5034f58bbe50808d85f3848980f4dfc5.ppt

- Количество слайдов: 83

Benefit Pitfalls & Health Care Reform Updates Presented by: Scott Rappoport Charles Bruder The material provided herein is for informational purposes only and is not intended as legal advice or counsel.

Please help yourself to food and drinks Please let us know if the room temperature is too hot or cold Bathrooms are located past the reception desk on the right Please turn OFF your cell phones Please complete and return surveys at the end of the seminar 2

Common Pitfalls • Renewal Train Wreck • Cost Control Strategies limited to deductibles, copayments, etc. • No Formal Benefit Communications Strategy • The renewal process is not strategic, focused on quotes and plan changes. © 2008 Benefit Sources & Solutions. All rights reserved.

Case Study NJ Based Not for Profit Private School-275 EE’s Critical Issues • Spiraling Costs & Budgetary Limitations • Limited Resources • Limited Insurance Carrier Options • Maintaining Employee Engagement & Morale © 2008 Benefit Sources & Solutions. All rights reserved.

Key Challenges • 27% Renewal Increase • Carrier Marketplace Declining to quote • Management desire to maintain culture of providing competitive benefits program • Budget constraints limited to 5% increase in employer cost © 2008 Benefit Sources & Solutions. All rights reserved.

What We Discovered • The renewal process generally began only 60 days prior to the renewal • Cost Control Strategies were historically limited to Cost Shifting • Benefit Communications were limited to memos and an occasional meeting • The renewal process was completely transactional © 2008 Benefit Sources & Solutions. All rights reserved.

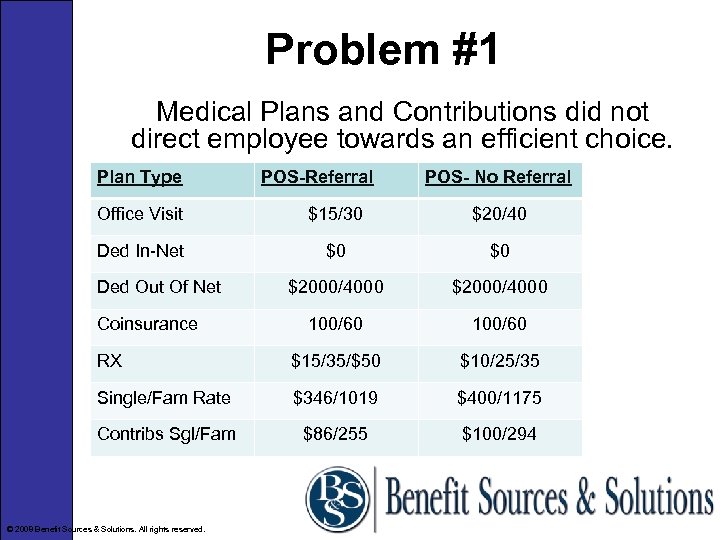

Problem #1 Medical Plans and Contributions did not direct employee towards an efficient choice. Plan Type POS-Referral POS- No Referral Office Visit $15/30 $20/40 Ded In-Net $0 $0 $2000/4000 100/60 RX $15/35/$50 $10/25/35 Single/Fam Rate $346/1019 $400/1175 Contribs Sgl/Fam $86/255 $100/294 Ded Out Of Net Coinsurance © 2008 Benefit Sources & Solutions. All rights reserved.

Our Advice • Create a two tier plan-Hi/Low • Employees must be properly induced to make a purchasing decision based on the cost of coverage and their medical needs. • Set a base employer contribution for the low plan and charge participants 100% of the difference for the high plan. © 2008 Benefit Sources & Solutions. All rights reserved.

Problem #2 -Eligibility • Employer had only 7% of employees waiving coverage compared to the national average in our benchmarking survey of 17. 2% • This revealed that contributions were too low. However, the employer was intent on maintaining a culture of paying for a high percentage of the total medical cost. • Our solution was to implement a new spousal eligibility policy © 2008 Benefit Sources & Solutions. All rights reserved.

Spousal Eligibility If your spouse is eligible for coverage where they work, they cannot be on your plan. Experience with our clients is that this generally results On average in a 20% disenrollment of spouses. Don’t try this at home without expert guidance. © 2008 Benefit Sources & Solutions. All rights reserved.

Problem #3 -Ancillary Lines • Dental coverage was through a well known dental carrier • Life and LTD were with one carrier • STD was self insured and the employer was self administering it. • Statutory TDB was with a private insurer and had been for years © 2008 Benefit Sources & Solutions. All rights reserved.

