8699c4daf9946258dc0572944fd08708.ppt

- Количество слайдов: 34

Belpex project and market coupling APEX Conference Seoul, 30 October 2006 B. den Ouden, CEO APX Group

Agenda n n n Development APX Belpex and Trilateral market Coupling Multilateral European perspective Page 2

Building the APX Group n n n Page 3 1999: Amsterdam Power Exchange 2003: APX UK (power), En. MO (gas) 2004: UKPX (power) 2004: Re-branding 2005: APX Gas ZEE, APX Gas NL

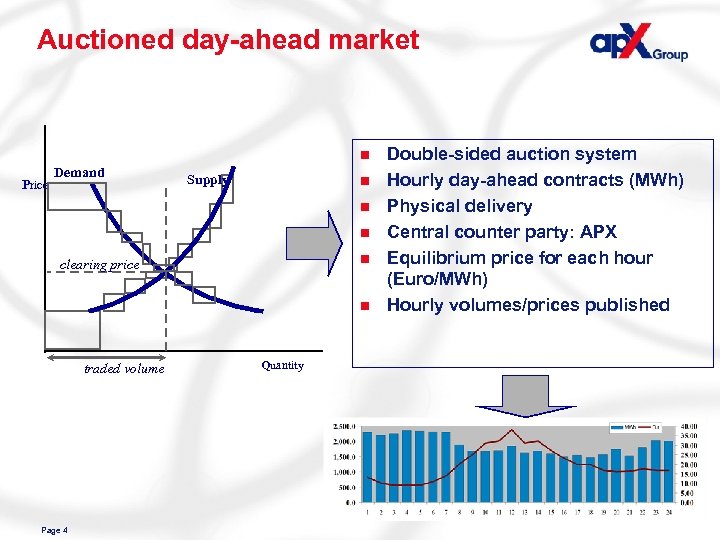

Auctioned day-ahead market n Price Demand Supply n n clearing price n traded volume Page 4 Quantity Double-sided auction system Hourly day-ahead contracts (MWh) Physical delivery Central counter party: APX Equilibrium price for each hour (Euro/MWh) Hourly volumes/prices published

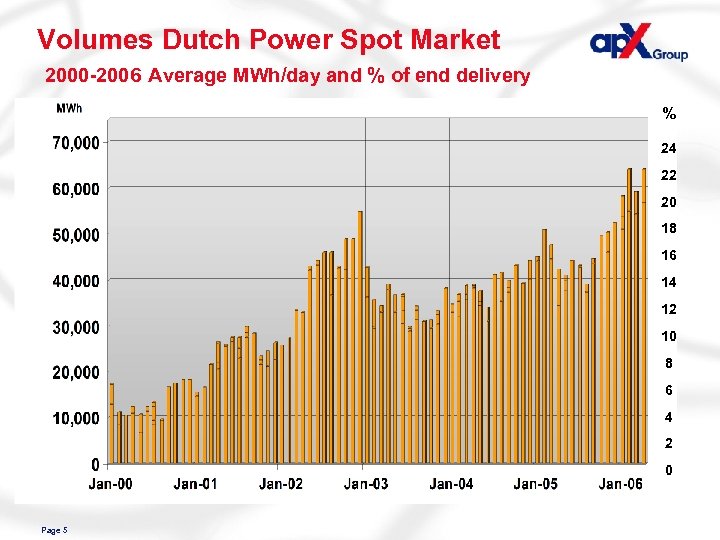

Volumes Dutch Power Spot Market 2000 -2006 Average MWh/day and % of end delivery % 24 22 20 18 16 14 12 10 8 6 4 2 0 Page 5

Development of intra-day market n n Regulator roadmap promoting intra-day cross-border market. An international intra-day market would be the best solution As APX Eurolight trading system allows fast implementation and members support this: APX has started up national market, precursor to international Willingness to develop this further with international partners APX Power NL Strips - Last update: 09: 15 - 12 th October 2006 Instrument Open (€) High (€) Low (€) Close (€) Volume (MW) NL BASE 13 OCT 06 52. 50 - 50. 0 APX Power NL Intraday - Last update: 18: 15 - 13 th October 2006 Instrument Open (€) High (€) Low (€) Close (€) Volume (MW) 13 OCT 06 - PTE 62 68. 00 - 15. 0 13 OCT 06 - PTE 63 68. 00 - 15. 0 13 OCT 06 - PTE 64 68. 00 - 25. 0 13 OCT 06 - PTE 81 69. 00 - 35. 0 13 OCT 06 - PTE 82 67. 00 69. 00 40. 0 13 OCT 06 - PTE 83 67. 00 69. 00 40. 0 13 OCT 06 - PTE 84 65. 00 20. 0 13 OCT 06 - PTE 96 36. 00 25. 0 14 OCT 06 - PTE 01 37. 00 50. 0 14 OCT 06 - PTE 02 37. 00 30. 0 Page 6

