0b599a7da7a641b99b0da34e3339acb4.ppt

- Количество слайдов: 31

Belgium-Japan Association & Chamber of Commerce With the generous support of: BFTB, AWEX, Brussels Region, Export Vlaanderen and AGORIA Survey Results: Doing Business in Japan 2001 0

SURVEY RESULTS: DOING BUSINESS IN JAPAN 2001 1. 2. 3. 4. 5. Introduction Survey Data Results and Analysis Review of obstacles and support requested from authorities Conclusion Survey Results: Doing Business in Japan 2001 1

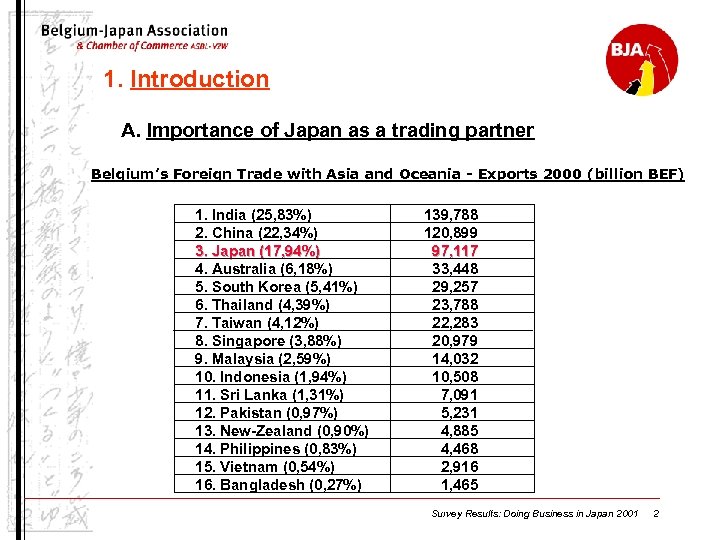

1. Introduction A. Importance of Japan as a trading partner Belgium’s Foreign Trade with Asia and Oceania - Exports 2000 (billion BEF) 1. India (25, 83%) 2. China (22, 34%) 3. Japan (17, 94%) 4. Australia (6, 18%) 5. South Korea (5, 41%) 6. Thailand (4, 39%) 7. Taiwan (4, 12%) 8. Singapore (3, 88%) 9. Malaysia (2, 59%) 10. Indonesia (1, 94%) 11. Sri Lanka (1, 31%) 12. Pakistan (0, 97%) 13. New-Zealand (0, 90%) 14. Philippines (0, 83%) 15. Vietnam (0, 54%) 16. Bangladesh (0, 27%) 139, 788 120, 899 97, 117 33, 448 29, 257 23, 788 22, 283 20, 979 14, 032 10, 508 7, 091 5, 231 4, 885 4, 468 2, 916 1, 465 Survey Results: Doing Business in Japan 2001 2

