ce8c546872e91d5f6c83649f2f54bf92.ppt

- Количество слайдов: 97

Ben Venter Chairman: BANKSETA Council & Conference Session Chair

7 October 2004 09 h 00 – 09 h 15 – 10 h 00 – 11 h 30 – 12 h 15 – 13 h 00 – 13 h 30 – 14 h 30 Introduction Minister Membathisi Mdladlana Stephen Regan Refreshments Lindsay Falkov Financial Charter Update Closing Lunch

TRANSFORMATION, SKILLS DEVELOPMENT AND LEADERSHIP: A Government perspective Minister Membathisi Mdladlana Minister of Labour

LEADERSHIP AND GOVERNANCE Stephen Regan Lecturer: Cranfield School of Management United Kingdom

Leadership and Governance Innovation from Investment in Human Capital - A Turning Point for Financial Services

Themes n Crisis in Governance • Excessive focus on shareholder value • Weak leadership n Transformation • Focus on customer value • Investment in human beings

Lessons from the UK n n Two and possibly three generations of retail banking Governance is about stakeholders – Customers, Shareholders, Staff, Regulators n Type 1 – Pre competition (say pre 1990) • Regulation by eyebrows • Winners: employees, regulators, • Losers: customers, shareholders

Type II banking in the UK n n n Driven by competition (HSBC etc…), and technology – Contested takeovers – Scale and Consolidation – Promiscuity and churn – Acquisition vs retention models – Poor structures for dealing with this – 40 million mail shots Winners • Shareholders • Customers (a little) – Losers • Staff What does a type II bank look like?

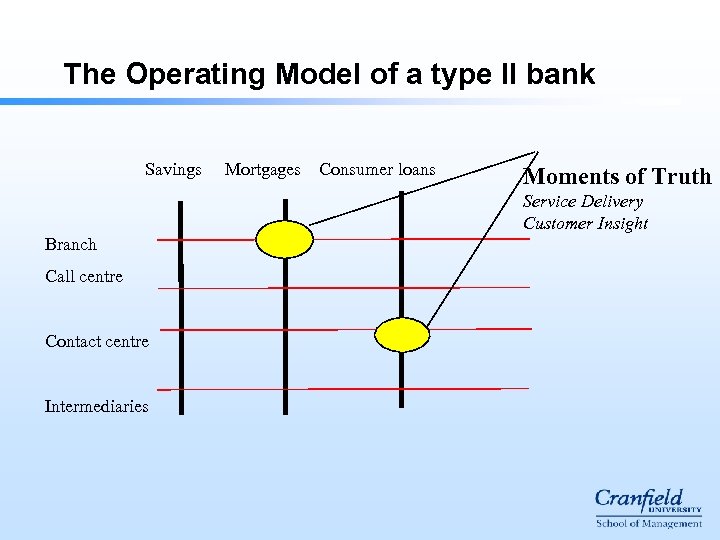

The Operating Model of a type II bank Savings Mortgages Consumer loans Moments of Truth Service Delivery Customer Insight Branch Call centre Contact centre Intermediaries

The problems with type II banks n “Product pipelines” push sales – But consumers cannot be separated into transactions n Channels manage (cut) costs – But there are linkages between the two • Eg driving service out of the branches • Driving sales in call centres n Type II not – A service proposition – A customer focussed proposition n What would a type III bank look like?

Leadership in Retail Banking

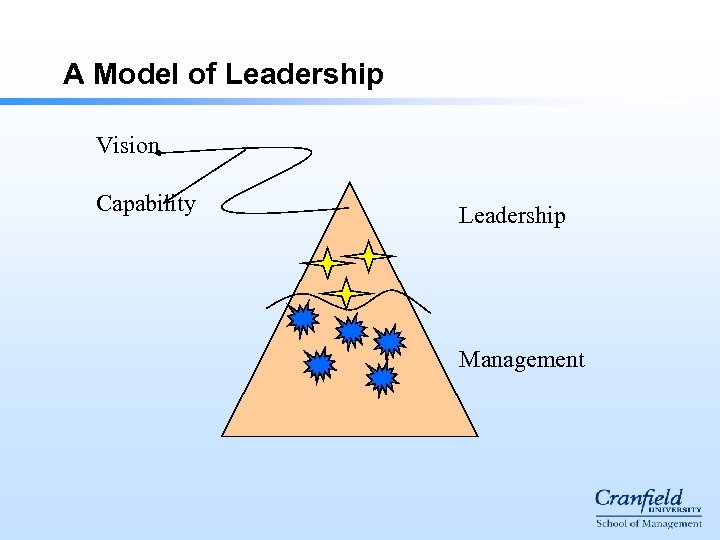

A Model of Leadership Vision Capability Leadership Management

Vision: Can you see it? n Managers think about doing – Reasoning from solutions back to problems – The doing drives the thinking – Task Cultures n Much management activity is about persuasion – Emotional – Rhetoric – Highly intuitive

Capability: Can you do it? n Robustness – Broadening your range of behaviours – Personal growth in this n Dialogue – The ZOUD n Maturity – Discretionary CEO type behaviour

Customer Focussed Innovation

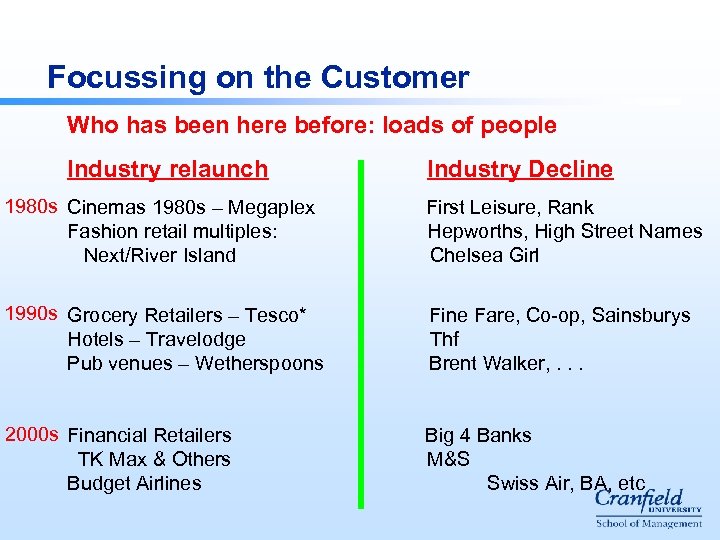

Focussing on the Customer Who has been here before: loads of people Industry relaunch Industry Decline 1980 s Cinemas 1980 s – Megaplex First Leisure, Rank Fashion retail multiples: Hepworths, High Street Names Next/River Island Chelsea Girl 1990 s Grocery Retailers – Tesco* Fine Fare, Co-op, Sainsburys Hotels – Travelodge Thf Pub venues – Wetherspoons Brent Walker, . . . 2000 s Financial Retailers Big 4 Banks TK Max & Others M&S Budget Airlines Swiss Air, BA, etc