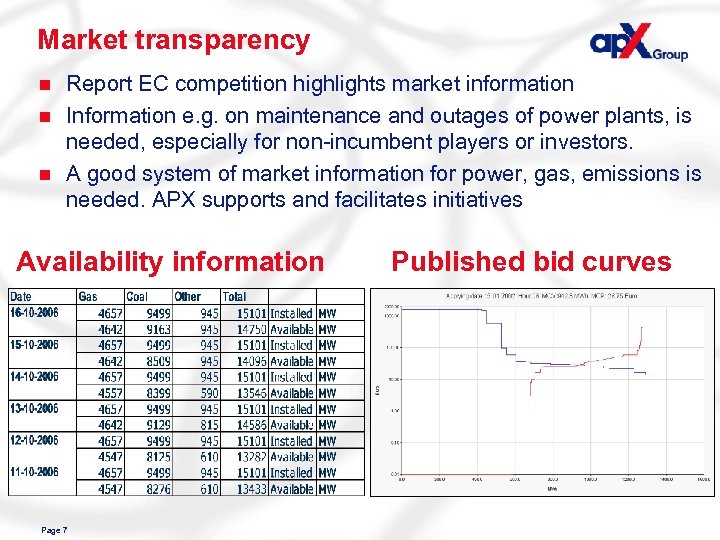

Market transparency n n n Report EC competition highlights market information Information e. g. on maintenance and outages of power plants, is needed, especially for non-incumbent players or investors. A good system of market information for power, gas, emissions is needed. APX supports and facilitates initiatives Availability information Page 7 Published bid curves

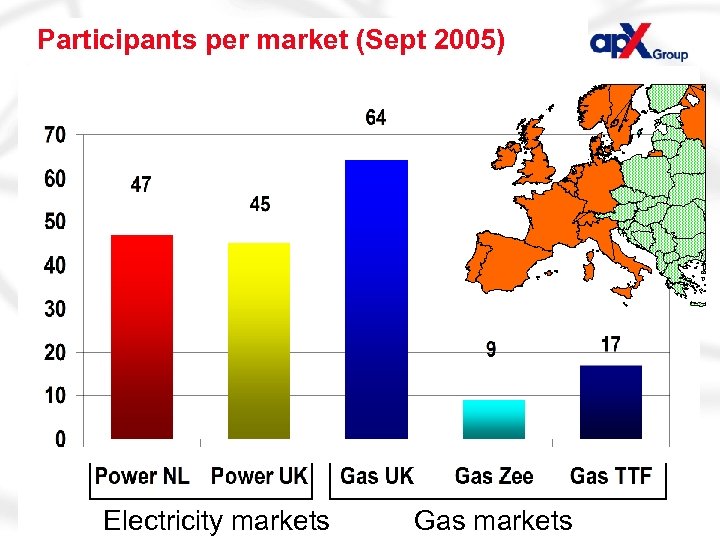

Participants per market (2002)2005) (Sept Page 8 Electricity markets Gas markets

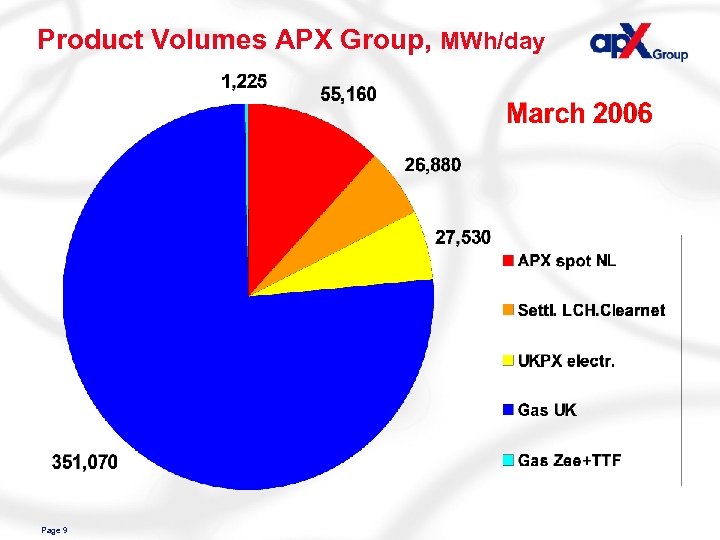

Product Volumes APX Group, MWh/day Page 9

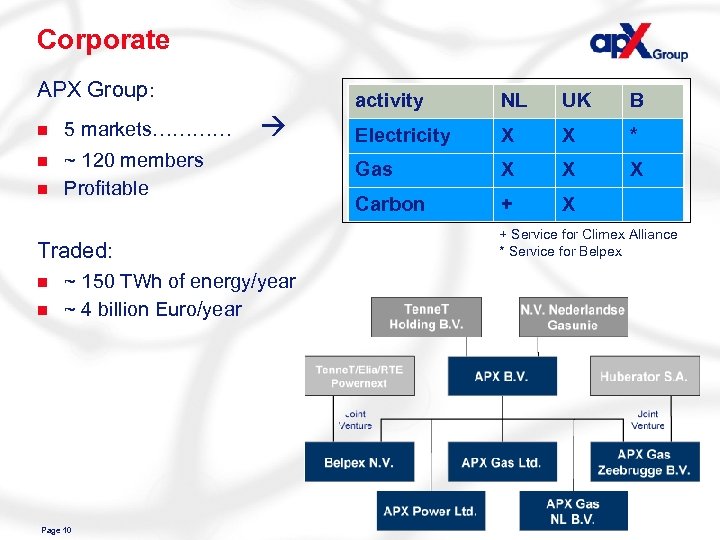

Corporate APX Group: n 5 markets………… n ~ 120 members Profitable n Traded: n n ~ 150 TWh of energy/year ~ 4 billion Euro/year Page 10 activity NL UK B Electricity X X * Gas X X X Carbon + X + Service for Climex Alliance * Service for Belpex

Agenda n n n Development APX Belpex and Trilateral market Coupling Multilateral European perspective Page 11