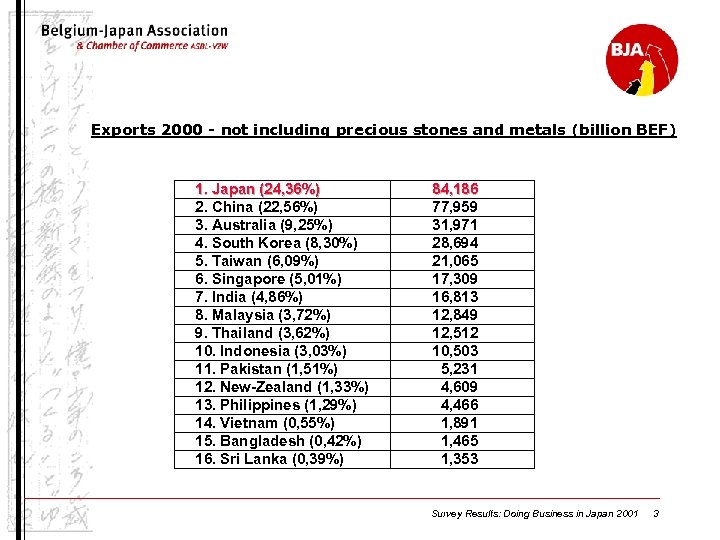

Exports 2000 - not including precious stones and metals (billion BEF) 1. Japan (24, 36%) 2. China (22, 56%) 3. Australia (9, 25%) 4. South Korea (8, 30%) 5. Taiwan (6, 09%) 6. Singapore (5, 01%) 7. India (4, 86%) 8. Malaysia (3, 72%) 9. Thailand (3, 62%) 10. Indonesia (3, 03%) 11. Pakistan (1, 51%) 12. New-Zealand (1, 33%) 13. Philippines (1, 29%) 14. Vietnam (0, 55%) 15. Bangladesh (0, 42%) 16. Sri Lanka (0, 39%) 84, 186 77, 959 31, 971 28, 694 21, 065 17, 309 16, 813 12, 849 12, 512 10, 503 5, 231 4, 609 4, 466 1, 891 1, 465 1, 353 Survey Results: Doing Business in Japan 2001 3

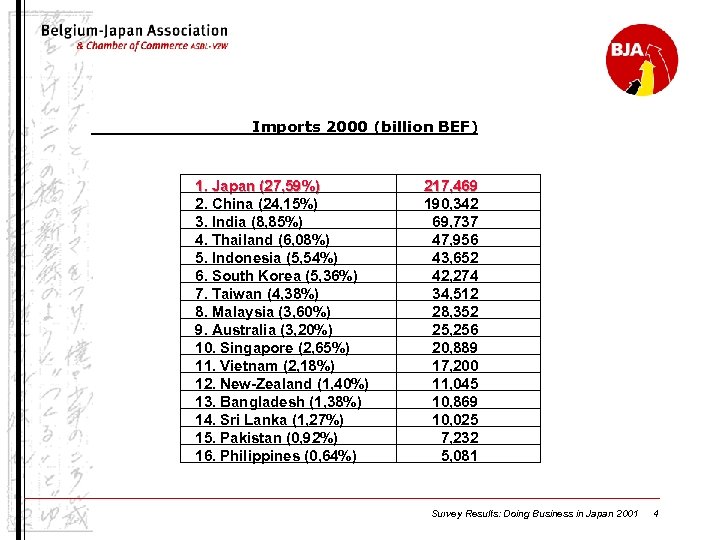

Imports 2000 (billion BEF) 1. Japan (27, 59%) 2. China (24, 15%) 3. India (8, 85%) 4. Thailand (6, 08%) 5. Indonesia (5, 54%) 6. South Korea (5, 36%) 7. Taiwan (4, 38%) 8. Malaysia (3, 60%) 9. Australia (3, 20%) 10. Singapore (2, 65%) 11. Vietnam (2, 18%) 12. New-Zealand (1, 40%) 13. Bangladesh (1, 38%) 14. Sri Lanka (1, 27%) 15. Pakistan (0, 92%) 16. Philippines (0, 64%) 217, 469 190, 342 69, 737 47, 956 43, 652 42, 274 34, 512 28, 352 25, 256 20, 889 17, 200 11, 045 10, 869 10, 025 7, 232 5, 081 Survey Results: Doing Business in Japan 2001 4

