da3383604ba07808f9232a223b47a2cd.ppt

- Количество слайдов: 22

Benefit Cap What’s Happened ? What next? Who does it affect ? How does this affect you?

Benefit Cap Ø The Government announced benefit cap measures to be introduced as part Welfare Reform Act Spending Review for 2010. From April 2013, a benefit cap would be introduced on the total amount of benefits that working age people can receive. Ø Workless households will no longer receive more in benefits than the average weekly wage for working families. Ø Working age: If you were 61 before 6 October 2012, you should not be affected by changes to occupancy rules or the benefits cap. However, it's possible that pensioners who have younger working age partners may be affected when the new Universal Credit is phased in. Ø The cap threshold will be limited to: Ø £ 500 per week for couples and lone parents and Ø £ 350 per week for single adults Ø Until the introduction of Universal Credit (UC) the cap will be delivered by Local Authorities and deducted from Housing Benefit. People not in receipt of Housing Benefit, will not see a reduction in their benefit income. Ø There has been a two staged Implementation approach to benefit cap, firstly April 2012 followed by April/July 2013.

Benefit Cap What the DWP did in 2012 Ø Claimant support since April 2012 : Ø Identifying potential benefit cap households Ø The issue of direct mails to each individual in the households in April, May, July, September 2012, February 2013 and March 2013 Ø Jobcentre Plus actively engaging with each potential benefit cap individual to offer Employment Support Ø Local Authorities provided housing support Ø Benefit cap on-line calculator available on GOV. UK which provides individuals with a forecast of how much HB they may potentially lose when the cap is applied in April 2013.

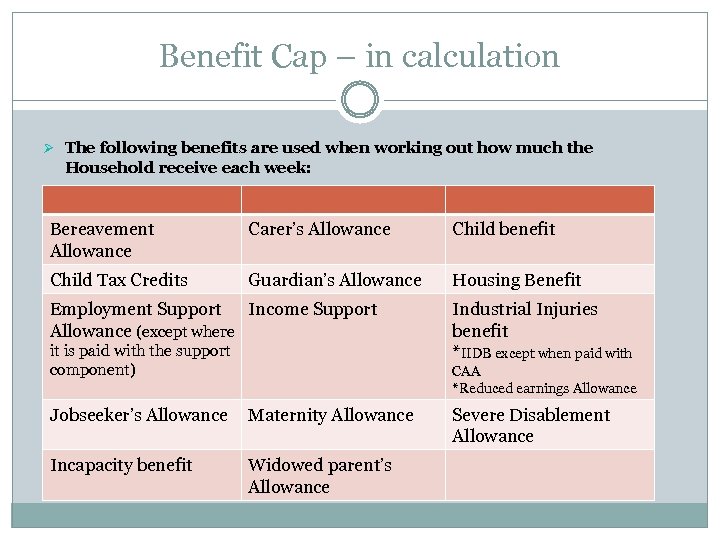

Benefit Cap – in calculation Ø The following benefits are used when working out how much the Household receive each week: Bereavement Allowance Carer’s Allowance Child benefit Child Tax Credits Guardian’s Allowance Housing Benefit Employment Support Income Support Allowance (except where it is paid with the support component) Industrial Injuries benefit *IIDB except when paid with CAA *Reduced earnings Allowance Jobseeker’s Allowance Maternity Allowance Incapacity benefit Widowed parent’s Allowance Severe Disablement Allowance