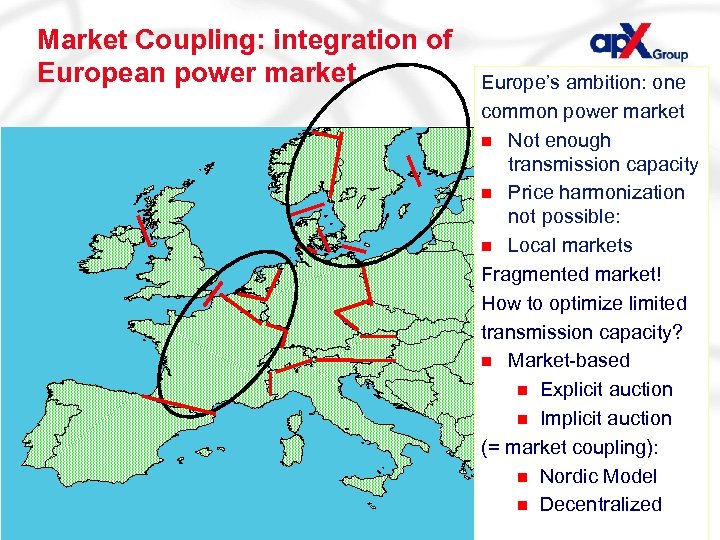

Market Coupling: integration of European power market Page 12 Europe’s ambition: one common power market n Not enough transmission capacity n Price harmonization not possible: n Local markets Fragmented market! How to optimize limited transmission capacity? n Market-based n Explicit auction n Implicit auction (= market coupling): n Nordic Model n Decentralized

Trilateral Market Coupling APX-Belpex-Powernext n n n Market coupling for daily allocated capacity between 3 countries: Trilateral Market Coupling Monthly and yearly auctions remain Co-operation project : – – n Exchanges and TSO’s; APX / Powernext Services to Belpex APX Tenne. T Belpex exchange: jointly owned 60% Elia, 10% Tenne. T-APX-RTE-Powernext n n n Page 13 Testing of Market Coupling system: good results Launch Nov 2006 Regulators decision Bel pex Elia Power next RTE

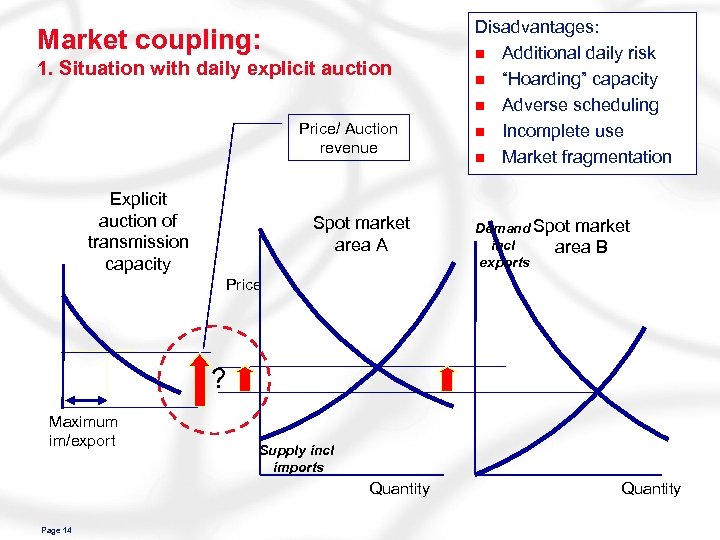

Market coupling: 1. Situation with daily explicit auction Price/ Auction revenue Explicit auction of transmission capacity Spot market area A Disadvantages: n Additional daily risk n “Hoarding” capacity n Adverse scheduling n Incomplete use n Market fragmentation Demand Spot market incl area B exports Price ? Maximum im/export Supply incl imports Quantity Page 14 Quantity

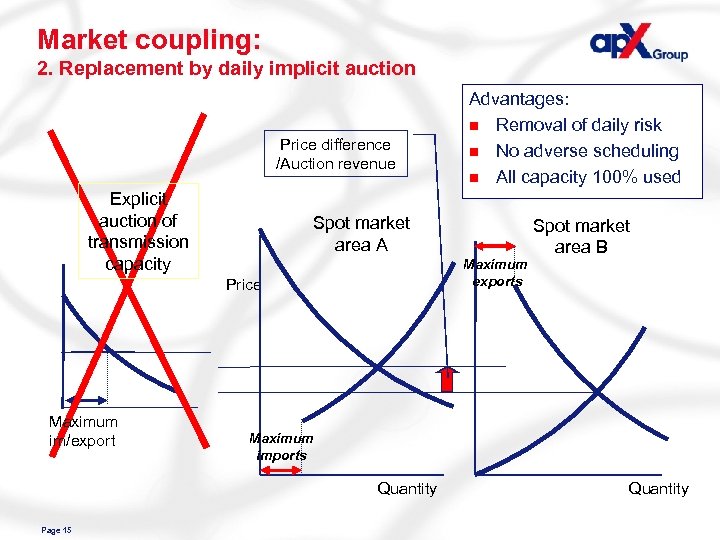

Market coupling: 2. Replacement by daily implicit auction Price difference /Auction revenue Explicit auction of transmission capacity Spot market area A Maximum exports Price Maximum im/export Spot market area B Maximum imports Quantity Page 15 Advantages: n Removal of daily risk n No adverse scheduling n All capacity 100% used Quantity