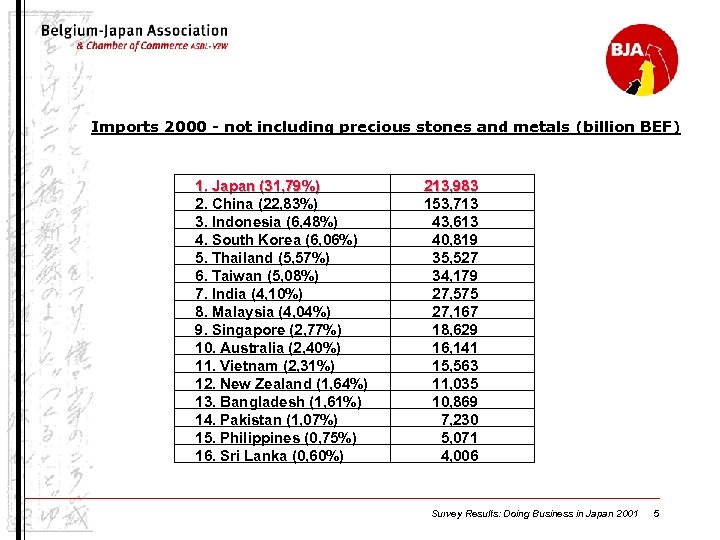

Imports 2000 - not including precious stones and metals (billion BEF) 1. Japan (31, 79%) 2. China (22, 83%) 3. Indonesia (6, 48%) 4. South Korea (6, 06%) 5. Thailand (5, 57%) 6. Taiwan (5, 08%) 7. India (4, 10%) 8. Malaysia (4, 04%) 9. Singapore (2, 77%) 10. Australia (2, 40%) 11. Vietnam (2, 31%) 12. New Zealand (1, 64%) 13. Bangladesh (1, 61%) 14. Pakistan (1, 07%) 15. Philippines (0, 75%) 16. Sri Lanka (0, 60%) 213, 983 153, 713 43, 613 40, 819 35, 527 34, 179 27, 575 27, 167 18, 629 16, 141 15, 563 11, 035 10, 869 7, 230 5, 071 4, 006 Survey Results: Doing Business in Japan 2001 5

Belgium’s trade balance with Japan Belgium has the biggest trade deficit with Japan, almost twice as much as its deficit with China. Exports: Belgium’s main exports in terms of value are chemical products, which account for as much as 42 % of total exports to Japan. Imports: Machinery and electric equipment rank 1 st in imports from Japan, accounting for 44. 86 % of the total. Survey Results: Doing Business in Japan 2001 6

B. The BJA and its Business Committee The Belgium-Japan Association and Chamber of Commerce (BJA) is a non-profit organization that promotes business and cultural relations between Belgium, Europe and Japan. The BJA Business Committee is composed of Belgian and Japanese executives, as well as government officials from Belgium and Japan. It pursues the following objectives: • Sustaining exports by offering the expertise and market vision of specialists to Belgian companies wishing to export to Japan. • Encouraging Japanese suppliers to invest in Belgium by presenting our country as an excellent investment location. • Contributing to maintain a free trade and fair competition, which is the best guarantee that the consumer gets value at the best price. The Business Committee meets four times yearly in the offices of member companies. Business activities are organised by a few specialised committees. Survey Results: Doing Business in Japan 2001 7

C. Background This survey on “Doing Business with Japan” was conducted in June 2001 by the Business Committee of the BJA, as a follow-up of the official visit to Japan by the Belgian Prime Minister Mr Guy Verhofstadt in February. The BJA wishes to express its warm appreciation to the following organizations, which have provided their support for the organization of the survey: • • • AGORIA, The Multisectorial Federation for the Technology Industry AWEX, Wallonia Export Agency Belgian Foreign Trade Board Brussels Region Foreign Trade Department Export Vlaanderen, Flanders Export Agency Survey Results: Doing Business in Japan 2001 8

2. Survey Data Number of surveys sent: 1. 350 Number of valid replies: 198 (invalid: 15) Proportion of replies: 15, 77 % (as of 9/08/01) Survey Results: Doing Business in Japan 2001 9