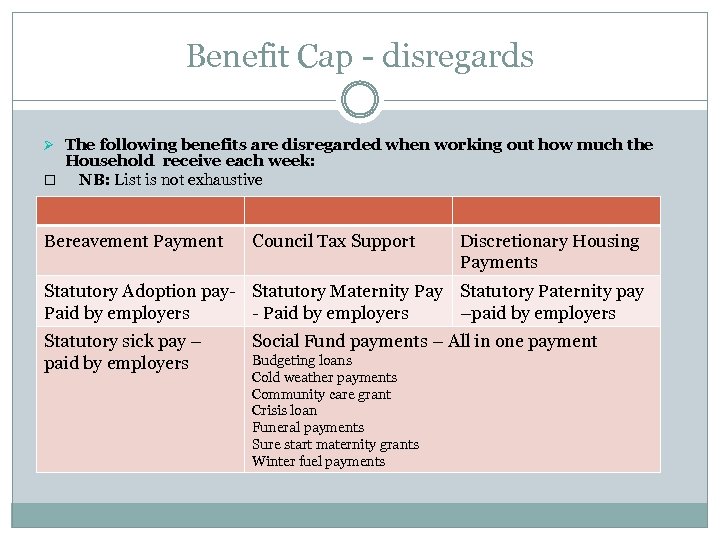

Benefit Cap - disregards Ø The following benefits are disregarded when working out how much the Household receive each week: NB: List is not exhaustive Bereavement Payment Council Tax Support Discretionary Housing Payments Statutory Adoption pay- Statutory Maternity Pay Statutory Paternity pay Paid by employers - Paid by employers –paid by employers Statutory sick pay – paid by employers Social Fund payments – All in one payment Budgeting loans Cold weather payments Community care grant Crisis loan Funeral payments Sure start maternity grants Winter fuel payments

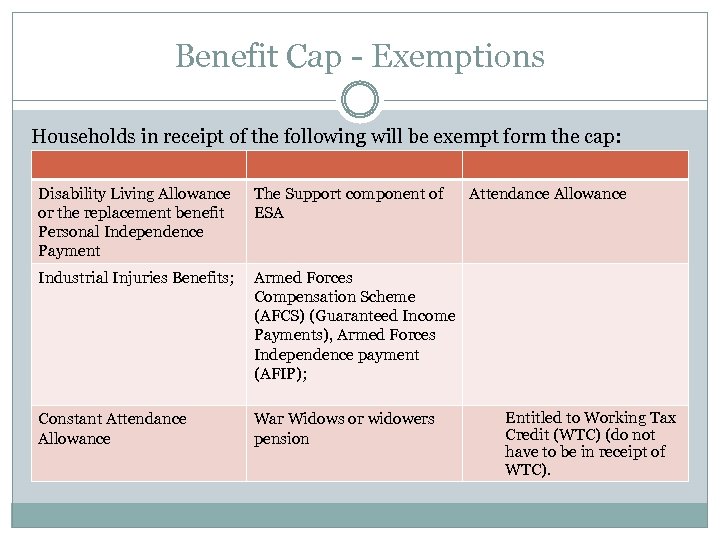

Benefit Cap - Exemptions Households in receipt of the following will be exempt form the cap: Disability Living Allowance or the replacement benefit Personal Independence Payment The Support component of ESA Industrial Injuries Benefits; Armed Forces Compensation Scheme (AFCS) (Guaranteed Income Payments), Armed Forces Independence payment (AFIP); Constant Attendance Allowance War Widows or widowers pension Attendance Allowance Entitled to Working Tax Credit (WTC) (do not have to be in receipt of WTC).

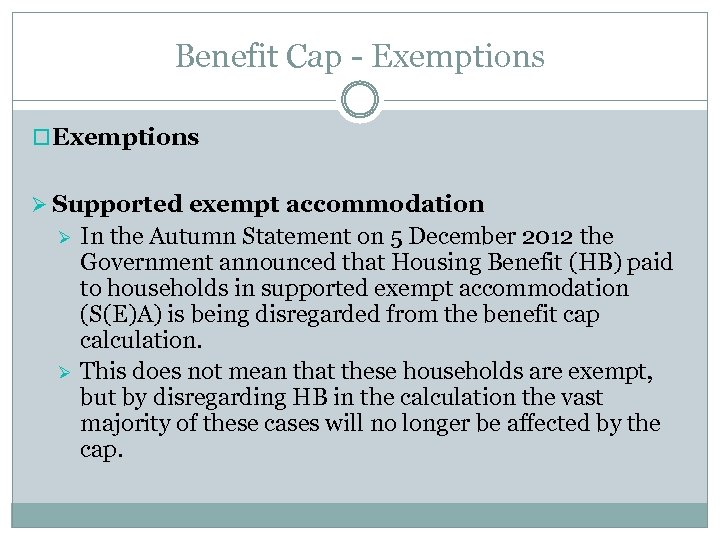

Benefit Cap - Exemptions Ø Supported exempt accommodation Ø Ø In the Autumn Statement on 5 December 2012 the Government announced that Housing Benefit (HB) paid to households in supported exempt accommodation (S(E)A) is being disregarded from the benefit cap calculation. This does not mean that these households are exempt, but by disregarding HB in the calculation the vast majority of these cases will no longer be affected by the cap.

