 42 m € 72 m Median market cap € 32 m € 26 m P/E ratio (median) 18. 2 12. 8 Bid-ask spread ratio (median) 3% 7% 42. 5% 50% 48% 42% Trading model Key indicators (Feb 2008) Volatility – 360 day (mean) Stocks with Analyst recommendations Spread ratio = bid–ask spread / last price £= € 1. 34 Volatility = annualized standard deviation of the relative price change for the 360 most recent trading days closing price Source: Euronext, LSE & Bloomberg * end January 2008 ** ICB - Industry Classification Benchmark 29

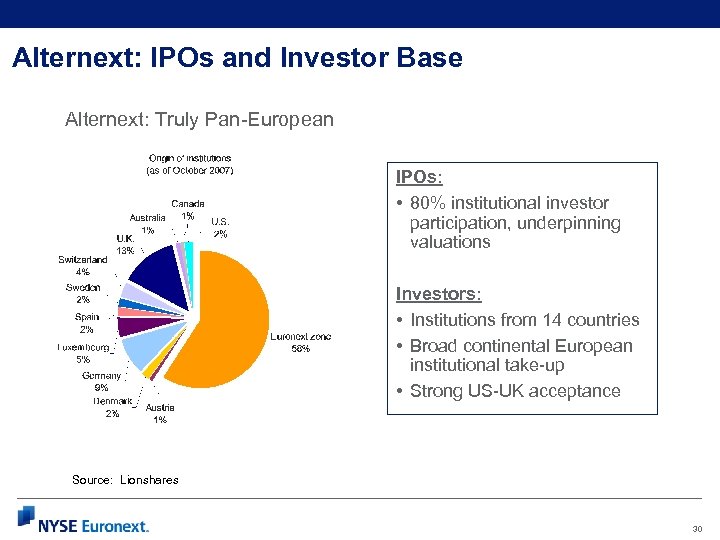

Alternext: IPOs and Investor Base Alternext: Truly Pan-European IPOs: • 80% institutional investor participation, underpinning valuations Investors: • Institutions from 14 countries • Broad continental European institutional take-up • Strong US-UK acceptance Source: Lionshares 30

Alternext - Listing Sponsors Use of a Listing Sponsor is mandatory Two main roles as the listed company's long-term partner: • Support the company in preparing for listing • Ensures company fulfils ongoing obligations No fees to be Listing Sponsor Requirements to become a Listing Sponsor: • 2 years relevant experience • Liability insurance • Fill in application form Over 60 Listing Sponsors registered…and counting 31

Alternext Listing Sponsors Aélios Finance EFI Allegra Finance Euroland Finance KPMG Corporate Finance Leleux Associated Brokers Amsterdams Effectenkantoor Exco L'Lione & Associés Arkéon Finance Fideuram Wargny Natexis Bleichroeder Atout Capital First Dutch Capital Nexfinance Atlantic Law Llp Aurel Leven Securities Fortis Nextcap Global Equities NIBC Avenir Finance Corporate Grant Thornton Oddo Corporate Finance Banque Degroof H & Associés OTC Securities Banque Palatine IBI Petercam Banque Privée Fideuram Wargny ING Bank NV Portzamparc Société de Bourse Bryan, Garnier & Co ING Belgium Pricewaterhouse. Coopers Cassagne Goirand et associés Intuitu Capital Rabobank CFD Corporate Finance Invest Securities Résalliance & Associés CIC Banque CIO IXIS Midcaps SNS Securities Clipperton Finance KBC Securities Société Générale Close Brothers Kempen & co Sodica CM-CIC Securities Kepler Equities Teather & Greenwood Crédit du nord Vizille Capital Finance Contact details: www. alternext. com 32

(1/2) Features: KKR Private Equity Investors is a Guernsey limited partnership investment vehicle created by KKR (Kohlberg Kravis Roberts), the US private equity firm. - Listed closed-end fund - 75% assets invested in KKR funds / 25% in opportunistic investments - KKR has a 30 year track record of superior investment returns IPO date – 3 rd May 2006: Funds raised: $5 billion Joint global coordinators and bookrunners: Morgan Stanley, Citigroup, Goldman Sachs Raised over 3 times original target Offer price: $25. 00 (approx. NAV) 33