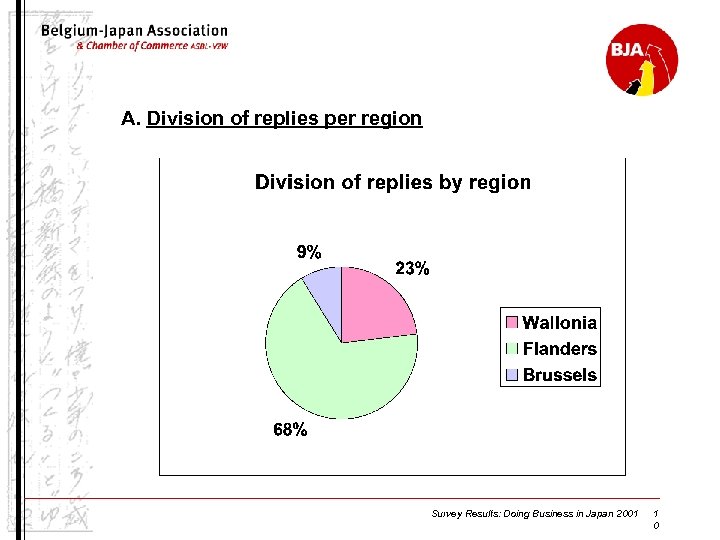

A. Division of replies per region Survey Results: Doing Business in Japan 2001 1 0

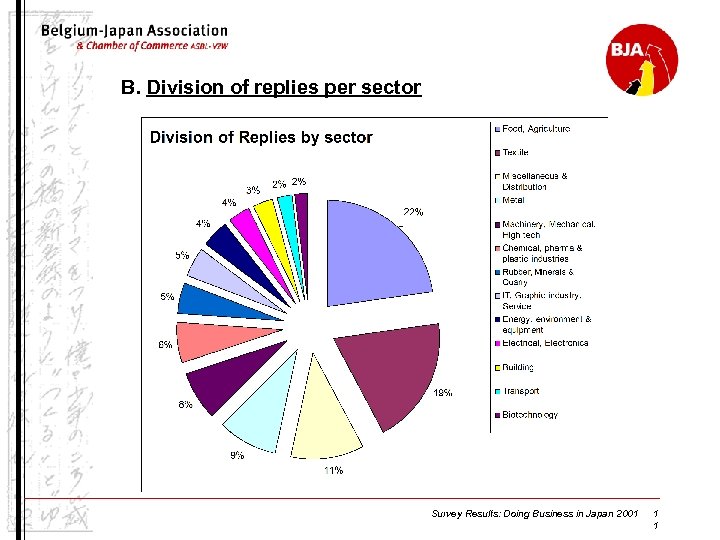

B. Division of replies per sector Survey Results: Doing Business in Japan 2001 1 1

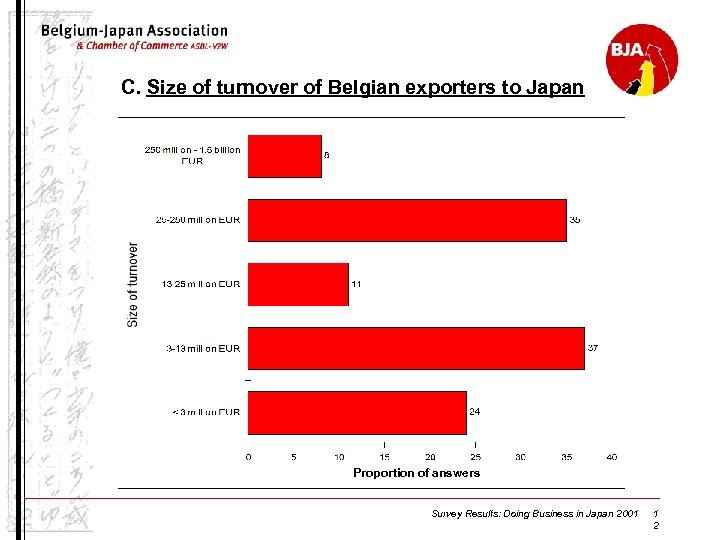

C. Size of turnover of Belgian exporters to Japan Proportion of answers Survey Results: Doing Business in Japan 2001 1 2

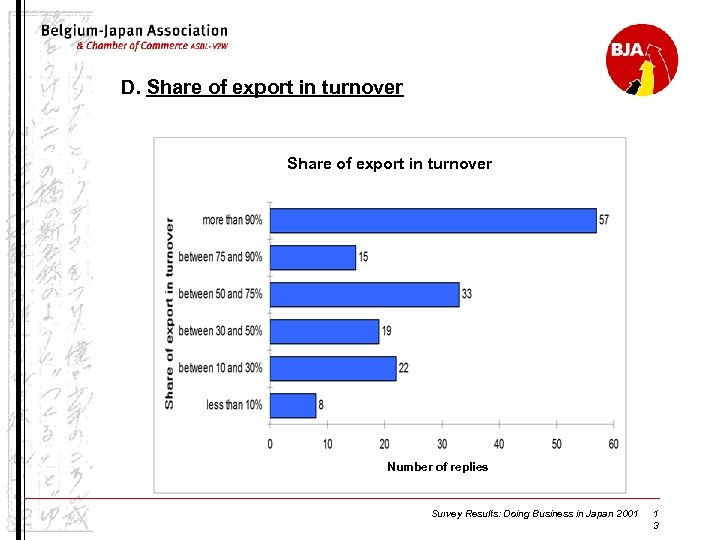

D. Share of export in turnover Number of replies Survey Results: Doing Business in Japan 2001 1 3

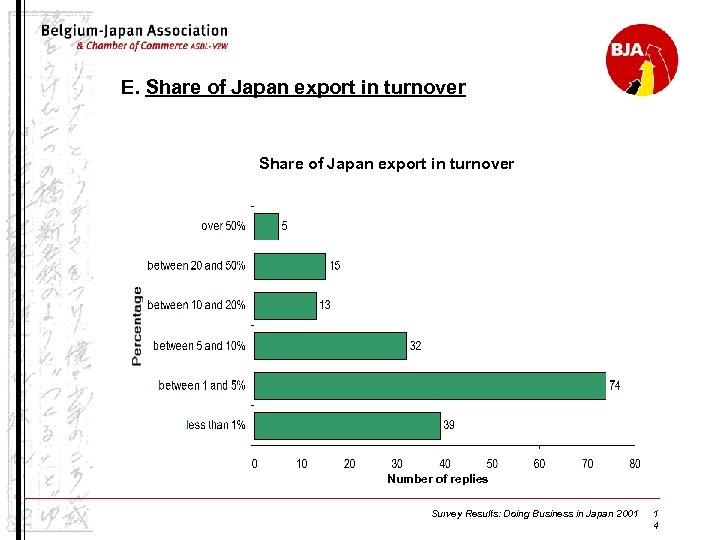