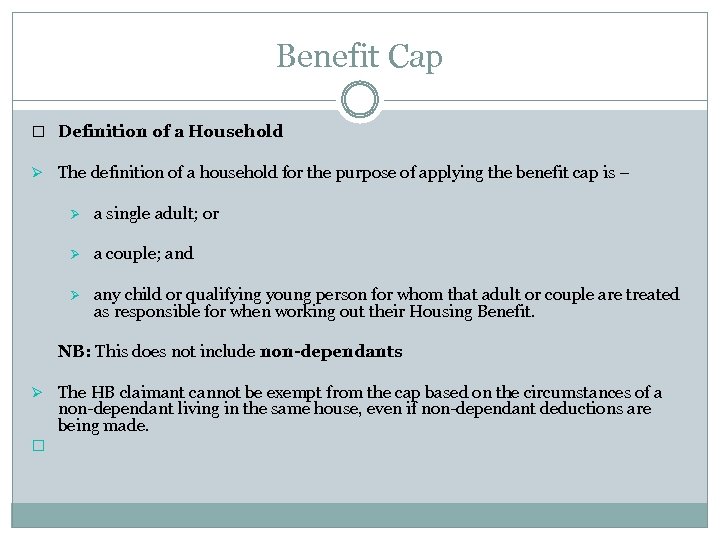

Benefit Cap Definition of a Household Ø The definition of a household for the purpose of applying the benefit cap is – Ø a single adult; or Ø a couple; and Ø any child or qualifying young person for whom that adult or couple are treated as responsible for when working out their Housing Benefit. NB: This does not include non-dependants Ø The HB claimant cannot be exempt from the cap based on the circumstances of a non-dependant living in the same house, even if non-dependant deductions are being made.

Benefit Cap Ø An additional measure to defer the benefit cap has been introduced called a grace period. The aim of the grace period is to protect individuals who lost their job through no fault of their own, giving them time to find alternative employment before the benefit cap is applied to their HB by their LA. A grace period is a continuous 39 weeks where the cap is not applied. Ø A grace period can apply if the claimant, partner or ex-partner Ø Ø Ø has been engaged in paid employment or self-employment for 50 out of 52 weeks immediately preceding their last day of work and during that time the claimant or partner have not made a claim to: Ø Income Support (IS) Ø Jobseeker’s Allowance (JSA) or Ø Employment and Support Allowance (ESA) for any period of days in more than 2 weeks Ø We will treat someone as being employed if they are on: Ø Ø maternity leave and in receipt of Statutory Maternity Pay (SMP), paternity leave, adoption leave, or in receipt of statutory sick pay

Benefit cap ØLAs receive files assessed by Belfast in 48/72 hours – file completed in Belfast on Monday will be received by the LA on Wednesday/Thursday. Depends on LA IT System used. ØFile loaded by LA into their IT system ØFour types of file sent to LAs: Ø Apply cap Ø Update cap, following change of circumstances Ø Remove cap Ø Grace period notification

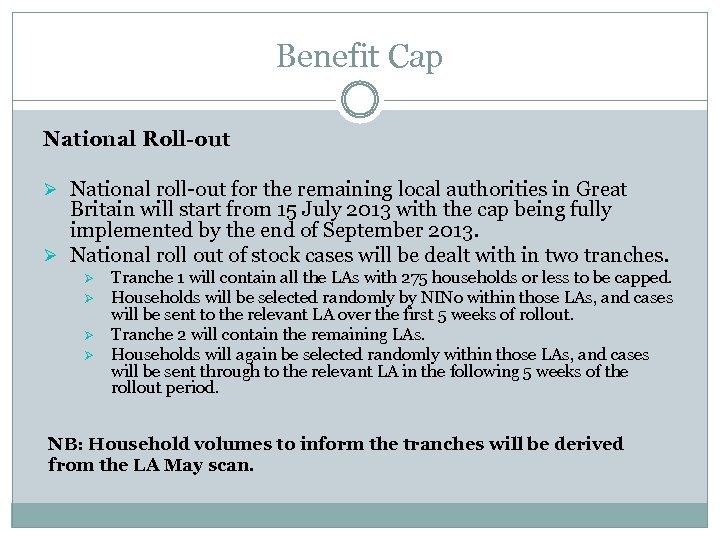

Benefit Cap National Roll-out Ø National roll-out for the remaining local authorities in Great Britain will start from 15 July 2013 with the cap being fully implemented by the end of September 2013. Ø National roll out of stock cases will be dealt with in two tranches. Ø Ø Tranche 1 will contain all the LAs with 275 households or less to be capped. Households will be selected randomly by NINo within those LAs, and cases will be sent to the relevant LA over the first 5 weeks of rollout. Tranche 2 will contain the remaining LAs. Households will again be selected randomly within those LAs, and cases will be sent through to the relevant LA in the following 5 weeks of the rollout period. NB: Household volumes to inform the tranches will be derived from the LA May scan.

