f8a0cbc1b1dfa1746832b7bb94bee920.ppt

- Количество слайдов: 31

Bell. South International And Colombia February 23 rd 2003 Victor Abad Sami Caracand David Cummings Maria Ximena Roa Eric Warren Finance 456: Emerging Markets Corporate Finance

Table of Contents • Introduction – Case Goals – Bell. South – Colombia • The Strategic Decision – Going into Colombia • Valuation – – Discount rate DCF Multiples Transaction Comparables • Conclusion - Findings What Happened Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Introduction

Case Goals Introduction • Three Questions – Should Bell. South go into Colombia? • Strategy Element – How should Bell. South go into Colombia? • Strategy Element – What should Bell. South pay? • Emerging Markets Finance Element – Discount Rate & DCF – Multiples Valuation Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

Bell. South, Inc. Introduction • 1984 - AT&T divests eight “Baby Bells” – Based in Atlanta, Georgia – 96, 000 employees – USD 21. 5 billion in assets • 1984 – Commenced cellular operations • 1990 – First to reach 500, 000 cell customers • 2000 April – Bell. South and SBC agree to combine wireless operations to form Cingular – 19 million subscribers – Second largest US wireless company • 2000 – “Adding a new customer somewhere in the world every 10 seconds” Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

Bell. South International (BSI) Introduction • Wholly owned Bell. South subsidiary – Created in 1985 to manage activities outside USA • Expanded through partnerships with local communications companies • In 2000, active in 14 countries – 10 in Latin America – China, Israel, Denmark, Germany • Entered Latin America in 1988 in Argentina • Stated goal is to be full-service telecom provider for entire region Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

Colombia Introduction • Gateway to South America – Coasts on both Atlantic and Pacific • 41. 5 million people • Turbulent history – Civil wars – Drug Trafficking • Key industries: Coffee and Oil • New government in 1998 – Pastrana elected – Engaging guerilla groups and factions – $1. 3 billion from US to fight drug trade Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

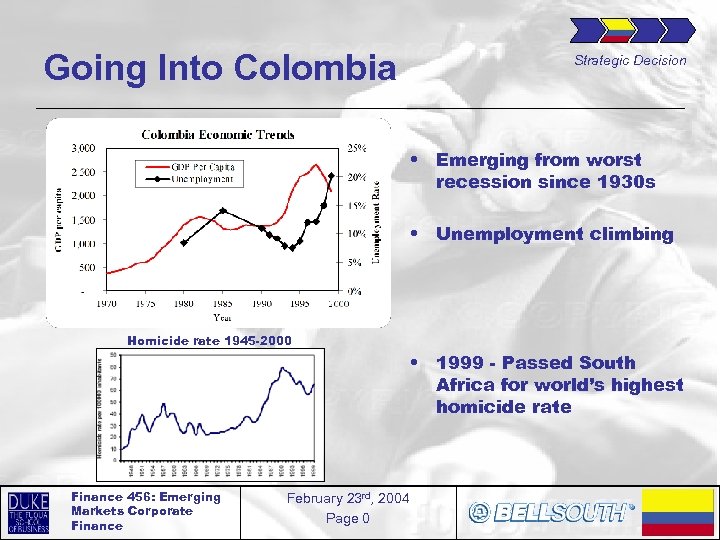

Going Into Colombia Strategic Decision • Emerging from worst recession since 1930 s • Unemployment climbing Homicide rate 1945 -2000 • 1999 - Passed South Africa for world’s highest homicide rate Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