E. Share of Japan export in turnover Number of replies Survey Results: Doing Business in Japan 2001 1 4

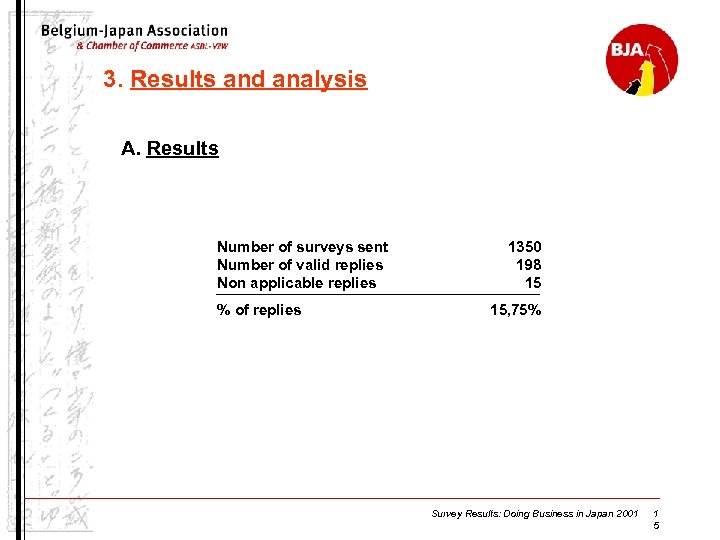

3. Results and analysis A. Results Number of surveys sent Number of valid replies Non applicable replies % of replies 1350 198 15 15, 75% Survey Results: Doing Business in Japan 2001 1 5

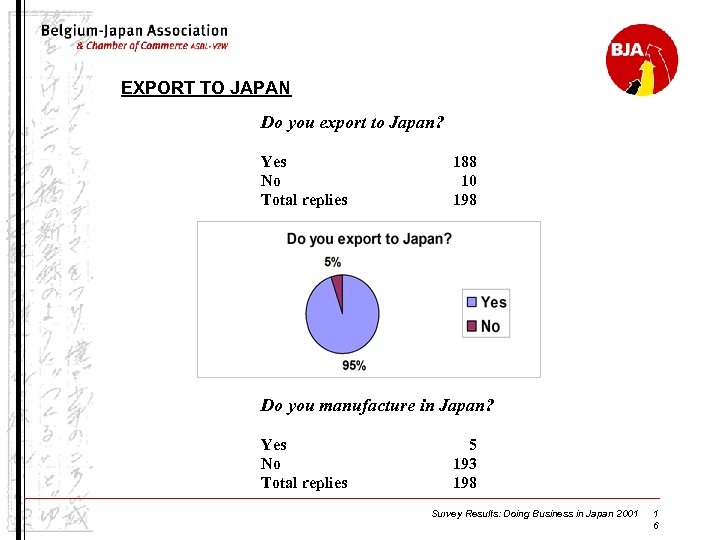

EXPORT TO JAPAN Do you export to Japan? Yes No Total replies 188 10 198 Do you manufacture in Japan? Yes No Total replies 5 193 198 Survey Results: Doing Business in Japan 2001 1 6