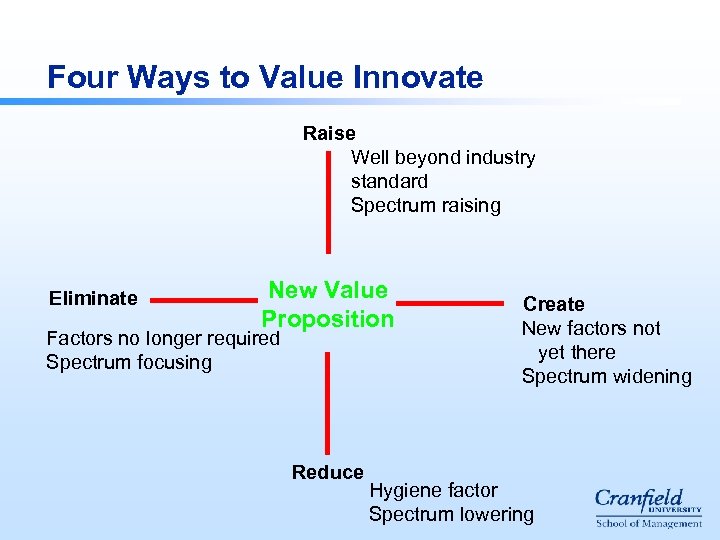

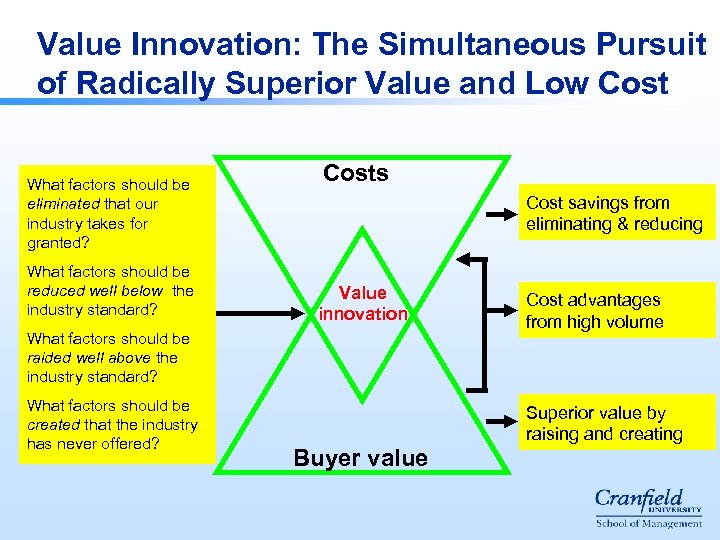

Four Ways to Value Innovate Raise Well beyond industry standard Spectrum raising Eliminate New Value Proposition Factors no longer required Spectrum focusing Reduce Create New factors not yet there Spectrum widening Hygiene factor Spectrum lowering

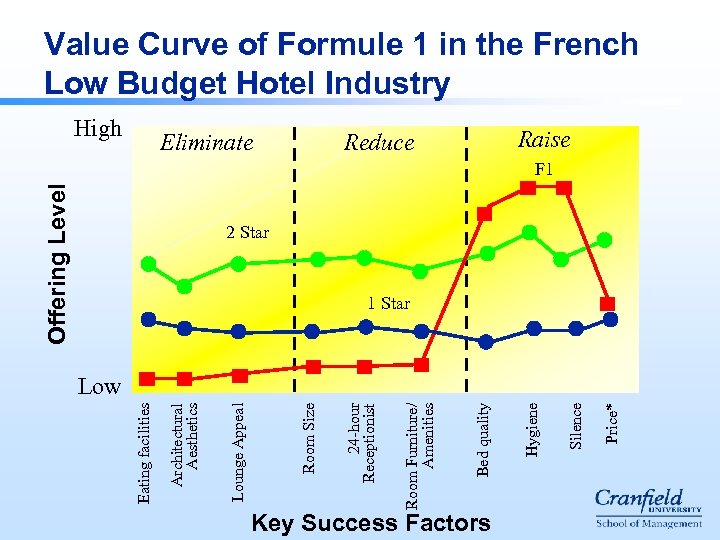

Key Success Factors Price* Silence Reduce Hygiene Bed quality Room Furniture/ Amenities Eliminate 24 -hour Receptionist Room Size Lounge Appeal High Architectural Aesthetics Eating facilities Offering Level Value Curve of Formule 1 in the French Low Budget Hotel Industry Raise F 1 2 Star 1 Star Low

Value Innovation: The Simultaneous Pursuit of Radically Superior Value and Low Cost What factors should be eliminated that our industry takes for granted? What factors should be reduced well below the industry standard? Costs Cost savings from eliminating & reducing Value innovation What factors should be raided well above the industry standard? What factors should be created that the industry has never offered? Cost advantages from high volume Superior value by raising and creating Buyer value

But you need to continuously do it. . . Repeating Value Innovation Leverage the Product, Service and Delivery platforms over time Do this by continuously investing in knowledge – human capital

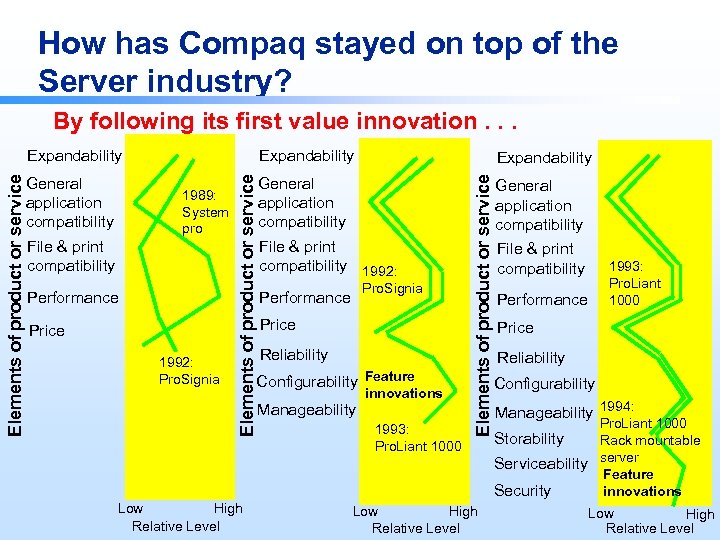

How has Compaq stayed on top of the Server industry? By following its first value innovation. . . 1989: System pro File & print compatibility Performance Price 1992: Pro. Signia Low High Relative Level Expandability General application compatibility File & print compatibility 1992: Pro. Signia Performance Price Reliability Configurability Feature innovations Manageability 1993: Pro. Liant 1000 Elements of product or service General application compatibility Expandability Elements of product or service Expandability Low High Relative Level General application compatibility File & print compatibility 1993: Pro. Liant 1000 Performance Price Reliability Configurability Manageability 1994: Pro. Liant 1000 Rack mountable Serviceability server Feature innovations Security Storability Low High Relative Level

Transformation by Investing in People

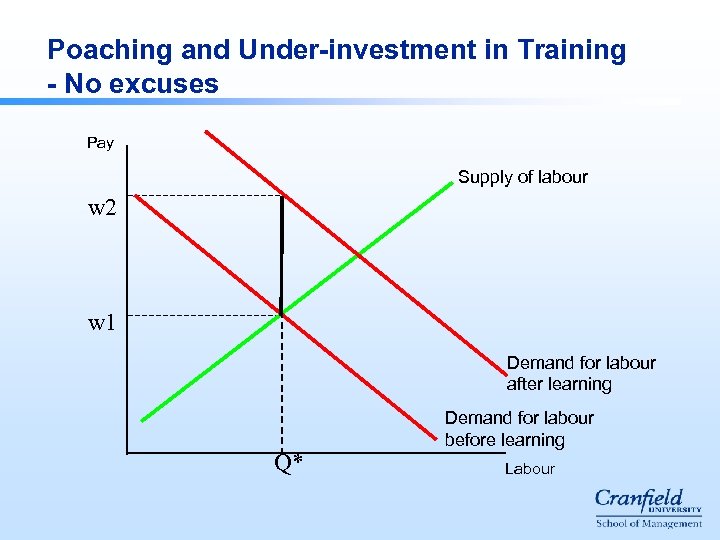

Poaching and Under-investment in Training - No excuses Pay Supply of labour w 2 w 1 Demand for labour after learning Q* Demand for labour before learning Labour