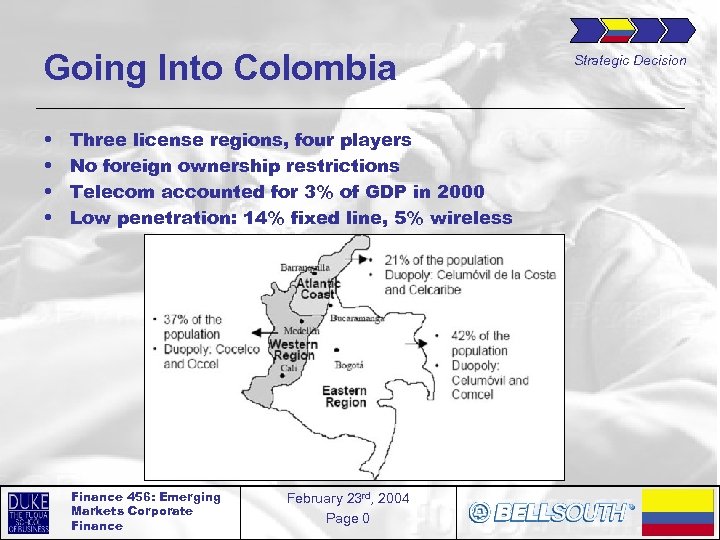

Going Into Colombia • • Three license regions, four players No foreign ownership restrictions Telecom accounted for 3% of GDP in 2000 Low penetration: 14% fixed line, 5% wireless Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Strategic Decision

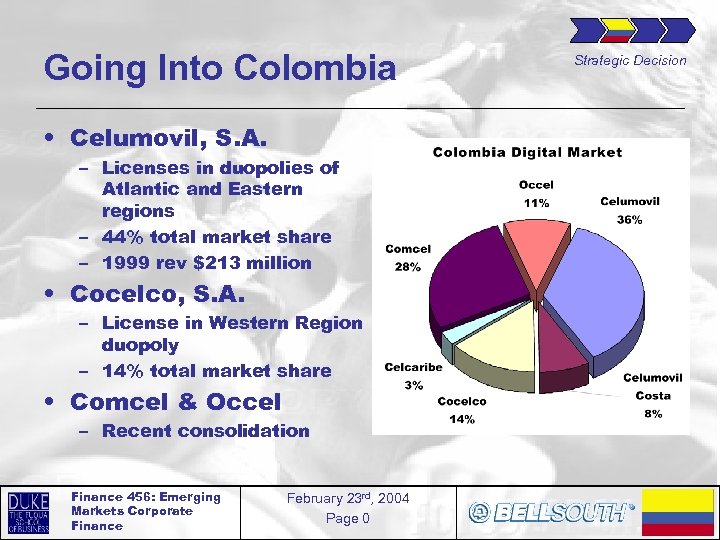

Going Into Colombia • Celumovil, S. A. – Licenses in duopolies of Atlantic and Eastern regions – 44% total market share – 1999 rev $213 million • Cocelco, S. A. – License in Western Region duopoly – 14% total market share • Comcel & Occel – Recent consolidation Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Strategic Decision

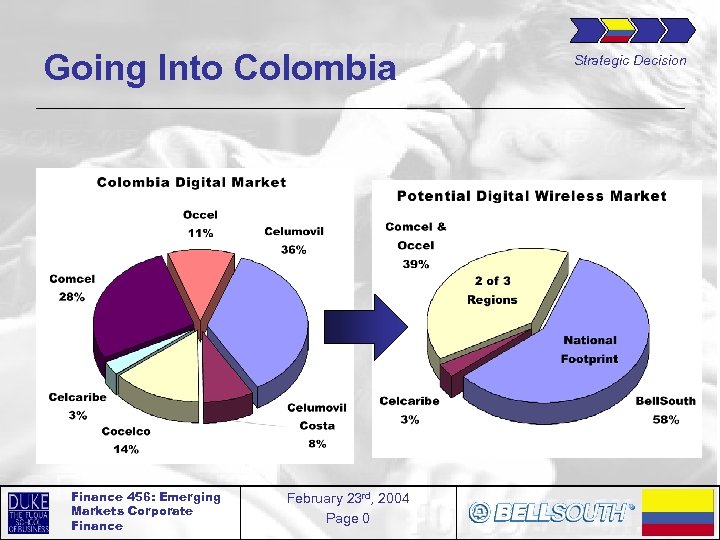

Going Into Colombia Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Strategic Decision

Going Into Colombia Strategic Decision • Consistent with goals to be full-service telecom provider in Latin America – Colombia is one of the last pieces • Prior experience in Latin America • Opportunity to gain first national footprint • Colombia Economic projections are positive • Large growth potential in wireless Acquire Celumovil and Cocelco… … but for how much? Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

