96a0a51122c2d29846dadfcc9818e137.ppt

- Количество слайдов: 38

Benefits of Free Enterprise Objective: • What are the basic principles of the U. S. free enterprise system? • What role does the consumer play in the system of free enterprise? • What is the role of the government in the free enterprise system? *Be sure to leave a couple blank lines under each question and answer the questions at the end of the lesson. Chapter 3 Section Main Menu

CA Standard(s) Covered 12. 3 Students analyze the influence of the federal government on the American economy. 1. Understand how the role of government in a market economy often includes providing for national defense, addressing environmental concerns, defining and enforcing property rights, attempting to make markets more competitive, and protecting consumers’ rights. Chapter 3 Section Main Menu

Current Event Video Chapter 3 Section Main Menu

Chapter 3 Video Chapter 3 Section Main Menu

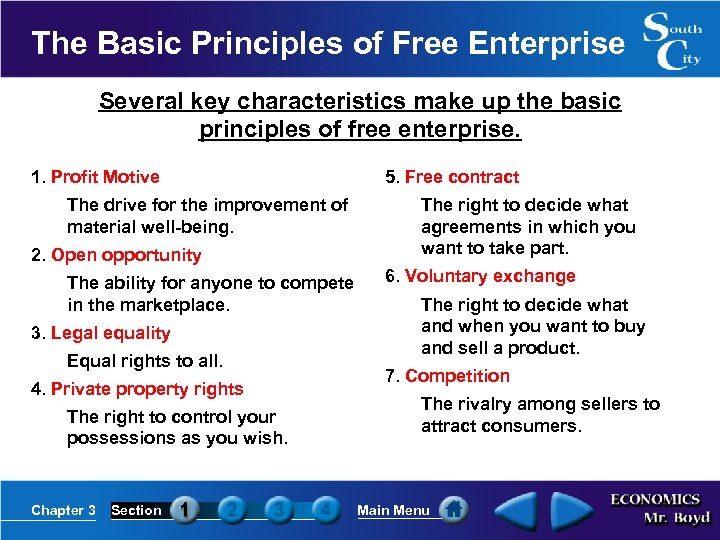

The Basic Principles of Free Enterprise Several key characteristics make up the basic principles of free enterprise. 1. Profit Motive The drive for the improvement of material well-being. 2. Open opportunity The ability for anyone to compete in the marketplace. 3. Legal equality Equal rights to all. 4. Private property rights The right to control your possessions as you wish. Chapter 3 Section 5. Free contract The right to decide what agreements in which you want to take part. 6. Voluntary exchange The right to decide what and when you want to buy and sell a product. 7. Competition The rivalry among sellers to attract consumers. Main Menu

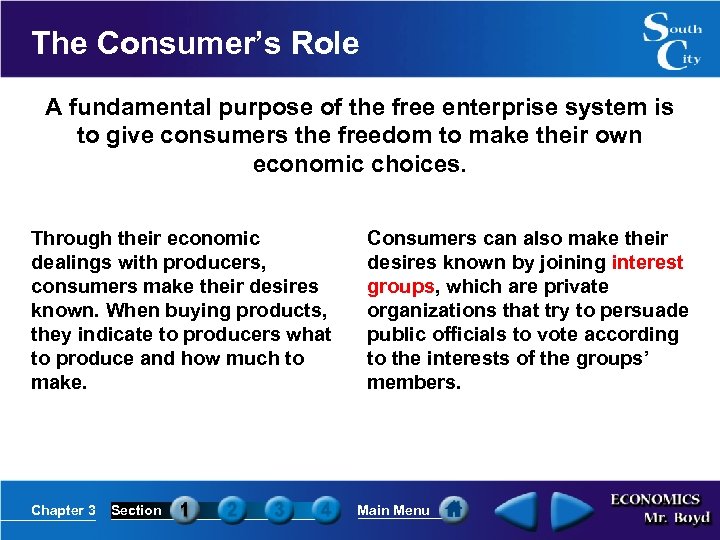

The Consumer’s Role A fundamental purpose of the free enterprise system is to give consumers the freedom to make their own economic choices. Through their economic dealings with producers, consumers make their desires known. When buying products, they indicate to producers what to produce and how much to make. Chapter 3 Section Consumers can also make their desires known by joining interest groups, which are private organizations that try to persuade public officials to vote according to the interests of the groups’ members. Main Menu