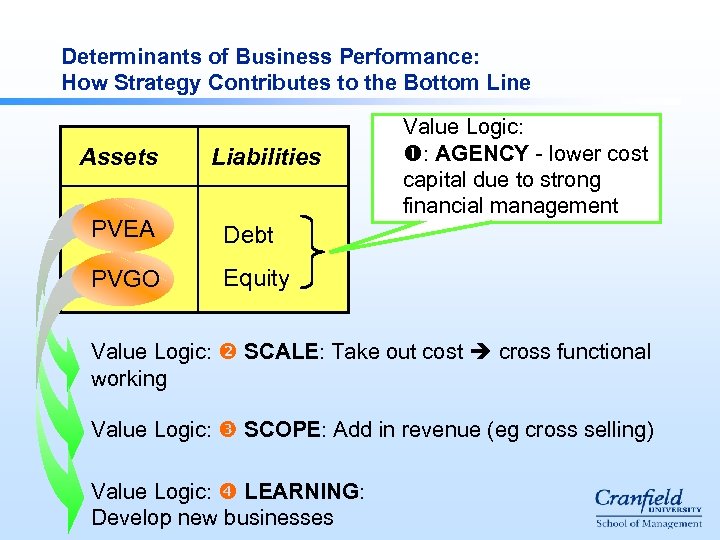

Determinants of Business Performance: How Strategy Contributes to the Bottom Line Assets Liabilities PVEA Debt PVGO Value Logic: : AGENCY - lower cost capital due to strong financial management Equity Value Logic: SCALE: Take out cost cross functional working Value Logic: SCOPE: Add in revenue (eg cross selling) Value Logic: LEARNING: Develop new businesses

Existing Big 4(5) Strategies Cost savings: consolidation + scale – exit definite Inertia not branding Ruthless HR Models Retention Recruitment Reward Type II HR model Financial incentives

Global Inequality n Three desiderata (UN) – Development • Economic and Social – including Life expectancy – Peace – Human Rights n Africa does much worse on these measures than other developing countries

Africa in particular n n n 1820 -1998 Africa share of world gdp declined, much of this since 1950 Africa from 1/3 European GDP to 1/13 Of the decline in extreme poverty 1980 – 2000 (1. 5 bn to 1. 1 bn <$1 per day: none in Africa, all in China)

Participative Growth n Unaimed opulence (the market alone) – Brazil, Oman, South Africa all have much higher gdp than China or Sri Lanka but do much worse on deprivation measures n Aimed non opulence – Health and education cheap in developing countries – China’s improvement in life expectency all came before 1979 (no improvement since then)

What do you aim at? n Kerala (India) Life expectancy 70, Indian average 56/58 – Kerala has very high levels of literacy and especially female literacy n Sri Lanka: – Lower infant mortality than the US – Higher adult literacy than the US n Health and education only occurred in Europe as a result of state intervention and only a century ago

The Heart of Darkness Stylised facts are: Resource rich, labour poor - capital intensive growth path - relative high cost labour Small domestic markets & lumpy investments needed - public sector ownership thus normal Rents - these are available in natural resources (imperfect global markets) - these are politicized (often ‘pleasantly’) owned taxed

The Heart of Darkness Resource prices downturn - PSBR rises (tax take falls) - tax burden intensifies - concentration of ownership in return - twin deficits, no FDI Economic nationalism - new nation building - expensive Colonial legacy

Resolve Group HUMAN RESOURCES BENCHMARKING IN THE BANKING SECTOR Lindsay Falkov Executive Director: Resolve Group 34 Copyright © Resolve 2004

Outline of Presentation Resolve Group v Introduction v Methodology v Benchmarking results v Main conclusions 35 Copyright © Resolve 2004

Outline of Presentation Resolve Group v Introduction v Methodology v Benchmarking results v Main conclusions 36 Copyright © Resolve 2004

Introduction Resolve Group v The purpose of the exercise was to strengthen data driven HR strategies and business alignment in the banking sector v Quantitative and qualitative data and benchmarking v Data issues: v Certain data were not sufficiently robust to use v General concerns regarding the data v Aggregate data skewed the results and limited analysis v Agreed that a good first round baseline is now in place v Focus Groups: v Encouraged dialogue on people measurement v Focused attention on internal benchmarking & measurement systems, and v Addressed the application of benchmarking results 37 Copyright © Resolve 2004

Outline of Presentation Resolve Group v Introduction v Methodology v Benchmarking results v Main conclusions 38 Copyright © Resolve 2004

Methodology Why Saratoga? Resolve Group v Saratoga human capital benchmarking measures key human resource management practices Ø Compare: Set performance standards for human capital Compare management. What have others achieved? Ø Understand current HR performance & its impact on organisational Understand performance. What are others doing? Ø Strategically align HR interventions with organisational objectives 39 Copyright © Resolve 2004

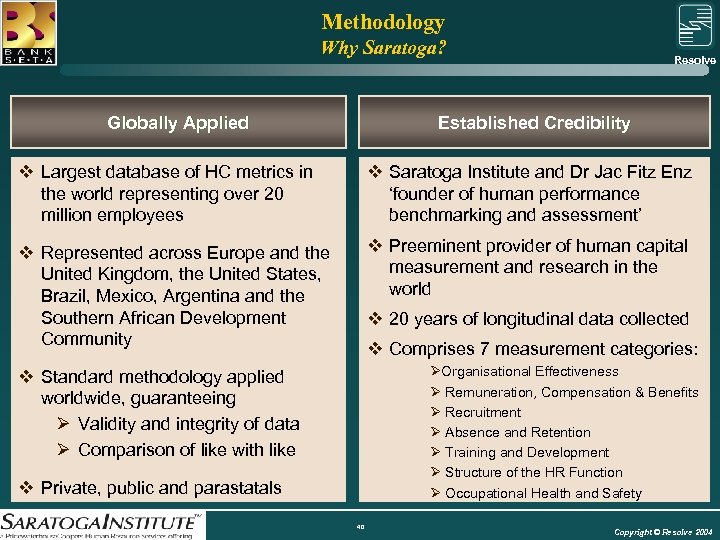

Methodology Why Saratoga? Resolve Group Globally Applied Established Credibility v Largest database of HC metrics in the world representing over 20 million employees v Saratoga Institute and Dr Jac Fitz Enz ‘founder of human performance benchmarking and assessment’ v Represented across Europe and the United Kingdom, the United States, Brazil, Mexico, Argentina and the Southern African Development Community v Preeminent provider of human capital measurement and research in the world v 20 years of longitudinal data collected v Comprises 7 measurement categories: ØOrganisational Effectiveness Ø Remuneration, Compensation & Benefits Ø Recruitment Ø Absence and Retention Ø Training and Development Ø Structure of the HR Function Ø Occupational Health and Safety v Standard methodology applied worldwide, guaranteeing Ø Validity and integrity of data Ø Comparison of like with like v Private, public and parastatals 40 Copyright © Resolve 2004