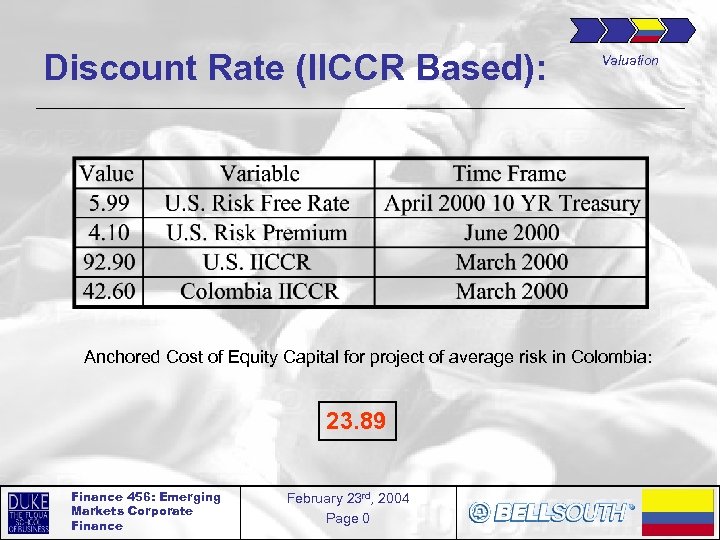

Discount Rate (IICCR Based): Valuation Anchored Cost of Equity Capital for project of average risk in Colombia: 23. 89 Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

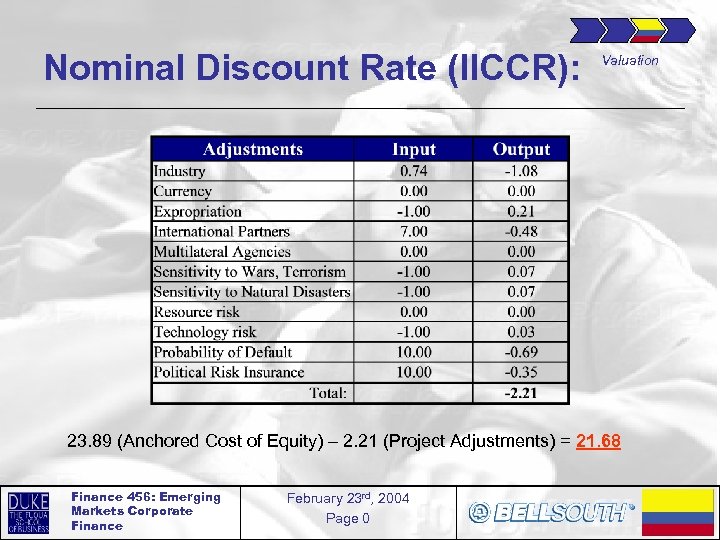

Nominal Discount Rate (IICCR): Valuation 23. 89 (Anchored Cost of Equity) – 2. 21 (Project Adjustments) = 21. 68 Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

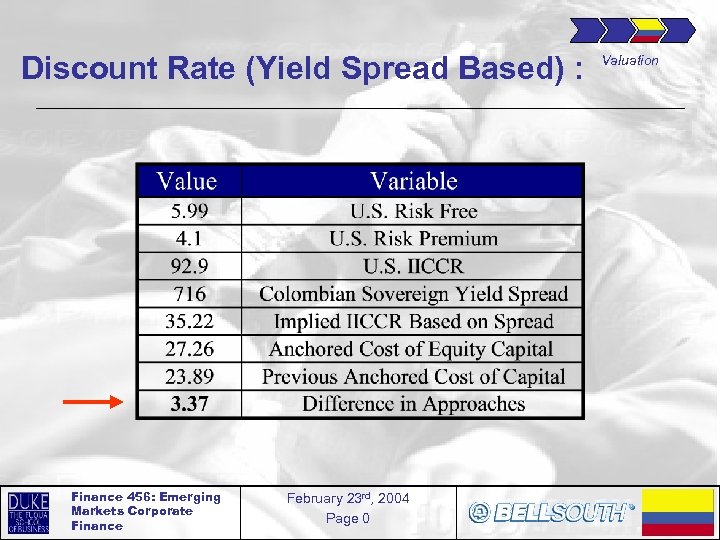

Discount Rate (Yield Spread Based) : Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