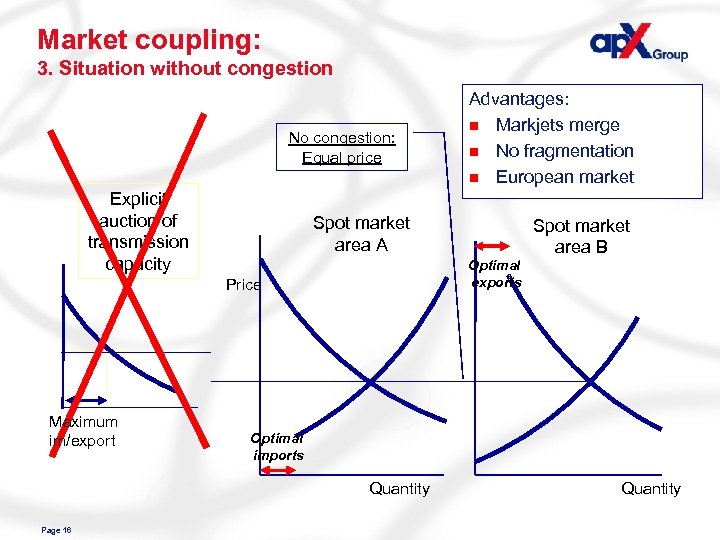

Market coupling: 3. Situation without congestion No congestion: Equal price Explicit auction of transmission capacity Spot market area A Optimal imports Quantity Page 16 Spot market area B Optimal exports Price Maximum im/export Advantages: n Markjets merge n No fragmentation n European market Quantity

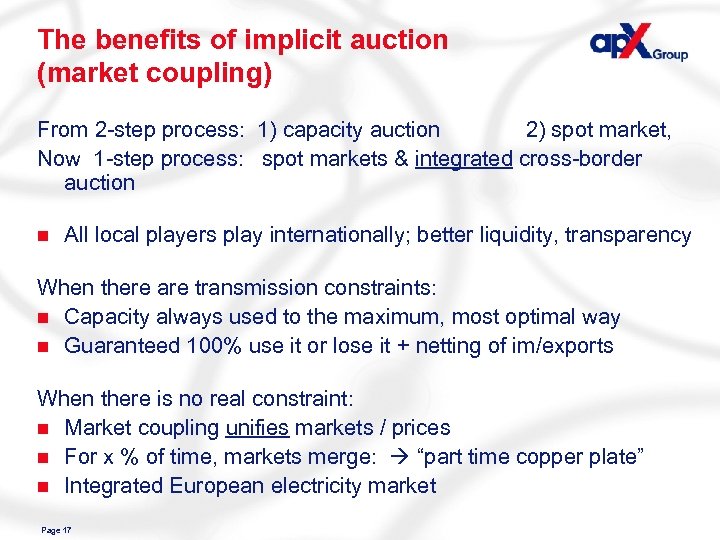

The benefits of implicit auction (market coupling) From 2 -step process: 1) capacity auction 2) spot market, Now 1 -step process: spot markets & integrated cross-border auction n All local players play internationally; better liquidity, transparency When there are transmission constraints: n Capacity always used to the maximum, most optimal way n Guaranteed 100% use it or lose it + netting of im/exports When there is no real constraint: n Market coupling unifies markets / prices n For x % of time, markets merge: “part time copper plate” n Integrated European electricity market Page 17

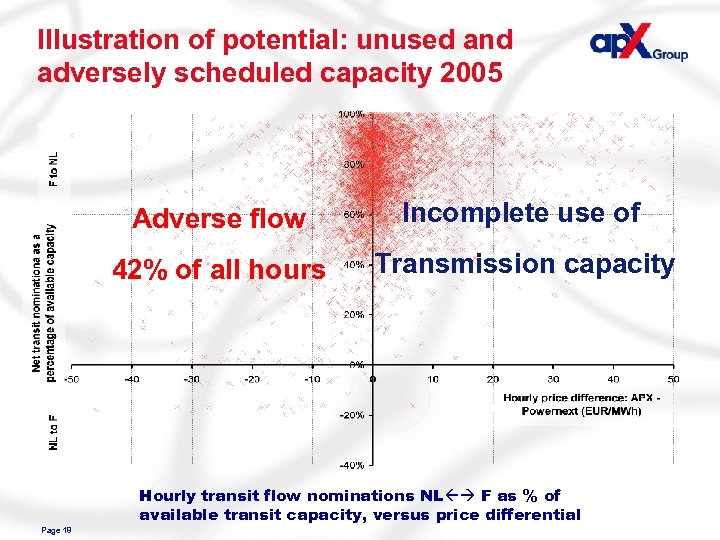

Illustration of potential: unused and adversely scheduled capacity 2005 Adverse flow Incomplete use of 42% of all hours Transmission capacity Hourly transit flow nominations NL F as % of available transit capacity, versus price differential Page 18

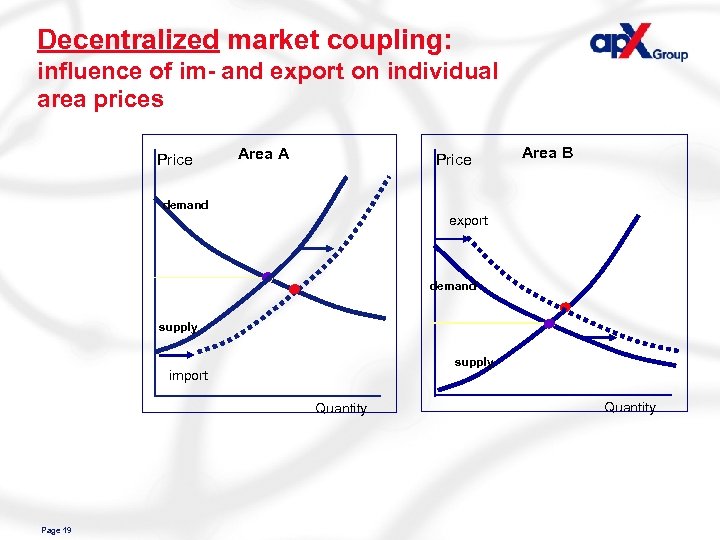

Decentralized market coupling: influence of im- and export on individual area prices Price Area A Price Area B demand export demand supply import Quantity Page 19 Quantity