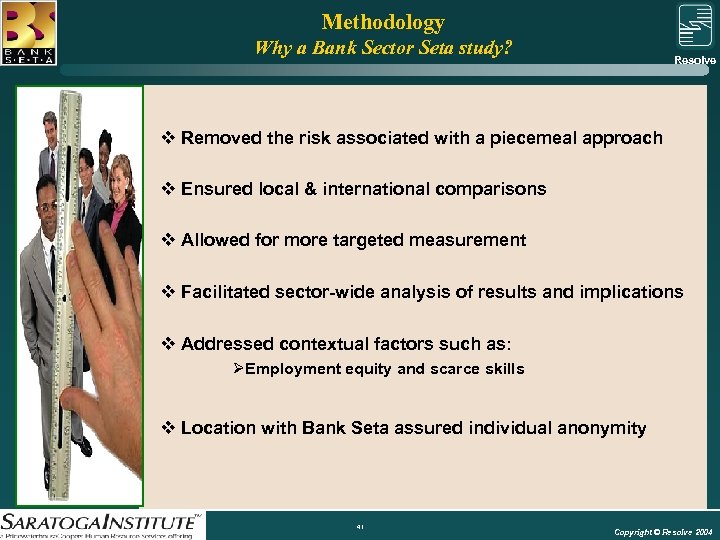

Methodology Why a Bank Sector Seta study? Resolve Group v Removed the risk associated with a piecemeal approach v Ensured local & international comparisons v Allowed for more targeted measurement v Facilitated sector-wide analysis of results and implications v Addressed contextual factors such as: ØEmployment equity and scarce skills v Location with Bank Seta assured individual anonymity 41 Copyright © Resolve 2004

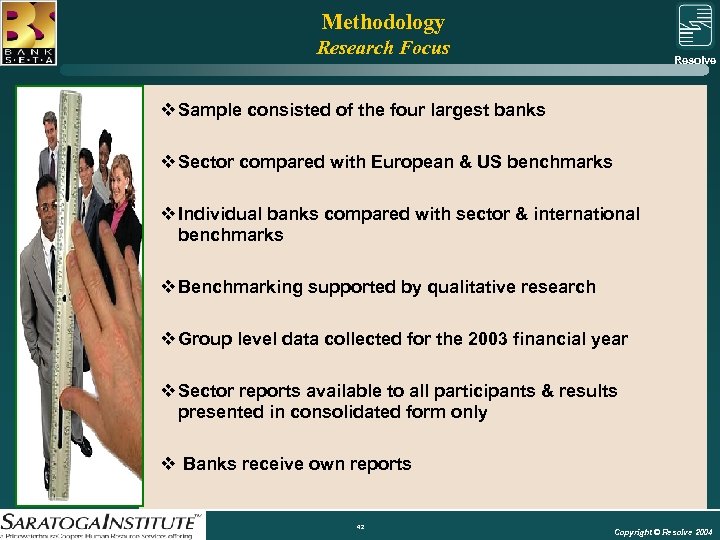

Methodology Research Focus Resolve Group v Sample consisted of the four largest banks v Sector compared with European & US benchmarks v Individual banks compared with sector & international benchmarks v Benchmarking supported by qualitative research v Group level data collected for the 2003 financial year v Sector reports available to all participants & results presented in consolidated form only v Banks receive own reports 42 Copyright © Resolve 2004

Methodology Reports Resolve Group Sector Report v Human capital scorecards v Comparative analysis of SA & international bank sectors v Diagnosis of gaps & good practice analysis Individual Bank Reports v Human capital scorecards v Comparative analysis of individual bank, SA & international banking sectors v Diagnosis of gaps & good practice analysis 43 Copyright © Resolve 2004

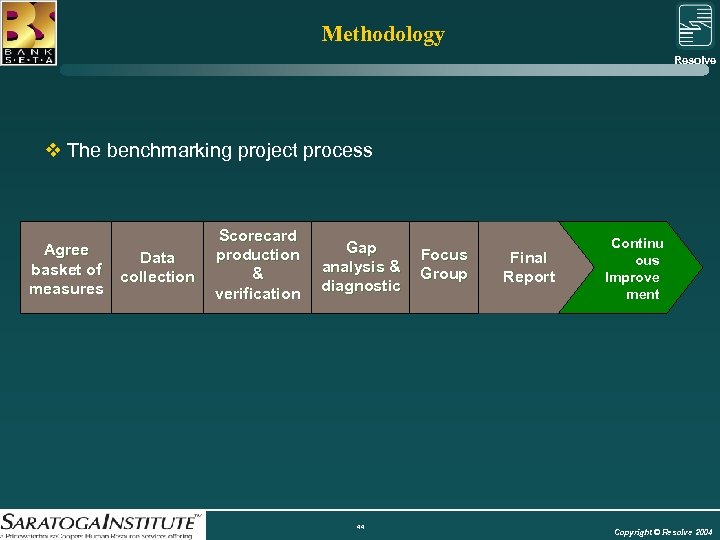

Methodology Resolve Group v The benchmarking project process Agree basket of measures Data collection Scorecard production & verification Gap analysis & diagnostic 44 Focus Group Final Report Continu ous Improve ment Copyright © Resolve 2004

Outline of Presentation Resolve Group v Introduction v Methodology v Benchmarking results v Main conclusions 45 Copyright © Resolve 2004

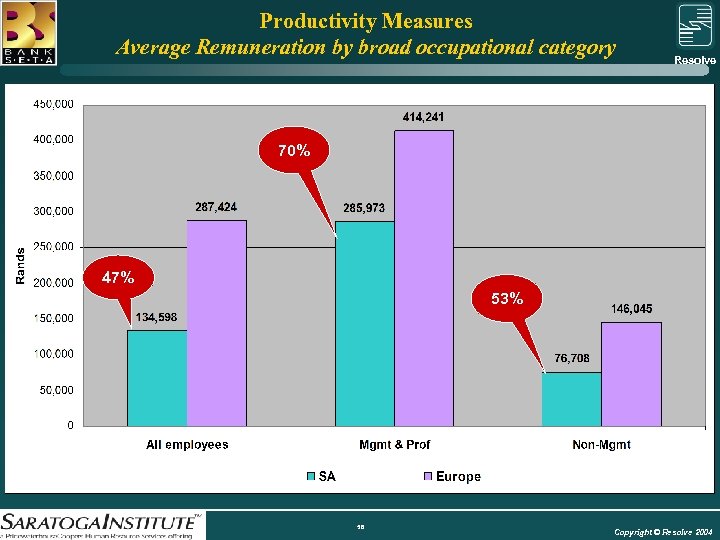

Main Findings Resolve Group v The SA banking sector’s per capita financial performance was relatively weak, while v The sector’s revenue and profit return on remuneration was comparatively high v The retail cost-to-income ratio was average, while the wholesale ratios were good on average v Average remuneration was comparatively low v Investment in training was comparatively good, though below average in relation to the management and professionals cohort v Incentive pay levels were on a par with peers v There was a strong focus on internal recruitment. One in four employees in the sector were affected, compared with an external recruitment rate of 12% 46 Copyright © Resolve 2004