Dental Experience was running about 70% of paid premium Dental claims are highly predictable. Self funding dental (paying for administration and network access while funding your own claims) has very little financial risk. It will be completely transparent to your participants and could result in as much as a 30% savings © 2008 Benefit Sources & Solutions. All rights reserved.

Short Term Disability The client thought they were saving money through their self administered sick pay policy. HR was mildly concerned that from time to time key personnel received special consideration. Note to C-Corps-Ad Hoc disability payments are deemed to be non-deductible dividends to the Corp An insured STD plan proved to be about 20% less than was spent on average over the past 3 years and all of the self administration and risk of discrimination was eliminated © 2008 Benefit Sources & Solutions. All rights reserved.

Statutory TDB was with a private insurer rather than the state plan. The rate was $1. 00. No one had looked at this plan since current management had been there (10+ years!) We obtained the claims experience (AC 174 -Aug. ) and marketed the plan. The Rate was $. 50 is the starting rate employees pay in the State plan. Savings to the employer was $23, 000. There was no change to the employee contributions. © 2008 Benefit Sources & Solutions. All rights reserved.

Economies of Scale There are more than 20 ancillary lines carriers vying for your business. Our approach is to squeeze the maximum value out of the carrier. Life and LTD were with the same carrier. We added the STD and TDB. The carrier offered a variety of bells and whistles (EAP, Flex Admin, FMLA Admin) The employer’s administration hassles and compliance liabilities were reduced considerably © 2008 Benefit Sources & Solutions. All rights reserved.

Results • 9. 4% Gross Renewal Increase • Majority of employees moved from hi to lo plan (cost neutral to the employer) • 24% spouse disenrollment saved nearly 10%-$66 k • $29, 000 savings due to TDB move • 10% Reduction in Life, LTD & STD • Free EAP, Flex Admin, FMLA Admin © 2008 Benefit Sources & Solutions. All rights reserved.

Case Study Int’l Self Funded Engineering Co-180 EE’s Critical Issues • Spiraling Costs & Budgetary Limitations • Unpredictable expenses • Maintaining Employee Engagement & Morale • PPACA Preparedness & Support © 2008 Benefit Sources & Solutions. All rights reserved.

Primary Problem ER Had been self funded for many years and on the advice of their TPA was buying 15/12 specific stop loss and 12/12 aggregate at an annual cost of $422, 000 Key Challenge - every year there were claims that fell outside the contract year leaving a big unknown liability and significant risk © 2008 Benefit Sources & Solutions. All rights reserved.

Our Advice • Negotiate 24/12 stop loss basis at an additional annual cost of $13, 000 • Undertake a comprehensive HCR Impact Analysis © 2008 Benefit Sources & Solutions. All rights reserved.

Result All liabilities ( both cost and HCR related) are finite and visible © 2008 Benefit Sources & Solutions. All rights reserved.

Case Study HVAC Contractor in NNJ -139 EE’s Key Challenges • Revenue off 30% for the 2 nd year in a row • Trying to avoid reduction in force • Management desire to maintain culture of providing competitive benefits program • Horizon renewal increase of 27% from $1. 33 M to $1. 7 M © 2008 Benefit Sources & Solutions. All rights reserved.

What We Discovered • Inefficient plan design • No creative cost control strategies • No formal employee communications • No compliance support (5500’s were 4 years past due!!!) • Administratively burdensome to manage © 2008 Benefit Sources & Solutions. All rights reserved.

Our Advice • Install Consumer Driven Health Plan • Plan and execute robust 12 month employee communications program • File VCR with DOL to resolve 5500 delinquency • Identify best in class HR/Benefit Technology Platform © 2008 Benefit Sources & Solutions. All rights reserved.