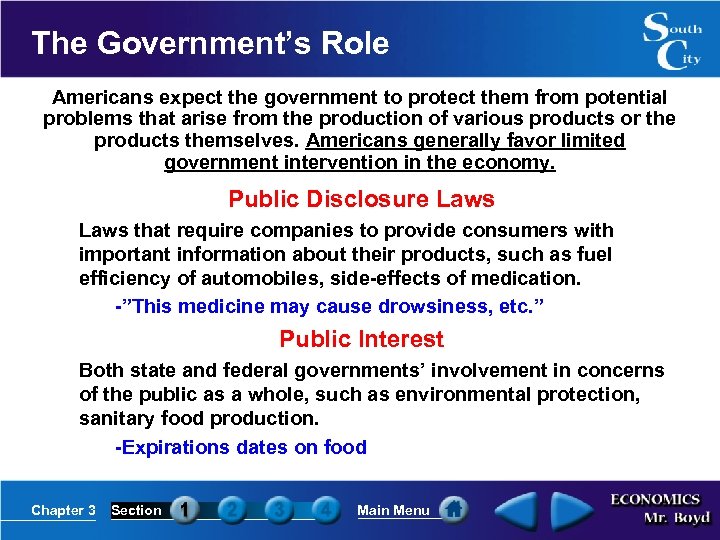

The Government’s Role Americans expect the government to protect them from potential problems that arise from the production of various products or the products themselves. Americans generally favor limited government intervention in the economy. Public Disclosure Laws that require companies to provide consumers with important information about their products, such as fuel efficiency of automobiles, side-effects of medication. -”This medicine may cause drowsiness, etc. ” Public Interest Both state and federal governments’ involvement in concerns of the public as a whole, such as environmental protection, sanitary food production. -Expirations dates on food Chapter 3 Section Main Menu

Current Event Video Chapter 3 Section Main Menu

Section 1 Assessment 1. Americans generally favor (a) strong government control of the economy. (b) limited government intervention in the economy. (c) no government intervention in the economy. (d) government control of manufacturing only. 2. The basic principles of free enterprise do NOT include (a) competition. (b) legal equality. (c) profit motive. (d) checks and balances. Let’s check out what’s NOT good to buy…Click Here! Chapter 3 Section Main Menu

Section 1 Assessment 1. Americans generally favor (a) strong government control of the economy. (b) limited government intervention in the economy. (c) no government intervention in the economy. (d) government control of manufacturing only. 2. The basic principles of free enterprise do NOT include (a) competition. (b) legal equality. (c) profit motive. (d) checks and balances. Let’s check out what’s NOT good to buy…Click Here! Chapter 3 Section Main Menu

HW • Read pages 51 - 55 and complete questions 1 -3 p. 55. Chapter 3 Section Main Menu

Promoting Growth and Stability Objective: • How does the government track and seek to influence business cycles? • How does the government try to promote economic strength? • Why and how does the government encourage innovation? *Be sure to leave a couple blank lines under each question and answer the questions at the end of the lesson. Chapter 3 Section Main Menu

CA Standard(s) Covered 12. 3 Students analyze the influence of the federal government on the American economy. 1. Understand how the role of government in a market economy often includes providing for national defense, addressing environmental concerns, defining and enforcing property rights, attempting to make markets more competitive, and protecting consumers’ rights. 12. 4 Students analyze the elements of the U. S. labor market in a global setting. 2. Describe the current economy and labor market, including the types of goods and services produced, the types of skills workers need, the effects of rapid technological change, and the impact of international competition. Chapter 3 Section Main Menu

Tracking Business Cycles • Macroeconomics is the study of the behavior and decision making of entire economies. • Microeconomics is the study of the economic behavior and decision making of individuals, families, households and businesses. • A business cycle is a period of a macroeconomic expansion followed by a period of contraction. • One measure of a nation’s macroeconomy is gross domestic product (GDP). GDP is the total value of all final goods and services produced in a particular economy. – Economists use GDP to predict business cycles Chapter 3 Section Main Menu