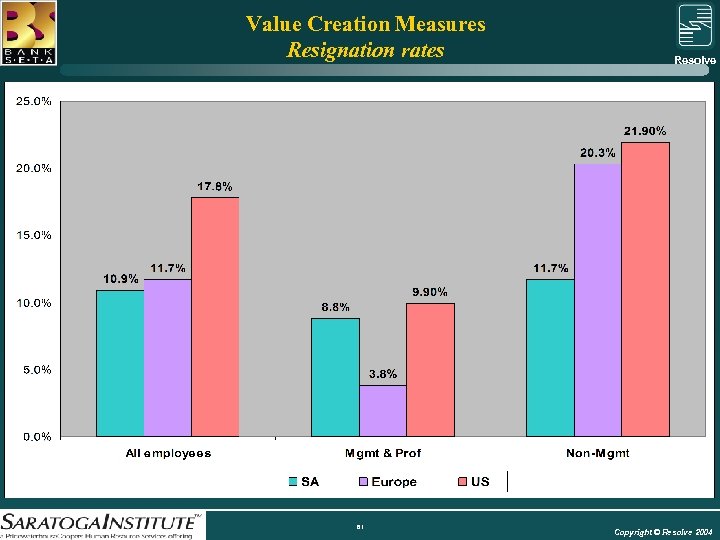

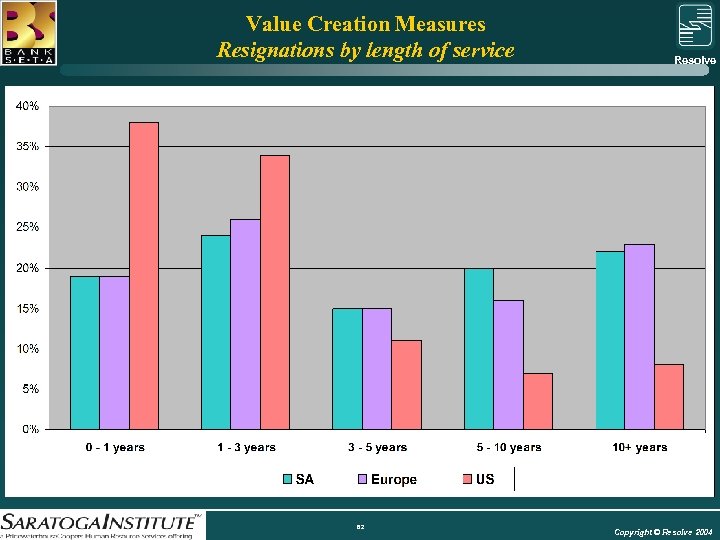

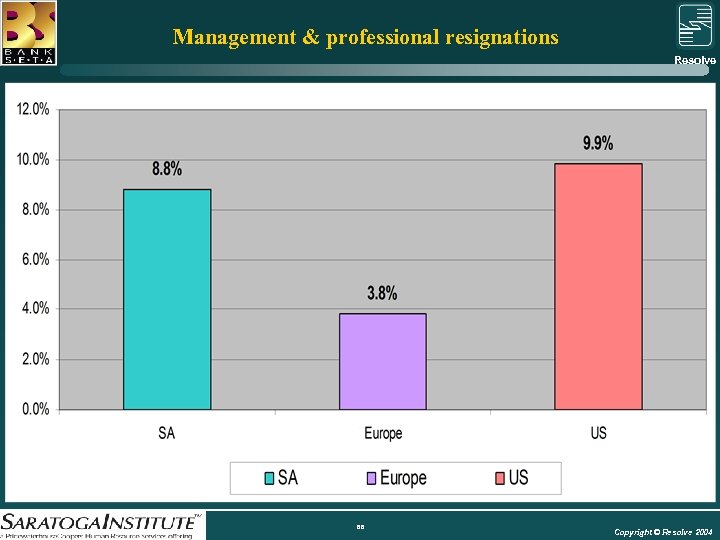

Main Findings Resolve Group v Resignation rates were low, but for management and professionals they were still double the European rate v Around one in every five employees resigning were in their first year of service, while one in every 2½ had a tenure of between 0 and 3 years v Absenteeism was very low v Time-to-fill and acceptance rate data were not available from SA sector 47 Copyright © Resolve 2004

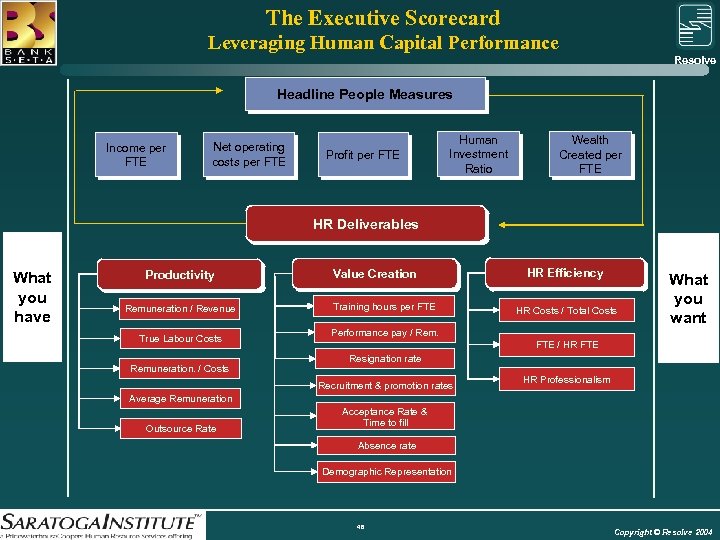

The Executive Scorecard Leveraging Human Capital Performance Resolve Group Headline People Measures Income per FTE Net operating costs per FTE Profit per FTE Human Investment Ratio Wealth Created per FTE HR Deliverables What you have Productivity Remuneration / Revenue True Labour Costs Remuneration. / Costs Value Creation Training hours per FTE HR Efficiency HR Costs / Total Costs What you want Performance pay / Rem. FTE / HR FTE Resignation rate Recruitment & promotion rates HR Professionalism Average Remuneration Outsource Rate Acceptance Rate & Time to fill Absence rate Demographic Representation 48 Copyright © Resolve 2004

Benchmarking Results Resolve Group Executive Scorecard 49 Copyright © Resolve 2004

Benchmarking Results Resolve Group Executive Scorecard Headline Measures 50 Copyright © Resolve 2004

Headline Measures Average Revenue, Cost and Profit Resolve Group 51 Copyright © Resolve 2004

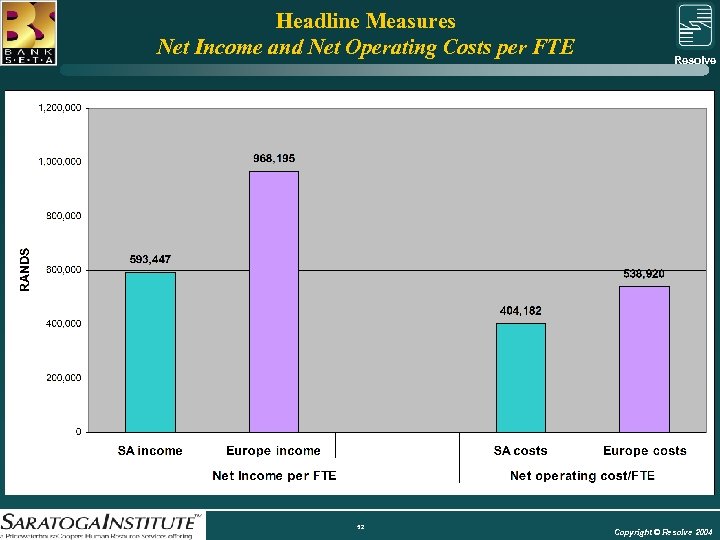

Headline Measures Net Income and Net Operating Costs per FTE Resolve Group 52 Copyright © Resolve 2004

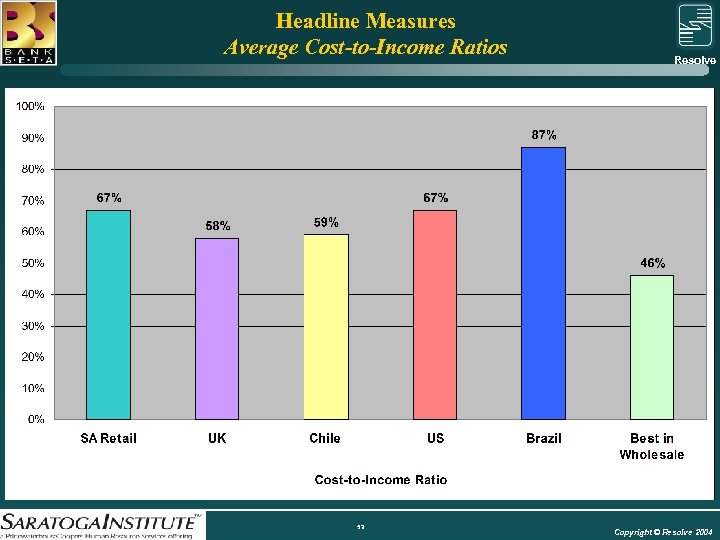

Headline Measures Average Cost-to-Income Ratios Resolve Group 53 Copyright © Resolve 2004