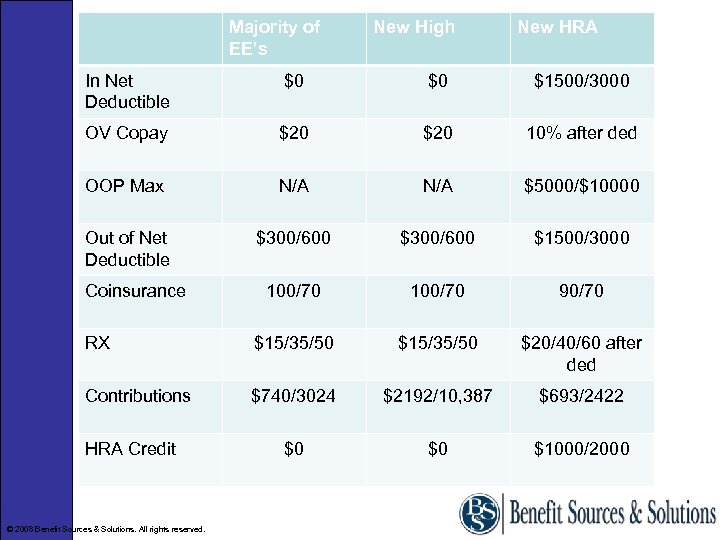

Majority of EE’s New High New HRA In Net Deductible $0 $0 $1500/3000 OV Copay $20 10% after ded OOP Max N/A $5000/$10000 Out of Net Deductible $300/600 $1500/3000 100/70 90/70 RX $15/35/50 $20/40/60 after ded Contributions $740/3024 $2192/10, 387 $693/2422 $0 $0 $1000/2000 Coinsurance HRA Credit © 2008 Benefit Sources & Solutions. All rights reserved.

HRA Case Study Results • We conducted 5 employee meetings in 3 different locations • We provided call center support to employees and their Dependents for assistance with enrollment decisions • 97% of all participants elected the HRA • We projected the client would be responsible for $175, 000 in HRA deductible funding and about $20, 000 in “safety net”. We estimated actual expenses at $151, 000. Actual results a year later $131, 000. © 2008 Benefit Sources & Solutions. All rights reserved.

Results $500, 000+ Savings Premium Plus HRA Funding Spousal Eligibility $435, 000 $ 75, 000 $138, 000 less than they spent the year before. Multiyear Cost Control Strategy-Assuming similar HRA claims in 2011 the client will spend about $20, 000 more in 2011 than they spent in 2009. In most cases, employee out of pocket costs are lower with the HRA © 2008 Benefit Sources & Solutions. All rights reserved.

Administrative Process 7 “Systems” • HRIS • Payroll • Medical • 401 k • Dental • Life, LTD, STD • Vision © 2008 Benefit Sources & Solutions. All rights reserved.

Supporting the 7 Systems • Open enrollment paperwork • Monthly adds & deletes in each system • Monthly billing reconciliation • Keeping your census up to date • Maintaining employee demographic data with each carrier & system • Data entry and transmission errors to carrier Sound Familiar? © 2008 Benefit Sources & Solutions. All rights reserved.

Our Advice • Identify Specific Technology Needs & Best in Class Solution providers • Identify possible funding sources (carriers? ) • Implement Technology Solution © 2008 Benefit Sources & Solutions. All rights reserved.

Result Single system w/ EDI link to payroll & carriers providing: • Online Enrollment • Benefits Management • HRIS • Employee Portal • Consolidated Billing • Time & Attendance • Performance Management • Resource & Property Tracking • Employee Surveys • Applicant Tracking • Etc. © 2008 Benefit Sources & Solutions. All rights reserved.

Compliance Pitfalls Assuming your insurance carrier or other party is going to: • Complete and file your 5500 • Provide your employees with annual notice of COBRA rights • Provide notices of HIPAA Special Election Rights • Provide Women’s Health Cancer Rights Notice • Complying with Medicare Parte D reporting • Provide Newborn Mothers’ Health Protection Act notices • Providing Annual CHIP notices © 2008 Benefit Sources & Solutions. All rights reserved.

PPACA Is it legal? Is it Going Away? © 2008 Benefit Sources & Solutions. All rights reserved.

Many Constitutional Challenges Suits Filed in Most States Five Federal Court Decisions © 2008 Benefit Sources & Solutions. All rights reserved.

Ruling Constitutional Thomas More Law Center v. Barack Obama, et al. (MI) Liberty University v. Timothy Geithner (VA) Mead v. Holder (DC) Ruling Unconstitutional Commonwealth of Virginia v. Sebelius (VA) Florida v. Dept of Health & Human Services (FL) (22 Attorney Generals & 4 Governors) © 2008 Benefit Sources & Solutions. All rights reserved.

What are the Issues • Supreme Court likely not to rule before 2013 • Question will be whether Inactivity = Activity • What does the federal government make you do? • 4 very liberal and 4 very conservative justices + Stephens • The big issue is severability © 2008 Benefit Sources & Solutions. All rights reserved.