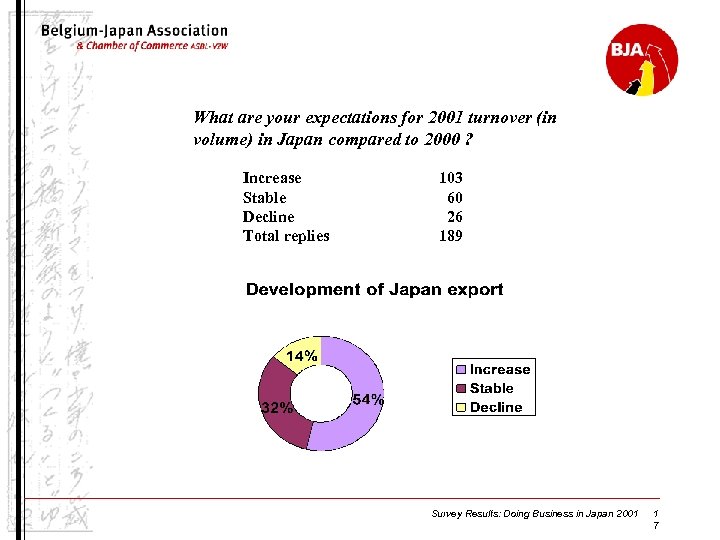

What are your expectations for 2001 turnover (in volume) in Japan compared to 2000 ? Increase Stable Decline Total replies 103 60 26 189 Survey Results: Doing Business in Japan 2001 1 7

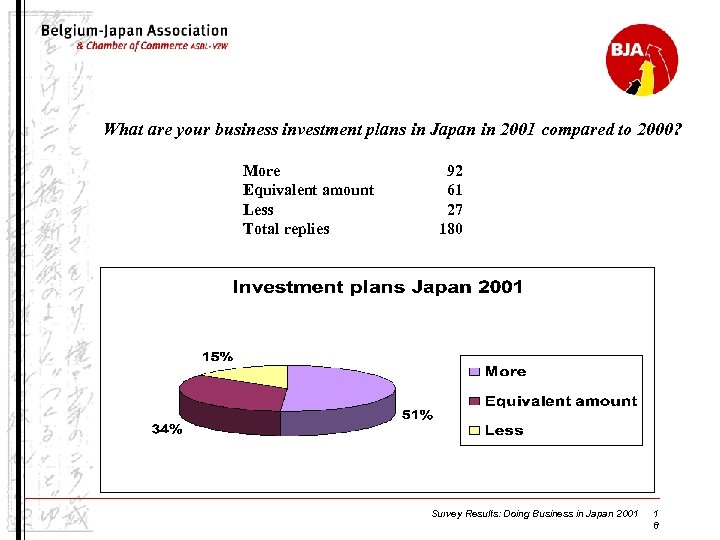

What are your business investment plans in Japan in 2001 compared to 2000? More Equivalent amount Less Total replies 92 61 27 180 Survey Results: Doing Business in Japan 2001 1 8

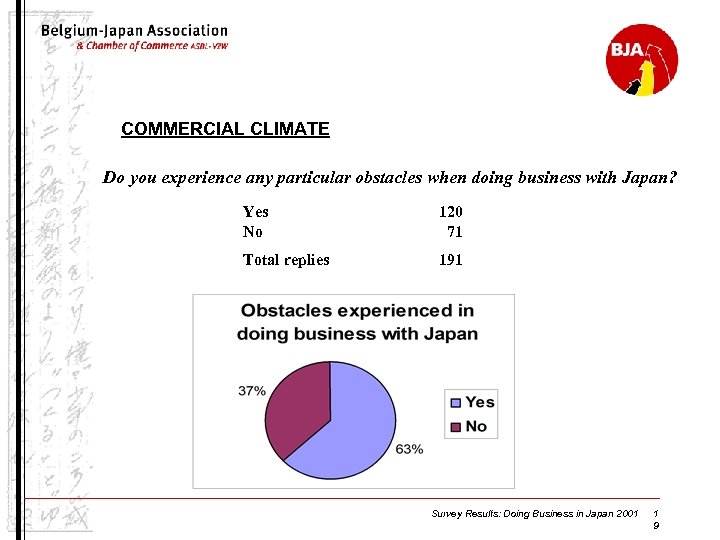

COMMERCIAL CLIMATE Do you experience any particular obstacles when doing business with Japan? Yes No 120 71 Total replies 191 Survey Results: Doing Business in Japan 2001 1 9