Promoting Economic Strength Policymakers pursue three main outcomes as they seek to stabilize the economy. Employment • One aim of federal economic policy is to provide jobs for everyone who is able to work. – Unemployment = 3% - 11% in US (over last 50 years) – Unemployment Rate: 9. 4% for 2010 Growth • For each generation of Americans to do better than previous ones, the economy must provide steady growth and continue to produce additional goods and services. Stability • Stability gives consumers, producers, and investors confidence in the economy and in our financial institutions, promoting economic freedom and growth. – Avoid sudden drastic changes in prices. Chapter 3 Section Main Menu

Encouraging Innovation The government encourages advances in technology and improvements in productivity in several ways. Technology is the process used to produce a good or service. • Federal agencies fund many research and development projects. Also, new technology often evolves out of government research. • Gov’t Grants • NASA Chapter 3 Section • A patent gives the inventor of a new product the exclusive right to produce and sell it for 20 years. Main Menu

Current Event Video Chapter 3 Section Main Menu

Section 2 Assessment 1. Policymakers encourage all of the following EXCEPT (a) stable productivity. (b) high employment. (c) stable prices. (d) steady growth. 2. The government encourages advances in technology and improvements in productivity by (a) maintaining steady price controls. (b) funding research and development projects at many levels. (c) hiring more workers to reduce unemployment. (d) regulating banks and other financial institutions. Let’s watch NASA TV!!! Click Here! Chapter 3 Section Main Menu

Section 2 Assessment 1. Policymakers encourage all of the following EXCEPT (a) stable productivity. (b) high employment. (c) stable prices. (d) steady growth. 2. The government encourages advances in technology and improvements in productivity by (a) maintaining steady price controls. (b) funding research and development projects at many levels. (c) hiring more workers to reduce unemployment. (d) regulating banks and other financial institutions. Let’s watch NASA TV!!! Click Here! Chapter 3 Section Main Menu

HW • Read pages 57 - 60 and complete questions 1 - 6 p. 60. Chapter 3 Section Main Menu

Providing Public Goods Objective: • What are public goods? • What is a market failure? • How does government manage externalities? *Be sure to leave a couple blank lines under each question and answer the questions at the end of the lesson. Chapter 3 Section Main Menu

CA Standard(s) Covered 12. 3 Students analyze the influence of the federal government on the American economy. 1. Understand how the role of government in a market economy often includes providing for national defense, addressing environmental concerns, defining and enforcing property rights, attempting to make markets more competitive, and protecting consumers’ rights. Chapter 3 Section Main Menu

Public Goods • A public good is a shared good or service for which it would be impractical to make consumers pay individually and to exclude nonpayers. – Public goods are funded by the public sector, the part of the economy that involves transactions of the government. – A free rider is someone who would not choose to pay for a certain good or service, but who would get the benefits of it anyway if it is provided as a public good. • Would you pay for the new Bay Bridge? Would you use it? Chapter 3 Section Main Menu

Market Failures • Would the free market ensure that roads are built everywhere they are needed? – It’s doubtful. Neither could individuals afford to pay for a freeway. A market failure is a situation in which the market, on its own, does not distribute resources efficiently. Chapter 3 Section Main Menu

Externalities • An externality is an economic side effect of a good or service. – The building of a new dam and creation of a lake generates: • Positive Externalities – A possible source of hydroelectric power – Swimming – Boating – Fishing – Lakefront views • Negative Externalities – Loss of wildlife habitat due to flooding – Disruption of fish migration along the river – Overcrowding due to tourism – Noise from racing boats and other watercraft *The government tries to encourage positive externalities and limit negative externalities. Chapter 3 Section Main Menu

Current Event Video Chapter 3 Section Main Menu

Section 3 Assessment 1. Which of the following is an example of the public sector (Public Good) of the economy? (a) consumers purchasing goods from a private company (b) laborers working for a private construction company (c) government funding for a new national park (d) individual donations to charity 2. What is government's role in controlling externalities in the American economy? (a) government tries to encourage positive externalities and limit negative externalities (b) government tries to limit all externalities because they represent market failure (c) government tries to limit positive externalities and encourage negative externalities (d) government tries to encourage all externalities so that the market will be competitive Let’s check out the Sierra Club in SF Bay Area… Click Here! Chapter 3 Section Main Menu