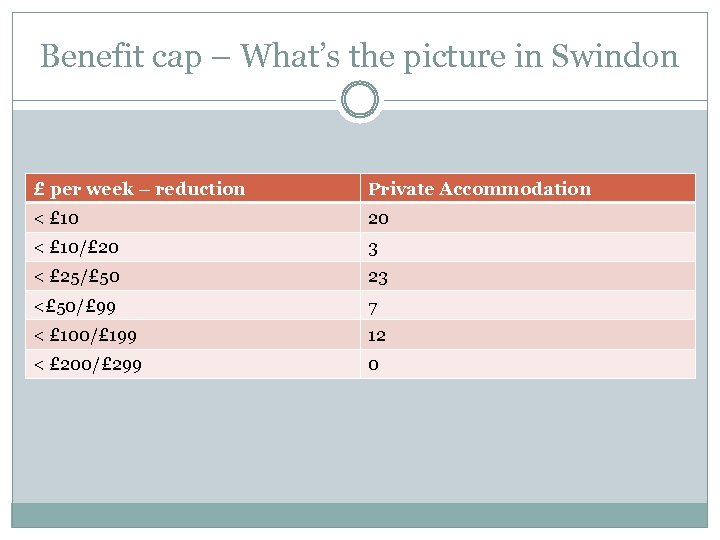

Benefit cap – What’s the picture in Swindon £ per week – reduction Private Accommodation < £ 10 20 < £ 10/£ 20 3 < £ 25/£ 50 23 <£ 50/£ 99 7 < £ 100/£ 199 12 < £ 200/£ 299 0

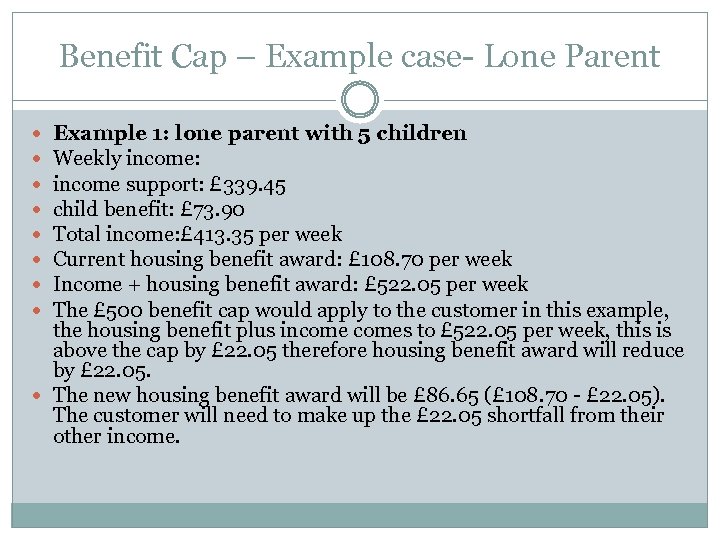

Benefit Cap – Example case- Lone Parent Example 1: lone parent with 5 children Weekly income: income support: £ 339. 45 child benefit: £ 73. 90 Total income: £ 413. 35 per week Current housing benefit award: £ 108. 70 per week Income + housing benefit award: £ 522. 05 per week The £ 500 benefit cap would apply to the customer in this example, the housing benefit plus incomes to £ 522. 05 per week, this is above the cap by £ 22. 05 therefore housing benefit award will reduce by £ 22. 05. The new housing benefit award will be £ 86. 65 (£ 108. 70 - £ 22. 05). The customer will need to make up the £ 22. 05 shortfall from their other income.