Is Grandfathering Still Relevant? Quick review: Everything measured against plan design of March 23, 2010. Plan Loses Grandfathered Status if it: • Eliminates a benefit, which includes elimination of an element necessary to diagnose or treat a condition • Increases the employee coinsurance percentage • Increases a copay by more than the greater of $5 or medical inflation plus 15% • Increases the deductible or out-of-pocket max by more than the greater of medical inflation plus 15% © 2008 Benefit Sources & Solutions. All rights reserved.

What Will Jeopardize Grandfathering Cont’d? • Decreases the employer’s contribution rate towards the cost of any tier of coverage by more than five percentage points. • Is amended to include new annual limits or decrease existing annual limits. • Changed carriers before November 15, 2010 • NOT-because the carrier said so? !? !? ! © 2008 Benefit Sources & Solutions. All rights reserved.

Advantages of Remaining Grandfathered plans are exempt from the following reform provisions: • Required coverage for emergency services at innetwork levels • Required first-dollar coverage for certain preventive services (immunizations and screenings), subject to no deductible; • A prohibition on restricting the designation of primary care providers or requiring referrals for OB/GYN services; © 2008 Benefit Sources & Solutions. All rights reserved.

Grandfathered plans are also exempt from: • Required coverage of routine expenses for participation in clinical trials; • Enhanced claim appeal procedures, including implementation of an external appeals process; and • Due to these exemptions, many plan sponsors will want to retain their plan's grandfathered status for as long as that proves to be feasible. • A prohibition on discriminating in favor of highly compensated individuals (i. e. , applying the same nondiscrimination rules to both insured and self-funded plans). © 2008 Benefit Sources & Solutions. All rights reserved.

Non-Discrimination Requirements • Applies to non-grandfathered plans • Delayed until further regulatory guidance is available! • Has always applied to self-funded plans • A prohibition on discriminating in favor of highly compensated individuals (top 25% top 5 highest paid and 10% shareholders) • For insured plans the penalty is $100/day person to whom the failure relates ($500, 000 maximum penalty) © 2008 Benefit Sources & Solutions. All rights reserved.

Examples of Discrimination • Management-only health coverage • Better benefits (reduced premium or increased benefits for management) • Post termination continuation coverage (including COBRA) for management or other HCE’s only • Coverage provided to HCE as result of resolution of employment litigation © 2008 Benefit Sources & Solutions. All rights reserved.

Avoiding Discrimination • Offer broad coverage, equal benefits and equal cost • Have HCE’s pay same contributions and gross-up wages for tax impact • Keep insured plans grandfathered for as long as reasonably possible © 2008 Benefit Sources & Solutions. All rights reserved.

Free Choice Vouchers Repealed Free choice voucher aspect of the mandate had the ability to destabilize the market It gave the right to young healthy employees who’s income fell within a certain range to buy coverage through the exchanges with the employer’s money and pocket the difference between the employer’s contribution and the cost through the exchange Repealed in April as part of the budget compromise! © 2008 Benefit Sources & Solutions. All rights reserved.

W-2 Reporting • Delayed until benefits payable during taxable years: Beginning on or after January 1, 2012 for employers that issue 250 or more W-2’s On or after January 1, 2013 for employers that issue fewer than 250 W-2’s © 2008 Benefit Sources & Solutions. All rights reserved.

Other Issues New ERISA Claims Procedures • Effective plan years after September, 23 2010 • Significant Changes to claims and appeals procedures • Does not apply to grandfathered plans • New & cumbersome external review requirements • Be sure your plan is amended! © 2008 Benefit Sources & Solutions. All rights reserved.

Other Issues Is your Flex Plan Amended? !? ! • Effective 1/1/11 it is illegal for your flex plan to cover OTC’s w/o a RX. Your plan document must be amended by 6/30/2011!! • Significant Changes to claims and appeals procedures • Does not apply to grandfathered plans • New & cumbersome external review requirements • Be sure your plan is amended! © 2008 Benefit Sources & Solutions. All rights reserved.

Dep Age 26 -Administration • Significant administrative implications: – Written notice – Special one time open enrollment – Effective latest of 1/1/11 for 1/1/ plans – Includes FSA’s & HRA’s – Plan document amendments – Allows for change in elections including FSA to pay for dep premiums – Does not apply to dental or vision • Discrepancy with NJ age 31 -awaiting guidance © 2008 Benefit Sources & Solutions. All rights reserved.

2011 Admin Issues-SPD’s Requires that all: • Group Health Plans (including self-insured plans) • Group Health Insurers • Individual Health Insurers Provide a summary of benefits and coverage explanation to: • All applicant a the time of application • All enrollees prior to the time of enrollment or re-enrollment • All policyholders at the time of issuance or delivery Must include specific information, be no more than 4 pages and be culturally and linguistically appropriate. $1000 per enrollee fine for non-compliance © 2008 Benefit Sources & Solutions. All rights reserved.