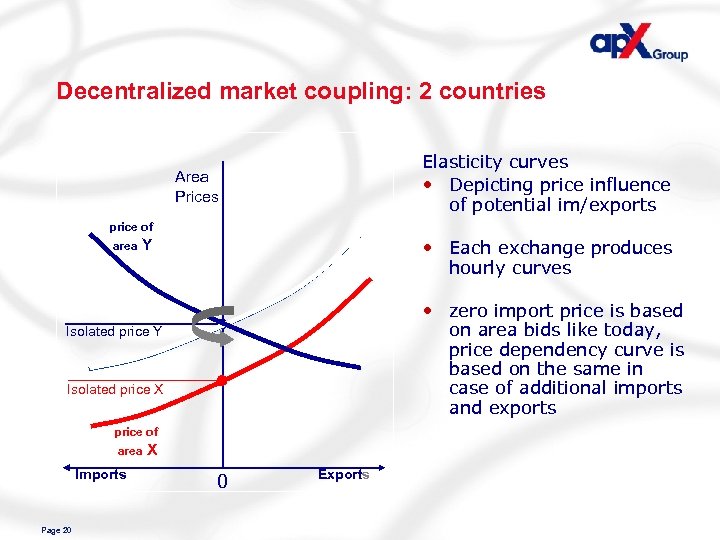

Decentralized market coupling: 2 countries Elasticity curves • Depicting price influence of potential im/exports Area Prices price of area Y • Each exchange produces hourly curves • zero import price is based on area bids like today, price dependency curve is based on the same in case of additional imports and exports Isolated price Y Isolated price X price of area Imports Page 20 X 0 Exports

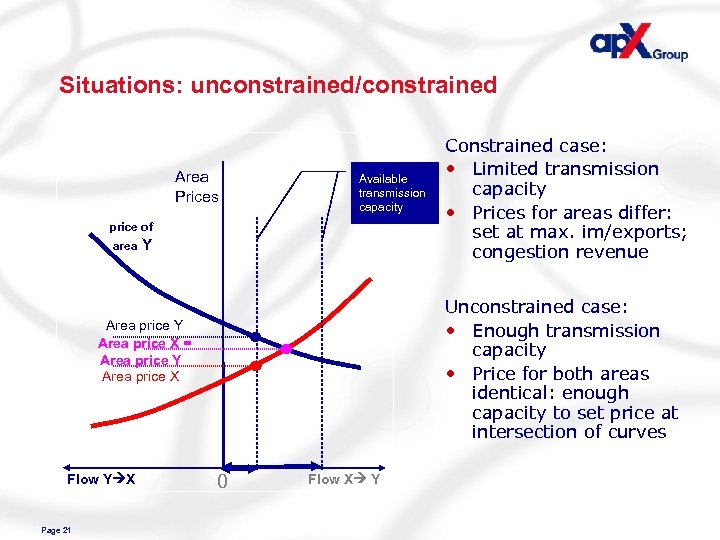

Situations: unconstrained/constrained Area Prices Available transmission capacity price of area Y Unconstrained case: • Enough transmission capacity • Price for both areas identical: enough capacity to set price at intersection of curves Area price Y Area price X = Area price Y Area price X Flow Y X Page 21 Constrained case: • Limited transmission capacity • Prices for areas differ: set at max. im/exports; congestion revenue 0 Flow X Y

System development n Current APX and Powernext systems for spot market n Prototype for 2 markets Prototype for 3 markets (somewhat more complicated) n Trilateral market coupling development n Joint development of APX and Powernext: central coupling module, local modules, iteration rules n Calculation for each hour: straightforward, no iterations n Calculation with multi-hour blocks: iteration needed n Development for X markets: underway Multilateral market Coupling (MLC) European development Page 22

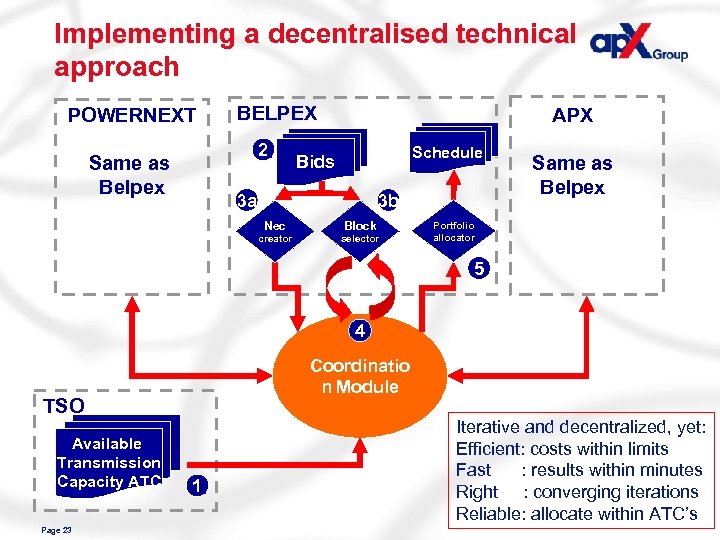

Implementing a decentralised technical approach POWERNEXT BELPEX 2 Same as Belpex APX Schedule Bids 3 a 3 b Nec Block creator selector Same as Belpex Portfolio allocator 5 4 Coordinatio n Module TSO Available Transmission Capacity ATC Page 23 1 Iterative and decentralized, yet: Efficient: costs within limits Fast : results within minutes Right : converging iterations Reliable: allocate within ATC’s