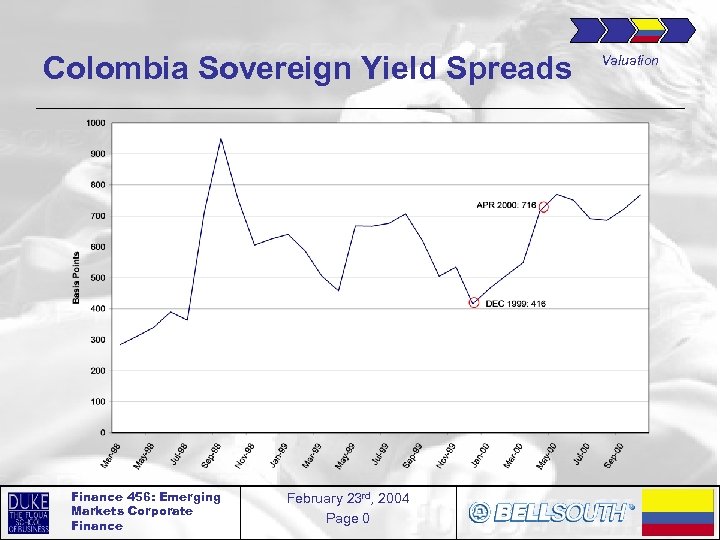

Colombia Sovereign Yield Spreads Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

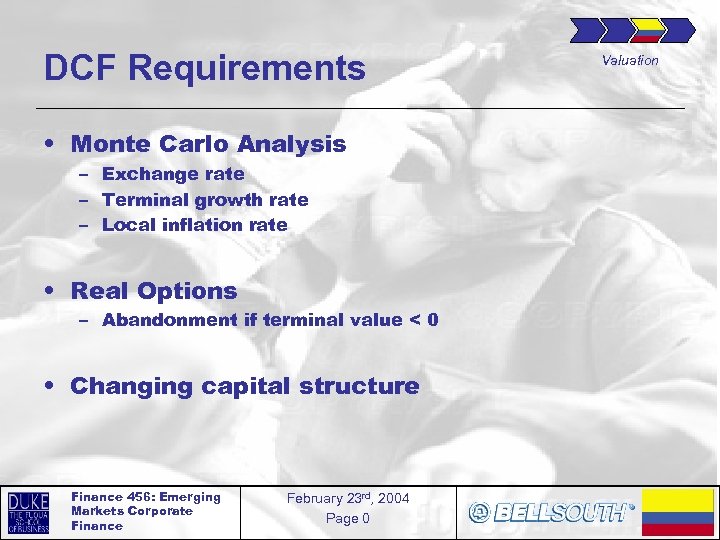

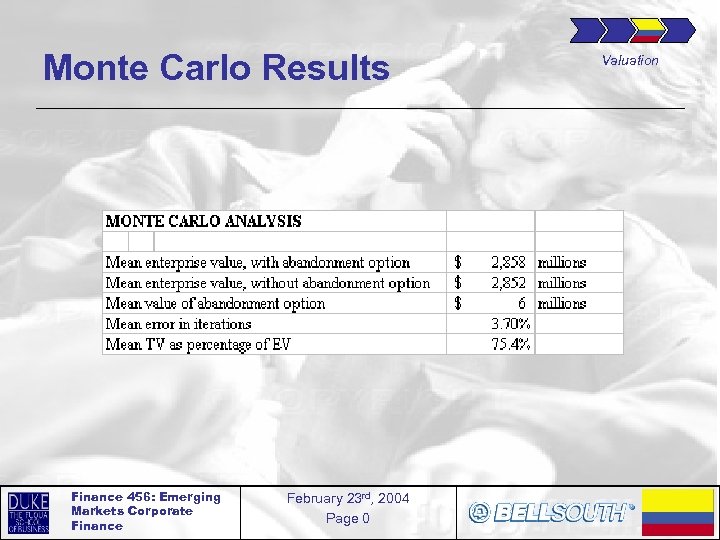

DCF Requirements • Monte Carlo Analysis – Exchange rate – Terminal growth rate – Local inflation rate • Real Options – Abandonment if terminal value < 0 • Changing capital structure Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