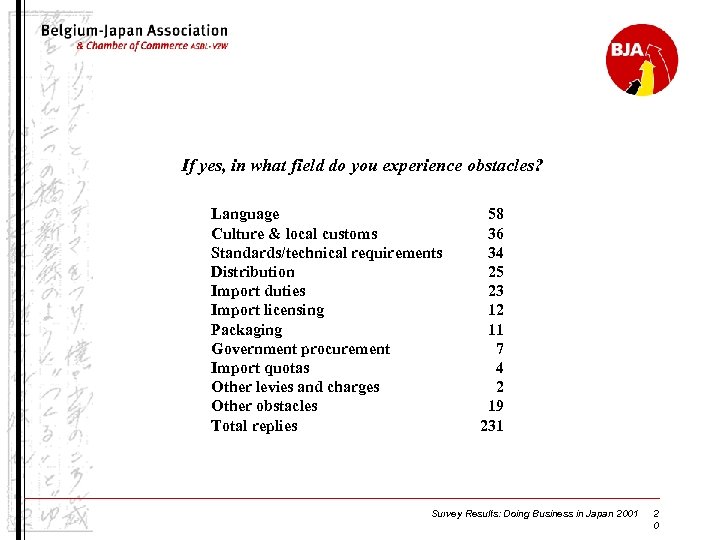

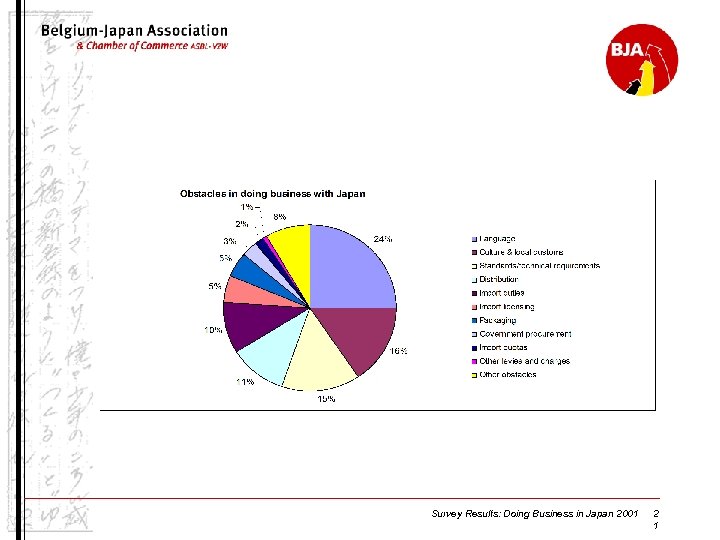

If yes, in what field do you experience obstacles? Language Culture & local customs Standards/technical requirements Distribution Import duties Import licensing Packaging Government procurement Import quotas Other levies and charges Other obstacles Total replies 58 36 34 25 23 12 11 7 4 2 19 231 Survey Results: Doing Business in Japan 2001 2 0

Survey Results: Doing Business in Japan 2001 2 1

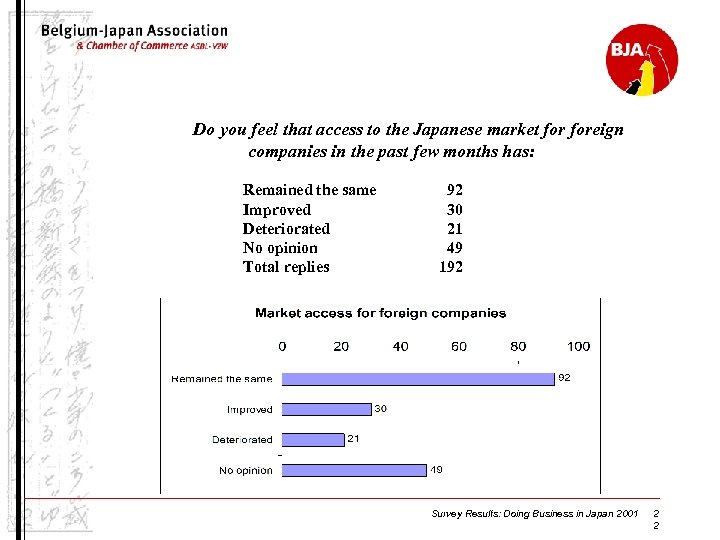

Do you feel that access to the Japanese market foreign companies in the past few months has: Remained the same Improved Deteriorated No opinion Total replies 92 30 21 49 192 Survey Results: Doing Business in Japan 2001 2 2