Headline Measures Human Investment Ratio Resolve Group Revenue – non-wage costs FTEs X average rem. 54 Copyright © Resolve 2004

Benchmarking Results Resolve Group Executive Scorecard Productivity Measures 55 Copyright © Resolve 2004

Productivity Measures Average Remuneration by broad occupational category Resolve Group 70% 47% 53% 56 Copyright © Resolve 2004

Productivity Measures Remuneration to Revenue & Cost Ratios Resolve Group 57 Copyright © Resolve 2004

Benchmarking Results Resolve Group Executive Scorecard Value Creation Measures 58 Copyright © Resolve 2004

Value Creation Measures Training Hours per FTE Resolve Group 59 Copyright © Resolve 2004

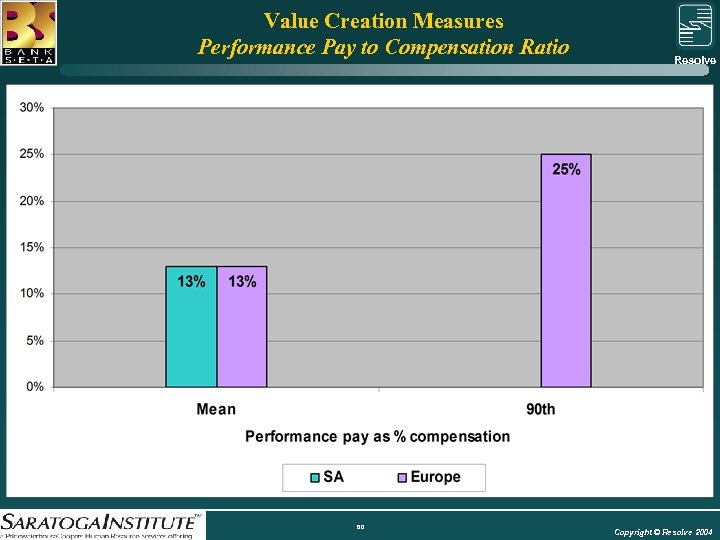

Value Creation Measures Performance Pay to Compensation Ratio Resolve Group 60 Copyright © Resolve 2004

Value Creation Measures Resignation rates Resolve Group 61 Copyright © Resolve 2004

Value Creation Measures Resignations by length of service Resolve Group 62 Copyright © Resolve 2004

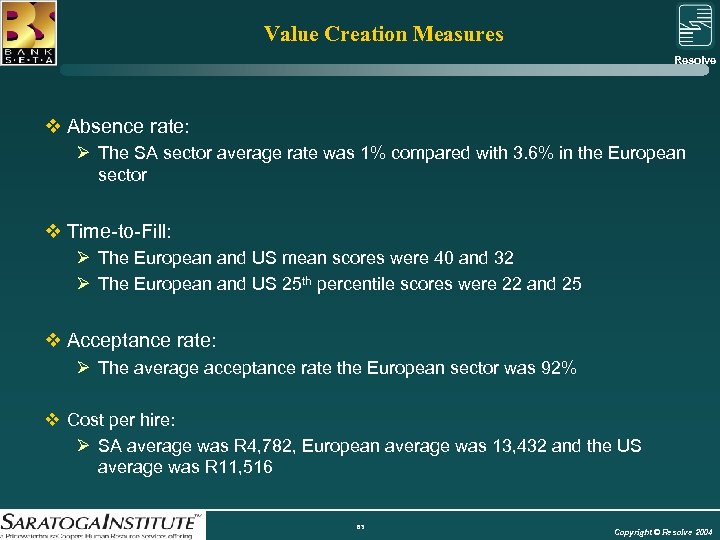

Value Creation Measures Resolve Group v Absence rate: Ø The SA sector average rate was 1% compared with 3. 6% in the European sector v Time-to-Fill: Ø The European and US mean scores were 40 and 32 Ø The European and US 25 th percentile scores were 22 and 25 v Acceptance rate: Ø The average acceptance rate the European sector was 92% v Cost per hire: Ø SA average was R 4, 782, European average was 13, 432 and the US average was R 11, 516 63 Copyright © Resolve 2004

Benchmarking Results Resolve Group Executive Scorecard HR Efficiency Measures 64 Copyright © Resolve 2004

HR Efficiency Resolve Group The SA Banking sector: v had an HR professional complement of 51%, which is just below the European average of 54%, v had a slightly lower average HR remuneration of R 251, 518 that is 88% of the European average but less than two thirds of the US rate, v had a higher average HR capacity of 75 FTEs per HR FTE compared to 84 in the US and 118 in Europe, but the SA sector tends to outsource more of its HR than European banks v had marginally lower HR costs than its peers in Europe and US, HR costs as a proportion of total costs equal to 0. 5% compared with 0. 5% and 0. 75%, and HR costs per FTE of R 7, 360 compared with R 8, 676 and R 7, 734. 65 Copyright © Resolve 2004

Benchmarking Results Resolve Group Management & professional Scorecard 66 Copyright © Resolve 2004

High-end skills performance Resolve Group v Management and professionals in the SA sector constituted ¼ of all employees compared with over 40% in Europe & the US v The average wage for this cohort was 70% of their European & US peers v They received 3 days training per FTE compared with 3. 6 days in Europe v 70% of the cohort had access to at least one training intervention in 2003, v There was a strong focus on internal recruitment, 23% of headcount, compared with an external recruitment rate of 10% v There was a net outflow of this cohort of 1% compared with a 5% increase in Europe v There is a healthy spread of youth & maturity in the tenure of executives in the sector – 29% between 0 and 3 years and 71% above 3 years v Absenteeism amongst this cohort was 1% 67 Copyright © Resolve 2004

Management & professional resignations Resolve Group 68 Copyright © Resolve 2004

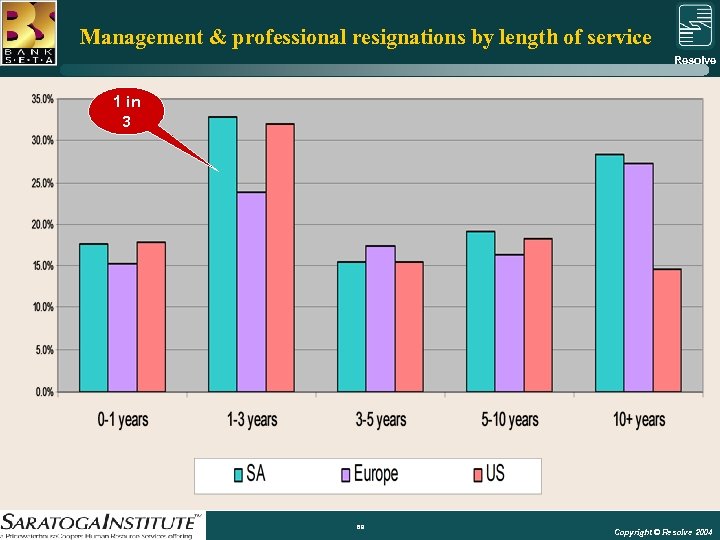

Management & professional resignations by length of service Resolve Group 1 in 3 69 Copyright © Resolve 2004

Benchmarking Results Resolve Group Training & Development Scorecard 70 Copyright © Resolve 2004