2014 -Market Reforms • All individual health insurance policies and all fully insured group policies 100 lives and under (and larger groups purchasing coverage through the exchanges) must abide by strict modified community rating standards • Market De-stabilization • States can waive out • 90 day Maximum waiting period for 50+ employers © 2008 Benefit Sources & Solutions. All rights reserved.

2014 -Exchanges • Requires each state to create an Exchange to facilitate the sale of qualified benefit plans to individuals, including new federally administered multi-state plans and non-profit co-operative plans – In addition the states must create “SHOP Exchanges” to help small employers purchase such coverage – The state can either create one exchange to serve both the individual and group market or they can create a separate individual market exchange and group SHOP exchange – States may choose to allow large groups (over 100) to purchase coverage through the exchanges in 2017 © 2008 Benefit Sources & Solutions. All rights reserved.

2014 -Coverage Mandate Requires all American citizens and legal residents to purchase qualified health insurance coverage. Exceptions are provided for: - Religious objectors - Individuals not lawfully present - Incarcerated individuals - Taxpayers with income under 100 percent of Poverty, and those who have a hardship waiver - Members of Indian tribes - Those who were not covered for a period of less than three months during the year - People with no income tax liability © 2008 Benefit Sources & Solutions. All rights reserved.

Coverage Mandate Penalties • Penalty for non compliance is either a flat dollar amount person or a percentage of the individual’s income, whichever is higher • In 2014 the percentage of income determining the fine amount will be 1%, then 2% in 2015, with the maximum fine of 2. 5% of taxable (gross) household income capped at the average bronze-level insurance premium (60% actuarial) rate for the person’s family beginning in 2016 • The alternative is a fixed dollar amount that phases in beginning with $325 person in 2015 to $695 in 2016 © 2008 Benefit Sources & Solutions. All rights reserved.

Surprise! Employer Mandate Applies to employers with 50 full time equivalent workers-no exception for temporary or seasonal workers. Special rules for construction and where all employees over 50 are seasonal. To determine full time employees take the total part time hours for the month and divide by 120 and add this to the number of employees working 30 or more hours per week. Applies when one or more employees receives a premium assistance tax credit to buy coverage through an exchange. An employer does not have to offer coverage. But if they do it must be both: • Qualified-must pay at least 60% of allowed charges and meet the minimum benefit standards-”essential coverage • Affordable-EE contribution must not exceed 9. 5% of household income © 2008 Benefit Sources & Solutions. All rights reserved.

Mandate Fines Employers must pay a fine: • If no coverage is offered, $2, 000 per year (calculated monthly) times the number of full-time employees; however: – The first 30 employees are exempted from the calculation – Full-time employees in the waiting period (90 days or less) are not counted – The surcharge does not apply to employees who get vouchers • If you offer coverage but it is not "qualified" AND "affordable", $3, 000 for each of those employees receiving a premium assistance tax credit (penalty capped at $2, 000 times the number of FTEs; the first 30 employees are again disregarded in this calculation. ) © 2008 Benefit Sources & Solutions. All rights reserved.

How Will They Know-2014 In order to determine if surcharges apply employers must report by 1/31 the following: • • • The employers coverage Eligibility Premium requirements Employer contributions Health plan enrollees Must be reported to both the IRS and covered individuals! © 2008 Benefit Sources & Solutions. All rights reserved.

2014 -Auto Enrollment Mandate • Requires employers of 200 or more employees to auto-enroll all new employees into any available employer-sponsored health insurance plan. – Waiting periods subject to limits may still apply. – Employees may opt out if they have another source of coverage. – Implementation date is unclear, may change to earlier via regulation © 2008 Benefit Sources & Solutions. All rights reserved.

Beyond 2014 -Cadillac Tax • 40% excise tax on insurers of employersponsored health plans with aggregate values that exceed $10, 200 for singles and from $27, 500 for families takes effect in 2018. © 2008 Benefit Sources & Solutions. All rights reserved.

Communicating to Employees • Employees should be provided with general responses to their questions • Stress that current law may change prior to implementation in future years • Focus on current provisions taking effect imminently • Communicate possible future costs of the law • Convey the cost and administrative burden placed on the employer © 2008 Benefit Sources & Solutions. All rights reserved.