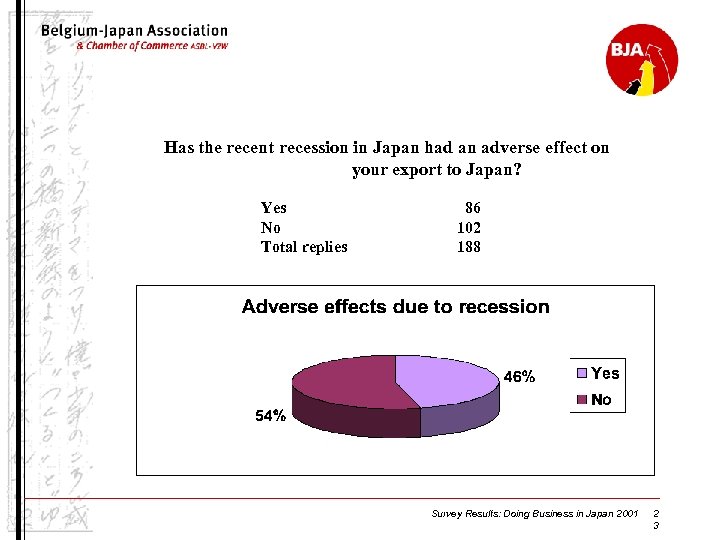

Has the recent recession in Japan had an adverse effect on your export to Japan? Yes No Total replies 86 102 188 Survey Results: Doing Business in Japan 2001 2 3

B. Analysis • Export to Japan 4 A majority of Belgian exporters are optimistic concerning future developments of their export to Japan: 86 % expect either an increase or a stabilization in 2001. 4 Most Belgian companies intend to continue their investments in Japan in 2001: 85 % intend to devote a higher or equivalent amount to the Japanese market. Survey Results: Doing Business in Japan 2001 2 4

• Commercial climate 4 More Belgian exporters reported experiencing obstacles when doing business with Japan: 64 % as compared to 50, 7 % in 1995. 4 As was the case the, non-tariff barriers make up the biggest share (75 %). Of these, a remarkable 40 percent of exporters mentioned challenges in language and cultural customs. 4 In spite of the obstacles faced, it is encouraging to note that 61 % of respondents feel that market access foreign companies has either remained the same (45, 6%) or even improved (15, 2 %). 4 Perhaps a little surprising, the recent economic recession has not had an adverse effect on export to Japan for a majority of Belgian companies: 54 % report not being affected. Survey Results: Doing Business in Japan 2001 2 5

4. Review of obstacles and support requested from authorities A. Review of obstacles • Import duties • Import quotas • Culture and customs • Language and communication • Packaging and specifications • Standards and technical requirements • Distribution Survey Results: Doing Business in Japan 2001 2 6

B. Support requested from authorities • Subsidies • Promotion • Networking • Standards • Sector-linked support 4 Chemical sector 4 Food sector • Information request • Cooperation Survey Results: Doing Business in Japan 2001 2 7

5. Conclusion Survey shows encouraging signs: five years after the original survey, most Belgian exporters are still optimistic concerning future developments of their export to Japan. One should perhaps grant more attention to the changes Japan has begun to implement: the Japanese government embarked upon an ambitious program to reduce regulatory barriers, stimulate the economy, improve market access, strengthen competition and promote inward investment. Language and culture have been singled out as the main obstacles in exporting to Japan, but there are literally hundreds of executives and scholars in Belgium with extensive experience in dealing with Japan. There are thousands of Japanese residents in Belgium. Why not hire Japanese staff at Belgian companies ? A trade relationship with Japan requires mutual investment from both sides, more than is traditionally required between nations of similar cultures. The Belgium-Japan Association will continue doing its utmost to put its efforts and resources towards bridging this divide. Survey Results: Doing Business in Japan 2001 2 8

YES III PROGRAM Introduction • What is the Yes Program ? Content • The seminars : 3 days intensive training • Introduction to the market: 10 days practical introduction to potential customers A few important points: – When ? • November 3 -16, 2002 – Financial contribution from each participant • € 1. 500 – How to apply ? • info@bja. be • 02/644. 13. 33 (Mrs Fujii-L’Hoost) Survey Results: Doing Business in Japan 2001 2 9

Survey Results: Doing Business in Japan 2001 3 0

0b599a7da7a641b99b0da34e3339acb4.ppt