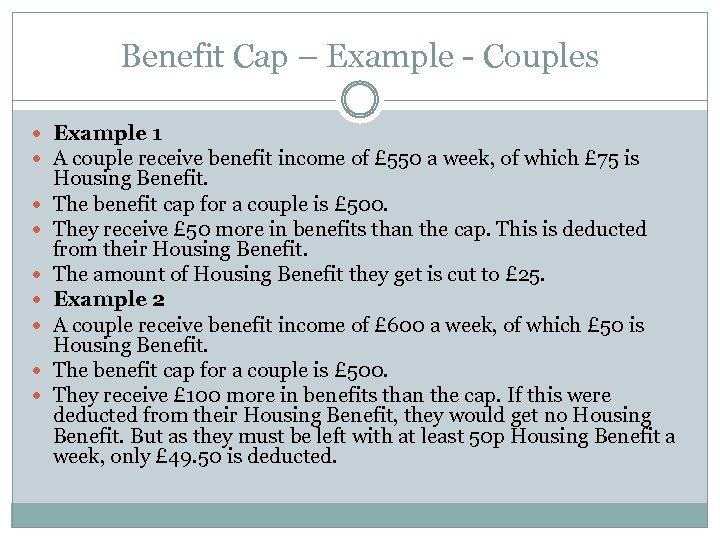

Benefit Cap – Example - Couples Example 1 A couple receive benefit income of £ 550 a week, of which £ 75 is Housing Benefit. The benefit cap for a couple is £ 500. They receive £ 50 more in benefits than the cap. This is deducted from their Housing Benefit. The amount of Housing Benefit they get is cut to £ 25. Example 2 A couple receive benefit income of £ 600 a week, of which £ 50 is Housing Benefit. The benefit cap for a couple is £ 500. They receive £ 100 more in benefits than the cap. If this were deducted from their Housing Benefit, they would get no Housing Benefit. But as they must be left with at least 50 p Housing Benefit a week, only £ 49. 50 is deducted.

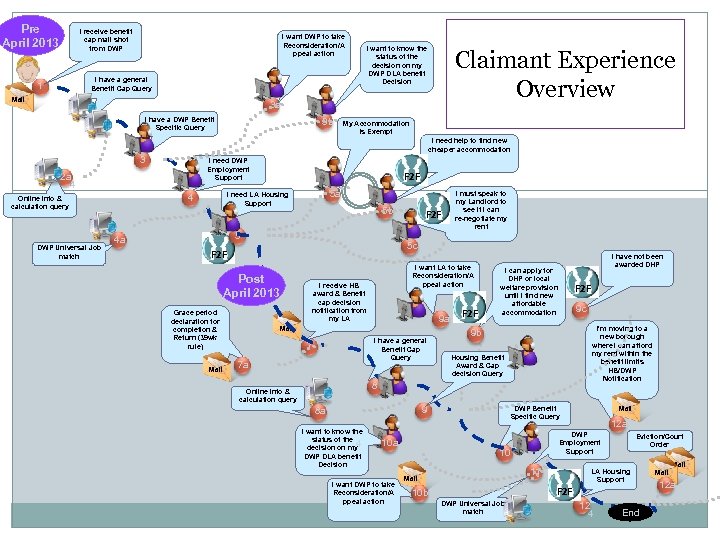

Pre April 2013 I receive benefit cap mail shot from DWP I want DWP to take Reconsideration/A ppeal action I have a general Benefit Cap Query 1 Mail I want to know the status of the decision on my DWP DLA benefit Decision Claimant Experience Overview 3 a I have a DWP Benefit Specific Query 2 3 b My Accommodation is Exempt I need help to find new cheaper accommodation 3 I need DWP Employment Support 2 a 4 4 Online info & calculation query DWP Universal Job match F 2 F 5 a I need LA Housing Support 4 5 4 a F 2 F 4 4 Grace period declaration for completion & Return (39 wk rule) F 2 F 5 c Post April 2013 Mail 5 b I must speak to my Landlord to see if I can re-negotiate my rent I want LA to take Reconsideration/A ppeal action I receive HB award & Benefit cap decision notification from my LA Mail I have a general Benefit Cap Query 7 7 a 4 F 2 F 9 a I have not been awarded DHP I can apply for DHP or local welfare provision until I find new affordable accommodation F 2 F 9 c I’m moving to a new borough where I can afford my rent within the benefit limits HB/DWP Notification 9 b Housing Benefit Award & Cap decision Query 8 Online info & calculation query 9 8 a I want to know the status of the 4 decision on my DWP DLA benefit Decision 10 a I want DWP to take Reconsideration/A ppeal action 10 b 4 DWP Universal Job match 12 a DWP Employment Support 10 Mail DWP Benefit Specific Query 11 4 4 Eviction/Court Order LA Housing Support F 2 F 12 4 End Mail 12 a