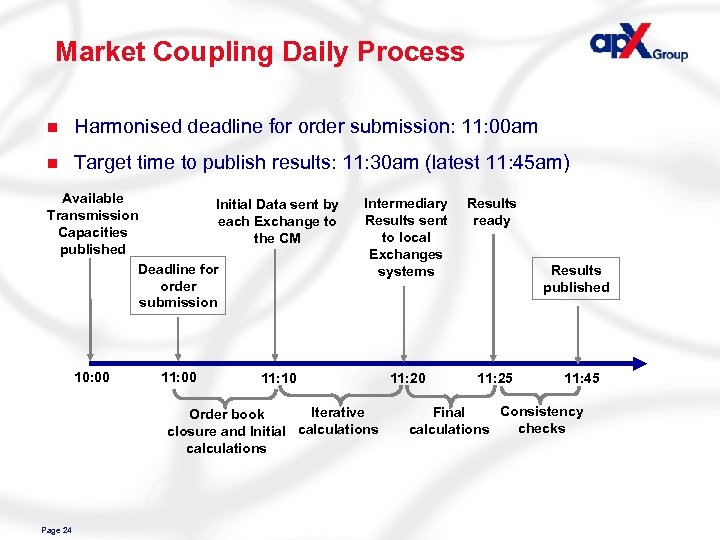

Market Coupling Daily Process n Harmonised deadline for order submission: 11: 00 am n Target time to publish results: 11: 30 am (latest 11: 45 am) Available Initial Data sent by Transmission each Exchange to Capacities the CM published Deadline for order submission 10: 00 11: 00 Intermediary Results sent to local Exchanges systems Results ready 11: 20 11: 25 11: 10 Iterative Order book closure and Initial calculations Page 24 Results published 11: 45 Consistency Final checks calculations

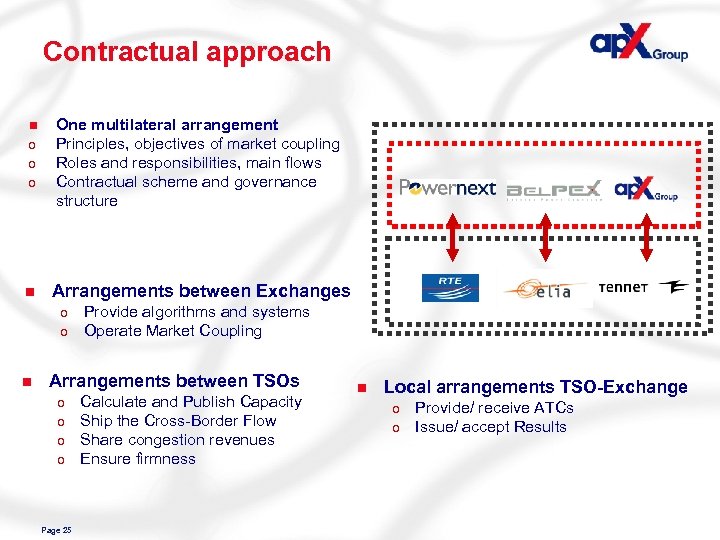

Contractual approach n o o o n One multilateral arrangement Principles, objectives of market coupling Roles and responsibilities, main flows Contractual scheme and governance structure Arrangements between Exchanges o o n Provide algorithms and systems Operate Market Coupling Arrangements between TSOs o o Page 25 Calculate and Publish Capacity Ship the Cross-Border Flow Share congestion revenues Ensure firmness n Local arrangements TSO-Exchange o o Provide/ receive ATCs Issue/ accept Results

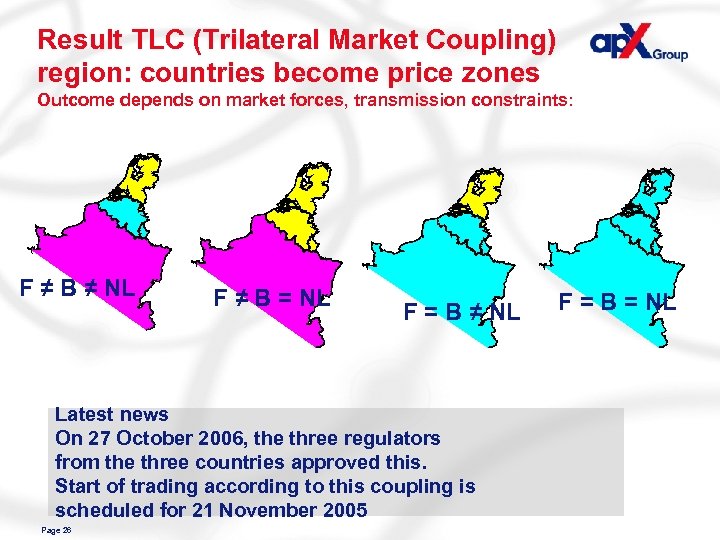

Result TLC (Trilateral Market Coupling) region: countries become price zones Outcome depends on market forces, transmission constraints: F ≠ B ≠ NL F ≠ B = NL F = B ≠ NL Latest news On 27 October 2006, the three regulators from the three countries approved this. Start of trading according to this coupling is scheduled for 21 November 2005 Page 26 F = B = NL

Agenda n n n Development APX Belpex and Trilateral market Coupling Multilateral European perspective Page 27