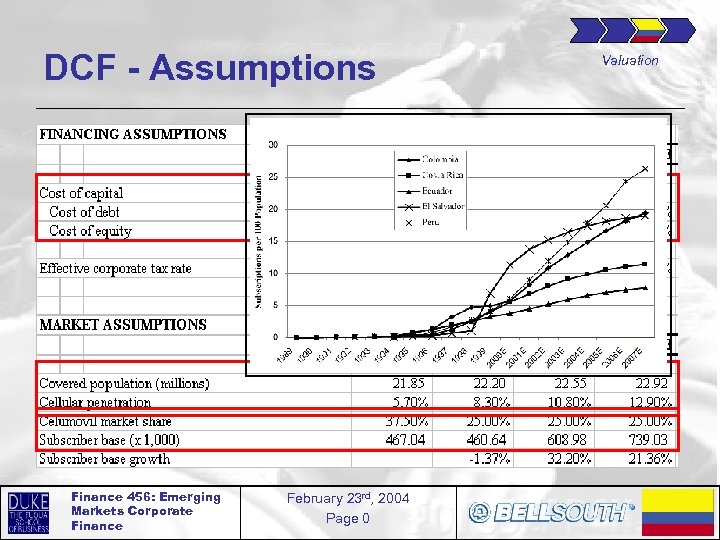

DCF - Assumptions Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

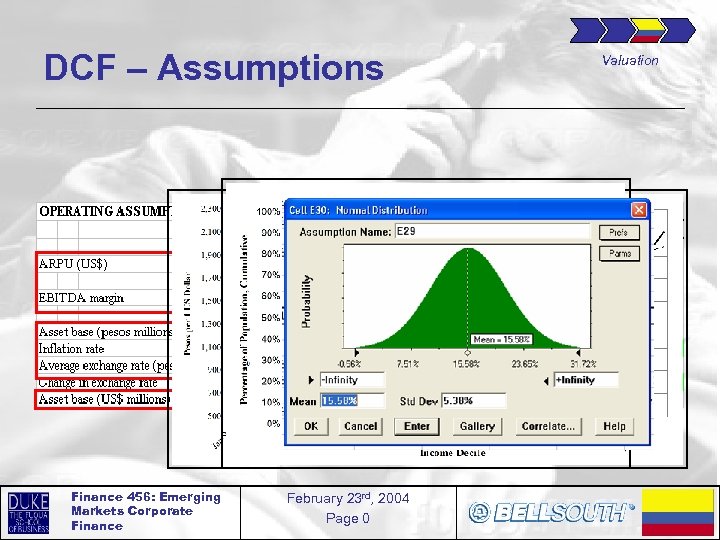

DCF – Assumptions Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

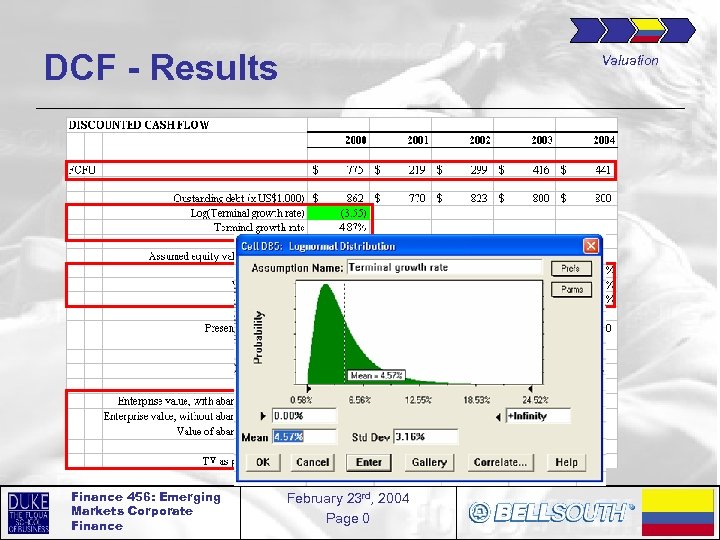

DCF - Results Finance 456: Emerging Markets Corporate Finance Valuation February 23 rd, 2004 Page 0