Employer Responsibilities • Focus on compliance!!! Fines will be onerous!!! • Reform impacts HR, Benefits, Payroll and Finance departments in your organization. It is important to coordinate with them. • Be ware of making changes you will regret later. • Be sure to align your self with a benefits broker/consultant who will guide you effectively through these murky waters • Focus on current provisions taking effect imminently • Prepare for cost implications © 2008 Benefit Sources & Solutions. All rights reserved.

How Can We Help? • Health Care Reform Impact Analysis • Employer Advocate Advantage TM • Fiduciary Due Diligence Impact Analysis • Benefits Benchmarking • Compliance Audit • Cost Control Analysis srappoport@benefitsource. com © 2008 Benefit Sources & Solutions. All rights reserved. 732 -560 -1010 x-111

Employee Benefits Pitfalls Outside of PPACA So. . . what else do we have to worry about? Presented by: Charles Bruder

Employee Benefits Pitfalls HIPAA Case Study #1 • 41 individuals make separate requests for a copy of their respective medical records • HIPAA Privacy Rule - Information requests must be processed with 30 days (and no more than 60 days) after the request date • Covered Entity fails to respond to the requests of the individuals - 27 complaints are filed 64

Employee Benefits Pitfalls HIPAA Case Study #1 • • • The requesting individuals file complaints with the Department of Health and Human Services Covered Entity fails to respond to information requests or to assist in the HHS investigation “Covered entities and business associates must uphold their responsibility to provide. . . access to their medical records, and adhere closely to all of HIPAA’s requirements, ” said OCR Director Georgina Verdugo. “The U. S. Department of Health and Human Services will continue to investigate and take action against those organizations that knowingly disregard their obligations under these rules. ” 65

Employee Benefits Pitfalls HIPAA Case Study #2 • The Office of Civil Rights imposes fines totaling $4. 3 Million. . . • Imposition of the penalties marks the first time that fines have been imposed for a violation of the HIPAA Privacy Rules 66

Employee Benefits Pitfalls HIPAA Case Study #2 • Egregious example? ? ? Maybe. . . but. . . • Employee decides to work from outside of the office • Takes files out of the workplace which consist of “billing encounter forms” for 192 individuals – Names, dates of birth, medical record numbers, health insurer information, diagnosis and medical provider information 67

Employee Benefits Pitfalls HIPAA Case Study #2 • Employee works on the documents, takes them on the subway and forgets them. The documents are never recovered, but there is no evidence that the information contained in the documents has been misused. • Settlement with HHS - $1 Million 68

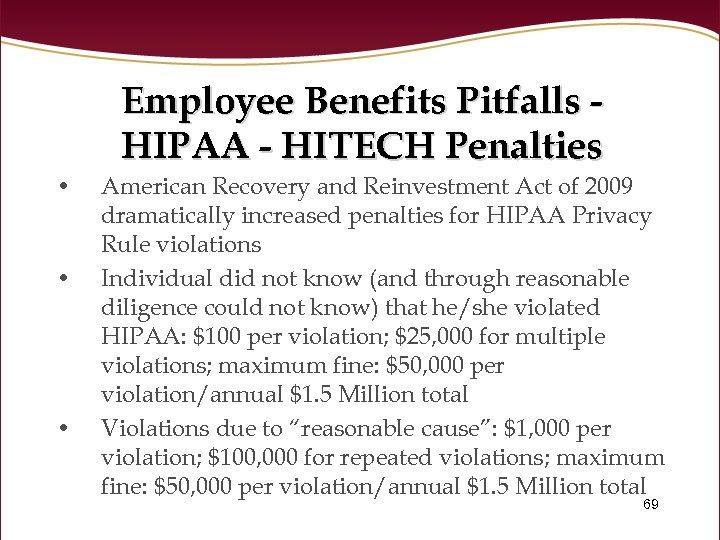

Employee Benefits Pitfalls HIPAA - HITECH Penalties • • • American Recovery and Reinvestment Act of 2009 dramatically increased penalties for HIPAA Privacy Rule violations Individual did not know (and through reasonable diligence could not know) that he/she violated HIPAA: $100 per violation; $25, 000 for multiple violations; maximum fine: $50, 000 per violation/annual $1. 5 Million total Violations due to “reasonable cause”: $1, 000 per violation; $100, 000 for repeated violations; maximum fine: $50, 000 per violation/annual $1. 5 Million total 69