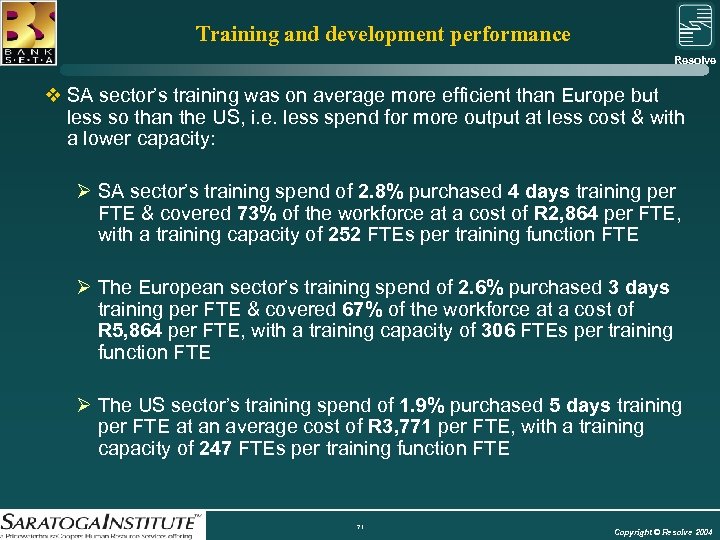

Training and development performance Resolve Group v SA sector’s training was on average more efficient than Europe but less so than the US, i. e. less spend for more output at less cost & with a lower capacity: Ø SA sector’s training spend of 2. 8% purchased 4 days training per FTE & covered 73% of the workforce at a cost of R 2, 864 per FTE, with a training capacity of 252 FTEs per training function FTE Ø The European sector’s training spend of 2. 6% purchased 3 days training per FTE & covered 67% of the workforce at a cost of R 5, 864 per FTE, with a training capacity of 306 FTEs per training function FTE Ø The US sector’s training spend of 1. 9% purchased 5 days training per FTE at an average cost of R 3, 771 per FTE, with a training capacity of 247 FTEs per training function FTE 71 Copyright © Resolve 2004

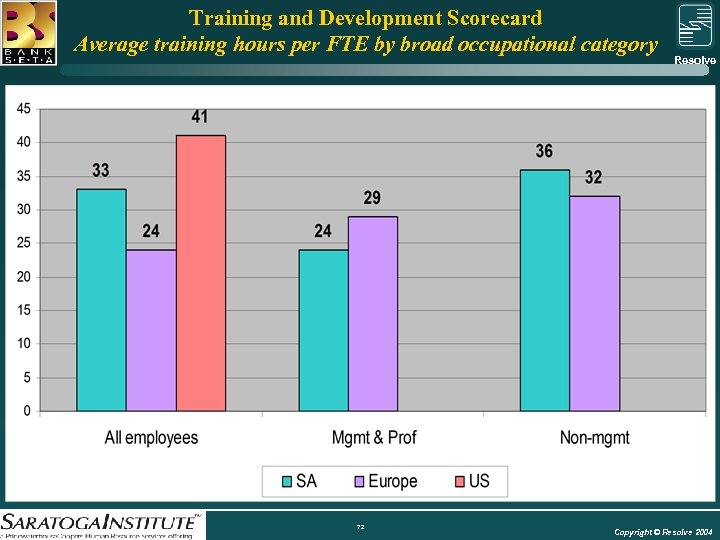

Training and Development Scorecard Average training hours per FTE by broad occupational category Resolve Group 72 Copyright © Resolve 2004