Monte Carlo Results Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

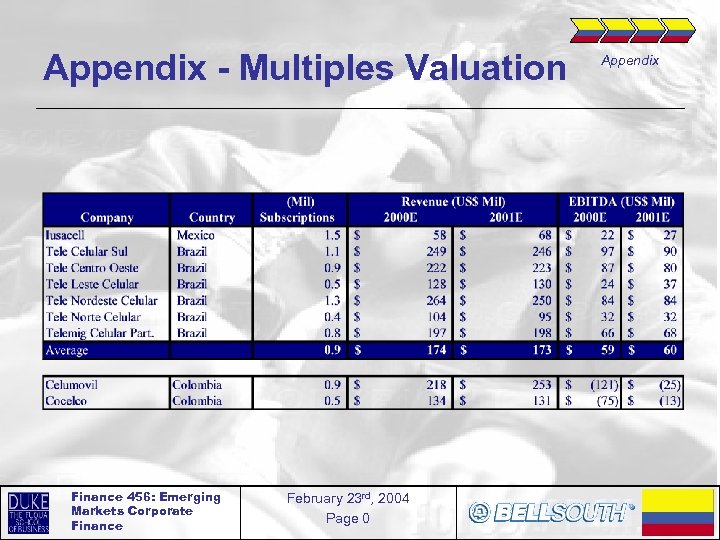

Multiples Valuation • Challenging implementation in Emerging Markets – Many privately held companies so information is difficult to obtain – Information on publicly traded companies not reliable • Stock markets are inefficient, concentrated and prices can be manipulated • Selection of comparables – Latin American companies – Purely wireless firms – Similar size Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

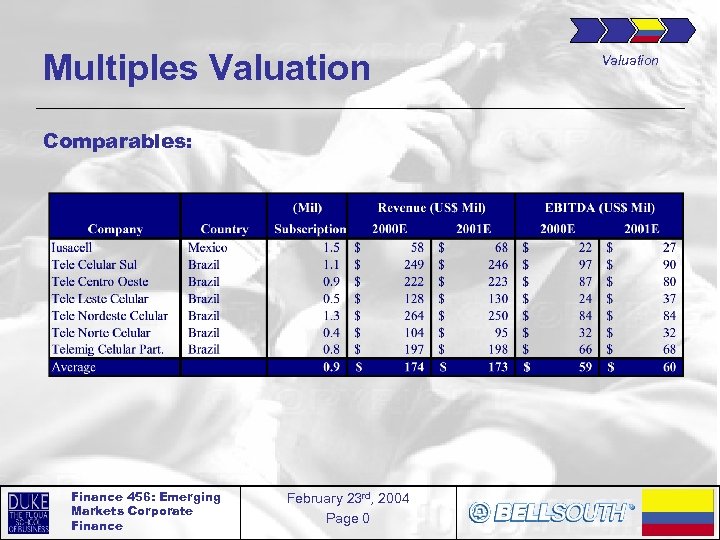

Multiples Valuation Comparables: Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

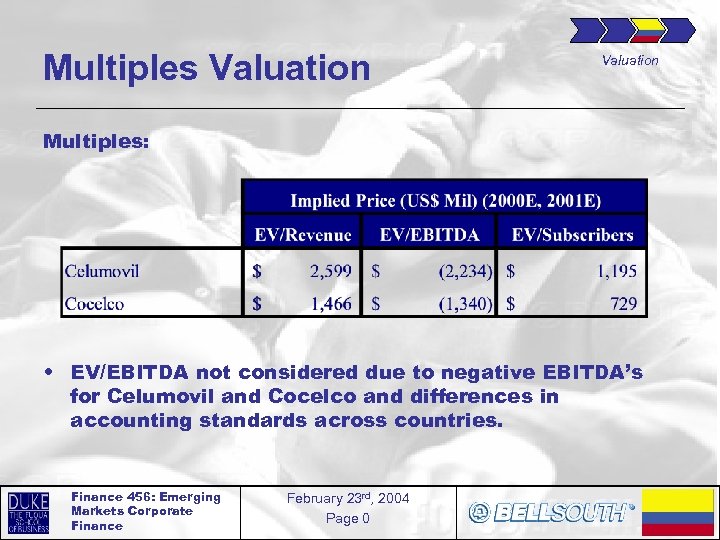

Multiples Valuation Multiples: • EV/EBITDA not considered due to negative EBITDA’s for Celumovil and Cocelco and differences in accounting standards across countries. Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