Employee Benefits Pitfalls HIPAA - HITECH Penalties • • • Violation due to willful neglect but corrected with a prescribed time period: $10, 000 per violation; $250, 000 fine for repeated violations; maximum penalty: $50, 000 per violation/annual $1. 5 Million total Violation due to willful neglect but not corrected: $50, 000 per violation; annual maximum $1. 5 Million Criminal charges are also possible for knowingly violating HIPAA Privacy Rules 70

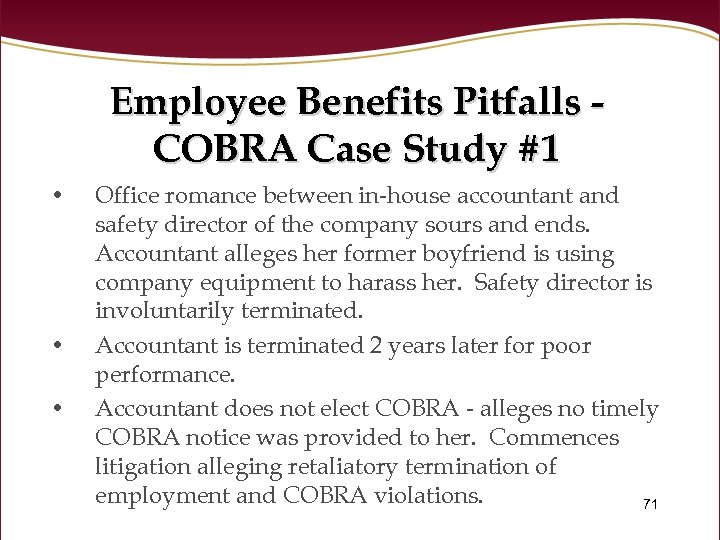

Employee Benefits Pitfalls COBRA Case Study #1 • • • Office romance between in-house accountant and safety director of the company sours and ends. Accountant alleges her former boyfriend is using company equipment to harass her. Safety director is involuntarily terminated. Accountant is terminated 2 years later for poor performance. Accountant does not elect COBRA - alleges no timely COBRA notice was provided to her. Commences litigation alleging retaliatory termination of employment and COBRA violations. 71

Employee Benefits Pitfalls COBRA Case Study #1 • • Third Party Administrator (TPA) contends it sent accountant a COBRA notice. . . but it was sent 49 days after the employment termination date After litigation commences, TPA sends accountant another COBRA notice, provides for retroactive COBRA coverage from the date of employment termination – Second COBRA notice contains errors Upon learning of these errors, TPA sends a third COBRA notice, permitting retroactive COBRA coverage from the date of employment termination Accountant alleges no COBRA notices were ever received; TPA cannot affirmatively prove that COBRA 72 notices were received

Employee Benefits Pitfalls COBRA Case Study #1 • • Court notes that COBRA notice requirements only provide that employers must use procedures that are reasonably calculated to be received by the individual Because the TPA sent all of the COBRA notices in good faith reliance upon its procedures, and could demonstrate through its records that the COBRA notices were sent, it dismissed the claims of the accountant. 73

Employee Benefits Pitfalls COBRA Case Study #1 • The Court further noted that the initial COBRA notice was mailed 5 days late, but it did not impose penalties for the late notice. – – – TPA had argued that accountant was not harmed by the late COBRA notice and the Court agreed Court noted that consideration of the degree of prejudice is a proper consideration Accountant experienced no medical claims during the potential COBRA coverage period and never elected coverage after receiving 3 COBRA notices 74

Employee Benefits Pitfalls COBRA • Some other recent decisions. . . – – Employer is not liable for use of a wrong address by TPA where all procedures were followed Use of the phrase “gross misconduct” on employment termination documents results in a litigation claim for COBRA benefits interference Use of a mailing manifest by a TPA results in a rebuttable presumption of a timely COBRA notice Backdating of a qualifying event in COBRA documents results in $13, 000 in fines and an Age Discrimination Act claim 75