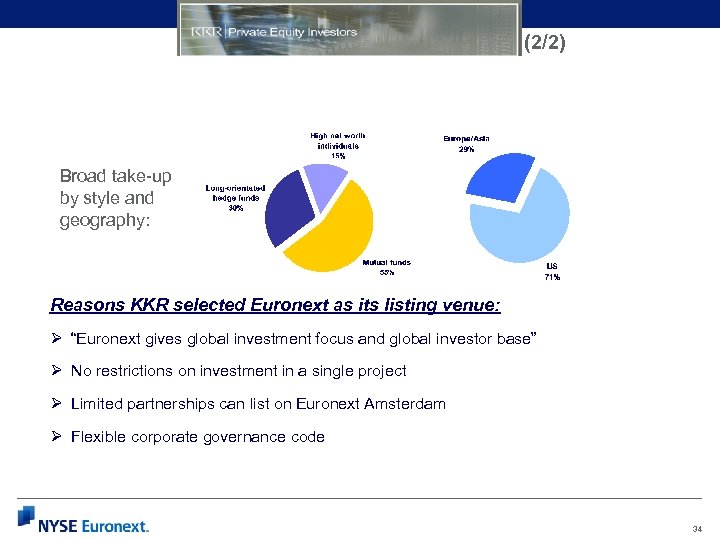

(2/2) Broad take-up by style and geography: Reasons KKR selected Euronext as its listing venue: Ø “Euronext gives global investment focus and global investor base” Ø No restrictions on investment in a single project Ø Limited partnerships can list on Euronext Amsterdam Ø Flexible corporate governance code 34

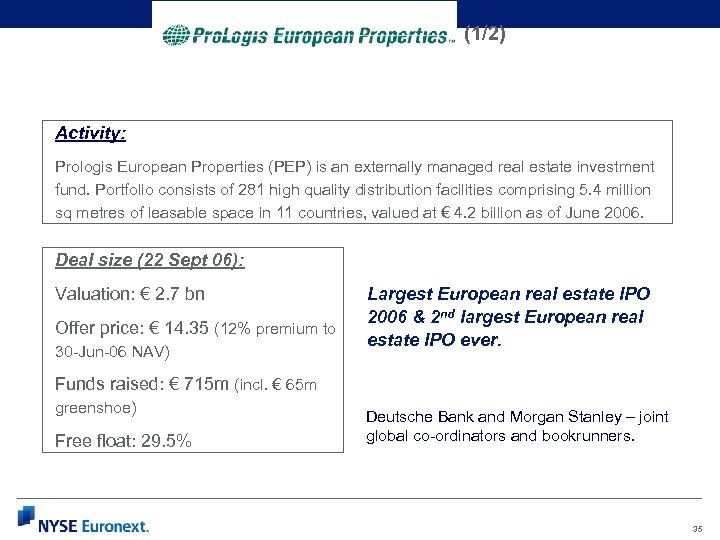

(1/2) Activity: Prologis European Properties (PEP) is an externally managed real estate investment fund. Portfolio consists of 281 high quality distribution facilities comprising 5. 4 million sq metres of leasable space in 11 countries, valued at € 4. 2 billion as of June 2006. Deal size (22 Sept 06): Valuation: € 2. 7 bn Offer price: € 14. 35 (12% premium to 30 -Jun-06 NAV) Largest European real estate IPO 2006 & 2 nd largest European real estate IPO ever. Funds raised: € 715 m (incl. € 65 m greenshoe) Free float: 29. 5% Deutsche Bank and Morgan Stanley – joint global co-ordinators and bookrunners. 35

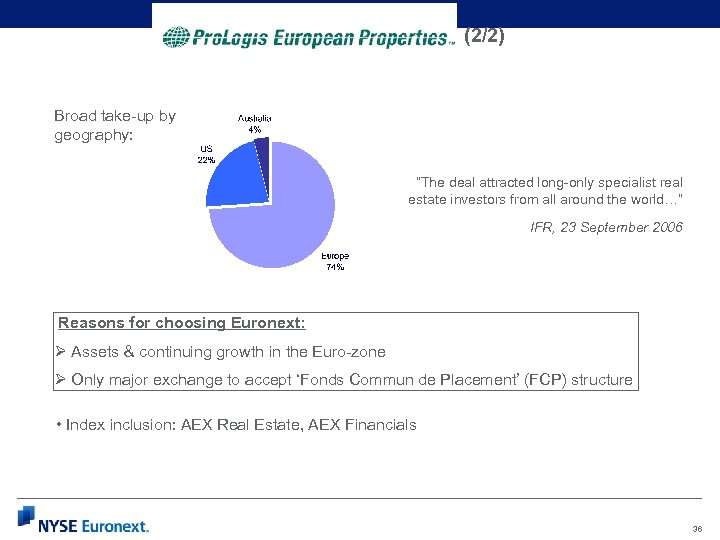

(2/2) Broad take-up by geography: “The deal attracted long-only specialist real estate investors from all around the world…” IFR, 23 September 2006 Reasons for choosing Euronext: Ø Assets & continuing growth in the Euro-zone Ø Only major exchange to accept ‘Fonds Commun de Placement’ (FCP) structure • Index inclusion: AEX Real Estate, AEX Financials 36

Why the NYSE Euronext European platform? è Gateway to the €uro-zone + Global Visibility • Publicity: cross-border access to investors, customers & business partners • Acquisition currency: €uro – a key currency • Huge pool of assets under management • Single entry point gives broad European access for listing and trading è Leading cross-border exchange with a pan-European reach • Top-ranked globally for capital raising • Largest central orderbook trading volumes in Europe • Largest exchange in Europe by market capitalisation • Broad service offering for early stage and mature companies 37

af344f9fc98570e12bb23fe4badd3fc7.ppt