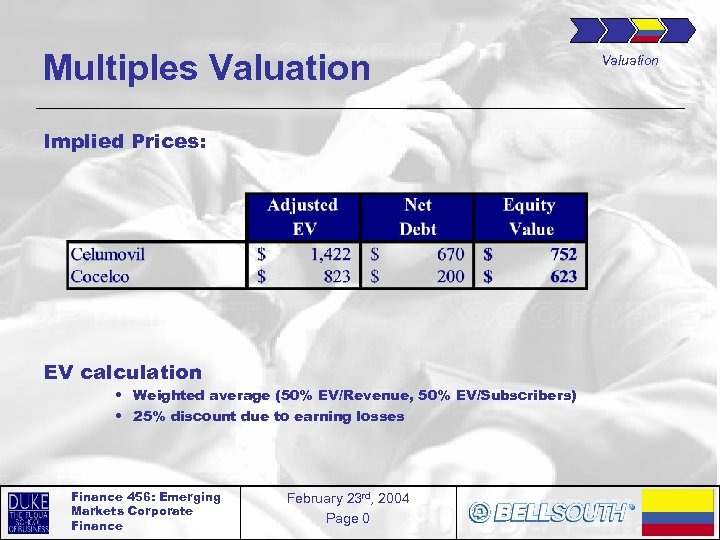

Multiples Valuation Implied Prices: EV calculation • Weighted average (50% EV/Revenue, 50% EV/Subscribers) • 25% discount due to earning losses Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

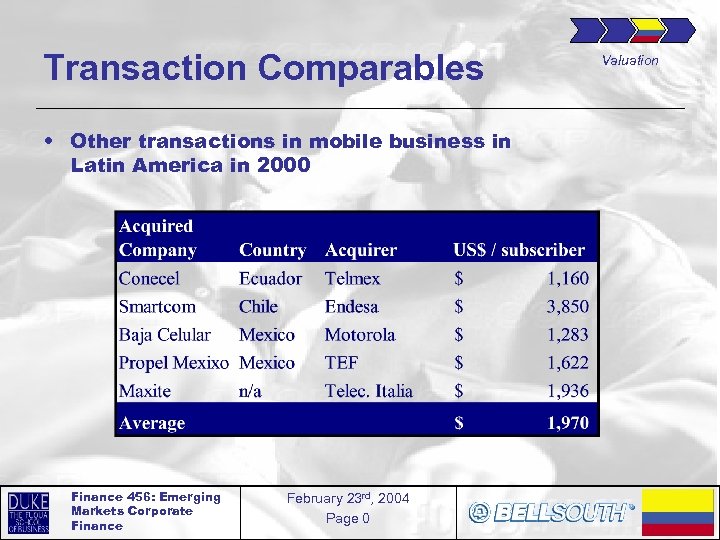

Transaction Comparables • Other transactions in mobile business in Latin America in 2000 Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Valuation

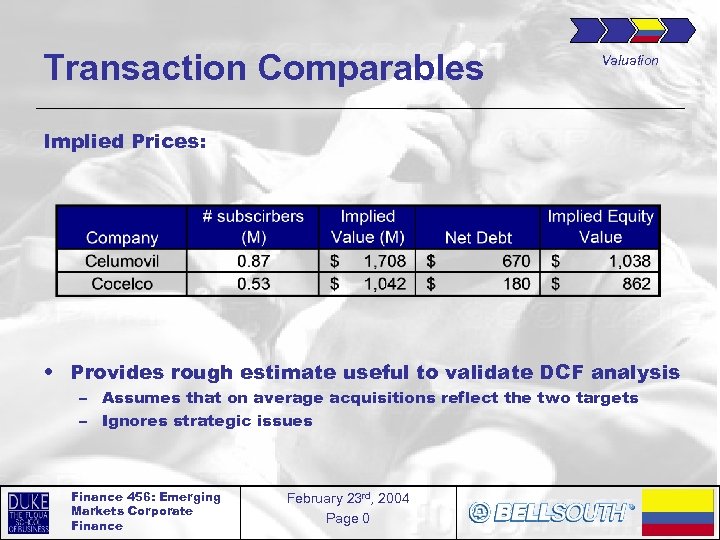

Transaction Comparables Valuation Implied Prices: • Provides rough estimate useful to validate DCF analysis – Assumes that on average acquisitions reflect the two targets – Ignores strategic issues Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