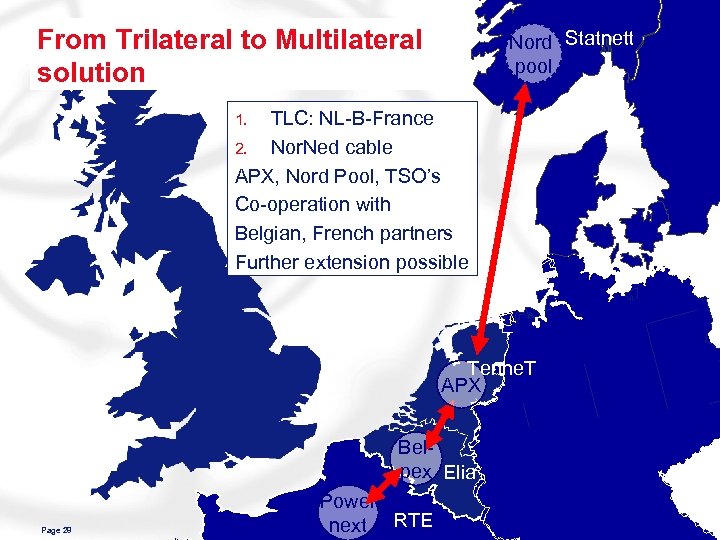

From Trilateral to Multilateral solution Nord Statnett pool TLC: NL-B-France 2. Nor. Ned cable APX, Nord Pool, TSO’s Co-operation with Belgian, French partners Further extension possible 1. Tenne. T APX Belpex Elia Page 28 Power next RTE

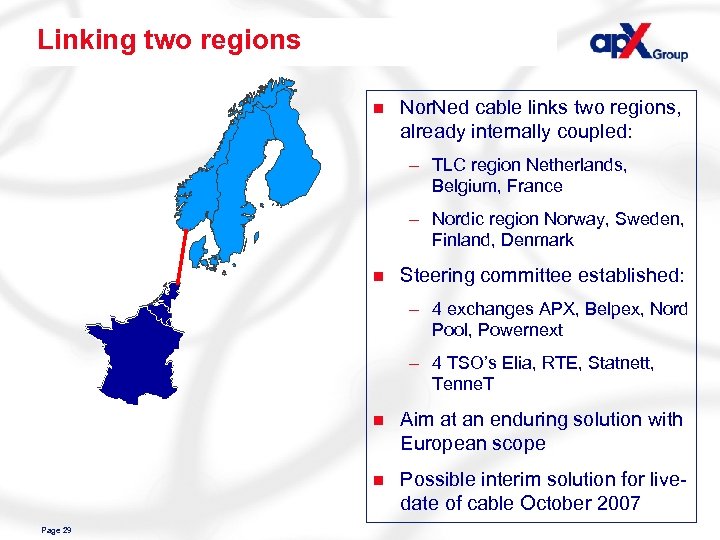

Linking two regions n Nor. Ned cable links two regions, already internally coupled: – TLC region Netherlands, Belgium, France – Nordic region Norway, Sweden, Finland, Denmark n Steering committee established: – 4 exchanges APX, Belpex, Nord Pool, Powernext – 4 TSO’s Elia, RTE, Statnett, Tenne. T n n Page 29 Aim at an enduring solution with European scope Possible interim solution for livedate of cable October 2007

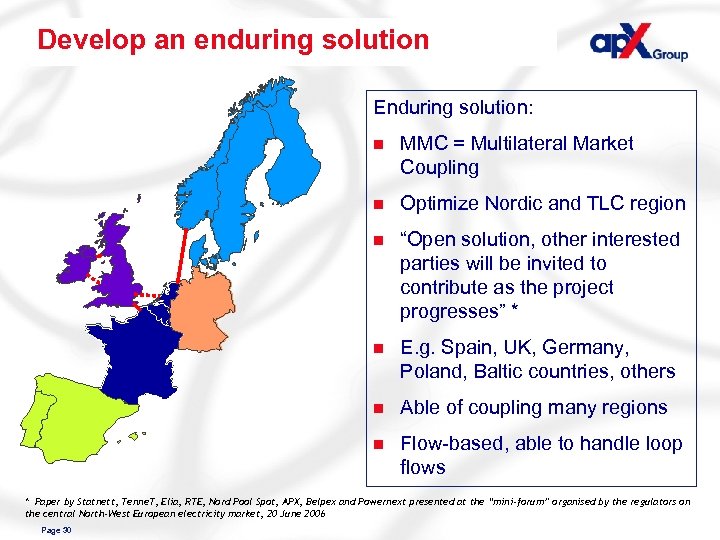

Develop an enduring solution Enduring solution: n MMC = Multilateral Market Coupling n Optimize Nordic and TLC region n “Open solution, other interested parties will be invited to contribute as the project progresses” * n E. g. Spain, UK, Germany, Poland, Baltic countries, others n Able of coupling many regions n Flow-based, able to handle loop flows * Paper by Statnett, Tenne. T, Elia, RTE, Nord Pool Spot, APX, Belpex and Powernext presented at the “mini-forum” organised by the regulators on the central North-West European electricity market, 20 June 2006 Page 30