Section 3 Assessment 1. Which of the following is an example of the public sector (Public Good) of the economy? (a) consumers purchasing goods from a private company (b) laborers working for a private construction company (c) government funding for a new national park (d) individual donations to charity 2. What is government's role in controlling externalities in the American economy? (a) government tries to encourage positive externalities and limit negative externalities (b) government tries to limit all externalities because they represent market failure (c) government tries to limit positive externalities and encourage negative externalities (d) government tries to encourage all externalities so that the market will be competitive Let’s check out the Sierra Club in SF Bay Area… Click Here! Chapter 3 Section Main Menu

HW • Read pages 62 -66 (Ch. 3 Section 3) and complete questions 1 -3 p. 66. • Read pages 67 -70 (Ch. 3 Section 4) and complete questions 1 -4 p. 70. • Study for Test! Chapter 3 Section Main Menu

Providing a Safety Net Objective: • What role does the government play in fighting poverty? • What government programs attempt to aid those facing poverty? *Be sure to leave a couple blank lines under each question and answer the questions at the end of the lesson. Chapter 3 Section Main Menu

CA Standard(s) Covered 12. 3 Students analyze the influence of the federal government on the American economy. 3. Describe the aims of government fiscal policies (taxation, borrowing, spending) and their influence on production, employment, and price levels. Chapter 3 Section Main Menu

The Poverty Problem The poverty threshold is an income level below that which is needed to support families or households. • The poverty threshold is determined by the federal government and is adjusted periodically. –In 2010 = $14, 570 (single parent w/ 1 child) • Welfare is a general term that refers to government aid to the poor. – Began by President FDR in the 1930’s * http: //aspe. hhs. gov/poverty/09 poverty. shtml Chapter 3 Section Main Menu

Redistribution Programs Cash transfers are direct payments of money to eligible people. Temporary Assistance for Needy Families (TANF) This program allows individual states to decide how to best use federally provided funds. Social Security provides direct cash transfers of retirement income to the nation’s elderly and living expenses to the disabled. Stability Unemployment compensation provides money to eligible workers who have lost their jobs. Workers’ Compensation Workers’ compensation provides a cash transfer of state funds to employees injured while on the job. Chapter 3 Section Main Menu

Other Redistribution Programs • Besides cash transfers, other redistribution programs include: In-kind benefits • In-kind benefits are goods and services provided by the government for free or at greatly reduced prices. Medical benefits • Health insurance is provided by the government for the elderly and disabled (Medicare) and for poor people who are unemployed or are not covered by their employer’s insurance (Medicaid). Education benefits • Federal, state, and local governments all provide educational opportunities for those in need. Chapter 3 Section Main Menu

Current Event Video Chapter 3 Section Main Menu

Section 4 Assessment 1. Welfare includes all of the following EXCEPT (a) Temporary Assistance to Needy Families (b) Occupational Safety and Health Administration (c) Social Security (d) Medicaid 2. Education programs make the economy more productive by (a) adding to human capital and labor productivity. (b) reducing taxes. (c) providing more jobs in manufacturing. (d) reducing injuries on the job. Check out how the government will help pay for college!!! Click Here! Chapter 3 Section Main Menu

Section 4 Assessment 1. Welfare includes all of the following EXCEPT (a) Temporary Assistance to Needy Families (b) Occupational Safety and Health Administration (c) Social Security (d) Medicaid 2. Education programs make the economy more productive by (a) adding to human capital and labor productivity. (b) reducing taxes. (c) providing more jobs in manufacturing. (d) reducing injuries on the job. Check out how the government will help pay for college!!! Click Here! Chapter 3 Section Main Menu

HW • Read pages 67 -70 (Ch. 3 Section 4) and complete questions 1 -4 p. 70. Study for Test! Chapter 3 Section Main Menu

96a0a51122c2d29846dadfcc9818e137.ppt