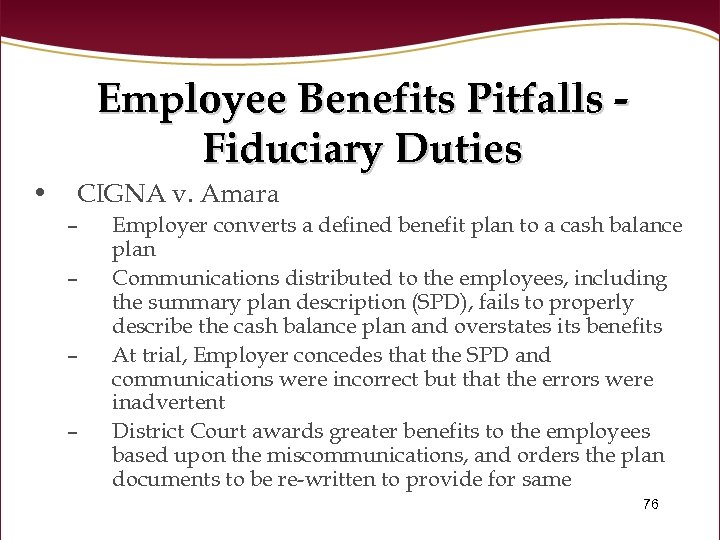

Employee Benefits Pitfalls Fiduciary Duties • CIGNA v. Amara – – Employer converts a defined benefit plan to a cash balance plan Communications distributed to the employees, including the summary plan description (SPD), fails to properly describe the cash balance plan and overstates its benefits At trial, Employer concedes that the SPD and communications were incorrect but that the errors were inadvertent District Court awards greater benefits to the employees based upon the miscommunications, and orders the plan documents to be re-written to provide for same 76

Employee Benefit Pitfalls Fiduciary Duties • Decision is upheld on appeal • U. S. Supreme Court – – ERISA does not provide authority for courts to rewrite plan documents The provisions of the SPD and communications do not constitute terms of the plan but rather provide summaries of the provisions of the plan SPD does not create a contractual right to benefits “Appropriate equitable relief” is available to the plan participants 77

Employee Benefits Pitfalls Fiduciary Duties • What is “appropriate equitable relief”? – – Not completely clear, but may include monetary relief Reformation of the plan documents may be appropriate in cases where false or misleading information is communicated to the plan participants “Surcharges” may be appropriate, but participants must demonstrate more than just compensatory damages Actual harm must be demonstrated - might be detrimental reliance. Is retirement required? 78

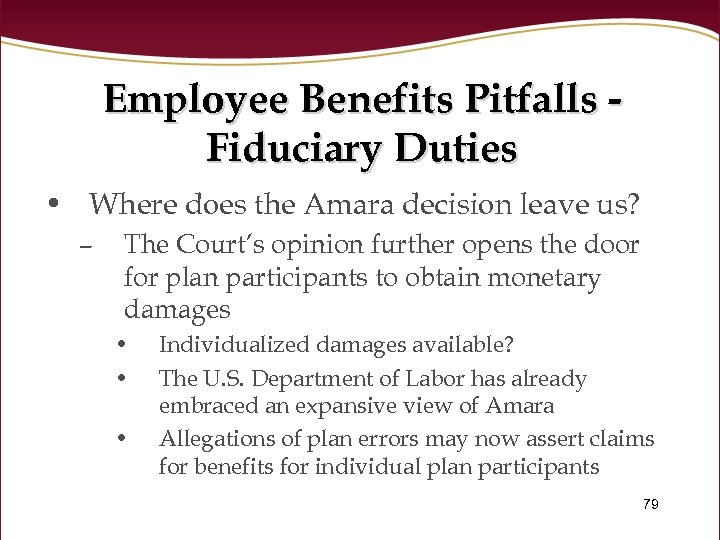

Employee Benefits Pitfalls Fiduciary Duties • Where does the Amara decision leave us? – The Court’s opinion further opens the door for plan participants to obtain monetary damages • • • Individualized damages available? The U. S. Department of Labor has already embraced an expansive view of Amara Allegations of plan errors may now assert claims for benefits for individual plan participants 79

Employee Benefits Pitfalls Fiduciary Duties • With monetary damages now arguably available, plan administration and communication-based claims may increase – Review and updates of SPDs and other plan documents is more critical than ever • – – SPD errors can result in monetary awards No more “feel good” communications to plan participants or employees - straight forward documents are key “Scrivener’s errors” may be more costly to plan sponsors 80

Employee Benefits Pitfalls Fiduciary Duties • Other areas potentially impacted by Amara: – Communications by third parties? • • – – TPAs, custodian representatives? Intranet postings? Claim forms? E-mails? What about DC plans and cafeteria/group health plans? Plan sponsors may now be subject to liability for any miscommunication made concerning the plan 81

Employee Benefits Pitfalls Fiduciary Duties • What should a plan sponsor do now? – – – Review all current documents Implement processes to control communications Discuss these issues with the plan advisors If you discover errors - EPCRS Process, process. . . Keep it simple 82

Question & Answer Session Thank you for coming!

5034f58bbe50808d85f3848980f4dfc5.ppt