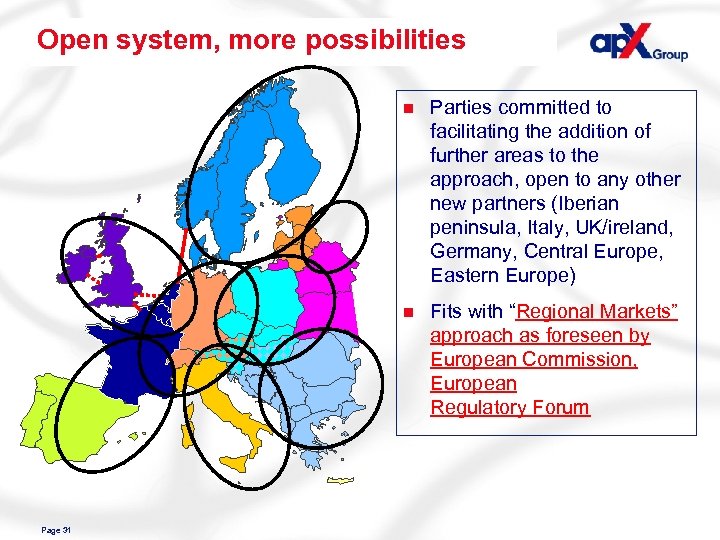

Open system, more possibilities n n Page 31 Parties committed to facilitating the addition of further areas to the approach, open to any other new partners (Iberian peninsula, Italy, UK/ireland, Germany, Central Europe, Eastern Europe) Fits with “Regional Markets” approach as foreseen by European Commission, European Regulatory Forum

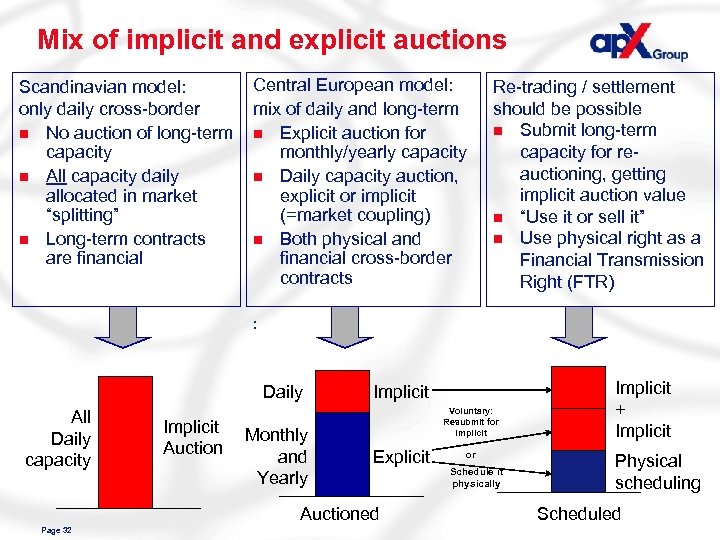

Mix of implicit and explicit auctions Scandinavian model: only daily cross-border n No auction of long-term capacity n All capacity daily allocated in market “splitting” n Long-term contracts are financial Central European model: mix of daily and long-term n Explicit auction for monthly/yearly capacity n Daily capacity auction, explicit or implicit (=market coupling) n Both physical and financial cross-border contracts Re-trading / settlement should be possible n Submit long-term capacity for reauctioning, getting implicit auction value n “Use it or sell it” n Use physical right as a Financial Transmission Right (FTR) : Daily All Daily capacity Implicit Auction Monthly and Yearly Implicit Voluntary: Resubmit for Implicit Explicit Auctioned Page 32 or Schedule it physically Implicit + Implicit Physical scheduling Scheduled

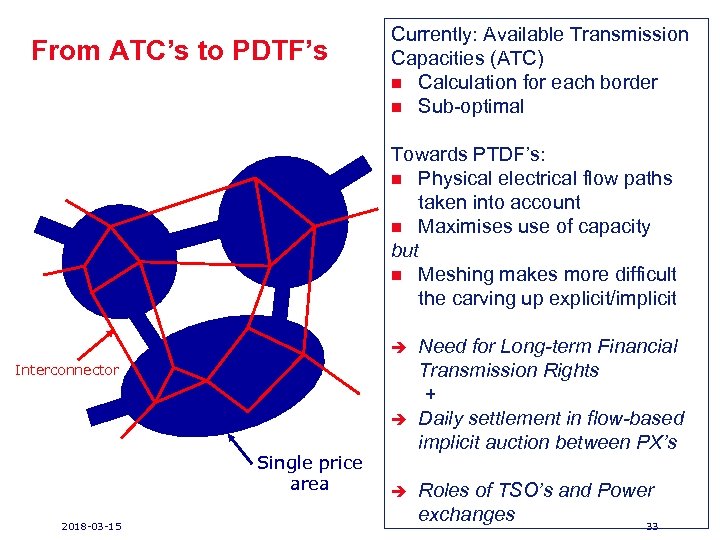

From ATC’s to PDTF’s Currently: Available Transmission Capacities (ATC) n Calculation for each border n Sub-optimal Towards PTDF’s: n Physical electrical flow paths taken into account n Maximises use of capacity but n Meshing makes more difficult the carving up explicit/implicit è Interconnector è Single price area 2018 -03 -15 è Need for Long-term Financial Transmission Rights + Daily settlement in flow-based implicit auction between PX’s Roles of TSO’s and Power exchanges 33

Summary North West European market is integrating fast n First step: Belpex + coupling France – Belgium – Netherlands Trilateral Market Coupling (TLC) n Based on intensive co-operation between exchanges, TSO’s n Due to start soon A VITAL LINK IN ENERGY TRADING n Next step: Nor. Ned cable: connect TLC and Nordic regions Towards an enduring an Multilateral system Towards a enduring European, flow-based solution n Open and accessible system, suitable for more countries n Other exchanges/countries invited to comment and contribute Page 34

8699c4daf9946258dc0572944fd08708.ppt