Summary of Valuations Valuation Implied Equity Value using different valuation methodologies Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

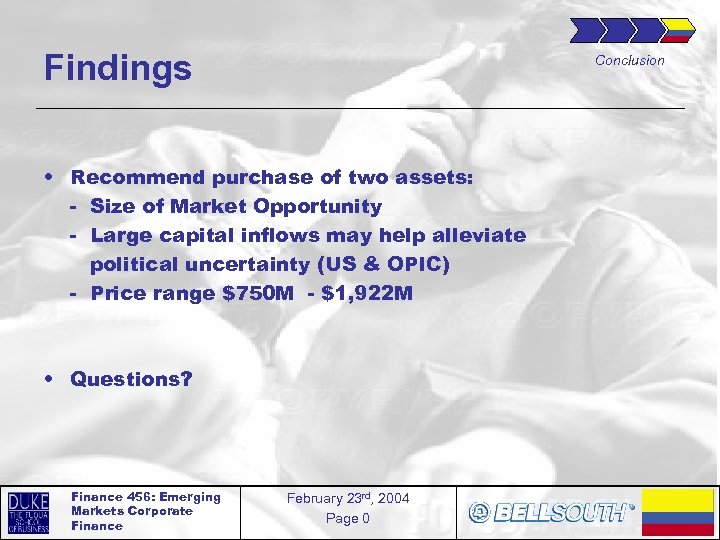

Findings Conclusion • Recommend purchase of two assets: - Size of Market Opportunity - Large capital inflows may help alleviate political uncertainty (US & OPIC) - Price range $750 M - $1, 922 M • Questions? Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

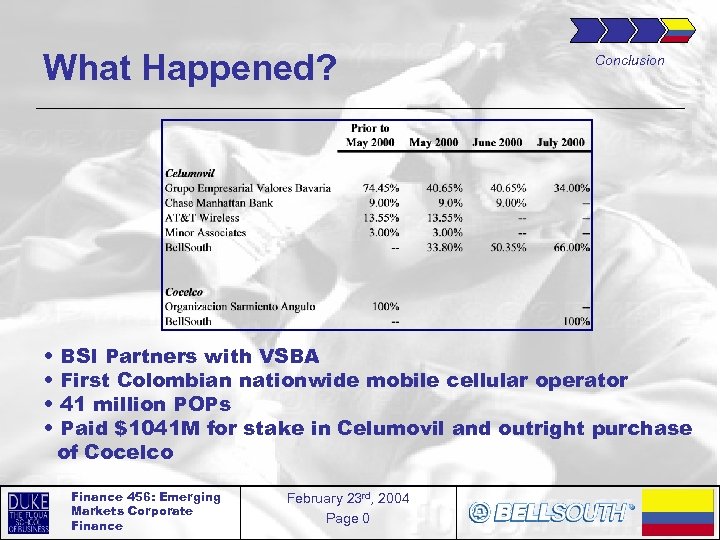

What Happened? • • Conclusion BSI Partners with VSBA First Colombian nationwide mobile cellular operator 41 million POPs Paid $1041 M for stake in Celumovil and outright purchase of Cocelco Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

Appendix - Multiples Valuation Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0 Appendix

Appendix – Cellular Standards Appendix • Early Mobile Era – Single Central Tower – 1960 s, 70 s. Big old James Bond movie cell phones • Cellular Era – – Began in 1980 s in US when FCC allocated frequencies Many smaller transmission areas called “cells” Original systems were analog Greater mobility, smaller phones • Digital Technology – Better quality, higher system capacity, improved security – TDMA (includes GSM and PCS), CDMA Finance 456: Emerging Markets Corporate Finance February 23 rd, 2004 Page 0

f8a0cbc1b1dfa1746832b7bb94bee920.ppt