Benchmarking Results Resolve Group Equity Scorecard 73 Copyright © Resolve 2004

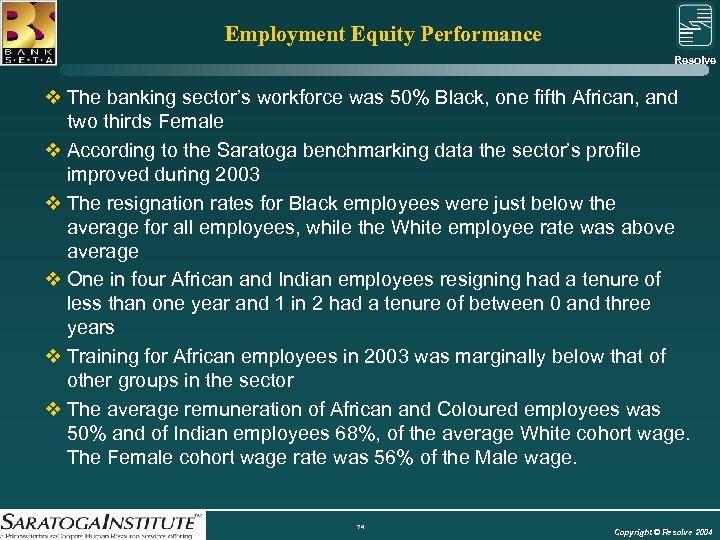

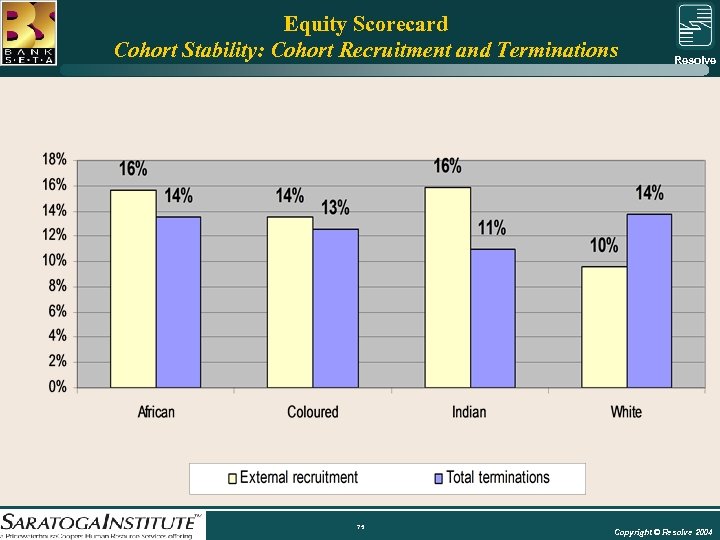

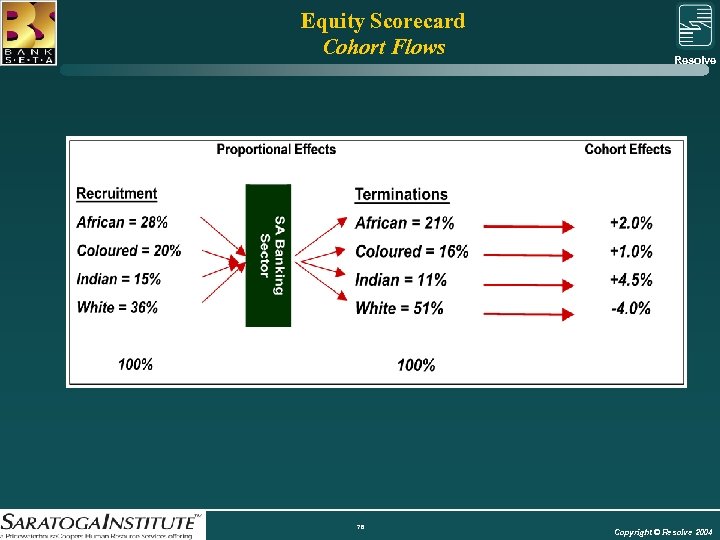

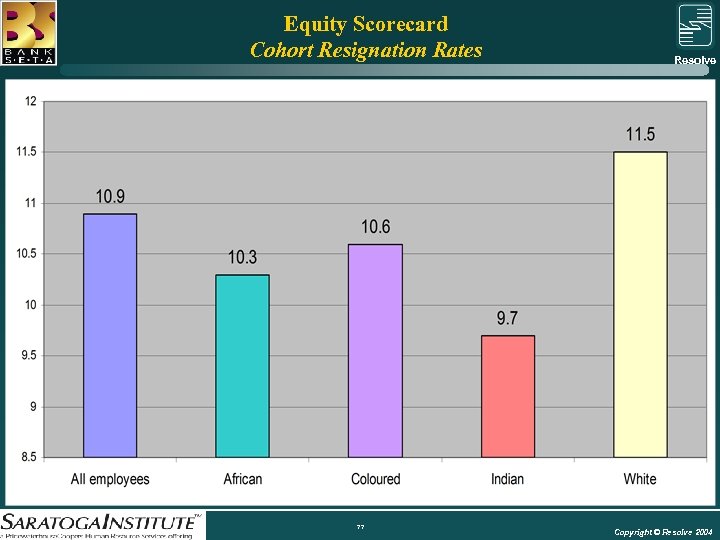

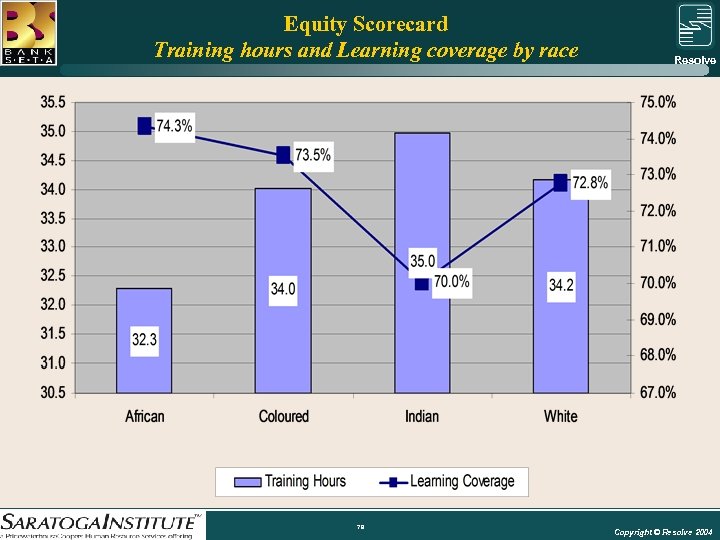

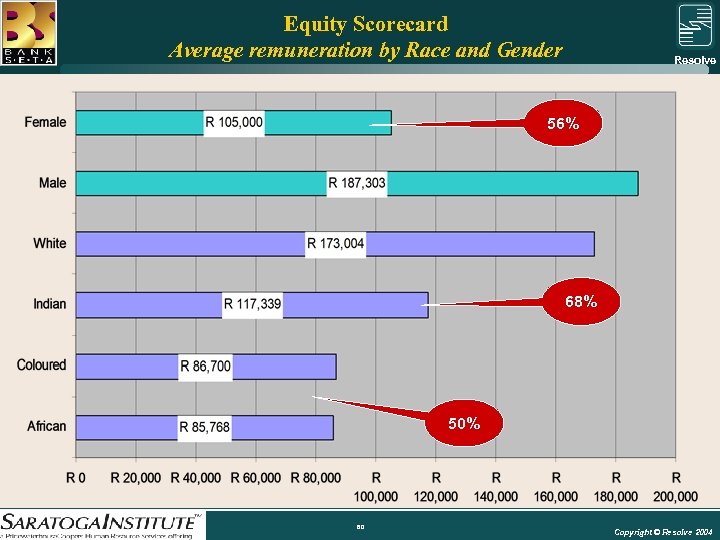

Employment Equity Performance Resolve Group v The banking sector’s workforce was 50% Black, one fifth African, and two thirds Female v According to the Saratoga benchmarking data the sector’s profile improved during 2003 v The resignation rates for Black employees were just below the average for all employees, while the White employee rate was above average v One in four African and Indian employees resigning had a tenure of less than one year and 1 in 2 had a tenure of between 0 and three years v Training for African employees in 2003 was marginally below that of other groups in the sector v The average remuneration of African and Coloured employees was 50% and of Indian employees 68%, of the average White cohort wage. The Female cohort wage rate was 56% of the Male wage. 74 Copyright © Resolve 2004

Equity Scorecard Cohort Stability: Cohort Recruitment and Terminations Resolve Group 75 Copyright © Resolve 2004

Equity Scorecard Cohort Flows Resolve Group 76 Copyright © Resolve 2004

Equity Scorecard Cohort Resignation Rates Resolve Group 77 Copyright © Resolve 2004

Equity Scorecard Cohort Resignations by length of service Resolve Group 1 in 2 78 Copyright © Resolve 2004

Equity Scorecard Training hours and Learning coverage by race Resolve Group 79 Copyright © Resolve 2004

Equity Scorecard Average remuneration by Race and Gender Resolve Group 56% 68% 50% 80 Copyright © Resolve 2004

Agenda Resolve Group v Introduction v Methodology v Benchmarking results v Main conclusions 81 Copyright © Resolve 2004

Main Conclusions Resolve Group v The results are largely related to retail banking v Grow revenue per capita and focus on higher margin activities v Increasing revenue is needed to sustain good revenue and profit return on remuneration v Continue good cost management, but reduce unit costs by raising the efficiencies of of IT platforms and core processes v There is still room for improving the resignation rate of the management and professional cohort v The tenure of resignations, especially amongst Black employees needs attention v The focus on internal recruitment should continue v Time to fill and acceptance rate data needs to be collected 82 Copyright © Resolve 2004

Main Conclusions Resolve Group v Training investment, outputs and efficiencies compare well with peers in Europe and the US, though there is a need to increase training for African employees in the sector v Race and gender remuneration disparities will need to be addressed through progression and external recruitment strategies into higher occupational brackets v The flow of employees in and out the sector, by levels / occupational categories, needs to monitored for equity and FSC purposes v The sector’s HR functions require regular review to be sure they have the capacity and skill-sets to respond to ever increasing and new demands v Interestingly, the SA sector appears to outsource more of its HR service than its European peers 83 Copyright © Resolve 2004

Lessons Resolve Group v Adequate time is needed for data collection and verification v Focus Groups to verify and engage data essential v Setting the baseline was difficult compared with future exercises, which will also compare and contrast external and internal longitudinal benchmark data v Future rounds must disaggregate – retail and wholesale and microlending sectors v Important missing data must be added next round v Workplace skills plan data, equity data and Saratoga data must be aligned to respond to the employment equity, skills development and human resources elements of the Financial Services Charter 84 Copyright © Resolve 2004

FINANANCIAL CHARTER UPDATE: Work in progress FACILITATOR: Given Mkhari Talk Show Host: Metro FM

FINANANCIAL CHARTER UPDATE: Work in progress Kennedy Bungane President: ABSIP

FINANANCIAL CHARTER UPDATE: Work in progress Frank Groenewald Chief Executive Officer: BANKSETA

FINANANCIAL CHARTER UPDATE: Work in progress Bob Tucker Chief Executive Officer: Banking Council

CLOSING SESSION Frank Groenewald Chief Executive Officer: BANKSETA

BANKSETA Conference Evaluation and the Way Forward Frank Groenewald CEO BANKSETA 7/8 October 2004

BANKSETA Mission “To support and give effect to legislation by establishing an education, training and development framework to enable stakeholders to advance the national and global position of the banking sector. ”

The Future Operational • SETA Operational Landscape ( Mergers) • Structural Efficiency Strategic • Transformation • Finance Sector Charter • SMME Development • Youth development • Consumer Education (Broad interpretation) • National Skills Development Strategy

Recognition • • • Project Steering Committee Project Manager Global Conferences Ikapa Kagiso Communications BANKSETA Stakeholders BANKSETA Staff

THANK YOU

ce8c546872e91d5f6c83649f2f54bf92.ppt