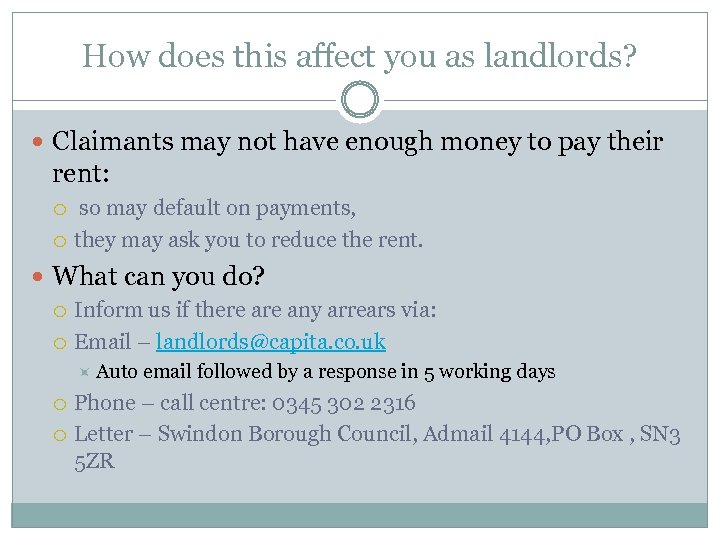

How does this affect you as landlords? Claimants may not have enough money to pay their rent: so may default on payments, they may ask you to reduce the rent. What can you do? Inform us if there any arrears via: Email – landlords@capita. co. uk Auto email followed by a response in 5 working days Phone – call centre: 0345 302 2316 Letter – Swindon Borough Council, Admail 4144, PO Box , SN 3 5 ZR

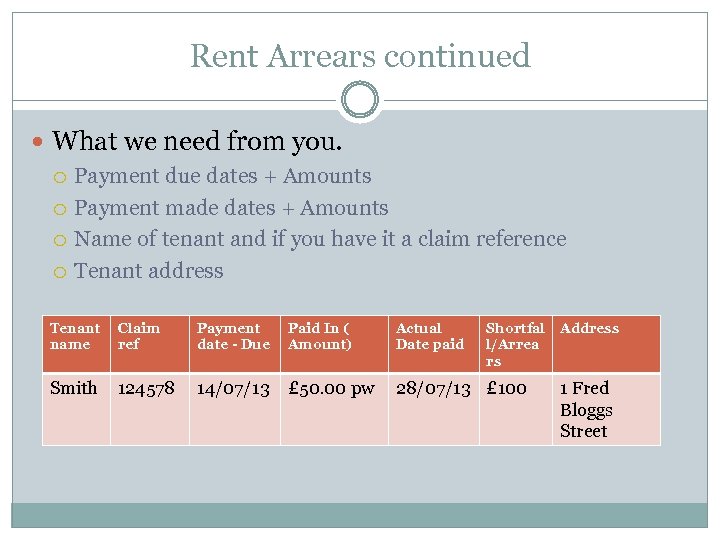

Rent Arrears continued What we need from you. Payment due dates + Amounts Payment made dates + Amounts Name of tenant and if you have it a claim reference Tenant address Tenant name Claim ref Payment date - Due Paid In ( Amount) Actual Date paid Shortfal l/Arrea rs Smith 124578 14/07/13 £ 50. 00 pw 28/07/13 £ 100 Address 1 Fred Bloggs Street

What we do Once we have your correspondence re the arrears we suspend the claim. Please note for Swindon you don’t have to wait until your tenant is 8 weeks in arrears. If they default by two weeks, let us know. If you haven’t already done so, we will ask you for proof of arrears. We will then contact the tenants to ask why they haven’t paid the rent and also issue them a safeguard form. If your tenant has been housed through Housing Option they may complete a Homeless pro-forma which mean that the tenants will automatically be safeguard so the payment will go to the landlord.

What we do continued If we are satisfied that the arrears are due to the tenants not paying and not because the HB payment date falls outside of the rental due dates, we will look to pay the landlord. If they fall under one of the safeguard categories, we will pay the landlord If you do contact us when the tenant is 8 weeks in arrears the payments will go to you without the need for a safeguard form. Both you and the tenant will be informed of any decision made regarding payments.

Who to contact again Email – landlords@capita. co. uk Auto email followed by a response in 5 working days Phone – call centre: 0345 302 2316 Letter – Swindon Borough Council, Admail 4144, PO Box , SN 3 5 ZR If you have been through these routes and you are still having problems then contact me: Ruth Mc. Grady My Contact details are on the last slide, or just ask me for a card

Questions?

Who am I ? ? Ruth Mc. Grady Stakeholder Liaison Manager (Capita Swindon partnership) 01793 464253 Ruth. Mc. Grady@capita. co. uk

da3383604ba07808f9232a223b47a2cd.ppt